Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is key to financial freedom. This guide delves into the world of MyGreatLakes student loans, offering a practical roadmap to manage your debt effectively. We’ll explore the features, repayment plans, and potential challenges, equipping you with the knowledge to make informed decisions about your financial future.

From understanding the application process and website navigation to mastering budgeting strategies and exploring loan forgiveness programs, we’ll cover essential aspects of managing your MyGreatLakes student loan. We’ll also provide real-world examples and address common concerns, ensuring you have the tools to confidently tackle your student loan journey.

Understanding MyGreatLakes Student Loan

MyGreatLakes is a student loan servicer responsible for managing federal student loans for borrowers. Understanding its features and processes is crucial for effective loan management and repayment. This section provides a comprehensive overview of MyGreatLakes, covering key aspects from loan features to website navigation.

MyGreatLakes Student Loan Features and Benefits

MyGreatLakes offers several features designed to simplify the student loan repayment process. These include online account access for viewing loan balances, payment history, and repayment schedules. Borrowers can also make payments online, enroll in various repayment plans, and receive important updates and notifications through their account. A key benefit is the accessibility of customer support resources, including online help, FAQs, and contact information for assistance. The system allows for proactive management of loans, promoting financial responsibility and potentially reducing the stress associated with loan repayment.

MyGreatLakes Repayment Plans

Several repayment plans are available through MyGreatLakes, catering to different financial situations and repayment preferences. These include the Standard Repayment Plan, which involves fixed monthly payments over a 10-year period; the Graduated Repayment Plan, where payments increase gradually over time; and the Extended Repayment Plan, offering longer repayment terms but potentially higher overall interest costs. Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, base monthly payments on income and family size, offering lower payments for those with limited financial resources. Borrowers should carefully consider their individual financial circumstances when choosing a repayment plan.

Applying for a MyGreatLakes Student Loan

Applying for a MyGreatLakes student loan isn’t directly done through their website; MyGreatLakes serves as a loan servicer, not a lender. The application process involves applying for a federal student loan through the Free Application for Federal Student Aid (FAFSA). Once approved, your loan will be assigned to a servicer, which might be MyGreatLakes. The FAFSA determines your eligibility for federal student aid based on factors like financial need and academic progress. After completing the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your eligibility and the types of aid you may receive. You will then need to accept the loan offer and complete any necessary loan documentation with your chosen lender.

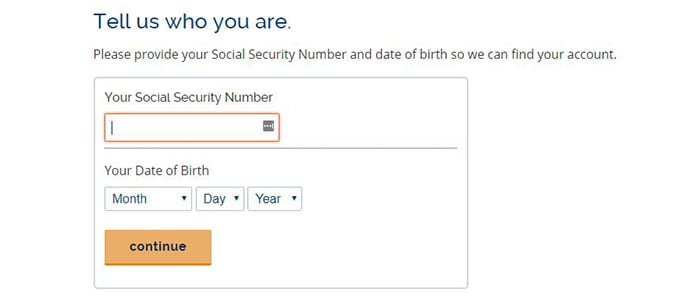

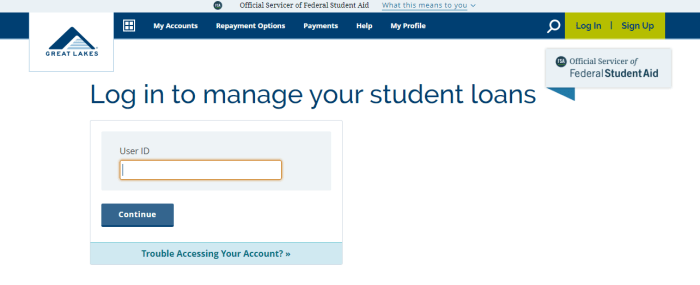

Navigating the MyGreatLakes Website

Accessing and navigating the MyGreatLakes website is straightforward. To log in, visit the MyGreatLakes website and click on the “Log In” button. You will need your username and password. If you are a first-time user, you will need to create an account using your loan information. Once logged in, the dashboard provides a summary of your loan information, including balances, payment due dates, and repayment plan details. The website offers intuitive navigation with clearly labeled sections for making payments, updating contact information, and accessing support resources. The site is generally user-friendly and provides easy access to all necessary loan management tools.

MyGreatLakes Compared to Other Student Loan Servicers

| Feature | MyGreatLakes | Navient | Nelnet |

|---|---|---|---|

| Online Account Access | Yes | Yes | Yes |

| Repayment Plan Options | Standard, Graduated, Extended, IDR Plans | Similar range of plans | Similar range of plans |

| Customer Service | Phone, email, online help | Phone, email, online help | Phone, email, online help |

| Website Usability | Generally user-friendly | Generally user-friendly | Generally user-friendly |

Managing Your MyGreatLakes Student Loan

Effective management of your MyGreatLakes student loan is crucial for minimizing stress and ensuring timely repayment. This involves careful budgeting, understanding repayment options, and proactively addressing potential challenges. Taking a proactive approach will help you navigate the repayment process smoothly and avoid unnecessary financial strain.

Budgeting and Managing Student Loan Debt

Creating a realistic budget is the cornerstone of successful student loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your financial progress. Prioritize essential expenses like housing, food, and transportation, then allocate as much as possible to your student loan payments. Remember to build an emergency fund to cover unexpected expenses, preventing you from falling behind on your loan payments. A sample budget is provided below.

Implications of Deferment and Forbearance

Deferment and forbearance temporarily postpone your student loan payments. However, interest may still accrue during these periods, potentially increasing your total loan amount. Deferment is typically granted due to specific circumstances like unemployment or enrollment in school. Forbearance is usually granted for temporary financial hardship. It’s crucial to understand the terms and conditions of each before opting for them, as they can impact your long-term repayment costs. Consider the potential impact of accumulated interest before choosing either option.

Consolidating Multiple Student Loans

Consolidating multiple student loans into a single MyGreatLakes loan can simplify repayment. This combines your various loans into one monthly payment, potentially lowering your monthly payment amount and streamlining the payment process. However, it’s essential to carefully review the terms and interest rates of the consolidated loan to ensure it’s financially advantageous. Consider the potential impact on your overall interest paid over the life of the loan before proceeding with consolidation.

Student Loan Payment Options

MyGreatLakes offers various payment methods to suit your convenience. You can make payments online through the MyGreatLakes website, a secure and efficient option. Alternatively, you can mail in your payment using the address provided on your billing statement. Some borrowers may also be able to set up automatic payments, ensuring consistent and timely repayments. Choose the method that best fits your lifestyle and payment preferences.

Sample Monthly Budget

| Income | Amount |

|---|---|

| Net Monthly Salary | $3000 |

| Expenses | Amount |

| Rent/Mortgage | $1000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, etc.) | $800 |

Note: This is a sample budget and should be adjusted to reflect your individual income and expenses.

Potential Issues and Solutions with MyGreatLakes

Navigating the complexities of student loan repayment can sometimes present challenges. This section addresses common problems encountered by MyGreatLakes borrowers and provides practical solutions for resolving them. Understanding these potential issues can empower you to proactively manage your student loans and avoid unnecessary complications.

Common Problems and Their Solutions

Borrowers frequently encounter issues such as inaccurate account information, difficulty accessing online accounts, payment processing delays, and confusion regarding repayment plans. Addressing these issues promptly is crucial for maintaining a positive repayment history. Solutions often involve verifying account details directly with MyGreatLakes, resetting passwords through the online portal’s password recovery function, contacting customer service for payment-related issues, and carefully reviewing the available repayment plan options to select the most suitable one based on individual financial circumstances. For example, a discrepancy in the interest rate displayed online could be resolved by comparing it to the rate stated in your loan documents and contacting customer service to report the discrepancy.

Resolving Disputes and Discrepancies

Disputes or discrepancies may arise concerning payment amounts, interest calculations, or loan forgiveness programs. A systematic approach to resolving these issues is essential. First, gather all relevant documentation, including loan agreements, payment confirmations, and any communication with MyGreatLakes. Next, contact MyGreatLakes customer service to explain the situation clearly and concisely. If the issue remains unresolved, consider submitting a formal written complaint detailing the problem and the steps already taken to resolve it. Keep copies of all correspondence. For instance, if you believe a payment was incorrectly applied, provide MyGreatLakes with proof of payment and request a review of your account.

Appealing a MyGreatLakes Decision

If you disagree with a decision made by MyGreatLakes, such as a denial of a repayment plan modification or a claim of default, you have the right to appeal. The appeal process typically involves submitting a written request outlining your reasons for disagreement, supported by relevant documentation. Clearly state the specific decision you are appealing and the desired outcome. Follow MyGreatLakes’ established appeal procedures, which are usually Artikeld on their website or provided by customer service. For example, if your application for an income-driven repayment plan was denied, you might appeal by providing updated income documentation or demonstrating extenuating circumstances.

Contacting MyGreatLakes Customer Service

Contacting MyGreatLakes customer service is often the first step in resolving any issues. Multiple channels are typically available, including phone, email, and online chat. Before contacting them, gather all necessary account information, including your loan ID number. Be prepared to clearly and concisely explain your issue. Note down the date, time, and method of contact, along with the name of the representative you spoke with (if applicable). Keeping a record of all communication is vital for future reference. For example, you might use email to document a request for a payment extension.

Frequently Asked Questions

Understanding common questions and their answers can proactively address many potential issues.

- Q: How do I access my MyGreatLakes account? A: Access your account through the MyGreatLakes website using your username and password. If you’ve forgotten your login credentials, use the password recovery function.

- Q: What repayment plans are available? A: Several repayment plans are typically offered, including standard, graduated, extended, and income-driven repayment plans. Review the options on the MyGreatLakes website to determine which plan best suits your financial situation.

- Q: What happens if I miss a payment? A: Missing a payment can negatively impact your credit score and may lead to late fees and potential default. Contact MyGreatLakes immediately if you anticipate difficulty making a payment to explore options for avoiding delinquency.

- Q: How can I update my contact information? A: Update your contact information (address, phone number, email) through your MyGreatLakes online account. This ensures you receive important notifications and updates.

- Q: Where can I find my loan documents? A: Your loan documents can usually be accessed through your MyGreatLakes online account. If you cannot find them, contact customer service to request copies.

Long-Term Planning and Loan Forgiveness

Successfully navigating student loan repayment requires a long-term strategy that considers various factors, including income, expenses, and potential loan forgiveness programs. Understanding your options and proactively planning your repayment approach can significantly impact your financial future. This section Artikels key considerations for long-term planning and explores the possibilities of loan forgiveness.

Types of Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with specific eligibility criteria and limitations. These programs aim to reduce or eliminate student loan debt for borrowers working in specific public service sectors or meeting certain income requirements. Examples include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans that can lead to forgiveness after 20-25 years. The details of each program vary, and it’s crucial to research the specific requirements before relying on them for complete debt elimination.

Eligibility Requirements for Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies significantly. Generally, programs require borrowers to have federal student loans, work full-time in a qualifying public service job (for PSLF, for example), and make consistent on-time payments for a specified period (often 10-120 months, depending on the program). Income limitations may also apply to some programs, restricting eligibility to borrowers below a certain income threshold. Specific requirements differ between programs and are subject to change, so careful review of the official program guidelines is essential.

Implications of Choosing Different Repayment Plans on Long-Term Loan Costs

The repayment plan you choose significantly impacts your total loan cost over time. Standard repayment plans offer the shortest repayment period but result in higher monthly payments. IDR plans, on the other hand, offer lower monthly payments but extend the repayment period, potentially leading to higher total interest paid. Choosing a plan depends on your financial situation and risk tolerance. For example, a borrower with a higher income might prefer a standard plan to minimize long-term interest costs, while a borrower with a lower income might opt for an IDR plan for more manageable monthly payments, accepting the higher overall cost.

Applying for Student Loan Forgiveness Programs

The application process for student loan forgiveness programs varies depending on the specific program. Generally, it involves completing an application form, providing documentation to verify employment and income, and ensuring your loans are consolidated into a Direct Loan program if necessary (for PSLF, for example). Regular monitoring of your progress and maintaining consistent communication with your loan servicer is crucial throughout the process. Failure to meet the program requirements, even by a small margin, can result in ineligibility for forgiveness.

Timeline for Planning Student Loan Repayment

Planning for student loan repayment is a multi-stage process that ideally begins even before graduation. A realistic timeline might look like this:

| Stage | Timeline | Activities |

|---|---|---|

| Assessment | Before Graduation | Understand loan amounts, interest rates, and repayment options. Explore potential career paths and income projections. |

| Planning | 6 months before Graduation | Research repayment plans and loan forgiveness programs. Create a realistic budget that incorporates loan payments. |

| Application | After Graduation | Choose a repayment plan, apply for loan consolidation (if necessary), and begin making timely payments. |

| Monitoring | Ongoing | Regularly review your repayment progress, track your payments, and maintain communication with your loan servicer. Explore refinancing options if necessary. |

Illustrative Scenarios

Understanding the impact of various factors on your student loan repayment is crucial for effective financial planning. The following scenarios illustrate key aspects of managing your MyGreatLakes loan, highlighting the consequences of different choices and approaches.

Impact of Interest Rates on Repayment Costs

Let’s compare two scenarios: Borrower A and Borrower B both borrow $20,000 at the same time, making monthly payments of $250. Borrower A has a 5% interest rate, while Borrower B has a 7% interest rate. Over the life of the loan, Borrower A will pay significantly less in interest than Borrower B. For example, using a loan amortization calculator (readily available online), we can see that Borrower A might pay approximately $3,000 in interest, while Borrower B might pay close to $5,000. This demonstrates how even a small difference in interest rate can substantially impact the total repayment cost. The higher interest rate results in a longer repayment period and significantly more money paid in interest.

Successful Navigation of a Challenging Situation

Imagine Sarah, a recent graduate facing unexpected job loss. She proactively contacted MyGreatLakes to explore her options. Through the MyGreatLakes website, she successfully applied for a temporary forbearance, pausing her payments for six months while she actively searched for employment. During this period, she utilized the online resources available to understand her loan terms and plan for repayment once she secured a new position. This proactive approach allowed her to avoid default and maintain a positive relationship with her loan servicer. Once employed, she resumed payments without incurring any penalties.

Benefits of Early Loan Repayment

Consider John, who diligently paid extra towards his student loans each month. Instead of the minimum payment, he made an additional $100 per month. This seemingly small amount significantly reduced his loan’s principal balance faster, resulting in substantial interest savings over the loan’s lifetime. Early repayment not only saves money on interest but also reduces the overall loan repayment period, freeing up financial resources sooner. A loan amortization calculator can clearly demonstrate the cumulative savings achieved through consistent extra payments.

Advantages of Loan Consolidation

Maria had multiple student loans with varying interest rates and repayment schedules, making it difficult to track and manage her debt. She decided to consolidate her loans through MyGreatLakes, simplifying her payments into a single monthly payment with a potentially lower interest rate. Consolidation provided a clearer picture of her debt, streamlined her repayment process, and reduced the administrative burden of managing multiple loans. This resulted in a more manageable repayment plan and potential cost savings.

Visual Representation of Loan Repayment Progression

Imagine a graph with time on the horizontal axis and loan balance on the vertical axis. Three lines represent different repayment scenarios: Line A shows a steady decline representing consistent minimum payments; Line B demonstrates a steeper decline showing the impact of consistent extra payments; and Line C depicts a slower decline with periods of flatness, illustrating the effect of forbearance. The graph visually demonstrates how different repayment strategies affect the loan balance over time, showcasing the benefits of consistent and proactive repayment.

Conclusive Thoughts

Successfully managing your MyGreatLakes student loan requires proactive planning and a thorough understanding of your options. By utilizing the strategies and information presented in this guide, you can effectively navigate the repayment process, minimize your long-term costs, and ultimately achieve financial stability. Remember, proactive engagement with your loan servicer and diligent financial planning are crucial for a positive outcome.

General Inquiries

What happens if I miss a payment on my MyGreatLakes loan?

Missing a payment can negatively impact your credit score and may lead to late fees. Contact MyGreatLakes immediately to discuss options like deferment or forbearance to avoid further penalties.

Can I change my repayment plan after I’ve already started?

Yes, you can typically change your repayment plan. However, there may be limitations depending on your loan type and current financial situation. Check MyGreatLakes’ website or contact them directly to explore your options.

How do I contact MyGreatLakes customer service?

You can usually find contact information, including phone numbers and online contact forms, on the MyGreatLakes website.

What types of income-driven repayment plans are available through MyGreatLakes?

MyGreatLakes offers various income-driven repayment plans, such as ICR, IBR, PAYE, and REPAYE. Eligibility criteria vary for each plan. Review the details on the MyGreatLakes website or contact them for clarification.