Navigating the complexities of higher education often involves understanding the financial landscape. A cornerstone of this landscape is the National Direct Student Loan program, offering crucial funding for millions of students pursuing their academic goals. This guide delves into the intricacies of these loans, providing a clear and concise overview of eligibility, application processes, repayment options, and potential pitfalls to avoid. Understanding the nuances of Direct Loans empowers students to make informed decisions, paving the way for a smoother path towards educational success and financial stability.

From the initial application through repayment and potential forgiveness programs, we’ll cover the essential aspects of National Direct Student Loans. We’ll explore the various loan types, interest rates, and repayment plans available, empowering you to choose the best option for your individual circumstances. This comprehensive resource aims to equip you with the knowledge needed to confidently manage your student loan journey.

Understanding National Direct Student Loan Programs

The National Direct Student Loan program is a cornerstone of higher education financing in the United States, providing millions of students with access to affordable education. Its history reflects a continuous evolution in response to changing economic conditions and educational needs. Understanding its intricacies is crucial for prospective and current borrowers.

A Brief History of Federal Student Loan Programs

The federal government’s involvement in student lending began in the mid-20th century, initially through various programs with varying levels of success. These early programs often suffered from administrative complexities and inconsistencies. The current Direct Loan program, established in 2010, consolidated several previous programs under a single, streamlined system administered directly by the U.S. Department of Education. This direct lending model replaced the previous Federal Family Education Loan (FFEL) program, which relied on private lenders. The shift aimed to simplify the process, reduce costs, and improve borrower services. This consolidation aimed to streamline the application process and provide greater transparency for borrowers.

Types of Federal Student Loans under the Direct Loan Program

The Direct Loan program offers several types of federal student loans, each designed to meet specific financial needs. The primary distinctions lie in eligibility requirements and interest accrual. These loans are crucial for students seeking to finance their education.

The main types include:

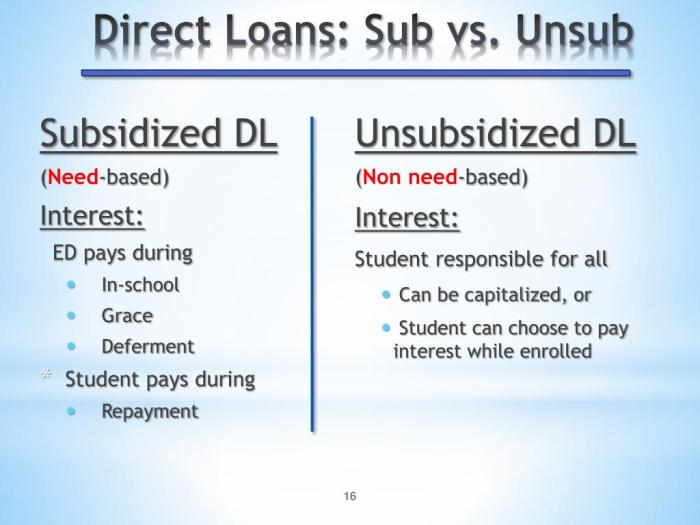

- Direct Subsidized Loans: These loans are need-based and are awarded based on financial need as determined by the Free Application for Federal Student Aid (FAFSA). The government pays the interest while the student is in school at least half-time, during grace periods, and during periods of deferment.

- Direct Unsubsidized Loans: These loans are not need-based and are available to both undergraduate and graduate students regardless of financial need. Interest begins to accrue immediately, even while the student is in school.

- Direct PLUS Loans: These loans are available to graduate and professional students, and to parents of undergraduate students. Credit checks are required, and borrowers must meet certain credit history requirements. Interest accrues from the time the loan is disbursed.

Interest Rates and Repayment Options for Direct Loans

Interest rates for Direct Loans are set annually by the federal government and vary depending on the loan type and the borrower’s loan origination date. These rates are typically lower than those offered by private lenders. Repayment options provide flexibility, allowing borrowers to tailor their repayment plans to their financial circumstances. Borrowers can choose from various repayment plans, including standard, extended, graduated, and income-driven repayment plans. Income-driven repayment plans, in particular, can significantly reduce monthly payments for borrowers with lower incomes.

Comparison of Subsidized and Unsubsidized Loans

The key differences between Subsidized and Unsubsidized loans are summarized below:

| Feature | Subsidized Loan | Unsubsidized Loan |

|---|---|---|

| Eligibility | Based on financial need (determined by FAFSA) | Available to all eligible students, regardless of need |

| Interest Accrual During Deferment | Government pays interest during deferment | Interest accrues during deferment |

| Interest Rate | Same as Unsubsidized Loans for the same loan period | Same as Subsidized Loans for the same loan period |

| Loan Limits | Subject to annual and aggregate limits | Subject to annual and aggregate limits |

Eligibility and Application Process

Securing a National Direct Student Loan involves understanding eligibility criteria and navigating the application process. This section Artikels the requirements for eligibility, details the steps involved in completing the Free Application for Federal Student Aid (FAFSA), explains the verification process, and provides a visual representation of the application journey.

Eligibility Requirements for National Direct Student Loans

Eligibility for federal student aid, including Direct Loans, hinges on several factors. Applicants must be U.S. citizens or eligible non-citizens, have a valid Social Security number, possess a high school diploma or GED, be enrolled or accepted for enrollment at least half-time in an eligible degree or certificate program at a participating institution, and maintain satisfactory academic progress. Furthermore, applicants must demonstrate financial need (for some loan types) and agree to comply with the terms and conditions of the loan program. Specific requirements may vary depending on the type of loan (subsidized, unsubsidized, PLUS loans, etc.). For example, Graduate PLUS loans have additional credit history requirements.

Completing the Free Application for Federal Student Aid (FAFSA)

The FAFSA is the cornerstone of the federal student aid application process. It’s a comprehensive form requesting detailed information about the student and their family’s financial situation. Completing the FAFSA involves several key steps:

- Gather Necessary Information: This includes Social Security numbers, federal tax returns (IRS 1040), W-2s, and other relevant financial documents for both the student and their parents (if applicable).

- Create an FSA ID: Both the student and a parent (if applicable) need to create an FSA ID, which serves as a digital signature for the application.

- Complete the Online FAFSA Form: The form is available online at studentaid.gov. Answer all questions accurately and completely. Remember to select the correct academic year.

- Review and Submit: Carefully review your answers before submitting the form. Once submitted, you can track its status online.

The Verification Process

After submitting the FAFSA, some applicants are selected for verification. This process aims to confirm the accuracy of the information provided on the application. Selected applicants will receive a Student Aid Report (SAR) indicating that verification is required. Common documents requested during verification include tax returns, W-2s, and bank statements. Providing accurate and timely documentation is crucial to avoid delays in processing your financial aid.

Application Process Flowchart

The following flowchart illustrates the steps involved in the application process:

[Imagine a flowchart here. The flowchart would start with “Submit FAFSA,” branch to “Verification Required” (yes/no), with the “yes” branch leading to “Submit Verification Documents,” then both branches converging to “FAFSA Processed,” followed by “Award Notification,” and finally “Loan Disbursement.”] The flowchart visually depicts the sequential steps, highlighting the potential branching point for verification and the ultimate goal of loan disbursement after successful completion of the process. Delays may occur at various points, particularly during the verification stage if additional documentation is needed.

Repayment Plans and Options

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and minimizing long-term costs. Understanding the various options available and their implications is key to responsible financial planning after graduation. This section will Artikel the different repayment plans and help you navigate the complexities of loan repayment.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. This plan offers predictability, as payments remain consistent throughout the repayment term. However, it generally results in higher monthly payments compared to income-driven repayment plans. The advantage lies in its simplicity and the relatively short repayment period, leading to quicker loan payoff. A disadvantage is the potentially higher monthly burden, which may be challenging for borrowers with limited early-career income.

Graduated Repayment Plan

The Graduated Repayment Plan offers lower initial monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating increased income in the future. The lower initial payments are attractive, especially during the early stages of a career when income might be lower. However, the steadily increasing payments can become a significant financial burden later on, potentially making budgeting more difficult. The longer repayment period compared to the Standard plan also leads to increased overall interest payments.

Extended Repayment Plan

The Extended Repayment Plan allows for longer repayment periods, up to 25 years, resulting in lower monthly payments. This option is suitable for borrowers with significant loan balances who need more manageable monthly payments. The benefit is reduced monthly financial stress, making repayment more feasible in the short term. The downside is that significantly more interest accrues over the extended repayment period, leading to substantially higher overall loan costs.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) tie your monthly payment to your income and family size. Several types exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans are designed to make repayment more manageable for borrowers with lower incomes.

Advantages and Disadvantages of Income-Driven Repayment Plans

Income-driven repayment plans offer several key advantages. The most significant is the lower monthly payments, making repayment more affordable, particularly during periods of lower income. They also offer the possibility of loan forgiveness after a specified period of repayment (typically 20 or 25 years), depending on the specific plan and your income. However, IDRs also have disadvantages. The lower monthly payments often mean a longer repayment period, leading to increased overall interest paid. The loan forgiveness aspect, while attractive, may be subject to tax implications upon forgiveness.

Implications of Different Repayment Plans on Long-Term Loan Costs

The choice of repayment plan significantly impacts the total cost of your loan over time. Standard and Graduated Repayment Plans typically lead to lower overall interest payments due to shorter repayment periods. However, the higher monthly payments may be a burden for some borrowers. Conversely, Extended and Income-Driven Repayment Plans result in lower monthly payments but often lead to significantly higher total interest paid over the life of the loan. For example, a $50,000 loan repaid under the Standard plan might cost $70,000 total, while the same loan under an IDR might cost $100,000 or more due to the longer repayment period and accumulated interest.

Resources for Borrowers Seeking Repayment Assistance

Numerous resources are available to help borrowers manage their student loan repayment. The Federal Student Aid website (StudentAid.gov) provides comprehensive information on repayment plans, options, and assistance programs. Your loan servicer is also a valuable resource, offering personalized guidance and assistance with your specific repayment plan. Additionally, many non-profit organizations and credit counseling agencies offer free or low-cost assistance with student loan repayment strategies. These organizations can help you navigate the complexities of repayment and develop a sustainable plan.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and consistent effort. Understanding your loan terms, budgeting effectively, and employing smart repayment strategies are crucial for minimizing stress and achieving financial freedom. This section provides practical advice to help you manage your student loans effectively.

Practical Tips for Effective Student Loan Debt Management

Effective student loan management involves a multifaceted approach. Prioritizing payments, understanding interest accrual, and exploring repayment options are key components. Regularly reviewing your loan statements and actively engaging with your loan servicer are also vital for staying informed and addressing any potential issues promptly.

Budgeting and Prioritizing Loan Payments

Creating a realistic budget is paramount to successful loan repayment. This involves tracking your income and expenses to identify areas where you can reduce spending and allocate more funds towards your loans. Prioritizing high-interest loans for repayment can significantly reduce the overall interest paid over the life of the loans. Consider using budgeting apps or spreadsheets to monitor your progress and stay organized. For example, a simple budget might involve allocating 20% of your monthly income to loan repayment, adjusting this percentage as your income and expenses change.

Understanding Loan Terms and Interest Rates

A thorough understanding of your loan terms, including interest rates, repayment periods, and any associated fees, is fundamental. High interest rates can significantly increase the total cost of your loans over time. Understanding the different types of interest (fixed vs. variable) and how they impact your monthly payments is crucial for making informed decisions. For instance, a loan with a 7% interest rate will accrue significantly more interest than a loan with a 4% interest rate, leading to a larger overall repayment amount.

Creating a Personal Student Loan Repayment Plan

Developing a personalized repayment plan involves several steps. First, consolidate your loans if feasible to simplify the repayment process and potentially secure a lower interest rate. Next, determine an affordable monthly payment amount based on your budget and income. Explore various repayment plans offered by your loan servicer, such as income-driven repayment plans or extended repayment plans, to find one that aligns with your financial circumstances. Finally, set realistic goals and track your progress regularly to ensure you stay on track. For example, you might aim to pay an extra $50 per month towards your loans, gradually increasing this amount as your income increases.

Consequences of Defaulting on Student Loans

Defaulting on your federal student loans has serious and far-reaching consequences that can significantly impact your financial well-being for years to come. It’s crucial to understand these repercussions to make informed decisions about managing your student loan debt. Ignoring your loan obligations can lead to a cascade of negative effects, making it more difficult to achieve your financial goals.

Defaulting on federal student loans triggers a series of actions by the Department of Education, designed to recover the outstanding debt. These actions can have a profound effect on your creditworthiness and future financial opportunities.

Impact on Credit Score and Future Borrowing

Defaulting on student loans severely damages your credit score. A negative mark remains on your credit report for seven years, making it significantly harder to obtain loans, credit cards, or even rent an apartment. Lenders view borrowers who default as high-risk, leading to higher interest rates or outright rejection of loan applications. For example, a borrower with a defaulted student loan might be denied a mortgage, even if they have a stable income, because the default significantly reduces their creditworthiness. The impact on your ability to secure favorable terms on future loans, including mortgages, auto loans, and credit cards, is substantial and long-lasting.

Collection Processes for Defaulted Loans

The Department of Education employs various collection methods for defaulted federal student loans. These can include wage garnishment, where a portion of your paycheck is automatically deducted to repay the loan. Tax refund offset is another method, where your federal tax refund is applied towards your debt. The government may also seize a portion of your Social Security benefits. Furthermore, the Department of Education may refer your debt to a collection agency, which can result in additional fees and aggressive collection tactics. In severe cases, the government may even pursue legal action, leading to the potential seizure of assets. The collection process can be relentless and intrusive, making it imperative to address loan difficulties proactively.

Resources for Borrowers Facing Repayment Difficulties

Fortunately, several resources are available to help borrowers facing difficulties with loan repayment. The Department of Education offers various repayment plans, such as income-driven repayment (IDR) plans, which base your monthly payments on your income and family size. These plans can significantly lower your monthly payments, making them more manageable. Borrowers can also explore options like loan consolidation, which combines multiple loans into a single loan with a potentially lower interest rate. Additionally, you can contact your loan servicer to discuss your options and explore potential solutions, such as forbearance or deferment, which temporarily suspend or reduce your payments. Finally, numerous non-profit organizations and student loan counselors provide free or low-cost assistance with navigating the complexities of student loan repayment. Proactive engagement with these resources can prevent default and mitigate the negative consequences.

Visual Representation of Loan Repayment

Understanding the impact of interest rates on your total loan repayment is crucial for effective financial planning. A visual representation can significantly aid in this understanding, allowing for a clearer comparison of different repayment scenarios. The following chart illustrates how varying interest rates affect the total cost of a loan over time.

This chart depicts a hypothetical $10,000 student loan with varying interest rates, showing the cumulative amount paid over a 10-year repayment period. We assume consistent monthly payments calculated using a standard amortization schedule. The key takeaway is the exponential growth of total interest paid as the interest rate increases.

Comparison of Loan Repayment Costs at Different Interest Rates

The following bar chart visually compares the total repayment costs for a $10,000 loan with different interest rates over a 10-year repayment period. Each bar represents the total amount paid (principal plus interest) for a specific interest rate.

Chart Description:

A bar chart is presented with the horizontal axis representing interest rates (e.g., 4%, 6%, 8%, 10%). The vertical axis represents the total repayment cost in dollars. Each bar corresponds to a specific interest rate, with its height indicating the total cost of repayment over 10 years for a $10,000 loan at that rate. For example, a bar representing a 4% interest rate would be shorter than a bar representing a 10% interest rate, visually demonstrating the significant impact of higher interest rates on the total amount paid.

Example Data (Illustrative):

Let’s assume the following approximate total repayment costs based on a $10,000 loan over 10 years:

- 4% Interest Rate: $11,500 (approximately)

- 6% Interest Rate: $13,000 (approximately)

- 8% Interest Rate: $14,500 (approximately)

- 10% Interest Rate: $16,000 (approximately)

These figures are for illustrative purposes only and actual amounts will vary based on the specific loan terms and amortization schedule.

Comparison with Private Student Loans

Choosing between federal (National Direct Student Loans) and private student loans is a crucial decision impacting your financial future. Understanding the key differences in terms, interest rates, and borrower protections is vital for making an informed choice. This section will Artikel these differences to help you navigate this important selection process.

National Direct Student Loans and private student loans differ significantly in several key aspects. Federal loans, administered by the government, generally offer more borrower protections and flexible repayment options. Private loans, offered by banks and credit unions, are subject to the lender’s terms and conditions, which can be less favorable to borrowers.

Interest Rates and Fees

Interest rates on federal student loans are typically fixed and lower than those on private loans. The interest rate for a federal loan is determined by the government and may vary based on the loan type and the borrower’s creditworthiness. In contrast, private loan interest rates are variable and depend on the borrower’s credit score, credit history, and the lender’s risk assessment. Private loans often come with higher origination fees than federal loans. For example, a federal subsidized loan might have a fixed rate of 5%, while a comparable private loan might have a variable rate starting at 7%, potentially rising higher over time. These differences can significantly impact the total cost of borrowing over the loan’s lifespan.

Borrower Protections

Federal student loans offer significant borrower protections not typically found with private loans. These include income-driven repayment plans, loan forgiveness programs (under specific circumstances like public service), and deferment or forbearance options during periods of financial hardship. Private loans generally lack such comprehensive protections. If a borrower experiences financial difficulty, they may have limited options for modifying their repayment terms with a private lender. The government’s involvement in federal loans ensures a degree of consumer protection absent in the private lending market.

Repayment Options

National Direct Student Loans provide a wider array of repayment plans than private loans. Borrowers can choose from standard repayment, extended repayment, graduated repayment, and income-driven repayment plans. Income-driven repayment plans adjust monthly payments based on the borrower’s income and family size, making repayment more manageable for those with lower incomes. Private loan repayment options are typically more limited, often only offering a standard repayment plan. The flexibility of federal loan repayment plans offers a safety net for borrowers who may experience unforeseen financial challenges.

Advantages and Disadvantages

The following table summarizes the advantages and disadvantages of each loan type to facilitate comparison.

| Feature | National Direct Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, fixed rates | Generally higher, variable or fixed rates |

| Borrower Protections | Stronger protections, including income-driven repayment, deferment, and forgiveness programs | Fewer protections, limited options for hardship |

| Repayment Options | More flexible repayment plans | Fewer repayment options |

| Eligibility Requirements | Generally easier to qualify | More stringent credit and income requirements |

| Fees | Lower or no origination fees | Higher origination fees often apply |

Final Conclusion

Securing a higher education is a significant investment, and understanding the intricacies of National Direct Student Loans is paramount. This guide has provided a comprehensive overview of the program, from eligibility and application to repayment strategies and potential forgiveness options. By carefully considering the information presented, prospective and current borrowers can make informed decisions that align with their financial goals and long-term well-being. Remember, proactive planning and a thorough understanding of your loan terms are key to successfully managing your student loan debt.

Expert Answers

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can offer options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Can I consolidate my federal student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new interest rate and repayment plan. This can simplify payments but may not always lower your overall cost.

How long does it take to get my loan disbursed after approval?

Disbursement timelines vary, but typically, you can expect to receive your funds within a few weeks of your school certifying your enrollment.

What is the difference between a subsidized and unsubsidized loan?

Subsidized loans don’t accrue interest while you’re in school, during grace periods, or in certain deferment periods. Unsubsidized loans accrue interest from the time they’re disbursed.