Navigating the world of student loans can be daunting, especially when considering the various options available. Navy Federal Credit Union offers a range of student loan products designed to help members finance their education. This guide provides a detailed overview of Navy Federal student loans, covering loan types, interest rates, repayment options, eligibility requirements, and more. We’ll explore the advantages and disadvantages, comparing Navy Federal’s offerings to those of other major lenders, to help you make informed decisions about financing your education.

Understanding the nuances of student loan financing is crucial for long-term financial well-being. This guide aims to demystify the process, equipping you with the knowledge needed to confidently choose the best loan option for your individual circumstances. We’ll cover everything from application procedures to potential risks and considerations, ensuring you’re prepared for every step of the journey.

Loan Types Offered by Navy Federal

Navy Federal Credit Union offers a range of student loan products designed to help members finance their education. These loans vary in terms of interest rates, repayment options, and eligibility requirements, providing flexibility to suit different financial situations and educational goals. Understanding the differences between these options is crucial for selecting the most appropriate loan for individual needs.

Navy Federal Student Loan Products

Choosing the right student loan is a significant decision. The following table details the various student loan types offered by Navy Federal, outlining key features to aid in your selection process. Note that specific interest rates and eligibility criteria are subject to change and should be verified directly with Navy Federal.

| Loan Type | Interest Rate Information | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Federal Student Loans (Direct Subsidized/Unsubsidized Loans, Grad PLUS Loans) | Interest rates are set by the federal government and vary depending on the loan type and the year the loan was disbursed. These rates are generally lower than private loan rates. | Standard repayment plans, graduated repayment plans, extended repayment plans, income-driven repayment plans. | U.S. citizenship or eligible non-citizen status, enrollment at least half-time in an eligible educational program, demonstrated financial need (for subsidized loans). |

| Navy Federal Private Student Loans | Variable or fixed interest rates, determined by Navy Federal based on creditworthiness and other factors. Rates are typically higher than federal loan rates. | Various repayment options, including fixed monthly payments, may be available depending on the loan terms. | Membership in Navy Federal Credit Union, acceptable credit history (or a co-signer), enrollment in an eligible educational program. |

| Parent Loans for Undergraduate Students | Interest rates are typically higher than federal student loan rates, and vary depending on creditworthiness. | Various repayment options are available depending on the loan terms. | Membership in Navy Federal Credit Union, acceptable credit history, parent of a student enrolled in an eligible educational program. |

Federal vs. Private Student Loans from Navy Federal

The key difference between federal and private student loans lies in their source and the associated benefits and drawbacks. Federal student loans are backed by the government, offering borrower protections like income-driven repayment plans and loan forgiveness programs under certain circumstances. Private student loans, like those offered by Navy Federal, are not government-backed, meaning they typically come with higher interest rates and fewer borrower protections. Eligibility requirements also differ, with federal loans generally having broader eligibility criteria.

Comparison of Navy Federal Student Loan Options

The following chart compares three distinct Navy Federal student loan options, highlighting key features to facilitate informed decision-making. Remember that actual rates and terms are subject to change.

| Loan Feature | Federal Student Loan (Example: Direct Unsubsidized Loan) | Navy Federal Private Student Loan (Variable Rate) | Navy Federal Parent Loan for Undergraduate Students |

|---|---|---|---|

| Interest Rate | Set by the government, generally lower | Variable, based on creditworthiness, generally higher | Variable, based on creditworthiness, generally higher |

| Repayment Options | Multiple options, including income-driven plans | Fewer options, typically fixed monthly payments | Fewer options, typically fixed monthly payments |

| Loan Forgiveness | Potential for forgiveness programs under certain circumstances | No government-backed forgiveness programs | No government-backed forgiveness programs |

| Eligibility | Generally broader eligibility criteria | Requires Navy Federal membership and acceptable credit (or co-signer) | Requires Navy Federal membership and acceptable credit |

Repayment Options and Plans

Choosing the right repayment plan for your Navy Federal student loan is crucial for managing your debt effectively and minimizing long-term costs. Several options are available, each designed to cater to different financial situations and repayment preferences. Understanding these options will empower you to make informed decisions about your loan repayment strategy.

Navy Federal offers a range of repayment plans to help borrowers manage their student loan debt. The best option will depend on individual financial circumstances and goals. Factors such as income, expenses, and loan amount should be considered when selecting a plan.

Standard Repayment Plan

The standard repayment plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan typically results in the lowest total interest paid over the life of the loan because of the shorter repayment term. However, monthly payments may be higher than other plans.

Graduated Repayment Plan

This plan features lower monthly payments in the initial years, gradually increasing over time. This can be beneficial for borrowers who anticipate an increase in income over the life of the loan. While providing more manageable payments initially, the total interest paid will likely be higher compared to the standard plan due to the longer repayment period.

Extended Repayment Plan

For borrowers with higher loan balances, an extended repayment plan might be a suitable choice. This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments. However, it is important to note that significantly higher interest will accrue over the extended repayment period.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans link your monthly payment amount to your income and family size. These plans are designed to make repayment more manageable for borrowers with lower incomes. Navy Federal may offer various IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). The specific plans available and their eligibility criteria may vary.

Applying for an Income-Driven Repayment Plan

To apply for an IDR plan, you’ll typically need to complete an application through the Navy Federal website or contact their customer service department. You’ll be required to provide documentation verifying your income and family size, such as tax returns or pay stubs. Once your application is approved, your monthly payment amount will be adjusted based on your financial information. Regular recertification of your income may be required periodically to ensure your payment remains accurate.

Hypothetical Repayment Schedule for a $50,000 Loan

The following table illustrates a hypothetical repayment schedule for a $50,000 loan with a 5% interest rate, demonstrating the impact of different repayment plans. Note that these are simplified examples and actual payments may vary depending on individual loan terms and interest rates. This data is purely hypothetical and for illustrative purposes only. Consult Navy Federal for accurate figures.

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard | 10 | $530 | $13,600 |

| Graduated | 10 | Starts at ~$400, increases gradually | ~$16,000 |

| Extended | 25 | ~$260 | ~$40,000 |

Eligibility Requirements and Application Process

Securing a Navy Federal student loan involves meeting specific eligibility criteria and navigating a straightforward application process. Understanding these requirements and steps will help you determine your suitability and ensure a smooth application experience. This section details the necessary steps and provides clarity on the required documentation.

Eligibility for Navy Federal Credit Union student loans hinges primarily on membership and creditworthiness. While specific credit score requirements aren’t publicly advertised, a strong credit history generally improves your chances of approval and may influence the interest rate offered. Additionally, maintaining a good academic standing is crucial throughout your studies.

Membership Requirements

To be eligible for a Navy Federal student loan, you must be a member of the Navy Federal Credit Union. Membership eligibility is generally extended to active-duty military personnel, veterans, Department of Defense employees, and their families. Specific eligibility details can be found on the Navy Federal Credit Union website. Becoming a member typically involves completing an application and meeting the specified criteria for membership.

Credit Score Considerations

While Navy Federal doesn’t explicitly state a minimum credit score, a higher credit score generally leads to more favorable loan terms, such as a lower interest rate. Applicants with limited or poor credit history may find it more challenging to secure a loan or may receive less favorable interest rates. Building a positive credit history before applying is beneficial. This might involve responsible credit card usage or establishing a positive payment history with other financial institutions.

Application Process

The application process for a Navy Federal student loan is generally straightforward and can be completed online. The following steps Artikel the process:

- Check Eligibility: Verify your eligibility for membership and review the loan requirements on the Navy Federal website.

- Gather Documentation: Collect necessary documents such as proof of enrollment, transcripts, and identification.

- Complete the Application: Fill out the online loan application form accurately and completely.

- Submit Supporting Documents: Upload or submit the required supporting documents as part of the application.

- Review and Accept: Carefully review the loan terms and conditions before accepting the loan offer.

- Loan Disbursement: Once approved, the loan funds will be disbursed according to the terms of your loan agreement.

Required Documentation

The specific documentation required may vary depending on the individual circumstances, but generally includes the following:

- Proof of enrollment (acceptance letter or enrollment verification)

- Official or unofficial transcripts (depending on the loan type and institution)

- Valid government-issued photo identification

- Social Security number

- Information about your chosen school and program

- Proof of income (if applicable)

Customer Service and Support

Accessing reliable and responsive customer service is crucial when dealing with significant financial matters like student loans. Navy Federal Credit Union offers various avenues for members to seek assistance and address concerns related to their student loan accounts. Understanding these options and the processes involved in resolving disputes is essential for a positive lending experience.

Navy Federal provides multiple channels for contacting their student loan customer service. These options cater to different preferences and levels of urgency.

Contacting Navy Federal Student Loan Services

Members can reach Navy Federal’s student loan support through several methods. Phone support offers immediate assistance from a representative who can address specific questions or concerns. For less urgent matters, online chat provides a convenient alternative, allowing for real-time interaction with a customer service agent. Email is another option, suitable for submitting detailed inquiries or documentation that may require a more thorough review. The availability and response times of each method may vary. It’s advisable to check Navy Federal’s website for the most up-to-date contact information and hours of operation.

Resolving Disputes and Complaints

Navy Federal Artikels a process for addressing disputes or complaints regarding their student loan services. This typically involves initially contacting customer service through one of the methods described above to attempt a resolution. If the initial contact doesn’t resolve the issue, escalating the complaint to a higher level of management within Navy Federal may be necessary. Documentation of all communication, including dates, times, and summaries of conversations, is highly recommended. Depending on the nature of the dispute, formal channels for complaint resolution, such as those Artikeld by the Consumer Financial Protection Bureau (CFPB), may also be available. Thorough record-keeping is crucial for navigating any potential disputes effectively.

Examples of Customer Experiences

Publicly available information, such as reviews on sites like the Better Business Bureau (BBB) and various online forums, provides insights into customer experiences with Navy Federal’s student loan services. Positive feedback frequently highlights the helpfulness and responsiveness of customer service representatives, efficient loan processing, and competitive interest rates. Negative experiences, however, sometimes mention difficulties in reaching customer service, lengthy wait times, or challenges in resolving specific issues. These varied experiences underscore the importance of utilizing all available resources and escalation procedures when necessary to ensure a satisfactory resolution. It is important to note that individual experiences can vary significantly, and these examples are not representative of all Navy Federal customer interactions.

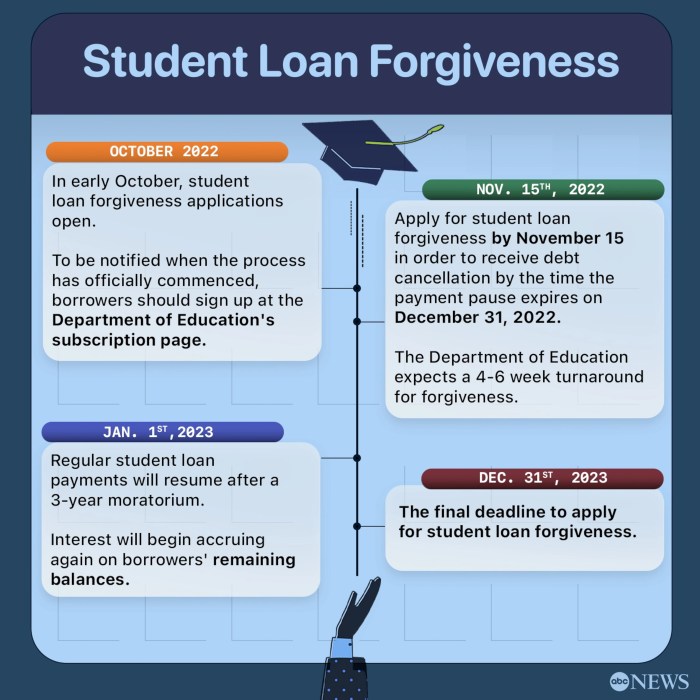

Financial Aid and Loan Consolidation

Navy Federal student loans can be a valuable tool in financing your education, but they’re often most effective when used strategically alongside other financial aid options. Understanding how these loans interact with grants, scholarships, and other loan programs is crucial for maximizing your financial aid package and minimizing your overall debt burden. This section will explore how to leverage Navy Federal student loans and the possibility of consolidating existing student loans for a potentially more manageable repayment plan.

Navy Federal student loans can complement other forms of financial aid by filling the gap between your total educational expenses and the funds received from grants and scholarships. For example, if your tuition and fees total $20,000, and you receive $10,000 in grants and scholarships, a Navy Federal student loan could cover the remaining $10,000. This approach allows you to utilize all available resources effectively. Furthermore, the interest rates and repayment terms offered by Navy Federal can be competitive, making them an attractive option when compared to other private lenders.

Consolidating Student Loans with Navy Federal

Consolidating multiple student loans into a single loan with Navy Federal can simplify the repayment process. Managing several loans with varying interest rates, repayment schedules, and lenders can be complex and time-consuming. Consolidation streamlines this process by combining all your eligible loans into one, often resulting in a single monthly payment and potentially a lower interest rate, depending on your creditworthiness and the terms offered by Navy Federal. However, it is important to carefully review the terms of the consolidation loan to ensure it is the best option for your financial situation. Not all loans are eligible for consolidation.

Impact of Loan Consolidation on Monthly Payments and Overall Interest

The impact of loan consolidation on monthly payments and total interest paid varies depending on several factors, including the interest rates of your existing loans, the interest rate of the consolidated loan, and the loan repayment term. Generally, a longer repayment term will result in lower monthly payments but higher overall interest paid. Conversely, a shorter repayment term will result in higher monthly payments but lower overall interest paid. Consider the following hypothetical example:

| Scenario | Number of Loans | Average Interest Rate | Original Loan Amount | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Before Consolidation | 3 | 7% | $30,000 | $350 | $10,500 |

| After Consolidation (10-year term) | 1 | 6% | $30,000 | $330 | $9,000 |

This example demonstrates how consolidation could potentially lower your monthly payment and the total interest paid over the life of the loan. However, it is crucial to remember that this is a hypothetical scenario, and your actual results may vary. It’s advisable to compare your current repayment plan with the terms offered by Navy Federal before making a decision. The specific terms offered will depend on your individual credit history and financial situation. Contacting a Navy Federal representative to discuss your options and obtain a personalized quote is highly recommended.

Final Thoughts

Securing funding for higher education is a significant step, and choosing the right student loan provider is paramount. Navy Federal Credit Union presents a viable option for eligible members, offering a variety of loan types and repayment plans. By carefully considering your financial situation, comparing options, and understanding the terms and conditions, you can make an informed decision that aligns with your long-term financial goals. Remember to thoroughly research all available options and seek professional financial advice when needed.

Key Questions Answered

What credit score is needed for a Navy Federal student loan?

While Navy Federal doesn’t publicly state a minimum credit score, a good credit history generally improves your chances of approval and securing favorable interest rates.

Can I refinance my existing student loans with Navy Federal?

Yes, Navy Federal offers student loan refinancing options, allowing you to potentially lower your interest rate and consolidate multiple loans into a single payment.

What happens if I miss a student loan payment?

Missing payments will negatively impact your credit score and may result in late fees. Contact Navy Federal immediately if you anticipate difficulties making a payment to explore potential solutions.

Are there any penalties for paying off my Navy Federal student loan early?

Navy Federal generally does not charge prepayment penalties on their student loans.