Navigating the complex world of student loans can feel overwhelming, especially in a bustling state like New York. This guide unravels the intricacies of New York student loans, offering clarity on the various options available, from federal and state programs to private lenders. We’ll explore eligibility requirements, repayment plans, and strategies for effective debt management, equipping you with the knowledge to make informed decisions about your financial future.

Understanding the landscape of New York student loans is crucial for students and their families. This guide aims to demystify the process, providing practical information and resources to help you secure funding for your education and navigate the repayment journey successfully. Whether you’re a prospective student or already managing student loan debt, this comprehensive resource will empower you to take control of your financial well-being.

New York State’s Student Loan Repayment Programs

New York State offers several programs designed to assist residents in managing their student loan debt. These programs provide various forms of assistance, from income-driven repayment plans to loan forgiveness opportunities, aiming to make higher education more accessible and affordable. Understanding these options is crucial for New York borrowers seeking to navigate their student loan repayment journey effectively.

Income-Driven Repayment Plans

New York State doesn’t have its own unique income-driven repayment (IDR) plans separate from the federal programs. However, New York residents are eligible for the federal IDR plans offered through the Department of Education. These plans calculate monthly payments based on your income and family size, potentially lowering your monthly payments and extending your repayment period. The specific plan and its terms will vary depending on your loan type and financial situation. Choosing the right IDR plan can significantly impact your long-term repayment strategy. It’s advisable to carefully compare the various federal IDR options—such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR)—to determine which best suits your individual needs.

New York State’s Public Service Loan Forgiveness Program

The federal Public Service Loan Forgiveness (PSLF) program is available to New York residents employed in qualifying public service jobs. This program can forgive the remaining balance on your Direct Loans after 120 qualifying monthly payments under an IDR plan. To be eligible, you must work full-time for a qualifying government organization or non-profit, make consistent payments, and have Direct Loans. The PSLF program requires careful planning and adherence to specific guidelines. Failing to meet the requirements can result in ineligibility for loan forgiveness. Detailed information on eligible employers and payment tracking can be found on the Federal Student Aid website.

Other New York State Loan Assistance Programs

While New York doesn’t have extensive state-specific loan forgiveness programs beyond those related to public service, it’s important to note that various state agencies and organizations may offer resources and guidance on student loan repayment. These resources might include workshops, financial counseling, and connections to debt management services. Checking with the New York State Higher Education Services Corporation (HESC) or other relevant state agencies can provide access to updated information on available resources and potential assistance programs.

- Public Service Loan Forgiveness (PSLF): Eligibility requires 120 qualifying monthly payments under an IDR plan while employed full-time for a qualifying government organization or non-profit. Benefit: Forgiveness of the remaining loan balance.

- Federal Income-Driven Repayment Plans (IBR, PAYE, REPAYE, ICR): Eligibility is based on income and family size. Benefit: Lower monthly payments and potentially extended repayment periods.

Navigating the Student Loan Application Process in New York

Securing funding for higher education in New York involves understanding the various loan options available and navigating the application processes effectively. Both federal and private loans offer different benefits and drawbacks, and careful consideration is crucial for responsible borrowing. This section details the steps involved in applying for both types of loans and highlights the importance of credit scores in the loan approval process.

Applying for Federal Student Loans in New York

The process for applying for federal student loans in New York is largely the same as in other states. It begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers necessary financial information to determine eligibility for federal grants, loans, and work-study programs. After submitting the FAFSA, students will receive a Student Aid Report (SAR) outlining their eligibility for federal aid. They then work with their chosen college’s financial aid office to accept the offered federal loans and complete any necessary loan paperwork. The federal government directly disburses these funds to the institution.

Applying for Private Student Loans in New York

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, eligibility for private loans is largely based on creditworthiness. Applicants typically need a credit history and a co-signer with good credit may be required, especially for students with limited or no credit history. The application process usually involves completing an online application, providing financial information, and undergoing a credit check. Once approved, the funds are disbursed directly to the student or to the educational institution.

Understanding Credit Scores and Their Impact on Loan Approval

Credit scores play a significant role in the approval process for private student loans and can even influence the interest rates offered. A higher credit score generally indicates lower risk to the lender, resulting in more favorable loan terms. A lower credit score may make it more difficult to secure a loan or may lead to higher interest rates and less favorable repayment terms. Students with limited or no credit history may need a co-signer with a good credit score to increase their chances of approval. Building and maintaining a good credit score is, therefore, crucial for accessing favorable loan terms.

A Step-by-Step Guide for Applying for Student Loans in New York

Understanding the steps involved in the application process can simplify the experience. This ordered list provides a structured approach for students seeking financial aid.

- Complete the FAFSA: This is the first step for federal student aid eligibility.

- Review your Student Aid Report (SAR): Carefully examine your eligibility for federal grants and loans.

- Contact your college’s financial aid office: Discuss your financial aid options and complete any necessary paperwork.

- Explore private loan options (if needed): Research different lenders and compare interest rates and terms.

- Complete the private loan application: Provide the required financial and credit information.

- Understand your loan terms and repayment options: Review the loan agreement carefully before signing.

- Manage your loans responsibly: Make timely payments to maintain a good credit history.

Understanding Student Loan Debt Management in New York

Effective management of student loan debt is crucial for New York residents to avoid financial hardship and maintain a positive credit history. Understanding repayment options, budgeting strategies, and the potential consequences of default are key to navigating this significant financial responsibility. This section will Artikel strategies for responsible debt management, the repercussions of default, and available resources for those struggling with repayment.

Strategies for Effective Student Loan Debt Management

Developing a comprehensive strategy for managing student loan debt involves several key steps. First, create a detailed budget that accurately reflects your income and expenses. This allows you to determine how much you can realistically allocate towards loan repayment each month. Next, prioritize your loans. Consider strategies like the avalanche method (paying off the highest-interest loan first) or the snowball method (paying off the smallest loan first for motivational purposes). Explore different repayment plans offered by your loan servicers, such as income-driven repayment plans, which adjust your monthly payments based on your income and family size. Finally, maintain open communication with your loan servicers. Contact them if you anticipate difficulties making payments to explore potential solutions before defaulting. Proactive communication is vital in preventing negative consequences.

Implications of Defaulting on Student Loans in New York

Defaulting on student loans in New York carries severe consequences. These consequences can significantly impact your financial future and creditworthiness. Defaulting can result in wage garnishment, where a portion of your paycheck is automatically withheld to repay the debt. Your tax refund may also be seized to cover outstanding loan balances. Furthermore, defaulting will negatively affect your credit score, making it difficult to obtain loans, rent an apartment, or even secure certain jobs in the future. The negative impact on your credit score can persist for years, making it harder to achieve long-term financial stability. It is crucial to understand that the repercussions of default extend beyond simple financial penalties; they significantly impact your overall financial health and opportunities.

Resources Available to New York Students Struggling with Student Loan Repayment

Several resources are available to New York students facing difficulties repaying their student loans. The New York State Higher Education Services Corporation (HESC) provides guidance and assistance to borrowers. They offer counseling services, information on repayment options, and resources for managing debt. Additionally, many non-profit organizations and credit counseling agencies provide free or low-cost assistance with student loan debt management. These agencies can help you create a budget, negotiate with your loan servicers, and explore options like debt consolidation or income-driven repayment plans. Seeking professional assistance can provide valuable support and guidance in navigating complex financial situations. Don’t hesitate to utilize these resources; they are designed to help you find solutions and avoid default.

Potential Consequences of Loan Default and Available Solutions

| Consequence of Default | Impact | Available Solution | Action to Take |

|---|---|---|---|

| Wage Garnishment | Portion of paycheck withheld for loan repayment. | Income-driven repayment plan, deferment, forbearance. | Contact your loan servicer immediately to explore options. |

| Tax Refund Seizure | Federal and state tax refunds seized to repay debt. | Negotiate a repayment plan, seek debt consolidation. | File your taxes early and contact your loan servicer. |

| Negative Credit Score Impact | Difficulty obtaining loans, renting, or securing employment. | Credit counseling, debt management plan. | Seek professional help to improve credit score. |

| Legal Action | Lawsuits and potential wage garnishment. | Negotiate a repayment plan, seek legal counsel. | Contact your loan servicer and consult with a legal professional. |

The Impact of Student Loans on New York’s Economy

Student loan debt significantly impacts New York’s economy, affecting both individual financial stability and the state’s overall economic health. The substantial amount of debt held by New Yorkers influences consumer spending, investment in businesses, and the state’s long-term workforce potential. Understanding this impact is crucial for developing effective economic and social policies.

The relationship between student loan debt and personal financial stability in New York is complex but demonstrably negative. High levels of debt can hinder major life decisions such as homeownership, starting a family, and even entrepreneurial pursuits. This constraint on personal spending power ripples through the state’s economy, limiting overall consumer demand and impacting various sectors.

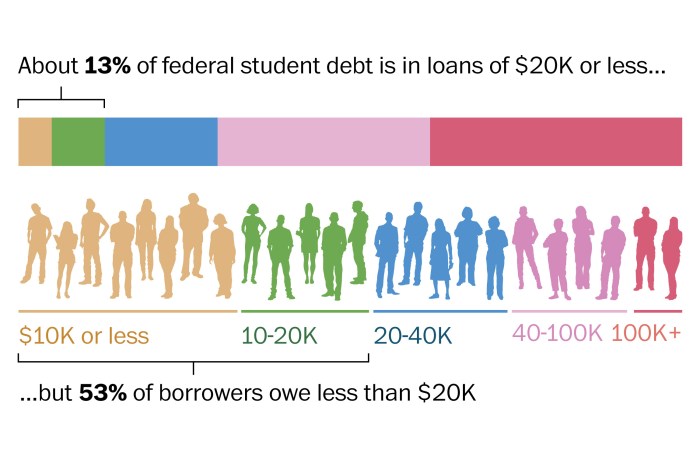

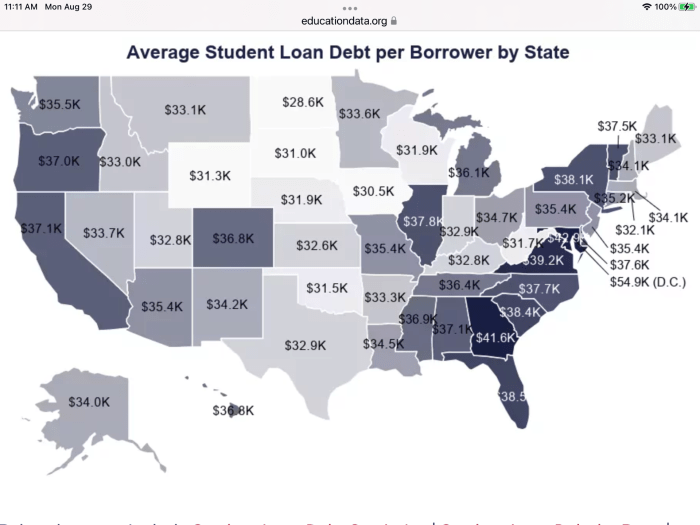

Prevalence of Student Loan Debt Among New York Residents

Data from the Federal Reserve and the New York State Department of Financial Services consistently show a high prevalence of student loan debt among New York residents. For example, a significant percentage of New York graduates leave college with substantial debt burdens, often exceeding $30,000. This figure is frequently higher for graduate degrees. The sheer number of borrowers and the average debt amount contribute significantly to the overall economic strain. The consequences of this high debt burden are widespread and far-reaching.

Long-Term Consequences of High Student Loan Debt on New York’s Workforce

High student loan debt presents several long-term consequences for New York’s workforce. Delayed homeownership, for instance, limits both individual wealth accumulation and the growth of the real estate market. Furthermore, the pressure to repay loans can discourage individuals from pursuing entrepreneurial ventures or relocating for better job opportunities, thereby hindering economic dynamism and innovation. The burden of debt can also lead to delayed family formation, affecting demographic trends and long-term economic growth. In short, the long-term effect of high student loan debt creates a significant drag on New York’s economic potential. For example, studies show a correlation between high student debt and delayed career progression in certain fields, reducing overall productivity and economic output.

Illustrative Examples of Student Loan Scenarios in New York

This section presents several hypothetical scenarios to illustrate the diverse experiences New York students may face with student loans, encompassing federal loans, state repayment programs, and instances of repayment difficulties. Understanding these scenarios can help students better navigate the complexities of student loan debt.

Federal Loan Scenario: Maria’s Experience

Maria, a New York resident, attends SUNY Albany and receives federal Direct Subsidized and Unsubsidized Loans to cover her tuition and living expenses. She diligently tracks her loan amounts and repayment plans, carefully budgeting to minimize her debt. Upon graduation, she secures a job in her field and begins making timely payments on her federal loans. While she experiences some financial strain initially, her proactive approach to loan management prevents significant hardship. Her careful budgeting and timely payments contribute to a positive credit history and facilitate future financial endeavors.

State-Sponsored Repayment Program Scenario: David’s Case

David, a recent graduate of a New York City college, works for a non-profit organization that qualifies him for New York’s Student Loan Repayment Assistance Program. This program helps him manage his student loan debt by reducing his monthly payments. The reduced payments significantly alleviate the financial burden, allowing David to focus on saving for a down payment on a home and investing in his professional development. The state-sponsored program offers a critical lifeline, enabling him to achieve his financial goals without excessive student loan debt stress.

Student Loan Repayment Struggle Scenario: Sarah’s Challenges

Sarah, a New York State resident, graduated with significant student loan debt and faces challenges in managing her repayments. After graduation, she experienced unemployment and unforeseen medical expenses, hindering her ability to make consistent loan payments. She is currently exploring options like income-driven repayment plans and contacting her loan servicers to discuss deferment or forbearance options. Sarah’s situation highlights the importance of proactive communication with lenders and exploring available assistance programs when facing financial hardship. She is actively seeking guidance from credit counseling agencies to create a manageable repayment strategy.

Outcome Summary

Securing a higher education in New York often involves navigating the complexities of student loans. This guide has provided a framework for understanding the different loan types, repayment options, and potential challenges. By carefully considering your individual circumstances and utilizing the available resources, you can create a manageable repayment plan and achieve long-term financial stability. Remember to proactively manage your debt and seek assistance when needed – your future financial health depends on it.

FAQs

What is the difference between federal and private student loans in New York?

Federal loans are offered by the government and typically have more favorable interest rates and repayment options. Private loans are offered by banks and credit unions and often have higher interest rates and stricter eligibility requirements.

Can I consolidate my New York student loans?

Yes, you can consolidate multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment, but it may not always lower your overall interest rate.

What happens if I default on my student loans in New York?

Defaulting on student loans can have severe consequences, including wage garnishment, tax refund offset, and damage to your credit score. It can also make it difficult to obtain future loans or credit.

Where can I find additional help with my New York student loans?

The New York State Higher Education Services Corporation (HESC) and the federal government’s StudentAid.gov website offer valuable resources and assistance.