Navigating the complexities of higher education financing can be daunting, particularly when understanding the nuances of state-specific loan programs. This guide delves into the world of NJ Class student loans, providing a clear and concise overview of their various types, application processes, repayment options, and associated financial aid considerations. We aim to equip New Jersey students with the knowledge necessary to make informed decisions about their educational funding.

From eligibility requirements and interest rates to repayment plans and debt management strategies, we cover all the essential aspects of NJ Class student loans. We’ll also explore how these loans compare to other financial aid options and offer practical advice for managing student loan debt effectively after graduation. This comprehensive resource serves as a valuable tool for students, parents, and anyone seeking a deeper understanding of this crucial aspect of financing a New Jersey education.

Understanding NJ Class Student Loans

Navigating the world of student loans can be daunting, especially when dealing with the specifics of state-sponsored programs. This section provides a clear overview of New Jersey Class student loans, outlining the various types available, their eligibility requirements, and key features to help you make informed decisions.

Types of NJ Class Student Loans

New Jersey offers several types of student loans under the Class loan program, each designed to cater to different financial needs and student profiles. These programs typically fall under the umbrella of the New Jersey Higher Education Student Assistance Authority (HESAA). While specific program names and details may change over time, the core categories generally remain consistent. Understanding these categories is crucial for selecting the most suitable loan option. Precise details should always be verified directly with HESAA.

Eligibility Requirements for NJ Class Student Loans

Eligibility for NJ Class student loans hinges on several factors. Generally, applicants must be New Jersey residents attending eligible institutions of higher education. Specific requirements might include maintaining satisfactory academic progress, demonstrating financial need (for need-based programs), and completing the Free Application for Federal Student Aid (FAFSA). Some programs might also have age restrictions or limitations based on the type of program or degree pursued. Again, it’s essential to confirm current requirements with HESAA.

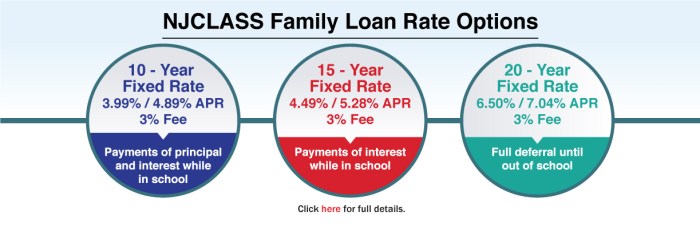

Interest Rates and Repayment Options for NJ Class Student Loans

Interest rates and repayment options vary across different NJ Class student loan programs. Interest rates are usually fixed, but they can fluctuate based on market conditions at the time of loan disbursement. Repayment plans typically include standard repayment schedules (fixed monthly payments over a set period), graduated repayment (payments increase over time), and income-driven repayment (payments are tied to your income). For precise interest rates and repayment plan details for any given period, you must consult HESAA’s official resources.

Comparison of NJ Class Student Loan Programs

The following table summarizes key features of different (hypothetical) NJ Class student loan programs. Remember that these are examples, and actual programs and their details may vary. Always refer to HESAA for the most up-to-date information.

| Loan Type | Interest Rate (Example) | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Need-Based Loan | 3.5% | Standard, Graduated, Income-Driven | NJ residency, FAFSA completion, demonstrated financial need |

| Merit-Based Loan | 4.0% | Standard, Graduated | NJ residency, high GPA, specific program enrollment |

| Parent Loan | 5.0% | Standard, Extended | NJ residency, parent of enrolled student |

| Unsubsidized Loan | 6.0% | Standard | NJ residency, enrollment in eligible program |

Applying for NJ Class Student Loans

Securing funding for your education through the NJ Class student loan program involves a straightforward application process. This section details the steps involved, required documentation, and helpful resources to guide you through the application. Careful preparation and attention to detail will ensure a smooth and successful application.

The application process for NJ Class student loans is primarily handled online, making it convenient and efficient. The entire process is designed to be user-friendly, minimizing any potential complexities. However, it’s crucial to gather all necessary documents beforehand to streamline the application submission.

Application Process Steps

The application process generally follows these steps. It is recommended to review the official website for the most up-to-date instructions, as procedures may be subject to minor revisions.

- Create an Account: Begin by creating an online account on the designated NJ Class student loan portal. This usually involves providing basic personal information and creating a secure password.

- Complete the Application Form: Once logged in, you will access the online application form. This form requires detailed information about your personal background, academic history, and financial situation. Accuracy is paramount; ensure all details are correct.

- Upload Supporting Documents: The online system will guide you through uploading the necessary supporting documents. This typically includes proof of enrollment, transcripts, and financial aid documentation.

- Review and Submit: Thoroughly review the completed application and all uploaded documents for accuracy and completeness before submitting it. Once submitted, you cannot make changes without contacting the loan office.

- Await Processing: After submission, your application will be processed. The processing time may vary depending on the volume of applications and the completeness of your submission. You will receive notifications regarding the status of your application.

Required Documentation

Having all necessary documentation prepared before starting the application process is crucial for a smooth and efficient experience. Incomplete applications may lead to delays.

- Proof of Enrollment: This typically includes an acceptance letter from your chosen college or university, or a current enrollment verification form.

- Transcript(s): Official transcripts from any previously attended colleges or universities are often required. These should be sent directly from the institution to the loan processing center.

- Financial Aid Information: This may include your FAFSA (Free Application for Federal Student Aid) data, or other financial aid award letters. This helps determine your financial need and eligibility for the loan.

- Government-Issued Identification: A valid driver’s license or other government-issued photo ID is usually necessary for verification purposes.

- Social Security Number: Your Social Security Number (SSN) is required for identity verification and loan processing.

Application Resources and Links

While specific links may change, it’s recommended to search for “NJ Class Student Loans” on the official New Jersey Higher Education website. This will provide the most current information on the application process and necessary forms. The website will typically have a dedicated section for student financial aid, where you’ll find application portals and relevant documentation.

Repaying NJ Class Student Loans

Successfully navigating the repayment of your NJ Class student loan is crucial to your financial well-being. Understanding the various repayment options and their implications will help you choose a plan that best suits your circumstances and avoid potential financial difficulties. This section details the different repayment plans, potential consequences of default, and available deferment and forbearance options.

The New Jersey Higher Education Student Assistance Authority (HESAA) offers several repayment plans for NJ Class loans. The best option for you will depend on your income, budget, and long-term financial goals. Choosing a plan that fits your current financial situation is vital to ensure timely repayment and avoid negative consequences.

Repayment Plan Options

Several repayment plans are available to borrowers of NJ Class student loans, each with its own terms and conditions. These plans allow for flexibility in managing loan repayments, catering to different financial situations. HESAA’s website provides detailed information on each plan’s specifics, including interest rates and repayment periods.

For example, a standard repayment plan might involve fixed monthly payments over a 10-year period. Let’s say a borrower has a $20,000 loan with a 5% interest rate. Their monthly payment might be approximately $212. A graduated repayment plan, on the other hand, would start with lower monthly payments that gradually increase over time, offering relief in the initial years but leading to higher payments later in the repayment period. An income-driven repayment plan would adjust payments based on the borrower’s income, potentially resulting in lower monthly payments but extending the repayment period.

Consequences of Default

Failing to make timely payments on your NJ Class student loan can lead to serious consequences. Defaulting on your loan negatively impacts your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Additionally, wage garnishment, tax refund offset, and legal action may be taken to recover the outstanding debt. These actions can significantly strain your finances and create long-term financial hardship.

For instance, a borrower who defaults on their loan could face a significant drop in their credit score, making it harder to secure a mortgage for a home purchase. Furthermore, a portion of their wages could be garnished, reducing their disposable income and creating financial stress. Understanding these consequences emphasizes the importance of proactive repayment planning and seeking assistance if facing difficulties.

Deferment and Forbearance Options

HESAA provides deferment and forbearance options to borrowers experiencing temporary financial hardship. These options offer temporary pauses or reductions in loan payments, preventing default while addressing short-term financial challenges. However, it is important to note that interest may still accrue during deferment or forbearance periods, increasing the total loan amount over time. Borrowers should carefully consider the implications before opting for these options.

- Deferment: A temporary postponement of loan payments. Common reasons for deferment include unemployment, graduate school enrollment, or military service. Specific eligibility criteria apply.

- Forbearance: A temporary reduction or suspension of loan payments. This option is typically granted due to temporary financial hardship, such as a medical emergency or job loss. The terms and conditions of forbearance vary depending on the circumstances.

Financial Aid and NJ Class Student Loans

NJ Class student loans represent one piece of the financial aid puzzle for New Jersey students pursuing higher education. Understanding how they fit within the broader landscape of available aid is crucial for effective financial planning. This section compares NJ Class loans with other aid options, highlighting their advantages and disadvantages, and explaining how they can be combined with other funding sources.

Many financial aid options exist beyond NJ Class loans, each with its own eligibility criteria and implications. These include federal grants and loans, state grants, institutional scholarships, and private loans. Choosing the right combination depends heavily on individual circumstances, including academic merit, financial need, and the chosen institution.

Comparison of NJ Class Loans with Other Financial Aid

NJ Class loans differ significantly from grants and scholarships, primarily in that they require repayment. Grants and scholarships, on the other hand, are generally forms of free money that don’t need to be paid back. While NJ Class loans offer a readily accessible funding source, they add to a student’s overall debt burden. Conversely, grants and scholarships reduce the overall cost of education, lessening the need for borrowing. The availability of grants and scholarships is often competitive, based on merit or financial need, whereas NJ Class loans are available to eligible New Jersey residents.

Combining NJ Class Loans with Other Financial Aid

The process of combining NJ Class loans with other aid sources is relatively straightforward. Students typically apply for federal financial aid (FAFSA), state grants, and institutional aid through their chosen college or university. After receiving their award letters outlining the grants, scholarships, and other aid received, students can then determine the remaining funding gap. This gap can be filled using NJ Class loans, private loans, or a combination of both. It’s crucial to carefully review all award letters and understand the terms and conditions of each funding source before accepting any aid.

Advantages and Disadvantages of Different Financial Aid Options

| Financial Aid Option | Advantages | Disadvantages |

|---|---|---|

| NJ Class Student Loans | Readily available to eligible NJ residents; predictable repayment terms; can fill funding gaps. | Accumulates debt; interest accrues; impacts credit score if not repaid on time. |

| Grants (e.g., Pell Grant) | Free money; does not need to be repaid; can significantly reduce educational costs. | Competitive; eligibility requirements; may not cover the full cost of education. |

| Scholarships (e.g., Merit-based scholarships) | Free money; does not need to be repaid; can be based on merit or specific criteria. | Highly competitive; requires strong academic record or specific qualifications; may have limited availability. |

| Private Loans | Can fill funding gaps; various lenders offer different options. | Typically higher interest rates than federal loans; may require a co-signer; can lead to significant debt. |

Managing Student Loan Debt in New Jersey

Graduating from college in New Jersey, or anywhere for that matter, often comes with the bittersweet reality of student loan debt. Effectively managing this debt is crucial for establishing financial stability and achieving long-term financial goals. This section Artikels strategies for navigating the complexities of student loan repayment in New Jersey.

Budgeting and Prioritizing Student Loan Payments

Creating a realistic budget is the cornerstone of successful student loan repayment. This involves tracking all income and expenses to identify areas where spending can be reduced. Prioritizing student loan payments within this budget ensures consistent repayment and avoids late payments, which can negatively impact your credit score. A practical approach involves categorizing expenses as needs (housing, food, transportation) and wants (entertainment, dining out). By focusing on reducing unnecessary spending in the “wants” category, you can free up funds for loan payments. For example, reducing daily coffee purchases or canceling unused subscriptions can accumulate significant savings over time. Consider using budgeting apps or spreadsheets to monitor your spending and track progress towards your financial goals.

Maintaining Good Credit While Repaying Student Loans

Maintaining a good credit score is paramount during student loan repayment. A strong credit score opens doors to better interest rates on future loans, credit cards, and even mortgages. Consistent on-time payments on your student loans are a significant factor in building credit. Additionally, monitoring your credit report regularly for errors and ensuring all accounts are reported accurately is essential. Paying more than the minimum payment each month can further enhance your credit score, demonstrating responsible financial behavior to lenders. In New Jersey, as in other states, accessing your credit report is free annually through AnnualCreditReport.com, allowing you to actively monitor your credit health.

Creating a Personal Student Loan Repayment Plan

Developing a personalized student loan repayment plan involves several steps. First, consolidate all your student loans into one manageable payment, if feasible. This simplifies tracking and payment. Second, explore different repayment plans offered by your loan servicer. Income-driven repayment plans, for example, adjust your monthly payments based on your income and family size. Third, prioritize higher-interest loans first, using the avalanche or snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first, while the snowball method prioritizes the loan with the smallest balance. Fourth, automate your payments to avoid missed payments and ensure consistency. Finally, regularly review and adjust your plan as your financial situation changes. This proactive approach allows for flexibility and adaptability as your income and expenses fluctuate.

Resources for NJ Student Loan Borrowers

Navigating student loan debt can be challenging, but New Jersey offers several resources and support services to help borrowers manage their finances and explore repayment options. Understanding these resources is crucial for borrowers facing financial difficulties or seeking ways to reduce their overall debt burden. This section Artikels key support systems available to New Jersey student loan borrowers.

Key Resources and Support Services for NJ Student Loan Borrowers

New Jersey provides a variety of support services designed to assist student loan borrowers in various situations. These services range from counseling and guidance to potential loan forgiveness programs and income-driven repayment plans. Utilizing these resources can significantly impact a borrower’s ability to manage their debt effectively and avoid default.

- Student Loan Counseling Services: These services provide personalized guidance on repayment strategies, budgeting techniques, and debt management options. Counselors can help borrowers understand their repayment options, explore potential hardship programs, and create a manageable repayment plan.

- State Agencies and Non-profit Organizations: Several state agencies and non-profit organizations offer assistance with student loan repayment. These organizations often provide free or low-cost counseling and resources to help borrowers navigate the complexities of student loan repayment.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust monthly payments based on income and family size. These plans can significantly lower monthly payments, making them more manageable for borrowers facing financial hardship. Eligibility criteria vary depending on the loan type and lender.

- Loan Forgiveness Programs: While opportunities for complete loan forgiveness are limited, some programs may offer partial loan forgiveness for borrowers working in specific public service fields, such as teaching or healthcare. Specific eligibility requirements and application processes vary depending on the program.

The Role of Student Loan Counseling Services in New Jersey

Student loan counseling services in New Jersey play a vital role in assisting borrowers facing financial challenges. These services offer personalized guidance and support, helping borrowers understand their repayment options and develop strategies for managing their debt effectively. Counselors can help borrowers navigate the complexities of federal and state loan programs, explore options such as income-driven repayment plans or loan consolidation, and create a budget to manage their monthly payments. Many counseling services are available at no cost or for a low fee.

Loan Forgiveness Programs and Income-Driven Repayment Plans for NJ Class Student Loan Borrowers

While specific loan forgiveness programs may be limited to federal student loans, income-driven repayment (IDR) plans are often available for both federal and some private student loans. IDR plans calculate monthly payments based on your income and family size, potentially reducing your monthly payment significantly. Several IDR plans exist, each with its own eligibility requirements and repayment terms. For NJ Class student loan borrowers, exploring IDR plans is a crucial step in managing debt effectively. Loan forgiveness programs, particularly those focused on public service, might be available depending on the borrower’s specific loan type and employment.

Contact Information for Relevant New Jersey State Agencies and Organizations

- New Jersey Higher Education Student Assistance Authority (HESAA): HESAA is the primary state agency responsible for administering student financial aid programs in New Jersey. They can provide information on various state-specific student loan programs and resources. Contact information can be found on their official website.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a federal agency that provides resources and tools to help consumers understand and manage their finances, including student loan debt. They offer educational materials and guidance on various debt management strategies.

- National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers certified credit counselors who can provide guidance on managing student loan debt. They offer various services, including budgeting assistance and debt management plans.

Final Review

Securing a higher education is a significant investment, and understanding the intricacies of student loan programs is crucial for financial success. This guide has provided a thorough exploration of NJ Class student loans, encompassing application procedures, repayment strategies, and the broader context of financial aid. By utilizing the information presented here, New Jersey students can confidently navigate the process of obtaining and managing their student loans, setting themselves on a path towards a brighter financial future. Remember to explore all available resources and seek professional guidance when needed to make the best decisions for your unique circumstances.

FAQ Corner

What happens if I miss a payment on my NJ Class student loan?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, impacting your ability to obtain future loans or credit.

Can I consolidate my NJ Class student loans?

Consolidation might be possible; check with your loan servicer or the New Jersey Higher Education Student Assistance Authority (HESAA) for details.

Are there any income-driven repayment plans available for NJ Class loans?

Yes, several income-driven repayment plans may be available. Contact your loan servicer or HESAA to learn more about your eligibility.

What resources are available if I’m struggling to repay my loans?

HESAA offers counseling services and may have programs to assist borrowers facing financial hardship. Explore their website for details.