Navigating the complexities of higher education often involves securing student loans. Understanding the intricacies of these financial instruments is crucial for successful academic pursuits and future financial well-being. This guide delves into the world of NLDS student loans, providing a clear and concise overview of their structure, eligibility requirements, repayment options, and potential challenges. We aim to empower prospective and current borrowers with the knowledge needed to make informed decisions and manage their student loan debt effectively.

From exploring the various types of NLDS loans available and comparing them to other student loan programs, to understanding interest rates, fees, and repayment strategies, this guide offers a holistic perspective. We’ll also address common concerns, such as managing financial hardship and avoiding loan default, providing practical solutions and resources to help borrowers navigate their financial journey successfully.

Understanding NLDS Student Loans

Navigating the world of student loans can be complex, and understanding the specifics of each program is crucial for responsible borrowing and repayment. This section focuses on National Direct Student Loan (NLDS) programs, outlining their structure, types, and comparison to other loan options. While the specifics can vary based on the lending institution and the year the loan was disbursed, the core principles remain consistent.

NLDS loans are federal student loans, meaning they are offered by the U.S. Department of Education. Unlike private student loans, these loans are backed by the government, offering borrowers certain protections and benefits. The structure of an NLDS loan typically includes a principal amount (the original loan amount), an interest rate (the cost of borrowing the money), and a repayment period (the timeframe for repaying the loan). These components interact to determine the total cost of the loan over time.

Types of NLDS Student Loans

NLDS loans historically encompassed several types, each designed for different educational needs and financial situations. These included subsidized and unsubsidized loans, both for undergraduates and graduate students. Subsidized loans typically did not accrue interest while the borrower was enrolled at least half-time, while unsubsidized loans accrued interest from the time of disbursement. Parent PLUS loans allowed parents to borrow on behalf of their children, and Graduate PLUS loans provided funding for graduate students. It’s important to note that the specific programs and their availability may change over time, so consulting the official Department of Education website for the most up-to-date information is recommended.

Comparison of NLDS Loans with Other Student Loan Programs

NLDS loans are often compared to private student loans and other federal loan programs. A key difference lies in the repayment options and protections offered. NLDS loans typically provide a range of income-driven repayment plans, forbearance options, and loan forgiveness programs, which may not be available with private loans. Private loans, while sometimes offering lower interest rates, usually lack the same level of government support and borrower protections. Other federal loan programs, like Perkins Loans (now largely discontinued), may have had different eligibility requirements and interest rates. A thorough comparison of these options is necessary to determine the best fit for individual circumstances.

Typical Repayment Plans for NLDS Student Loans

Several repayment plans exist for NLDS loans, designed to accommodate various income levels and financial situations. Standard repayment plans typically involve fixed monthly payments over a 10-year period. However, income-driven repayment plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, adjust monthly payments based on income and family size. These plans can result in lower monthly payments but may extend the repayment period and increase the total interest paid over the life of the loan. Deferment and forbearance options can temporarily suspend or reduce payments under specific circumstances, such as unemployment or financial hardship. It is essential to understand the terms and conditions of each plan before selecting one. For example, a borrower earning $40,000 annually might find an income-driven plan more manageable than a standard plan, even though the total repayment time would be longer.

Eligibility Criteria for NLDS Student Loans

Securing an NLDS student loan hinges on meeting specific eligibility requirements. These criteria are designed to ensure that the loan program effectively supports students who demonstrate both financial need and a commitment to their education. Understanding these requirements is crucial for prospective applicants to determine their suitability for the program and to prepare a strong application.

The eligibility criteria for NLDS student loans typically encompass several key areas: academic standing, enrollment status, citizenship or residency requirements, and financial considerations including income and credit history. The specific requirements might vary slightly depending on the lending institution and the specific loan program, so it’s always recommended to check the official guidelines of the lender.

Key Requirements for NLDS Student Loan Applicants

Applicants generally need to be enrolled or accepted for enrollment in an eligible educational program at a participating institution. This often means being a full-time or part-time student pursuing a degree, certificate, or other recognized qualification. Proof of enrollment or acceptance letter is usually required. Additionally, most programs require applicants to be a citizen or permanent resident of the country administering the NLDS loan program. Specific age limits might also apply, depending on the program. Finally, satisfactory academic progress is usually a requirement, demonstrating a commitment to completing studies successfully. This is often measured by maintaining a minimum GPA or credit completion rate.

Income and Credit History Considerations for Loan Approval

While not all NLDS student loan programs require a robust credit history, many lenders will consider an applicant’s creditworthiness as part of the approval process. A positive credit history, demonstrating responsible financial management, can improve the chances of loan approval and potentially lead to more favorable interest rates. Conversely, a poor credit history, including defaults or late payments, might negatively impact the application. Similarly, income verification is often a part of the process. Lenders may assess an applicant’s income and financial resources to determine their ability to repay the loan after graduation. This might involve submitting tax returns or pay stubs. The income requirements can vary, but generally, the higher the income, the greater the borrowing capacity.

The Process of Applying for NLDS Student Loans

Applying for an NLDS student loan usually involves completing an online application form. This form will require detailed personal information, academic details, and financial information. Applicants should be prepared to provide supporting documentation, such as proof of enrollment, transcripts, tax returns, and pay stubs. The application process also includes credit checks and verification of income. After the application is submitted, the lender will review the application and supporting documents and will notify the applicant of their decision.

Step-by-Step Guide for Completing the NLDS Loan Application

- Gather Necessary Documents: Collect all required documents, including proof of enrollment, transcripts, identification, tax returns, and pay stubs.

- Complete the Online Application: Carefully fill out the online application form, ensuring accuracy and completeness of all information.

- Upload Supporting Documents: Upload all necessary supporting documents as specified in the application instructions.

- Review and Submit: Thoroughly review the completed application and supporting documents before submitting.

- Await Notification: After submission, wait for notification from the lender regarding the status of the application.

Interest Rates and Fees Associated with NLDS Student Loans

Understanding the financial aspects of NLDS student loans is crucial for responsible borrowing. This section details the interest rates and fees associated with these loans, allowing you to make informed decisions about your financing. We will examine how interest rates are calculated, Artikel various fees, and offer a comparison with other lending institutions.

Interest Rate Determination for NLDS Student Loans

The interest rate applied to an NLDS student loan is not a fixed number; rather, it’s variable and depends on several factors. These factors typically include the prevailing market interest rates at the time of loan disbursement, the loan’s repayment term, and potentially the borrower’s creditworthiness (though this is less common with government-backed student loans). The specific formula used by NLDS to calculate the interest rate might not be publicly available, but it’s generally tied to a benchmark rate, such as the prime lending rate or a government bond yield, plus a margin that reflects the risk associated with the loan. This means interest rates can fluctuate over the life of the loan, potentially leading to changes in your monthly payments. For example, if market interest rates rise, your interest rate may also increase.

Fees Associated with NLDS Student Loans

Several fees can be associated with NLDS student loans. These fees contribute to the overall cost of borrowing and should be carefully considered when planning your finances.

Origination Fees

Origination fees are charges levied by the lender (in this case, NLDS) to cover the administrative costs involved in processing your loan application and disbursing the funds. These fees are typically a percentage of the total loan amount and are usually deducted from the loan proceeds before they are paid to the student. For instance, an origination fee of 1% on a $10,000 loan would result in a $100 fee.

Late Payment Penalties

Late payment penalties are imposed if you fail to make your loan payments on time. These penalties can significantly increase the total cost of your loan. The amount of the penalty varies depending on the NLDS’s policies and might be a fixed dollar amount or a percentage of the missed payment. Consistent on-time payments are crucial to avoid incurring these additional costs.

Comparison of NLDS Loan Interest Rates and Fees with Other Lenders

Comparing NLDS loan interest rates and fees with those offered by private lenders is essential for making an informed decision. Generally, NLDS loans are considered to have lower interest rates compared to private student loans. However, this can vary depending on prevailing market conditions and the specific loan terms. Private lenders often charge higher interest rates to compensate for the increased risk associated with lending to students, which may offset the potential benefits of a lower origination fee. The key is to carefully review the total cost of borrowing, including all fees and interest, from both NLDS and private lenders, before making a decision.

Interest Rates and Fees Summary Table

| Loan Type | Interest Rate Type | Typical Interest Rate Range (%) | Typical Fees |

|---|---|---|---|

| NLDS Student Loan | Variable | 3-7 (Example range, actual rates vary) | Origination Fee (e.g., 1%), Late Payment Penalty (e.g., $25 or percentage of payment) |

| Private Student Loan (Example) | Variable or Fixed | 5-12 (Example range, actual rates vary greatly depending on creditworthiness) | Origination Fee (variable), Late Payment Penalty (variable), other potential fees |

Repayment Options and Strategies for NLDS Student Loans

Understanding your repayment options and developing a sound strategy are crucial for successfully managing your NLDS student loan debt. Choosing the right repayment plan and sticking to a budget can significantly impact the length of time it takes to repay your loans and the total amount of interest you pay. This section Artikels available repayment options and provides strategies for effective debt management.

Available Repayment Options for NLDS Student Loans

The specific repayment options available for NLDS student loans may vary depending on the lender and the type of loan. However, common options generally include:

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a standard repayment period (e.g., 10 years). The payment amount is calculated based on the loan’s principal balance and interest rate.

- Graduated Repayment Plan: This plan offers lower payments initially, which gradually increase over time. This can be helpful for borrowers who anticipate increased income in the future.

- Extended Repayment Plan: This plan extends the repayment period beyond the standard timeframe, resulting in lower monthly payments but potentially higher total interest paid over the life of the loan.

- Income-Driven Repayment Plans (IDR): These plans base your monthly payment on your income and family size. Several IDR plans exist, each with its own eligibility criteria and payment calculation methods. These plans often lead to loan forgiveness after a specified period (e.g., 20 or 25 years) if you make consistent payments.

- Deferment and Forbearance: These options temporarily postpone your loan payments. Deferment is typically available under specific circumstances (e.g., unemployment or return to school), while forbearance is granted when you experience temporary financial hardship. Interest may still accrue during deferment or forbearance, depending on the loan type.

Strategies for Managing and Minimizing Student Loan Debt

Effective management of student loan debt requires a proactive approach. Strategies include:

- Create a Budget: Track your income and expenses meticulously to identify areas where you can cut back and allocate funds towards loan repayment.

- Prioritize High-Interest Loans: Focus on repaying loans with the highest interest rates first to minimize the overall interest paid.

- Consider Refinancing: If interest rates have fallen since you took out your loans, refinancing could lower your monthly payments and save you money on interest in the long run. However, carefully consider the terms and conditions before refinancing.

- Make Extra Payments: Whenever possible, make extra payments towards your principal balance to reduce the loan’s lifespan and the total interest paid.

- Explore Loan Forgiveness Programs: Research and understand the eligibility criteria for any loan forgiveness programs relevant to your NLDS loans and profession.

Sample Repayment Schedule for a Typical NLDS Student Loan

Let’s assume a typical NLDS student loan of $20,000 with a 6% annual interest rate and a 10-year repayment period using a standard repayment plan. The approximate monthly payment would be $222. (This is a simplified example and does not account for any fees or changes in interest rates).

| Month | Beginning Balance | Payment | Interest | Principal | Ending Balance |

|---|---|---|---|---|---|

| 1 | $20,000.00 | $222.00 | $100.00 | $122.00 | $19,878.00 |

| 2 | $19,878.00 | $222.00 | $99.39 | $122.61 | $19,755.39 |

| … | … | … | … | … | … |

| 120 | $0.00 | $222.00 | $0.00 | $222.00 | $0.00 |

Note: This is a simplified example. Actual repayment schedules will vary based on the loan amount, interest rate, and repayment plan chosen.

Budgeting Techniques for Effective Loan Repayment

Effective budgeting is essential for successful loan repayment. Several techniques can be employed:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Track every dollar of income and allocate it to a specific expense category, ensuring your income equals your expenses.

- Envelope System: Allocate cash for specific expense categories into separate envelopes, helping to visualize and control spending.

- Budgeting Apps and Software: Utilize budgeting apps or software to track expenses, create budgets, and monitor progress towards financial goals.

Potential Challenges and Solutions Related to NLDS Student Loans

Navigating the NLDS student loan system can present various challenges for borrowers. Understanding these potential hurdles and proactively implementing solutions is crucial for successful loan management and avoiding negative consequences. This section will Artikel common difficulties, strategies for mitigating financial hardship, the implications of default, and resources available to assist borrowers in need.

Financial Hardship and Loan Deferment

Experiencing unexpected financial difficulties, such as job loss or illness, can significantly impact a borrower’s ability to meet their loan repayment obligations. The NLDS likely offers several options to alleviate this pressure, including deferment and forbearance programs. Deferment temporarily suspends loan payments, while forbearance allows for reduced payments or temporary suspension. Eligibility criteria for these programs vary depending on the specific circumstances and the NLDS’s guidelines. It is crucial for borrowers experiencing hardship to actively contact their loan servicer to explore available options and initiate the necessary paperwork promptly. Failure to do so could lead to delinquency and negatively impact credit scores.

Implications of Loan Default and Available Solutions

Defaulting on an NLDS student loan has severe consequences. It can result in damage to credit scores, wage garnishment, tax refund offset, and potential legal action. The impact on a borrower’s financial future can be substantial and long-lasting. However, even after default, there are often pathways to rehabilitation. These might involve loan consolidation, repayment plans tailored to individual financial situations, or participation in rehabilitation programs that help borrowers get back on track with their payments. Early intervention is key; contacting the loan servicer as soon as difficulties arise is crucial to explore available options and prevent the situation from escalating.

Resources for Borrowers Facing Difficulties

Accessing support and guidance is vital when facing challenges with NLDS student loans. Several resources can provide assistance and direction.

- The NLDS (National Loan Data System) website: This website should provide comprehensive information on loan programs, repayment options, and contact details for loan servicers.

- Loan Servicer: The borrower’s designated loan servicer is the primary point of contact for addressing payment issues, exploring deferment or forbearance options, and obtaining general information about their loan.

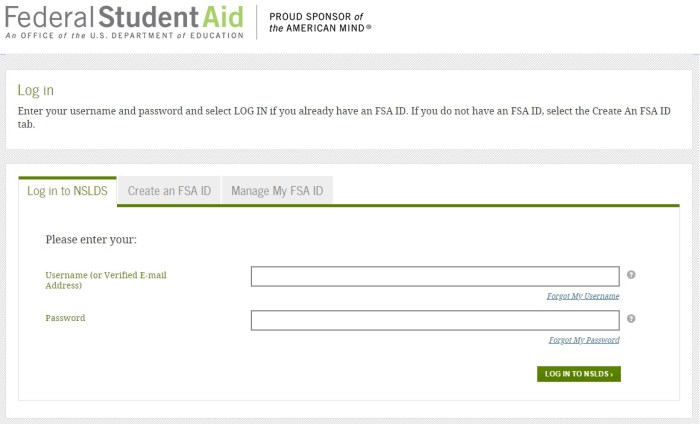

- National Student Loan Data System (NSLDS): The NSLDS provides a centralized location to access information about your federal student loans. This allows you to view your loan history, repayment status, and contact information for your loan servicer.

- Financial Counseling Services: Many non-profit organizations and credit counseling agencies offer free or low-cost financial counseling services. These services can provide guidance on budgeting, debt management, and exploring options for resolving financial difficulties.

- Government Agencies: Depending on the specific circumstances and location, government agencies might offer assistance programs or resources to help borrowers manage their student loan debt.

Impact of NLDS Student Loans on Borrowers’ Financial Future

Securing an education through NLDS student loans can significantly shape a borrower’s financial trajectory for years to come. The long-term effects extend beyond the immediate repayment period, influencing major financial decisions such as homeownership, investment, and retirement planning. Understanding these implications is crucial for responsible financial management.

The weight of student loan debt can cast a long shadow over a borrower’s financial future. The monthly payments represent a consistent outflow of funds, potentially reducing the amount available for savings, investments, or other crucial financial goals. This can lead to delayed milestones like purchasing a home or starting a family, and may even impact retirement planning due to reduced savings capacity during peak earning years.

Impact on Credit Scores and Future Borrowing Capacity

Student loan debt significantly impacts credit scores. Consistent on-time payments contribute positively to a credit score, while missed or late payments can severely damage it. A strong credit score is essential for securing favorable interest rates on future loans, such as mortgages or auto loans. Conversely, a poor credit score, often a consequence of managing student loan debt poorly, can result in higher interest rates and reduced borrowing capacity, hindering major financial goals. For instance, a borrower with a low credit score due to delinquent student loan payments might face a higher interest rate on a mortgage, leading to substantially increased borrowing costs over the life of the loan.

Comparison of Financial Outcomes: Borrowers with and without NLDS Student Loan Debt

Borrowers without NLDS student loan debt generally enjoy greater financial flexibility. They have more disposable income, allowing for earlier investment in assets like property or retirement accounts. This leads to a potentially faster accumulation of wealth and a more comfortable financial position in the long term. Conversely, borrowers with significant NLDS student loan debt often experience a delayed start in wealth accumulation. They may need to prioritize debt repayment over saving and investing, potentially missing out on opportunities for significant returns. This difference in financial trajectory can be substantial, particularly over the long term. A hypothetical example illustrates this: A borrower without student loan debt might save 10% of their income annually, whereas a borrower with significant debt might only be able to save 2%, resulting in a substantial difference in accumulated wealth after 20 years.

Impact of NLDS Loans on Long-Term Financial Planning

NLDS student loans significantly influence long-term financial planning. The presence of loan repayments necessitates careful budgeting and financial discipline. Borrowers must integrate loan payments into their monthly budget, potentially limiting their ability to contribute to retirement savings or other investment opportunities. Strategies like aggressive repayment plans, refinancing to lower interest rates, and prioritizing high-yield savings accounts can help mitigate the negative impact. For example, a borrower might choose to contribute to a Roth IRA despite student loan debt, recognizing the long-term tax advantages and potential for growth. Alternatively, they may explore income-driven repayment plans to manage monthly expenses more effectively while still repaying the loan.

Final Summary

Securing an education is a significant investment, and understanding the implications of student loans is paramount. This guide has explored the multifaceted nature of NLDS student loans, providing a framework for informed decision-making and responsible debt management. By understanding the eligibility criteria, repayment options, and potential challenges, borrowers can effectively plan for their financial future and mitigate potential risks. Remember to utilize the available resources and seek professional advice when needed to ensure a smooth and successful journey through the complexities of student loan repayment.

Question Bank

What happens if I miss a payment on my NLDS student loan?

Missing payments can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact your lender immediately if you anticipate difficulty making a payment to explore options like deferment or forbearance.

Can I consolidate my NLDS student loans?

Consolidation may be possible, depending on your specific loan terms and the available programs. Check with your lender or a financial advisor to explore this option.

What is the difference between subsidized and unsubsidized NLDS loans?

Subsidized loans typically do not accrue interest while you are in school (under specific conditions), whereas unsubsidized loans accrue interest from the time the loan is disbursed.

Where can I find additional resources for managing my NLDS student loan debt?

Your lender’s website is a good starting point. You can also explore resources from government agencies and non-profit organizations dedicated to student loan assistance.