Securing higher education shouldn’t be financially crippling. Non-interest student loans offer a potentially attractive alternative to traditional loans, promising debt relief without the burden of accumulating interest. This guide explores the various types of non-interest student loans available, eligibility criteria, application processes, repayment terms, and the long-term financial implications of choosing this path. We’ll delve into the advantages and disadvantages, comparing them to other financial aid options and providing practical advice for navigating the complexities of securing and repaying these loans.

Understanding the nuances of non-interest student loans is crucial for making informed decisions about your financial future. This guide aims to equip you with the knowledge necessary to assess whether this type of loan is the right fit for your educational aspirations and long-term financial goals. We will explore various scenarios, providing clear explanations and comparisons to help you make the best choice for your circumstances.

Types of Non-Interest Student Loans

Securing a higher education shouldn’t be solely dependent on financial resources. While interest-bearing loans are common, several countries offer non-interest student loan programs designed to make education more accessible. Understanding the nuances of these programs, including eligibility criteria and specific features, is crucial for prospective students. This section details the various types of non-interest student loans available globally, highlighting key differences between government-backed and private options.

Government-Backed Non-Interest Student Loans versus Private Non-Interest Student Loans

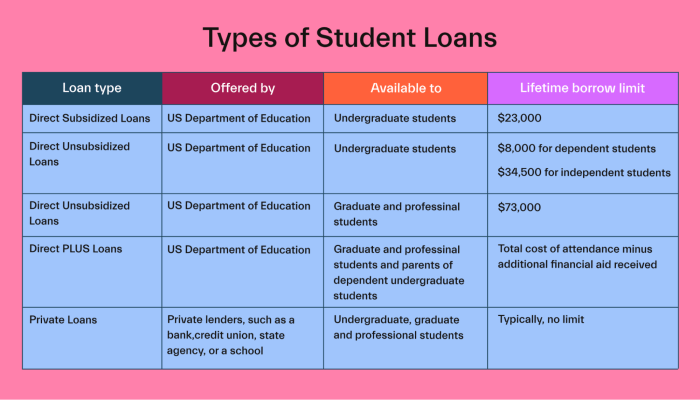

Government-backed non-interest student loans typically offer more favorable terms and conditions compared to private options. These loans are often characterized by lower or absent fees, simpler application processes, and more lenient repayment schedules. Government programs are generally designed to promote broader access to education, often targeting students from low-income backgrounds or specific fields of study. Conversely, private non-interest loans, while potentially offering flexibility, might come with stricter eligibility criteria, higher fees, and potentially less forgiving repayment plans. The availability of private non-interest student loans is significantly less prevalent than government-backed options.

Examples of Non-Interest Student Loan Programs

The availability and specifics of non-interest student loans vary significantly across countries. The following table provides a glimpse into some examples, but it is not exhaustive and should not be considered a complete guide. Always consult the official sources of each country’s education ministry or relevant financial institutions for the most up-to-date and accurate information.

| Country | Loan Program Name | Eligibility Requirements | Key Features |

|---|---|---|---|

| (Example: Country A) | (Example: National Merit-Based Loan) | (Example: High academic achievement, demonstrated financial need, citizenship) | (Example: No interest, flexible repayment terms, potential for loan forgiveness under certain conditions) |

| (Example: Country B) | (Example: Scholarships and Grants Program with Loan Component) | (Example: Specific field of study, residency, income threshold) | (Example: Partial non-interest loan combined with grant, merit-based, limited funding) |

| (Example: Country C) | (Example: Regional Development Loan) | (Example: Study within a specific region, commitment to work in that region post-graduation) | (Example: Low or no interest, tied to regional economic development initiatives) |

| (Note: This table provides illustrative examples. Actual programs and their details may differ.) |

Specific Criteria and Qualifications for Non-Interest Student Loan Applications

The application process and required documentation will vary depending on the specific loan program and the country in which it is offered. Generally, applicants should expect to provide detailed information about their academic record, financial situation (including income and assets), and future career plans. Some programs may require additional documentation, such as letters of recommendation or proof of enrollment in an eligible institution. Furthermore, many programs will have specific deadlines and application windows. Thorough research into the requirements of each specific program is crucial for a successful application. Failing to meet all eligibility requirements can lead to application rejection.

Eligibility and Application Process

Securing a non-interest student loan often involves a straightforward application process, though the specific requirements can vary depending on the lender and the type of loan. Understanding the eligibility criteria and the steps involved is crucial for a successful application.

Eligibility for non-interest student loans typically hinges on several key factors. Lenders assess applicants based on a combination of creditworthiness, financial stability, and academic standing. While the specific weight given to each factor can differ, a strong profile in these areas significantly increases the chances of loan approval.

Factors Determining Eligibility

Several factors influence eligibility for non-interest student loans. These include credit history, income level, and academic performance. A strong credit history demonstrates responsible financial management, while a stable income provides assurance of repayment capability. Academic performance, often measured by GPA or standardized test scores, indicates the applicant’s commitment to education and their potential for future earning potential. Some programs may also consider factors such as co-signers, the type of educational program being pursued, and the amount of loan requested. The absence of a strong credit history might necessitate a co-signer to vouch for the applicant’s ability to repay the loan.

Application Process Steps

The application process for non-interest student loans generally follows a structured sequence. The exact steps may vary slightly depending on the lender, but the core elements remain consistent.

- Pre-qualification: Many lenders offer a pre-qualification process, allowing prospective borrowers to get an estimate of their eligibility without impacting their credit score. This involves providing basic information, such as income and educational details.

- Formal Application: Once pre-qualified, applicants complete a formal application, providing detailed personal and financial information, including identification documents, proof of income, and academic transcripts.

- Credit Check: The lender performs a credit check to assess the applicant’s creditworthiness. A good credit history is beneficial, though some programs may offer options for borrowers with limited credit history.

- Documentation Review: The lender reviews all submitted documentation to verify the accuracy and completeness of the information provided.

- Loan Approval or Denial: Based on the review, the lender approves or denies the loan application. If approved, the applicant will receive loan terms and conditions.

- Loan Disbursement: Upon acceptance of the loan terms, the funds are disbursed directly to the educational institution or, in some cases, to the borrower.

Comparison of Application Requirements Across Programs

Different non-interest student loan programs may have varying application requirements. Some programs may prioritize applicants with strong academic records, while others may place greater emphasis on financial stability. For instance, a program specifically designed for students pursuing STEM fields might prioritize academic excellence in science and technology subjects. Conversely, a program targeting students from low-income backgrounds might place more emphasis on financial need and less on credit history. It is crucial to carefully review the specific requirements of each program before applying to ensure a successful application. Comparing eligibility criteria across various programs allows applicants to identify the best fit based on their individual circumstances.

Repayment Terms and Conditions

Understanding the repayment terms and conditions of your non-interest student loan is crucial for successful repayment and avoiding potential financial difficulties. These terms will vary depending on the lender and the specific loan agreement, but some common elements are consistently found. This section will Artikel standard repayment structures, explore the consequences of default, and offer strategies for effective debt management.

Standard Repayment Terms

Non-interest student loans typically offer several repayment plans, each with its own schedule and implications. The most common plans include standard repayment, graduated repayment, and extended repayment. The specific terms, such as the loan term (the length of time you have to repay the loan) and the minimum monthly payment, are usually detailed in the loan agreement. It is vital to carefully review this document to understand your obligations.

Comparison of Repayment Plans

The choice of repayment plan significantly impacts the total cost of the loan. A shorter repayment period, while requiring larger monthly payments, generally results in lower overall interest charges (though in the case of non-interest loans, this translates to lower total repayment). Conversely, longer repayment periods mean smaller monthly payments but a higher total repayment amount due to the extended repayment timeline. The following table illustrates a simplified comparison:

| Repayment Plan | Loan Term (Years) | Approximate Monthly Payment (Example Loan of $10,000) | Total Repayment |

|---|---|---|---|

| Standard | 5 | $167 | $10,000 |

| Graduated | 10 | Starting at $83, increasing gradually | $10,000 |

| Extended | 20 | Starting at $42, increasing gradually | $10,000 |

Note: These are simplified examples and actual payments will vary based on the loan amount, interest rate (which is 0% in this case), and lender’s specific terms.

Consequences of Default

Defaulting on a non-interest student loan, meaning failing to make payments according to the agreed-upon schedule, can have serious repercussions. While the interest charges are absent, the principal balance remains due. Consequences can include damage to your credit score, wage garnishment, difficulty obtaining future loans, and potential legal action by the lender. The severity of these consequences can vary depending on the jurisdiction and the lender’s policies. For example, a defaulted loan could significantly impact your ability to secure a mortgage or rent an apartment in the future.

Challenges During Repayment and Debt Management Strategies

Borrowers may encounter several challenges during the repayment period. Unexpected job loss, medical emergencies, or other unforeseen circumstances can make it difficult to meet monthly payments. Proactive debt management is crucial. This includes budgeting carefully to prioritize loan repayments, exploring options like deferment or forbearance (if offered by the lender) during periods of financial hardship, and seeking financial counseling from reputable organizations if needed. Open communication with the lender is also vital to explore potential solutions and avoid default. For example, a borrower might contact their lender to discuss a temporary reduction in payments or an alternative repayment plan if faced with unforeseen job loss.

Advantages and Disadvantages

Choosing a non-interest student loan can significantly impact your financial future. Understanding both the benefits and drawbacks is crucial before making a decision. This section will clearly Artikel the advantages of non-interest loans compared to traditional loans and highlight potential limitations. A comparison with other financial aid options will also be provided to aid in a comprehensive evaluation.

The primary appeal of non-interest student loans lies in their simplicity and cost-effectiveness. Unlike interest-bearing loans, they do not accrue interest over time, significantly reducing the total repayment amount. This translates to a lower overall cost of education, leaving you with more financial flexibility after graduation.

Advantages of Non-Interest Student Loans

The advantages of non-interest student loans are compelling for students seeking affordable higher education. The absence of accumulating interest represents a substantial financial saving compared to traditional loans. The following points summarize the key benefits:

- Lower Total Repayment: You only repay the principal loan amount, eliminating the burden of interest accumulation over the loan term. This can result in thousands of dollars saved compared to interest-bearing loans.

- Predictable Repayment Schedule: Knowing the exact amount you owe simplifies budgeting and financial planning. There are no surprises from fluctuating interest rates or compounding interest.

- Reduced Financial Stress: The absence of interest payments reduces the overall financial burden, allowing graduates to focus on career development and establishing financial stability.

- Greater Financial Flexibility: Lower monthly payments provide more financial freedom to manage other expenses, such as rent, utilities, and personal savings.

Disadvantages of Non-Interest Student Loans

While non-interest loans offer significant advantages, it’s important to acknowledge their potential limitations. The availability of these loans is often restricted, and the application process might be more rigorous. The following points Artikel the potential drawbacks:

- Limited Availability: Non-interest student loans are not as widely available as interest-bearing loans, meaning competition for these funds can be fierce.

- Strict Eligibility Criteria: Applicants typically need to meet stringent academic or financial requirements to qualify. This can exclude some students who might benefit from this type of loan.

- Potentially Lower Loan Amounts: The amount offered through non-interest loans might be less than what’s available through traditional loans, potentially leaving a funding gap for students with high tuition costs.

- Repayment Deadlines: While avoiding interest is beneficial, the need to repay the full principal amount within a set timeframe can still be challenging for some graduates.

Comparison with Other Financial Aid

Non-interest student loans should be considered alongside other forms of financial aid, such as scholarships and grants. Understanding the differences and advantages of each option is essential for making an informed decision.

Scholarships and grants are generally considered more favorable as they do not need to be repaid. However, they are often highly competitive and based on merit or financial need. Non-interest loans offer a more predictable funding source but require repayment. The best approach often involves a combination of these options, leveraging grants and scholarships to reduce reliance on loans.

Impact on Future Financial Planning

Securing a non-interest student loan can significantly influence your long-term financial trajectory, impacting major life decisions like homeownership and investment opportunities. Understanding these implications is crucial for responsible financial planning. While the absence of interest payments offers immediate relief, the overall financial burden and its effect on future opportunities need careful consideration.

Non-interest student loans, while advantageous in their lack of accruing interest, still represent a debt that needs repayment. This debt commitment can directly affect your ability to save for a down payment on a house, invest in retirement accounts, or pursue other significant financial goals. The monthly repayment amount, even without interest, reduces the disposable income available for these crucial long-term investments. Delaying higher education, on the other hand, might mean forgoing potential career advancement and higher lifetime earnings, which could offset the financial strain of student loan repayment in the long run. The optimal choice depends on individual circumstances, career aspirations, and risk tolerance.

Long-Term Financial Implications of Borrowing versus Delaying Education

Choosing between taking out a non-interest student loan and delaying higher education involves weighing immediate financial burdens against potential long-term financial gains. For example, consider two individuals: Person A immediately pursues higher education using a non-interest student loan, while Person B delays their education to save money and pay for it outright. Person A might face immediate debt repayment but potentially earns a higher salary sooner, leading to faster debt repayment and earlier access to investment opportunities. Person B, while debt-free, may experience a delay in career advancement and income, potentially limiting their investment potential in the long term. The ultimate outcome depends on factors such as the individual’s chosen field, earning potential, and personal financial management skills. A detailed financial projection considering both scenarios is crucial for making an informed decision.

Hypothetical Scenario Illustrating Financial Impact

Let’s imagine Sarah, a recent graduate, who took out a $20,000 non-interest student loan. She repays this loan over five years at $333.33 per month. While she avoids interest charges, this monthly payment reduces her disposable income, potentially impacting her ability to save for a down payment on a house or contribute significantly to a retirement account. If Sarah had delayed her education and saved diligently, she might have accumulated a larger down payment, reducing her reliance on a mortgage and potentially lowering her long-term housing costs. Further, if she had consistently invested her savings during those five years, she could have benefited from compound interest, potentially building a substantial investment portfolio. In this scenario, while Sarah avoided interest on her loan, her immediate financial obligations may have inadvertently limited her long-term financial growth. Her credit score would remain unaffected if she makes timely payments, but her overall financial health may be less optimal compared to a scenario where she delayed her education and invested diligently.

Finding and Comparing Loan Options

Securing a non-interest student loan requires careful consideration and thorough research. Understanding the nuances of different loan options is crucial for making an informed decision that aligns with your financial situation and long-term goals. This involves comparing interest rates, repayment terms, eligibility criteria, and other crucial factors across various lenders.

Finding the best non-interest student loan requires a strategic approach to researching and comparing available options. Several resources can assist in this process, ensuring you make a well-informed decision based on a comprehensive understanding of the market.

Reliable Resources for Researching Non-Interest Student Loans

Accessing accurate and up-to-date information is paramount when comparing loan options. Reputable sources offer unbiased information, helping you avoid misleading claims or hidden fees. These sources provide crucial details about interest rates, repayment plans, eligibility requirements, and other important factors. Failing to thoroughly investigate these aspects can lead to financial difficulties down the line.

- Government Websites: Many government websites dedicated to education or financial aid offer comprehensive information on student loans, including those with no interest. These often provide unbiased comparisons and tools to help you assess your eligibility for different programs.

- Nonprofit Organizations: Numerous nonprofit organizations specializing in financial literacy and student aid provide valuable resources and guidance on navigating the student loan landscape. These organizations often offer free counseling services and educational materials.

- Independent Financial Aid Websites: Several independent websites dedicated to student financial aid offer detailed comparisons of different loan options, including non-interest loans. These websites often include user reviews and ratings, providing valuable insights from past borrowers.

- Educational Institutions: Your college or university’s financial aid office is a valuable resource. They can provide information on available non-interest loans and guide you through the application process specific to your institution.

Examples of Reputable Websites and Organizations

Utilizing a variety of resources ensures a comprehensive understanding of the available options. It is recommended to consult multiple sources to verify information and gain a holistic perspective on the loan market. Relying on a single source may lead to an incomplete or biased understanding of your options.

- Federal Student Aid (FSA): A U.S. government website providing comprehensive information on federal student aid programs.

- Sallie Mae: A well-known private student loan provider offering a range of resources and information on student loans, although their information may be biased towards their own products.

- National Endowment for Financial Education (NEFE): A nonprofit organization providing financial education resources, including information on student loans.

- The Institute for College Access & Success (TICAS): A nonprofit organization that researches and advocates for affordable higher education, offering data and analysis on student debt.

The Importance of Thorough Research and Comparison

Before committing to any non-interest student loan, a thorough comparison of different options is essential. This ensures you choose a loan that best suits your financial circumstances and repayment capabilities. Failing to do so could lead to unforeseen financial burdens and difficulties in managing your debt.

Making an informed decision about student loans requires careful consideration of all available options and a thorough understanding of the terms and conditions.

Illustrative Examples

Understanding the practical application of non-interest student loans is crucial. The following examples illustrate various scenarios, highlighting both the potential benefits and drawbacks.

A Hypothetical Student’s Loan Journey

Let’s consider Sarah, a diligent student pursuing a degree in nursing. She secured a $20,000 non-interest student loan from a reputable credit union to cover her tuition and living expenses. The application process was straightforward, requiring her to provide her acceptance letter, financial aid information, and a co-signer (her parent). The loan was disbursed directly to her university. Sarah opted for a five-year repayment plan, with monthly payments of approximately $333. She diligently made her payments on time, resulting in the loan being fully repaid without incurring any interest charges. Her responsible financial management allowed her to graduate debt-free, aside from the principal amount, and begin her nursing career without the burden of significant student loan debt. This positive experience demonstrates the potential for non-interest loans to be a valuable financial tool for responsible borrowers.

Typical Repayment Schedule Visualization

Imagine a bar graph. The horizontal axis represents the repayment period (e.g., 5 years), divided into equal monthly intervals. The vertical axis represents the dollar amount. Each bar represents a monthly payment. For a non-interest loan, the height of each bar remains consistent throughout the repayment period, representing the equal principal payments. There is no separate “interest” component as there is with traditional loans. A line graph could also be used, showing a steady decline in the outstanding principal balance over time, eventually reaching zero at the end of the repayment period. This visual representation clearly shows the simplicity and predictability of non-interest loan repayment.

Beneficial and Detrimental Scenarios

A non-interest student loan proved beneficial for Maria, a high-achieving student who secured a scholarship covering a portion of her tuition. The non-interest loan filled the remaining funding gap, allowing her to focus on her studies without the stress of high-interest debt. Upon graduation, she secured a well-paying job and easily managed the repayment schedule. Conversely, a non-interest loan might not be the best choice for John, who underestimated his living expenses. While the lack of interest was appealing, the high principal amount, coupled with unexpected financial challenges, strained his ability to make timely payments. This situation highlights the importance of careful budgeting and realistic financial planning before taking out any loan, even one without interest.

Final Thoughts

Navigating the world of student loans can be daunting, but understanding the options available empowers you to make informed decisions. Non-interest student loans represent a unique opportunity to pursue higher education without the immediate pressure of accruing substantial debt. By carefully considering eligibility requirements, repayment terms, and long-term financial implications, prospective students can determine if this financing method aligns with their individual needs and circumstances. Remember to thoroughly research all available options and seek professional financial advice when necessary.

Answers to Common Questions

What are the common reasons for non-interest student loan applications being denied?

Common reasons include failing to meet income requirements, insufficient credit history, or incomplete application materials.

Can I consolidate a non-interest student loan with other loans?

The possibility of consolidation depends on the specific loan program and lender. Check with your lender for details.

What happens if I miss a repayment on a non-interest student loan?

Late payments can negatively impact your credit score and may incur late fees, depending on the lender’s policies. Consistent communication with your lender is crucial.

Are there tax benefits associated with non-interest student loans?

Tax benefits vary by country and specific loan program. Consult a tax professional for personalized advice.