The New York Times’ extensive coverage of the student loan crisis offers a multifaceted perspective on this pressing societal issue. From detailed borrower profiles to in-depth analyses of proposed policies, the NYT has shaped public discourse and understanding. This examination delves into the newspaper’s reporting, exploring recurring narratives, visual representations of data, and comparisons with other major news outlets.

We will analyze the NYT’s portrayal of student loan borrowers, examining their demographics, debt burdens, and the challenges they face. Furthermore, we will investigate the newspaper’s coverage of various student loan repayment plans and the arguments surrounding student loan forgiveness, considering both the economic and social implications.

NYT Coverage of Student Loan Issues

The New York Times has consistently covered the student loan debt crisis over the past five years, offering a multifaceted perspective encompassing the personal struggles of borrowers, the broader economic implications, and the ongoing political debates surrounding potential solutions. Their reporting has evolved alongside shifting policy landscapes and public discourse, reflecting a complex and dynamic issue.

Summary of NYT Student Loan Debt Reporting (2019-2023)

The following table summarizes key aspects of NYT’s student loan coverage over the past five years. Note that this is a representative sample, and the NYT has published numerous articles on this topic. Due to the dynamic nature of news reporting, specific headline examples may not perfectly reflect every nuance of the coverage.

| Year | Headline Examples (Illustrative) | Key Themes | Overall Tone |

|---|---|---|---|

| 2019 | “The Crushing Weight of Student Debt,” “Navigating the Student Loan Repayment System” | Personal struggles of borrowers, rising debt levels, limited repayment options | Concerned, investigative |

| 2020 | “Pandemic Exposes the Fragility of Student Loan System,” “Forgiveness Proposals Gain Traction” | Impact of COVID-19 on borrowers, increased calls for forgiveness, political debate | Concerned, analytical |

| 2021 | “Biden Administration Extends Student Loan Pause,” “Debate Rages Over Forgiveness Plan” | Policy shifts under Biden administration, ongoing debate over forgiveness, economic impact analysis | Balanced, informative |

| 2022 | “Supreme Court Strikes Down Biden’s Student Loan Forgiveness Plan,” “The Long-Term Implications of Student Debt” | Legal challenges to forgiveness plans, long-term economic consequences, impact on different demographics | Analytical, cautious |

| 2023 | “Student Loan Payments Resume,” “The Future of Student Loan Policy” | Return to repayment, ongoing policy discussions, lasting effects of the debt crisis | Informative, forward-looking |

Recurring Narratives in NYT Student Loan Coverage

Three consistent narratives emerge from the NYT’s reporting: the personal burden of student loan debt, the systemic flaws within the student loan system, and the political complexities surrounding debt forgiveness proposals.

The narrative of personal burden focuses on individual stories of borrowers struggling to manage their debt, often highlighting the impact on their life choices, financial stability, and mental health. This narrative humanizes the issue, making it relatable to a wider audience and fostering empathy. Examples include profiles of graduates delaying major life decisions due to debt or facing financial hardship despite possessing advanced degrees.

The narrative of systemic flaws exposes the shortcomings of the student loan system itself, including predatory lending practices, confusing repayment options, and the lack of sufficient consumer protection. This narrative provides context for the personal struggles, arguing that individual responsibility alone cannot solve the problem. The NYT has frequently highlighted the role of for-profit colleges and the increasing cost of higher education in contributing to the crisis.

The narrative of political complexities centers on the ongoing debate surrounding student loan forgiveness proposals, analyzing the arguments for and against such policies, and exploring their potential economic and political ramifications. This narrative reflects the political polarization surrounding the issue, highlighting the challenges of finding bipartisan solutions. The Supreme Court’s decision on Biden’s plan exemplifies the complexities involved.

Comparison of NYT Coverage with Other Major News Outlets

The NYT’s coverage, while comprehensive, differs from other major news outlets in several key aspects:

- Focus on personal narratives: The NYT frequently incorporates personal stories of borrowers, humanizing the issue more than some other outlets, such as the Wall Street Journal, which tends to focus more on the economic and policy aspects.

- Nuance in policy discussions: Compared to the often more partisan coverage in outlets like Fox News, the NYT generally presents a more balanced and nuanced perspective on student loan forgiveness proposals, exploring both the potential benefits and drawbacks.

- In-depth investigative reporting: The NYT’s investigative reporting on predatory lending practices and systemic issues within the student loan industry often surpasses the depth of coverage found in other major outlets.

Student Loan Borrowers Featured in NYT Articles

The New York Times has consistently covered the student loan crisis, profiling borrowers from diverse backgrounds and circumstances. These profiles offer valuable insights into the multifaceted nature of the problem, highlighting the significant financial and emotional burdens faced by many. Analyzing these portrayals reveals how the NYT’s reporting shapes public understanding of the issue and its impact on individuals.

Profiles of Student Loan Borrowers in NYT Articles

The following table summarizes the profiles of several student loan borrowers featured in NYT articles. Due to the sensitive nature of personal financial information and the varying levels of detail provided in different articles, precise debt amounts and specific identifying information are not always available. This table represents a generalized overview based on recurring themes and reported data.

| Borrower Profile | Debt Amount (Approximate Range) | Educational Background | Challenges Faced |

|---|---|---|---|

| Recent Graduate, Public University | $30,000 – $60,000 | Bachelor’s Degree in Humanities | High debt relative to income, difficulty finding a job in their field, uncertainty about repayment options. |

| Older Borrower, Private University | $100,000+ | Master’s Degree in Business Administration | Struggling to manage debt alongside other financial responsibilities, considering bankruptcy, significant interest accrual. |

| Graduate Student, Specialized Program | $150,000+ | Doctoral Degree in Medicine | High debt despite high earning potential, long repayment period, potential for career changes impacting repayment ability. |

| Parent Borrower | $50,000 – $100,000 | N/A (Borrowed for Child’s Education) | Debt impacting retirement savings, financial strain on the family, difficulty balancing multiple financial obligations. |

Impact of NYT’s Portrayal on Public Perception

The NYT’s detailed accounts of individual borrowers’ struggles have humanized the student loan crisis, moving beyond statistics to showcase the real-life consequences of high debt. For example, articles focusing on borrowers facing wage garnishment or struggling to afford basic necessities have heightened public awareness of the devastating impact of loan defaults. Conversely, profiles of successful borrowers who managed their debt effectively through strategic planning or career choices provide a sense of hope and highlight the importance of financial literacy. The nuanced portrayal, encompassing both hardship and success stories, fosters a more comprehensive understanding of the issue among readers.

Hypothetical Case Study: A Student Loan Borrower

Sarah, a 28-year-old graduate of a state university, holds a Bachelor’s degree in English Literature. She accumulated approximately $45,000 in student loan debt, relying on federal loans and private loans to finance her education. After graduation, Sarah struggled to find a job in her field that offered a salary commensurate with her debt burden. She currently works as a freelance writer, earning a variable income that makes consistent loan repayments challenging. She faces difficulties balancing her monthly expenses with loan payments, experiencing periods of financial stress and anxiety about her long-term financial future. Sarah’s situation exemplifies the challenges faced by many borrowers with humanities degrees, where job prospects and salaries may not always align with the cost of higher education.

Policy Discussions in NYT Articles on Student Loans

The New York Times has extensively covered the complexities of student loan policies, offering a platform for diverse viewpoints and detailed analyses of their potential impacts. These discussions often center on the various repayment plans available, the ongoing debate surrounding loan forgiveness, and the broader economic and social consequences of different policy approaches. This section will delve into these key areas, drawing examples directly from NYT reporting.

Student Loan Repayment Plans Compared

The NYT has highlighted several student loan repayment plans, each with its own set of advantages and disadvantages. Understanding these differences is crucial for borrowers seeking the most suitable option.

| Repayment Plan | Features | Benefits | Drawbacks |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Simple and straightforward; relatively low monthly payments. | Higher total interest paid; may not be affordable for low-income borrowers. |

| Income-Driven Repayment (IDR) Plans | Monthly payments based on income and family size; remaining balance forgiven after 20-25 years. | More affordable monthly payments; potential for loan forgiveness. | Longer repayment periods; potentially higher total interest paid over the life of the loan. |

| Extended Repayment Plan | Longer repayment period (up to 25 years) compared to standard plan. | Lower monthly payments. | Higher total interest paid. |

| Graduated Repayment Plan | Payments start low and gradually increase over time. | Lower initial payments; potentially easier to manage initially. | Payments can become significantly higher later in the repayment period. |

Arguments For and Against Student Loan Forgiveness

The debate surrounding student loan forgiveness has been a prominent feature in NYT articles. The arguments presented often reflect differing economic and social philosophies.

Arguments for student loan forgiveness often center on:

- Stimulating the economy by freeing up borrowers’ disposable income.

- Addressing systemic inequalities in access to higher education.

- Reducing the burden on borrowers struggling with debt.

Conversely, arguments against student loan forgiveness frequently highlight:

- The potential for increased inflation.

- The unfairness to those who already paid off their loans.

- The moral hazard of encouraging future irresponsible borrowing.

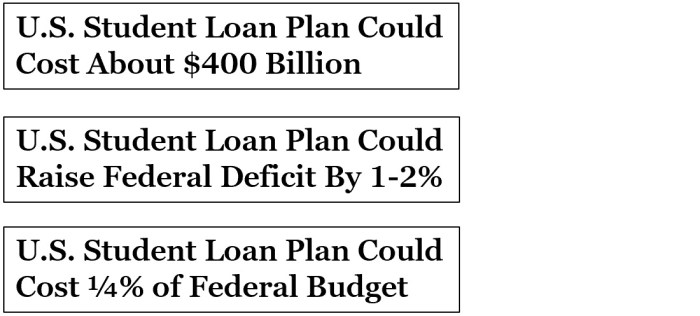

Economic and Social Implications of Student Loan Policies

NYT reporting consistently emphasizes the far-reaching consequences of student loan policies, impacting both individuals and the broader economy.

| Policy | Short-Term Effects | Long-Term Effects |

|---|---|---|

| Loan Forgiveness | Increased consumer spending; potential short-term economic boost. | Potential inflation; impact on future borrowing behavior; questions of long-term fiscal sustainability. |

| Increased Funding for Pell Grants | Increased access to higher education for low-income students. | Improved social mobility; increased workforce skills; potential for long-term economic growth. |

| Expansion of Income-Driven Repayment Plans | Increased affordability for low-income borrowers; reduced delinquency rates. | Potential increase in overall loan debt; longer repayment periods. |

Visual Representations of Student Loan Data in NYT

The New York Times, known for its data-driven journalism, employs a variety of visual aids to effectively communicate the often complex and nuanced data surrounding student loan debt. These visuals go beyond simple bar charts, utilizing sophisticated designs to highlight key trends and disparities. Their approach emphasizes clarity and accessibility, making even intricate financial information understandable to a broad audience.

The NYT’s visual representations of student loan data are characterized by their clean aesthetic, focus on clear data visualization, and use of interactive elements where appropriate. They frequently employ a muted color palette, allowing the data itself to stand out. This deliberate design choice ensures the reader’s focus remains on the information being presented, rather than being distracted by overly flashy visuals.

Examples of NYT Visualizations of Student Loan Data

The NYT utilizes a range of visual aids to present student loan data, each chosen strategically to highlight specific aspects of the issue. Three examples illustrate this approach:

First, interactive maps are frequently used to show geographical variations in student loan debt burdens. These maps typically use color-coding to represent debt levels at the state or even county level. For instance, darker shades of red might represent areas with higher average student loan debt, while lighter shades indicate lower debt levels. The interactivity allows readers to zoom in on specific regions, revealing a granular level of detail and enabling a deeper understanding of regional disparities. The combination of visual representation and interactivity makes this a powerful tool for communicating complex geographical data.

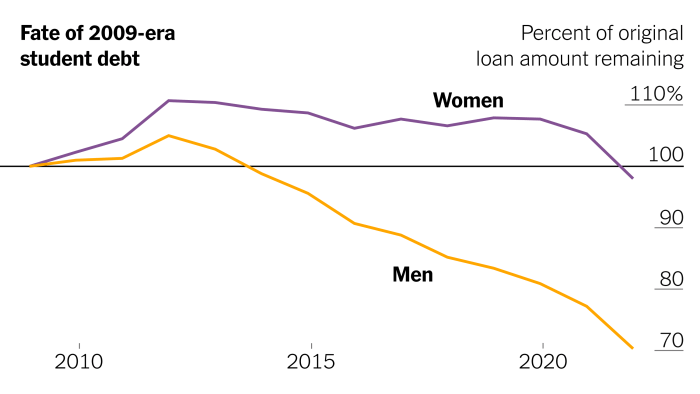

Second, bar charts and line graphs are commonly used to compare trends over time. These charts might track the growth of student loan debt nationally, or they may compare the debt burdens of different demographic groups. The NYT’s use of these traditional chart types is noteworthy for its precision and clarity. Axes are clearly labeled, data points are easily identifiable, and the overall design is uncluttered, ensuring the reader can quickly grasp the key trends being presented. For example, a line graph might show the steady increase in average student loan debt per borrower over the past two decades, highlighting the escalating cost of higher education.

Third, infographics are used to synthesize large amounts of data into easily digestible formats. These infographics often combine different visual elements, such as charts, maps, and illustrations, to create a holistic picture of the student loan crisis. For example, an infographic might juxtapose statistics on student loan debt with images illustrating the impact of debt on borrowers’ lives, such as delayed homeownership or difficulty saving for retirement. This multi-faceted approach allows the NYT to effectively communicate both the quantitative and qualitative aspects of the issue.

Hypothetical Infographic on Student Loan Debt Distribution

A hypothetical NYT-style infographic on the distribution of student loan debt across demographics could utilize a combination of a segmented bar chart and accompanying text annotations. The horizontal axis would represent different demographic groups (e.g., age, race, income level, educational attainment). The vertical axis would represent the average student loan debt for each group. Each segment of the bar would be color-coded according to the demographic group. The infographic would also include small icons or text annotations to highlight key findings, such as the disproportionate burden of student loan debt on minority groups or those with lower incomes. The overall design would be clean and minimalist, utilizing the NYT’s signature muted color palette and clear typography to maximize readability and data clarity. The use of simple, easily understood icons would further enhance accessibility. For example, a house icon might represent the impact on homeownership, while a graduation cap might illustrate the level of education attained.

Comparison of NYT Visualizations with Other Media Outlets

While many media outlets use similar visual aids to represent student loan data, the NYT distinguishes itself through its emphasis on data accuracy, rigorous design principles, and a focus on clear and accessible communication. Some outlets might prioritize eye-catching visuals over data clarity, leading to potentially misleading or confusing representations. The NYT, however, prioritizes a balanced approach, ensuring that the visual elements effectively enhance the understanding of the underlying data without sacrificing accuracy or clarity. This commitment to responsible data visualization makes the NYT’s coverage particularly valuable for readers seeking a nuanced and well-informed understanding of the student loan crisis.

Epilogue

The New York Times’ reporting on student loans provides a valuable resource for understanding the complexities of this pervasive issue. By analyzing the newspaper’s coverage, we gain insights into the experiences of borrowers, the nuances of policy debates, and the effective use of visual data to communicate complex information. The consistent focus on human stories alongside economic analysis contributes to a comprehensive understanding of the student loan crisis and its far-reaching consequences.

Question Bank

What is the average student loan debt amount reported by the NYT?

The NYT’s reporting reveals a wide range, but often highlights figures exceeding $50,000, with many borrowers facing significantly higher amounts.

How does the NYT’s coverage compare to that of other international news outlets?

A comparative analysis would be needed to fully answer this; however, it is likely the NYT’s coverage focuses heavily on the US context while international outlets may offer a broader, global perspective.

What are some common repayment plans mentioned in NYT articles?

The NYT frequently discusses income-driven repayment plans, standard repayment plans, and the potential implications of loan forgiveness programs.

Does the NYT offer solutions to the student loan crisis?

While the NYT doesn’t propose specific solutions, its reporting illuminates the complexities of the issue, highlighting various policy proposals and their potential impacts, informing the public discourse on potential solutions.