Navigating the complex world of student loans requires expert guidance. This exploration delves into the multifaceted role of the student loan author, examining their background, the diverse content they create, and the ethical considerations inherent in this field. We’ll uncover the skills needed to write authoritatively about student loans, from financial literacy to legal understanding, and how effective communication shapes readers’ understanding and financial decisions.

From insightful books and informative articles to engaging blog posts and practical guides, we’ll analyze the various formats used to educate and empower individuals facing the challenges of student loan debt. We’ll also discuss the crucial role of ethical considerations in ensuring accurate and responsible information, protecting readers from misinformation and manipulative tactics.

Student Loan Author’s Background and Expertise

Authorship on the complex subject of student loans demands a unique blend of skills and experience. A successful student loan author needs more than just a strong writing ability; they require a deep understanding of the financial, legal, and educational landscapes that shape the student loan experience. Their background often reflects this multifaceted requirement.

The typical background of an author specializing in student loans is diverse. While a background in finance or law is highly beneficial, many successful authors come from fields like education, journalism, or even personal finance blogging. The common thread is a demonstrated understanding of the intricacies of student loans, coupled with strong communication skills.

Necessary Skills and Experiences

Effective student loan writing requires a combination of hard and soft skills. Hard skills encompass a thorough understanding of student loan programs (federal and private), repayment plans (including income-driven repayment), loan forgiveness programs, and the overall financial implications of student debt. Experience in financial analysis, legal research, or educational policy would significantly enhance an author’s credibility. Soft skills, such as clear and concise writing, strong research capabilities, and the ability to explain complex financial concepts in an accessible manner, are equally crucial. Authors must be able to translate jargon into plain language, ensuring readers can understand and apply the information presented.

Types of Relevant Expertise

Authors specializing in student loans often possess expertise in one or more of the following areas:

Financial expertise is paramount. This includes understanding interest rates, amortization schedules, debt management strategies, and the long-term financial consequences of student loan debt. Authors with this background can provide readers with practical advice on budgeting, repayment planning, and financial wellness.

Legal expertise offers valuable insight into the legal aspects of student loans, including default, bankruptcy, and the rights and responsibilities of borrowers. Authors with this background can help readers navigate the legal complexities of student loan agreements and potential legal remedies.

Educational expertise provides a crucial perspective on the link between higher education costs, student loan borrowing, and career outcomes. Authors with this background can offer valuable insights into the value of a college education, the relationship between student loan debt and career choices, and the broader societal impact of student loan debt.

Comparison of Writing Styles

The writing style of a student loan author often reflects their background. An author with a strong financial background might emphasize quantitative analysis and data-driven insights, focusing on the numbers and financial implications of various loan scenarios. An author with a legal background may prioritize a more precise and formal style, emphasizing the legal nuances and potential risks associated with student loans. Conversely, an author with an educational background might adopt a more narrative approach, weaving personal stories and case studies into their writing to illustrate the broader human impact of student loan debt. Each approach serves a different purpose and caters to a specific audience, but all aim to provide accurate and useful information.

Types of Student Loan Content Created

This section details the various types of content created by the student loan author, categorized by format, target audience, and structural elements. Understanding these distinctions is crucial for effectively reaching and informing different segments of the student loan borrower population. The author’s diverse content portfolio caters to a broad range of needs and knowledge levels.

The author produces content across a variety of formats, each designed to address specific needs and preferences within the student loan landscape. This approach ensures maximum reach and impact for the information provided.

Books on Student Loan Management

Books provide in-depth, comprehensive guidance on navigating the complexities of student loans. They typically cover a wide range of topics, from understanding loan terms and repayment options to developing effective budgeting strategies and exploring loan forgiveness programs. The target audience for books is generally individuals seeking a thorough understanding of student loans and those looking for long-term strategies for repayment. A typical book might include chapters on loan types, repayment plans, budgeting, credit scores, and potential consequences of default.

Informative Articles on Student Loan Topics

Articles offer concise, focused information on specific student loan-related issues. These shorter pieces often target a more specific audience interested in a particular aspect of student loan management, such as refinancing or income-driven repayment plans. The structure is typically straightforward, presenting information clearly and concisely. Examples might include articles focusing on the benefits of refinancing, comparing different repayment plans, or explaining the process of applying for loan forgiveness. The target audience ranges from those seeking quick answers to specific questions to those already familiar with the basics who want to delve deeper into a particular area.

Blog Posts on Current Student Loan News and Trends

Blog posts offer timely updates and commentary on current events impacting student loan borrowers. They provide a less formal, more conversational approach, often incorporating personal anecdotes or examples to engage readers. The target audience is generally those seeking current news and updates on student loan policies and regulations. A blog post might discuss a recent change in repayment options, analyze the impact of a new law, or offer advice on navigating the latest challenges in the student loan system.

Comprehensive Guides to Student Loan Repayment

Guides offer step-by-step instructions and practical advice on specific aspects of student loan repayment. They are often structured as a series of actionable steps or checklists, making them easy to follow. The target audience consists of individuals actively seeking to manage and repay their student loans. A typical guide might walk a borrower through the process of consolidating loans, applying for an income-driven repayment plan, or creating a personalized repayment budget.

| Content Type | Target Audience | Typical Structure | Key Elements |

|---|---|---|---|

| Books | Individuals seeking comprehensive understanding; long-term strategists | Multiple chapters, in-depth explanations, case studies | Detailed analysis, diverse perspectives, long-term strategies |

| Articles | Individuals with specific questions; those seeking focused information | Concise, focused writing; clear and direct | Specific facts, data, actionable advice |

| Blog Posts | Those seeking current news and updates; engaged readers | Conversational tone; timely information; examples | Current events, analysis, personal anecdotes |

| Guides | Individuals actively managing and repaying loans | Step-by-step instructions; checklists; actionable advice | Clear steps, practical advice, templates |

Key Themes and Topics Addressed

Student loan literature consistently revolves around a core set of interconnected themes, reflecting the multifaceted nature of the student loan experience. These themes are explored from various perspectives, including those of borrowers, lenders, policymakers, and researchers. Understanding these themes and their interrelationships is crucial for navigating the complexities of student loan debt and developing effective solutions. This section Artikels the key themes, presents diverse viewpoints, and provides illustrative examples.

Repayment Strategies and Options

This theme focuses on the practical aspects of managing and repaying student loans. Different perspectives exist regarding the efficacy and accessibility of various repayment plans, such as income-driven repayment (IDR), standard repayment, and loan consolidation. For example, while IDR plans offer lower monthly payments based on income, they often result in higher total interest paid over the life of the loan. Conversely, standard repayment plans offer quicker payoff but may present significant financial hardship for borrowers with limited income. Specific topics within this theme include the intricacies of different repayment plans, the impact of interest capitalization, and strategies for accelerating loan repayment.

The Impact of Student Loan Debt on Personal Finances

This theme examines the broader financial consequences of student loan debt on individuals and families. Perspectives vary regarding the severity and long-term effects of this debt, with some arguing it significantly hinders major life decisions such as homeownership, starting a family, and retirement planning. Others contend that the benefits of higher education outweigh the financial burden of loans. Specific topics explored include the correlation between student loan debt and delayed homeownership, the impact on savings and investment opportunities, and the potential for financial stress and mental health challenges related to student loan debt. For instance, studies have shown a direct link between high student loan debt and delayed marriage and childbirth.

The Role of Government Policy and Regulation

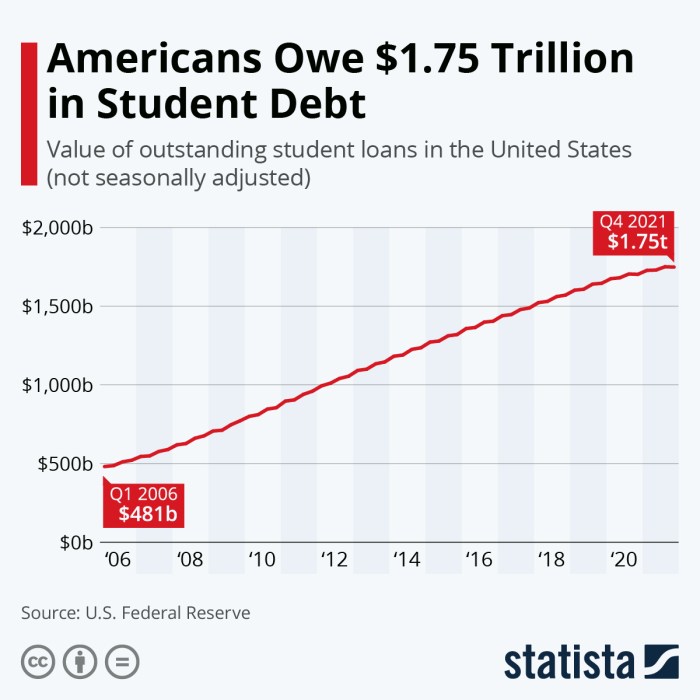

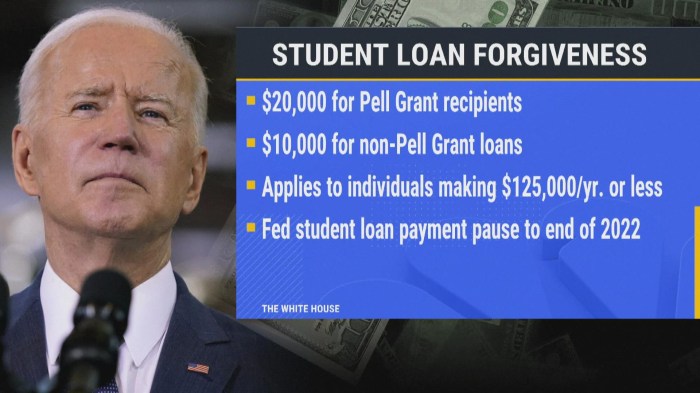

This theme analyzes the influence of government policies and regulations on the student loan system. Perspectives differ regarding the effectiveness of current policies in addressing issues like affordability, accessibility, and loan forgiveness programs. Some advocate for increased government intervention to control costs and expand access to affordable education, while others emphasize the importance of market-based solutions and individual responsibility. Specific topics include the impact of interest rate changes, the effectiveness of loan forgiveness programs (such as Public Service Loan Forgiveness), and the debate surrounding the role of government subsidies in higher education. The ongoing debate surrounding the forgiveness of student loan debt exemplifies this complex interplay of perspectives.

The Relationship Between Higher Education and Economic Outcomes

This theme explores the connection between obtaining a higher education, incurring student loan debt, and achieving improved economic outcomes. Perspectives differ on the return on investment (ROI) of higher education, considering factors such as the type of degree, field of study, and the prevailing job market. Some argue that a college degree is essential for career advancement and financial success, while others highlight the rising costs of higher education and the increasing difficulty of securing well-paying jobs even with a degree. Specific topics include the analysis of earnings differentials between college graduates and non-graduates, the influence of specific majors on post-graduation employment, and the growing concern about the rising cost of college tuition exceeding the rate of wage growth. The impact of automation on the job market and its interaction with the value of a college education is a particularly relevant topic within this theme.

Audience Engagement and Impact

Student loan authors employ a variety of strategies to connect with their audience and ensure their message resonates. Effective engagement is crucial, as it directly impacts readers’ understanding and, ultimately, their financial decisions regarding student loan management. The success of this engagement hinges on clear communication, relatable examples, and a tailored approach to different reader needs and comprehension levels.

Effective communication in this field relies on clarity and accessibility. The complexity of student loan systems often necessitates simplifying complex financial information without sacrificing accuracy.

Effective Communication Techniques

Successful student loan authors utilize several techniques to enhance reader engagement. These include employing clear and concise language, avoiding jargon, and using real-world examples to illustrate key concepts. For instance, instead of explaining amortization schedules with complex formulas, an author might use a simple chart showing how monthly payments reduce the principal balance over time. Another effective technique is the use of storytelling; sharing personal anecdotes or case studies of individuals successfully navigating student loan repayment can make the information more relatable and memorable. Finally, interactive elements, such as quizzes or worksheets, can actively involve readers in the learning process, boosting comprehension and retention.

Influence of Writing Style on Comprehension and Retention

The writing style significantly impacts how well readers understand and retain information. A formal, academic style, while precise, might alienate readers who prefer a more conversational tone. Conversely, an overly casual style might lack the credibility needed for financial advice. The optimal approach often involves a balance: clear, concise language, combined with relatable examples and a friendly, approachable tone. For instance, a blog post employing a conversational style, interspersed with bullet points and short paragraphs, would generally be more accessible than a dense, academic paper on the same topic. The use of visual aids, such as graphs and charts, can also improve comprehension, particularly for readers who are visually oriented learners.

Impact on Financial Decisions

Well-crafted student loan literature can significantly influence readers’ financial decisions. By providing clear and accurate information, authors empower readers to make informed choices about repayment strategies, budgeting, and long-term financial planning. For example, an article detailing the benefits of income-driven repayment plans could lead readers to explore this option, potentially saving them thousands of dollars in interest payments over the life of their loan. Similarly, articles emphasizing the importance of budgeting and financial literacy can equip readers with the skills they need to manage their debt effectively and avoid financial hardship. Access to accurate and unbiased information can be the difference between successfully managing student loan debt and facing financial distress.

Illustrations and Examples in Student Loan Writing

Effective communication about student loans requires clear and relatable examples. Abstract concepts like amortization schedules and interest capitalization become much more understandable when illustrated with concrete scenarios and practical applications. This section will demonstrate how various illustrative techniques can enhance the clarity and impact of student loan writing.

Illustrative Examples of Complex Student Loan Concepts

To explain the concept of interest capitalization, consider this example: Imagine a student takes out a $10,000 loan with a 5% interest rate. If they defer payments for two years, the unpaid interest will be added to the principal balance. After two years, the accrued interest might be $1,000. Interest capitalization means the new principal balance becomes $11,000, and future interest calculations will be based on this higher amount, leading to a larger total repayment amount than if interest was not capitalized. This illustrates how deferment, while seemingly beneficial in the short term, can significantly increase the overall cost of the loan over its lifetime. Another example would be explaining the difference between subsidized and unsubsidized loans. A subsidized loan, the government pays the interest while the student is in school, whereas with an unsubsidized loan, the interest accrues immediately and is added to the principal balance. This results in a larger loan balance at the end of the grace period for unsubsidized loans.

Scenarios Depicting Different Student Loan Situations

Scenario 1: A recent graduate with a $30,000 loan balance chooses a standard 10-year repayment plan. We can illustrate the monthly payment amount, the total interest paid over the life of the loan, and compare it to a shorter 5-year repayment plan, highlighting the trade-offs between higher monthly payments and lower overall interest costs.

Scenario 2: A student who needs to defer their loan payments due to unexpected unemployment. This scenario can explain the implications of deferment, including the accrual of interest and the potential increase in the total loan amount. We can then contrast this with an income-driven repayment plan, showing how it can adjust payments based on the borrower’s income and potentially reduce monthly payments while extending the repayment period.

Scenario 3: A borrower who consolidates multiple student loans into a single loan. This example can illustrate the benefits of consolidation, such as simplifying repayment and potentially lowering the monthly payment. However, it’s important to also explain the potential drawbacks, such as a longer repayment period and the possibility of a higher overall interest cost if a lower interest rate isn’t secured.

Detailed Description of a Hypothetical Case Study

Let’s consider Sarah, a recent college graduate with $40,000 in federal student loan debt. She’s exploring different repayment options. She could opt for a standard 10-year repayment plan, resulting in relatively high monthly payments but a shorter repayment period. Alternatively, she could choose an income-driven repayment plan, resulting in lower monthly payments but a longer repayment timeline. This case study would detail the monthly payments, total interest paid, and the total cost of each plan, allowing readers to understand the trade-offs involved in choosing a repayment plan. Further, it could explore the impact of making extra payments towards the principal balance, demonstrating how this can shorten the repayment period and save money on interest.

Visual Representation of a Typical Student Loan Repayment Plan

Imagine a table showing a simplified amortization schedule.

| Year | Beginning Balance | Payment | Interest Paid | Principal Paid | Ending Balance |

|—|—|—|—|—|—|

| 1 | $20,000 | $2,500 | $1,000 | $1,500 | $18,500 |

| 2 | $18,500 | $2,500 | $925 | $1,575 | $16,925 |

| 3 | $16,925 | $2,500 | $846 | $1,654 | $15,271 |

| … | … | … | … | … | … |

| 10 | $X | $2,500 | $Y | $Z | $0 |

*Note: X, Y, and Z represent the calculated values at the end of the loan term. This is a simplified example and actual amortization schedules will vary based on loan terms and interest rates.* This table visually represents how the loan balance decreases over time as payments are made, with a clear breakdown of interest and principal payments in each year. It illustrates the concept of amortization in a straightforward and accessible manner.

Ethical Considerations in Student Loan Writing

Writing about student loans demands a high degree of ethical responsibility. The topic is deeply personal and financial, impacting readers’ futures significantly. Authors must prioritize accuracy, transparency, and avoidance of manipulative tactics to ensure responsible and helpful content. Failure to do so can have severe consequences for readers already facing considerable financial pressure.

The potential for ethical dilemmas is significant in student loan writing. The financial stakes are high, and readers are often vulnerable, seeking clear and reliable information to navigate complex systems. This vulnerability creates an ethical imperative for authors to act with integrity and avoid exploiting readers’ anxieties.

Accuracy and Transparency in Student Loan Information

Accuracy is paramount. Misinformation about repayment plans, interest rates, or loan forgiveness programs can lead to devastating financial consequences for borrowers. Authors must meticulously verify all information from reputable sources, such as government websites, established financial institutions, and peer-reviewed research. Transparency is equally crucial; clearly identifying the sources of information builds trust and allows readers to independently verify claims. For example, stating “According to the Department of Education’s website…” establishes clear provenance and avoids ambiguity. Omitting relevant details or presenting information selectively to favor a particular viewpoint is unethical and potentially harmful.

Avoiding Misleading or Manipulative Information

Authors must actively avoid any language or presentation that could mislead or manipulate readers. This includes exaggerated claims about loan forgiveness programs, promises of unrealistic financial outcomes, or the use of emotionally charged language to pressure readers into specific actions. For instance, headlines like “Erase Your Student Loans Overnight!” are manipulative and irresponsible. Instead, authors should focus on presenting factual information clearly and concisely, empowering readers to make informed decisions. Transparency in affiliations or financial incentives is also critical; if an author receives compensation from a specific lender or loan consolidation company, this must be clearly disclosed to avoid conflicts of interest.

Different Approaches to Ethical Student Loan Writing

Several approaches prioritize ethical considerations in student loan writing. One approach focuses on providing comprehensive, unbiased information, presenting various options and their potential consequences without advocating for a particular course of action. This approach prioritizes reader autonomy and informed decision-making. Another approach might focus on a specific audience, such as low-income borrowers or those facing particular challenges, tailoring the information to their unique needs and circumstances while maintaining accuracy and avoiding exploitation. A third approach might prioritize advocacy for policy changes to improve student loan accessibility and affordability, but even in this context, the information presented must be factual and avoid misleading rhetoric. The ethical considerations remain consistent across these approaches: accuracy, transparency, and the avoidance of manipulation. The choice of approach depends on the author’s goals and the intended audience but must always prioritize the reader’s well-being.

Final Thoughts

Understanding the landscape of student loan authorship reveals a critical need for accuracy, empathy, and ethical responsibility. Authors play a vital role in helping individuals navigate the complexities of student loan debt, empowering them to make informed financial decisions. By examining the various aspects of this field, from content creation to ethical considerations, we gain a deeper appreciation for the impact of well-researched and responsible student loan literature.

User Queries

What qualifications are typically required to write authoritatively about student loans?

Authors often possess a combination of financial expertise, legal knowledge, or educational background, coupled with strong writing and research skills. Experience in the student loan industry is also beneficial.

How do student loan authors typically earn income?

Income sources vary widely, including royalties from books, fees for articles or blog posts, consulting work, and speaking engagements.

Are there any legal restrictions on what student loan authors can claim?

Yes, authors must adhere to legal and ethical guidelines, avoiding misleading or deceptive claims. Accuracy and transparency are paramount.

What is the best way for someone struggling with student loan debt to find trustworthy information?

Look for authors and resources affiliated with reputable organizations, such as government agencies, non-profit consumer advocacy groups, or accredited financial institutions. Verify information from multiple sources.