Navigating the complexities of higher education often involves the significant financial hurdle of student loans. Understanding your options is crucial for responsible borrowing and successful repayment. This guide delves into OnRamp student loans, providing a detailed overview of eligibility, repayment plans, interest rates, and potential benefits and drawbacks. We aim to equip you with the knowledge needed to make informed decisions about your educational financing.

From exploring eligibility requirements and comparing repayment options to understanding interest rates and fees, we cover all the essential aspects of OnRamp student loans. We also compare OnRamp to traditional federal loans and other alternative lenders, highlighting key differences to help you determine the best fit for your individual circumstances. This comprehensive guide is designed to demystify the process and empower you to confidently manage your student loan journey.

OnRamp Student Loan Eligibility Requirements

Securing an OnRamp student loan requires meeting specific eligibility criteria. These criteria are designed to assess the applicant’s ability to repay the loan and ensure responsible borrowing. Understanding these requirements is crucial before applying.

Income Requirements

OnRamp’s income requirements are designed to ensure borrowers have a consistent income stream sufficient to manage loan repayments. While specific income thresholds aren’t publicly advertised, they are likely evaluated on a case-by-case basis, considering factors like the loan amount requested and the applicant’s overall financial picture. Applicants should demonstrate a stable income history, preferably through consistent employment or self-employment documentation. The lender assesses the applicant’s ability to comfortably handle monthly payments alongside other financial obligations.

Credit Score Criteria

A strong credit score significantly impacts OnRamp’s loan approval process. While the exact minimum credit score isn’t publicly stated, a higher credit score generally improves the chances of approval and may lead to more favorable loan terms. Applicants with limited or damaged credit histories may find it more challenging to qualify. OnRamp likely utilizes credit reports from major credit bureaus to evaluate the applicant’s creditworthiness and repayment history. A higher credit score demonstrates a responsible borrowing history, reducing the lender’s perceived risk.

Application Process and Required Documentation

The OnRamp student loan application process typically involves several steps. First, applicants need to gather the necessary documentation, which usually includes proof of income (pay stubs, tax returns, bank statements), proof of identity (driver’s license, passport), and academic transcripts demonstrating enrollment or acceptance at an eligible institution. Next, the application is submitted online, and the lender reviews the provided information and documentation. Finally, upon approval, the loan terms are finalized, and the funds are disbursed.

Eligibility Criteria Summary

| Requirement | Description | Supporting Documents | Examples |

|---|---|---|---|

| Income | Demonstrates sufficient income to repay the loan. | Pay stubs, tax returns, bank statements, self-employment documentation. | Consistent employment for at least one year, documented self-employment income exceeding a certain threshold, proof of consistent freelance work. |

| Credit Score | A favorable credit score indicating responsible borrowing history. | Credit report from major credit bureaus. | A credit score above 650 (this is an example and the actual requirement is not publicly disclosed). Consistent on-time payments on existing debts. |

| Enrollment/Acceptance | Proof of enrollment or acceptance at an eligible educational institution. | Official academic transcripts, acceptance letter from the institution. | Official transcript from a university, college acceptance letter, enrollment confirmation. |

| Identity Verification | Valid government-issued photo identification. | Driver’s license, passport, national ID card. | A valid driver’s license, a current passport, a national identity card. |

OnRamp Student Loan Repayment Options

Understanding your repayment options is crucial for successfully managing your OnRamp student loan. OnRamp likely offers several repayment plans, each designed to cater to different financial situations and borrower preferences. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

OnRamp Student Loan Repayment Plans: A Comparison

OnRamp likely provides a range of repayment plans, including standard repayment, graduated repayment, extended repayment, and potentially income-driven repayment plans. While specific details may vary, we can illustrate the general characteristics of these plans and their potential impact on a borrower’s repayment schedule. It’s crucial to consult the official OnRamp documentation for the most up-to-date and accurate information on their offerings.

Standard Repayment Plan

The standard repayment plan typically involves fixed monthly payments over a set period (e.g., 10 years). This plan offers predictability and the shortest repayment timeline. However, the fixed monthly payments may be higher than other plans, especially for borrowers with larger loan amounts.

Graduated Repayment Plan

A graduated repayment plan features lower initial monthly payments that gradually increase over time. This can be beneficial for borrowers anticipating increased income in the future. However, the increasing payments can become challenging to manage if income growth doesn’t keep pace.

Extended Repayment Plan

This plan extends the repayment period, resulting in lower monthly payments. However, the extended timeline means paying more in total interest over the life of the loan.

Example Repayment Schedules

Let’s consider a hypothetical $20,000 loan at a 5% interest rate. The exact repayment schedule will depend on the chosen plan and loan terms. These are illustrative examples and may not reflect OnRamp’s specific calculations.

| Repayment Plan | Loan Amount | Interest Rate | Repayment Period | Approximate Monthly Payment | Total Interest Paid (Estimate) |

|---|---|---|---|---|---|

| Standard (10 years) | $20,000 | 5% | 120 months | $212 | $2,540 |

| Graduated (10 years) | $20,000 | 5% | 120 months | Starts lower, increases gradually | $2,540 (approximately) |

| Extended (20 years) | $20,000 | 5% | 240 months | $127 (approximately) | $5,080 (approximately) |

Sample Repayment Plan for a $20,000 Loan at 5% Interest

For a $20,000 loan at 5% interest, a standard 10-year repayment plan would result in approximate monthly payments of $212. A graduated plan might start around $150 and gradually increase to over $250 per month. An extended 20-year plan could lower monthly payments to approximately $127, but significantly increase the total interest paid. These are estimates; the actual figures from OnRamp may differ.

Pros and Cons of OnRamp Repayment Options

Understanding the advantages and disadvantages of each plan is crucial for informed decision-making.

Before listing the pros and cons, remember that these are generalizations. The specifics of each plan will depend on OnRamp’s current offerings and your individual loan terms.

- Standard Repayment:

- Pros: Predictable payments, shortest repayment period, lowest total interest paid.

- Cons: Highest monthly payments.

- Graduated Repayment:

- Pros: Lower initial payments, manageable for those anticipating income growth.

- Cons: Payments increase over time, potentially becoming unaffordable, higher total interest paid compared to standard.

- Extended Repayment:

- Pros: Lowest monthly payments.

- Cons: Longest repayment period, significantly higher total interest paid.

OnRamp Student Loan Interest Rates and Fees

Understanding the interest rates and fees associated with your OnRamp student loan is crucial for effective financial planning. This section will detail the factors influencing your interest rate, Artikel any additional fees, explain the interest calculation method, and illustrate how different loan amounts and interest rates impact your total repayment cost.

OnRamp student loan interest rates are variable, meaning they can fluctuate over the life of the loan. Several factors influence the rate you’ll receive. Your creditworthiness plays a significant role; a higher credit score generally translates to a lower interest rate. The loan term also affects the rate; longer loan terms often come with higher interest rates to compensate for the lender’s increased risk. Finally, prevailing market interest rates are a key determinant, as lenders adjust their rates based on broader economic conditions.

Factors Influencing OnRamp Student Loan Interest Rates

Several interconnected factors determine the interest rate applied to your OnRamp student loan. These include your credit history, which reflects your ability to manage debt responsibly. A strong credit history often results in a more favorable interest rate. The loan term, or the length of time you have to repay the loan, also influences the interest rate; longer repayment periods typically involve higher interest rates due to increased risk for the lender. Finally, prevailing market conditions significantly impact interest rates, as lenders adjust their offerings based on broader economic trends and the cost of borrowing money. For example, during periods of high inflation, interest rates tend to rise.

Additional Fees Associated with OnRamp Student Loans

While OnRamp aims for transparency, it’s important to be aware of potential fees. Late payment fees are a common example. If you miss a payment, you’ll likely incur a late fee, the amount of which will be specified in your loan agreement. Other potential fees could include origination fees (charged upfront to process the loan) or prepayment penalties (though less common). Review your loan documents carefully to understand all applicable fees.

OnRamp Student Loan Interest Calculation Method

OnRamp typically uses a simple interest calculation method. This means interest is calculated on the principal loan amount, and this interest accrues daily. The daily interest is then added to your principal balance, creating a compounding effect. Your monthly payment will cover both the interest accrued and a portion of the principal. The exact formula used might vary slightly depending on the specifics of your loan agreement, but the underlying principle remains consistent.

The formula is generally: Interest = (Principal x Interest Rate x Time)/365

, where time is expressed in days.

Impact of Loan Amount and Interest Rate on Total Repayment Cost

The following table demonstrates how varying loan amounts and interest rates affect the total repayment cost. These are illustrative examples and your actual repayment cost will depend on your specific loan terms and repayment plan.

| Loan Amount | Interest Rate | Loan Term (Years) | Total Repayment Cost (Estimate) |

|---|---|---|---|

| $10,000 | 5% | 10 | $12,577 |

| $10,000 | 7% | 10 | $13,950 |

| $20,000 | 5% | 10 | $25,154 |

| $20,000 | 7% | 10 | $27,900 |

OnRamp Student Loan Benefits and Drawbacks

Choosing a student loan requires careful consideration of various factors. OnRamp student loans, while offering certain advantages, also present some limitations compared to other options, particularly federal student loans. Understanding these benefits and drawbacks is crucial for making an informed decision.

Advantages of OnRamp Student Loans

OnRamp student loans may offer certain advantages depending on individual circumstances. These advantages could include streamlined application processes, potentially faster funding compared to some federal loan programs, and potentially more flexible repayment options tailored to specific income levels. However, it’s crucial to remember that these advantages are not universally applicable and depend on factors such as creditworthiness and income. Specific terms and conditions vary, and it’s essential to review the loan agreement thoroughly.

Disadvantages and Limitations of OnRamp Student Loans

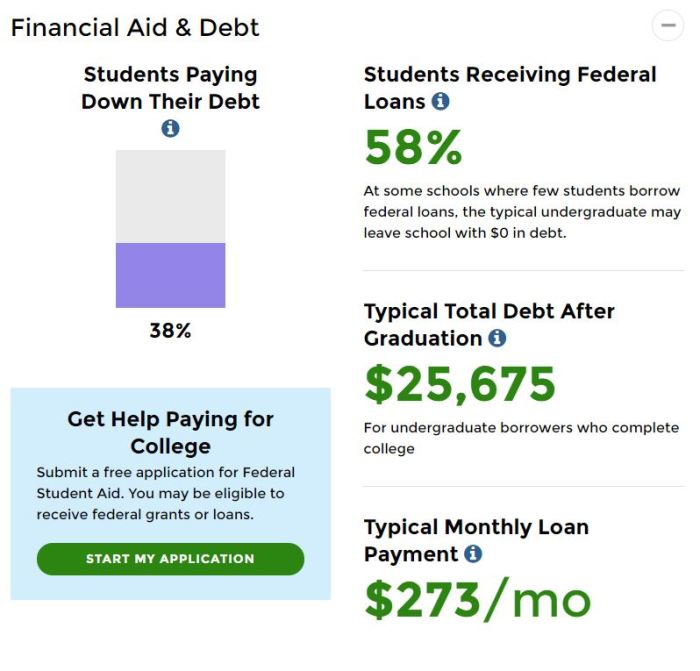

OnRamp loans, like any private loan, may have higher interest rates than federal loans, leading to a greater overall cost. They may also lack the same borrower protections as federal loans, such as income-driven repayment plans or loan forgiveness programs. Furthermore, eligibility requirements for OnRamp loans may be stricter than for federal loans, potentially excluding borrowers with less-than-perfect credit histories or lower incomes. The absence of government backing also means that OnRamp loans may not offer the same level of financial safety net in case of unforeseen circumstances.

Comparison of OnRamp and Federal Student Loans

A key difference between OnRamp and federal student loans lies in their funding source and associated benefits. Federal loans are backed by the government, offering various borrower protections and repayment options. OnRamp loans, being private loans, lack these government guarantees and may have less flexible repayment terms. This comparison highlights the importance of weighing the potential benefits of private loans against the safety net provided by federal loans.

| Feature | OnRamp vs. Federal |

|---|---|

| Funding Source | Private lender vs. U.S. Government |

| Interest Rates | Generally higher for OnRamp loans vs. potentially lower rates for Federal loans, depending on the loan type and creditworthiness. |

| Repayment Options | May offer various repayment plans, but potentially less flexible than federal loan options like income-driven repayment. |

| Borrower Protections | Fewer protections compared to federal loans, which offer options like deferment and forbearance in times of financial hardship. |

| Eligibility Requirements | Typically stricter credit and income requirements for OnRamp loans compared to federal loans. |

| Loan Forgiveness Programs | Generally not eligible for federal loan forgiveness programs, unlike some federal loan types. |

OnRamp Student Loan Customer Service and Support

Navigating the complexities of student loans can sometimes feel overwhelming. Fortunately, OnRamp provides several avenues for borrowers to access support and resolve any issues they may encounter. Understanding these options and how to utilize them effectively can significantly improve the overall borrowing experience.

OnRamp offers a multi-channel approach to customer service, ensuring borrowers can connect with support in a way that suits their preferences and needs. This includes various methods for obtaining assistance, from online resources to direct communication with representatives. The process for contacting support is generally straightforward and designed to provide timely and helpful resolutions.

Available Customer Support Channels

OnRamp’s customer support channels aim to provide convenient and accessible assistance. Borrowers can typically reach out via phone, email, and through their online portal. The online portal often features a comprehensive FAQ section addressing frequently asked questions, further enhancing self-service options. This tiered approach allows borrowers to find answers quickly and efficiently. For more complex issues or those requiring personalized attention, direct contact with a representative is usually recommended.

Contacting OnRamp Customer Service

The process for contacting OnRamp customer service usually involves identifying the most appropriate channel based on the nature of the inquiry. For simple questions or accessing account information, the online portal may suffice. For more involved issues requiring immediate attention, a phone call may be preferable. Emails are generally suitable for less urgent inquiries or for providing documentation. Regardless of the chosen method, clear and concise communication is crucial to ensure a prompt and effective resolution. Providing relevant account information, such as loan ID numbers, will expedite the process.

Examples of Common Customer Service Issues and Resolutions

Several common issues arise regarding student loans, and OnRamp’s customer service is designed to address them. For instance, questions about payment options and due dates are frequently addressed through the online portal or by phone. Issues regarding loan modifications or deferments often require a more in-depth discussion with a representative. Technical problems accessing the online portal might involve troubleshooting steps guided by customer service, potentially leading to password resets or account recovery. Disputes over billing amounts usually involve reviewing account statements and clarifying any discrepancies. In each case, providing accurate information and clearly articulating the problem greatly aids in efficient resolution.

Contact Information:

Phone: (Please insert OnRamp’s actual phone number here)

Email: (Please insert OnRamp’s actual email address here)

Website: (Please insert OnRamp’s actual website link here)

OnRamp Student Loan Alternatives

Choosing a student loan involves careful consideration of various factors, including interest rates, repayment options, and overall borrower experience. While OnRamp offers a specific set of features, several other lenders provide alternative options that might better suit individual needs and circumstances. Exploring these alternatives allows borrowers to make informed decisions based on their unique financial situations.

Exploring alternative student loan providers is crucial for finding the best fit for your financial circumstances. This section will compare OnRamp to three other prominent lenders, highlighting their key differences in terms of interest rates, repayment options, and suitability for specific borrower profiles. We will also consider situations where an alternative might be a more advantageous choice than OnRamp.

Comparison of OnRamp with Three Alternative Student Loan Providers

This section compares OnRamp to three alternative student loan providers: Sallie Mae, Discover Student Loans, and Ascent. The comparison focuses on interest rates, repayment terms, and circumstances under which each alternative might be preferable. It’s important to note that interest rates and terms are subject to change and depend on individual creditworthiness and loan type.

Sallie Mae

Sallie Mae is one of the largest student loan providers in the United States, offering a range of federal and private student loans. They generally offer a competitive range of interest rates, though these will vary based on creditworthiness and the type of loan. Repayment options include standard repayment plans, graduated repayment plans, and extended repayment plans. Sallie Mae might be preferable to OnRamp for borrowers who need a wider variety of repayment plan options or prefer a well-established, large-scale lender with a strong reputation.

- Offers both federal and private loans.

- Variety of repayment plan options.

- Strong reputation and established presence in the student loan market.

- Interest rates vary depending on creditworthiness and loan type.

Discover Student Loans

Discover Student Loans focuses on providing private student loans with competitive interest rates and flexible repayment options. They often offer features like autopay discounts and various repayment plan choices. Discover might be a better choice than OnRamp for borrowers who prioritize lower interest rates and appreciate the added benefit of autopay discounts. Their streamlined application process is also often cited as a positive aspect.

- Often offers competitive interest rates.

- Autopay discounts may be available.

- Streamlined application process.

- Flexible repayment options.

Ascent Student Loans

Ascent is a newer player in the student loan market, but they’ve gained traction by offering loans specifically designed for students pursuing specific career paths or those with co-signers. They often focus on providing support and resources for borrowers, particularly those who may have limited credit history. Ascent might be a preferable option to OnRamp for borrowers with limited credit history or those pursuing specific fields of study where Ascent offers specialized loan programs.

- Offers loans tailored to specific career paths.

- May be more lenient with borrowers with limited credit history.

- Provides support and resources for borrowers.

- May require a co-signer.

Illustrative Scenario: OnRamp Student Loan Application

This scenario follows Sarah, a recent college graduate, as she navigates the OnRamp student loan application process. Her experience highlights the typical steps, emotional considerations, and financial planning involved in securing and repaying a student loan.

Sarah, having just completed her degree in nursing, faces the reality of significant student loan debt. While excited about her future career, the weight of her financial obligations is palpable. She researched various loan options and decided that OnRamp’s flexible repayment plans and potential for lower interest rates aligned with her financial goals.

Application Submission

Sarah began the OnRamp application online. The process was straightforward, requiring her to provide personal information, details about her education, and her desired loan amount. She carefully reviewed all the information before submitting her application, ensuring accuracy to avoid any delays. She felt a mix of hope and anxiety as she clicked the “submit” button, knowing this was a significant step towards her financial future. The online portal provided clear instructions and progress updates, which eased her concerns about the complexity of the process.

Approval and Disbursement

Within a week, Sarah received an email notification that her OnRamp loan application had been approved. She experienced a wave of relief; the approval meant she could finally focus on her career without the immediate stress of outstanding tuition bills. The disbursement process was equally efficient; the funds were transferred directly to her university account within a few business days, settling her outstanding balance. This swift and transparent process was a positive contrast to her initial anxieties.

Post-Graduation Repayment Strategy

Sarah’s post-graduation repayment plan involved careful budgeting and prioritizing her loan payments. Understanding the importance of minimizing interest charges, she opted for OnRamp’s income-driven repayment plan. This plan adjusted her monthly payments based on her income, offering a safety net during her early career years when her income might be lower. She created a detailed monthly budget, allocating a specific amount for her loan repayment each month, ensuring she met her payment obligations consistently. She also researched resources available for nurses seeking to reduce their debt load, such as loan forgiveness programs specific to her profession. She recognized that consistent, proactive repayment would save her money in the long run and reduce the overall debt burden.

Last Recap

Securing a student loan can be a pivotal step towards achieving your educational goals. This guide has provided a thorough exploration of OnRamp student loans, covering eligibility, repayment options, costs, and comparisons to alternatives. By carefully considering the information presented, you can approach the loan application process with confidence and make informed choices that align with your financial situation and long-term objectives. Remember to always compare options and explore all available resources to ensure you find the best financing solution for your educational journey.

Common Queries

What is the maximum loan amount offered by OnRamp?

The maximum loan amount varies depending on factors such as your program of study and creditworthiness. It’s best to check directly with OnRamp for the most current information.

Does OnRamp offer loan forgiveness programs?

OnRamp’s loan forgiveness programs, if any, are not as widely available as those offered through federal student loan programs. Check their website for details on any potential programs.

What happens if I miss a loan payment?

Missing a payment will likely result in late fees and negatively impact your credit score. Contact OnRamp immediately if you anticipate difficulty making a payment to explore possible solutions.

Can I refinance my OnRamp student loan?

Refinancing options may be available once you’ve made a certain number of payments. Contact OnRamp or explore other refinancing lenders to see if this is an option for you.