The weight of student loan debt is a significant concern for many, impacting not only personal finances but also mental well-being. This guide delves into the complexities of paid student loans, exploring various types, repayment strategies, and the long-term consequences of this pervasive financial burden. We’ll examine government policies, explore coping mechanisms, and offer practical advice to navigate this challenging landscape.

From understanding the differences between federal and private loans to strategizing for effective repayment and managing the emotional toll, this comprehensive resource aims to equip readers with the knowledge and tools needed to successfully manage their student loan journey. We’ll cover everything from interest rates and repayment plans to the impact on credit scores and future financial goals.

The Burden of Paid Student Loans

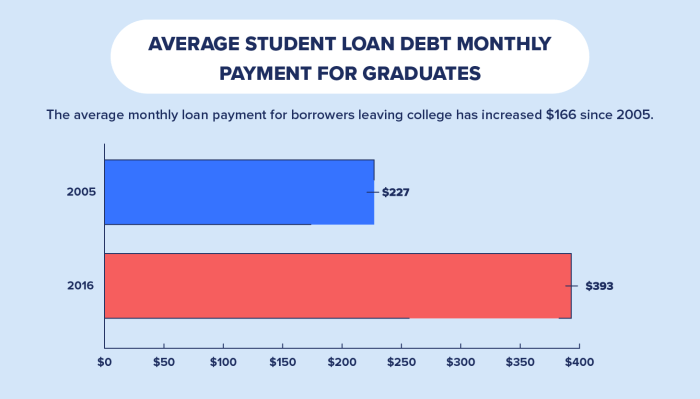

The rising cost of higher education has created a significant burden for many students and their families, leading to a dramatic increase in student loan debt. This debt can significantly impact an individual’s financial well-being for years, even decades, after graduation. Understanding the different types of loans, their associated costs, and repayment terms is crucial for navigating this complex financial landscape.

The Rising Cost of Higher Education and its Impact on Student Loan Debt

Tuition fees, room and board, and other educational expenses have been increasing at a rate far exceeding inflation for several years. This upward trend forces students to rely increasingly on loans to finance their education. The consequences are substantial: graduates enter the workforce saddled with significant debt, delaying major life milestones like homeownership, starting a family, or investing in retirement. This financial strain can also affect career choices, as graduates may prioritize higher-paying jobs over those aligned with their passions. For example, a recent study showed that the average student loan debt for a bachelor’s degree recipient is now over $37,000, significantly impacting their ability to save for a down payment on a house or invest in their future.

Types of Student Loans

There are two primary types of student loans: federal and private. Federal student loans are offered by the U.S. government and generally offer more favorable terms and repayment options, including income-driven repayment plans and loan forgiveness programs for certain professions. Private student loans, on the other hand, are offered by banks and other financial institutions. These loans often have higher interest rates and less flexible repayment options than federal loans. The choice between federal and private loans depends heavily on individual financial circumstances and creditworthiness. Borrowers with excellent credit may qualify for better rates on private loans, while those with limited credit history or lower credit scores may find federal loans more accessible.

Average Student Loan Debt Amounts by Degree Type and Institution

The average amount of student loan debt varies considerably depending on the type of degree pursued and the institution attended. Students pursuing graduate degrees, such as master’s or doctoral programs, typically accumulate significantly more debt than those pursuing undergraduate degrees. Similarly, students attending private institutions generally borrow more than those attending public institutions due to higher tuition costs. For instance, the average debt for a master’s degree recipient from a private university might be double that of a bachelor’s degree recipient from a public university. These differences highlight the importance of carefully considering the cost of education when choosing a program and institution.

Comparison of Student Loan Interest Rates and Repayment Terms

The following table compares the interest rates and repayment terms for various student loan options. Note that these are examples and actual rates and terms can vary depending on the lender, creditworthiness, and other factors.

| Loan Type | Interest Rate (Example) | Repayment Term (Example) | Deferment/Forbearance Options |

|---|---|---|---|

| Federal Subsidized Loan | Variable, currently around 5% | 10-20 years | Available under certain circumstances |

| Federal Unsubsidized Loan | Variable, currently around 6% | 10-20 years | Available under certain circumstances |

| Federal Grad PLUS Loan | Variable, currently around 7% | 10-20 years | Limited options |

| Private Student Loan | Variable, typically 7-12% or higher | 5-15 years | Limited or no options |

Repayment Strategies for Student Loans

Navigating the repayment of student loans can feel overwhelming, but understanding the available options and developing a sound strategy is crucial for long-term financial well-being. Choosing the right repayment plan depends on your individual financial situation, income, and loan type. This section Artikels various repayment strategies and provides guidance on managing student loan payments effectively.

Standard Repayment Plan

The standard repayment plan is the most common option. It typically involves fixed monthly payments over a 10-year period. The benefit of this plan is its simplicity and predictability; you know exactly how much you’ll pay each month and when your loans will be paid off. However, the monthly payments can be significantly higher than other plans, potentially straining your budget, especially in the early years after graduation when income may be lower. For example, a $30,000 loan at a 5% interest rate would require monthly payments of approximately $316, resulting in a total repayment of approximately $37,920.

Extended Repayment Plan

An extended repayment plan offers longer repayment periods, typically up to 25 years, leading to lower monthly payments compared to the standard plan. This can be beneficial for borrowers with limited income or those facing high debt burdens. The drawback, however, is that you’ll pay significantly more in interest over the life of the loan. Using the same $30,000 loan example, a 25-year extended repayment plan would reduce monthly payments, but the total interest paid would increase substantially, potentially exceeding the original loan amount.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. These plans, such as ICR, PAYE, REPAYE, andIBR, are designed to make student loan repayment more manageable for borrowers with lower incomes. Payments are typically recalculated annually based on your income and family size. While monthly payments are lower, the repayment period is extended, often to 20 or 25 years, and the total interest paid may be higher. The benefit lies in affordability, particularly during periods of low income, and the potential for loan forgiveness after a certain number of qualifying payments.

Loan Consolidation and Refinancing

Loan consolidation combines multiple federal student loans into a single loan, simplifying repayment. This can streamline the payment process and potentially lower your monthly payment, though it doesn’t reduce the total amount owed. Refinancing, on the other hand, involves replacing your existing student loans with a new loan from a private lender, potentially at a lower interest rate. This can lead to significant savings over the life of the loan but may come with stricter eligibility requirements and potentially lose certain federal loan benefits like income-driven repayment plans or loan forgiveness programs.

Budgeting Strategies for Managing Student Loan Payments

Effective budgeting is essential for successful student loan repayment. Strategies include creating a detailed budget that tracks all income and expenses, identifying areas where spending can be reduced, and automating loan payments to ensure timely payments. Prioritizing high-interest loans for repayment can minimize the overall interest paid. For example, using budgeting apps or spreadsheets to track expenses and creating a realistic monthly budget, including a dedicated line item for student loan payments, can significantly improve repayment management. Furthermore, exploring opportunities for increased income, such as a part-time job or side hustle, can provide additional funds to allocate towards loan repayment.

The Impact of Paid Student Loans on Personal Finances

Student loan debt can significantly impact various aspects of personal finances, extending far beyond the immediate repayment schedule. Understanding these long-term effects is crucial for effective financial planning and achieving long-term financial goals. The weight of student loan payments can influence major life decisions and create unforeseen challenges if not managed proactively.

Long-Term Effects on Financial Planning

Student loan debt can dramatically alter long-term financial planning. Large monthly payments can severely restrict the ability to save for significant life events. For instance, saving for a down payment on a home becomes considerably more difficult, potentially delaying homeownership indefinitely. Similarly, contributions to retirement accounts may be reduced or eliminated entirely, jeopardizing retirement security. The need to prioritize loan repayments often leaves little room for investing in other assets, hindering wealth accumulation and potentially reducing the overall return on investment over a lifetime. A hypothetical example illustrates this: Someone with $50,000 in student loan debt at a 6% interest rate might pay $500-$800 monthly, significantly reducing their ability to contribute to a 401k or IRA. This could lead to a substantial shortfall in retirement savings compared to someone without this debt burden.

The Impact of Student Loans on Credit Scores and Future Borrowing

Student loans, like any other debt, impact credit scores. Consistent on-time payments build positive credit history, while missed or late payments negatively affect credit scores. A lower credit score can lead to higher interest rates on future loans, such as mortgages, auto loans, or even personal loans, increasing the overall cost of borrowing. Conversely, responsible loan management can demonstrate creditworthiness, making it easier to secure loans in the future with favorable terms. For example, a borrower with a strong credit history due to consistent student loan payments might qualify for a lower interest rate on a mortgage, saving thousands of dollars over the life of the loan.

The Influence of Student Loan Debt on Career Choices and Lifestyle Decisions

The burden of student loan repayment can influence career choices. Individuals might prioritize higher-paying jobs, even if they are less fulfilling, to accelerate loan repayment. This can lead to career dissatisfaction and limit exploration of other professional paths. Lifestyle decisions are also affected. The need to manage loan payments often restricts spending on leisure activities, travel, and other non-essential expenses. For instance, a recent graduate might delay starting a family or buying a car due to the financial constraints imposed by student loans. This is especially true if the graduate chooses a career path with lower earning potential that aligns with their interests, rather than a higher-paying job that might not be as fulfilling.

Resources Available to Borrowers Struggling with Student Loan Repayment

Managing student loan debt can be challenging, but various resources are available to help borrowers. Understanding and utilizing these resources can significantly improve the repayment process and alleviate financial stress.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on income and family size, making them more manageable for borrowers with limited financial resources.

- Deferment and Forbearance: These options temporarily postpone or reduce loan payments during periods of financial hardship, providing a breathing room to recover financially.

- Student Loan Counseling Services: Nonprofit organizations offer free counseling to help borrowers understand their repayment options and create a manageable repayment plan.

- Loan Consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower interest rates.

- Government Websites and Resources: Federal government websites provide comprehensive information on student loan programs, repayment options, and available resources.

Government Policies and Student Loan Forgiveness Programs

Government policies surrounding student loan repayment and forgiveness in the United States are complex and constantly evolving. They aim to balance the need to support higher education access with the fiscal responsibility of managing a massive national debt. These policies significantly impact millions of borrowers and the overall economy.

Current Government Policies Regarding Student Loan Repayment

The federal government offers various repayment plans designed to make student loan repayment more manageable. These include income-driven repayment (IDR) plans, which tie monthly payments to a borrower’s income and family size. Examples include the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans. These plans often lead to loan forgiveness after a set number of years, typically 20 or 25, depending on the plan and loan type. Additionally, there are standard repayment plans with fixed monthly payments over a set period, usually 10 years. The government also offers deferment and forbearance options for borrowers experiencing temporary financial hardship, allowing them to temporarily suspend or reduce their payments. However, interest may still accrue during deferment or forbearance, potentially increasing the total loan amount owed.

Eligibility Criteria and Limitations of Existing Student Loan Forgiveness Programs

Eligibility for student loan forgiveness programs varies depending on the specific program. Generally, borrowers must have federal student loans, meet specific income requirements, and make timely payments for a certain period under a qualifying repayment plan. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of federal student loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. However, even with PSLF, many borrowers have faced difficulties meeting the stringent eligibility requirements, including maintaining continuous employment and making timely payments under an IDR plan. Furthermore, some borrowers have discovered that their loans were not eligible for forgiveness due to inconsistencies in loan servicing or loan consolidation. These limitations highlight the need for clearer communication and more streamlined processes for loan forgiveness programs.

Potential Economic and Social Implications of Widespread Student Loan Forgiveness

Widespread student loan forgiveness could have significant economic and social implications. Proponents argue it would stimulate the economy by freeing up borrowers’ disposable income, leading to increased consumer spending and economic growth. It could also address wealth inequality by reducing the financial burden on borrowers, particularly those from low-income backgrounds. However, critics argue that forgiveness would be costly to taxpayers, potentially increasing the national debt and leading to inflationary pressures. There are also concerns about the fairness of forgiving loans for those who already benefited from higher education while leaving others who did not attend college to shoulder the burden. The actual economic and social impact would depend on the design and scale of any forgiveness program, and careful consideration must be given to its potential consequences. For example, a targeted forgiveness program focusing on specific demographics or loan types might mitigate some of the negative economic effects.

A Hypothetical Alternative Policy Proposal

Instead of widespread loan forgiveness, a more sustainable approach might involve a combination of reforms. This could include expanding and simplifying income-driven repayment plans, ensuring greater transparency and accountability in loan servicing, and increasing funding for higher education to reduce the need for extensive borrowing. Furthermore, strengthening financial literacy programs could help students make informed decisions about borrowing and managing their debt. This multi-pronged approach would address the root causes of the student loan debt crisis while minimizing the potential negative consequences of large-scale forgiveness. This would require a comprehensive review of current policies and collaboration between government agencies, educational institutions, and lending institutions to ensure a more equitable and sustainable system for managing student loan debt.

The Psychological Impact of Student Loan Debt

The weight of significant student loan debt extends far beyond the financial realm, significantly impacting the emotional and mental well-being of borrowers. The constant pressure of repayment can lead to chronic stress, anxiety, and even depression, affecting various aspects of daily life, from relationships to career choices. Understanding this psychological burden is crucial for developing effective coping mechanisms and accessing necessary support.

The emotional and mental health challenges associated with substantial student loan debt are multifaceted. Many borrowers experience heightened stress and anxiety stemming from the ongoing financial obligation. This stress can manifest physically, leading to sleep disturbances, headaches, and digestive issues. The feeling of being overwhelmed and trapped by debt can also contribute to feelings of hopelessness and depression. Furthermore, the constant worry about repayment can negatively impact relationships, as financial strain often puts a significant burden on personal connections. Career choices may also be influenced, with individuals potentially accepting less fulfilling jobs for higher salaries to accelerate repayment, leading to feelings of dissatisfaction and resentment.

Coping Strategies for Student Loan Stress

Effective coping strategies are essential for managing the stress and anxiety associated with student loan repayment. These strategies can include practicing mindfulness techniques, such as meditation or deep breathing exercises, to manage immediate feelings of overwhelm. Regular physical activity can also be beneficial, helping to release endorphins and improve overall mood. Seeking support from friends, family, or a therapist can provide emotional relief and guidance. Financial counseling can help individuals create a manageable repayment plan and gain a sense of control over their finances. Finally, prioritizing self-care, including adequate sleep, healthy eating, and engaging in enjoyable activities, is crucial for maintaining mental well-being.

Available Resources for Students and Graduates

Numerous resources are available to students and graduates struggling with the financial and emotional burden of student loan debt. Many universities and colleges offer counseling services that address both financial and mental health concerns. Non-profit organizations, such as the National Foundation for Credit Counseling, provide free or low-cost financial counseling and debt management assistance. Government agencies, like the Department of Education, offer information on repayment plans and loan forgiveness programs. Online resources and support groups provide a platform for connecting with others facing similar challenges, fostering a sense of community and shared understanding. It is crucial to remember that seeking help is a sign of strength, not weakness, and accessing available resources can significantly improve mental and financial well-being.

Visual Representation of the Emotional Toll of Student Loan Debt

Imagine a towering, dark mountain representing the weight of student loan debt. The mountain is jagged and unforgiving, its peaks shrouded in a perpetual fog of anxiety and uncertainty. A tiny figure, representing the individual borrower, struggles to ascend the steep slopes, their path littered with obstacles like missed payments, unexpected expenses, and feelings of hopelessness. The sky above is often stormy, symbolizing the emotional turmoil and stress, while occasional glimpses of sunshine represent moments of hope and progress. The figure’s progress is slow and arduous, reflecting the long-term nature of repayment, but even small advancements are marked by a sense of accomplishment and relief. The overall image evokes a sense of overwhelming burden, yet also resilience and the possibility of eventual success.

Closing Notes

Successfully navigating the complexities of paid student loans requires a proactive and informed approach. By understanding the various loan types, exploring available repayment options, and proactively managing personal finances, individuals can mitigate the long-term impact of student debt. Remember to utilize available resources and seek professional guidance when needed to create a sustainable path towards financial freedom. The journey may be challenging, but with careful planning and informed decision-making, you can achieve your financial goals.

Question & Answer Hub

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can discuss options like forbearance or deferment to temporarily suspend payments or explore income-driven repayment plans.

Can I deduct student loan interest from my taxes?

Potentially, yes. The student loan interest deduction allows you to deduct the amount you paid in student loan interest during the tax year, up to a certain limit. Eligibility requirements apply.

What is loan consolidation?

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment plan. This can simplify payments but may not always result in lower overall interest.

How do income-driven repayment plans work?

These plans base your monthly payment on your income and family size. Payments are typically lower, but the repayment period is often longer.