Navigating the world of higher education financing can feel like traversing a complex maze. Two prominent paths often emerge: parent loans and student loans. While both aim to fund a student’s education, they differ significantly in eligibility requirements, interest rates, repayment terms, and long-term financial implications. Understanding these nuances is crucial for making informed decisions that align with your financial goals and circumstances. This guide provides a clear comparison of parent and student loans, empowering you to choose the best option for your unique situation.

This detailed comparison will explore the key differences between parent and student loans, examining factors such as credit requirements, interest rates, repayment schedules, and the potential impact on credit history. We will also delve into the tax implications of each loan type and discuss alternative financing options to help you make a well-informed decision about funding your education.

Loan Eligibility Requirements

Securing a student loan, whether for yourself or as a parent, involves meeting specific eligibility criteria. These requirements vary depending on the loan type and lender, but generally center around creditworthiness, income, and enrollment status. Understanding these differences is crucial for a successful application.

Parent Loan Eligibility Criteria

Parent PLUS loans, for example, have stricter requirements than student loans. The primary applicant, the parent, must be a U.S. citizen or eligible non-citizen. They must also have a Social Security number and be the biological or adoptive parent of a dependent student enrolled at least half-time in a degree or certificate program at an eligible school. A satisfactory credit check is mandatory; adverse credit history, including bankruptcies or foreclosures, may result in loan denial. Furthermore, the parent must complete a Master Promissory Note (MPN) agreeing to the terms of the loan. Income verification is usually conducted through tax documents or pay stubs, demonstrating sufficient income to manage the loan repayment. The lender will assess the parent’s debt-to-income ratio to determine their ability to repay the loan.

Student Loan Eligibility Criteria

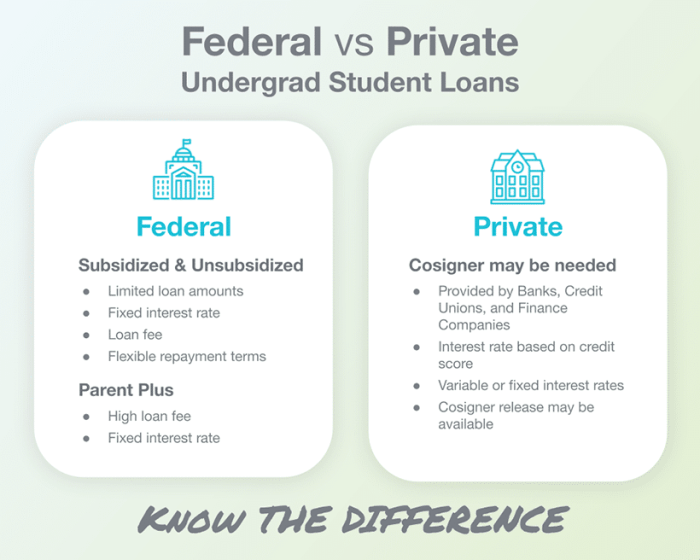

Student loan eligibility hinges on factors such as enrollment status, citizenship, and financial need (for need-based loans). Applicants must be enrolled at least half-time in a degree or certificate program at a title IV eligible institution. U.S. citizenship or eligible non-citizen status is typically required. While a credit check might be conducted, the credit history requirements are generally less stringent than for parent loans. Many student loans, particularly federal ones, are need-based, meaning the student’s financial need is assessed through the FAFSA (Free Application for Federal Student Aid). This process considers factors such as parental income and assets, the student’s income and assets, and the cost of attendance. Income verification for student loans usually involves submitting the FAFSA, which pulls information from the IRS and other relevant sources.

Credit Score Requirements: Parent vs. Student Loans

A significant difference lies in the credit score requirements. Parent PLUS loans often necessitate a minimum credit score, which varies by lender, but is generally higher than the threshold for student loans. A poor credit history can lead to loan denial or necessitate a co-signer for a parent loan. Student loans, particularly federal ones, are often more lenient in their credit score requirements, sometimes not requiring a credit check at all, especially for subsidized loans. Unsubsidized loans may require a credit check, but the requirements are generally less strict.

Income Verification Processes

The income verification process differs between parent and student loans. For parent PLUS loans, lenders typically require tax returns or pay stubs to verify income and assess repayment ability. This is a direct verification process focusing on the parent’s financial capacity. For student loans, the income verification is largely handled through the FAFSA, which uses a more indirect approach, gathering information from the IRS and other sources to assess the student’s and their family’s financial need. While additional documentation may be requested, the initial verification process is primarily facilitated by the FAFSA.

Interest Rates and Repayment Terms

Understanding the interest rates and repayment terms for both parent loans and student loans is crucial for effective financial planning. These factors significantly impact the overall cost of borrowing and the length of time it takes to repay the debt. Differences in interest rates and repayment options exist between these two loan types, which we will explore in detail below.

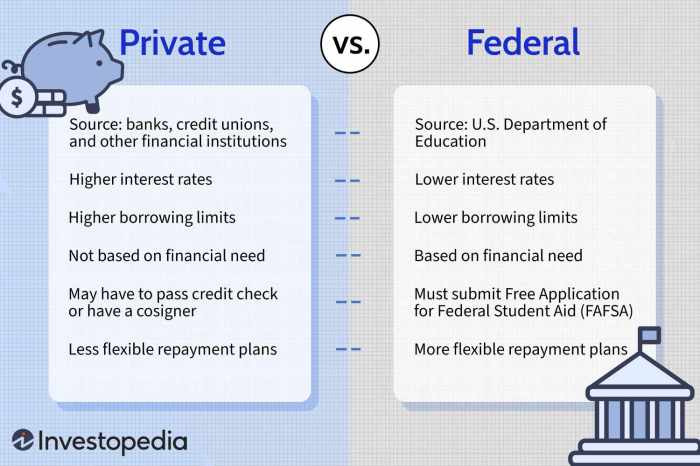

Parent loans and student loans typically have different interest rates, reflecting the varying levels of risk associated with each. Student loans often come with lower interest rates because they are typically backed by the government and are considered less risky for lenders. Parent loans, on the other hand, are often unsecured and may carry higher interest rates, reflecting the increased risk to the lender.

Interest Rate Comparison

Let’s consider two hypothetical scenarios. Scenario 1: A student takes out a federal student loan with a fixed interest rate of 5% for $20,000. Scenario 2: A parent borrows $20,000 through a private parent loan with a variable interest rate that starts at 7% but could potentially rise or fall based on market conditions. The difference in interest rates immediately highlights a potential cost difference over the loan’s life. The parent loan, with its potentially higher interest rate, will likely lead to significantly higher total interest payments compared to the student loan.

Repayment Options

Both parent and student loans offer various repayment options. Student loans often include income-driven repayment plans, which adjust monthly payments based on the borrower’s income and family size. These plans can be beneficial for borrowers facing financial hardship. Parent loans typically offer standard repayment plans with fixed monthly payments over a set period. Some lenders may offer options such as variable interest rates or extended repayment periods, but these options often come with higher overall interest costs. Fixed interest rates provide predictability, while variable rates offer the potential for lower payments initially but carry the risk of higher payments if interest rates rise.

Repayment Schedule Comparison

The following table illustrates potential repayment schedules for both parent and student loans under different scenarios. Note that these are simplified examples and actual repayment schedules can vary based on lender policies and individual circumstances.

| Loan Type | Loan Amount | Interest Rate | Repayment Term (Years) |

|---|---|---|---|

| Federal Student Loan | $20,000 | 5% Fixed | 10 |

| Private Parent Loan | $20,000 | 7% Fixed | 10 |

| Federal Student Loan | $30,000 | 6% Fixed | 15 |

| Private Parent Loan | $30,000 | 8% Variable (starting rate) | 15 |

Loan Amounts and Limits

Understanding the maximum loan amounts available for both parent and student loans is crucial for effective financial planning during higher education. These limits are designed to balance the need for accessible funding with responsible borrowing practices and are subject to change based on factors such as the student’s financial need, the cost of attendance at their chosen institution, and the type of loan.

Loan limits are established annually and are often reviewed and adjusted by the relevant lending institutions or government agencies. These adjustments consider factors like inflation, changes in tuition costs, and overall economic conditions. It’s therefore vital to check the current limits with your lender before applying for a loan.

Parent Loan Limits Per Academic Year

Parent PLUS loans, offered by the federal government, allow parents to borrow up to the total cost of attendance (COA) minus other financial aid received by the student. The COA encompasses tuition, fees, room and board, and other necessary educational expenses. However, the parent must pass a credit check, and if they have adverse credit history, they may be denied the loan or required to have a credit-worthy co-signer. The loan amount is disbursed directly to the educational institution to cover the student’s expenses. For example, if a student’s COA is $30,000 and they receive $10,000 in grants and scholarships, the maximum parent PLUS loan amount would be $20,000.

Student Loan Limits Per Academic Year

Federal student loans, including subsidized and unsubsidized loans, have annual and aggregate limits. These limits vary depending on the student’s year in school (freshman, sophomore, junior, senior) and their dependency status. For instance, a dependent undergraduate student might have an annual limit of $5,500 for their freshman year, increasing each subsequent year. Independent undergraduate students generally have higher limits. Graduate students also have different, usually higher, loan limits. These limits are set by the federal government and are designed to ensure students borrow responsibly. Furthermore, exceeding the loan limit in one year doesn’t necessarily allow for higher borrowing in future years.

Scenario Illustrating Combined Borrowing Capacity

Let’s consider a scenario where a student, Sarah, is attending a four-year university. Her cost of attendance (COA) is $25,000 per year. She receives $5,000 per year in scholarships. Her parents can obtain a Parent PLUS loan. Let’s assume Sarah’s eligibility for federal student loans allows her to borrow the maximum amount each year. For simplicity, we’ll assume consistent annual loan limits and scholarship amounts.

Year | Student Loan (Max) | Parent PLUS Loan (Max) | Total Loan Amount

——- | ——– | ——– | ——–

Freshman | $5,500 | $20,000 | $25,500

Sophomore | $6,500 | $20,000 | $26,500

Junior | $7,500 | $20,000 | $27,500

Senior | $7,500 | $20,000 | $27,500

This scenario illustrates how combining parent and student loans can significantly increase a student’s borrowing capacity to meet their educational expenses. It’s crucial to remember that these are illustrative figures, and actual loan limits and available financial aid may vary.

Impact on Credit History

Taking out a student loan or a parent loan will impact your credit history, but the specifics depend on several factors, including whether the loan is in your name, whether you’re a co-signer, and how diligently you make your payments. Both types of loans can help build credit if managed responsibly, but defaulting on either can have severe and long-lasting consequences.

Both parent and student loans are installment loans, meaning they are repaid over a set period with regular payments. On-time payments are reported to credit bureaus and contribute to a positive credit history, boosting your credit score. Conversely, late or missed payments negatively impact your credit score. The severity of the negative impact depends on the frequency and severity of the missed payments. Consistent responsible repayment builds a strong credit history, while consistent delinquency can severely damage it.

Consequences of Loan Default

Defaulting on a loan, whether it’s a parent loan or a student loan, has serious repercussions. This occurs when you fail to make payments for a significant period, as defined by the lender. The consequences include damage to your credit score, wage garnishment, tax refund offset, and potential legal action. For federal student loans, default can also lead to the loss of eligibility for future federal student aid. For parent loans, the consequences are similar, although the specific repercussions may vary based on the lender and the type of loan. A default will significantly lower your credit score, making it difficult to obtain future loans, credit cards, or even rent an apartment. The impact of a default can remain on your credit report for seven years or more.

Co-Signer’s Credit History Impact

When a parent co-signs a student loan for their child, they assume the responsibility of repayment should the student default. This means that any missed payments by the student will directly impact the co-signer’s credit history, just as if the co-signer had taken out the loan themselves. A co-signer’s credit score can be severely damaged by the borrower’s default. This is a crucial factor to consider before co-signing a loan, as the co-signer’s financial future is directly tied to the borrower’s ability to repay the loan. For example, if a parent co-signs a $20,000 loan and the student defaults, the parent’s credit score could suffer significantly, making it harder to obtain a mortgage or other loans in the future. The negative impact on the co-signer’s credit report can persist for years.

Tax Implications

Understanding the tax implications of both parent and student loans is crucial for effective financial planning. The tax benefits, or lack thereof, can significantly impact your overall tax liability. This section will Artikel the key differences in how these loan types are treated for tax purposes.

The primary difference lies in who is responsible for the loan and, consequently, who can claim deductions or credits. Student loans are borrowed by the student, while parent loans are borrowed by a parent on behalf of the student. This distinction directly affects the eligibility for tax benefits.

Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount of interest they paid on qualified student loans during the tax year. This deduction can reduce your taxable income, ultimately lowering your tax bill. To be eligible, the student must be pursuing a degree or other credential at an eligible educational institution, and the loan must be used to pay for qualified education expenses. The deduction is limited to the actual interest paid, up to a maximum amount set annually by the IRS. For example, if a student paid $2,000 in student loan interest during the year, and they meet all eligibility requirements, they could deduct this amount from their gross income, resulting in a lower tax liability. The amount of the deduction may be phased out for higher income taxpayers.

Parent PLUS Loan Interest Deduction

Unlike student loans, there is no specific tax deduction for interest paid on Parent PLUS loans. While the interest paid is not deductible, it’s important to note that the parent borrower can still include the interest paid on their tax return as part of their total itemized deductions, if they itemize rather than using the standard deduction. This could potentially indirectly reduce their taxable income, but only if their total itemized deductions exceed their standard deduction. The impact of this would depend on their other itemized deductions and their overall income. For example, a parent paying $3,000 in Parent PLUS loan interest would not get a specific deduction for that interest, but it could be factored into their itemized deductions if it helps them exceed the standard deduction.

Long-Term Financial Implications

Choosing between parent loans and student loans carries significant long-term financial consequences that extend far beyond the repayment period. Understanding these implications is crucial for making informed decisions about financing your education and planning for your future. The differences in loan terms, interest rates, and repayment schedules can dramatically impact your financial health for years to come.

The long-term financial impact of parent loans versus student loans differs significantly due to several factors. Parent loans, while potentially offering lower interest rates in some cases, place a direct financial burden on the parents. This can delay or prevent them from achieving their own financial goals, such as retirement savings or homeownership. Student loans, on the other hand, place the burden directly on the student, impacting their ability to save for a down payment, manage credit, and build financial stability post-graduation. Both scenarios, however, have the potential to negatively affect credit scores if not managed responsibly.

Impact on Future Financial Decisions

The debt incurred from either parent or student loans can significantly impact major life decisions, particularly home buying. A large loan balance can reduce credit scores, limiting access to favorable mortgage rates and potentially disqualifying borrowers from securing a mortgage altogether. For example, a family taking out substantial parent loans might find it challenging to save enough for a down payment and closing costs on a house, delaying homeownership. Similarly, a student burdened with significant student loan debt might need to postpone home buying or settle for a less desirable property due to reduced borrowing power. The impact extends beyond homeownership to other major purchases, such as cars and investments. Careful budgeting and debt management are crucial to mitigate these effects.

Strategies for Managing Debt Burden

Effective debt management strategies are essential regardless of whether the loan is a parent or student loan. For parent loans, creating a detailed repayment plan that fits within the family’s budget is paramount. This might involve adjusting spending habits, increasing income, or refinancing the loan to secure a lower interest rate. For student loans, exploring different repayment plans, such as income-driven repayment or extended repayment periods, can make monthly payments more manageable. Prioritizing high-interest debt and aggressively paying down the principal can save significant money in the long run. Additionally, regular communication with lenders and financial advisors can help borrowers navigate the complexities of loan repayment and develop personalized strategies for managing their debt. Budgeting tools and financial literacy resources can also play a significant role in responsible debt management.

Alternative Financing Options

Securing funding for higher education can be a significant undertaking. While parent and student loans are common routes, several alternative financing options exist, each with its own set of advantages and disadvantages. Understanding these alternatives is crucial for making informed decisions about how to best finance your education.

Exploring alternative financing methods allows students and families to diversify their funding sources, potentially reducing reliance on loans with high interest rates and long repayment periods. These options can provide flexibility and potentially lower overall educational costs.

Scholarships and Grants

Scholarships and grants represent a significant source of need-based and merit-based financial aid. They are generally awarded based on academic achievement, extracurricular involvement, demonstrated financial need, or specific talents. Unlike loans, scholarships and grants do not need to be repaid. Numerous organizations, including colleges, universities, private foundations, and corporations, offer scholarships and grants. Students should diligently research and apply to various programs to maximize their chances of receiving funding. The Free Application for Federal Student Aid (FAFSA) is a crucial tool for determining eligibility for federal grants such as the Pell Grant.

Work-Study Programs

Work-study programs provide part-time employment opportunities to students while they are enrolled in school. These programs allow students to earn money to help cover educational expenses, reducing their dependence on loans. The earnings from work-study jobs are often tax-free, further enhancing their financial benefit. Eligibility for work-study is determined through the FAFSA application. Students typically work on campus, but some programs allow for off-campus employment opportunities.

Savings and Investments

Utilizing existing savings and investments is a vital aspect of financing higher education. Families should consider setting aside funds specifically for college expenses well in advance. 529 plans, for instance, are tax-advantaged savings plans designed to encourage saving for future education costs. These plans offer tax-deferred growth and tax-free withdrawals when used for qualified education expenses. Careful financial planning and disciplined saving habits can significantly reduce the need for borrowing.

Family Contributions

Family contributions, including financial support from parents, grandparents, or other relatives, can substantially reduce the reliance on external financing options. Open communication within the family regarding financial resources and expectations is essential. Families may pool resources or establish a savings plan to contribute to educational expenses. This approach fosters a collaborative effort in financing the student’s education and minimizes the need for significant borrowing.

Employer Tuition Reimbursement

Some employers offer tuition reimbursement programs to their employees, helping cover the costs of furthering their education. These programs often require employees to maintain a certain level of performance and may have specific eligibility requirements. Employees should inquire with their employers about available tuition assistance programs. This benefit can significantly reduce the overall cost of education and provide an alternative to student loans.

Comparison of Financing Options

| Financing Option | Advantages | Disadvantages | Repayment |

|---|---|---|---|

| Scholarships/Grants | Free money, no repayment | Competitive, requires applications | None |

| Work-Study | Earns income, reduces loan burden | Limited hours, may impact studies | None |

| Savings/Investments | Reduces loan need, tax advantages (529 plans) | Requires long-term planning, market risk | None |

| Family Contributions | Reduces loan burden, strengthens family bonds | Relies on family resources, may create financial strain | None |

| Employer Tuition Reimbursement | Covers tuition costs, reduces loan need | Specific eligibility requirements, limited availability | None |

| Parent Loans | Larger loan amounts available | Debt burden on parents, interest accrues | Monthly payments over a set period |

| Student Loans | Access to funds for education | Interest accrues, debt burden on student | Monthly payments over a set period |

Last Word

Ultimately, the choice between a parent loan and a student loan depends on individual circumstances and financial profiles. Careful consideration of eligibility requirements, interest rates, repayment terms, and long-term financial implications is essential. By understanding the strengths and weaknesses of each loan type and exploring alternative financing options, you can make an informed decision that supports your educational aspirations without jeopardizing your long-term financial well-being. Remember to thoroughly research and compare offers before committing to any loan.

FAQ Explained

What happens if I default on a parent loan?

Defaulting on a parent loan severely damages the credit score of both the parent borrower and any co-signers. It can lead to wage garnishment, tax refund offset, and difficulty securing future loans.

Can I refinance a parent loan?

Refinancing options for parent loans are limited compared to student loans. The availability depends on factors like credit score and loan terms. Often, refinancing is only possible if the parent borrower has excellent credit.

Are there income-driven repayment plans for parent loans?

Generally, income-driven repayment plans are not available for parent loans. Repayment terms are typically fixed and based on the loan amount and interest rate.

What if my parents can’t get a parent loan?

If your parents are ineligible for a parent loan, you can explore alternative options such as federal student loans, private student loans, scholarships, grants, and work-study programs.