Navigating the complexities of higher education funding often involves exploring various financial aid options. For many families, the Parent PLUS Loan becomes a crucial component of their college financing strategy. This loan program, offered by the federal government, allows parents to borrow money to help cover their child’s educational expenses. Understanding the intricacies of Parent PLUS Loans—from eligibility requirements to repayment options—is paramount to making informed financial decisions and avoiding potential pitfalls.

This guide delves into the key aspects of Parent PLUS Loans, providing a comprehensive overview of the application process, interest rates, repayment plans, and potential long-term financial implications. We aim to equip parents with the necessary knowledge to determine if a Parent PLUS Loan is the right choice for their family and, if so, how to manage it effectively. We will also address common concerns and offer strategies for responsible borrowing and repayment.

Parent PLUS Loan Eligibility Requirements

Securing a Parent PLUS Loan requires meeting specific criteria established by the Federal Student Aid program. Understanding these requirements is crucial for parents seeking to finance their children’s higher education. This section details the eligibility process, including income considerations, credit checks, and application procedures. It also provides a comparison with other federal student loan programs.

Income Requirements for Parent PLUS Loan Eligibility

There are no specific income requirements to be eligible for a Parent PLUS Loan. However, your credit history plays a significant role in the approval process. While the government doesn’t set an income threshold, lenders will review your creditworthiness to determine your ability to repay the loan. A strong credit history increases your chances of approval. Conversely, a poor credit history might lead to denial, requiring you to explore alternative financing options, such as applying for a loan with a co-signer or seeking private loans.

Credit History Check Process for Parent PLUS Loan Applicants

The Department of Education conducts a credit check on all Parent PLUS loan applicants. This check assesses your creditworthiness based on your credit history and report, including factors such as payment history, outstanding debts, and any bankruptcies or foreclosures. A favorable credit report, indicating responsible financial management, significantly increases your likelihood of approval. Adverse credit history, such as late payments or defaults, can result in loan denial. In such cases, the Department of Education may offer the opportunity to obtain an endorser (co-signer) to secure the loan.

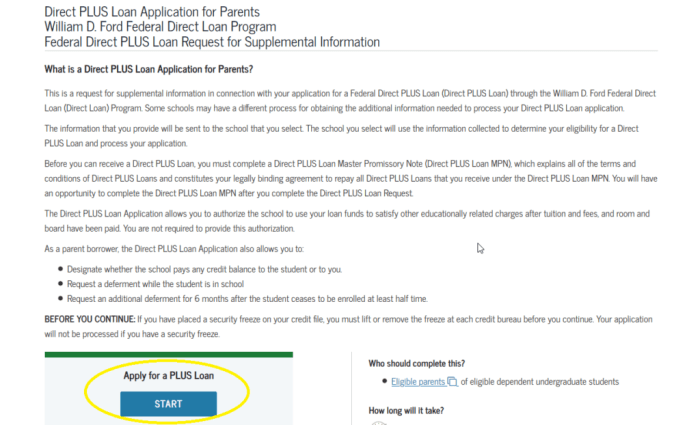

Step-by-Step Guide on Completing the Parent PLUS Loan Application

The Parent PLUS loan application process is typically completed online through the Federal Student Aid website (StudentAid.gov). The steps generally include:

- Complete the Free Application for Federal Student Aid (FAFSA): This application provides essential financial information needed to determine eligibility for federal student aid, including Parent PLUS loans.

- Submit the Parent PLUS Loan application: After completing the FAFSA, you’ll receive an invitation to apply for a Parent PLUS loan, which you’ll submit online.

- Credit check and approval: The Department of Education will conduct a credit check. Approval depends on the outcome of this check.

- Loan disbursement: Once approved, the funds will be disbursed directly to the student’s school to cover eligible educational expenses.

Comparison of Parent PLUS Loan Eligibility with Other Federal Student Loan Programs

Parent PLUS loans differ significantly from other federal student loan programs, primarily in their applicant. Unlike subsidized or unsubsidized federal student loans, which are directly given to students based on their financial need and creditworthiness, Parent PLUS loans are given to parents to finance their child’s education. Eligibility for Parent PLUS loans hinges primarily on the parent’s credit history, while student loan eligibility is based on the student’s financial need and enrollment status. The interest rates and repayment terms may also vary between these loan types.

Key Parent PLUS Loan Eligibility Factors

| Requirement | Description | Documentation Needed | Impact on Application |

|---|---|---|---|

| U.S. Citizenship or Eligible Non-Citizen Status | Applicant must be a U.S. citizen or eligible non-citizen. | Proof of citizenship or eligible non-citizen status (e.g., passport, birth certificate). | Required for application; lack of documentation leads to denial. |

| Credit Check | Applicant undergoes a credit check to assess creditworthiness. | Credit report and credit history information. | Positive credit history increases approval chances; negative history may lead to denial or requirement of an endorser. |

| Student Enrollment | The student must be enrolled at least half-time in an eligible degree or certificate program. | Acceptance letter or enrollment verification from the educational institution. | Essential for loan approval; lack of enrollment renders the application ineligible. |

| Financial Responsibility | Demonstrated ability to manage finances responsibly. | Credit report, income documentation, and payment history. | Strong financial responsibility increases the likelihood of approval. |

Interest Rates and Fees Associated with Parent PLUS Loans

Parent PLUS loans, while offering crucial financial assistance for higher education, come with associated interest rates and fees that significantly impact the overall cost of borrowing. Understanding these financial aspects is vital for responsible financial planning. This section will detail the current interest rates, how they are determined, and the associated origination fees. We will also provide a comparison to illustrate the total cost of borrowing under different scenarios.

The interest rate for Parent PLUS loans is a fixed rate, meaning it remains constant throughout the loan’s life. Unlike some variable-rate loans, this predictability allows for easier budgeting and repayment planning. However, the specific rate is determined by the U.S. Department of Education and is subject to change each fiscal year (July 1st to June 30th). Therefore, it’s crucial to check the current rate directly with the Federal Student Aid website before applying for a loan. The rate is usually announced in the spring for the upcoming academic year.

Parent PLUS Loan Interest Rate Determination

The interest rate for Parent PLUS loans is set by the government and is based on several factors including prevailing market interest rates and the overall economic climate. These rates are not directly tied to an individual borrower’s creditworthiness, unlike private student loans. The rate is generally higher than federal student loans available directly to students. For example, the rate may increase if overall interest rates in the economy are rising, reflecting the higher cost of borrowing for the government.

Parent PLUS Loan Origination Fees

Origination fees are upfront charges deducted from the total loan amount disbursed to the borrower. These fees are a percentage of the loan amount and help cover the administrative costs associated with processing and managing the loans. The fee is typically a fixed percentage. For example, if the origination fee is 4.228%, and a parent borrows $10,000, the fee would be $422.80. This amount is deducted from the $10,000 before the funds are disbursed to the school.

Comparison of Total Borrowing Costs

The following table illustrates the total cost of borrowing for different loan amounts and repayment plans, assuming a fixed interest rate and consistent monthly payments. Remember that these are examples and the actual costs will depend on the current interest rate, loan amount, and repayment plan chosen.

| Loan Amount | Interest Rate (Example: 7.5%) | 10-Year Repayment | 15-Year Repayment |

|---|---|---|---|

| $10,000 | 7.5% | $11,700 (approx.) | $13,500 (approx.) |

| $20,000 | 7.5% | $23,400 (approx.) | $27,000 (approx.) |

| $30,000 | 7.5% | $35,100 (approx.) | $40,500 (approx.) |

*Note: These figures are estimates and do not include origination fees. Actual costs may vary.*

Strategies for Minimizing Parent PLUS Loan Costs

Borrowing only the amount needed is crucial. Careful budgeting and exploring other financial aid options can reduce reliance on Parent PLUS loans. Choosing a shorter repayment plan, while resulting in higher monthly payments, significantly reduces the total interest paid over the life of the loan. Exploring income-driven repayment plans, if eligible, might lower monthly payments, although it may extend the repayment period and increase the total interest paid. Finally, prompt repayment is key to minimizing overall costs.

Repayment Options for Parent PLUS Loans

Understanding your repayment options is crucial for effectively managing your Parent PLUS loan. The repayment plan you choose will significantly impact your monthly payments, the total amount you pay over the life of the loan, and your overall financial health. Several options are available, each with its own advantages and disadvantages.

Standard Repayment Plan

The standard repayment plan is the default option for Parent PLUS loans. It’s a fixed monthly payment plan spread over a 10-year period. This plan offers predictability and simplicity; however, the fixed monthly payment may be relatively high compared to other repayment options. The total interest paid over the life of the loan will generally be lower than some other plans due to the shorter repayment term. A key consideration is that higher monthly payments may be challenging for some borrowers to manage within their budget.

Alternative Repayment Plans

Beyond the standard plan, several alternative repayment options exist to cater to different financial situations. These plans often involve lower monthly payments but typically extend the loan repayment period, leading to a higher total interest paid. The availability of specific plans can change over time. It’s essential to check the Federal Student Aid website for the most up-to-date information.

Extended Repayment Plan

This plan allows for longer repayment terms, resulting in lower monthly payments. The extended repayment plan offers flexibility for borrowers facing financial constraints, allowing them to manage their debt more comfortably. However, this extended timeframe leads to significantly higher total interest paid over the life of the loan.

Graduated Repayment Plan

The graduated repayment plan features lower monthly payments initially, which gradually increase over time. This can be helpful for borrowers who anticipate their income will increase over the life of the loan. However, similar to the extended repayment plan, the total interest paid will be higher than the standard plan due to the longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) are designed to tie monthly payments to your income and family size. These plans typically offer lower monthly payments and potentially loan forgiveness after a certain number of years. However, eligibility criteria apply, and the exact terms and conditions vary based on the specific IDR plan chosen. Furthermore, while monthly payments are lower, the total interest paid can be substantial due to the extended repayment period, and loan forgiveness is not guaranteed.

Comparison of Repayment Plans

The table below summarizes the key features of each repayment plan. Remember that these are general examples, and the specific amounts will vary depending on the loan amount, interest rate, and individual circumstances.

| Repayment Plan | Monthly Payment (Example) | Loan Term | Total Interest Paid (Example) |

|---|---|---|---|

| Standard | $500 | 10 years | $10,000 |

| Extended | $300 | 25 years | $25,000 |

| Graduated | $350 (increasing annually) | 10 years | $15,000 |

| Income-Driven (Example) | $200 | 20-25 years (depending on income and plan) | $20,000+ (highly variable) |

Note: The example figures in the table are for illustrative purposes only and do not represent actual loan amounts or interest rates. Actual amounts will vary significantly depending on the individual loan and chosen repayment plan.

Calculating Monthly Payments

Calculating the exact monthly payment for each plan requires using a loan amortization calculator. These calculators are readily available online through various financial websites and the Federal Student Aid website. You input your loan amount, interest rate, and chosen repayment plan to determine your estimated monthly payment. For instance, a $20,000 loan at 7% interest on a standard 10-year plan might result in a monthly payment around $230. However, this is just an estimate; you should use a calculator for precise figures. The formula for calculating monthly payments is complex and involves several factors; therefore, using a calculator is highly recommended.

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

where M = Monthly Payment, P = Principal Loan Amount, i = Monthly Interest Rate (Annual Interest Rate/12), and n = Number of Months (Loan Term in Years * 12).

Managing and Monitoring Parent PLUS Loans

Effective management of your Parent PLUS loan is crucial for successful repayment and avoiding potential financial difficulties. This section details the processes involved in staying informed about your loan and managing your payments. Understanding these processes will empower you to navigate your loan responsibly.

Accessing and Reviewing Parent PLUS Loan Statements Online

Accessing your Parent PLUS loan statements online is straightforward. You will typically need to create an account on the National Student Loan Data System (NSLDS) website or through your loan servicer’s website. Once logged in, you can usually view your loan details, including payment history, current balance, and upcoming payments. The specific steps may vary slightly depending on your servicer, so refer to their website or contact customer service for guidance. Regularly reviewing your statements helps you track your payments, identify any discrepancies, and stay on top of your loan’s status.

Making Parent PLUS Loan Payments

Several methods are available for making Parent PLUS loan payments. Common options include online payments through your loan servicer’s website, automatic debit payments from your bank account, and mailing a check or money order. Online payments offer convenience and often allow for scheduling future payments. Automatic debit payments ensure timely payments and can potentially reduce the risk of late fees. When mailing a payment, ensure you include your loan ID number and send it to the address provided by your servicer. It’s important to always make payments on time to avoid late fees and negative impacts on your credit score.

Contacting the Loan Servicer

Your loan servicer is your primary point of contact for all Parent PLUS loan-related inquiries. Their contact information, including phone numbers, email addresses, and mailing addresses, is usually available on your loan statements and your servicer’s website. Don’t hesitate to reach out if you have questions about your loan balance, payment options, or any other concerns. They can provide personalized assistance and help you navigate any challenges you may encounter. Maintaining open communication with your servicer is vital for a smooth repayment experience.

Resources for Borrowers Struggling with Payments

If you are experiencing difficulty making your Parent PLUS loan payments, several resources are available to help. Your loan servicer can discuss options such as deferment or forbearance, which temporarily postpone or reduce your payments. They may also be able to offer income-driven repayment plans, adjusting your monthly payment based on your income and family size. Additionally, you can explore resources like the Federal Student Aid website, which provides information on repayment options and financial counseling services. Seeking help early is crucial to prevent delinquency and potential negative consequences.

Parent PLUS Loan Management Flowchart

The following describes a flowchart illustrating the Parent PLUS loan management process. The flowchart would begin with the “Application” stage, followed by “Approval/Denial.” If approved, the next step would be “Loan Disbursement.” After disbursement, the borrower enters the “Repayment” phase, which involves making regular payments as scheduled. During repayment, there is a feedback loop for “Managing Account” (online access to statements, payment methods, and contacting the servicer). The flowchart concludes with “Loan Completion” upon full repayment. Each stage would be represented by a box, and arrows would indicate the flow between stages. Branching paths would represent the “Approval/Denial” and various options within “Managing Account” and “Repayment.”

Potential Impacts of Parent PLUS Loans on Borrowers and Students

Taking out a Parent PLUS loan can significantly impact both the borrowing parents and the student’s future. Understanding these potential effects is crucial for making informed decisions about financing higher education. While Parent PLUS loans offer a vital pathway to college, they also carry considerable financial responsibility that requires careful consideration.

Long-term financial implications for borrowers can be substantial. The loan amount, coupled with interest accruing over the repayment period, can lead to a significantly larger debt burden than initially anticipated. This can affect retirement savings, purchasing a home, or other significant financial goals. For example, a $50,000 Parent PLUS loan at a 7% interest rate could easily balloon to over $70,000 or more over 10 years, depending on the repayment plan chosen. This increase is due to the compounding interest charged on the loan’s principal. Careful planning and a realistic understanding of the total cost are essential.

Parent PLUS Loans and Student’s Higher Education Pursuit

Parent PLUS loans can indirectly affect a student’s educational choices. The availability of these loans might encourage students to pursue more expensive institutions or longer programs than they could otherwise afford. This could lead to increased pressure to secure a high-paying job after graduation to manage the debt incurred, potentially limiting career choices or creating financial stress during the crucial early career years. Conversely, if the parents are unable to secure a Parent PLUS loan, it might limit the student’s educational options, forcing them to choose less expensive colleges or to forgo higher education altogether.

Financial Challenges Associated with Parent PLUS Loan Repayment

Repaying Parent PLUS loans can present significant financial challenges. The monthly payments can be substantial, particularly for loans with high interest rates or longer repayment terms. Unexpected job loss, illness, or other life events can severely impact a parent’s ability to make timely payments, leading to delinquency, negatively impacting their credit score, and potentially resulting in default. Furthermore, the repayment period often extends for many years, potentially impacting long-term financial planning and delaying other financial goals. Careful budgeting and contingency planning are essential to navigate these potential challenges.

Developing a robust strategy for responsible borrowing and repayment is paramount. Consider these strategies:

- Borrow only what’s necessary: Explore all other financial aid options before resorting to Parent PLUS loans.

- Understand the terms: Carefully review the loan agreement to understand the interest rate, fees, and repayment terms.

- Create a repayment budget: Incorporate the monthly payments into your household budget and explore ways to reduce other expenses.

- Explore repayment options: Investigate different repayment plans offered by the federal government, such as extended repayment or income-driven repayment (though these may not be available for Parent PLUS loans).

- Prioritize timely payments: Make every effort to avoid late payments to avoid penalties and maintain a good credit score.

- Consider refinancing (if applicable): Explore refinancing options to potentially secure a lower interest rate, though this might impact the loan’s federal protections.

Potential Risks and Benefits of Parent PLUS Loans

| Risk | Benefit | Mitigation Strategy | Example |

|---|---|---|---|

| High interest rates leading to significant debt accumulation. | Enables access to higher education for students otherwise unable to afford it. | Borrow only what is absolutely necessary; explore all other financial aid options first. | A $40,000 loan at 7% interest could cost significantly more than the principal amount over time. |

| Potential for default due to unforeseen financial hardship. | Fixed interest rate provides predictability in repayment. | Develop a detailed budget and emergency fund to manage unexpected expenses. | Job loss could significantly impact the ability to make timely payments. |

| Impact on parents’ long-term financial goals (retirement, homeownership). | Federal loan protection, such as deferment options (though limited for Parent PLUS loans). | Prioritize repayment while balancing other financial goals; consider longer repayment terms. | Delayed retirement or inability to purchase a home due to loan repayment. |

| Negative impact on credit score if payments are missed. | Flexible repayment options (depending on loan terms). | Automate payments to avoid missed payments; monitor credit report regularly. | Late payments can significantly lower credit scores, impacting future borrowing. |

Closing Summary

Securing a college education often requires a multifaceted approach to financing. The Parent PLUS Loan program offers a valuable tool for parents seeking to support their children’s higher education aspirations. However, careful consideration of eligibility criteria, interest rates, and repayment options is essential to ensure responsible borrowing. By understanding the potential financial implications and employing effective management strategies, parents can leverage the benefits of Parent PLUS Loans while mitigating potential risks. Remember to explore all available resources and seek professional financial advice when needed to make the best decisions for your family’s financial well-being.

FAQ Guide

What happens if I am denied a Parent PLUS Loan?

If denied, you can explore alternative options like private loans or appealing the decision based on extenuating circumstances. You can also work with your child to apply for additional federal student aid.

Can I refinance my Parent PLUS Loan?

Yes, you can refinance your Parent PLUS Loan with a private lender, but be aware that this may change your interest rate and repayment terms. Carefully compare offers before refinancing.

What if I can’t make my Parent PLUS Loan payments?

Contact your loan servicer immediately to explore options like deferment, forbearance, or income-driven repayment plans. Failure to make payments can negatively impact your credit score.

How long does it take to receive the Parent PLUS Loan funds?

The disbursement timeline varies but generally takes several weeks after the loan is approved and the school certifies the loan amount.