Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is the first step towards financial freedom. This guide provides a clear and concise overview of various repayment strategies, from traditional plans to refinancing options and government assistance programs. We’ll explore the pros and cons of each approach, empowering you to make informed decisions about your financial future.

Whether you’re just starting your repayment journey or looking to optimize your existing plan, this resource offers practical advice and actionable steps to manage your student loan debt effectively. We’ll delve into budgeting techniques, common pitfalls to avoid, and the long-term impact of student loan debt on significant financial milestones.

Understanding Student Loan Repayment Options

Navigating the complexities of student loan repayment can feel overwhelming. Understanding the various repayment plans available is crucial for effectively managing your debt and minimizing long-term financial strain. Choosing the right plan depends on your individual financial circumstances, income, and long-term goals.

Student Loan Repayment Plan Types

Several repayment plans cater to different financial situations. These plans vary significantly in their monthly payment calculations, loan forgiveness possibilities, and eligibility requirements. The three main categories are Standard Repayment, Extended Repayment, and Income-Driven Repayment plans.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeline, leading to quicker debt elimination and less overall interest paid. However, the fixed monthly payments can be substantial, potentially creating financial hardship for borrowers with limited income.

Extended Repayment Plans

Extended repayment plans offer longer repayment terms, typically between 12 and 25 years, resulting in lower monthly payments compared to standard plans. This approach provides more manageable monthly payments, but it significantly increases the total interest paid over the loan’s life. Eligibility usually requires a loan balance exceeding a certain threshold.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically result in lower monthly payments, especially during periods of lower income. Many IDR plans also offer loan forgiveness after a specific number of qualifying payments (often 20 or 25 years). However, the lower monthly payments often translate to a longer repayment period and higher overall interest paid.

Comparison of Repayment Plans

The following table summarizes key features of various repayment plans. Remember that specific details and eligibility criteria can vary depending on the lender and loan type.

| Plan Name | Monthly Payment Calculation | Loan Forgiveness Options | Eligibility Criteria |

|---|---|---|---|

| Standard Repayment | Fixed payment over 10 years | None | Generally available for all federal student loans |

| Extended Repayment | Fixed payment over 12-25 years (depending on loan amount) | None | Loan balance exceeds a certain threshold |

| Income-Based Repayment (IBR) | Based on discretionary income and family size | Potential forgiveness after 20 or 25 years of qualifying payments | Specific income and family size requirements |

| Pay As You Earn (PAYE) | Based on discretionary income and family size | Potential forgiveness after 20 years of qualifying payments | Specific income and family size requirements; generally requires loans disbursed after October 1, 2007 |

| Revised Pay As You Earn (REPAYE) | Based on discretionary income and family size | Potential forgiveness after 20 or 25 years of qualifying payments | Generally available for most federal student loans |

| Income-Contingent Repayment (ICR) | Based on discretionary income and family size | Potential forgiveness after 25 years of qualifying payments | Specific income and family size requirements |

Exploring Loan Refinancing

Refinancing your student loans can be a powerful tool for managing your debt, but it’s crucial to understand its implications before taking the plunge. This section explores the benefits and drawbacks of refinancing, helping you determine if it’s the right strategy for your financial situation.

Refinancing involves replacing your existing student loans with a new loan from a different lender, typically at a lower interest rate. This can lead to significant savings over the life of the loan, allowing you to pay off your debt faster and reduce the overall amount you pay in interest. However, it’s not always the best option, and careful consideration is essential.

Benefits of Refinancing Student Loans

Lower interest rates are the primary benefit. A lower rate directly translates to lower monthly payments and less interest paid over the life of the loan. For example, refinancing from a 7% interest rate to a 4% interest rate on a $50,000 loan could save thousands of dollars over the repayment period. Another potential benefit is the simplification of loan management. If you have multiple loans with varying interest rates and repayment terms, refinancing can consolidate them into a single, easier-to-manage loan. Finally, refinancing might offer the option of extending the repayment term, resulting in lower monthly payments (though this will increase the total interest paid).

Drawbacks of Refinancing Student Loans

While refinancing offers advantages, there are also potential drawbacks. One major consideration is the loss of federal student loan benefits. Federal loans often come with protections such as income-driven repayment plans and loan forgiveness programs. Refinancing into a private loan typically forfeits these benefits. Another drawback is the possibility of a higher interest rate if your credit score is low or the market interest rates rise during the refinancing process. Furthermore, the refinancing application process itself can be time-consuming and may involve a hard credit inquiry, which could temporarily lower your credit score. Finally, prepayment penalties might apply to your original loans, negating the savings from refinancing.

Situations Where Refinancing is Advantageous

Refinancing is often beneficial for borrowers with good credit scores and multiple federal loans at high interest rates. For instance, a borrower with excellent credit and several federal loans averaging 6% interest could significantly reduce their monthly payments and overall interest paid by refinancing into a private loan with a lower interest rate. It can also be advantageous if you’re seeking a shorter loan term to pay off your debt more quickly.

Situations Where Refinancing is Not Advantageous

Refinancing may not be advisable for borrowers with poor credit scores or those who rely on federal loan benefits. For example, a borrower with a low credit score may not qualify for a lower interest rate, or a borrower needing an income-driven repayment plan might lose this protection by refinancing into a private loan. Additionally, if current market interest rates are higher than your existing loan interest rates, refinancing would be detrimental.

Factors to Consider When Choosing a Refinancing Company

Choosing the right refinancing company is critical. Several factors should be considered, including interest rates, fees, repayment terms, and customer service. Compare interest rates from multiple lenders to secure the most favorable offer. Be aware of any origination fees or prepayment penalties. Consider the flexibility of repayment terms, such as the ability to choose a shorter or longer repayment period. Finally, research the lender’s reputation and customer reviews to ensure a positive experience.

Refinancing Process Flowchart

[Imagine a flowchart here. The flowchart would begin with “Consider Refinancing?”, branching to “Yes” and “No.” The “Yes” branch would lead to “Check Credit Score & Loan Offers,” followed by “Compare Lenders & Rates,” then “Apply for Refinancing,” and finally “Loan Approval/Denial.” The “No” branch would lead to “Maintain Current Loan Repayment Plan.”] This visual representation clarifies the step-by-step process, highlighting decision points and actions.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and consistent effort. Understanding your repayment options and developing effective strategies for managing your debt are crucial steps toward financial freedom. This section provides practical advice and resources to help you effectively manage your student loans.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is paramount to successfully managing student loan payments. Begin by listing all monthly income and expenses. Categorize your expenses (housing, transportation, food, entertainment, etc.) to identify areas where you can potentially reduce spending. Allocate a specific amount each month for your student loan payments, ensuring it’s a sum you can consistently afford without jeopardizing other essential expenses. Consider using budgeting apps or spreadsheets to track your income and expenses and monitor your progress toward your financial goals. For example, using a budgeting app like Mint or YNAB (You Need A Budget) allows you to categorize expenses, set budgets, and track your spending in real-time. This provides a clear picture of your financial health and helps you stay on track with your loan payments.

Common Mistakes in Student Loan Debt Management

Ignoring your student loans or delaying repayment can lead to serious consequences, including accumulating interest, impacting your credit score, and potentially facing wage garnishment or legal action. Another common mistake is failing to understand the terms of your loan agreements, leading to missed payments or unawareness of available repayment options. Overspending and neglecting to prioritize loan repayment can also lead to financial strain. Finally, not exploring options like income-driven repayment plans or loan refinancing can mean missing opportunities to lower monthly payments or reduce the overall cost of borrowing. For instance, failing to explore an income-driven repayment plan could lead to significantly higher monthly payments than necessary, making it harder to manage your budget effectively.

Staying Organized and Tracking Loan Payments

Maintaining meticulous records of your loan payments is essential for avoiding late payments and disputes. Create a system for tracking your loan details, including loan balances, interest rates, due dates, and payment history. Consider using a spreadsheet, a dedicated loan management app, or a personal finance management software to consolidate this information. Regularly review your statements to ensure accuracy and identify any potential discrepancies. Setting up automatic payments can also help prevent missed payments and reduce the administrative burden. For example, scheduling automatic payments directly from your bank account ensures timely payments and minimizes the risk of late fees.

Resources for Borrowers Struggling with Student Loan Debt

Several resources are available to assist borrowers facing challenges with their student loan debt. The National Foundation for Credit Counseling (NFCC) offers free and low-cost credit counseling services, helping individuals create a budget and manage their debt effectively. The Student Loan Borrower Assistance website provides comprehensive information on student loan programs, repayment options, and available resources. Additionally, individual loan servicers often offer hardship programs, deferment, or forbearance options for borrowers experiencing temporary financial difficulties. Contacting your loan servicer directly to discuss your situation and explore available options is crucial. Remember, seeking help is a sign of strength, not weakness, and proactive engagement with available resources can significantly improve your financial situation.

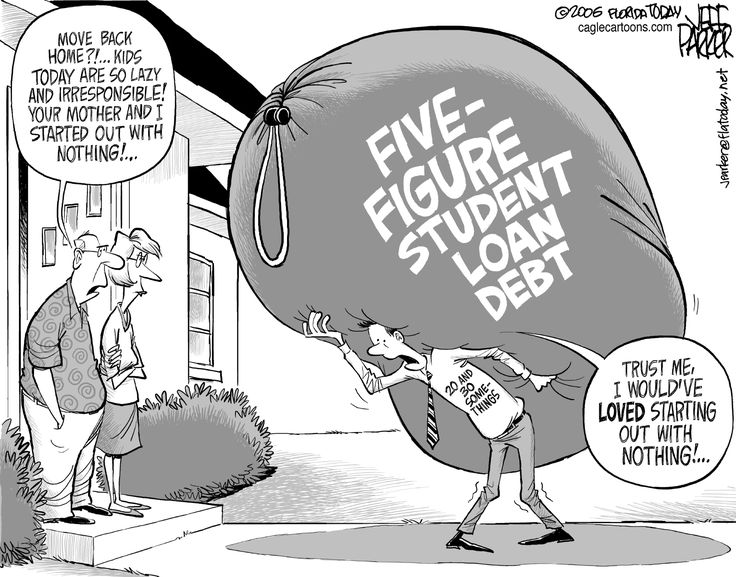

The Impact of Student Loan Debt on Financial Decisions

Student loan debt significantly influences major financial decisions, impacting everything from homeownership to investment strategies. The weight of these loans can alter the timeline and feasibility of achieving key financial goals, necessitating careful planning and strategic budgeting. Understanding the implications of carrying student loan debt is crucial for navigating the complexities of personal finance.

Student loan debt’s effect on financial decisions is multifaceted, impacting long-term financial health and shaping choices related to major purchases and investments. The size of the debt burden directly correlates with the extent of these effects; a smaller loan balance offers more financial flexibility than a substantial one.

Homeownership and Student Loan Debt

The presence of significant student loan debt can significantly delay or even prevent homeownership. Lenders consider student loan payments when assessing a borrower’s debt-to-income ratio (DTI), a crucial factor in mortgage approval. A high DTI, driven by substantial student loan payments, can reduce the amount a lender is willing to loan or even disqualify an applicant entirely. For example, someone with $50,000 in student loan debt and a monthly payment of $500 might struggle to qualify for a mortgage compared to someone with no student loan debt, even if their income is similar. Careful budgeting and potentially a longer savings period are essential for homebuyers burdened with student loan debt.

Investing and Student Loan Debt

Student loan debt can also limit investment opportunities. The monthly payments required to service the loans reduce the amount of disposable income available for investing in stocks, bonds, or retirement accounts. This can significantly hinder long-term wealth accumulation. For instance, someone allocating $500 monthly to student loan repayment might have that $500 less to contribute to a retirement plan or investment portfolio. Prioritizing debt reduction while still maintaining a reasonable investment strategy requires careful balancing of financial priorities.

Creating a Financial Plan that Incorporates Student Loan Payments

Developing a comprehensive financial plan is crucial for managing student loan debt effectively. This plan should Artikel realistic goals, such as debt repayment timelines and strategies, and integrate these goals into the overall financial picture. A detailed budget that meticulously tracks income and expenses is fundamental. This budget should clearly allocate funds for student loan payments, alongside essential living expenses and savings targets. Consider exploring different repayment plans, such as income-driven repayment options, to potentially reduce monthly payments and free up more cash flow. Regularly reviewing and adjusting the plan as circumstances change is vital for maintaining its effectiveness.

Financial Goals Impacted by Student Loan Debt

The following financial goals are often significantly impacted by student loan debt:

- Homeownership: High debt can restrict mortgage approval or necessitate a smaller, less desirable home.

- Retirement Savings: Limited disposable income may delay or reduce contributions to retirement accounts.

- Investment Portfolio Growth: Less available capital for investment can slow wealth accumulation.

- Emergency Fund Creation: Difficulties in saving may delay building a sufficient emergency fund.

- Vehicle Purchase: Loan payments might limit the ability to purchase a new or used car.

- Higher Education for Children: Financial constraints might postpone or limit educational opportunities for children.

Government Programs and Assistance

Navigating the complexities of student loan repayment can be daunting. Fortunately, several government programs offer assistance to borrowers facing financial hardship or seeking to manage their debt more effectively. Understanding these programs and their eligibility requirements is crucial for making informed decisions about your repayment strategy. These programs provide a safety net and can significantly impact your long-term financial well-being.

Income-Driven Repayment (IDR) Plans

Income-Driven Repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. Several IDR plans exist, each with slightly different eligibility requirements and payment calculation methods. These plans are particularly beneficial for borrowers with low incomes or high debt burdens. For example, a recent graduate with a low-paying job and substantial student loan debt could significantly reduce their monthly payments through an IDR plan, making repayment more feasible.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) program offers complete forgiveness of your federal student loans after 120 qualifying monthly payments under an IDR plan, while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and consistent payments under an eligible IDR plan. A teacher working in a low-income school district, for example, could benefit significantly from this program, ultimately having their loans forgiven after ten years of service.

Deferment and Forbearance

Deferment and forbearance are temporary pauses in your student loan payments. Deferment is typically granted due to specific circumstances, such as returning to school or experiencing unemployment. Forbearance is usually granted due to temporary financial hardship. Both options can offer short-term relief, but interest may still accrue during deferment, depending on the loan type. A borrower facing unexpected job loss, for instance, might request a forbearance to temporarily suspend payments until they secure new employment.

Table of Key Government Programs and Features

| Program Name | Eligibility Criteria | Benefits Offered | Application Process |

|---|---|---|---|

| Income-Driven Repayment (IDR) Plans | Federal student loans; meet income requirements | Lower monthly payments based on income and family size | Apply through your loan servicer’s website |

| Public Service Loan Forgiveness (PSLF) Program | Federal student loans; employed full-time by a qualifying employer; 120 qualifying monthly payments under an IDR plan | Loan forgiveness after 120 qualifying payments | Apply through your loan servicer’s website; requires certification of employment |

| Deferment | Federal student loans; specific qualifying circumstances (e.g., unemployment, return to school) | Temporary pause in payments (interest may accrue depending on loan type) | Apply through your loan servicer’s website; requires documentation of qualifying circumstances |

| Forbearance | Federal student loans; temporary financial hardship | Temporary pause in payments (interest typically accrues) | Apply through your loan servicer’s website; may require documentation of financial hardship |

Visualizing the Burden of Student Loan Debt

Understanding the true weight of student loan debt often requires more than just looking at the numbers; visualizing the repayment process can significantly improve comprehension. This section will illustrate how charts and graphs can effectively depict the complexities of student loan repayment, allowing for a clearer understanding of the financial burden involved.

A Typical Student Loan Repayment Schedule

A common way to visualize a student loan repayment schedule is through a line graph. The horizontal axis (x-axis) represents time, typically in months or years, from the start of repayment to the loan’s completion. The vertical axis (y-axis) represents the monetary value, showing the principal balance, accrued interest, and monthly payments. The principal balance line would begin at the initial loan amount and gradually decrease over time as payments are made. A separate line would track the accumulated interest, starting at zero and gradually increasing until the loan is paid off. Finally, a third line could represent the constant monthly payment amount, showing a flat horizontal line across the graph’s duration. Data points would be plotted at regular intervals (e.g., monthly or annually) to show the balance, interest, and payment at each point in time. The intersection of the principal balance line and the x-axis marks the loan payoff date. The total area under the interest line visually represents the total interest paid over the life of the loan. This visualization clearly demonstrates how a significant portion of the total repayment can consist of interest.

The Impact of Interest Accumulation on the Total Loan Amount

A bar graph effectively illustrates the impact of interest accumulation. This graph would compare the initial loan amount (represented by one bar) to the total amount repaid (represented by a much larger bar), with the difference visually representing the accumulated interest. Multiple bars could be used to compare the total repayment amounts under different interest rates or repayment plans. For example, one bar could represent the total repayment amount under a standard 10-year repayment plan with a 5% interest rate, while another could show the total repayment under a 15-year plan with the same interest rate. A third bar might demonstrate the impact of a higher interest rate (e.g., 7%) on the total repayment amount over the same 10-year period. This visual comparison powerfully demonstrates how even small differences in interest rates or repayment plan lengths can significantly impact the total cost of the loan. For instance, consider a $30,000 loan: a 5% interest rate over 10 years might result in a total repayment of $38,000, while a 7% rate over the same period could lead to a total repayment exceeding $42,000. The difference, clearly visible in the bar graph, highlights the significant cost of interest.

Conclusive Thoughts

Successfully managing student loan debt requires a proactive and informed approach. By understanding the diverse repayment plans, exploring refinancing opportunities, and leveraging available government assistance, you can significantly reduce the burden of student loan repayments. Remember, careful planning, consistent budgeting, and seeking help when needed are key to achieving your financial goals and building a secure future free from the constraints of overwhelming student loan debt.

Essential Questionnaire

What happens if I miss a student loan payment?

Missing a payment can result in late fees, negatively impact your credit score, and potentially lead to loan default. Contact your loan servicer immediately if you anticipate difficulties making a payment.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into a single loan, often simplifying repayment. However, it may not always lower your interest rate.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, but interest usually still accrues. Deferment postpones payments, and under certain circumstances, interest may not accrue.

How do I find my student loan servicer?

You can typically find your servicer’s information on the National Student Loan Data System (NSLDS) website or your loan documents.