The age-old question for recent graduates and those burdened by student loan debt: attack the debt aggressively or start investing for the future? This isn’t a simple yes or no answer; the optimal strategy hinges on a careful evaluation of your individual financial circumstances, risk tolerance, and long-term goals. This guide provides a framework for making an informed decision, navigating the complexities of student loan repayment plans and investment vehicles, and ultimately charting a course towards financial security.

We will explore various student loan repayment strategies, from standard plans to income-driven options and refinancing possibilities. Furthermore, we will delve into the world of investing, examining different asset classes, risk profiles, and portfolio diversification techniques. By comparing the long-term financial implications of each approach, we aim to empower you to create a personalized financial plan that aligns with your unique needs and aspirations.

Financial Situation Assessment

Understanding your current financial situation is crucial before deciding whether to prioritize paying off student loan debt or investing. A thorough assessment involves analyzing your income, expenses, debt, and potential investment returns. This process will help you make an informed decision aligned with your financial goals.

Creating a Personal Budget

A personal budget meticulously tracks all income sources and expenses. Start by listing all your monthly income streams, including salary, part-time jobs, side hustles, and any other regular income. Next, categorize your expenses. Common categories include housing, transportation, food, utilities, entertainment, and debt payments. Use budgeting apps or spreadsheets to meticulously track your spending for at least a month to get a clear picture of your spending habits. Compare your actual spending against your budgeted amounts to identify areas where you can potentially reduce expenses. This comprehensive view will provide a realistic foundation for your financial planning.

Calculating Net Monthly Income After Student Loan Payments

To determine your net monthly income after student loan payments, begin with your gross monthly income (total income before taxes and deductions). Subtract all pre-tax deductions, such as health insurance premiums and retirement contributions. Then, subtract your taxes (federal, state, and local) and finally, deduct your monthly student loan payment amount. The remaining amount represents your net monthly income available for other expenses, savings, and investments. For example, if your gross monthly income is $5,000, your pre-tax deductions are $500, your taxes are $1000, and your student loan payment is $300, your net monthly income is $2,200 ($5000 – $500 – $1000 – $300 = $2200).

Determining Total Student Loan Debt and Interest Rates

Gather all your student loan statements to determine the total amount of debt you owe. This includes the principal balance for each loan. Note the interest rate for each loan, as these rates will vary depending on the loan type and lender. Many lenders provide online portals where you can easily access this information. It’s vital to distinguish between fixed and variable interest rates, as variable rates can fluctuate over time, impacting your total repayment cost. For instance, you might have one loan with a 5% fixed interest rate and another with a 7% variable interest rate. Keeping track of these details is crucial for accurate financial planning.

Calculating Minimum Monthly Student Loan Payment

Your minimum monthly payment is usually specified on your student loan statement. It’s calculated based on your loan amount, interest rate, and loan term. However, you can also use online loan calculators to determine your minimum payment if you don’t have access to your statement. These calculators require your loan amount, interest rate, and loan term as input. Remember that making only the minimum payment will prolong the repayment period and increase the total interest paid over the life of the loan. Consider exploring repayment options like accelerated repayment to reduce the overall cost and shorten the repayment period.

Comparing Interest Rates of Student Loan Types and Investment Options

The following table compares typical interest rates for various student loan types and common investment options. Remember that these are approximate values and can fluctuate. Always consult current market data for the most accurate figures.

| Loan/Investment Type | Interest Rate (Approximate) | Risk Level | Potential Return |

|---|---|---|---|

| Federal Subsidized Loan | Variable, currently around 4-7% | Low | N/A |

| Federal Unsubsidized Loan | Variable, currently around 4-7% | Low | N/A |

| Private Student Loan | Variable, 6-12% or higher | Moderate to High | N/A |

| High-Yield Savings Account | 0.5-2% | Low | Low |

| Index Funds (S&P 500) | N/A (expense ratio ~0.1%) | Moderate | 7-10% (historical average) |

| Individual Stocks | N/A | High | Variable, potentially high |

Student Loan Repayment Strategies

Navigating student loan repayment can feel overwhelming, but understanding your options and strategically choosing a plan is crucial for your financial well-being. This section Artikels different repayment strategies, highlighting their advantages and disadvantages to help you make informed decisions about managing your debt and maximizing your investment potential.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments over a 10-year period. This approach offers predictability and the shortest repayment timeline, allowing you to become debt-free quickly. However, the fixed monthly payments can be substantial, potentially limiting your ability to invest aggressively during this period. For example, a $50,000 loan at a 5% interest rate would result in monthly payments of approximately $537. While this ensures rapid debt elimination, it might leave less disposable income for investing.

Extended Repayment Plans

Extended repayment plans stretch your repayment period to up to 25 years. This significantly lowers your monthly payments, freeing up more cash flow for other financial goals, including investments. For the same $50,000 loan at 5% interest, a 25-year plan could reduce monthly payments to approximately $280. However, the extended timeframe means you’ll pay significantly more in interest over the life of the loan, potentially diminishing your overall investment returns compared to a shorter repayment plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) tie your monthly payments to your income and family size. These plans, such as ICR, PAYE, REPAYE, and IBR, offer lower monthly payments, making them particularly attractive for borrowers with lower incomes or unpredictable financial situations. The lower payments allow for more investment opportunities. However, IDR plans often extend the repayment period to 20 or 25 years, resulting in higher total interest paid. Furthermore, remaining balances may be forgiven after a certain period, but this forgiveness is considered taxable income.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. For instance, refinancing a $50,000 loan from 5% to 3% could lower monthly payments and save thousands of dollars in interest over the repayment period. However, refinancing might eliminate certain benefits of federal student loans, such as income-driven repayment plans and potential forgiveness programs. Carefully weigh the pros and cons before refinancing.

Applying for Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. Eligibility requirements vary depending on the program. A step-by-step guide to applying generally includes:

- Determine eligibility based on employment and loan type.

- Ensure your loans are eligible for the specific program.

- Complete and submit the necessary application forms through the relevant government agency.

- Maintain consistent employment and repayment under a qualifying repayment plan.

- Regularly monitor your loan status and application progress.

Note that forgiveness programs often have strict requirements, and approval is not guaranteed.

Choosing a Repayment Plan: A Decision-Making Flowchart

A flowchart would visually represent the decision-making process. Starting with the question “What are my financial goals?”, it would branch into considering income, debt amount, risk tolerance, and investment objectives. Each branch would lead to a recommendation of a suitable repayment plan: Standard, Extended, Income-Driven, or Refinancing. The flowchart would highlight the trade-offs between lower monthly payments and total interest paid for each option. Finally, the flowchart would advise checking eligibility for loan forgiveness programs before making a final decision.

Investment Options and Strategies

Investing your money wisely is crucial for building long-term wealth. Understanding different investment vehicles and their associated risks and returns is essential before making any investment decisions. This section will explore various investment options, outlining their characteristics and providing examples of diversified portfolios.

Investment Vehicles

Several investment vehicles offer diverse opportunities for growth and income generation. Each carries a different level of risk and potential return. Understanding these differences is key to building a portfolio aligned with your financial goals and risk tolerance.

Stocks represent ownership in a company. Their value fluctuates based on company performance and market conditions, offering high growth potential but also significant risk. Bonds, on the other hand, are loans you make to a company or government. They typically offer lower returns than stocks but are considered less risky. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets, providing diversification and professional management. Real estate involves investing in properties, offering potential rental income and long-term appreciation, but it requires significant capital and can be illiquid.

Risk and Return Profiles

The relationship between risk and return is fundamental to investing. Generally, higher potential returns are associated with higher risk. Stocks, for example, have historically offered higher average returns than bonds, but they also carry greater volatility. Real estate investments can offer substantial returns but also require significant upfront capital and involve market fluctuations and maintenance costs. Mutual funds offer a balance, providing diversification to mitigate risk while still aiming for reasonable returns. A conservative investor might prioritize lower-risk investments like bonds or low-volatility mutual funds, while a more aggressive investor might allocate a larger portion of their portfolio to stocks.

Opening a Brokerage Account and Making Investments

Opening a brokerage account is the first step to investing in stocks, bonds, and mutual funds. Most brokerage firms offer online accounts, requiring personal information, tax identification, and funding. Once the account is funded, you can research and select investments based on your risk tolerance and financial goals. Most platforms offer tools to research individual stocks and bonds, screen mutual funds, and execute trades. It is advisable to consult a financial advisor before making any significant investments.

Examples of Diversified Investment Portfolios

Diversification is a key strategy to mitigate risk. A diversified portfolio spreads investments across different asset classes to reduce the impact of poor performance in any single investment. A conservative portfolio might consist primarily of bonds and low-risk mutual funds, while a more aggressive portfolio might include a larger allocation to stocks and potentially real estate. For example, a conservative portfolio might allocate 70% to bonds and 30% to a balanced mutual fund, while a moderate portfolio could allocate 50% to stocks, 30% to bonds, and 20% to real estate. An aggressive portfolio might allocate 80% to stocks, 10% to bonds, and 10% to alternative investments. These are just examples, and the optimal allocation depends on individual circumstances and risk tolerance.

Risk and Return Summary

| Investment Vehicle | Potential Return | Risk Level | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Moderate | Low | Moderate |

| Mutual Funds | Moderate to High | Moderate | High |

| Real Estate | High | High | Low |

Comparative Analysis

The decision of whether to prioritize paying off student loan debt or investing hinges on a complex interplay of factors, including your risk tolerance, financial goals, and the specific terms of your loans. Both strategies offer significant long-term financial benefits, but the optimal approach varies considerably depending on individual circumstances. A thorough analysis of the opportunity costs and psychological implications associated with each choice is crucial for making an informed decision.

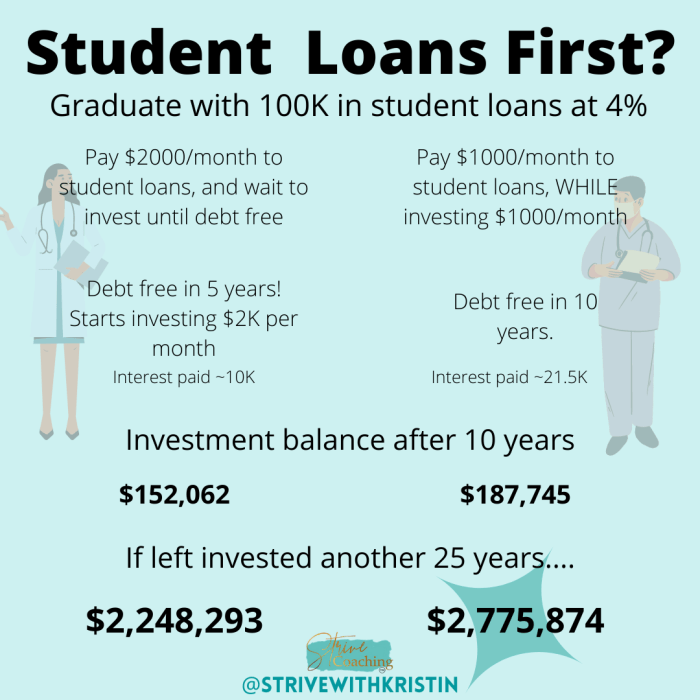

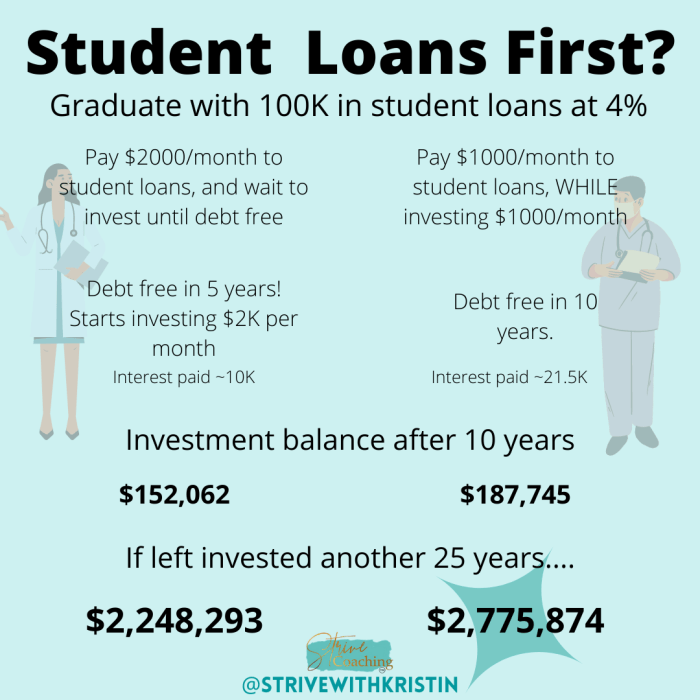

The long-term financial implications of prioritizing one strategy over the other can be substantial. Paying off high-interest student loans quickly minimizes the total interest paid, freeing up more cash flow for future investments and reducing financial stress. Conversely, investing early can leverage the power of compounding returns, potentially leading to significantly greater wealth accumulation over time, particularly if investment returns exceed loan interest rates.

Opportunity Cost of Choosing One Strategy

The opportunity cost represents the potential benefits forgone by choosing one option over another. For example, aggressively paying down debt might delay the accumulation of investment wealth, potentially missing out on substantial long-term gains. Conversely, prioritizing investments while carrying high-interest debt could result in paying significantly more in interest over the life of the loan, reducing the overall return on investments. This trade-off necessitates a careful evaluation of the relative returns of each strategy based on individual loan interest rates and projected investment returns. A realistic assessment of both possibilities is essential for effective financial planning.

Psychological Impact of Debt vs. Investment Wealth

The psychological impact of carrying student loan debt can be significant, causing stress, anxiety, and a feeling of being financially constrained. This can negatively impact overall well-being and decision-making. Conversely, building investment wealth can foster a sense of security, control, and optimism about the future. This positive psychological impact can lead to improved financial behavior and a greater willingness to pursue ambitious financial goals. The emotional burden of debt versus the psychological benefits of investment growth are important, often overlooked, considerations.

Influence of Financial Goals on the Decision

Different financial goals significantly influence the optimal strategy. For example, individuals prioritizing early retirement might favor aggressive investing to maximize long-term growth, even if it means carrying some student loan debt. Conversely, individuals focused on immediate homeownership might prioritize rapid debt repayment to improve their credit score and qualify for a mortgage more quickly. The time horizon associated with each financial goal plays a critical role in determining whether to prioritize debt reduction or investment.

Projected Growth Comparison: Debt Payoff vs. Investment

Imagine two parallel lines representing the passage of time.

Line 1: Student Loan Debt Reduction: This line starts at a high point representing the initial loan balance. It gradually slopes downwards, reflecting consistent monthly payments. The slope is steeper initially, as more of the payment goes toward principal, and then gradually flattens as interest becomes a larger portion of the payment. The line eventually reaches zero, representing the complete payoff of the debt. Let’s assume a $50,000 loan with a 5% interest rate, paid off over 10 years with consistent monthly payments. The line would show a steady decline, reaching zero at the 10-year mark.

Line 2: Investment Growth: This line begins at a low point, representing the initial investment amount. It initially shows slower growth, then gradually curves upwards at an increasing rate, illustrating the power of compounding returns. Let’s assume a $5,000 initial investment with an average annual return of 7%. The line would show a slow but steadily increasing curve over the 10-year period. The contrast between the two lines highlights the trade-off: the steady decline of debt versus the potentially exponential growth of investments. While the debt line reaches zero, the investment line continues to climb beyond the initial loan amount, illustrating the long-term potential of investment. The optimal strategy depends on the individual’s risk tolerance and the relative slopes of these lines, given their specific circumstances.

Developing a Personalized Financial Plan

Creating a comprehensive financial plan that balances student loan repayment with investment requires a structured approach. This plan should be dynamic, adapting to life changes and financial fluctuations. A well-defined plan provides clarity, allowing you to prioritize goals and make informed decisions regarding your finances.

Steps in Creating a Comprehensive Financial Plan

Developing a personalized financial plan involves several key steps. First, a thorough assessment of your current financial situation is crucial, including income, expenses, assets, and liabilities (like student loans). Next, you’ll define your short-term and long-term financial goals. These could range from paying off your student loans within a specific timeframe to saving for a down payment on a house or retirement. Then, you’ll create a detailed budget that allocates funds toward your goals, factoring in both loan repayment and investments. Regularly reviewing and adjusting your budget is vital to ensure it remains aligned with your evolving needs and priorities. Finally, implementing your plan and monitoring your progress are essential steps to achieve your financial objectives.

Setting Realistic Financial Goals and Tracking Progress

Realistic goal setting is paramount. Start by identifying your financial aspirations, both short-term (e.g., paying off a credit card) and long-term (e.g., retirement savings). Break down large goals into smaller, manageable steps to avoid feeling overwhelmed. For instance, if your goal is to pay off $30,000 in student loans, break it down into monthly or quarterly payments. Track your progress using spreadsheets, budgeting apps, or financial tracking software. Regular review – monthly or quarterly – helps maintain momentum and allows for course correction if needed. Visualizing your progress, perhaps using charts or graphs, can be a powerful motivator. For example, if you’re aiming for a specific investment portfolio value, tracking its growth visually can reinforce your commitment.

Managing Unexpected Expenses and Maintaining Financial Discipline

Unexpected expenses are inevitable. Establishing an emergency fund is crucial; aim for 3-6 months’ worth of living expenses. This fund acts as a buffer against unexpected events like medical bills or car repairs, preventing you from derailing your financial plan. Maintaining financial discipline involves sticking to your budget, avoiding impulsive purchases, and prioritizing your financial goals. Consider using budgeting techniques like the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) to guide your spending. Regularly reviewing your spending habits and identifying areas for improvement is key to staying disciplined. For example, tracking your daily coffee purchases might reveal opportunities for savings.

Adjusting the Financial Plan Based on Changing Circumstances

Life throws curveballs. Your financial plan should be flexible enough to adapt to changing circumstances, such as a job change, a salary increase, or unexpected medical expenses. Regularly reviewing your plan (at least annually) allows you to make necessary adjustments. For example, a job loss might necessitate a temporary reduction in investment contributions to prioritize essential expenses. Conversely, a salary increase might allow you to allocate more funds towards both loan repayment and investments. Open communication with your financial advisor, if you have one, can help you navigate significant life changes and adapt your plan accordingly.

Sample Financial Plan Template

A well-organized template can streamline your financial planning. This template provides a framework; you can customize it to reflect your specific needs and goals.

- Budgeting Section:

- Monthly Income:

- Fixed Expenses (rent, utilities, loan payments):

- Variable Expenses (groceries, entertainment):

- Savings Allocation (emergency fund, investments):

- Debt Repayment Allocation (student loans, credit cards):

- Debt Management Section:

- Outstanding Student Loan Balance:

- Monthly Student Loan Payment:

- Interest Rate:

- Repayment Strategy (e.g., snowball, avalanche):

- Projected Payoff Date:

- Investment Tracking Section:

- Investment Accounts (e.g., 401k, brokerage account):

- Investment Portfolio Allocation (stocks, bonds, etc.):

- Monthly Investment Contributions:

- Investment Returns (gains/losses):

- Projected Portfolio Value (future dates):

End of Discussion

Ultimately, the decision to prioritize paying off student loan debt or investing is deeply personal. There’s no one-size-fits-all answer. By carefully assessing your financial situation, understanding the nuances of different repayment plans and investment options, and developing a comprehensive financial plan, you can confidently navigate this crucial crossroads. Remember, consistent financial planning, discipline, and periodic review are key to achieving your long-term financial goals, whether that involves eliminating debt or building wealth through strategic investments.

Answers to Common Questions

What if I have multiple student loans with different interest rates?

Prioritize paying off loans with the highest interest rates first. This minimizes the total interest paid over time, saving you money in the long run. Consider using the avalanche or snowball method to structure your repayment strategy.

How much should I invest versus how much should I put towards my loans?

There’s no magic number. The ideal balance depends on your risk tolerance, financial goals, and the interest rates on your loans. If loan interest rates are significantly higher than potential investment returns, focusing on debt reduction may be more prudent. Consult with a financial advisor for personalized guidance.

Can I invest while still paying off student loans?

Absolutely. Many people successfully balance both. Start small and gradually increase your investment contributions as your debt decreases and your financial situation improves. Consider automating your investments to ensure consistency.

What if my income fluctuates?

Income-driven repayment plans for student loans can be beneficial in these situations. These plans adjust your monthly payments based on your income, offering flexibility during periods of financial uncertainty. For investments, consider a more conservative approach during times of income instability.