Navigating the complexities of Sallie Mae student loan repayment can feel overwhelming, but understanding the available options and strategies can empower you to manage your debt effectively. This guide provides a comprehensive overview of repayment plans, budgeting techniques, refinancing possibilities, and the impact on your credit score, equipping you with the knowledge to make informed decisions about your financial future.

From exploring various repayment plans and budgeting strategies to understanding the implications of late payments and the benefits of refinancing, we’ll delve into the intricacies of managing your Sallie Mae student loans. We will also cover how to effectively communicate with Sallie Mae customer service and explore loan forgiveness programs. The ultimate goal is to help you develop a personalized strategy for successful repayment and long-term financial well-being.

Understanding Sallie Mae Student Loan Payments

Managing your Sallie Mae student loans effectively requires a clear understanding of the repayment process. This includes familiarizing yourself with the available repayment plans, the factors affecting your monthly payments, and the various methods for making payments. This section provides a comprehensive overview to help you navigate this crucial aspect of loan management.

Sallie Mae Repayment Plans

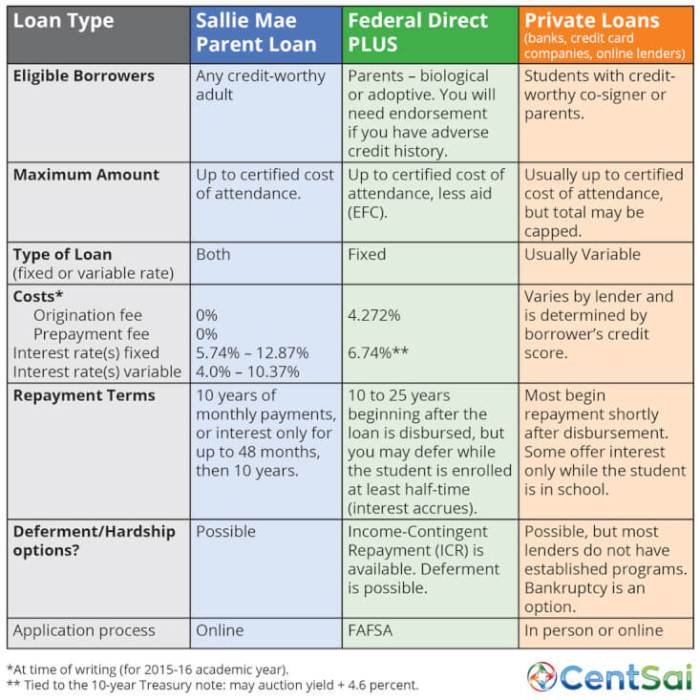

Sallie Mae offers several repayment plans designed to cater to different financial situations and repayment preferences. Choosing the right plan is essential for managing your debt effectively and avoiding delinquency. The availability and specifics of each plan may vary, so it’s crucial to check directly with Sallie Mae for the most up-to-date information. Generally, options may include standard repayment plans, graduated repayment plans, extended repayment plans, and potentially income-driven repayment plans (though eligibility for these may depend on specific federal loan programs). A standard plan involves fixed monthly payments over a set period. A graduated plan starts with lower payments that increase over time. An extended plan stretches payments over a longer period, lowering the monthly amount but increasing the total interest paid. Income-driven plans base payments on your income and family size.

Factors Influencing Monthly Payment Amounts

Several factors significantly influence the amount you’ll pay each month on your Sallie Mae student loans. These factors interact to determine your individual monthly payment. The principal loan amount, the interest rate, and the loan term (the length of the repayment period) are the most significant determinants. A larger loan balance naturally leads to higher monthly payments. A higher interest rate also increases the monthly payment, as does choosing a shorter repayment period. For example, a $30,000 loan at 5% interest over 10 years will have a higher monthly payment than the same loan over 20 years. Additionally, any fees or capitalized interest can increase your overall loan balance and consequently, your monthly payments.

Making a Payment Online

Paying your Sallie Mae student loan online is a convenient and efficient process. Here’s a step-by-step guide:

1. Log in: Access your Sallie Mae account online through their official website. You’ll need your username and password.

2. Navigate to Payments: Find the section dedicated to making payments. This is usually clearly labeled.

3. Select Payment Method: Choose your preferred payment method (discussed in the next section).

4. Enter Payment Information: Provide the necessary details, such as the amount you wish to pay and any relevant account information.

5. Review and Submit: Carefully review the payment details to ensure accuracy before submitting.

6. Confirmation: Once submitted, you’ll receive a confirmation of your payment. Keep this confirmation for your records.

Common Payment Methods

Sallie Mae typically accepts various payment methods to accommodate diverse preferences. Common options often include online payments through their website (using checking accounts or debit cards), automatic payments (recurring payments set up directly from your bank account), and payments via phone. They may also accept payments via mail, though this method is generally less efficient. Specific details on accepted payment methods and any associated fees should be verified on the Sallie Mae website or by contacting their customer service.

Managing Sallie Mae Student Loan Debt

Effectively managing your Sallie Mae student loan debt requires a proactive and organized approach. This involves creating a realistic budget, developing a strategic repayment plan, and understanding the potential consequences of missed payments. By taking control of your finances and implementing sound strategies, you can significantly reduce your debt burden and improve your financial well-being.

Sample Budget Incorporating Student Loan Payments

Creating a budget is crucial for successful debt management. A comprehensive budget should account for all income and expenses, allocating a specific amount for your Sallie Mae student loan payments. This ensures consistent payments and avoids late fees. Consider using budgeting apps or spreadsheets to track your income and expenses. A sample budget might look like this:

| Income | Amount |

|---|---|

| Monthly Salary | $3000 |

| Expenses | Amount |

| Rent | $1000 |

| Groceries | $300 |

| Transportation | $200 |

| Utilities | $150 |

| Student Loan Payment | $500 |

| Other Expenses | $350 |

| Savings | $500 |

This is a simplified example; your budget will depend on your individual circumstances. Remember to adjust the amounts to reflect your specific income and expenses. The key is to allocate enough for your student loan payment while maintaining a reasonable level of savings.

Plan for Faster Student Loan Repayment

Several strategies can accelerate your student loan repayment. One effective approach is to make extra payments whenever possible. Even small additional payments can significantly reduce the principal balance and shorten the repayment period, ultimately saving you money on interest. Another strategy is to refinance your loans with a lower interest rate, reducing the total amount you pay over the life of the loan. Consider exploring income-driven repayment plans if your financial situation necessitates it, although these often extend the repayment period.

Consequences of Missing or Late Payments

Missing or making late student loan payments can have serious consequences. Late payments can result in late fees, which add to your overall debt. Repeated late payments can damage your credit score, making it more difficult to obtain loans or credit cards in the future. In severe cases, your loan could go into default, leading to wage garnishment, tax refund offset, and potential legal action. Maintaining consistent on-time payments is crucial for protecting your financial health.

Comparison of Repayment Strategies

Different repayment strategies offer various advantages and disadvantages. The standard repayment plan provides a fixed monthly payment over a set period. Income-driven repayment plans adjust your monthly payment based on your income and family size, making them suitable for those with lower incomes. Accelerated repayment plans, such as making extra payments or refinancing, can significantly shorten the repayment period and reduce the total interest paid. The best strategy depends on your individual financial situation and goals. Carefully consider your financial circumstances and long-term goals when choosing a repayment plan.

Exploring Sallie Mae Loan Refinancing Options

Refinancing your Sallie Mae student loans can be a strategic move to potentially lower your monthly payments and overall interest costs. However, it’s crucial to understand the process and determine if it’s the right choice for your financial situation. This section will explore Sallie Mae loan refinancing options, outlining eligibility requirements, advantages, disadvantages, and the application process.

Sallie Mae Loan Refinancing Eligibility Criteria

Eligibility for Sallie Mae loan refinancing depends on several factors. Generally, you’ll need a good credit score, a stable income, and a manageable debt-to-income ratio. Specific requirements may vary depending on the lender and the type of loan being refinanced. Lenders typically prefer applicants with a credit score above 670, demonstrating financial responsibility. A steady employment history also significantly increases your chances of approval, assuring the lender of your ability to make timely payments. Finally, a low debt-to-income ratio (the percentage of your monthly income dedicated to debt payments) shows lenders you have sufficient disposable income to handle additional debt obligations. Some lenders may also require a minimum loan amount or specific types of student loans to be eligible for refinancing.

Advantages and Disadvantages of Refinancing Sallie Mae Loans

Refinancing your Sallie Mae loans offers potential benefits, but also carries certain drawbacks. A primary advantage is the possibility of securing a lower interest rate. This can lead to significant savings over the life of the loan, reducing the total amount you pay. Another advantage is the potential to simplify your payments by consolidating multiple loans into a single monthly payment. This can make budgeting easier and streamline the repayment process. However, refinancing might extend the repayment term, potentially increasing the total interest paid despite a lower interest rate. Moreover, refinancing might result in the loss of federal student loan benefits, such as income-driven repayment plans or loan forgiveness programs. It’s therefore crucial to weigh the potential benefits against these potential drawbacks carefully.

Scenarios Where Refinancing Might Be Beneficial

Refinancing can be particularly advantageous in specific situations. For example, if you’ve significantly improved your credit score since initially taking out your student loans, you might qualify for a lower interest rate. This is especially true if you originally had a lower credit score, resulting in a higher interest rate. Another scenario where refinancing is beneficial is when interest rates have dropped significantly since you took out your loans. This allows you to lock in a lower rate and reduce your monthly payments. Consider refinancing if you’ve secured a higher-paying job, improving your debt-to-income ratio and making you a more attractive candidate for a lower interest rate. Finally, consolidating multiple loans into a single payment can simplify repayment and improve your financial organization.

Key Information Needed to Apply for Refinancing

To apply for Sallie Mae loan refinancing, you’ll need to gather several key pieces of information. This includes your Social Security number, date of birth, current employment information (employer, income, and length of employment), and details about your existing Sallie Mae student loans (loan amounts, interest rates, and account numbers). You’ll also need to provide your credit history information, allowing lenders to assess your creditworthiness. Furthermore, you may be asked to provide bank statements or pay stubs as proof of income and financial stability. Accurate and complete information ensures a smooth and efficient application process.

Understanding Sallie Mae Customer Service and Support

Effective communication with Sallie Mae is crucial for managing your student loans successfully. Understanding the various support channels and the process for resolving issues will help ensure a smooth experience. This section details the available resources and provides guidance on interacting with Sallie Mae representatives.

Contacting Sallie Mae Customer Support

Sallie Mae offers multiple avenues for contacting customer support, allowing borrowers to choose the method most convenient for them. These options provide flexibility and accessibility for addressing inquiries or concerns.

| Contact Method | Description | Availability | Considerations |

|---|---|---|---|

| Phone | Directly speak with a representative. | Typically during business hours. Specific hours may vary. | Expect potential wait times, especially during peak hours. Have your account information ready. |

| Online Chat | Real-time text-based communication with a representative. | Generally available during business hours. | Provides a quicker alternative to phone calls for less complex inquiries. |

| Send a detailed message with your inquiry. | Response times may vary. | Best for non-urgent issues or situations requiring detailed explanations. | |

| Send correspondence via traditional mail. | Response times are typically the longest. | Use this method only for situations requiring physical documentation or when other methods are unavailable. |

Disputing Billing Errors or Incorrect Payments

If you believe there’s an error on your statement or a problem with a payment, Sallie Mae provides a clear process for resolving these discrepancies. Promptly reporting any issues is key to a timely resolution.

To dispute a billing error or incorrect payment, immediately contact Sallie Mae through one of the channels mentioned above. Clearly and concisely explain the discrepancy, providing any supporting documentation such as transaction records or payment confirmations. Sallie Mae will investigate the issue and notify you of their findings within a reasonable timeframe, typically Artikeld in their terms and conditions. Keep records of all communication with Sallie Mae regarding the dispute.

Effective Communication with Sallie Mae Representatives

Successful communication with Sallie Mae representatives hinges on clear and concise messaging. Preparing in advance will help streamline the process.

Before contacting Sallie Mae, gather all relevant account information, including your loan number, the nature of your inquiry, and any supporting documentation. Clearly articulate your issue and be prepared to answer any questions the representative may have. Remain calm and polite throughout the interaction, even if you are frustrated. If the issue is not resolved to your satisfaction, request a supervisor or escalate the issue through the appropriate channels. Document all interactions, including dates, times, and the names of representatives.

Potential Impact of Sallie Mae Payments on Credit Score

Your Sallie Mae student loan payments have a significant impact on your credit score, a crucial factor influencing your financial future. Responsible repayment demonstrates creditworthiness to lenders, potentially unlocking better interest rates on future loans, credit cards, and even mortgages. Conversely, neglecting payments can have serious and long-lasting negative consequences.

Understanding the relationship between your Sallie Mae payments and your credit score is essential for building a strong financial foundation. Consistent, on-time payments contribute positively, while missed or late payments can severely damage your creditworthiness. This section details the specifics of how your payment behavior impacts your credit report and ultimately your credit score.

On-Time Payments and Credit Score Improvement

On-time payments are the cornerstone of a good credit history. Each timely payment to Sallie Mae is reported to the major credit bureaus (Equifax, Experian, and TransUnion). This positive activity directly contributes to your payment history, a significant component (typically 35%) of your FICO credit score, the most widely used scoring system. Consistent on-time payments demonstrate your reliability and responsible financial behavior, leading to a gradual increase in your credit score over time. For example, someone consistently making on-time payments for two years might see their credit score improve by 50-100 points, depending on their initial score and other credit factors.

Impact of Late or Missed Payments on Credit Reports

Late or missed Sallie Mae payments have a considerably negative effect. These instances are recorded on your credit report, remaining there for seven years. A single late payment can lower your score, while multiple late payments or defaults can significantly damage your creditworthiness, making it difficult to obtain loans or credit cards with favorable terms in the future. For instance, a single 30-day late payment could result in a score drop of 30-50 points, depending on your overall credit profile. A pattern of late payments can lead to much more substantial score reductions, making it harder to qualify for mortgages, auto loans, or even rent an apartment.

Examples of Strong Payment History and Improved Creditworthiness

Consider two individuals: Person A consistently makes on-time payments on their Sallie Mae loan and other debts. Their credit score reflects this responsible behavior, resulting in a high score, allowing them to secure a mortgage with a favorable interest rate. Person B, however, frequently misses payments on their Sallie Mae loan and other debts. Their credit score suffers significantly, limiting their access to credit and potentially resulting in higher interest rates on any future borrowing. This stark contrast illustrates the importance of responsible repayment. A consistently strong payment history translates to better financial opportunities and lower borrowing costs.

Monitoring Your Credit Score and Report

Regularly monitoring your credit report and score is crucial to identifying and addressing any issues promptly. You can obtain your credit report for free annually from AnnualCreditReport.com. Many credit card companies and financial institutions also provide free credit score access. By reviewing your report regularly, you can verify the accuracy of your Sallie Mae payment history and detect any errors or discrepancies. Early detection of problems allows for prompt action, minimizing potential negative impacts on your credit score. For example, if you notice a late payment reported incorrectly, you can dispute it with the credit bureau to correct the record.

Exploring Sallie Mae Loan Forgiveness or Cancellation Programs

Sallie Mae, while primarily a private lender, doesn’t offer its own loan forgiveness programs in the same way the federal government does. However, borrowers with Sallie Mae loans might still qualify for federal loan forgiveness programs if their loans meet specific criteria. Understanding these programs and their eligibility requirements is crucial for borrowers seeking debt relief.

It’s important to note that the information provided here is for general understanding and should not be considered legal or financial advice. Always consult with a qualified professional for personalized guidance.

Federal Loan Forgiveness Programs Applicable to Sallie Mae Loans

Several federal programs offer loan forgiveness or cancellation, and some borrowers with Sallie Mae loans might be eligible if their loans were initially federal loans or were consolidated into federal loans. Eligibility depends on factors such as loan type, employment, and income.

Public Service Loan Forgiveness (PSLF) Program

This program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization.

Eligibility requires employment by a qualifying employer, consistent on-time payments under an income-driven repayment plan, and the correct type of federal loans. Examples of qualifying employers include government agencies, public schools, and non-profit organizations. The application process involves meticulously documenting employment and repayment history.

Teacher Loan Forgiveness Program

This program forgives up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. The loans must be Direct Subsidized or Unsubsidized Loans, Stafford Loans, or Consolidation Loans.

Eligibility hinges on teaching in a qualifying school or agency, meeting the required teaching time, and having the correct type of federal loans. This program benefits teachers committed to working in underserved communities.

Other Federal Loan Forgiveness Programs

Several other federal programs exist with varying eligibility criteria, including loan forgiveness for specific professions like nurses or military personnel. These programs often have specific requirements regarding loan type, employment, and location of service. Researching these programs individually is crucial to determine potential eligibility.

Steps in Applying for Federal Loan Forgiveness

The application process varies depending on the specific program. Generally, it involves:

- Determining eligibility based on the program’s specific requirements.

- Gathering necessary documentation, such as employment verification and repayment history.

- Completing the appropriate application form through the Federal Student Aid website.

- Submitting the application and supporting documentation.

- Monitoring the application’s status and responding to any requests for additional information.

Illustrating the Long-Term Financial Implications of Student Loan Payments

Understanding the long-term financial implications of your Sallie Mae student loans is crucial for making informed decisions about your repayment strategy and achieving your long-term financial goals. The choices you make today will significantly impact your financial well-being for years to come, influencing everything from your ability to save for retirement to your capacity to purchase a home.

The repayment strategy you choose will dramatically affect the total cost of your loan and your overall financial health. Different plans offer varying monthly payments and repayment periods, leading to significantly different total interest paid. Choosing the wrong plan can lead to paying thousands of extra dollars over the life of the loan.

Comparison of Total Interest Paid Under Various Repayment Plans

The total interest paid can vary greatly depending on the repayment plan selected. Consider these examples to illustrate the potential differences. These are hypothetical examples and actual interest paid will depend on your specific loan terms and interest rate.

- Standard Repayment Plan: This plan typically involves fixed monthly payments over a 10-year period. For a $30,000 loan at 5% interest, the total interest paid might be approximately $6,000.

- Extended Repayment Plan: This plan stretches payments over a longer period, often 25 years. While monthly payments are lower, the total interest paid will likely be significantly higher. For the same $30,000 loan at 5% interest, the total interest paid could exceed $15,000.

- Income-Driven Repayment Plan: These plans adjust your monthly payments based on your income. While this can offer lower monthly payments during periods of lower income, the repayment period is often extended, resulting in higher total interest paid compared to the standard plan. The total interest paid on a $30,000 loan at 5% could potentially be around $8,000 to $12,000, depending on income fluctuations.

Effects of Student Loan Debt on Major Life Decisions

Student loan debt can significantly impact major life decisions like buying a house or starting a family. High monthly payments can limit your ability to save for a down payment on a home or reduce the amount you can afford to borrow. Similarly, the financial strain of student loan payments can delay plans to start a family or limit your ability to provide for your children. For example, a couple carrying $50,000 in student loan debt might delay buying a house until they pay off a significant portion of their loans, potentially delaying homeownership by several years. Similarly, the financial burden could postpone plans to have children, as the added expenses would be difficult to manage with existing debt.

Visual Representation of Long-Term Effects of Repayment Plans on Net Worth

Imagine a graph showing net worth over time for three individuals, each with the same initial student loan debt.

* Line 1 (Standard Repayment): This line shows a steeper upward trajectory after the initial loan repayment period, indicating faster growth in net worth due to lower overall interest paid.

* Line 2 (Extended Repayment): This line shows a slower, more gradual increase in net worth, reflecting the longer repayment period and higher cumulative interest.

* Line 3 (Income-Driven Repayment): This line shows a fluctuating trajectory, reflecting the variable monthly payments and potentially longer repayment period. The upward trend is less steep compared to the standard repayment plan, but it’s generally more stable than the extended repayment plan, offering flexibility during periods of lower income.

The graph illustrates how choosing a repayment plan with lower monthly payments can lead to higher total interest paid, slowing the accumulation of net worth over time. Conversely, a higher monthly payment plan leads to faster debt repayment, allowing for more rapid growth in net worth in the long run.

Conclusion

Successfully managing your Sallie Mae student loan requires a proactive approach, combining careful planning with a deep understanding of available resources. By implementing the strategies Artikeld in this guide—from crafting a personalized budget and exploring refinancing options to leveraging customer support and monitoring your credit score—you can navigate the repayment process with confidence and pave the way for a brighter financial future. Remember, responsible financial management empowers you to achieve your long-term goals.

Common Queries

What happens if I miss a Sallie Mae payment?

Missing a payment can negatively impact your credit score and potentially lead to late fees and collection actions. Contact Sallie Mae immediately if you anticipate difficulty making a payment to explore possible solutions.

Can I consolidate my Sallie Mae loans with other student loans?

Sallie Mae offers refinancing options that may allow you to consolidate multiple loans into a single payment. Eligibility criteria apply.

How long does it typically take to receive a response from Sallie Mae customer service?

Response times vary depending on the method of contact. Expect a quicker response via phone or live chat than through email.

What documents do I need to provide when applying for Sallie Mae loan refinancing?

Required documents typically include proof of income, employment history, and possibly tax returns. Check Sallie Mae’s website for the most up-to-date requirements.