Navigating the complexities of student loan repayment can feel overwhelming, but understanding the FAFSA (Free Application for Federal Student Aid) is the crucial first step. This guide demystifies the process, providing a comprehensive overview of federal student loan options, repayment plans, and strategies for effective debt management. We’ll explore various income-driven repayment plans, loan consolidation options, and government resources available to help you successfully repay your student loans and achieve financial freedom.

From deciphering your FAFSA data to understanding loan terms and conditions, we’ll equip you with the knowledge and tools to make informed decisions about your financial future. We’ll cover everything from budgeting and financial planning to understanding the consequences of defaulting on your loans, ensuring you’re well-prepared for every stage of the repayment journey.

Understanding FAFSA and Student Loan Repayment

The Free Application for Federal Student Aid (FAFSA) is the gateway to federal student financial aid, including loans. Understanding the FAFSA process and the various repayment options available is crucial for responsible borrowing and long-term financial planning. This section will clarify the relationship between FAFSA and federal student loan repayment, detail the different loan types, and guide you through accessing and interpreting your FAFSA data.

The Relationship Between FAFSA and Federal Student Loan Repayment

The FAFSA determines your eligibility for federal student aid, including federal student loans. The information you provide on the FAFSA—such as your income, family size, and assets—is used to calculate your Expected Family Contribution (EFC). This EFC, along with your cost of attendance, determines your financial need and the amount of federal aid you may receive, which may include federal student loans. The type and amount of loans offered are directly tied to the FAFSA data. Once you accept federal student loans, you will receive loan disbursement information from your school and the loan servicer. Your repayment plan begins after you leave school or drop below half-time enrollment.

Types of Federal Student Loans

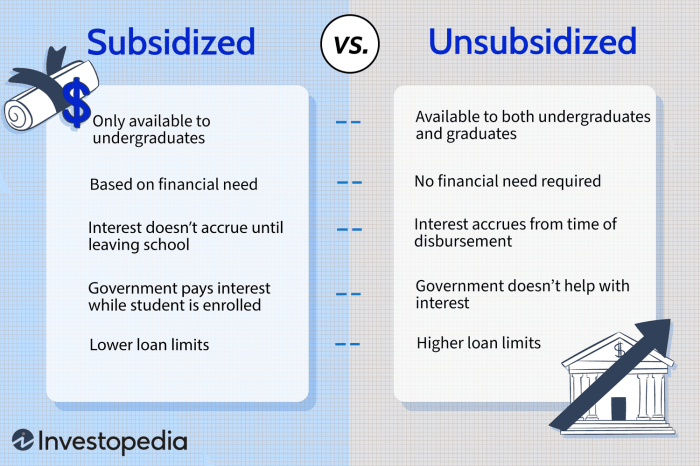

Several types of federal student loans exist, each with its own terms and conditions. Understanding these differences is essential for making informed borrowing decisions.

- Subsidized Federal Stafford Loans: The government pays the interest while you are in school at least half-time, during grace periods, and during deferment periods. These loans are based on financial need.

- Unsubsidized Federal Stafford Loans: Interest accrues from the time the loan is disbursed, regardless of your enrollment status. These loans are not based on financial need.

- Federal PLUS Loans: These loans are available to graduate or professional students and parents of undergraduate students. Credit checks are required, and borrowers must meet specific creditworthiness standards.

Accessing and Understanding Your FAFSA Data Related to Loan Amounts

To access your FAFSA data and understand your loan amounts, follow these steps:

- Log in to StudentAid.gov: Visit the official website and log in using your FSA ID.

- Access Your FAFSA Data: Navigate to your FAFSA data summary. This will show the information you provided on your application, including your EFC and any federal student aid you were offered.

- Review Your Award Letter: Your school will send you an award letter outlining the financial aid package offered, including the types and amounts of loans. This is crucial for understanding your total loan amount.

- Check Your Loan Documents: Your loan servicer will provide documents specifying the loan terms, interest rate, and repayment schedule. Review these carefully.

Federal Student Loan Repayment Plans

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Several plans cater to different financial situations.

| Plan Name | Monthly Payment Calculation | Loan Forgiveness Options | Eligibility Requirements |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payment over 10 years | None | All federal student loan borrowers |

| Extended Repayment Plan | Fixed monthly payment over 25 years | None | All federal student loan borrowers |

| Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Payment based on income and family size; typically recalculated annually | Loan forgiveness after 20-25 years of payments, depending on the plan | All federal student loan borrowers; specific eligibility requirements may apply depending on the plan. |

Navigating Repayment Options

Successfully navigating student loan repayment requires understanding the various options available and choosing the plan that best aligns with your individual financial circumstances. This involves careful consideration of income-driven repayment plans, loan consolidation, and the potential long-term implications of each choice. Making informed decisions in this area can significantly impact your financial well-being for years to come.

Income-Driven Repayment Plans: Overview

Income-driven repayment (IDR) plans are designed to make student loan repayment more manageable by basing your monthly payments on your income and family size. Several plans exist, each with its own eligibility criteria and payment calculation method. Choosing the right plan depends on your specific financial situation and long-term goals. Careful consideration of the pros and cons of each plan is crucial before making a selection.

Income-Driven Repayment Plans: Pros and Cons

Different IDR plans offer varying advantages and disadvantages. For example, the Revised Pay As You Earn (REPAYE) plan generally offers lower monthly payments than the Income-Based Repayment (IBR) plan, but may result in a higher total amount paid over the life of the loan. Conversely, IBR might have slightly higher monthly payments initially but could lead to loan forgiveness after a certain period, depending on the plan and loan type. Understanding these nuances is key to making an informed decision. A detailed comparison of these and other plans (like PAYE and Income-Contingent Repayment – ICR) is readily available on the Federal Student Aid website.

Applying for an Income-Driven Repayment Plan

The application process for an IDR plan typically involves completing a form online through the Federal Student Aid website (StudentAid.gov). This form requires information about your income, family size, and loan details. You’ll need to recertify your income annually to ensure your payments remain aligned with your current financial situation. Failure to recertify can result in payment adjustments or even default. The specific steps and required documentation may vary slightly depending on the chosen IDR plan.

Eligibility Criteria for Income-Driven Repayment Plans

Eligibility for IDR plans generally requires having federal student loans. Specific requirements may vary by plan, but generally include factors like income level, family size, and loan type. For instance, some plans may not be available for Parent PLUS loans. It’s essential to check the eligibility criteria for each plan on the Federal Student Aid website to determine which options are available to you.

Loan Consolidation: An Overview

Loan consolidation combines multiple federal student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment by reducing the number of payments you need to track. However, it’s important to carefully weigh the potential benefits against the potential drawbacks, such as a potentially higher total interest paid over the life of the loan if the new interest rate is higher than the weighted average of your existing loans.

Loan Consolidation: Impact on Repayment

Consolidating your loans can potentially lower your monthly payment, particularly if you choose an IDR plan after consolidation. However, the new interest rate, which is a weighted average of your existing loans, could increase your total repayment amount over time. Furthermore, consolidating your loans may affect your eligibility for certain loan forgiveness programs. Careful consideration of these factors is vital before making a decision to consolidate. For example, consolidating subsidized loans with unsubsidized loans can result in the subsidized portion accruing interest, increasing the total amount owed.

Managing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and consistent effort. Understanding your repayment options and developing a robust budget are crucial first steps towards becoming debt-free. This section will provide practical strategies and resources to help you effectively manage your student loan debt.

Sample Student Loan Repayment Budget

A realistic budget is essential for successful loan repayment. This example assumes a monthly net income of $3,000 and a monthly student loan payment of $500. Adjust these figures to reflect your individual circumstances.

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1,000 |

| Student Loan Payment | $500 |

| Food | $400 |

| Transportation | $200 |

| Utilities (Electricity, Water, Gas) | $150 |

| Healthcare | $100 |

| Savings (Emergency Fund & Other Goals) | $250 |

| Other Expenses (Entertainment, Clothing, etc.) | $400 |

This budget demonstrates the importance of prioritizing loan payments while still allocating funds for essential living expenses and savings. Remember to track your spending meticulously to identify areas where you can reduce expenses and allocate more towards loan repayment.

Strategies for Effective Student Loan Debt Management

Effective student loan management involves a multi-pronged approach. This includes prioritizing payments, exploring repayment plans, and actively seeking ways to reduce your debt burden.

- Prioritize Loan Payments: Make on-time payments a top priority to avoid late fees and negative impacts on your credit score. Consider automating payments to ensure consistency.

- Explore Repayment Plans: Investigate different repayment plans offered by your loan servicer, such as income-driven repayment (IDR) plans, which adjust your monthly payment based on your income and family size. These plans can provide temporary relief, but it’s crucial to understand the long-term implications, such as potential for higher total interest paid.

- Consider Refinancing: Refinancing your student loans might lower your interest rate, leading to lower monthly payments and reduced overall interest paid. However, carefully compare offers from different lenders to find the best deal and ensure it aligns with your financial goals. Be aware that refinancing federal loans into private loans might eliminate access to federal repayment programs and protections.

- Budgeting and Expense Tracking: Regularly review your budget to identify areas where you can cut back on spending and allocate more funds towards your loan payments. Using budgeting apps or spreadsheets can help you track your expenses and stay organized.

Financial Tools and Resources for Borrowers

Several resources can assist borrowers in managing their student loan debt.

- StudentAid.gov: The official website for the U.S. Department of Education’s Federal Student Aid provides comprehensive information on federal student loans, repayment plans, and other resources.

- National Student Loan Data System (NSLDS): This system allows you to access your federal student loan information, including loan balances, repayment schedules, and servicer contact information.

- Loan Servicer Websites: Your loan servicer’s website provides personalized information about your loans, including payment options, account statements, and contact information.

- Financial Counseling Services: Non-profit credit counseling agencies can offer free or low-cost guidance on managing debt, including student loans. They can help you create a budget, explore repayment options, and develop a long-term financial plan.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences.

- Damaged Credit Score: A default will significantly damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The government can garnish your wages to recover the defaulted loan amount.

- Tax Refund Offset: Your tax refund can be seized to pay off your defaulted loans.

- Difficulty Obtaining Federal Financial Aid: Future access to federal student aid programs may be denied.

- Collection Agency Involvement: Your debt may be transferred to a collection agency, which will aggressively pursue payment.

Government Programs and Resources

Navigating the complexities of student loan repayment can be daunting, but several government programs and resources are designed to provide assistance. Understanding these programs and how to access them is crucial for borrowers seeking to manage their debt effectively. This section details key government initiatives aimed at alleviating the burden of student loan debt.

Government loan forgiveness programs offer the potential for partial or complete cancellation of student loan debt under specific circumstances. These programs typically target borrowers working in public service, those with disabilities, or those who have experienced specific hardships. Eligibility requirements vary significantly depending on the program, and careful review of program guidelines is essential. The benefits can be substantial, potentially eliminating a significant financial burden.

Loan Forgiveness Program Requirements and Benefits

Several federal loan forgiveness programs exist, each with its own eligibility criteria and benefits. For example, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance of your Direct Loans after you’ve made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. Teacher Loan Forgiveness offers forgiveness of up to $17,500 on qualifying federal student loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. The Income-Driven Repayment (IDR) plans, while not strictly forgiveness programs, can significantly reduce monthly payments and potentially lead to loan forgiveness after 20 or 25 years, depending on the plan. These programs are designed to assist specific groups of borrowers, and understanding the requirements for each is paramount.

Applying for Government Assistance Programs

The application process for government assistance programs varies depending on the specific program. Generally, it involves completing an application form, providing documentation to verify eligibility (such as employment verification or proof of disability), and potentially undergoing a review process. The Department of Education’s website provides detailed information and application forms for each program. Borrowers should carefully review the instructions and submit all required documentation to ensure timely processing. Seeking assistance from a student loan counselor can be beneficial in navigating the application process and ensuring all requirements are met.

The Department of Education’s Role in Student Loan Repayment

The U.S. Department of Education plays a central role in managing federal student loan programs, including repayment. The Department oversees the various loan forgiveness and repayment assistance programs, processes applications, and ensures compliance with program guidelines. It also provides resources and information to borrowers to help them understand their repayment options and manage their debt. The Department’s website serves as a valuable resource for borrowers seeking information and assistance with their student loans.

Frequently Asked Questions about FAFSA and Student Loan Repayment

Understanding the FAFSA process and student loan repayment options is crucial for responsible financial planning. Here are some frequently asked questions and their answers:

- What is FAFSA? The Free Application for Federal Student Aid (FAFSA) is a form that students complete to determine their eligibility for federal student aid, including grants, loans, and work-study programs.

- How does FAFSA affect my student loan repayment? Your FAFSA information helps determine your eligibility for federal student loans and influences your repayment plan options.

- What are my repayment plan options? Several repayment plans exist, including standard, graduated, extended, and income-driven repayment plans. The best option depends on your individual financial circumstances.

- What happens if I don’t repay my student loans? Failure to repay your student loans can result in negative consequences, including damage to your credit score, wage garnishment, and tax refund offset.

- Where can I find more information about student loan repayment? The U.S. Department of Education’s website (studentaid.gov) provides comprehensive information on student loan repayment.

Understanding Loan Terms and Conditions

Successfully navigating the student loan repayment process hinges on a thorough understanding of your loan terms and conditions. Failing to grasp these details can lead to unexpected costs and difficulties in managing your debt. This section clarifies key aspects of your loan agreement to empower you to make informed financial decisions.

Loan Interest Rates and Capitalization

Understanding your loan’s interest rate is crucial, as it directly impacts the total amount you’ll repay. The interest rate is the percentage of your principal loan amount charged as interest each year. A higher interest rate means you’ll pay more in interest over the life of the loan. Capitalization is the process of adding accumulated interest to your principal loan balance. This increases the principal amount on which future interest is calculated, leading to significantly higher overall repayment costs. For example, imagine a $10,000 loan with a 5% interest rate. If interest capitalizes annually, after one year, the interest accrued ($500) is added to the principal, making the new principal $10,500. The following year’s interest is calculated on this higher amount, resulting in even greater interest accumulation. Understanding capitalization helps you appreciate the importance of timely payments to minimize its effect.

Student Loan Fees

Several fees can be associated with student loans, impacting your overall cost. These might include origination fees (charged by the lender when the loan is disbursed), late payment fees (imposed for missed or late payments), and non-sufficient funds (NSF) fees (charged if a payment bounces due to insufficient funds in your account). Some lenders may also charge prepayment penalties if you pay off your loan early. It is vital to carefully review your loan documents to understand all applicable fees and their implications. Budgeting for these fees alongside your monthly payments is essential for responsible financial management.

Deferment and Forbearance

Deferment and forbearance are temporary pauses in your loan repayment, offering relief during financial hardship. Deferment postpones payments and may or may not accrue interest, depending on the type of loan and your eligibility. Forbearance temporarily reduces or suspends your payments, but interest usually continues to accrue. Both options can provide temporary relief, but they should be considered carefully, as interest continues to accrue during forbearance and may be added to the principal. The implications of deferment and forbearance include extending the repayment period and increasing the total cost of the loan. It’s crucial to weigh the short-term benefits against the long-term consequences before utilizing these options.

Interest Accrual and Repayment Plan Impact

Imagine a graph with time on the horizontal axis and loan balance on the vertical axis. A line representing a loan with a standard repayment plan would show a steady decrease in the balance over time. However, if interest is accruing, the line initially slopes downward more slowly, reflecting the impact of interest on the overall balance. A loan with a longer repayment period will show a slower decline in the balance, as interest accrues over a longer period. Conversely, a shorter repayment period, such as an accelerated repayment plan, would show a steeper decline in the balance, as payments are larger and reduce the principal more quickly, minimizing the total interest paid. The impact of different repayment plans on interest accrual is significant; shorter repayment plans generally result in less total interest paid. This visual representation demonstrates how repayment plan selection directly influences the total amount repaid over the life of the loan.

Last Word

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. By leveraging the information provided in this guide, you can confidently navigate the repayment process, choose the most suitable repayment plan, and develop a sustainable strategy for achieving financial stability. Remember, seeking guidance from financial advisors and utilizing government programs can significantly impact your journey towards becoming debt-free. Take control of your financial future, and begin your path to a brighter tomorrow.

Q&A

What happens if I don’t complete the FAFSA?

You won’t be eligible for most federal student aid, including grants and subsidized loans. This significantly limits your financial aid options.

Can I refinance my federal student loans?

Yes, but refinancing with a private lender means losing federal protections like income-driven repayment plans and potential forgiveness programs.

What if I lose my job and can’t make my student loan payments?

Explore options like deferment or forbearance. Contact your loan servicer immediately to discuss your situation and avoid default.

How long does it take to repay student loans?

This depends on your loan amount, interest rate, and repayment plan. Standard plans typically last 10 years, but income-driven plans can extend repayment over a longer period.

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments and may or may not stop interest accrual, depending on the loan type. Forbearance also suspends payments but typically results in interest accumulating.