The weight of student loan debt is a significant reality for many, and understanding the intricacies of interest payments is crucial for successful repayment. This guide delves into the often-overlooked aspects of student loan interest, providing a clear and comprehensive overview to empower borrowers to make informed financial decisions.

From deciphering fixed versus variable interest rates to exploring strategies for minimizing interest accumulation, we’ll navigate the complexities of student loan repayment, empowering you to take control of your financial future. We’ll cover everything from calculating interest and exploring repayment options to accessing valuable resources and support.

Understanding Student Loan Interest

Understanding student loan interest is crucial for responsible repayment. Interest significantly impacts the total cost of your education, potentially adding thousands of dollars to your final loan balance. This section will clarify the different types of interest, how it accrues, and the factors that influence its rate.

Fixed vs. Variable Interest Rates

Student loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability in your monthly payments. A variable interest rate, however, fluctuates based on an underlying index, such as the prime rate or LIBOR. This means your monthly payment could increase or decrease over time, depending on market conditions. Choosing between a fixed and variable rate depends on your risk tolerance and predictions about future interest rate movements. A fixed rate offers stability, while a variable rate could potentially lead to lower payments initially, but carries the risk of higher payments later.

Interest Capitalization

Interest capitalization is the process of adding accrued but unpaid interest to the principal balance of your loan. This typically occurs when your loan enters a grace period (the period after graduation before repayment begins) or during periods of deferment or forbearance (temporary pauses in repayment). For example, if you have $10,000 in student loans with 5% interest and accrue $500 in interest during a grace period, capitalization would increase your principal balance to $10,500. Future interest will then be calculated on this higher amount, leading to a larger total repayment amount over the life of the loan. Understanding capitalization is vital, as it significantly increases the overall cost of borrowing.

Factors Influencing Student Loan Interest Rates

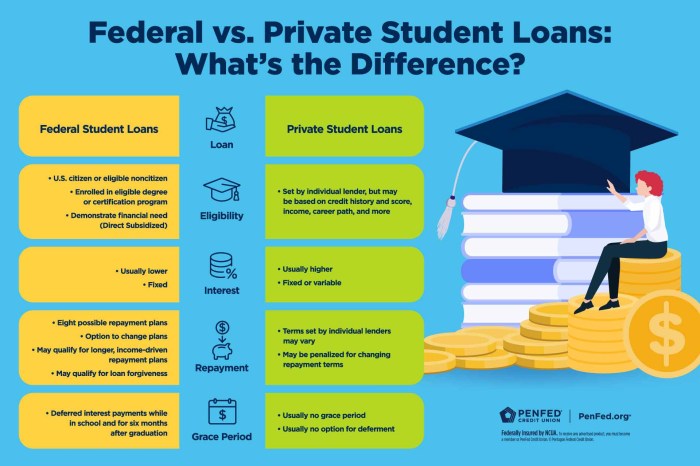

Several factors determine the interest rate you’ll receive on your student loans. These include your credit history (for private loans), the type of loan (federal or private), the loan’s term length, and the current market interest rates. Federal student loans generally offer lower interest rates than private loans because they are backed by the government. Your creditworthiness, as assessed by your credit score and history of responsible borrowing, also plays a major role in determining the interest rate on private student loans. A higher credit score typically qualifies you for a lower interest rate. Longer loan terms may result in lower monthly payments but often lead to higher overall interest paid. Finally, prevailing market interest rates influence both fixed and variable rates, impacting the cost of borrowing across the board.

Comparison of Student Loan Interest Rates

The following table provides a comparison of interest rates for various federal and private student loan programs. Note that these rates are subject to change and should be considered illustrative rather than definitive. Always check the most current rates with the lender or government agency before making borrowing decisions.

| Loan Type | Lender | Interest Rate Type | Approximate Interest Rate Range (%) |

|---|---|---|---|

| Federal Direct Subsidized Loan | U.S. Department of Education | Fixed | Variable; check the official website for current rates |

| Federal Direct Unsubsidized Loan | U.S. Department of Education | Fixed | Variable; check the official website for current rates |

| Federal Grad PLUS Loan | U.S. Department of Education | Fixed | Variable; check the official website for current rates |

| Private Student Loan | Various Banks and Credit Unions | Fixed or Variable | Variable, depending on creditworthiness and market conditions; typically higher than federal loan rates |

Calculating Student Loan Interest

Understanding how student loan interest is calculated is crucial for effectively managing your debt. This section will detail the methods used to calculate both simple and compound interest, providing clear examples and demonstrating the impact of different repayment plans. We will also briefly compare the approaches taken by various lenders.

Student loan interest accrues over time, increasing the total amount you owe. The two primary methods for calculating this interest are simple interest and compound interest. While simple interest is a straightforward calculation, compound interest, more commonly used for student loans, involves accruing interest on both the principal and previously accumulated interest.

Simple Interest Calculation

Simple interest is calculated only on the principal loan amount. The formula is straightforward:

Simple Interest = Principal x Interest Rate x Time

Where:

- Principal: The original loan amount.

- Interest Rate: The annual interest rate (expressed as a decimal).

- Time: The loan term in years.

For example, a $10,000 loan with a 5% annual interest rate over 5 years would accrue simple interest of $2,500 ($10,000 x 0.05 x 5). The total amount owed would be $12,500.

Compound Interest Calculation

Compound interest is calculated on the principal amount plus any accumulated interest. This means interest earns interest, leading to faster growth of the total debt. The formula is more complex and typically involves iterative calculations, often best handled with a loan calculator or spreadsheet software.

A common approach uses the following formula to calculate the future value (FV) of the loan including compound interest:

FV = PV (1 + r/n)^(nt)

Where:

- FV = Future value of the loan

- PV = Present value (principal loan amount)

- r = Annual interest rate (decimal)

- n = Number of times interest is compounded per year (e.g., 12 for monthly compounding)

- t = Number of years

Let’s use the same $10,000 loan at 5% interest compounded annually over 5 years. Using the formula, the future value would be approximately $12,762.82, significantly higher than the simple interest example. This difference highlights the power of compounding.

Calculating Total Interest Paid Over Loan Lifetime

To calculate the total interest paid, subtract the principal loan amount from the total amount repaid. This total amount repaid is the future value (FV) calculated using the compound interest formula (or obtained from a loan amortization schedule). For our compound interest example above, the total interest paid would be approximately $2,762.82 ($12,762.82 – $10,000).

Impact of Different Repayment Plans on Total Interest Paid

Different repayment plans significantly impact the total interest paid. A shorter repayment period, while requiring higher monthly payments, will result in less interest paid overall. Conversely, a longer repayment period will lower monthly payments but lead to substantially higher total interest paid due to the longer accrual period.

For instance, consider two scenarios with a $20,000 loan at 6% interest:

| Repayment Plan | Loan Term (Years) | Approximate Total Interest Paid |

|---|---|---|

| Standard 10-year plan | 10 | $6,000 |

| Extended 20-year plan | 20 | $16,000 |

This example clearly demonstrates the considerable cost savings of choosing a shorter repayment plan despite higher monthly payments.

Comparison of Interest Calculation Methods Used by Various Lenders

Most student loan lenders utilize compound interest calculations. However, the frequency of compounding (daily, monthly, annually) can vary. Some lenders might offer different interest rates based on creditworthiness or loan type. It’s crucial to review the specific terms and conditions of your loan agreement to understand precisely how your interest is calculated.

- Most lenders use daily or monthly compounding for student loans.

- Interest rates can vary based on factors such as credit score and loan type (e.g., subsidized vs. unsubsidized).

- Loan agreements should clearly Artikel the interest calculation method and applicable rate.

Strategies for Minimizing Interest Payments

Minimizing student loan interest payments is crucial for long-term financial health. Strategic planning and proactive actions can significantly reduce the total amount paid over the life of your loans, freeing up funds for other financial goals. This section Artikels several key strategies to achieve this.

Extra Principal Payments

Making extra principal payments on your student loans is one of the most effective ways to reduce the total interest paid and shorten the repayment period. Each extra payment directly reduces the loan’s principal balance, meaning less principal accrues interest in subsequent months. Even small, consistent extra payments can have a substantial cumulative impact over time. For example, an extra $100 per month on a $30,000 loan could save thousands of dollars in interest and potentially pay off the loan years earlier. The earlier you start making extra payments, the greater the savings will be.

Repayment Plan Options

Several repayment plans exist, each with its own advantages and disadvantages. The Standard Repayment Plan offers fixed monthly payments over a 10-year period. While it’s the shortest repayment term, resulting in the lowest total interest paid, the monthly payments can be high. Extended Repayment Plans stretch payments over a longer period (up to 25 years), lowering monthly payments but increasing the total interest paid. Income-Driven Repayment Plans (IDR) base monthly payments on your income and family size, making them more manageable for those with lower incomes. However, IDR plans often extend repayment timelines significantly, potentially leading to higher overall interest costs. Choosing the right plan depends on individual financial circumstances and priorities. A careful comparison of total interest paid and monthly payment affordability is crucial.

Student Loan Refinancing

Refinancing student loans involves replacing your existing loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing may not always be beneficial. It’s important to compare interest rates from multiple lenders, considering fees and the length of the new loan term. Additionally, refinancing might eliminate certain benefits associated with federal student loans, such as income-driven repayment plans or deferment options. Careful consideration of the long-term implications is necessary before refinancing. For example, refinancing federal loans with private loans might mean losing access to federal loan forgiveness programs.

Long-Term Financial Implications of Interest Reduction Strategies

The long-term financial impact of each interest-reduction strategy varies considerably. Making extra principal payments yields the greatest long-term savings by reducing both the loan’s lifespan and the total interest paid. While refinancing can offer immediate interest rate relief, it’s crucial to assess the overall cost and potential loss of federal loan benefits. Income-driven repayment plans provide short-term affordability but can result in significantly higher interest payments over the extended repayment period. A comprehensive financial plan considering individual circumstances and long-term goals is essential to choose the most effective strategy. For instance, a borrower prioritizing early debt elimination might favor extra principal payments, while someone prioritizing short-term affordability might choose an IDR plan.

The Impact of Interest on Repayment

Understanding how student loan interest affects your repayment is crucial for responsible financial planning. Interest significantly increases the total amount you’ll pay back, often exceeding the initial loan principal. Failing to grasp this impact can lead to unexpected financial burdens and hinder long-term financial goals.

Interest affects the total cost of a student loan by adding to the principal balance over time. This means that you are not only repaying the original amount borrowed but also the accumulated interest. The longer you take to repay the loan, the more interest accrues, resulting in a substantially larger total repayment amount. This compounding effect can dramatically increase the overall cost.

Consequences of Delayed Loan Repayment

Delaying student loan repayment has significant financial repercussions. Postponing payments allows interest to accumulate, increasing the total debt. This can lead to difficulty managing monthly payments, impacting credit scores, and potentially resulting in default. The longer the delay, the greater the financial burden becomes. For example, a delay of even a few years on a substantial loan can add thousands of dollars to the total repayment amount. This can severely impact future financial plans, such as buying a home or investing.

Interest Accumulation’s Impact on Long-Term Financial Goals

The accumulation of interest on student loans can significantly hinder long-term financial goals. The added cost of repayment can restrict savings, limit investment opportunities, and delay major life purchases. For instance, someone burdened by high student loan payments might struggle to save for a down payment on a house, delaying homeownership. Similarly, the need to allocate a large portion of income to loan repayment may reduce the amount available for retirement savings, potentially compromising long-term financial security. A significant portion of income dedicated to loan repayment could mean less disposable income available for investments, hindering wealth building.

Visual Representation of Interest Growth

Imagine a graph with “Time” on the x-axis and “Loan Balance” on the y-axis. The line representing the loan balance starts at the initial loan amount. It then curves upward, steeply at first and then gradually less steeply as time progresses. This curve represents the compounding effect of interest. The steeper the curve, the faster the interest is accumulating. The difference between the initial loan amount and the final amount on the y-axis represents the total interest paid. Different lines could be plotted to show the effect of different repayment strategies; a line with a less steep curve represents aggressive repayment, minimizing the overall interest paid. A steeper curve demonstrates a slower repayment, leading to significantly higher interest costs.

Resources and Support for Managing Student Loan Interest

Navigating the complexities of student loan interest can feel overwhelming, but thankfully, numerous resources exist to help borrowers understand their options and manage their debt effectively. This section details various government programs, reputable organizations, online tools, and strategies for effective communication with lenders to help you gain control of your student loan interest.

Government Resources for Student Loan Borrowers

The federal government offers several programs and resources designed to assist student loan borrowers. The Federal Student Aid website (studentaid.gov) is a central hub for information on federal student loans, including repayment plans, interest rates, and loan forgiveness programs. The site provides detailed explanations of different loan types and their associated interest rates, allowing borrowers to compare options and make informed decisions. Additionally, borrowers can access their loan details, make payments, and explore options for managing their debt directly through the website. The Department of Education also offers various publications and guides on managing student loan debt, providing valuable insights into interest calculations and repayment strategies.

Reputable Organizations Offering Financial Counseling

Several non-profit organizations provide free or low-cost financial counseling services specializing in student loan debt management. These organizations often offer personalized guidance on repayment strategies, budgeting, and debt consolidation. The National Foundation for Credit Counseling (NFCC) is one such organization with a network of certified credit counselors who can provide expert advice. Similarly, many local community colleges and universities offer free or low-cost financial literacy workshops and individual counseling sessions, connecting students and recent graduates with professionals who can help them navigate their financial situations. These organizations typically provide unbiased advice, ensuring borrowers receive accurate and helpful information.

Online Tools and Calculators for Estimating Interest Payments

Numerous online tools and calculators can help borrowers estimate their interest payments and project their repayment schedules. Many financial websites, including those of reputable banks and credit unions, offer free student loan calculators. These calculators typically require users to input their loan amount, interest rate, and repayment term to generate an estimated repayment schedule, showing the breakdown of principal and interest payments over time. Some calculators even allow users to explore the impact of different repayment plans and extra payments on the total interest paid. Using these tools empowers borrowers to understand the long-term implications of their loan choices and make informed decisions. For example, a calculator might show how making even small extra payments each month can significantly reduce the total interest paid over the life of the loan.

Navigating Communication with Lenders About Interest-Related Questions

Effective communication with your lender is crucial for managing your student loan interest effectively. Here’s a guide to ensure a smooth and productive interaction:

- Gather necessary information: Before contacting your lender, collect all relevant information about your loans, including loan numbers, account balances, and interest rates.

- Choose the right communication method: Determine the best way to contact your lender (phone, email, or online portal). Check your lender’s website for preferred contact methods.

- Be clear and concise: State your questions or concerns clearly and concisely. Avoid jargon and ambiguity.

- Keep records: Maintain records of all communication with your lender, including dates, times, and summaries of conversations.

- Be persistent: If you don’t receive a satisfactory response, follow up with your lender until your questions are answered.

- Understand your rights: Familiarize yourself with your rights as a borrower under federal law. The Federal Student Aid website provides valuable information on borrower rights and protections.

Final Conclusion

Successfully managing student loan interest requires proactive planning and a thorough understanding of the various factors at play. By employing the strategies and resources Artikeld in this guide, borrowers can effectively minimize interest payments, accelerate repayment, and achieve long-term financial well-being. Remember, informed action is the key to navigating the complexities of student loan repayment successfully.

Questions and Answers

What happens if I don’t pay my student loan interest?

Unpaid interest will be capitalized, meaning it’s added to your principal loan balance, increasing the total amount you owe and potentially lengthening your repayment period.

Can I deduct student loan interest from my taxes?

In some countries, you may be able to deduct a portion of the student loan interest you paid during the tax year. Check with your tax advisor or the relevant tax authority for eligibility and details.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your loan payments, but interest usually continues to accrue. Deferment temporarily postpones your payments, and in some cases, interest may not accrue.

How often is interest calculated on my student loans?

Interest calculation frequency varies by lender, but it’s typically either daily or monthly. Your loan documents will specify the exact calculation method.