Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available options and strategies is crucial for long-term financial health. This guide explores various repayment plans, factors influencing payment amounts, and effective debt management techniques, empowering you to make informed decisions about your student loan journey.

From understanding the nuances of income-driven repayment to exploring loan consolidation and refinancing, we’ll equip you with the knowledge to confidently manage your student loan debt. We’ll also delve into potential pitfalls, such as scams and fraudulent schemes, and provide resources to help you avoid them. Ultimately, our aim is to provide a clear and practical path toward successful student loan repayment.

Types of Student Loan Payments

Understanding your student loan repayment options is crucial for managing your debt effectively. Choosing the right plan can significantly impact your monthly payments and the total amount of interest you pay over the life of your loan. Several repayment plans cater to different financial situations and priorities.

Standard Repayment Plan

The standard repayment plan is the most common option. It involves fixed monthly payments over a 10-year period. This plan offers the shortest repayment timeframe, leading to less interest paid overall. However, the fixed monthly payments might be higher than other plans, potentially straining your budget, especially in the early years after graduation.

Graduated Repayment Plan

A graduated repayment plan starts with lower monthly payments that gradually increase over time. This can be beneficial for recent graduates who typically have lower incomes initially. The lower initial payments offer more breathing room in the early stages of repayment, but it’s important to note that you’ll pay significantly more in interest over the life of the loan due to the longer repayment period.

Extended Repayment Plan

The extended repayment plan stretches your payments over a longer period, typically up to 25 years. This significantly reduces your monthly payments, making it more manageable for borrowers with limited income. However, it also results in substantially higher total interest paid. This plan is often a last resort for borrowers struggling with repayment under other plans.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans base your monthly payments on your income and family size. Several types of IDR plans exist, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans are designed to make repayment more affordable, especially for borrowers with lower incomes. However, they often result in longer repayment periods (potentially 20-25 years) and higher total interest paid compared to standard repayment plans. Forgiveness of remaining loan balances after a certain number of payments may be possible, depending on the specific plan and your circumstances. It’s crucial to understand the specific forgiveness requirements and timelines of each plan.

| Repayment Plan | Monthly Payment Example | Total Interest Paid Example | Eligibility Criteria |

|---|---|---|---|

| Standard | $500 (for a $30,000 loan) | $10,000 (approximate) | Generally available for all federal student loans. |

| Graduated | Starts at $300, increases over time (for a $30,000 loan) | $15,000 (approximate) | Generally available for all federal student loans. |

| Extended | $200 (for a $30,000 loan) | $20,000 (approximate) | Generally available for all federal student loans. |

| Income-Driven (IBR, PAYE, REPAYE) | Varies based on income and family size | Varies significantly | Generally available for all federal student loans. Specific criteria may vary by plan. |

Factors Affecting Student Loan Payments

Understanding the various factors influencing your student loan payments is crucial for effective financial planning and managing your debt. Several key elements significantly impact your monthly payments and the overall cost of repayment. Failing to grasp these factors can lead to unexpected expenses and prolonged repayment periods.

Interest Rates and Total Loan Cost

Interest rates directly determine the total cost of your student loan. A higher interest rate means you’ll pay significantly more in interest over the life of the loan, increasing the overall amount you repay. For example, a loan with a 7% interest rate will accrue more interest than a loan with a 5% interest rate, even if the principal amounts are the same. The compounding effect of interest can dramatically increase the total repayment amount over time. Borrowers should actively seek out loans with the lowest possible interest rates available to them. Careful comparison shopping and exploring federal loan options are essential strategies to minimize interest costs.

Loan Principal and Loan Term Length

The loan principal—the original amount borrowed—directly impacts your monthly payment. A larger principal necessitates higher monthly payments, assuming the interest rate and loan term remain constant. Similarly, the loan term length, or the repayment period, significantly affects both monthly payments and the total interest paid. A shorter loan term leads to higher monthly payments but reduces the total interest paid over the life of the loan. Conversely, a longer loan term results in lower monthly payments but increases the overall interest paid. Consider this scenario: a $20,000 loan with a 10-year term will have significantly higher monthly payments than the same loan with a 20-year term, but the shorter term will result in substantially less interest paid overall.

Loan Consolidation and its Effects

Loan consolidation combines multiple student loans into a single loan with a new interest rate and repayment term. While consolidation can simplify repayment by reducing the number of monthly payments, the impact on the overall interest paid can vary. In some cases, consolidation may result in a lower interest rate, reducing the total cost. However, if the new interest rate is higher than the weighted average of the original loans, or if a longer repayment term is chosen, the total interest paid could increase. Careful consideration of the new interest rate and repayment term offered by the consolidation program is essential before making a decision.

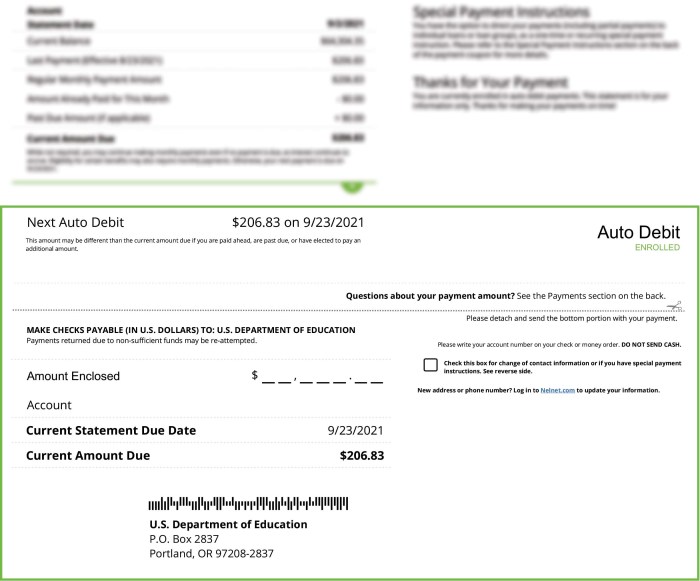

Consequences of Missed or Late Payments

Missing or making late student loan payments has serious consequences. Late payments negatively impact your credit score, making it harder to obtain future loans or credit cards with favorable terms. Furthermore, late payments can lead to additional fees and penalties, significantly increasing the overall cost of the loan. In severe cases, repeated late payments can result in loan default, leading to wage garnishment, tax refund offset, and damage to your credit history. Maintaining a consistent payment schedule is crucial for avoiding these detrimental repercussions.

Managing Student Loan Debt

Successfully navigating student loan repayment requires a proactive and organized approach. Understanding your financial situation, exploring available options, and consistently implementing a repayment strategy are key to minimizing stress and achieving debt freedom. This section Artikels practical strategies and resources to help you manage your student loan debt effectively.

Budgeting and Prioritizing Student Loan Payments

Effective budgeting is crucial for managing student loan debt. Start by tracking your income and expenses meticulously for at least a month. Categorize your spending to identify areas where you can reduce unnecessary expenses. Once you have a clear picture of your financial situation, prioritize your student loan payments within your budget. Consider using budgeting apps or spreadsheets to streamline this process. Prioritize higher-interest loans first to minimize long-term interest accumulation. Allocate a specific amount each month towards your loans, even if it’s a small amount, to maintain momentum and build a positive repayment habit. For example, if you have a $1000 monthly income and expenses of $700, you have $300 available for debt repayment. Prioritize allocating as much as possible of that $300 towards the loan with the highest interest rate.

Creating a Realistic Repayment Plan

Developing a realistic repayment plan hinges on aligning your monthly loan payments with your income and expenses. Consider your current financial situation, including your income, essential living expenses (housing, food, transportation, utilities), and other debts. Use online student loan repayment calculators to estimate monthly payments under different repayment plans (standard, extended, income-driven). These calculators will require information about your loan amount, interest rate, and loan term. Adjust your expenses or explore additional income sources if your projected payments exceed your comfort level. A realistic plan accounts for unexpected expenses, such as medical bills or car repairs, by incorporating a buffer into your budget. For example, someone earning $40,000 annually with high essential expenses might need to consider an income-driven repayment plan to avoid financial strain.

Exploring Student Loan Refinancing Options

Refinancing your student loans involves replacing your existing loans with a new loan from a private lender at a potentially lower interest rate. This can save you money on interest over the life of the loan. Before refinancing, compare interest rates from multiple lenders and carefully review the terms and conditions of each offer. Consider factors such as loan fees, repayment terms, and the lender’s reputation. Ensure you understand the implications of refinancing, such as losing access to federal loan benefits like income-driven repayment plans. It’s advisable to have a good credit score to qualify for favorable refinancing terms. For example, someone with federal loans at 7% interest could potentially refinance to a private loan with a 4% interest rate, significantly reducing their total interest paid.

Resources for Borrowers Facing Financial Hardship

Borrowers facing financial hardship can access several resources to alleviate their burden. Federal student loan programs offer options such as forbearance (temporary suspension of payments) and deferment (postponement of payments). Contact your loan servicer to explore these options. Additionally, you can seek guidance from non-profit credit counseling agencies that offer free or low-cost financial counseling services. These agencies can help you create a budget, negotiate with creditors, and explore debt management options. Some employers offer student loan repayment assistance programs as an employee benefit. Explore whether your employer provides such a program. Finally, consider contacting a financial advisor for personalized guidance tailored to your specific circumstances.

Government Programs and Student Loan Forgiveness

Navigating the complexities of student loan repayment can be daunting, but several government programs offer pathways to loan forgiveness or substantial reductions in debt. Understanding the eligibility criteria, application processes, and long-term financial implications of these programs is crucial for borrowers seeking relief. This section Artikels key aspects of these programs to help you make informed decisions.

Eligibility Requirements for Federal Student Loan Forgiveness Programs

Eligibility for federal student loan forgiveness programs varies significantly depending on the specific program. Generally, borrowers must meet specific criteria related to their loan type, employment history, and income. For instance, the Public Service Loan Forgiveness (PSLF) program requires borrowers to work full-time for a qualifying government or non-profit organization, while income-driven repayment (IDR) plans often lead to loan forgiveness after a specified period of payments, based on income. Specific requirements for each program are regularly updated, so consulting the official government website for the most current information is essential. Failure to meet all requirements, even a single one, can disqualify a borrower from forgiveness.

Processes Involved in Applying for and Obtaining Loan Forgiveness

The application process for federal student loan forgiveness programs involves several steps. Borrowers typically need to consolidate their loans into a Direct Consolidation Loan, if they haven’t already. This simplifies the process of tracking payments and eligibility. Next, borrowers must complete and submit an application form, often requiring extensive documentation to verify employment, income, and loan details. Regular monitoring of the application status is vital, as processing times can vary. After the application is approved, borrowers may need to continue making payments for a set period before forgiveness is granted. This process can take several months or even years, depending on the program and individual circumstances. Accurate and timely documentation is paramount to successful application.

Comparison of Federal Student Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, each with its own eligibility requirements and benefits. For example, the PSLF program forgives the remaining balance of federal student loans after 120 qualifying monthly payments under an IDR plan, while the Teacher Loan Forgiveness program offers forgiveness of up to $17,500 in qualifying federal student loans for teachers who have completed five years of full-time service in a low-income school. The income-driven repayment (IDR) plans, such as PAYE, REPAYE, and IBR, offer varying monthly payment amounts based on income and family size, leading to potential loan forgiveness after 20 or 25 years. Each program has distinct requirements and benefits, so careful consideration of individual circumstances is crucial in determining the most suitable option.

Long-Term Financial Implications of Student Loan Forgiveness

While student loan forgiveness offers immediate relief from debt, it has significant long-term financial implications. The forgiven amount is considered taxable income in the year it is forgiven, potentially leading to a significant tax liability. This means borrowers should plan for this potential tax burden. Furthermore, the long-term impact on credit scores is generally minimal, as forgiveness does not typically report negatively to credit bureaus. However, the initial debt reduction can positively impact a borrower’s overall financial health, freeing up resources for other financial goals like saving, investing, or paying off other debts. The long-term benefits depend heavily on how the borrower manages their finances after receiving forgiveness. For example, a borrower might use the freed-up funds to build a strong savings account or to invest in their future.

Student Loan Repayment Scams and Fraud

Navigating the complexities of student loan repayment can be challenging, and unfortunately, this vulnerability is exploited by scammers seeking to profit from borrowers’ anxieties. Understanding common tactics, warning signs, and preventative measures is crucial to protecting yourself from these fraudulent schemes. This section Artikels the key aspects of student loan repayment scams and how to avoid them.

Common Tactics Used in Student Loan Repayment Scams

Scammers employ various deceptive tactics to target student loan borrowers. A common approach involves unsolicited phone calls, emails, or text messages promising immediate loan forgiveness or consolidation at a significantly reduced rate. These communications often pressure borrowers to act quickly, creating a sense of urgency. Another tactic involves impersonating government agencies or legitimate loan servicers. Scammers may create websites or documents that mimic official government websites, making it difficult to discern authenticity. They may also request personal information, such as Social Security numbers, bank account details, or login credentials, under the guise of verifying information or processing a loan modification. Finally, some scams involve upfront fees for services that are either unnecessary or never delivered. These fees can range from a few hundred to thousands of dollars.

Warning Signs of Fraudulent Student Loan Repayment Schemes

Several warning signs can indicate a potential student loan repayment scam. Unsolicited contact is a major red flag; legitimate loan servicers rarely initiate contact unless you have previously contacted them. Requests for upfront payments are another significant warning sign; legitimate loan servicers do not charge fees for loan consolidation or forgiveness. High-pressure tactics, such as demands for immediate action, are also indicative of a scam. Promises that seem too good to be true, such as significant loan forgiveness with minimal effort, should be treated with extreme caution. Finally, poor grammar and spelling in communications, as well as suspicious websites or email addresses, are further indicators of potential fraud.

Preventative Measures to Protect Against Student Loan Repayment Fraud

Protecting yourself from student loan repayment scams requires vigilance and awareness. Always verify the identity of anyone contacting you regarding your student loans. Contact your loan servicer directly using the contact information listed on their official website to confirm any communication you’ve received. Never provide personal information, such as your Social Security number or bank account details, unless you have independently verified the legitimacy of the request. Be wary of unsolicited emails, phone calls, or text messages promising quick solutions to your student loan debt. If a deal seems too good to be true, it probably is. Finally, keep your antivirus software up-to-date and be cautious about clicking on links in unsolicited emails.

Resources for Reporting Student Loan Scams

It is essential to know where to report suspected student loan scams. Prompt reporting can help prevent others from falling victim to these schemes.

- Federal Trade Commission (FTC): The FTC is the primary agency for reporting fraud. You can file a complaint online at ReportFraud.ftc.gov or by phone at 1-877-FTC-HELP (1-877-382-4357).

- Federal Student Aid (FSA): FSA provides resources and information related to student loan repayment. You can find their contact information on StudentAid.gov.

- Your Loan Servicer: Contact your loan servicer directly to report any suspicious activity.

- Your State Attorney General’s Office: State attorneys general offices often handle consumer fraud complaints.

The Impact of Student Loan Debt on Personal Finances

Student loan debt can significantly impact personal finances, extending far beyond the monthly payment. The weight of this debt can influence major life decisions and long-term financial well-being, potentially creating a ripple effect across various aspects of one’s financial life. Understanding these implications is crucial for effective debt management and planning for a secure financial future.

Student loan debt’s long-term effects are multifaceted and can significantly hinder financial progress. High monthly payments can restrict disposable income, limiting opportunities for saving, investing, and building wealth. This constraint can delay or prevent achieving significant financial milestones, such as purchasing a home or securing financial stability for retirement. Furthermore, the burden of debt can lead to increased stress and financial anxiety, impacting overall quality of life.

Long-Term Financial Implications of Student Loan Debt

Carrying a substantial student loan debt burden can have profound long-term consequences. The consistent monthly payments can consume a large portion of one’s income, leaving less available for other crucial financial goals. This can lead to delayed homeownership, as a significant portion of income is allocated to loan repayments, reducing the ability to save for a down payment and cover associated expenses. Similarly, starting a family might be postponed due to financial constraints imposed by loan payments, impacting life plans and potentially delaying parenthood. Retirement savings can also suffer, as funds are diverted to debt repayment, leaving less for long-term financial security. The opportunity cost of these delayed financial goals can be substantial, potentially resulting in a lower overall quality of life in the long run. For example, a person with a $50,000 loan at 6% interest might pay significantly more than the initial loan amount over the repayment period, affecting their ability to save for a down payment on a house or invest in other opportunities.

Impact of Student Loan Debt on Major Life Decisions

Student loan debt significantly influences major life decisions. Buying a house, often a cornerstone of financial stability, becomes more challenging. Lenders consider student loan payments as part of the debt-to-income ratio, potentially impacting loan approval or requiring a larger down payment. Starting a family also presents financial hurdles. The added expenses of childcare, healthcare, and education necessitate a stable financial foundation, which can be jeopardized by substantial loan repayments. These decisions are often interconnected; the inability to buy a home might delay starting a family due to limited space or financial constraints. Consider the example of a young couple, both burdened with student loan debt. Their combined monthly payments might restrict their ability to save for a down payment, forcing them to delay homeownership and potentially impacting their decision to have children.

Impact of Student Loan Debt on Credit Scores

Student loan debt directly impacts credit scores. Consistent on-time payments contribute positively, while missed or late payments negatively affect creditworthiness. The amount of debt relative to available credit (credit utilization ratio) is also a significant factor. A high debt-to-credit ratio can lower credit scores, making it harder to secure loans with favorable interest rates for future purchases like a car or a house. For instance, consistently making on-time payments on student loans can boost credit scores, improving access to credit and potentially securing better interest rates on future loans. Conversely, missed payments can lead to a significant drop in credit scores, impacting the ability to obtain loans or secure favorable terms in the future.

Visual Representation of the Impact of Student Loan Debt

Imagine a graph charting long-term financial well-being (represented on the vertical axis) against different levels of student loan debt (on the horizontal axis). The graph would show a generally downward sloping line, illustrating that as student loan debt increases, long-term financial well-being decreases. For example, a person with no student loan debt would be positioned at the highest point on the graph, indicating high financial well-being. As the level of debt increases, the point on the graph would move downward, reflecting the reduced financial well-being due to increased debt burden and its associated constraints. The slope of the line could be steeper for higher interest rates, illustrating the accelerated negative impact of higher interest payments on long-term financial health. The graph would clearly depict the negative correlation between the level of student loan debt and long-term financial well-being, highlighting the importance of responsible debt management.

Final Review

Successfully managing student loan debt requires proactive planning and a comprehensive understanding of available resources. By carefully considering your repayment options, budgeting effectively, and staying vigilant against scams, you can navigate this crucial financial phase with confidence and achieve long-term financial well-being. Remember, seeking professional financial advice can provide personalized guidance tailored to your specific circumstances.

FAQ Corner

What happens if I miss a student loan payment?

Missing payments can result in late fees, damage to your credit score, and potentially lead to default, which has serious financial consequences.

Can I consolidate different types of student loans?

Yes, loan consolidation combines multiple loans into a single loan, often simplifying repayment but potentially affecting your overall interest rate.

What are income-driven repayment plans?

These plans base your monthly payment on your income and family size, potentially lowering your monthly payment but extending the repayment period.

Where can I find help if I’m struggling to make payments?

Contact your loan servicer immediately to explore options like deferment, forbearance, or income-driven repayment plans. You can also seek guidance from non-profit credit counseling agencies.