The phrase “peanut butter student loans” immediately conjures a curious image: the creamy sweetness of peanut butter juxtaposed against the often bitter reality of crippling student debt. This seemingly incongruous pairing serves as a compelling metaphor for the complex and often overwhelming experience of navigating higher education financing. This exploration delves into the humorous implications of this unusual phrase while simultaneously addressing the serious financial realities facing students worldwide.

We will examine the societal impact of rising student loan debt, explore effective debt management strategies, and consider alternative approaches to higher education that might alleviate the burden. From exploring creative interpretations of the “peanut butter student loans” concept to offering practical advice, this discussion aims to provide both insightful commentary and tangible solutions.

The Allusion and its Implications

The phrase “peanut butter student loans” immediately creates a humorous dissonance. The smooth, comforting image of peanut butter clashes sharply with the stressful, often financially crippling reality of student loan debt. This unexpected juxtaposition is the source of the humor, playing on the incongruity between a typically pleasant, everyday food and a significant source of anxiety and hardship for many.

The unusual pairing can be interpreted in several ways. On a surface level, it’s simply absurd and funny. However, it can also be seen as a commentary on the absurdity of the student loan crisis. The seemingly innocuous image of peanut butter serves to highlight the overwhelming and sometimes absurd weight of debt, suggesting that the problem is so large and pervasive that even something as simple and commonplace as peanut butter can become associated with it. The juxtaposition might also be interpreted as a form of dark humor, acknowledging the grim reality of student loan debt while attempting to cope with it through a slightly ridiculous, yet relatable, image.

Unexpected Juxtapositions in Popular Culture

Many examples of unexpected juxtapositions exist in popular culture, often used for comedic or thought-provoking effect. Consider the juxtaposition of high fashion and everyday items in humorous memes, like images of luxury handbags filled with groceries or expensive shoes worn while doing yard work. These pairings, like “peanut butter student loans,” highlight the contrast between aspiration and reality, creating a humorous tension. Similarly, the use of whimsical imagery in documentaries about serious topics can create a similar effect, softening the harsh reality while still allowing for a thoughtful consideration of the subject. Another example would be the use of upbeat music in a scene depicting a somber event in a movie or television show; the incongruity heightens the emotional impact.

A Short Story Featuring “Peanut Butter Student Loans”

Eliza stared at the jar of peanut butter, its label blurring through her tears. The creamy, brown substance had become a symbol, a grotesque metaphor for the crushing weight of her student loans. Each spoonful was a reminder of the years spent studying, the sacrifices made, and the looming debt that threatened to swallow her whole. She’d joked about “peanut butter student loans” with her friends, a dark humor born of desperation, but the joke felt less funny now. The aroma of the peanut butter, usually comforting, felt suffocating. She squeezed the jar, the smooth glass cool against her feverish skin. Suddenly, a small, almost imperceptible crack appeared. It wasn’t the jar itself that cracked, but something inside Eliza. She felt a surge of defiance, a stubborn refusal to be defined by this debt. She would find a way, she decided, to spread her own brand of peanut butter—a brand made of resilience, hard work, and the unwavering belief in a future free from the shadow of those “peanut butter student loans.”

Financial Literacy and Student Debt

Navigating the complexities of student loan debt requires a strong foundation in financial literacy. Understanding budgeting, repayment options, and long-term financial planning is crucial for graduates to avoid overwhelming debt and build a secure financial future. This section will explore strategies for effective debt management, the importance of financial planning for young adults, and resources available to those struggling with loan repayment.

Effective management of student loan debt involves a proactive and strategic approach. It’s not simply about making minimum payments; it’s about actively working towards debt reduction while maintaining a healthy financial life.

Strategies for Managing Student Loan Debt

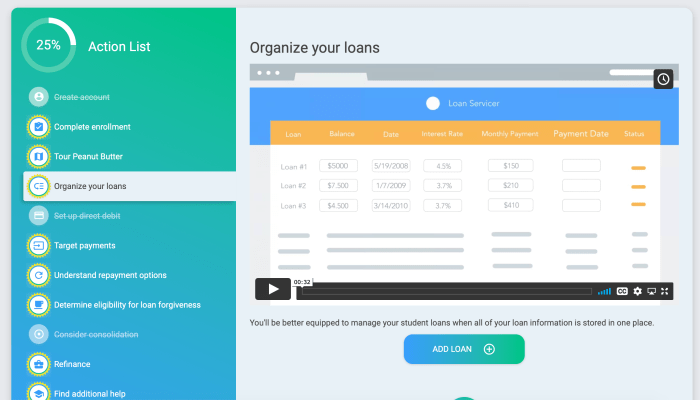

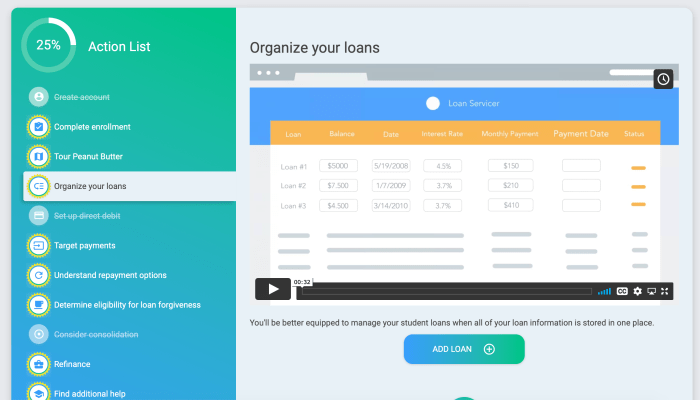

Creating a realistic budget is the first step. This involves tracking income and expenses to identify areas where spending can be reduced. Prioritizing high-interest loans for repayment can significantly reduce the overall interest paid over the life of the loans. Exploring different repayment plans, such as income-driven repayment (IDR) plans, can lower monthly payments, though it may extend the repayment period and increase total interest paid. Consolidation can simplify repayment by combining multiple loans into a single loan with a potentially lower interest rate. Finally, exploring options like refinancing can also lower monthly payments or reduce the overall repayment period, but it’s essential to carefully compare offers and understand the implications before making a decision.

The Importance of Financial Planning for Young Adults

Financial planning isn’t just for older generations; it’s essential for young adults, especially those burdened with student loan debt. A well-defined financial plan helps establish financial goals, such as buying a home or saving for retirement, and creates a roadmap for achieving them. It encourages responsible spending habits and provides a framework for managing debt effectively. Early financial planning fosters good financial habits and minimizes the risk of long-term financial struggles. This includes establishing an emergency fund, saving for retirement through employer-sponsored plans or individual retirement accounts (IRAs), and investing wisely to build wealth over time.

Comparison of Student Loan Repayment Plans

Different repayment plans offer varying levels of flexibility and long-term financial implications. Choosing the right plan depends on individual financial circumstances and goals.

| Repayment Plan | Monthly Payment | Repayment Period | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | Fixed, typically higher | 10 years | Potentially lower |

| Graduated Repayment | Starts low, gradually increases | 10 years | Potentially higher |

| Extended Repayment | Lower monthly payments | Up to 25 years | Potentially much higher |

| Income-Driven Repayment (IDR) | Based on income and family size | 20-25 years | Potentially highest |

Resources for Students Struggling with Loan Repayment

Numerous resources are available to assist students facing challenges with loan repayment. These resources provide guidance, support, and potential solutions to alleviate financial burdens.

- National Student Loan Data System (NSLDS): Provides access to student loan information and repayment options.

- StudentAid.gov: The official U.S. Department of Education website for student financial aid information.

- Your Loan Servicer: Contact your loan servicer for assistance with repayment plans, deferments, and forbearances.

- Nonprofit Credit Counseling Agencies: Offer free or low-cost credit counseling and debt management services.

- Financial Aid Offices at Colleges and Universities: Can provide guidance and resources related to student loans and financial planning.

The Burden of Student Loans

The escalating cost of higher education globally has created a significant societal challenge: the burden of student loan debt. This debt impacts not only individual borrowers but also national economies and social well-being, creating a ripple effect with far-reaching consequences. Understanding the extent and implications of this burden is crucial for developing effective solutions.

The societal impact of rising student loan debt is multifaceted and far-reaching. It can hinder economic growth by reducing consumer spending and delaying major life milestones such as homeownership and starting a family. This postponement of financial stability can have generational consequences, perpetuating cycles of debt and impacting future economic mobility. Furthermore, the burden disproportionately affects low-income and minority students, exacerbating existing inequalities. High levels of student debt can also strain public resources as governments grapple with the need to address loan defaults and the potential for widespread economic instability.

Long-Term Consequences of High Student Loan Balances

High student loan balances can have significant long-term consequences for individuals. These include delayed retirement, reduced savings for retirement, and difficulty in building wealth. Borrowers may struggle to afford essential expenses like healthcare and housing, leading to financial stress and potentially impacting their overall health. The constant pressure of loan repayments can limit career choices, as individuals may prioritize higher-paying jobs over pursuing their passions or pursuing further education. In some cases, high debt levels can lead to bankruptcy or other serious financial difficulties. For example, a recent study showed that individuals with significant student loan debt were more likely to delay marriage and starting a family, and less likely to purchase a home compared to their peers without such debt.

International Comparison of Student Loan Situations

Student loan systems vary significantly across countries. In some countries, such as the United States, tuition fees are high, leading to substantial student loan debt. Other countries, like Germany or Norway, have significantly lower tuition fees or tuition-free higher education, resulting in lower levels of student loan debt. These differences highlight the impact of government policies and funding models on student financial burdens. For instance, Germany’s system, which relies heavily on government funding and lower tuition costs, results in a far lower percentage of students burdened by substantial debt compared to the United States. Conversely, the UK, while offering government loans, has seen a steady rise in tuition fees and thus student debt in recent years.

Effects of Student Loan Debt on Mental Health and Well-being

The stress associated with managing significant student loan debt can have a detrimental effect on mental health and well-being. Many borrowers experience anxiety, depression, and sleep disturbances due to the financial pressure. The constant worry about repayment can lead to feelings of hopelessness and overwhelm, impacting their overall quality of life. Studies have linked high levels of student loan debt to increased rates of mental health issues, including higher instances of depression and anxiety disorders among young adults. This mental health burden can have cascading effects, impacting relationships, productivity, and overall life satisfaction. Support systems and financial literacy programs are crucial to mitigate the negative psychological impacts of student loan debt.

Creative Interpretations

Exploring the concept of “peanut butter student loans” beyond its literal meaning allows for a richer understanding of the complexities and burdens associated with student debt. By employing creative mediums, we can better visualize and communicate the pervasive impact of this financial challenge. The following interpretations aim to illuminate different facets of this issue through metaphorical imagery, poetic expression, humorous storytelling, and the suggestion of potential solutions.

Metaphorical Representation of Student Loan Debt

Imagine a colossal jar of peanut butter, its label reading “Student Loan Debt.” The jar is impossibly large, dwarfing even the tallest skyscrapers. Its contents, instead of smooth, creamy peanut butter, are thick, viscous, and stubbornly clinging to the sides, representing the difficulty of paying down the debt. A tiny figure, representing a student, struggles to even make a dent in the massive jar, their spoon hopelessly small against the overwhelming scale of the problem. The peanut butter itself is speckled with dark, gritty inclusions—representing the stress, anxiety, and lost opportunities associated with crippling debt. The overall image conveys the immense weight and seemingly insurmountable nature of student loan burdens.

Peanut Butter Student Loans: A Poem

A sticky situation, a debt so grand,

Peanut butter student loans across the land.

Spreading thin, a never-ending spread,

A financial burden weighing on the head.

Each spoonful taken, a battle hard-fought,

Against the interest, a costly thought.

The jar seems endless, the taste bittersweet,

A future uncertain, a hard-won feat.

Yet hope remains, a flicker in the night,

To break the cycle, to make things right.

With careful planning and strategies sound,

Escape the sticky trap, on solid ground.

Humorous Skit: The Peanut Butter Loan Interview

Characters: A stressed-out student (Sarah), a ridiculously cheerful loan officer (Bob).

(Scene: A brightly lit, overly cheerful loan office. Bob sits behind a desk piled high with jars of peanut butter.)

Bob: Welcome, Sarah! Ready to taste the sweet success of higher education? (Gestures dramatically to the peanut butter mountain.) We’re offering the best peanut butter student loan on the market! It’s…sticky, but oh so delicious!

Sarah: (nervously) Um, I’m more interested in the repayment terms…

Bob: Terms? Details? My dear, it’s peanut butter! You just…spread it on! Think of all the delicious sandwiches you can make with your future! (He tries to hand her a jar.)

Sarah: But…the interest…

Bob: Interest? That’s just the extra peanut butter flavor! Adds a certain…*je ne sais quoi*!

(Sarah stares blankly. Bob continues to enthusiastically spread peanut butter on everything in sight.)

Potential Solutions to the Student Loan Crisis

Addressing the student loan crisis requires a multifaceted approach involving both immediate relief and long-term structural changes. The following points represent some potential avenues for tackling this significant issue:

* Income-Driven Repayment Plans: Expanding and improving existing income-driven repayment plans to ensure affordability for borrowers based on their actual income.

* Loan Forgiveness Programs: Targeted loan forgiveness programs for specific professions or for borrowers facing significant financial hardship.

* Increased Funding for Pell Grants: Increasing the maximum Pell Grant award and expanding eligibility to make college more affordable for low-income students.

* Tuition Reform: Implementing policies to control the rising cost of tuition and fees, such as limiting tuition increases or providing incentives for colleges to keep costs down.

* Investing in Career and Technical Education: Expanding access to affordable career and technical education programs to provide alternative pathways to employment and reduce reliance on four-year college degrees.

* Debt Consolidation and Refinancing Options: Providing easier access to debt consolidation and refinancing options with lower interest rates.

* Financial Literacy Programs: Implementing comprehensive financial literacy programs for students to help them make informed decisions about borrowing and managing debt.

End of Discussion

The seemingly absurd juxtaposition of “peanut butter student loans” ultimately highlights a critical issue: the pervasive and often overwhelming weight of student debt. While the humor provides a unique lens through which to examine this complex problem, the underlying message remains serious. By understanding the various facets of this challenge—from financial planning to exploring alternative educational paths—individuals can navigate the complexities of higher education financing more effectively and work towards a future free from the crushing burden of debt.

FAQ Insights

What are some common misconceptions about student loan repayment?

Many believe that only high earners struggle with student loan debt, but individuals across income levels can face challenges. Another misconception is that there’s only one repayment plan available; in reality, various options exist to suit different financial situations.

Are there any government programs to help with student loan repayment?

Yes, many countries offer programs like income-driven repayment plans, loan forgiveness programs for specific professions, and deferment options for those experiencing financial hardship. It’s crucial to research the programs available in your specific region.

How can I improve my credit score while managing student loan debt?

On-time payments are key. Consider consolidating loans to simplify payments and explore credit counseling services for personalized guidance on improving your credit health.