Navigating the complexities of higher education often involves the significant consideration of student loans. For Penn State University students, understanding the various loan options, repayment plans, and available resources is crucial for successful financial planning. This guide delves into the intricacies of Penn State student loans, providing a clear and concise overview of the process from application to repayment.

From understanding average debt levels and the factors influencing them to exploring different repayment strategies and accessing crucial financial aid resources, this guide aims to empower Penn State students and alumni with the knowledge necessary to make informed decisions about their financial futures. We’ll examine the impact of student loan debt on post-graduation life and highlight the importance of financial literacy programs offered by the university.

Average Student Loan Debt at Penn State

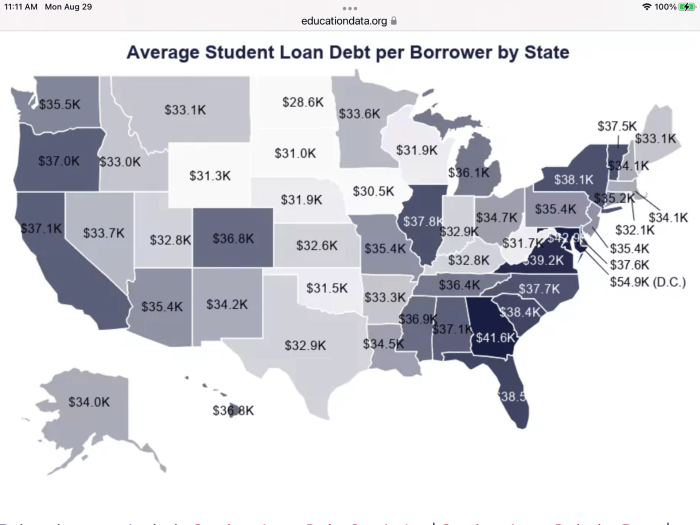

Understanding the financial landscape of higher education is crucial for prospective and current Penn State students. This section provides an overview of average student loan debt at Penn State, considering factors that contribute to variations in borrowing amounts. While precise, publicly available data disaggregated by program and campus is limited, we can examine general trends and averages to paint a clearer picture.

Average Student Loan Debt by Student Type

Determining the exact average student loan debt for undergraduate and graduate students at Penn State requires access to internal university data, which is not publicly released in a comprehensive manner. However, national averages and reports on similar institutions can offer some insight. Generally, graduate students tend to accrue higher levels of debt due to longer program lengths and potentially higher tuition costs. Specific program differences within graduate studies (e.g., MBA versus a Master’s in Arts) would also significantly impact debt accumulation. For undergraduate students, factors such as major, living arrangements (on-campus vs. off-campus), and scholarship receipt play a role in determining overall borrowing needs.

Percentage of Penn State Students Borrowing for Education

A significant portion of Penn State students utilize student loans to finance their education. Precise percentages vary year to year and are not consistently reported publicly. However, based on national trends and reports from similar universities, it’s safe to estimate that a substantial majority—likely exceeding 50%—of Penn State students rely on some form of student loan assistance. This highlights the importance of careful financial planning and exploring various financial aid options.

Factors Influencing Variation in Student Loan Debt

Several factors contribute to the significant variation in student loan debt among Penn State students. These include: the chosen program of study (graduate programs generally costing more than undergraduate programs), the student’s living expenses (on-campus housing tends to be more expensive than off-campus options), the receipt of financial aid (scholarships, grants, and work-study programs can significantly reduce borrowing needs), and the student’s personal spending habits. Students from lower-income families often need to borrow more to cover educational costs, while those from wealthier backgrounds may have fewer borrowing needs. The length of time spent completing a degree also impacts the total debt accumulated.

Average Student Loan Debt Across Penn State Campuses

Gathering precise data on average student loan debt across all Penn State campuses is challenging due to the lack of publicly available, disaggregated data. However, a general estimation can be made based on the understanding that campuses with higher tuition rates and living costs (such as University Park) are likely to see higher average debt levels compared to smaller, regional campuses.

| Campus | Estimated Average Undergraduate Debt | Estimated Average Graduate Debt | Notes |

|---|---|---|---|

| University Park | $30,000 – $40,000 | $50,000 – $70,000 | Higher tuition and living costs |

| Other Commonwealth Campuses | $20,000 – $30,000 | $30,000 – $50,000 | Lower tuition and living costs generally |

| World Campus | Variable | Variable | Highly dependent on program and individual circumstances |

Repayment Options for Penn State Student Loans

Graduating from Penn State is a significant achievement, but it often comes with the responsibility of managing student loan debt. Understanding your repayment options is crucial for navigating this next chapter successfully. Choosing the right plan depends on your individual financial circumstances and long-term goals. Several repayment plans are available, each with its own advantages and disadvantages.

Standard Repayment Plan

The standard repayment plan is the most straightforward option. It involves fixed monthly payments over a 10-year period. This plan offers the quickest path to loan repayment, minimizing the total interest paid. However, the monthly payments can be substantial, potentially straining your budget, especially in the early years after graduation when income may be lower. This plan is suitable for graduates with stable, higher incomes who prioritize rapid debt elimination.

Extended Repayment Plan

For those who find the standard plan’s monthly payments too high, the extended repayment plan provides longer repayment terms, typically up to 25 years. This lowers monthly payments, making them more manageable. The trade-off is that you’ll pay significantly more interest over the life of the loan. This option is beneficial for graduates with lower incomes or those facing unexpected financial challenges.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans tie your monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments than standard plans, making them particularly attractive to graduates entering lower-paying professions or experiencing financial hardship. However, IDR plans generally extend the repayment period, leading to higher total interest payments over time. Eligibility requirements vary by plan.

Applying for Repayment Plans

The process of applying for different repayment plans typically involves logging into the National Student Loan Data System (NSLDS) website or contacting your loan servicer directly. You will need your Federal Student Aid ID and loan information. The application process usually requires providing details about your income and family size. Once your application is processed, your loan servicer will inform you of your assigned repayment plan and monthly payment amount.

Loan Forgiveness Programs

Certain professions, such as teaching and public service, may qualify for loan forgiveness programs. These programs can partially or fully forgive your federal student loans after a specified period of qualifying employment. For example, the Public Service Loan Forgiveness (PSLF) program may forgive the remaining balance of your federal direct loans after 120 qualifying monthly payments. Eligibility criteria and application procedures for loan forgiveness programs vary, so it’s crucial to thoroughly research the specific programs and confirm your eligibility. The requirements are often stringent, so careful planning and adherence to the program’s rules are essential for success.

Resources Available to Penn State Students for Loan Management

Navigating student loan debt can be challenging, but Penn State offers a robust network of support services designed to help students understand, manage, and ultimately repay their loans. These resources provide crucial guidance throughout the entire loan lifecycle, from initial borrowing decisions to long-term repayment strategies. Effective utilization of these services can significantly reduce stress and improve financial outcomes after graduation.

Penn State’s commitment to student financial well-being extends beyond simply providing financial aid. The university actively works to equip students with the knowledge and tools necessary to make informed decisions about borrowing and repayment, fostering responsible financial habits that benefit them long after they leave campus.

Financial Aid and Student Loan Counseling Services at Penn State

The University’s financial aid office plays a central role in providing comprehensive counseling services to students. These services are designed to assist students in understanding their financial aid packages, including loans, grants, and scholarships. Counselors provide personalized guidance on loan selection, exploring different repayment options, and budgeting strategies to manage debt effectively. They also offer workshops and presentations on various aspects of financial literacy, including credit scores, budgeting, and long-term financial planning. These resources aim to empower students to make sound financial choices, ensuring they graduate with a clear understanding of their financial obligations and the tools to navigate them successfully.

Accessing and Utilizing Penn State’s Financial Aid Resources

Accessing these resources is straightforward. Students can begin by visiting the Penn State Financial Aid website. This website provides a wealth of information, including FAQs, downloadable resources, and contact information for financial aid counselors. Students can schedule individual appointments with counselors to discuss their specific financial situation and receive personalized advice. The website also features a calendar of upcoming workshops and presentations, covering topics such as budgeting, loan repayment, and credit management. Additionally, many resources are available online, such as webinars and interactive tools designed to simplify the process of understanding and managing student loans. Finally, the university’s financial aid office typically has walk-in hours where students can receive immediate assistance with simple questions.

Role of the Penn State Financial Aid Office in Loan Repayment

The Penn State financial aid office continues to support students even after graduation. They provide guidance on various repayment plans, including income-driven repayment options and consolidation programs. Counselors can help students understand their repayment options and choose the plan that best suits their individual circumstances. They also offer assistance with navigating potential difficulties, such as forbearance or deferment, and can connect students with external resources if needed. The office’s ongoing support underscores Penn State’s commitment to helping students successfully manage their student loan debt and achieve their financial goals.

Helpful Websites and Resources for Managing Student Loan Debt

Understanding and managing student loan debt requires access to reliable information. The following websites and resources provide valuable tools and guidance:

- National Student Loan Data System (NSLDS): Provides a central location to view your federal student loan information.

- Federal Student Aid (FSA): The official website for the U.S. Department of Education’s federal student aid programs. Offers information on repayment plans, loan forgiveness programs, and other important resources.

- StudentAid.gov: A comprehensive resource for managing federal student loans.

- Penn State Financial Aid Website: Provides specific information and resources relevant to Penn State students.

- Consumer Financial Protection Bureau (CFPB): Offers consumer resources and information on managing debt.

Impact of Student Loans on Penn State Graduates

The weight of student loan debt significantly impacts the lives of Penn State graduates, influencing their career paths, financial stability, and long-term life plans. The amount of debt accumulated during their education can create both immediate and long-term financial challenges, shaping decisions in ways that might not be apparent to those without such burdens.

Career Choices and Post-Graduation Plans

The pressure of repaying student loans often influences career choices for Penn State alumni. Graduates may prioritize higher-paying jobs, even if those jobs aren’t their ideal career path, to accelerate debt repayment. This can lead to career dissatisfaction and potentially limit exploration of other, potentially more fulfilling, career options. For instance, a graduate with substantial debt might choose a high-paying but less fulfilling corporate job over a lower-paying position in a non-profit organization they are passionate about. This financial constraint can also impact post-graduation plans, such as delaying further education (like a Master’s degree) or choosing to live at home longer to save money.

Long-Term Financial Implications of High Student Loan Debt

High student loan debt can have significant long-term financial implications, potentially impacting retirement savings, homeownership, and overall financial security. The monthly payments can consume a substantial portion of a graduate’s income, leaving less available for saving and investing. This can lead to a delayed start in saving for retirement, potentially resulting in a smaller nest egg in later life. Furthermore, high debt levels can negatively impact credit scores, making it more difficult to secure loans for major purchases like a home or a car, further hindering financial progress.

Student Loan Debt and Major Life Purchases

The correlation between student loan debt and a graduate’s ability to purchase a home or start a family is undeniable. The significant monthly payments associated with student loans can reduce disposable income, making it challenging to save for a down payment on a house or manage the expenses of raising a family. For example, a graduate burdened with significant debt might delay homeownership indefinitely, opting to rent for longer periods, or might postpone having children until their financial situation improves. The financial strain can also impact the quality of life, potentially limiting the ability to save for other important life events or emergencies.

Financial Comparison: Graduates with and without Significant Student Loan Debt

A visual representation comparing the two groups could be a simple bar graph. The horizontal axis would represent key financial metrics, such as average monthly disposable income, average savings rate, percentage of graduates owning a home within five years of graduation, and average age of first home purchase. The vertical axis would show the values for each metric. The graph would feature two bars for each metric: one representing Penn State graduates with significant student loan debt (defined as exceeding $50,000, for example) and another representing graduates with minimal or no student loan debt. This visual would clearly demonstrate the disparity in financial outcomes between the two groups, highlighting the negative impact of high student loan debt on key life milestones.

Financial Literacy Programs at Penn State

Penn State University recognizes the importance of equipping students with strong financial management skills, crucial for navigating the complexities of student loan repayment and overall financial well-being. To that end, the university offers a range of financial literacy programs and workshops designed to empower students to make informed decisions about their finances. These programs provide valuable tools and resources, fostering a responsible approach to borrowing and managing debt.

These programs help students make informed decisions about borrowing and managing their student loans by providing practical knowledge and skills in budgeting, saving, investing, and debt management. Participants learn to create realistic budgets, understand the terms and conditions of their loans, explore various repayment options, and develop strategies for long-term financial success. The emphasis is on proactive planning and responsible financial behavior, empowering students to avoid financial pitfalls and build a secure financial future.

Financial Literacy Workshops Offered

Penn State offers a variety of workshops throughout the academic year, covering topics such as budgeting, credit management, and understanding student loans. These workshops often feature interactive sessions, guest speakers from financial institutions, and opportunities for one-on-one consultations with financial advisors. The workshops are typically advertised through campus email announcements, student organization newsletters, and the university’s financial aid website. Many sessions are free and open to all Penn State students. Workshop topics are tailored to student needs, reflecting current trends in personal finance and addressing common student financial concerns. Past workshop examples have included sessions on “Building a Budget That Works for You,” “Understanding Your Credit Score,” and “Navigating Student Loan Repayment Options.”

Online Financial Literacy Resources

In addition to workshops, Penn State provides access to numerous online resources designed to enhance students’ financial literacy. The university’s financial aid website typically hosts a dedicated section with articles, videos, and interactive tools covering various financial topics. These online resources offer a flexible and convenient way for students to learn at their own pace, accessing information whenever and wherever it suits them. Examples include online budgeting calculators, interactive quizzes to test financial knowledge, and articles on topics such as saving for retirement and investing. The online platform often includes frequently asked questions and answers, providing quick and easy access to commonly sought information.

Successful Financial Literacy Initiatives

One successful initiative has been the implementation of peer-to-peer financial education programs. Trained student leaders conduct workshops and presentations, sharing their personal experiences and insights with their peers. This approach creates a relatable and engaging learning environment, fostering a sense of community and mutual support among students. Another successful program has been the integration of financial literacy modules into existing student orientation programs. This approach ensures that students receive crucial financial information early in their college careers, equipping them with the knowledge and skills they need from the start. The university also collaborates with local financial institutions to offer workshops and resources specifically tailored to the needs of Penn State students. These partnerships provide access to expertise and resources beyond what the university might offer independently.

Accessing Financial Literacy Programs

Students can access Penn State’s financial literacy programs through several avenues. The university’s financial aid website typically serves as a central hub for information on upcoming workshops, online resources, and contact information for financial advisors. Students can also check their university email for announcements and updates on financial literacy events. Many student organizations also promote financial literacy workshops and resources, offering additional avenues for engagement. Finally, the university’s career services department may offer financial literacy workshops as part of their broader career development programming, providing valuable context for long-term financial planning.

Closing Notes

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. Penn State University provides a comprehensive support system for its students, encompassing financial aid counseling, repayment plan options, and financial literacy programs. By leveraging these resources and employing informed decision-making strategies, Penn State graduates can confidently navigate the challenges of student loan repayment and build a secure financial future. This guide serves as a starting point for a journey towards financial well-being.

Essential FAQs

What is the interest rate on Penn State student loans?

Interest rates vary depending on the loan type (federal or private), the lender, and the loan’s disbursement date. Check your loan documents for the specific rate.

Can I consolidate my Penn State student loans?

Yes, you can consolidate federal student loans through the Federal Direct Consolidation Loan program. This combines multiple loans into a single loan with a new interest rate.

What happens if I default on my Penn State student loans?

Defaulting on your loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. Contact your lender immediately if you’re facing difficulties.

Are there scholarships available to help reduce loan debt at Penn State?

Yes, Penn State offers various scholarships based on merit, need, and specific criteria. Check the Penn State financial aid website for details and application deadlines.