Navigating the complexities of postgraduate education often involves the significant financial commitment of a student loan. This guide provides a clear and concise overview of PG student loans, addressing key aspects from eligibility criteria and application processes to repayment strategies and alternative funding options. Understanding these factors is crucial for prospective postgraduate students to make informed decisions and manage their finances effectively throughout their studies and beyond.

We will explore the various types of loans available, comparing interest rates, repayment terms, and the potential long-term financial implications. We’ll also delve into effective debt management strategies and discuss alternative funding sources to help you secure the financial resources needed to pursue your postgraduate education.

Understanding PG Student Loan Eligibility

Securing funding for postgraduate studies often involves navigating the complexities of student loan eligibility. Understanding the specific requirements is crucial for a smooth application process and avoiding potential delays. This section Artikels the key eligibility criteria, income limitations, and variations across different lending institutions.

General Eligibility Criteria for Postgraduate Student Loans

Generally, eligibility for postgraduate student loans hinges on factors such as enrollment status, the type of program pursued, and citizenship or residency status. Applicants typically need to be enrolled full-time in a postgraduate program at an accredited institution. Proof of acceptance into the program is usually required, along with documentation confirming citizenship or residency status, which may vary depending on the lender and the country of study. Furthermore, some lenders may specify minimum GPA requirements or require a co-signer if the applicant lacks a strong credit history.

Income Requirements and Limitations

Income requirements and limitations for postgraduate student loan applicants vary significantly depending on the lender. Some lenders may assess the applicant’s income and credit history to determine their ability to repay the loan. Others may focus primarily on the applicant’s enrollment status and the cost of the postgraduate program. High-income earners may find their loan applications limited or denied due to the perception that they can afford the program’s costs without borrowing. Conversely, those with low incomes may struggle to meet the minimum income thresholds or find it difficult to secure a loan without a co-signer. The specific income limitations are rarely fixed numbers and are often assessed on a case-by-case basis, taking into account factors such as debt-to-income ratio and credit score.

Comparison of Eligibility Requirements Across Different Lending Institutions

Eligibility requirements can differ substantially between various lending institutions. For instance, one lender might prioritize the applicant’s credit score, while another may focus on the reputation of the educational institution. Some lenders may offer loans specifically for certain postgraduate programs, such as medical or law degrees, while others may have a broader range of eligible programs. It’s essential to compare offers from multiple lenders to find the most suitable option based on individual circumstances and financial profiles. Interest rates, repayment terms, and additional fees should also be carefully considered when comparing offers.

Eligibility Factors for Various Postgraduate Programs

| Program Type | Institution Type | Minimum GPA (Example) | Income Considerations (Example) |

|---|---|---|---|

| Master of Business Administration (MBA) | Private University | 3.0 | Debt-to-income ratio assessment |

| Master of Science in Engineering | Public University | 3.2 | Income verification, but less stringent than for MBA programs |

| Doctor of Medicine (MD) | Medical School | 3.5 | Often requires co-signer due to high program cost and length |

| Master of Arts in Liberal Studies | Small Private College | 2.8 | May be less stringent, potentially focusing more on program cost |

Loan Application Process

Applying for a postgraduate student loan can seem daunting, but breaking down the process into manageable steps makes it significantly easier. This section details the application procedure, required documentation, and key stages involved in securing your funding. We will also provide a visual representation of the process to aid understanding.

The application process generally involves several key stages, each requiring careful attention to detail to ensure a smooth and successful outcome. Failure to provide complete and accurate information can lead to delays or rejection of your application.

Required Documentation

Supporting documentation is crucial for a successful loan application. Lenders require evidence to verify your identity, academic standing, and financial need. Commonly requested documents include: proof of identity (passport, driver’s license), proof of address (utility bill, bank statement), acceptance letter from your chosen postgraduate program, transcripts of previous academic records, and details of any existing financial aid or scholarships. In some cases, you may also need to provide evidence of your income or assets, particularly if you are applying for a larger loan amount or have co-signers. The specific requirements will vary depending on the lender.

Key Stages of the Application Process

A typical postgraduate student loan application involves the following key stages:

- Pre-application Research: This involves researching different lenders, comparing interest rates and repayment terms, and understanding the eligibility criteria for each loan program.

- Online Application Completion: This stage involves completing the lender’s online application form, providing accurate personal and financial information.

- Document Upload: Uploading all the necessary supporting documents as specified by the lender. This is a critical step, as incomplete submissions can delay the process.

- Application Review: The lender reviews your application and supporting documents to assess your eligibility and creditworthiness.

- Approval/Rejection Notification: You will receive notification from the lender regarding the approval or rejection of your application. If approved, you will receive details about the loan terms and disbursement process.

- Loan Disbursement: Once approved, the loan amount will be disbursed according to the agreed-upon schedule, usually directly to the educational institution.

Loan Application Flowchart

Imagine a flowchart where the process begins with “Start”. The next box would be “Pre-application Research,” leading to “Online Application Completion.” This then branches to “Document Upload,” followed by “Application Review.” The review stage branches into two paths: “Approved” leading to “Loan Disbursement” and “Rejected” leading to “Review Application Requirements”. The “Review Application Requirements” box then loops back to “Document Upload” allowing for corrections and resubmission. Finally, the process ends with “End.” Each box represents a stage, with arrows showing the flow of the process. This visual representation clearly illustrates the sequential nature of the loan application journey and potential branching points.

Types of PG Student Loans

Choosing the right postgraduate student loan can significantly impact your financial journey. Understanding the various options available, their features, and associated benefits and drawbacks is crucial for making an informed decision. This section will Artikel several common types of postgraduate student loans, allowing you to compare and contrast their key characteristics.

Government-Backed Postgraduate Loans

Government-backed postgraduate loans are typically offered by national or regional governments to support students pursuing postgraduate studies. These loans often come with favorable interest rates, flexible repayment terms, and may offer deferment options during periods of unemployment or financial hardship. However, eligibility criteria can be stringent, and the loan amount may be capped. The application process often involves completing a detailed financial assessment. For example, in some countries, these loans might cover tuition fees and living expenses, while others may only cover tuition. Repayment schedules are typically linked to income, meaning higher earners repay more, while lower earners may have smaller monthly payments or extended repayment periods.

Private Postgraduate Loans

Private postgraduate loans are offered by banks, credit unions, and other financial institutions. These loans often have more flexible eligibility criteria than government-backed loans, making them accessible to a wider range of students. However, they typically come with higher interest rates and less favorable repayment terms compared to government-backed options. Borrowers should carefully compare interest rates, fees, and repayment schedules from different lenders before selecting a private loan. A significant advantage is that private lenders might offer larger loan amounts than government schemes, covering unforeseen expenses. Conversely, a disadvantage is the potential for higher overall repayment costs due to interest accumulation.

Institution-Specific Postgraduate Loans

Some universities and colleges offer their own postgraduate student loan programs. These loans might be specifically designed for students enrolled in particular programs or departments within the institution. The terms and conditions of these loans can vary significantly, so it’s crucial to review the specific details offered by your chosen institution. Benefits could include streamlined application processes and potential integration with existing financial aid packages. However, these loans may have limited availability, depending on the institution’s resources and funding.

International Postgraduate Loans

For international students pursuing postgraduate studies abroad, specialized international loan programs are available. These loans are often designed to cater to the specific financial needs of international students and might have different eligibility criteria and repayment terms compared to domestic loan options. These loans may be offered by international organizations, private lenders specializing in international student financing, or in conjunction with home country government initiatives. The advantages lie in providing access to funding for international students, while disadvantages might include higher interest rates or more complex application processes due to cross-border regulations.

Table Summarizing Key Features of Postgraduate Student Loan Options

| Loan Type | Interest Rate | Repayment Terms | Advantages | Disadvantages |

|---|---|---|---|---|

| Government-Backed | Generally lower | Flexible, income-driven | Favorable rates, deferment options | Stringent eligibility, loan amount limits |

| Private | Generally higher | Variable, lender-specific | Flexible eligibility, potentially higher loan amounts | Higher interest rates, less favorable terms |

| Institution-Specific | Variable | Institution-specific | Streamlined application, potential integration with aid | Limited availability |

| International | Variable, often higher | Variable, complex | Access to funding for international students | Higher rates, complex application process |

Repayment Options and Strategies

Successfully navigating postgraduate studies often involves securing a student loan. Understanding the repayment options and developing effective strategies is crucial for managing your debt responsibly and avoiding potential financial hardship. This section details various repayment plans and provides practical advice for responsible debt management.

Postgraduate student loan repayment plans vary depending on the lender and the specific loan terms. Generally, repayment begins after a grace period, typically six months to a year after completing your studies or leaving your course. The length of the repayment period, the interest rate, and the monthly payment amount will significantly impact your overall repayment cost.

Repayment Plan Options

Several repayment plans are commonly available. These include standard repayment plans, graduated repayment plans, and income-driven repayment plans. Standard plans involve fixed monthly payments over a set period, typically 10-20 years. Graduated plans begin with lower monthly payments that gradually increase over time. Income-driven plans adjust your monthly payments based on your income and family size, potentially extending the repayment period but lowering monthly expenses. The specific terms and conditions of each plan should be carefully reviewed before selection.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt requires a proactive and organized approach. Creating a realistic budget is the first step, ensuring loan payments are prioritized alongside other essential expenses. Exploring options for loan consolidation or refinancing could potentially lower interest rates and simplify repayments. Careful financial planning and consistent budgeting are crucial to stay on track with payments and avoid default. Furthermore, actively monitoring your loan balance and interest accrual allows for informed decision-making regarding repayment strategies.

Repayment Schedule Examples

Let’s consider three scenarios illustrating different repayment schedules:

Scenario 1: Standard Repayment Plan – A postgraduate student borrows $50,000 at a 6% interest rate with a 10-year repayment period. Their monthly payment would be approximately $550, resulting in a total repayment of approximately $66,000.

Scenario 2: Graduated Repayment Plan – The same $50,000 loan, but with a graduated plan, might start with monthly payments of $300, gradually increasing to $700 over the 10-year period. The total repayment amount would still be similar, around $66,000, but the lower initial payments could be beneficial during the early stages of post-graduation employment.

Scenario 3: Income-Driven Repayment Plan – If the student’s income is low in the initial years post-graduation, an income-driven plan might result in significantly lower monthly payments, perhaps $200-$300, but extending the repayment period to 20 or even 25 years. The total repayment amount could potentially be higher due to the longer repayment period and accrued interest.

Consequences of Student Loan Default

Defaulting on a student loan has serious consequences. It can severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Wage garnishment, tax refund offset, and even legal action are potential outcomes of loan default. Furthermore, it can impact your ability to secure future employment, particularly in professions requiring security clearances or professional licenses. Maintaining consistent communication with your lender and actively exploring repayment options is crucial to prevent default.

Impact of PG Student Loans on Future Finances

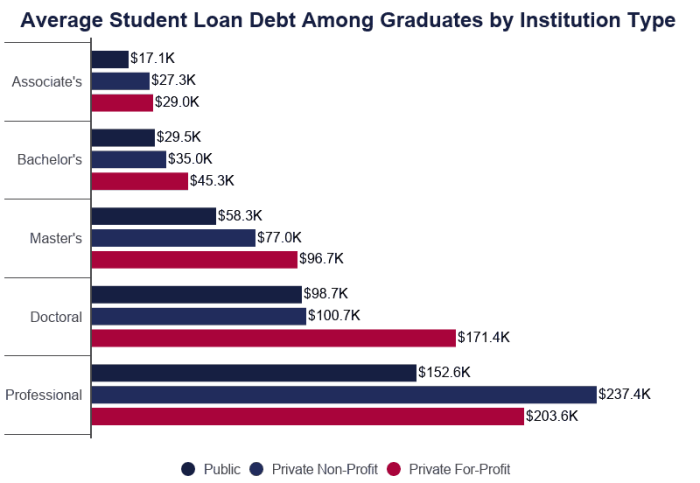

Postgraduate student loans can significantly influence your financial trajectory for years after graduation. Understanding the long-term implications is crucial for responsible borrowing and effective financial planning. While a postgraduate degree can boost earning potential, the associated debt requires careful management to avoid hindering your future goals.

Postgraduate loans, unlike undergraduate loans, often involve larger sums borrowed at potentially higher interest rates, leading to a more substantial debt burden. This increased debt can affect various aspects of your financial life, from everyday budgeting to major life decisions like purchasing a home. Careful consideration of repayment options and proactive financial planning are essential to navigate this challenge successfully.

Budgeting and Financial Planning After Graduation

Successfully managing postgraduate loan repayments requires a well-defined budget and a proactive approach to financial planning. Immediately after graduation, create a realistic budget that accounts for loan repayments, living expenses, and any other financial obligations. Prioritize essential expenses and identify areas where you can reduce spending. Consider tracking your income and expenses using budgeting apps or spreadsheets to maintain transparency and control over your finances. Furthermore, exploring options for additional income streams, such as part-time employment or freelance work, can help alleviate the financial strain of loan repayments. Regularly reviewing and adjusting your budget as your circumstances change is also crucial for long-term financial stability.

Impact of Student Loan Debt on Homeownership

Student loan debt can significantly impact your ability to purchase a home. Lenders assess your debt-to-income ratio (DTI) when evaluating mortgage applications. A high DTI, primarily influenced by student loan repayments, can reduce your borrowing capacity and make it more challenging to secure a mortgage. Moreover, higher interest rates on student loans can limit your ability to save for a down payment, further delaying homeownership. Proactive strategies such as aggressively paying down student loans before applying for a mortgage or exploring government-backed loan programs can help mitigate these challenges. It’s crucial to carefully weigh the financial implications of homeownership against your student loan burden to make an informed decision.

Hypothetical Example of Long-Term Loan Cost

Let’s consider a hypothetical example. Suppose a student borrows £50,000 for a postgraduate program at a 6% annual interest rate, with a 10-year repayment period. Using a standard loan amortization calculator (easily found online), the monthly repayment would be approximately £600. Over the 10-year repayment period, the total amount repaid would exceed £72,000, reflecting the significant impact of accumulated interest. This example highlights the importance of understanding the total cost of borrowing and planning accordingly. This hypothetical scenario underscores the long-term financial implications of postgraduate loans, emphasizing the need for careful budgeting and financial planning to manage the debt effectively. A similar calculation with a longer repayment period would show a lower monthly payment but a significantly higher total repayment amount.

Alternative Funding Options for Postgraduate Studies

Securing funding for postgraduate studies can be a significant hurdle, but thankfully, student loans aren’t the only avenue. A range of alternative funding options exist, each with its own set of advantages and disadvantages. Careful consideration of these options can significantly reduce the financial burden of advanced education and potentially eliminate the need for substantial borrowing.

Exploring these alternatives is crucial for prospective postgraduate students. Understanding the nuances of each option allows for a more informed decision, ultimately leading to a more manageable financial future. This section will Artikel several key alternatives, highlighting their key features and potential benefits.

Scholarships and Grants

Scholarships and grants represent a significant source of non-repayable funding for postgraduate studies. These awards are typically merit-based, need-based, or a combination of both, and are offered by a variety of organizations, including universities, government agencies, and private foundations. Unlike loans, scholarships and grants do not need to be repaid, making them highly attractive funding options. However, competition for these awards can be fierce, and the application process can be time-consuming and demanding.

Types of Scholarships and Grants and Example Providers

A wide array of scholarships and grants cater to specific fields of study, demographics, or research interests. For instance, the Fulbright program offers prestigious scholarships for graduate study in the United States and abroad, while the Gates Cambridge Scholarship supports outstanding students from around the world to pursue postgraduate studies at the University of Cambridge. Many universities also offer internal scholarships to their own students, often based on academic merit or demonstrated financial need. Government agencies, such as the National Science Foundation (NSF) in the United States, provide grants for research-based postgraduate programs in various scientific disciplines. Private foundations, such as the Rhodes Trust, offer highly competitive scholarships for exceptional students.

- University Scholarships: Offered by universities themselves, often based on academic merit or demonstrated financial need. These are typically competitive and require a strong application.

- Government Grants and Scholarships: Funded by national or regional governments, these often target specific fields of study or demographic groups. Examples include the NSF Graduate Research Fellowship Program (USA) and various UK government-funded postgraduate loans and scholarships.

- Private Foundation Scholarships: Offered by charitable organizations and foundations, these scholarships may be based on merit, need, or specific criteria set by the foundation. The Gates Cambridge Scholarship is a prime example.

- Employer-Sponsored Scholarships: Some employers offer tuition assistance or scholarships to employees pursuing further education, often to enhance their skills relevant to the workplace.

Advantages and Disadvantages of Alternative Funding Options

While scholarships and grants offer the significant advantage of not requiring repayment, securing them can be challenging. The application process is often rigorous, requiring substantial time and effort. Furthermore, the availability of scholarships and grants varies considerably depending on the field of study, the applicant’s background, and the funding cycle. Loans, on the other hand, provide more predictable funding, but come with the obligation of repayment, along with interest charges. The choice between these options requires a careful assessment of individual circumstances and financial projections.

| Funding Option | Advantages | Disadvantages |

|---|---|---|

| Scholarships/Grants | No repayment required, can significantly reduce overall cost | Highly competitive, requires extensive application process, availability varies |

| Student Loans | Predictable funding, readily available | Requires repayment with interest, can lead to significant debt |

| Part-time Employment | Reduces reliance on loans, provides practical experience | Can impact study time and academic performance |

Part-Time Employment and Family Support

Working part-time during postgraduate studies can provide a supplementary income stream, reducing reliance on loans. However, balancing work and studies can be demanding and may affect academic performance. Similarly, family support can be a significant source of funding, although this is not always a reliable or consistent option for all students. These options, while not always readily quantifiable like scholarships or loans, can contribute significantly to a student’s overall financial plan.

Understanding Interest Rates and Fees

Securing a postgraduate student loan involves understanding the associated costs, primarily interest rates and fees. These can significantly impact the total repayment amount, so careful consideration is crucial before borrowing. This section details how these costs are calculated and provides examples to illustrate their influence on your overall financial burden.

Interest Rate Calculation

Postgraduate student loan interest rates are typically variable, meaning they fluctuate based on market conditions. The calculation of interest depends on the loan’s principal amount, the interest rate, and the repayment period. Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus accumulated interest. Most student loans use compound interest, meaning the interest charges accrue over time, increasing the overall cost. For example, a £10,000 loan with a 5% annual interest rate compounded annually will accrue £500 in interest in the first year. In the second year, the interest will be calculated on £10,500 (principal + year 1 interest), resulting in a higher interest payment. The specific calculation method will be Artikeld in your loan agreement.

Examples of Interest Rate Structures and Their Impact

Different lenders offer various interest rate structures. Fixed-rate loans offer a consistent interest rate throughout the loan term, providing predictability in repayments. Variable-rate loans, however, adjust periodically based on market benchmarks, leading to fluctuating monthly payments. For instance, a fixed-rate loan at 6% will have consistent monthly payments, whereas a variable-rate loan starting at 5% might increase to 7% after a year, resulting in higher monthly payments in subsequent years. The total loan cost for a variable-rate loan can be higher or lower than a fixed-rate loan depending on market fluctuations. Borrowers should carefully consider their risk tolerance and financial planning when choosing between these structures.

Loan Fees

Several fees are associated with postgraduate student loans. These can include application fees, origination fees (charged by the lender for processing the loan), late payment fees, and potential early repayment fees (though these are less common). Application fees are usually a one-time charge for submitting the loan application. Origination fees are a percentage of the loan amount and are added to the principal balance. Late payment fees are penalties for missed or delayed payments, and they vary depending on the lender. Understanding these fees is essential for accurate budgeting and avoiding unexpected charges.

Comparison of Interest Rates and Fees

The following table compares the interest rates and fees charged by three hypothetical lenders. Remember that actual rates and fees can vary significantly depending on individual circumstances and lender policies. Always check the terms and conditions before committing to a loan.

| Lender | Interest Rate (Variable/Fixed) | Application Fee | Origination Fee |

|---|---|---|---|

| Lender A | 6% (Fixed) | £50 | 1% |

| Lender B | 5-7% (Variable) | £0 | 0.5% |

| Lender C | 6.5% (Fixed) | £75 | 0% |

Managing Student Loan Debt

Successfully navigating postgraduate studies often involves managing significant student loan debt. This section Artikels effective strategies for repayment, emphasizing the importance of financial literacy and proactive budgeting. Understanding these principles is crucial for minimizing financial stress and ensuring a smooth transition into your professional life.

Effective Strategies for Managing Student Loan Debt

Managing student loan debt requires a multifaceted approach. Prioritizing repayment, exploring repayment plans, and maintaining good financial habits are all key components of a successful strategy. A proactive approach to managing debt minimizes long-term financial burdens and fosters a sense of control over your finances.

Budgeting Techniques for Loan Repayment

Creating a realistic budget is paramount to successful loan repayment. This involves carefully tracking income and expenses to identify areas where savings can be maximized. A well-structured budget allows you to allocate sufficient funds towards loan repayments while maintaining a comfortable standard of living. Consider using budgeting apps or spreadsheets to simplify the process. For example, a student earning $3,000 per month might allocate $500 towards loan repayment, $1000 for rent, $500 for groceries, and $1000 for other expenses, leaving a small amount for savings. This specific allocation can be adjusted based on individual needs and circumstances.

The Importance of Financial Literacy in Managing Student Loan Debt

Financial literacy is the foundation of effective debt management. Understanding concepts like interest rates, repayment schedules, and credit scores empowers you to make informed decisions about your finances. Without this knowledge, you may struggle to make optimal repayment choices, potentially leading to increased debt burdens. Seek resources like online courses, workshops, or financial advisors to enhance your understanding of personal finance. A strong understanding of these concepts allows for better negotiation with lenders and proactive planning for financial stability. For instance, understanding compound interest allows for better strategic repayment planning, potentially saving thousands of dollars over the life of the loan.

Sample Budget Demonstrating Effective Debt Management

| Income | Amount |

|---|---|

| Monthly Salary | $3,500 |

| Expenses | Amount |

| Rent | $1,200 |

| Groceries | $400 |

| Utilities | $200 |

| Transportation | $300 |

| Student Loan Payment | $600 |

| Savings | $200 |

| Other Expenses | $600 |

| Total Expenses | $3,500 |

This sample budget shows a balanced approach to managing expenses while prioritizing loan repayment and saving. Remember that this is a template, and your specific budget will need to reflect your individual income and expenses. The key is to consistently track your spending and adjust your budget as needed. Regularly reviewing and adjusting this budget will ensure you remain on track with your repayment goals. Consider using budgeting apps to automate tracking and provide visual representations of your spending habits.

Conclusion

Securing funding for postgraduate studies is a critical step in achieving academic goals. This guide has explored the intricacies of PG student loans, offering a comprehensive understanding of eligibility, application procedures, repayment options, and alternative funding avenues. By carefully considering the information presented and proactively planning your financial strategy, you can confidently navigate the financial aspects of postgraduate education and focus on your academic pursuits.

Detailed FAQs

What happens if I can’t repay my PG student loan?

Failure to repay your loan can lead to damaging consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you anticipate difficulties in repayment to explore options such as deferment or forbearance.

Can I consolidate multiple PG student loans?

Yes, consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payments. However, carefully compare interest rates and fees before consolidating to ensure it’s financially beneficial.

Are there tax benefits associated with PG student loan interest?

Tax laws vary by country. Some countries may offer tax deductions or credits for student loan interest payments; check with your local tax authority for specific details.

What is the difference between a subsidized and unsubsidized PG student loan?

Subsidized loans typically don’t accrue interest while you’re in school, whereas unsubsidized loans do. This means you’ll owe more on an unsubsidized loan after graduation.