The student loan interest deduction, a long-standing provision in the US tax code, is facing increasing scrutiny. Its potential phase-out has sparked considerable debate, raising questions about its effectiveness, economic consequences, and the impact on millions of student loan borrowers. This examination delves into the multifaceted implications of such a policy change, exploring its effects on the federal budget, individual taxpayers, and the future of higher education.

This analysis will consider the potential for increased student loan delinquency, the distributional effects across different demographic groups, and the viability of alternative approaches to student loan debt relief. We will examine the arguments both for and against eliminating the deduction, weighing the potential benefits against the potential drawbacks for borrowers and the overall economy.

Impact on Student Borrowers

The elimination of the student loan interest deduction will significantly impact both current and future borrowers, leading to increased overall borrowing costs and potentially exacerbating existing financial strains. The magnitude of this impact will vary depending on factors such as loan type, loan amount, and individual financial circumstances. This change necessitates a careful examination of its potential consequences.

The phasing out of this deduction will directly translate into higher monthly payments for many borrowers. This increase, however small it may seem individually, can accumulate over the life of the loan, resulting in a substantially larger total repayment amount. This added financial burden could force borrowers to make difficult choices, potentially impacting their ability to save for retirement, purchase a home, or even meet basic living expenses.

Impact on Federal and Private Student Loans

The impact of the deduction’s elimination will differ depending on the type of student loan. Federal student loans, while often offering more favorable repayment options and protections, will still see an increase in overall cost. However, private student loans, which typically carry higher interest rates and less flexible repayment terms, will be disproportionately affected. Borrowers with private loans are likely to experience a more significant increase in their monthly payments and overall debt burden, potentially pushing them closer to delinquency or default. For example, a borrower with a $50,000 private loan at 7% interest might see their monthly payments increase by several hundred dollars annually after the deduction is removed, compared to a similar federal loan with a lower interest rate. The difference in interest rates alone compounds the financial strain.

Increased Student Loan Delinquency and Default Rates

The removal of the student loan interest deduction is projected to increase student loan delinquency and default rates. The added financial pressure on borrowers, particularly those with private loans or already struggling with debt, could push them into financial hardship. This could lead to a ripple effect, potentially impacting the overall economy as defaults increase and lenders face higher losses. Historical data on similar economic policy shifts can be used to model the potential magnitude of this increase. For instance, studies have shown that even small increases in monthly payments can significantly correlate with increased default rates, particularly among borrowers with lower incomes or those facing unexpected financial setbacks.

Potential Coping Mechanisms for Borrowers

The elimination of the deduction necessitates proactive strategies for borrowers to mitigate the increased financial burden. A multi-pronged approach is crucial.

The following coping mechanisms can help borrowers manage the increased costs:

- Budgeting and Expense Reduction: Carefully review and adjust personal budgets to accommodate higher loan payments. This may involve reducing discretionary spending or identifying areas for cost savings.

- Income Increase Strategies: Explore opportunities to increase income through additional work, promotions, or career changes. A higher income can ease the burden of increased loan payments.

- Refinancing Options: Investigate the possibility of refinancing student loans to secure a lower interest rate. This can significantly reduce monthly payments and overall interest paid over the life of the loan.

- Seeking Financial Counseling: Consult with a financial advisor or credit counselor to develop a personalized debt management plan. Professional guidance can offer valuable insights and strategies for managing debt effectively.

- Income-Driven Repayment Plans: Explore government-sponsored income-driven repayment plans (IDRs) which adjust monthly payments based on income and family size. These plans can offer more manageable payment amounts, especially during periods of financial hardship.

Policy Alternatives and Considerations

Eliminating the student loan interest deduction necessitates exploring alternative approaches to address student debt and maintain equitable access to higher education. Several policy options exist, each with its own set of advantages and disadvantages, and significant political implications. Careful consideration of these alternatives is crucial for crafting effective and sustainable solutions.

Alternative Methods for Student Loan Debt Relief

Several alternative approaches could achieve similar goals to the student loan interest deduction without the inherent complexities and potential inequities. These include direct subsidies for higher education, income-based repayment programs, and targeted grants for specific demographics or fields of study. Each of these offers a different pathway to easing the burden of student debt.

Comparison of Policy Options: Pros and Cons

Direct subsidies, for instance, could provide upfront financial assistance to students, reducing the need for borrowing altogether. This approach, however, requires significant government investment and may not address existing debt. Income-based repayment plans, on the other hand, adjust monthly payments based on income, making them more manageable for borrowers. However, this can lead to longer repayment periods and potentially higher overall interest paid. Targeted grants, such as those for students pursuing STEM fields or those from low-income backgrounds, offer focused support where it’s most needed, but could face challenges in terms of equitable distribution and potential administrative complexities.

Political Ramifications of Eliminating the Deduction

The elimination of the student loan interest deduction is likely to generate considerable political debate. Those who benefit from the deduction, primarily higher-income taxpayers, may oppose its removal, while proponents of the change will argue it’s regressive and inefficient. The debate will likely center on the trade-offs between tax fairness and access to higher education. The political landscape will significantly influence the feasibility and implementation of any alternative policy. For example, the success of a similar policy, such as expanding Pell Grants, will be contingent on political will and support.

Comparison Table of Policy Alternatives

| Policy Option | Estimated Cost | Potential Benefits | Potential Drawbacks |

|---|---|---|---|

| Increased Pell Grants | High (depending on grant expansion) – Potentially hundreds of billions of dollars annually, depending on the scale of the expansion. This could be compared to the current annual cost of the Pell Grant program, which is already in the tens of billions. | Increased access to higher education for low- and middle-income students, reduced reliance on loans. | Requires significant government funding, may not fully address existing debt. |

| Income-Driven Repayment Expansion | Moderate (depending on program parameters) – The cost would depend on the extent of the expansion, but it could potentially involve tens of billions of dollars annually in forgone revenue from interest payments. This is a hard figure to estimate without specific parameters. | More manageable monthly payments for borrowers, potentially preventing defaults. | Longer repayment periods, potentially higher total interest paid over the life of the loan. |

| Targeted Loan Forgiveness Programs | High (depending on program criteria) – The cost could range from tens of billions to potentially trillions, depending on the eligibility criteria and the amount of debt forgiven. This could be compared to the cost of the recent student loan forgiveness plans that were proposed or implemented, which faced similar cost estimates. | Direct debt relief for specific groups (e.g., public service workers), improved economic outcomes. | Potential for inequities, may not address the root causes of student debt. |

| Increased Funding for State-Based Grants | Variable (depending on state participation) – This is difficult to estimate precisely without knowing the level of state participation and funding commitment. It could range from minimal to substantial depending on the states’ decisions. | Increased state-level support for higher education, potentially reducing the need for federal loans. | Relies on state-level cooperation and funding, may not be equally distributed across states. |

Distributional Effects

Eliminating the student loan interest deduction would have a significant and uneven impact across various demographic groups, disproportionately affecting lower- and middle-income borrowers and potentially exacerbating existing inequalities in higher education access. The effects are complex and intertwined with income levels, race, and the type of institution attended.

The removal of this deduction would likely increase the overall cost of higher education for many, potentially discouraging enrollment and limiting access for those already facing financial barriers. This is particularly true for students from lower socioeconomic backgrounds who often rely more heavily on loans to finance their education and may have fewer alternative funding sources. The impact on higher education access and affordability is a critical concern, requiring careful consideration of alternative policies to mitigate potential negative consequences.

Impact on Different Income Brackets

The distributional effects of eliminating the student loan interest deduction are most clearly seen when examining its impact across different income brackets. High-income earners, who often have larger loan balances and higher tax brackets, would experience a greater absolute reduction in tax savings compared to lower-income earners. However, the *relative* impact on lower- and middle-income borrowers is considerably more significant. For example, a high-income earner might see a $2,000 reduction in tax savings, representing a small fraction of their overall income. In contrast, a lower-income borrower might see a $500 reduction, which could represent a substantial portion of their disposable income, potentially impacting their ability to manage loan repayments and other financial obligations. This difference highlights the regressive nature of the deduction’s elimination, disproportionately burdening those least able to afford it. We can illustrate this with a hypothetical example: consider two borrowers, one earning $100,000 annually and another earning $30,000. The high-income borrower might deduct $2,000, representing 2% of their income. The low-income borrower might deduct $500, representing 1.67% of their income – a seemingly small difference, but that $500 is a far greater proportion of their overall budget. This difference could significantly impact their ability to meet other financial needs.

Impact on Higher Education Access and Affordability

The elimination of the student loan interest deduction is projected to reduce the affordability of higher education, particularly for students from low-income families and underrepresented minority groups. This could manifest in several ways, including decreased enrollment rates, increased reliance on more expensive private loans, and a potential shift toward less expensive, but potentially lower-quality, educational options. The resulting decreased access to higher education could widen the existing achievement gap and perpetuate economic inequality across generations. For instance, a student from a low-income family who might have previously been able to afford college with the help of the deduction might now be forced to forgo higher education entirely or take on a significantly larger debt burden, impacting their future financial stability.

Exacerbation of Existing Inequalities

The elimination of the student loan interest deduction has the potential to exacerbate existing inequalities in access to higher education. Students from marginalized communities, including racial and ethnic minorities and first-generation college students, often face greater financial barriers to higher education than their more privileged peers. These students may be more reliant on federal student loans and less likely to have access to alternative funding sources, such as family contributions or private scholarships. The loss of the deduction would disproportionately affect these students, further limiting their opportunities for upward mobility and potentially perpetuating cycles of poverty. The impact is particularly pronounced given that these groups often attend institutions with higher tuition costs, making the loss of the deduction even more detrimental.

Long-Term Implications for Higher Education

The phase-out of the student loan interest deduction will likely have profound and multifaceted long-term consequences for the higher education landscape in the United States. The ramifications extend beyond individual borrowers to encompass institutional finances, enrollment trends, and the overall accessibility and affordability of higher education. Understanding these implications is crucial for policymakers and institutions alike to adapt and mitigate potential negative impacts.

The elimination of this deduction will directly impact the cost of higher education for many students, potentially influencing their decisions regarding college enrollment and the types of institutions they attend. This, in turn, will affect the financial stability of colleges and universities, particularly those heavily reliant on tuition revenue from students utilizing loans. The interplay between these factors will shape the future of higher education in the years to come.

Impact on College Enrollment and Student Debt Levels

The removal of the student loan interest deduction is expected to increase the overall cost of borrowing for students. This added expense could discourage some prospective students from pursuing higher education altogether, leading to a potential decrease in college enrollment, especially among lower-income families who are more sensitive to price changes. Furthermore, even if enrollment remains stable, the increased cost of borrowing could result in higher levels of student loan debt for graduating students, potentially impacting their long-term financial well-being and delaying major life decisions like homeownership or starting a family. For example, a study by the Brookings Institution projected that eliminating the deduction could lead to a slight decrease in college enrollment, most significantly impacting students from lower-income backgrounds.

Differential Impact on Public Versus Private Institutions

The impact of the deduction’s phase-out will not be uniform across all institutions. Public universities, often more affordable than their private counterparts, might experience a less dramatic decline in enrollment compared to private institutions. Private colleges, which often rely more heavily on tuition revenue and attract a larger proportion of students utilizing loans, could face greater financial challenges. This could lead to increased tuition costs at private institutions to compensate for lost revenue, further exacerbating the affordability crisis. The shift in enrollment patterns could potentially lead to increased competition among institutions and a reshaping of the higher education market.

The long-term effects of phasing out the student loan interest deduction on higher education are likely to be complex and far-reaching, potentially resulting in decreased college enrollment, increased student debt levels, and a disproportionate impact on private institutions. This necessitates a proactive approach from policymakers and higher education institutions to mitigate these challenges and ensure continued access to affordable higher education for all.

Closing Summary

Ultimately, the decision to phase out the student loan interest deduction is a complex one with far-reaching consequences. While eliminating the deduction could generate significant savings for the federal government, it would undoubtedly place a greater burden on many student loan borrowers, potentially exacerbating existing inequalities in access to higher education. A thorough cost-benefit analysis, coupled with a comprehensive exploration of alternative policy options, is crucial before implementing such a significant change to the tax code. The long-term implications for higher education affordability and access must be carefully considered.

Essential Questionnaire

What are the current eligibility requirements for the student loan interest deduction?

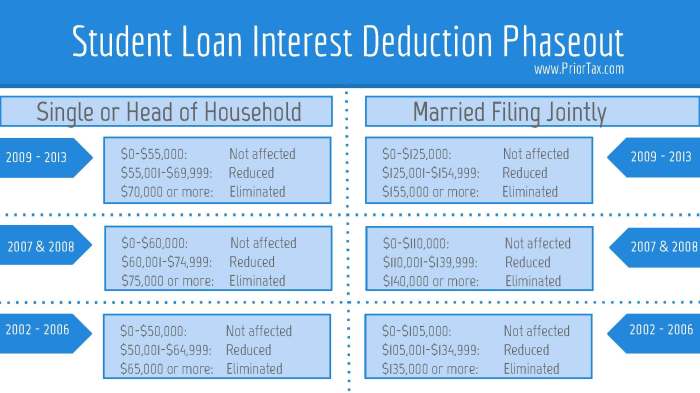

Eligibility requirements vary and are subject to change. Generally, the deduction is available for interest paid on qualified education loans, with income limits and other restrictions applying.

How would the phase-out affect those who have already taken out student loans?

The impact on existing borrowers would depend on the specifics of the phase-out plan. Some proposals might grandfather in existing borrowers, while others might phase out the deduction gradually.

Are there alternative methods for providing student loan debt relief that are less disruptive?

Yes, several alternatives exist, including income-driven repayment plans, loan forgiveness programs targeted at specific professions or demographics, and increased funding for grant programs.

What is the potential impact on private student loan lenders?

The phase-out could potentially affect private lenders, as the deduction might influence borrowing decisions and the overall demand for private student loans.