The pursuit of higher education often involves navigating the complex world of student loans. For many, the PLUS loan program offers a crucial pathway to funding their studies, but understanding its intricacies is key to successful management. This guide delves into the various aspects of PLUS student loans, from eligibility and application processes to repayment strategies and long-term financial implications. We aim to equip you with the knowledge necessary to make informed decisions and avoid common pitfalls.

We’ll cover everything from understanding the different repayment plans available and how they impact your monthly payments and overall interest paid, to exploring strategies for managing debt and minimizing its long-term financial effects. We’ll also address the unique considerations for parents acting as co-signers, ensuring a thorough understanding of the responsibilities involved. By the end, you’ll have a clear picture of how PLUS loans can impact your financial future and how to best navigate this crucial aspect of higher education financing.

Understanding PLUS Loans

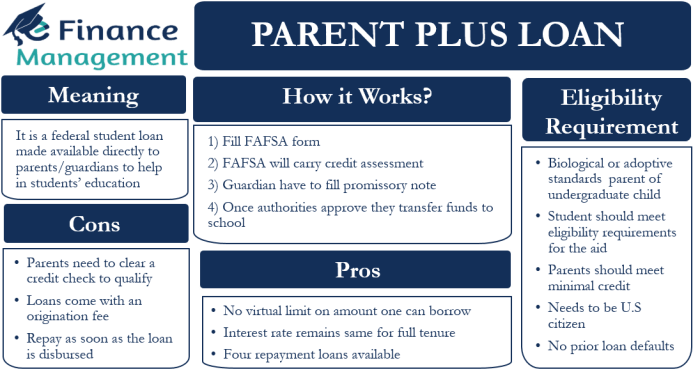

Parent PLUS Loans and Graduate PLUS Loans are federal loan programs designed to help parents of dependent undergraduate students and graduate students, respectively, finance their education. Understanding the nuances of these loans is crucial for responsible borrowing and financial planning.

Eligibility Criteria for PLUS Loans

To be eligible for a Parent PLUS Loan, the parent must be a U.S. citizen or eligible non-citizen, have a Social Security number, and not have an adverse credit history. For Graduate PLUS Loans, the student must be enrolled at least half-time in a graduate or professional degree program and meet the basic citizenship and Social Security number requirements. The Department of Education reviews credit reports to assess creditworthiness. Those with adverse credit histories may still be eligible if they obtain an endorser or meet specific conditions.

Interest Rates and Fees Associated with PLUS Loans

PLUS loan interest rates are fixed and are determined by the U.S. Department of Education. The interest rate is generally higher than that of subsidized or unsubsidized federal student loans. Furthermore, a loan fee is charged upon disbursement of the loan, which is a percentage of the loan amount. These rates and fees can vary from year to year, so it is essential to check the current rates on the Federal Student Aid website before applying. For example, in a given year, the interest rate might be 7.5% with a 4.228% loan fee. It’s crucial to factor these costs into the overall borrowing strategy.

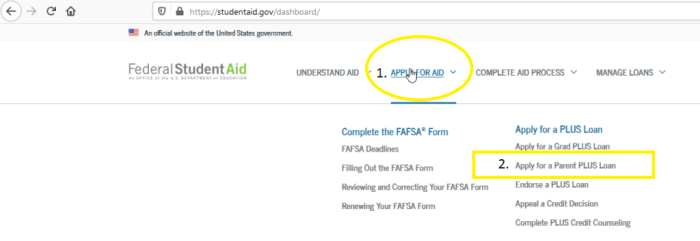

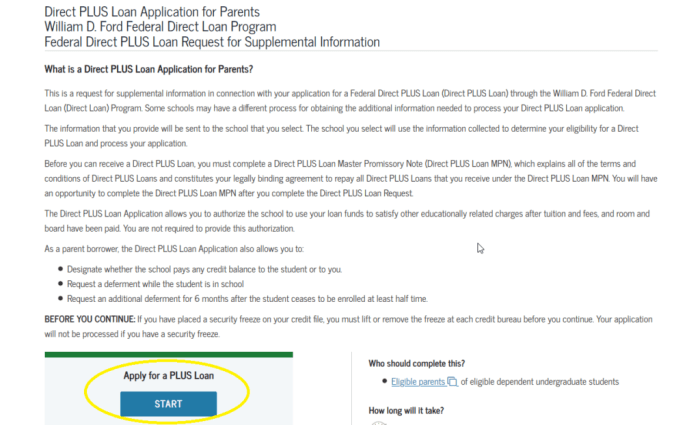

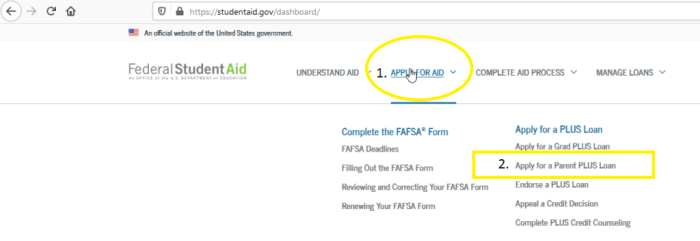

Applying for a PLUS Loan

Applying for a PLUS loan involves a multi-step process. First, the student must complete the Free Application for Federal Student Aid (FAFSA). Second, the parent or graduate student must complete the PLUS loan application through the Federal Student Aid website. Third, the credit check will be performed. Fourth, upon approval, the funds are disbursed directly to the educational institution. Finally, the borrower will receive loan documents outlining the terms and conditions. It is important to carefully review all documentation.

Comparison of PLUS Loans to Other Student Loan Options

PLUS loans differ from other student loan options, such as subsidized and unsubsidized federal student loans. Subsidized loans have government-paid interest during periods of deferment, while unsubsidized loans accrue interest throughout the loan term. Private student loans offer alternative financing but often come with variable interest rates and potentially higher fees. The key differences lie in eligibility, interest rates, repayment terms, and the availability of deferment or forbearance options. For instance, a subsidized Stafford loan might have a lower interest rate than a PLUS loan, but it has eligibility limitations based on financial need.

Repayment Options for PLUS Loans

Repaying your PLUS loan involves understanding the various repayment plans available to manage your debt effectively. Choosing the right plan depends on your financial situation and long-term goals. Several options exist, offering flexibility in monthly payments and overall repayment timelines.

The Federal government offers a variety of repayment plans for PLUS Loans, allowing borrowers to tailor their repayment strategy to their individual financial circumstances. These plans differ in monthly payment amounts, total repayment time, and eligibility requirements. Understanding these differences is crucial for making informed decisions about managing your loan debt.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans, including PLUS loans. It involves fixed monthly payments over a 10-year period. This plan offers predictable payments but may result in higher total interest paid compared to some income-driven repayment plans. The fixed monthly payment is calculated based on the loan’s principal balance and interest rate.

Extended Repayment Plan

This plan extends the repayment period beyond the standard 10 years, reducing monthly payments. However, this longer repayment period generally leads to significantly higher total interest paid over the life of the loan. Eligibility typically requires a loan balance exceeding a certain threshold.

Graduated Repayment Plan

The Graduated Repayment Plan features lower initial monthly payments that gradually increase over time. While this starts with more manageable payments, the later payments become substantially higher. This plan also generally results in higher total interest paid compared to the Standard Repayment Plan.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) link your monthly payment to your income and family size. These plans are designed to make repayment more manageable, especially during periods of lower income. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans typically extend the repayment period to 20 or 25 years, potentially resulting in loan forgiveness after a certain period, but often leading to higher total interest paid over the life of the loan.

Sample Repayment Schedule for a $20,000 PLUS Loan at 7% Interest (Standard Repayment Plan)

This is a simplified example and does not include potential fees or changes in interest rates. Actual payments may vary.

Loan Amount: $20,000

Interest Rate: 7%

Repayment Period: 10 years (120 months)

Approximate Monthly Payment: $232

Approximate Total Interest Paid: $7,440

Note: This is a simplified example and does not account for potential changes in interest rates or other factors that may influence the actual payment amounts. Contact your loan servicer for accurate calculations.

Comparison of Repayment Plans

| Plan Name | Monthly Payment (Example) | Total Interest Paid (Example) | Eligibility Criteria |

|---|---|---|---|

| Standard Repayment | $232 (for $20,000 loan at 7%) | ~$7,440 (for $20,000 loan at 7%) | Generally available for all federal student loans |

| Extended Repayment | Varies based on repayment period | Significantly higher than Standard | Loan balance typically exceeds a certain threshold |

| Graduated Repayment | Starts low, increases over time | Higher than Standard | Generally available for all federal student loans |

| Income-Driven Repayment (IBR, PAYE, REPAYE, ICR) | Based on income and family size | Potentially very high due to extended repayment | Generally available for federal student loans; income verification required |

Managing PLUS Loan Debt

Successfully navigating PLUS loan debt requires proactive planning and a clear understanding of available resources. Many borrowers unintentionally encounter challenges that prolong repayment and increase overall costs. This section will Artikel common pitfalls and effective strategies for managing your PLUS loan debt effectively.

Common Mistakes in PLUS Loan Management

Failing to understand the terms of your loan agreement is a frequent mistake. This includes overlooking crucial details like interest rates, repayment schedules, and potential penalties for late payments. Another common error is neglecting to explore available repayment options, potentially missing out on programs that could lower monthly payments or shorten the loan repayment term. Finally, many borrowers fail to budget effectively, leading to missed payments and accumulating additional debt through late fees and interest capitalization.

Strategies for Reducing PLUS Loan Debt

Several strategies can significantly reduce the burden of PLUS loan debt. Refinancing involves securing a new loan with more favorable terms, such as a lower interest rate or a shorter repayment period. This can lead to substantial savings over the life of the loan. Consolidation combines multiple loans into a single payment, simplifying the repayment process and potentially reducing the overall interest rate. Careful consideration of both options is crucial, as eligibility requirements and associated fees vary depending on the lender and individual circumstances. For example, a borrower with excellent credit might qualify for a significantly lower interest rate through refinancing, while someone with multiple federal loans might benefit from the streamlined payment of consolidation.

Budgeting Plan for a $30,000 PLUS Loan with $3,000 Monthly Income

This example assumes a 7% annual interest rate and a 10-year repayment plan (120 months). The estimated monthly payment is approximately $350.

| Category | Amount | |

|---|---|---|

| Housing | $800 | |

| Food | $400 | |

| Transportation | $300 | |

| PLUS Loan Payment | $350 | |

| Utilities | $200 | |

| Other Expenses | $250 | Total Expenses: $2300 |

| Savings/Debt Reduction | $700 |

This budget allocates a significant portion of the income towards debt repayment while still allowing for essential living expenses. The remaining $700 can be used for additional debt reduction or emergency savings. It’s important to adjust this budget based on individual needs and circumstances.

Impact of Extra Payments on Loan Repayment

Making extra payments on your PLUS loan can substantially reduce the total interest paid and shorten the repayment period. Even small additional payments, made regularly, can have a significant cumulative effect.

For example, an extra $100 per month on a $30,000 loan at 7% interest could save thousands of dollars in interest and potentially reduce the repayment period by several years.

This illustrates the power of consistent extra payments. By diligently paying more than the minimum payment, borrowers can accelerate their debt repayment and achieve financial freedom faster.

The Impact of PLUS Loans on Financial Planning

Taking out a PLUS loan can significantly impact your long-term financial well-being, influencing everything from your ability to save for retirement to your capacity for future borrowing. Understanding these potential effects is crucial for responsible financial planning. Careful consideration of the loan’s implications is essential for navigating your financial future successfully.

PLUS Loans and Long-Term Financial Goals

PLUS loans can hinder the achievement of long-term financial goals by increasing your overall debt burden. For example, a parent borrowing $30,000 in PLUS loans for their child’s education might find it challenging to simultaneously save for retirement or a down payment on a house. The monthly loan payments represent a significant outflow of funds, reducing the amount available for other savings and investment opportunities. This could delay retirement plans, necessitate a smaller down payment on a home, or limit the ability to invest in other assets, potentially reducing long-term wealth accumulation.

Consequences of Defaulting on a PLUS Loan

Defaulting on a PLUS loan has severe consequences. This includes damaging your credit score, potentially making it difficult to obtain credit in the future (such as for a mortgage or car loan). The government can garnish your wages, seize your tax refunds, and even pursue legal action to recover the debt. Furthermore, defaulting on a federal student loan, like a PLUS loan, can impact your ability to obtain government benefits or clearances for certain jobs. In short, defaulting can have profound and long-lasting negative financial repercussions.

Credit Scores and PLUS Loans

PLUS loans directly impact your credit score. On-time payments contribute positively, while missed or late payments negatively affect your creditworthiness. A lower credit score can result in higher interest rates on future loans, making borrowing more expensive. Conversely, maintaining a good payment history on your PLUS loan can help build and maintain a strong credit profile, beneficial for securing favorable terms on future credit applications. This is particularly important when considering larger financial commitments like mortgages or business loans.

PLUS Loans and Future Borrowing Opportunities

The presence of PLUS loans on your credit report influences your eligibility for future borrowing. Lenders assess your debt-to-income ratio when considering loan applications. A high debt-to-income ratio, stemming from substantial PLUS loan payments, might make it challenging to qualify for additional loans, such as a mortgage or an auto loan, or might result in higher interest rates. Therefore, careful management of PLUS loan debt is essential for preserving future borrowing opportunities and securing favorable terms on future credit applications.

PLUS Loans and Parental Responsibility

Taking out a PLUS loan involves significant financial responsibility, and when parents co-sign, they assume a crucial role in their child’s education and future financial well-being. Understanding the implications of co-signing is paramount to making an informed decision.

Parents play a vital role in the PLUS loan process, acting as co-signers and ultimately sharing responsibility for repayment. Their credit history is a key factor in loan approval, and their financial stability directly impacts the loan’s success. The parent’s involvement extends beyond the application; they share the burden of repayment should the student be unable to meet their obligations.

Parental Roles in the PLUS Loan Process

Parents act as co-signers, guaranteeing the loan’s repayment. This means that if the student defaults on the loan, the lender can pursue the parent for the outstanding balance. The parent’s creditworthiness is assessed during the application process, influencing the approval and interest rate offered. Good credit significantly increases the chances of approval and may result in a lower interest rate. Ongoing communication between parent and student regarding loan repayment is essential for successful management of the debt.

Advice for Parents Considering a PLUS Loan

Before co-signing, parents should carefully evaluate their own financial situation. They need to consider their current debt, income, and future financial projections. It is crucial to assess whether they can comfortably afford the monthly payments, even if the student is unable to contribute. A thorough understanding of the loan terms, including interest rates, repayment schedules, and potential fees, is essential. Parents should also explore alternative financing options before committing to a PLUS loan, such as scholarships, grants, or private loans with more favorable terms. Finally, open and honest communication with their child about the financial responsibilities involved is critical.

Legal and Financial Responsibilities of Co-signing

Co-signing a PLUS loan carries significant legal and financial obligations. Legally, parents become equally responsible for repaying the loan. This means lenders can pursue them for the full amount if the student defaults. Financially, co-signing can impact a parent’s credit score, potentially making it harder to obtain future loans or credit cards. The loan repayment also becomes a significant financial commitment, potentially affecting their retirement savings, other financial goals, or overall financial health. It is essential to understand that co-signing is not a trivial matter and has long-term implications.

Checklist for Parents Before Co-signing a PLUS Loan

Before agreeing to co-sign a PLUS loan, parents should create a comprehensive checklist addressing several key areas. This checklist should include:

- Reviewing the student’s financial aid package and exploring all other funding options.

- Analyzing their own credit report and credit score to understand their financial standing.

- Carefully reviewing the loan terms, including interest rates, fees, and repayment schedules.

- Estimating the monthly payment amount and assessing their ability to afford it.

- Considering the potential impact on their credit score and future borrowing capacity.

- Discussing the loan and repayment plan with their child, establishing clear expectations and responsibilities.

- Seeking professional financial advice if needed to make an informed decision.

Visual Representation of PLUS Loan Information

Understanding the financial implications of a PLUS loan is significantly enhanced by visual representations of key data. Graphs and charts can clarify complex information, making it easier to grasp the loan’s trajectory and the impact of various repayment strategies. This section explores how visualizations can illuminate the details of a PLUS loan.

Amortization Schedule Visualization

A typical amortization schedule for a PLUS loan is usually represented as a table or a line graph. The table format displays each payment’s breakdown: the date of the payment, the payment amount, the portion allocated to principal, the portion allocated to interest, and the remaining loan balance. A line graph, on the other hand, visually tracks these elements over the loan’s lifespan. The x-axis represents time (months or years), while the y-axis represents the monetary value. Three lines would typically be displayed: one for the remaining balance (decreasing over time), one for the cumulative interest paid (increasing over time), and one for the principal paid (increasing over time). The steepness of the interest line relative to the principal line visually highlights the significant portion of early payments allocated to interest. For example, a $50,000 loan with a 7% interest rate over 10 years might show a substantial initial interest component, with a slower decline in the remaining balance initially. Later payments would show a larger portion going towards principal repayment, as the balance decreases.

Impact of Different Repayment Plans Visualization

The impact of different repayment plans (e.g., standard, extended, graduated) on total interest paid can be effectively visualized using bar charts or stacked bar charts. Each bar represents a repayment plan, with its height corresponding to the total interest paid over the loan’s lifetime. A stacked bar chart could further break down each bar to show the proportion of interest paid versus principal paid for each plan. For instance, a standard repayment plan might have a shorter bar compared to an extended repayment plan, visually illustrating the trade-off between longer repayment periods and higher total interest costs. Using different colors for interest and principal within the stacked bar chart would provide a clear visual distinction. A legend would be essential for identifying the different components. A comparison might show that an extended repayment plan results in a significantly taller bar for total interest paid compared to a standard plan, but a graduated repayment plan might fall somewhere in between, clearly demonstrating the financial implications of each choice.

Summary

Securing a higher education is a significant investment, and understanding the financial tools available is paramount. PLUS student loans, while offering a valuable resource, require careful planning and proactive management. By understanding the eligibility criteria, repayment options, and potential long-term implications, you can make informed decisions that align with your financial goals. Remember, proactive planning and responsible borrowing practices are crucial for minimizing debt and maximizing the benefits of a higher education.

Expert Answers

What happens if I can’t make my PLUS loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your loan servicer immediately if you anticipate difficulty making payments to explore options like deferment or forbearance.

Can I refinance my PLUS loan?

Yes, you may be able to refinance your PLUS loan with a private lender, potentially securing a lower interest rate. However, refinancing federal loans into private loans means losing federal protections like income-driven repayment plans.

What is the difference between a subsidized and unsubsidized PLUS loan?

PLUS loans are unsubsidized. Interest accrues from the time the loan is disbursed, regardless of your enrollment status. Subsidized loans, typically available to undergraduate students, do not accrue interest while the borrower is enrolled at least half-time.

Are there any penalties for early repayment of a PLUS loan?

Generally, there are no penalties for early repayment of a PLUS loan. Paying extra towards your principal can significantly reduce the total interest paid and shorten the repayment period.