The escalating cost of higher education casts a long shadow over many professions, and law enforcement is no exception. Police officers, often burdened by significant student loan debt, face unique challenges balancing financial obligations with the demands of public service. This exploration delves into the complex issue of police officer student loan forgiveness, examining the arguments for and against such programs, exploring existing initiatives, and proposing potential models for targeted relief.

This critical discussion considers the potential benefits of a more financially secure police force, including improved recruitment and retention, enhanced morale, and ultimately, a positive impact on community relations. Conversely, we will also analyze potential drawbacks, addressing concerns about fairness, cost-effectiveness, and unintended consequences. The goal is to present a balanced perspective, facilitating a comprehensive understanding of this multifaceted issue.

The Current State of Student Loan Debt for Police Officers

The financial burdens faced by police officers are multifaceted, with student loan debt emerging as a significant challenge impacting their personal well-being and professional stability. Understanding the scope of this issue is crucial for developing effective support strategies. While precise, nationwide data is limited, available research offers insights into the prevalent debt levels and associated difficulties faced by law enforcement personnel.

The financial strain of student loans can significantly affect police officers’ lives, impacting their ability to save for retirement, purchase homes, and manage their overall financial well-being. This, in turn, can influence morale, job satisfaction, and potentially even retention rates within police departments.

Average Student Loan Debt and Loan Type Distribution Among Police Officers

Precise figures on average student loan debt for police officers are difficult to obtain due to the lack of comprehensive, publicly available data specifically targeting this demographic. However, we can extrapolate from broader studies on law enforcement salaries and educational requirements, combined with national trends in student loan debt. The following table presents estimated data based on available information, recognizing the limitations of precise quantification. It is important to note that these are estimations and may vary significantly depending on factors such as rank, jurisdiction, educational level, and the year of graduation.

| Rank | Average Debt (Estimate) | Loan Type Distribution (Estimate) | Percentage with Significant Debt (Estimate) |

|---|---|---|---|

| Patrol Officer | $50,000 – $75,000 | 60% Federal, 40% Private | 70-80% |

| Sergeant | $60,000 – $90,000 | 55% Federal, 45% Private | 65-75% |

| Lieutenant | $70,000 – $100,000 | 50% Federal, 50% Private | 60-70% |

| Captain/Higher Ranks | $80,000 – $120,000+ | 45% Federal, 55% Private (potentially higher due to advanced degrees) | 55-65% |

The estimates provided reflect a broad range, acknowledging the significant variability across different jurisdictions and individual circumstances. The distribution of loan types is also an approximation, with a higher percentage of private loans likely reflecting the increasing reliance on private lenders for financing graduate and professional degrees.

Impact of Significant Student Loan Debt on Police Officers

A substantial percentage of police officers carry significant student loan debt, impacting their financial security and overall well-being. This debt can create financial stress, limiting their ability to save for retirement, purchase a home, or manage unexpected expenses. The high cost of higher education, combined with relatively moderate starting salaries for many police officers, contributes to this significant financial burden. For instance, an officer might find themselves making significant monthly payments on student loans while simultaneously facing the costs of maintaining a household, raising a family, and meeting other financial obligations. This financial strain can have broader consequences, potentially impacting job satisfaction, morale, and even leading to higher turnover rates within police departments.

Arguments for Police Officer Student Loan Forgiveness Programs

Implementing student loan forgiveness programs specifically targeted at police officers offers a multifaceted approach to addressing critical issues within law enforcement agencies nationwide. These programs aim to improve recruitment, bolster retention rates, and ultimately enhance the quality and effectiveness of police services provided to communities. The rationale rests on the premise that a more educated and financially stable police force translates to a safer and more prosperous society.

The primary argument for such programs centers on the persistent challenges faced by law enforcement in attracting and retaining qualified personnel. Competitive salaries are often insufficient to offset the high cost of education, particularly for those pursuing advanced degrees in criminal justice or related fields. Student loan debt can be a significant barrier, discouraging prospective candidates from entering the profession or forcing current officers to seek higher-paying positions elsewhere. Forgiveness programs directly alleviate this financial burden, making a career in law enforcement a more attractive and financially viable option.

Societal Benefits of a More Educated and Financially Stable Police Force

A highly educated police force equipped with advanced knowledge in areas such as criminal psychology, community policing strategies, and conflict resolution can significantly improve law enforcement outcomes. Studies have shown a correlation between higher education levels among officers and reduced crime rates, improved community relations, and a decrease in instances of police misconduct. Furthermore, financially stable officers are less likely to engage in corruption or unethical behavior driven by financial stress. This leads to increased public trust and a more positive relationship between law enforcement and the communities they serve. A more stable force also means less money spent on recruitment and training, a significant cost saving for taxpayers.

Positive Impact on Officer Morale and Job Satisfaction

The substantial weight of student loan debt can significantly impact an officer’s morale and overall job satisfaction. The constant financial pressure can lead to stress, burnout, and ultimately, a decision to leave the profession. Loan forgiveness programs provide much-needed financial relief, reducing stress levels and allowing officers to focus on their duties and contribute more effectively to their communities. This, in turn, leads to improved job performance, reduced absenteeism, and a more positive work environment within police departments.

Economic Benefits to Communities with Reduced Police Turnover

The high cost of police officer turnover is a significant burden on communities. Replacing officers involves substantial expenses related to recruitment, background checks, training, and equipment. Reducing turnover through loan forgiveness programs can lead to significant cost savings.

- Reduced Recruitment Costs: Fewer officers leaving means less money spent on advertising, screening, and background checks for new recruits.

- Lower Training Expenses: Experienced officers contribute more effectively and require less ongoing training compared to newly hired personnel.

- Improved Community Relations: Stable, experienced officers build stronger relationships with community members, fostering trust and cooperation.

- Enhanced Public Safety: A more experienced and stable police force translates to more effective crime prevention and response.

- Increased Efficiency: Reduced turnover leads to a more efficient and effective police department, better equipped to address community needs.

Arguments Against Police Officer Student Loan Forgiveness Programs

Implementing student loan forgiveness programs specifically for police officers presents several complex challenges that warrant careful consideration. While such programs aim to improve recruitment and retention, they also raise concerns about fairness, cost-effectiveness, and potential unintended consequences. A balanced assessment requires examining both the potential benefits and drawbacks.

The primary concern revolves around the potential for inequity. Allocating significant public funds to forgive the student loans of police officers raises questions about fairness to other public servants, such as teachers, firefighters, and social workers, who also face significant student loan burdens but may not receive similar benefits. This could lead to resentment and a perception of preferential treatment, undermining morale across various public sectors.

Fairness and Equity Concerns

The argument for fairness extends beyond comparing police officers to other public service professions. Within law enforcement itself, there are variations in educational requirements and salary levels across different agencies and ranks. A blanket forgiveness program might disproportionately benefit higher-ranking officers or those in wealthier jurisdictions, further exacerbating existing inequalities. A targeted approach, perhaps focusing on officers serving in underserved communities or those with exceptionally high student loan debt relative to their income, could mitigate some of these issues. However, such a targeted approach would require careful design to avoid creating new avenues for inequity.

Cost-Effectiveness Compared to Other Initiatives

Another crucial consideration is the cost-effectiveness of student loan forgiveness compared to alternative strategies for improving police recruitment and retention. The financial resources required for a large-scale loan forgiveness program could be substantial. These funds might be better allocated to other initiatives, such as increasing starting salaries, improving benefits packages, or investing in better training and equipment. For example, a comprehensive study comparing the cost-per-officer-recruited for loan forgiveness versus a salary increase could provide valuable data for policymakers. Such a comparison should account for the long-term effects of each approach on recruitment and retention rates.

Potential Drawbacks and Unintended Consequences

Beyond the issues of fairness and cost-effectiveness, several potential drawbacks and unintended consequences must be considered. For instance, a loan forgiveness program could incentivize individuals to enter law enforcement primarily for the financial benefit, potentially attracting candidates less committed to public service. Furthermore, the program might not address the root causes of recruitment and retention challenges, such as high stress levels, occupational hazards, and limited career advancement opportunities. Addressing these underlying issues is crucial for creating a sustainable and effective law enforcement workforce. Without such complementary measures, loan forgiveness might prove to be a costly, short-term solution with limited long-term impact.

Comparison of Loan Forgiveness and Alternative Solutions

The following table summarizes the pros and cons of police officer student loan forgiveness versus alternative solutions for addressing recruitment and retention challenges.

| Solution | Pros | Cons |

|---|---|---|

| Student Loan Forgiveness | Attracts new recruits, improves retention for existing officers with high debt. | Expensive, potentially unfair to other public sector employees, may not address root causes of recruitment/retention issues. |

| Salary Increases | Directly improves compensation, attracts and retains officers. | Requires ongoing budgetary commitment, may not be sufficient to address all recruitment/retention challenges. |

| Improved Benefits Packages | Enhances overall compensation, improves work-life balance. | Can be expensive, may not be as effective as salary increases in attracting new recruits. |

| Enhanced Training and Professional Development | Improves officer skills and morale, increases career opportunities. | Requires upfront investment, may not have immediate impact on recruitment. |

Existing Programs and Policies Related to Public Service Loan Forgiveness

The federal government and some states offer loan forgiveness programs aimed at encouraging individuals to pursue careers in public service, including law enforcement. These programs vary significantly in their eligibility criteria, the amount of loan forgiveness offered, and the application process. Understanding these differences is crucial for police officers considering these options.

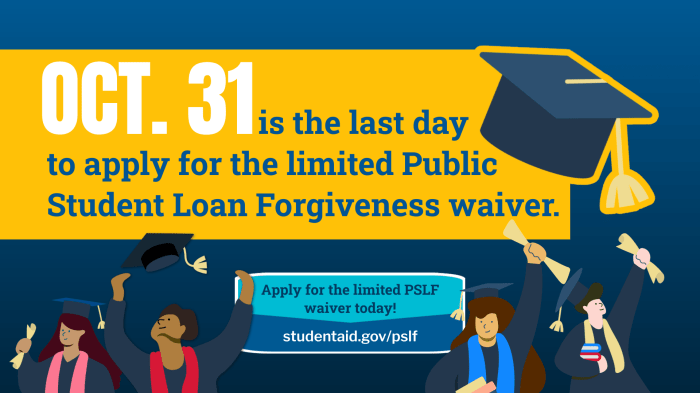

The Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program is a federal initiative designed to forgive the remaining balance on federal Direct Loans after 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer, consistent payments under an income-driven repayment plan, and consolidation of all federal student loans into a Direct Consolidation Loan. The program has faced significant criticism due to its stringent requirements and high rejection rate. Many applicants have been denied forgiveness due to inconsistencies in their employment verification or payment history. For example, an applicant might be denied if their employer isn’t properly certified or if they missed even a single qualifying payment.

State-Level Loan Forgiveness Programs

Several states have established their own loan forgiveness programs for public service employees, often including law enforcement. These programs typically have more lenient eligibility requirements and higher forgiveness amounts than the federal PSLF program. However, the specifics vary widely by state. For instance, some states may prioritize specific public service roles, offer a fixed amount of forgiveness regardless of the loan balance, or require a certain number of years of service before eligibility. These programs also often have limited funding, leading to competitive application processes and potential waiting lists.

Comparison of Federal and State Programs

A direct comparison highlights the key differences. The federal PSLF program offers broad applicability but has rigorous requirements and a complex application process leading to high denial rates. State programs often provide more generous benefits and simpler processes but have limited funding and may focus on specific roles or agencies. For a police officer, choosing between these options requires careful consideration of their individual circumstances and the specific benefits offered by each program.

Application Processes and Challenges

Applying for both federal and state loan forgiveness programs can be a lengthy and complex process. Applicants must meticulously document their employment history, loan repayment history, and other qualifying criteria. Challenges often arise from incomplete or inaccurate documentation, delays in processing applications, and difficulties in meeting the stringent requirements. For example, inconsistencies in employment records or a single missed payment can lead to application rejection, even after years of qualifying payments. Many applicants find navigating the complex bureaucratic processes overwhelming and often require assistance from loan counselors or legal professionals.

Examples of Program Implementations

The PSLF program’s implementation has been marked by both successes and significant failures. While some applicants have successfully had their loans forgiven, many have experienced delays and denials, highlighting the program’s complexities. Conversely, some state-level programs have demonstrated greater success in providing loan forgiveness to public service employees, though the scale and scope of these programs are generally smaller than the federal initiative. The success or failure often hinges on the clarity of the program’s guidelines, the effectiveness of the application process, and the availability of resources to support applicants.

Potential Models for Police Officer Student Loan Forgiveness

Designing effective student loan forgiveness programs for police officers requires careful consideration of various factors, including financial feasibility, recruitment impact, and program fairness. Several models can be explored, each with its own advantages and disadvantages. The key is to create a system that incentivizes recruitment and retention without placing an undue burden on taxpayers.

Income-Based Repayment Model for Police Officers

This model would tie loan forgiveness to the officer’s income. For example, a percentage of the officer’s income above a certain threshold could be applied towards loan repayment, with full forgiveness granted after a set number of years or upon reaching a specific income-based repayment threshold. This approach addresses concerns about equity, as higher-earning officers would contribute more towards loan repayment. The financial implications would involve establishing an income verification system and calculating the appropriate forgiveness percentages based on income brackets and years of service. Resource allocation would depend on the number of participating officers and the average loan balances. The impact on recruitment and retention could be positive, as it offers a more manageable repayment plan, particularly appealing to officers in lower-paying departments or those starting their careers.

Years of Service Model for Police Officer Loan Forgiveness

Under this model, loan forgiveness would be directly tied to the number of years an officer serves in law enforcement. For example, partial forgiveness could be granted after five years, with increasing amounts forgiven for each subsequent year of service, up to full forgiveness after a specified number of years (e.g., 10 or 20 years). The financial implications are relatively straightforward to calculate, based on the number of officers meeting the service requirements and their average loan balances. Resource allocation would be predictable, making budgeting easier. This model’s impact on recruitment and retention is likely to be strong, providing a clear incentive for long-term commitment to the profession. It may also encourage officers to remain in their positions longer.

Combined Income-Based and Years of Service Model

This model combines the strengths of the previous two. It could involve partial loan forgiveness based on years of service, with additional forgiveness contingent on income. For example, an officer might receive 25% forgiveness after five years of service and an additional 25% based on income levels after ten years. This approach provides a more nuanced and potentially equitable system, rewarding both longevity and addressing income disparities. The financial implications would be more complex to calculate, requiring a sophisticated system to track both income and years of service. Resource allocation would be more challenging to predict accurately. However, the potential positive impact on recruitment and retention could be significant, offering a comprehensive incentive structure.

Visual Representation of Proposed Models

A simple table can illustrate the differences:

| Model | Forgiveness Trigger | Financial Implications | Recruitment/Retention Impact |

|————————–|————————-|——————————————————–|—————————————————-|

| Income-Based Repayment | Income level & years of service | Complex calculations, income verification system needed | Potentially high, especially for lower-income officers |

| Years of Service | Years of service | Relatively straightforward calculations | High, incentivizes long-term commitment |

| Combined Model | Years of service & income level | Complex calculations, income verification system needed | Potentially very high, balances both factors |

The Impact on Police Departments and Communities

Student loan forgiveness programs for police officers could significantly reshape police departments and their relationships with the communities they serve. The potential effects are multifaceted, impacting budgets, staffing, community trust, and officer training. Understanding these impacts is crucial for evaluating the long-term viability and societal benefit of such programs.

Impact on Police Department Budgets and Staffing Levels

The immediate impact on police department budgets is difficult to predict precisely, as it depends on the scale and design of the forgiveness program. A large-scale program could lead to significant upfront costs for the government, although it might indirectly reduce the need for salary increases to attract and retain officers burdened by debt. Conversely, a smaller, targeted program might have a minimal impact on the overall budget. The effect on staffing levels is similarly complex. Loan forgiveness could incentivize more individuals to pursue careers in law enforcement, potentially alleviating staffing shortages in departments facing recruitment challenges. However, it’s also possible that the program wouldn’t significantly change staffing numbers if other factors, such as salary and working conditions, remain unattractive. For example, a department in a high-cost-of-living area might still struggle to recruit and retain officers even with loan forgiveness if salaries aren’t competitive.

Effect on Community Trust and Relationships with Law Enforcement

Improved officer morale and reduced financial stress, resulting from loan forgiveness, could positively influence community relations. Officers facing less financial strain might be better equipped to focus on community engagement and build stronger relationships with residents. This could lead to increased trust and cooperation, improving the effectiveness of policing. Conversely, if the program is perceived as unfair or inequitable by the community, it could erode trust and create further divisions. For example, if the program disproportionately benefits officers in wealthier communities, it could exacerbate existing inequalities and fuel resentment. A successful program would require careful consideration of equity and transparency to ensure it builds, rather than undermines, community trust.

Influence on Police Officer Training and Professional Development

Loan forgiveness could indirectly support improved police training and professional development. With reduced financial burdens, officers might have more time and resources to pursue advanced training opportunities, enhancing their skills and expertise. This could lead to better-equipped and more effective law enforcement, improving public safety. Departments could also use loan forgiveness as an incentive to encourage officers to participate in specialized training programs, such as crisis intervention or de-escalation techniques. However, this positive impact depends on departments proactively investing in training and development programs and ensuring that officers have the time and support to participate. Without such support, loan forgiveness alone may not lead to substantial improvements in training.

Hypothetical Scenarios Illustrating Long-Term Effects

Scenario 1: A city implements a comprehensive loan forgiveness program, attracting a wave of new recruits. These officers, relieved of substantial debt, actively participate in community outreach initiatives, leading to increased trust and reduced crime rates. The city experiences a decrease in police-related complaints and an increase in community satisfaction.

Scenario 2: A state implements a limited loan forgiveness program, with limited funds and stringent eligibility requirements. This leads to resentment among officers who don’t qualify and does little to address the underlying issues of low pay and high stress in the profession. Community trust remains unchanged, and the program is seen as a failure.

Summary

Ultimately, the question of police officer student loan forgiveness hinges on a careful balancing act. While the potential benefits for recruitment, retention, and community relations are undeniable, careful consideration must be given to the financial implications, equitable distribution of resources, and potential unintended consequences. A thoughtful and comprehensive approach, informed by data-driven analysis and a commitment to fairness, is crucial to developing effective and sustainable solutions that serve both the needs of law enforcement and the communities they protect.

Common Queries

What are the typical repayment terms for federal student loans?

Federal student loan repayment terms vary depending on the loan type (e.g., subsidized, unsubsidized, PLUS loans) and the repayment plan chosen. Common options include standard repayment, graduated repayment, and income-driven repayment plans.

Are there any income limits for eligibility in existing public service loan forgiveness programs?

Eligibility for public service loan forgiveness programs generally doesn’t have specific income limits. However, the programs often require borrowers to make 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying employer.

How does student loan debt impact police officer retention rates?

Studies suggest a correlation between high student loan debt and higher turnover rates among police officers. The financial strain can lead officers to seek employment in less demanding, higher-paying fields.

What are some alternative solutions to address police officer recruitment and retention besides loan forgiveness?

Alternative solutions include increased salaries and benefits, improved working conditions, enhanced training and professional development opportunities, and improved mental health support.