Navigating the complex world of higher education often requires financial assistance beyond the reach of federal student aid. Private student loans offer a potential solution, but understanding their nuances is crucial for responsible borrowing. This guide delves into the landscape of popular private student loans, exploring eligibility, application processes, repayment options, and potential risks, equipping you with the knowledge to make informed decisions.

From understanding the diverse range of loan types and lenders to comparing interest rates and repayment plans, we aim to demystify the process. We’ll also contrast private loans with their federal counterparts, highlighting the key differences and helping you determine which option best suits your individual circumstances. Ultimately, this guide empowers you to approach private student loan borrowing with confidence and clarity.

Understanding the Market for Private Student Loans

The private student loan market is a significant segment of the overall student lending landscape, offering an alternative funding source for higher education expenses beyond federal loans. This market is dynamic, influenced by various economic and regulatory factors, and presents both opportunities and challenges for borrowers and lenders alike.

The current landscape is characterized by a diverse range of lenders, each with its own lending criteria, interest rates, and repayment options. Competition among lenders is intense, leading to innovative products and services aimed at attracting borrowers. However, the market is also subject to regulatory scrutiny and evolving consumer protection laws.

Key Players and Market Share

Determining precise market share for private student loan lenders is challenging due to the lack of publicly available, comprehensive data. However, some major players consistently appear at the forefront. These include large banks (such as Sallie Mae, formerly the Student Loan Marketing Association, though it now focuses more on managing existing loans), credit unions, and specialized financial institutions focusing solely on student lending. Their market share fluctuates based on economic conditions and changes in lending practices. Larger institutions tend to have a broader reach and greater market share, while smaller lenders often focus on niche markets or specific borrower demographics.

Factors Driving Demand for Private Student Loans

Several factors contribute to the persistent demand for private student loans. Firstly, the rising cost of higher education often exceeds the borrowing limits of federal student loan programs. Secondly, private loans can offer more flexible repayment options, potentially tailored to individual financial circumstances. Thirdly, some borrowers may prefer the perceived convenience and streamlined application process offered by certain private lenders. Finally, creditworthy borrowers may find access to lower interest rates than those offered by federal programs.

Comparison of Interest Rates Offered by Major Private Lenders

The interest rates offered by private student loan lenders vary significantly depending on factors like the borrower’s creditworthiness, the type of loan, and the prevailing market interest rates. It is crucial to compare offers from multiple lenders before making a decision. The following table provides a sample of potential interest rate ranges, understanding that these are subject to change and may not reflect the exact rates offered at any given time. It is crucial to check directly with lenders for the most current information.

| Lender Name | Interest Rate Range (%) | Loan Type | Repayment Options |

|---|---|---|---|

| Example Lender A | 6.00 – 14.00 | Undergraduate, Graduate | Standard, Graduated, Income-Driven |

| Example Lender B | 7.50 – 16.00 | Undergraduate | Standard, Extended |

| Example Lender C | 5.50 – 13.00 | Graduate, Professional | Standard, Income-Based |

| Example Lender D | 8.00 – 15.00 | Undergraduate, Graduate, Parent | Standard, Accelerated |

Eligibility Criteria and Application Process

Securing a private student loan involves navigating a specific set of eligibility requirements and a detailed application process. Understanding these aspects is crucial for prospective borrowers to successfully obtain the funding they need for their education. This section will Artikel the typical criteria, detail the application procedure, compare the processes of several major lenders, and provide a step-by-step guide to help you through the process.

Typical Eligibility Requirements for Private Student Loans

Private student loan lenders typically assess applicants based on several key factors. Credit history plays a significant role, with lenders often requiring a minimum credit score, demonstrating responsible financial behavior. Income verification is another common requirement, ensuring the applicant possesses the means to repay the loan. Co-signers, individuals who agree to share responsibility for repayment, are often requested for applicants with limited or poor credit histories. Enrollment at an eligible institution is also a prerequisite; lenders typically verify the applicant’s acceptance at an accredited college or university. Finally, the loan amount requested is considered, ensuring it aligns with the applicant’s financial capacity and the cost of their education. Specific requirements may vary depending on the lender and the type of loan.

The Private Student Loan Application Process

The application process generally involves several key steps. First, applicants will need to complete a comprehensive application form, providing personal and financial information. This often includes details such as Social Security number, date of birth, address, and employment history. Next, lenders typically require documentation to verify the information provided. This documentation often includes tax returns, pay stubs, and bank statements, to confirm income and financial stability. Credit reports are also commonly requested to assess creditworthiness. After reviewing the application and supporting documents, the lender will make a decision regarding loan approval and the offered terms. Finally, upon approval, the borrower will need to sign the loan documents and accept the terms and conditions before receiving the funds.

Comparison of Application Processes Across Prominent Lenders

While the general application process remains consistent across lenders, specific requirements and procedures may differ. For example, some lenders may offer streamlined online applications, while others may require more extensive paperwork. Some may prioritize credit scores more heavily than others, and their requirements for co-signers might also vary. Sallie Mae, for instance, is known for its user-friendly online platform and relatively straightforward application process. Discover Student Loans, on the other hand, might have a more rigorous review process, particularly for applicants with less-than-perfect credit. It is crucial to research and compare the application processes of different lenders to find one that best suits your individual circumstances.

Step-by-Step Guide for Navigating the Private Student Loan Application

1. Research and Compare Lenders: Begin by researching different private student loan lenders, comparing interest rates, fees, and repayment options.

2. Check Your Credit Report: Obtain a copy of your credit report to identify any errors and understand your credit score. A higher credit score generally improves your chances of loan approval and secures better interest rates.

3. Gather Required Documentation: Collect all necessary documentation, including tax returns, pay stubs, bank statements, and proof of enrollment. Having these documents readily available will streamline the application process.

4. Complete the Application: Carefully complete the online application form, ensuring accuracy and completeness of all information provided.

5. Submit Supporting Documents: Submit all required supporting documentation as instructed by the lender.

6. Review Loan Terms: Carefully review the loan terms and conditions before signing the loan agreement. Pay close attention to interest rates, fees, and repayment schedule.

7. Accept the Loan: Once you’ve reviewed and accepted the loan terms, you will receive the loan funds according to the lender’s disbursement schedule.

Types of Private Student Loans

Private student loans offer a diverse range of options to supplement federal student aid. Understanding these variations is crucial for selecting the loan that best aligns with individual financial circumstances and repayment capabilities. Different lenders offer various loan structures, impacting interest rates, repayment terms, and overall borrowing costs.

Fixed vs. Variable Interest Rates

Private student loans typically come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s term, providing predictable monthly payments. Conversely, a variable interest rate fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (although LIBOR is being phased out). This fluctuation can lead to unpredictable monthly payments, potentially increasing or decreasing over time.

Fixed-rate loans offer stability and predictability, making them suitable for borrowers who prefer consistent monthly payments and want to avoid the risk of rising interest rates. Variable-rate loans might offer lower initial interest rates, appealing to borrowers who anticipate paying off the loan quickly or believe interest rates will remain low or fall. However, the potential for increased payments makes them riskier for borrowers with less financial flexibility.

Loan Types Based on Borrower Profile

The ideal private student loan type varies significantly depending on the borrower’s individual financial situation and risk tolerance. For example, a borrower with a strong credit history and stable income might qualify for loans with more favorable terms, such as lower interest rates and flexible repayment options. Conversely, a borrower with a limited credit history or unstable income might face higher interest rates and less favorable repayment terms. Some lenders cater specifically to certain borrower profiles, offering specialized loan programs. For instance, some lenders might focus on graduate students, offering loans with higher borrowing limits tailored to the higher costs of advanced education.

Key Features of Different Private Student Loan Products

The following table summarizes key features of different private student loan products. Note that these are general examples and specific terms and conditions will vary based on the lender and individual borrower profile.

| Loan Type | Interest Rate Type | Repayment Options | Typical Borrower |

|---|---|---|---|

| Undergraduate Loan | Fixed or Variable | Standard, Graduated, Extended | Undergraduate student with co-signer |

| Graduate Loan | Fixed or Variable | Standard, Income-Driven (some lenders), Extended | Graduate student with or without co-signer (depending on credit history) |

| Parent Loan | Fixed or Variable | Standard, Extended | Parent borrowing on behalf of a student |

| Refinance Loan | Fixed or Variable | Standard, Extended | Borrower with existing student loans seeking lower interest rates or better terms |

Repayment Options and Considerations

Choosing the right repayment plan for your private student loan is crucial for managing your debt effectively and minimizing the total interest paid. Understanding the various options available and their implications is key to responsible borrowing. Different lenders offer different plans, so it’s vital to carefully review the terms and conditions before signing any loan agreement.

Private Student Loan Repayment Plans

Private student loan lenders typically offer several repayment plans, although the specific options and their features may vary. Common options include:

- Standard Repayment: This is usually a fixed monthly payment spread over a set period (often 10-15 years). It’s the simplest option but may result in higher total interest payments due to the longer repayment period.

- Graduated Repayment: Payments start low and gradually increase over time. This can be helpful in the early years after graduation when income is typically lower. However, the later payments can become significantly higher.

- Extended Repayment: This plan extends the repayment period beyond the standard timeframe, lowering monthly payments. However, extending the loan term significantly increases the total interest paid over the life of the loan.

- Interest-Only Repayment: For a specified period, borrowers only pay the interest accrued on the loan, delaying principal repayment. This can provide temporary relief, but the principal balance remains unchanged, leading to higher overall interest costs.

Impact of Repayment Schedules on Total Interest Paid

The length of your repayment plan significantly impacts the total interest paid. A longer repayment period, while resulting in lower monthly payments, means you’ll pay more interest over the loan’s lifetime. For example, a $50,000 loan with a 7% interest rate repaid over 10 years might have a total interest cost of $15,000, while the same loan repaid over 20 years could result in a total interest cost exceeding $30,000. This demonstrates the considerable financial implications of choosing a longer repayment schedule.

Strategies for Effective Student Loan Debt Management

Effective management of student loan debt involves proactive planning and disciplined budgeting. Strategies include:

- Budgeting and Prioritization: Create a detailed budget that includes your loan payments as a top priority. Track your income and expenses meticulously to ensure you can afford your monthly payments.

- Exploring Refinancing Options: Refinancing your loans with a lower interest rate can significantly reduce your total interest paid and monthly payments. However, carefully compare offers from different lenders before refinancing.

- Making Extra Payments: Whenever possible, make extra payments towards your principal balance to accelerate loan payoff and reduce the total interest paid. Even small extra payments can make a substantial difference over time.

- Seeking Professional Advice: If you’re struggling to manage your student loan debt, consider consulting a financial advisor or credit counselor for personalized guidance and support.

Tips for Borrowers Struggling with Repayment

Facing difficulty with student loan repayment requires immediate action to avoid delinquency and damage to your credit score. Options include:

- Contacting Your Lender: Reach out to your lender as soon as you anticipate trouble making payments. They may offer forbearance, deferment, or other temporary relief options.

- Income-Driven Repayment Plans (if applicable): While primarily associated with federal student loans, some private lenders may offer similar income-driven plans. Explore these options to potentially reduce monthly payments based on your income.

- Debt Consolidation: Combining multiple loans into a single loan with a potentially lower interest rate can simplify repayment and improve management.

- Seeking Government Assistance Programs: Explore if any government assistance programs are available in your region that might provide financial aid or support for debt repayment.

Risks and Potential Downsides

Private student loans, while offering a crucial funding source for higher education, come with inherent risks that borrowers must carefully consider. Understanding these risks and their potential consequences is vital to making informed borrowing decisions and avoiding future financial hardship. Failing to do so can lead to significant financial strain and negatively impact credit scores.

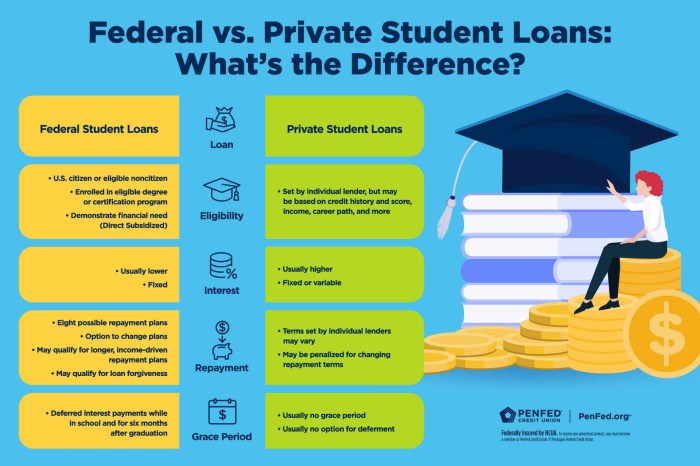

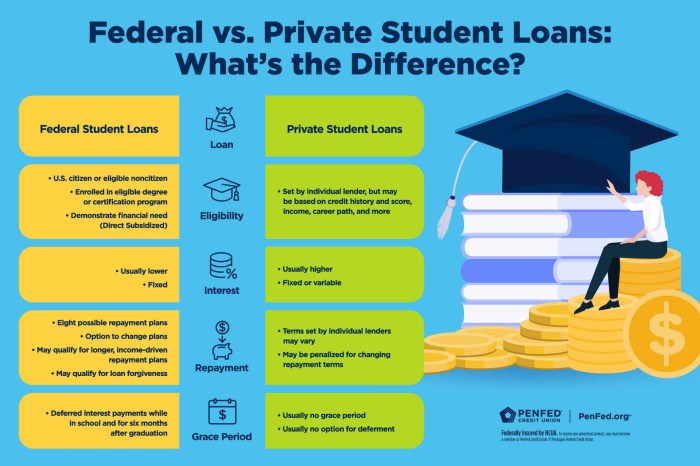

Private student loans differ significantly from federal student loans in terms of risk and protections. While federal loans offer various borrower protections, including income-driven repayment plans and loan forgiveness programs under certain circumstances, private loans generally lack such safeguards. This difference in risk profile necessitates a thorough understanding of the potential downsides before committing to a private loan.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe repercussions. Unlike federal student loans, which have specific processes for default and subsequent actions, private loan defaults often lead to immediate and aggressive collection efforts. These can include wage garnishment, bank account levies, and damage to credit scores. The impact on credit history can make it difficult to obtain future loans, mortgages, or even rent an apartment. Furthermore, private lenders may pursue legal action, potentially resulting in judgments and liens against assets. The specific consequences will vary based on the lender and the terms of the loan agreement, but the potential financial damage is substantial. For example, a borrower defaulting on a $50,000 private student loan could face significant legal fees, collection agency charges, and a severely damaged credit score, making it incredibly difficult to rebuild their financial stability for years.

Comparison of Risks: Private vs. Federal Student Loans

The key difference lies in the protections afforded to borrowers. Federal student loans offer various repayment options, including income-driven repayment plans that adjust payments based on income and family size. They also have programs like loan forgiveness for public service employees. Private loans generally lack these protections. Federal loans also typically have more lenient default processes and options for rehabilitation. In contrast, private loan defaults can trigger swift and aggressive collection actions with potentially devastating consequences. For instance, a borrower struggling with a federal student loan might be able to negotiate a repayment plan or explore options like deferment or forbearance. However, similar options are rarely available with private student loans, making them riskier for borrowers facing financial difficulties.

Mitigating Risks Associated with Private Student Loan Borrowing

Borrowers can take several steps to mitigate the risks associated with private student loans. Thoroughly researching and comparing loan offers from multiple lenders is crucial to securing the best terms and interest rates. Carefully considering the total cost of borrowing, including interest and fees, is essential to avoid accumulating excessive debt. Only borrowing what is absolutely necessary for educational expenses is a critical strategy. Creating a realistic budget and repayment plan before taking out a loan allows borrowers to assess their ability to manage monthly payments. Finally, maintaining open communication with the lender throughout the repayment process can help resolve issues proactively and avoid default. Proactive financial planning, such as establishing an emergency fund and tracking expenses diligently, will also help in mitigating potential risks.

Comparison with Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding the key differences between these two loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. Both offer funding for higher education, but their terms, benefits, and risks differ significantly.

Federal student loans, offered by the U.S. government, provide several borrower protections and benefits not typically found with private loans. Private student loans, on the other hand, are offered by banks and other private lenders, and their terms are often less favorable to borrowers.

Advantages and Disadvantages of Federal Student Loans

Federal student loans offer several advantages, including income-driven repayment plans, deferment and forbearance options during periods of financial hardship, and loan forgiveness programs for certain professions. However, they may have lower loan limits compared to private loans, and the application process can sometimes be more complex. The interest rates are typically fixed, but these rates are set by the government and can change annually. Additionally, federal student loans may require a credit check for some loan types, although this is not always the case.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer higher loan amounts and potentially lower interest rates than federal loans, particularly for borrowers with excellent credit. However, they lack the borrower protections of federal loans, such as income-driven repayment plans and loan forgiveness programs. Private loan interest rates are often variable, meaning they can fluctuate, leading to unpredictable monthly payments. Furthermore, obtaining a private loan typically requires a creditworthy co-signer, especially for students with limited or no credit history.

Circumstances Where a Private Loan Might Be Preferable

A private student loan might be a preferable option in situations where a student has exhausted their federal loan eligibility and still requires additional funding to cover educational expenses. Borrowers with excellent credit histories and stable financial situations may also qualify for lower interest rates on private loans than they would on federal loans. However, it is crucial to weigh these potential benefits against the risks involved, such as the lack of borrower protections. For example, a student pursuing a high-demand, high-earning career might be willing to take on a private loan with a potentially higher interest rate in exchange for the increased loan amount, knowing they will be able to manage the repayment comfortably.

Key Differences Between Federal and Private Student Loans

The following table summarizes the key differences between federal and private student loans:

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Lender | U.S. Government | Banks, credit unions, and other private lenders |

| Interest Rates | Fixed or variable, set by the government | Fixed or variable, set by the lender |

| Borrower Protections | Income-driven repayment plans, deferment, forbearance, loan forgiveness programs | Generally fewer borrower protections |

| Credit Check | May or may not be required depending on the loan type | Usually required, often requiring a co-signer |

| Loan Limits | Set by the government, may be lower than private loan limits | Generally higher loan limits, but dependent on creditworthiness |

Illustrative Examples of Loan Scenarios

Understanding the financial implications of private student loans requires examining real-world examples. These scenarios illustrate how loan terms, repayment plans, and borrower profiles influence the overall cost and repayment experience. We will explore two distinct cases to highlight the variability inherent in private student loan borrowing.

Scenario 1: Undergraduate Student with Standard Repayment

This example follows Sarah, a recent college graduate who borrowed $30,000 in private student loans to cover her undergraduate education. Her loan has a fixed interest rate of 7%, and a 10-year repayment term. The monthly payment, calculated using a standard amortization schedule, is approximately $360. Over the life of the loan, Sarah will pay approximately $13,200 in interest, resulting in a total repayment of $43,200.

Scenario 1: Impact of Different Repayment Options

If Sarah had chosen a shorter repayment term, such as 5 years, her monthly payments would increase significantly to approximately $600. However, the total interest paid would decrease substantially, potentially resulting in a total repayment closer to $36,000. Conversely, extending the repayment term to 15 years would lower her monthly payments to approximately $260, but the total interest paid would increase significantly, potentially exceeding $20,000 and leading to a total repayment exceeding $50,000. This demonstrates the trade-off between monthly payment affordability and long-term cost.

Scenario 2: Graduate Student with Variable Interest Rate

This scenario involves David, a graduate student pursuing a Master’s degree. He borrowed $50,000 with a variable interest rate loan, starting at 6% but potentially fluctuating throughout the repayment period. His loan has a 12-year repayment term. Because of the variable rate, predicting his exact total repayment is challenging. However, assuming an average interest rate of 7% over the loan’s lifetime, his monthly payment would be approximately $500, leading to an estimated total interest payment of approximately $22,000 and a total repayment of $72,000. The fluctuating interest rate introduces a degree of uncertainty into his repayment plan, emphasizing the importance of careful budgeting and financial planning in such situations. The variable interest rate could increase his total repayment significantly if rates rise during his repayment period.

Final Review

Securing a higher education often necessitates careful consideration of financing options. While private student loans provide an avenue for funding, responsible borrowing is paramount. By understanding the intricacies of eligibility, loan types, repayment schedules, and potential risks, you can navigate the application process effectively and make informed decisions aligned with your financial capabilities. Remember to compare options thoroughly and explore all available resources before committing to a private student loan.

FAQ Insights

What is the difference between a fixed and variable interest rate on a private student loan?

A fixed interest rate remains constant throughout the loan’s term, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may initially be lower but could increase over time.

Can I consolidate my private student loans?

Yes, some lenders offer private student loan consolidation options, allowing you to combine multiple loans into a single payment. This can simplify repayment but may not always lower your overall interest rate.

What happens if I default on a private student loan?

Defaulting on a private student loan can severely damage your credit score, potentially impacting your ability to secure loans, rent an apartment, or even get a job. Collection agencies may pursue legal action to recover the debt.

Are there any government programs to help with private student loan repayment?

Unlike federal student loans, private student loans generally don’t qualify for government repayment assistance programs like income-driven repayment plans. However, some lenders may offer hardship programs.