Navigating the complexities of postgraduate education often involves confronting the substantial financial burden of student loans. This guide delves into the multifaceted world of post-grad student loan debt, providing essential information and practical strategies for managing repayment, minimizing financial strain, and making informed decisions about your future.

From understanding the various loan types and repayment plans available to developing effective budgeting techniques and exploring career paths that align with your financial realities, we aim to empower you with the knowledge and tools needed to successfully manage your post-graduate student loan debt. We’ll also address the long-term implications of these loans on major life decisions, ensuring you’re well-equipped to build a secure financial future.

Understanding Post-Grad Student Loan Debt

Pursuing postgraduate education often requires significant financial investment, and student loans frequently play a crucial role in bridging the gap between tuition costs and personal resources. Understanding the nuances of post-graduate student loan debt is therefore paramount for successful financial planning and responsible borrowing. This section will provide a clearer picture of the landscape of post-graduate student loans in the United States.

The average amount of student loan debt for postgraduate students in the US varies depending on the degree pursued, the institution attended, and the student’s individual circumstances. However, data from sources like the National Center for Education Statistics and the Federal Reserve consistently show that postgraduate students often carry significantly higher loan balances than undergraduate students. While precise figures fluctuate, it’s not uncommon for postgraduate students to graduate with debts exceeding $50,000, with many owing considerably more, particularly those pursuing professional degrees like law or medicine.

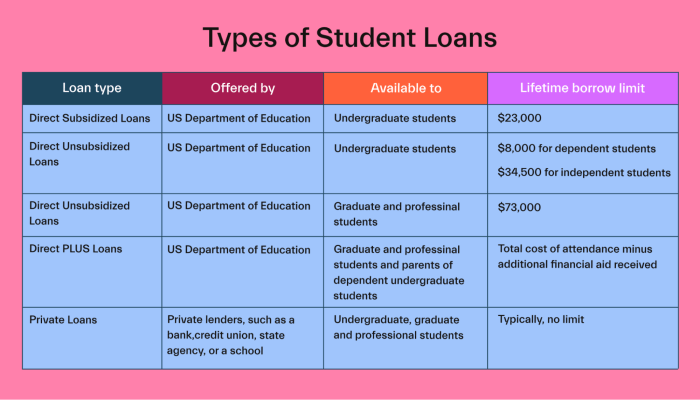

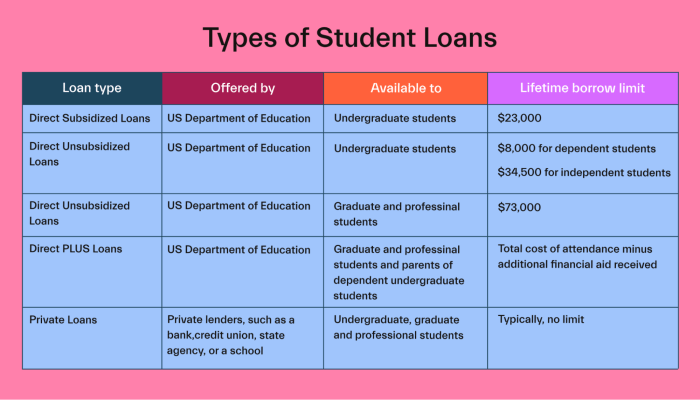

Types of Post-Graduate Student Loans

Postgraduate students have access to several types of loans to fund their education. These loans differ significantly in their terms, interest rates, and eligibility requirements. A thorough understanding of these distinctions is vital for making informed borrowing decisions.

Federal student loans are generally preferred due to their borrower protections and flexible repayment options. These include Direct Unsubsidized Loans and Direct Graduate PLUS Loans. Direct Unsubsidized Loans accrue interest from the time of disbursement, while Direct Graduate PLUS Loans are available to graduate students who meet certain credit requirements. Private student loans, offered by banks and other financial institutions, are another option but typically come with higher interest rates and less favorable repayment terms. They are often considered only after exhausting federal loan options.

Interest Rates and Repayment Terms

Interest rates and repayment terms are key factors influencing the overall cost of a postgraduate loan. Federal loan interest rates are set by the government and are typically lower than private loan rates. These rates can fluctuate, depending on market conditions and the specific loan program. Repayment terms for federal loans offer various options, including standard repayment plans (fixed monthly payments over a 10-year period), graduated repayment plans (payments increase over time), and income-driven repayment plans (payments are based on a percentage of the borrower’s discretionary income).

Private loan interest rates are generally variable and often higher than federal loan rates. Repayment terms for private loans vary depending on the lender, but they typically offer shorter repayment periods than federal loans. For example, a private loan might offer a 5-year repayment term, while a federal loan might have a 10-year repayment term. This shorter term results in higher monthly payments but potentially lower overall interest paid.

Implications of Different Repayment Plans

Choosing the right repayment plan significantly impacts the long-term cost of a postgraduate loan. A standard repayment plan offers predictable monthly payments but may lead to higher overall interest payments due to the longer repayment period. Graduated repayment plans start with lower payments but increase over time, potentially making later payments difficult to manage.

Income-driven repayment plans (IDR) are designed to make loans more manageable for borrowers with lower incomes. These plans tie monthly payments to a percentage of discretionary income, and any remaining balance may be forgiven after a specified period (typically 20 or 25 years), depending on the specific plan. However, IDR plans generally result in higher total interest paid over the life of the loan due to the extended repayment period and potential forgiveness of remaining balance.

Managing Post-Grad Student Loan Repayment

Successfully navigating post-graduate student loan debt requires a proactive and organized approach. Understanding your repayment options and developing a robust budget are crucial steps to minimizing stress and ensuring timely payments. This section will guide you through the process of creating a manageable repayment plan.

Creating a Post-Graduation Budget Incorporating Loan Repayment

Building a budget that accommodates your student loan payments is fundamental to responsible repayment. This involves meticulously tracking your income and expenses, allocating funds for loan repayments, and identifying areas where you can potentially reduce spending. A realistic budget will prevent missed payments and associated penalties.

- Track your income: Record all sources of income, including your salary, any part-time jobs, or other earnings.

- Categorize your expenses: List all your monthly expenses, such as rent, utilities, groceries, transportation, and entertainment. Be as detailed as possible.

- Determine your loan payment amount: Calculate your monthly student loan payment based on your loan terms and repayment plan.

- Allocate funds for loan repayment: Include your loan payment as a non-negotiable expense in your budget.

- Identify areas for savings: Analyze your spending habits and identify areas where you can cut back to free up more money for loan repayment.

- Regularly review and adjust: Your budget isn’t static. Regularly review your income and expenses to make necessary adjustments.

Sample Loan Repayment Schedule

The following table illustrates a simplified example of loan repayment over a 12-month period. Remember, this is a sample and your actual repayment schedule will depend on your loan terms and payment plan.

| Month | Income | Loan Payment | Remaining Balance |

|---|---|---|---|

| January | $3000 | $500 | $15000 |

| February | $3000 | $500 | $14500 |

| March | $3000 | $500 | $14000 |

| April | $3000 | $500 | $13500 |

| May | $3000 | $500 | $13000 |

| June | $3000 | $500 | $12500 |

| July | $3000 | $500 | $12000 |

| August | $3000 | $500 | $11500 |

| September | $3000 | $500 | $11000 |

| October | $3000 | $500 | $10500 |

| November | $3000 | $500 | $10000 |

| December | $3000 | $500 | $9500 |

Strategies for Minimizing Interest Payments

Making extra payments, even small ones, can significantly reduce the total interest paid over the life of your loan. Consider making bi-weekly payments instead of monthly, or making one extra payment per year. This will shorten the repayment period and lower your overall interest costs. Additionally, exploring options like income-driven repayment plans can provide temporary relief and potentially lower monthly payments, though it might extend the repayment period.

Refinancing Student Loans: Benefits and Drawbacks

Refinancing student loans involves replacing your existing loans with a new loan from a different lender, often with a lower interest rate.

Benefits: Lower interest rates can lead to significant savings over the life of the loan and lower monthly payments.

Drawbacks: Refinancing might extend the repayment period, potentially increasing the total interest paid if you don’t pay it off early. Furthermore, refinancing federal loans with private loans can mean losing access to federal repayment assistance programs and protections. Careful consideration of the terms and conditions of any refinancing offer is crucial before making a decision.

The Impact of Post-Grad Student Loans on Career Choices

The weight of postgraduate student loan debt significantly impacts the career paths pursued by recent graduates. The financial burden often necessitates prioritizing immediate income over passion or long-term career goals, leading to potentially less fulfilling professional lives. This influence extends beyond immediate salary considerations, affecting choices regarding location, industry, and even job security.

The financial constraints imposed by substantial student loan debt can significantly alter career trajectories. Graduates may feel pressured to accept higher-paying jobs, even if those positions don’t align with their interests or long-term career aspirations. This can lead to feelings of dissatisfaction and a sense of being trapped in a career path chosen primarily for financial necessity rather than personal fulfillment. The pressure to repay loans quickly can also limit the exploration of less lucrative but potentially more fulfilling career options, such as non-profit work or artistic pursuits.

Challenges Faced by Graduates with High Student Loan Debt

High levels of student loan debt present numerous challenges for post-graduate students entering the workforce. These challenges often extend beyond the immediate financial burden, impacting mental health, lifestyle choices, and overall career satisfaction. The constant pressure of repayment can lead to increased stress and anxiety, affecting job performance and overall well-being. Moreover, the financial burden can limit opportunities for professional development, such as attending conferences or pursuing further education, which can hinder career advancement. The need to prioritize debt repayment may also delay major life decisions, such as buying a home or starting a family, impacting overall life satisfaction.

Job Satisfaction Comparison: Graduates with and without Significant Student Loan Debt

Studies have indicated a correlation between high student loan debt and lower levels of job satisfaction among graduates. While direct causation is difficult to establish definitively, graduates burdened with significant debt often report feeling less fulfilled in their careers. This is likely due to the compromises they make in their career choices to prioritize debt repayment. Conversely, graduates without substantial debt often have more freedom to pursue careers aligned with their passions, potentially leading to greater job satisfaction and a stronger sense of career fulfillment. For example, a graduate with significant debt might accept a high-paying but stressful corporate job, while a graduate without debt might choose a lower-paying but more fulfilling role in a non-profit organization.

Strategies for Navigating Career Decisions While Managing Student Loan Debt

Managing student loan debt while making crucial career decisions requires careful planning and strategic thinking. It’s essential to create a comprehensive budget that accounts for loan repayments, living expenses, and other financial obligations.

- Prioritize Budgeting and Financial Planning: Create a detailed budget that accounts for all income and expenses, including loan repayments. This allows for informed decision-making regarding career choices and lifestyle adjustments.

- Explore Income-Driven Repayment Plans: Investigate various income-driven repayment plans offered by the government. These plans adjust monthly payments based on income, making them more manageable for graduates with lower salaries.

- Negotiate Salary and Benefits: Don’t be afraid to negotiate salary and benefits during the job search process. A slightly higher salary can significantly impact the ability to manage loan repayments.

- Seek Career Counseling: Utilize career counseling services to explore career options that align with both your interests and financial realities. A counselor can help navigate the complexities of balancing passion and financial constraints.

- Consider Part-Time or Gig Work: Supplement income through part-time work or freelance opportunities to accelerate loan repayment and alleviate financial stress.

Resources and Support for Post-Grad Student Loan Borrowers

Navigating the complexities of post-graduate student loan debt can feel overwhelming, but numerous resources and support systems are available to help borrowers manage their repayments and alleviate financial stress. Understanding these options is crucial for successful repayment and overall financial well-being. This section Artikels key resources, assistance programs, and strategies for managing your student loan debt effectively.

Reputable Organizations and Government Agencies Offering Assistance

Several organizations and government agencies provide invaluable assistance to student loan borrowers. These entities offer a range of services, from loan repayment counseling to programs designed to reduce or forgive debt. Accessing these resources can significantly improve your ability to manage your student loans.

- The Federal Student Aid website (studentaid.gov): This is the primary source for information on federal student loans, including repayment plans, forgiveness programs, and other assistance options. The site provides detailed information on eligibility requirements and application processes.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that offers free and low-cost credit counseling services, including assistance with student loan debt management. They can help you create a budget, explore repayment options, and negotiate with your lenders.

- Your Loan Servicer: Your loan servicer is the company responsible for managing your student loans. They can answer questions about your loan, provide information about repayment options, and help you navigate any difficulties you may encounter.

- State and Local Agencies: Many states and local governments offer resources and programs to assist with student loan repayment. These programs may vary, so it’s important to check with your state’s education or financial aid agency.

Types of Assistance Available for Student Loan Borrowers

A variety of assistance programs exist to help borrowers manage their student loan debt. These programs offer different levels of support, catering to various financial situations and needs.

- Income-Driven Repayment (IDR) Plans: IDR plans adjust your monthly payments based on your income and family size. Several IDR plans exist, including the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE) plans. These plans can significantly lower monthly payments, making repayment more manageable.

- Loan Forgiveness Programs: Certain professions, such as teaching and public service, may qualify for loan forgiveness programs after meeting specific requirements, such as a set number of years of service. These programs can eliminate a portion or all of your student loan debt.

- Deferment and Forbearance: In times of financial hardship, borrowers may be eligible for deferment or forbearance, which temporarily suspends or reduces their loan payments. These options should be considered carefully, as interest may still accrue during these periods.

- Loan Consolidation: Combining multiple student loans into a single loan can simplify repayment and potentially lower your interest rate. However, it’s crucial to compare the terms and conditions of consolidation options before making a decision.

Applying for Income-Driven Repayment Plans

The application process for IDR plans typically involves completing a form that requests information about your income and family size. This information is used to calculate your monthly payment. The process is generally straightforward and can be completed online through the Federal Student Aid website. It’s recommended to carefully review the requirements and eligibility criteria for each plan before applying. Many servicers offer online tools and resources to guide you through the application.

Managing Financial Stress Related to Student Loan Debt

Student loan debt can be a significant source of stress. Effective strategies for managing this stress involve both financial planning and mental health support.

- Debt Management Strategies: Creating a realistic budget, prioritizing debt repayment, and exploring options like debt consolidation or IDR plans can alleviate financial stress. Seeking professional financial advice can provide personalized guidance and support.

- Mental Health Support: The emotional toll of student loan debt can be substantial. Seeking support from mental health professionals, support groups, or online resources can help manage stress, anxiety, and depression related to financial concerns. Open communication with friends and family can also provide valuable emotional support.

Long-Term Financial Planning with Post-Grad Student Loans

Navigating the complexities of post-graduate life often involves managing significant student loan debt. Successfully integrating loan repayment into a comprehensive long-term financial plan is crucial for achieving financial stability and pursuing your long-term goals. This section Artikels key strategies to achieve this.

Incorporating Student Loan Repayment into a Long-Term Financial Plan

A successful long-term financial plan must account for student loan repayments. This requires a realistic assessment of your income, expenses, and loan repayment schedule. Begin by creating a detailed budget that includes all income sources and necessary expenses, such as housing, transportation, food, and utilities. Allocate a specific amount each month for student loan payments, ensuring this amount is manageable within your budget. Consider exploring different repayment plans (e.g., income-driven repayment) to find one that aligns with your financial situation. Regularly review and adjust your budget as your income and expenses change. This proactive approach ensures your loan payments remain manageable and you can still save and invest.

Building Good Credit After Graduation and Loan Repayment

Establishing good credit is vital for accessing future financial opportunities, such as mortgages, auto loans, and credit cards with favorable interest rates. Consistent on-time student loan payments significantly contribute to building a positive credit history. Beyond loan repayment, consider obtaining a secured credit card, which requires a security deposit, to establish credit. Use the card responsibly, keeping your spending low and paying your balance in full each month. Regularly monitor your credit report for accuracy and identify any potential issues. Over time, responsible credit use will improve your credit score, opening doors to better financial products and terms.

Saving and Investing While Managing Student Loan Debt

Saving and investing may seem challenging while managing student loan debt, but it’s crucial for long-term financial security. Prioritize building an emergency fund to cover unexpected expenses, aiming for three to six months’ worth of living expenses. Once the emergency fund is established, start investing, even if it’s a small amount. Consider low-cost index funds or employer-sponsored retirement plans like 401(k)s. Investing early allows your money to grow over time through compound interest, helping you build wealth for the future despite your loan payments.

Impact of Student Loan Debt on Major Life Decisions

Student loan debt can significantly influence major life decisions. For example, buying a home may require a larger down payment or a longer mortgage term to compensate for the debt. Similarly, starting a family can necessitate careful budgeting and financial planning to manage childcare expenses alongside loan repayments. Consider delaying major purchases until your debt is reduced or manageable. Thorough financial planning, including realistic budgeting and exploring different financial options, is essential to navigate these life decisions effectively while managing student loan debt. For example, a couple with significant student loan debt might choose to rent a smaller apartment initially rather than buying a large house, delaying homeownership until their debt is reduced. Similarly, they might delay having children until their financial situation is more stable.

Closure

Successfully managing post-graduate student loan debt requires a proactive and informed approach. By understanding the various loan options, developing a realistic budget, and utilizing available resources, you can navigate this challenging financial landscape effectively. Remember, seeking guidance from financial professionals and utilizing available support services can significantly alleviate stress and pave the way for a financially secure future, even with significant student loan debt.

Answers to Common Questions

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can help explore options like forbearance, deferment, or income-driven repayment plans to avoid default.

Can I deduct student loan interest from my taxes?

Possibly. The student loan interest deduction allows you to deduct the amount you paid in student loan interest during the tax year, up to a certain limit. Eligibility requirements apply; check the IRS website for details.

What is loan forgiveness?

Loan forgiveness programs, such as those for public service or certain professions, can eliminate a portion or all of your student loan debt after meeting specific requirements. Eligibility varies greatly depending on the program.

How does credit score impact loan refinancing?

A higher credit score typically qualifies you for lower interest rates when refinancing student loans. Lenders assess your creditworthiness to determine the risk involved in lending you money.