The intersection of poverty and student loans presents a complex challenge for millions of students globally. While higher education is often touted as a pathway to economic mobility, the high cost of tuition and the burden of student loan debt can exacerbate existing inequalities for those already struggling financially. This exploration delves into the multifaceted relationship between poverty, student loans, and educational attainment, examining the effectiveness of current loan programs, identifying barriers to access, and proposing potential solutions to ensure equitable access to higher education for all.

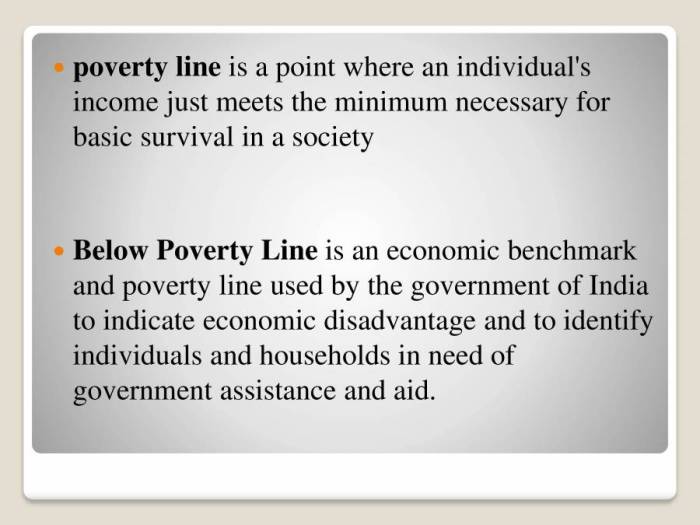

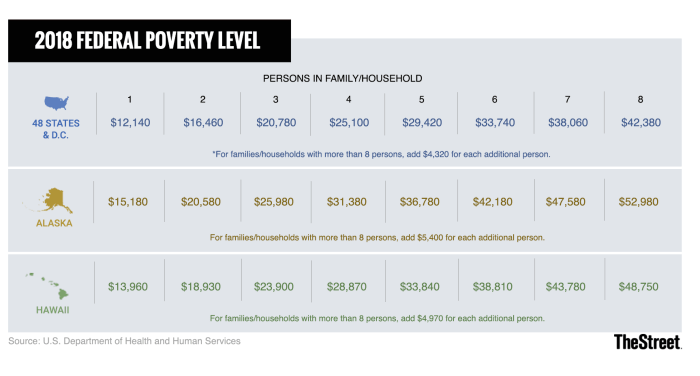

We will analyze how varying definitions of the poverty line across different regions impact student access to financial aid, explore the socioeconomic factors contributing to students’ financial struggles, and investigate the long-term consequences of student loan debt on individuals and society. The analysis will also include a comparative study of student loan programs, highlighting their strengths and weaknesses in supporting low-income students, and will conclude with policy recommendations aimed at improving affordability and accessibility.

Defining the Poverty Line and its Impact on Students

The poverty line, a crucial socioeconomic indicator, significantly impacts students’ access to education and overall well-being. Its definition and implications vary considerably across the globe, highlighting the complex nature of global inequality and its effect on educational opportunities. Understanding these variations is essential for developing effective policies to support students from impoverished backgrounds.

Variations in Poverty Line Definitions

The poverty line, also known as the poverty threshold, isn’t universally defined. Different countries and regions employ varying methodologies, leading to diverse interpretations of what constitutes poverty. Some nations utilize absolute poverty lines, based on a fixed minimum level of consumption or income necessary for basic survival, often expressed in terms of purchasing power parity (PPP). Others use relative poverty lines, which define poverty relative to the median or average income within a specific country or region. This means a family considered poor in a wealthy country might be considered relatively affluent in a less developed one. Furthermore, the components considered—food, housing, healthcare, education—can also differ, resulting in significant variations in poverty rates across geographical areas. For instance, the World Bank uses an international poverty line, adjusted for purchasing power parity, while individual countries often have their own national poverty lines reflecting their specific economic conditions and cost of living.

Socioeconomic Factors Contributing to Student Poverty

Several socioeconomic factors contribute to students falling below the poverty line. These include parental unemployment or underemployment, low family income, lack of access to quality healthcare and nutrition, unstable housing situations, and limited access to resources like technology and reliable transportation. In many cases, these factors are interconnected, creating a cycle of poverty that is difficult to break. For example, a lack of access to quality healthcare can lead to chronic illnesses affecting a parent’s ability to work, thus reducing family income and increasing the likelihood of children living in poverty. Similarly, inadequate housing can negatively impact a child’s education by disrupting their sleep, leading to poor concentration in school, and reducing access to safe learning environments.

Challenges Faced by Students Living in Poverty

Students living in poverty face numerous challenges that significantly impact their educational outcomes. These include difficulties concentrating in class due to hunger or lack of sleep, limited access to educational resources such as textbooks and technology, and increased stress related to financial insecurity and unstable living situations. Many students from impoverished backgrounds may also lack access to adequate healthcare, leading to absenteeism and difficulty keeping up with their studies. The added burden of working to support their families further reduces their time available for studying, impacting their academic performance. Additionally, the stigma associated with poverty can create social isolation and psychological distress, affecting their overall well-being and academic success.

Statistics on Students Affected by Poverty

Precise global statistics on students affected by poverty are challenging to obtain due to variations in data collection methods and definitions. However, numerous reports from organizations like UNICEF, UNESCO, and the World Bank highlight the significant number of children and young people affected. The following table provides a snapshot of estimated figures, acknowledging the limitations and potential inaccuracies due to data variations across regions and countries. It is crucial to note that these are estimates and the actual numbers could be significantly higher.

| Region | Poverty Level (Example: % of children under 18 below national poverty line) | Number of Students Affected (Estimate) | Source/Notes |

|---|---|---|---|

| Sub-Saharan Africa | 40% | (Illustrative – Requires specific research to populate) | UNICEF, World Bank data (requires specific citation) |

| South Asia | 30% | (Illustrative – Requires specific research to populate) | UNICEF, World Bank data (requires specific citation) |

| Latin America | 15% | (Illustrative – Requires specific research to populate) | World Bank, regional reports (requires specific citation) |

| East Asia and Pacific | 10% | (Illustrative – Requires specific research to populate) | World Bank, regional reports (requires specific citation) |

The Role of Student Loans in Addressing Poverty

Student loan programs are designed to provide access to higher education for individuals who may not otherwise be able to afford it. However, their effectiveness in alleviating poverty is a complex issue with both benefits and drawbacks, particularly for students from low-income backgrounds. While loans can open doors to better-paying jobs and improved socioeconomic mobility, the burden of debt can also create significant financial hardship, potentially exacerbating existing inequalities.

The effectiveness of student loan programs in poverty alleviation hinges on several factors, including the availability of sufficient funding, the design of repayment plans, and the overall economic climate. For example, programs offering generous grants alongside loans might prove more effective in reducing the financial strain on low-income students compared to loan-only programs. Conversely, a weak job market after graduation can significantly hinder the ability of students to repay their loans, regardless of the initial loan terms.

Accessibility and Affordability of Different Student Loan Programs

Several types of student loan programs exist, each with varying levels of accessibility and affordability for low-income students. Federal student loan programs, such as subsidized and unsubsidized Stafford Loans and Perkins Loans, often offer lower interest rates and more flexible repayment options than private loans. However, even federal loans can be challenging for low-income students to manage, especially if they lack access to financial literacy resources or family support. Private loans, while potentially easier to obtain, frequently come with higher interest rates and less favorable terms, potentially leading to a greater debt burden. The availability of grant programs and scholarships plays a crucial role in mitigating the need for borrowing and reducing the overall financial burden on low-income students.

Barriers to Accessing Student Loans for Low-Income Students

Low-income students often face several barriers in accessing student loans. These include limited awareness of available programs, complex application processes, and stringent credit requirements. Many low-income students lack the financial literacy skills necessary to navigate the loan application process effectively and make informed decisions about borrowing. Furthermore, a lack of family support or access to financial advising can significantly hinder their ability to secure adequate funding. The requirement for a credit history, often lacking among young adults from low-income backgrounds, can also prevent them from accessing private loans.

Consequences of Student Loan Debt for Low-Income Students

The consequences of student loan debt can be particularly severe for students from low-income backgrounds. The burden of repayment can delay major life milestones such as homeownership, starting a family, and retirement planning. High levels of student loan debt can also negatively impact mental health and overall well-being. In extreme cases, it can lead to bankruptcy or other serious financial difficulties. The inability to repay loans can also affect credit scores, making it more difficult to secure loans or other financial products in the future. For example, a student from a low-income family who takes out significant loans to attend a four-year university might find themselves struggling to repay the debt even after securing a job, potentially leading to a cycle of debt that limits their future financial opportunities.

The Relationship Between Poverty, Student Loans, and Educational Outcomes

The complex interplay between poverty, student loan debt, and educational attainment significantly impacts individuals’ life trajectories. Students from low-income backgrounds often face considerable challenges in accessing and completing higher education, and the burden of student loan debt can exacerbate these difficulties, leading to long-term financial instability and limiting career options. Understanding this relationship is crucial for developing effective interventions to promote educational equity and economic mobility.

Correlation Between Poverty, Student Loan Debt, and College Completion Rates

Numerous studies demonstrate a strong negative correlation between poverty and college completion rates. Students from low-income families are less likely to enroll in college, and even if they do enroll, they face higher rates of attrition. This is partly due to factors like limited access to high-quality K-12 education, lack of financial resources for college expenses (beyond tuition), and increased stress related to financial insecurity. The accumulation of student loan debt further complicates matters; students struggling financially may be forced to work more hours, reducing their ability to focus on their studies, increasing the likelihood of dropping out before graduation. For instance, a study by the National Center for Education Statistics (NCES) consistently shows a lower graduation rate for students receiving Pell Grants (a federal need-based grant program) compared to their non-Pell Grant receiving peers. This disparity highlights the significant challenges faced by low-income students.

Impact of Student Loan Debt on Career Choices and Long-Term Financial Stability

The weight of student loan debt can significantly influence career choices and long-term financial stability. Graduates burdened with substantial debt may prioritize higher-paying jobs, even if those jobs are less fulfilling or don’t align with their passions. This can lead to career dissatisfaction and reduced overall well-being. Furthermore, high levels of student loan debt can delay major life decisions such as homeownership, starting a family, or investing in retirement. The long repayment periods and potentially high interest rates can create a cycle of debt, limiting financial flexibility and hindering the accumulation of wealth. For example, a graduate with $100,000 in student loan debt at a 7% interest rate might face monthly payments significantly impacting their disposable income for many years, delaying major financial milestones.

Examples of Support Systems and Programs for Low-Income Students

Several support systems and programs aim to assist low-income students in achieving academic and financial success. Federal Pell Grants provide need-based financial aid, reducing the burden of tuition costs. Many colleges and universities offer institutional grants and scholarships specifically for low-income students. Additionally, programs like the TRIO programs (e.g., Upward Bound, Talent Search) provide academic support, mentoring, and college preparation services. Some institutions also offer financial literacy workshops and counseling services to help students manage their finances effectively. These initiatives, while valuable, often face funding limitations and are not universally accessible.

Effective Strategies for Institutions to Improve Support for Low-Income Students

Institutions can implement several strategies to enhance support for students from low-income backgrounds.

- Increase the availability and accessibility of need-based financial aid.

- Expand mentoring and academic support programs tailored to the specific needs of low-income students.

- Offer comprehensive financial literacy education and counseling services.

- Create pathways to reduce the overall cost of attendance, such as tuition reduction programs and affordable housing options.

- Implement early alert systems to identify students at risk of academic failure and provide timely interventions.

- Foster a supportive and inclusive campus climate that addresses the unique challenges faced by low-income students.

Policy Recommendations and Potential Solutions

Addressing the intertwined challenges of poverty and student loan debt requires a multifaceted approach focusing on increased accessibility, affordability, and alternative financial aid models. This section Artikels specific policy recommendations and solutions designed to alleviate the burden on low-income students and improve their educational and economic outcomes.

Improved Accessibility and Affordability of Student Loans

Several policy changes can significantly improve access to and affordability of student loans for low-income students. These include expanding eligibility criteria for need-based grants and scholarships, increasing the maximum loan amounts available to students from low-income families, and simplifying the application process to reduce administrative burdens and potential barriers. Furthermore, implementing income-driven repayment plans that cap monthly payments at a percentage of discretionary income can make repayment more manageable for borrowers struggling with financial hardship. This could be modeled after existing income-driven repayment programs, but with adjustments to ensure lower monthly payments for the lowest income earners. For example, a program could cap monthly payments at 5% of discretionary income for borrowers earning below the federal poverty line.

Addressing Challenges Faced by Students Burdened by Debt and Living in Poverty

Students burdened by student loan debt while living in poverty often face a cascade of interconnected challenges. A comprehensive plan must address these issues holistically. This involves expanding access to debt counseling and financial literacy programs specifically tailored to the needs of low-income students. Furthermore, implementing loan forgiveness programs for borrowers who work in public service or low-income communities could incentivize individuals to pursue careers that benefit society while alleviating their debt burden. Finally, integrating mental health support services into financial aid packages can address the stress and anxiety associated with financial hardship. A pilot program in a specific state could test the efficacy of providing subsidized therapy sessions to students struggling with student loan debt.

Alternative Financial Aid Models

Exploring alternative financial aid models is crucial to create a more equitable system. One such model is expanding the use of income-share agreements (ISAs), where investors provide funding in exchange for a percentage of a student’s future earnings. This model aligns repayment with a student’s ability to pay, reducing the risk of default. However, careful regulation is needed to prevent predatory practices. Another alternative is increasing investment in grant programs and scholarships, shifting the emphasis away from loans and towards direct financial support. This could include expanding Pell Grants and creating new, targeted scholarship programs for students from specific low-income communities or those pursuing high-demand, low-wage careers like nursing or teaching.

Visual Representation of Policy Changes

A bar graph could effectively illustrate the impact of proposed policy changes. The horizontal axis would represent time (e.g., years), and the vertical axis would represent the percentage of students in poverty and the average student loan debt. One bar would represent the current situation, showing high poverty rates and substantial student debt. A second bar, representing the projected impact of the proposed policies, would demonstrate a decrease in both poverty rates and average student loan debt. The difference between the two bars would visually highlight the positive impact of the proposed interventions. For example, the graph could show a hypothetical reduction in poverty rates from 20% to 15% and a reduction in average student loan debt from $40,000 to $30,000 over a five-year period. This visual representation would effectively communicate the potential benefits of the proposed policy changes.

Long-Term Impacts and Societal Consequences

The burden of student loan debt extends far beyond the immediate financial strain on individuals. Its long-term consequences ripple through various aspects of personal lives and have significant societal implications, impacting economic growth, social mobility, and overall well-being. Understanding these impacts is crucial for developing effective policies to mitigate the negative effects and harness the potential benefits of education for all.

The accumulation of substantial student loan debt can significantly hinder an individual’s ability to achieve key life milestones. For example, delayed homeownership, postponed family planning, and reduced retirement savings are common experiences. This financial burden can lead to increased stress, impacting mental and physical health, and potentially limiting career choices as individuals prioritize debt repayment over pursuing potentially higher-paying but riskier career paths. On a societal level, high levels of student debt can stifle economic growth by reducing consumer spending and hindering entrepreneurship. Individuals burdened by debt may be less likely to invest in businesses or contribute to the economy through purchases of goods and services.

Long-Term Consequences for Individuals

High student loan debt can lead to a cascade of negative consequences for individuals. Delayed marriage and parenthood are frequently observed, as individuals prioritize debt repayment over starting a family. The inability to purchase a home, a significant investment for many, is another common consequence. This can lead to reduced financial security and limit opportunities for wealth accumulation. Furthermore, the constant pressure of debt repayment can contribute to increased stress levels and negatively impact mental health, potentially leading to anxiety and depression. Career choices may be restricted, with individuals opting for stable, lower-paying jobs to ensure reliable income for debt repayment, potentially hindering their professional growth and earning potential. Finally, the long-term financial strain of student loan debt can significantly reduce retirement savings, leading to financial insecurity in later life.

Societal Benefits of Investing in Education for Low-Income Students

Investing in education for low-income students yields substantial societal benefits. A well-educated population is more productive and innovative, contributing to economic growth and technological advancement. Increased educational attainment leads to lower crime rates and improved public health outcomes, reducing the strain on social services. Furthermore, a more educated populace is better equipped to participate in democratic processes, leading to a more engaged and informed citizenry. Improved social mobility, allowing individuals to rise above the circumstances of their birth, strengthens social cohesion and reduces inequality. This investment not only benefits individuals but also strengthens the fabric of society as a whole. For instance, studies have shown a strong correlation between increased educational attainment and reduced poverty rates.

Intergenerational Effects of Poverty and Student Loan Debt

The effects of poverty and student loan debt are often intergenerational. Parents struggling with significant debt may be less able to provide financial support for their children’s education, perpetuating a cycle of poverty and limited opportunities. Children from low-income families may face additional barriers to accessing higher education, further limiting their future prospects. This cycle can be broken through targeted interventions such as increased financial aid, mentoring programs, and improved access to early childhood education, fostering a more equitable and just society. The legacy of student loan debt can also influence family structures and financial stability for generations to come.

Potential Positive Societal Outcomes from Improved Student Loan Accessibility and Affordability

Improved student loan accessibility and affordability for low-income students would lead to several positive societal outcomes.

- Increased graduation rates and reduced dropout rates, leading to a more skilled workforce.

- Higher earning potential for individuals, resulting in increased tax revenue and economic growth.

- Reduced poverty rates and improved social mobility, creating a more equitable society.

- Improved public health outcomes due to increased access to healthcare and healthier lifestyles.

- Enhanced civic engagement and participation in democratic processes.

- Reduced crime rates and increased social stability.

- Increased innovation and technological advancement driven by a more highly skilled workforce.

Summary

Addressing the challenges faced by students living below the poverty line requires a multi-pronged approach. Simply providing access to loans is insufficient; we must also address the underlying systemic issues that perpetuate poverty and limit educational opportunities. This requires a commitment to comprehensive reforms that improve affordability, increase accessibility to financial aid, and provide robust support systems to help students succeed academically and financially. Ultimately, investing in education for low-income students is an investment in a more equitable and prosperous future for all.

Query Resolution

What are the typical repayment options for poverty line student loans?

Repayment options vary depending on the loan program and country. Income-driven repayment plans, which tie monthly payments to income, are often available. Deferment or forbearance may also be options in certain circumstances.

Can I get grants or scholarships in addition to student loans if I’m below the poverty line?

Yes, many grants and scholarships are specifically designed for low-income students. Exploring options through your institution’s financial aid office and external scholarship databases is crucial.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit.

Are there any organizations that provide financial literacy education for low-income students?

Yes, many non-profit organizations and government agencies offer financial literacy programs specifically tailored to low-income individuals and students. Research local and national resources for available programs.