Navigating the world of higher education financing can be daunting, especially when considering private student loans. Unlike federal loans, private student loans are offered by banks and credit unions, each with its own unique terms and conditions. Understanding these differences is crucial for making informed decisions that align with your financial situation and long-term goals. This guide delves into the intricacies of private lenders’ student loans, providing a clear understanding of eligibility, application processes, repayment options, and potential risks.

We’ll explore the key factors to consider when comparing offers from various private lenders, including interest rates, fees, and repayment plans. We’ll also examine alternative funding options and provide practical strategies for managing student loan debt effectively. Ultimately, our aim is to empower you with the knowledge needed to make sound financial choices regarding your education.

Understanding Private Student Loan Lenders

Private student loans offer an alternative funding source for higher education, supplementing or sometimes replacing federal loan options. Understanding the differences between these loan types and the nuances of private lenders is crucial for making informed borrowing decisions. This section will clarify the distinctions, profile key lenders, and illustrate typical loan terms.

Private vs. Federal Student Loans

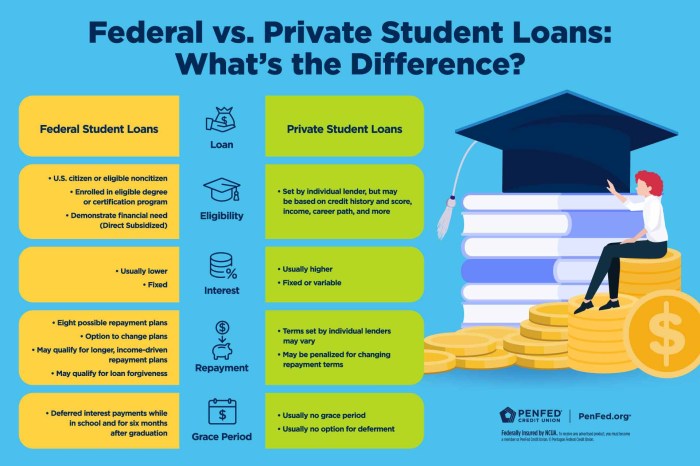

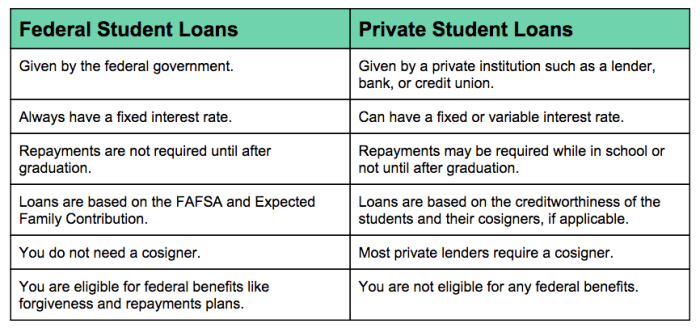

Federal student loans, offered through the government, generally come with more borrower protections, including income-driven repayment plans and loan forgiveness programs. Interest rates are typically lower than those offered by private lenders, and eligibility is based on financial need and enrollment status. Private student loans, on the other hand, are offered by banks, credit unions, and other financial institutions. They often require a creditworthy co-signer, have higher interest rates, and lack the same government-backed protections. Eligibility depends heavily on credit history and income.

Prominent Private Student Loan Lenders and Lending Criteria

Several prominent private lenders cater to students’ financial needs. Their lending criteria vary, but generally involve creditworthiness assessment, income verification, and enrollment confirmation.

Examples of lenders include:

- Sallie Mae: Often requires a co-signer for students with limited or no credit history. Considers credit score, debt-to-income ratio, and academic standing.

- Discover: Offers student loans with competitive interest rates. Assessment focuses on creditworthiness, income, and the applicant’s overall financial profile. May offer options without a co-signer depending on credit score.

- Wells Fargo: Provides student loans with various repayment options. Evaluates credit history, income, and debt levels. A co-signer may be necessary.

- PNC: Offers a range of student loan products, with varying requirements based on the applicant’s financial situation and credit history. Similar to other lenders, co-signers are frequently required.

Examples of Loan Terms and Conditions

Private student loan terms vary significantly across lenders and individual borrowers. Factors such as credit score, co-signer availability, and loan amount influence the interest rate, repayment period, and fees.

Illustrative examples (these are hypothetical and may not reflect current offerings):

- Sallie Mae: A student with excellent credit might receive a fixed interest rate of 6% with a 10-year repayment period and a 1% origination fee. A student with limited credit history and a co-signer might receive a rate of 8% with similar terms.

- Discover: May offer variable interest rates tied to an index, such as LIBOR, plus a margin. Repayment periods typically range from 5 to 15 years. Fees might include an origination fee and late payment penalties.

Comparison of Private Student Loan Offers

The following table compares hypothetical interest rates, repayment options, and fees for three major private lenders. Remember that actual rates and terms will vary based on individual circumstances.

| Lender | Interest Rate (Variable/Fixed) | Repayment Options | Fees |

|---|---|---|---|

| Sallie Mae | 7-10% (Fixed) | Standard, Graduated, Extended | 1-3% Origination Fee |

| Discover | 6-9% (Variable) | Standard, Income-Based (may vary by state) | 0-2% Origination Fee |

| Wells Fargo | 7.5-11% (Fixed) | Standard, Extended | 1-4% Origination Fee |

Eligibility and Application Process

Securing a private student loan hinges on meeting specific eligibility criteria and navigating a relatively straightforward application process. However, understanding these requirements and the potential hurdles is crucial for a successful application. This section details the typical requirements, necessary documentation, the step-by-step application process, and common reasons for loan application rejections.

Credit Score and Income Requirements

Private student loan lenders typically assess both your creditworthiness and your ability to repay the loan. A good credit score is often a prerequisite, although some lenders may offer loans to students with co-signers who possess a strong credit history. The specific credit score requirement varies among lenders, but generally, a score above 670 is considered favorable. Furthermore, lenders often require proof of income, either from the student or a co-signer, to demonstrate repayment capacity. This income verification might involve providing tax returns, pay stubs, or bank statements. The required income level is again lender-dependent but reflects the lender’s assessment of your ability to manage monthly loan repayments. For example, a lender might require a minimum monthly income that is several times the monthly loan payment amount.

Required Documentation

Applying for a private student loan requires submitting various documents to verify your identity, financial stability, and enrollment status. These typically include:

- Completed loan application form.

- Government-issued photo identification (e.g., driver’s license, passport).

- Social Security number.

- Proof of enrollment (acceptance letter or enrollment verification from your school).

- Tax returns or proof of income (W-2s, pay stubs, bank statements).

- Credit report (often pulled by the lender).

- Co-signer information and documentation (if applicable).

The specific documentation required may differ slightly depending on the lender and the applicant’s circumstances. It is always advisable to check the lender’s specific requirements before starting the application.

Step-by-Step Application Process

The application process generally involves these steps:

- Pre-qualification: Many lenders allow you to check your eligibility without impacting your credit score. This provides a preliminary understanding of your potential loan terms.

- Application submission: Complete the lender’s online application form and upload the necessary documentation.

- Credit and income verification: The lender will verify your credit history and income information.

- Loan approval or denial: Based on the verification, the lender will either approve or deny your application.

- Loan agreement review and signing: If approved, carefully review the loan terms and conditions before signing the agreement.

- Disbursement of funds: Once the loan agreement is signed, the funds are disbursed directly to your educational institution.

Potential challenges during the application process might include incomplete documentation, discrepancies in the provided information, or credit issues that prevent loan approval. Addressing these challenges proactively, through thorough preparation and accurate information submission, can significantly improve the chances of a successful application.

Reasons for Loan Application Rejection

Failing to meet the lender’s eligibility criteria often leads to application rejection. Common reasons include:

- Insufficient credit score.

- Lack of verifiable income (for both the student and co-signer, if applicable).

- Incomplete or inaccurate application information.

- Negative credit history (e.g., bankruptcies, defaults, collections).

- High debt-to-income ratio.

- Failure to provide required documentation.

- Enrollment in a non-accredited institution.

Understanding these potential pitfalls can help applicants prepare thoroughly and increase their likelihood of loan approval.

Interest Rates and Fees

Understanding the interest rates and fees associated with private student loans is crucial for borrowers to make informed decisions and manage their finances effectively. These costs significantly impact the overall loan repayment amount, and a thorough understanding is essential for responsible borrowing. This section will explore the intricacies of interest rates and various fees charged by private lenders.

Private student loan interest rates are variable, meaning they fluctuate based on market conditions, and are generally higher than federal student loan interest rates. The specific rate offered to a borrower depends on a combination of factors, leading to significant variation between lenders and individual borrowers. Comparing offers from multiple lenders is highly recommended to secure the most favorable terms.

Factors Influencing Interest Rates

Several key factors influence the interest rate a borrower receives. Credit history is paramount; borrowers with strong credit scores typically qualify for lower rates. The loan’s term length also plays a role; longer repayment periods often come with higher interest rates. The chosen loan type (e.g., fixed vs. variable rate) will affect the rate, with variable rates offering the potential for lower initial payments but greater risk of rate increases. Co-signers, who share responsibility for the loan, can sometimes help secure a lower interest rate for the primary borrower. Finally, the lender’s own pricing models and market conditions also influence the offered rate.

Fees Associated with Private Student Loans

Private student loans often involve various fees that add to the overall cost of borrowing. Origination fees are common; these are charged by the lender to process the loan application and are usually a percentage of the loan amount. Late payment fees are assessed if a borrower misses a payment, adding to the debt. Other fees might include prepayment penalties (though less common now), returned payment fees, and potentially other administrative charges depending on the lender. Understanding these fees is vital for budgeting and managing repayments effectively.

Sample Loan Fee Comparison

The following table illustrates a hypothetical comparison of fees for a $10,000 private student loan from two different lenders, Lender A and Lender B. Remember that these are examples, and actual fees will vary depending on the lender, loan amount, and individual borrower circumstances.

| Fee Type | Lender A | Lender B |

|---|---|---|

| Origination Fee | $100 (1%) | $0 |

| Late Payment Fee | $25 per instance | $30 per instance |

| Returned Payment Fee | $35 | $40 |

Repayment Options and Strategies

Understanding your repayment options is crucial for effectively managing your private student loans. Choosing the right plan and implementing a sound repayment strategy can significantly impact your long-term financial health. This section details various repayment plans and provides practical strategies for minimizing your debt burden.

Private Student Loan Repayment Plans

Private student loan lenders offer a variety of repayment plans to suit different borrowers’ financial situations. The most common options include fixed and variable interest rate plans. A fixed interest rate plan maintains a consistent interest rate throughout the loan’s life, providing predictable monthly payments. In contrast, a variable interest rate plan’s interest rate fluctuates based on market indices, leading to potentially changing monthly payments. Some lenders may also offer graduated repayment plans, where payments start low and gradually increase over time, or income-driven repayment plans, which tie payments to a percentage of your income. The specifics of available plans vary considerably among lenders.

Repayment Schedule Examples

Let’s consider two examples to illustrate the impact of different loan amounts and interest rates on repayment schedules.

Example 1: A $20,000 loan with a 7% fixed interest rate, repaid over 10 years, would result in an estimated monthly payment of approximately $240. The total interest paid over the life of the loan would be roughly $8,800.

Example 2: A $30,000 loan with a 5% variable interest rate (assuming an average rate over the loan term), repaid over 15 years, could result in an estimated monthly payment ranging from $220 to $280 depending on interest rate fluctuations. The total interest paid could be significantly higher if interest rates increase throughout the repayment period. These are estimations; the actual figures depend on the specific lender and their terms.

Strategies for Managing Student Loan Debt

Effective management of student loan debt requires a proactive and strategic approach. Budgeting meticulously and tracking expenses is paramount to ensure loan payments are prioritized. Exploring options for refinancing your loans to secure a lower interest rate can significantly reduce your total interest payments. Consolidating multiple loans into a single loan can simplify repayment and potentially lower your monthly payment. Finally, consistently making on-time payments helps build a positive credit history, which can benefit you in the long run.

Developing a Personalized Repayment Plan

Creating a personalized repayment plan involves a step-by-step process:

- Assess your financial situation: Calculate your monthly income, expenses, and available funds after covering essential needs.

- List all your loans: Note the principal balance, interest rate, and minimum monthly payment for each loan.

- Choose a repayment plan: Select a plan (fixed, variable, graduated, income-driven) that aligns with your financial capabilities and long-term goals.

- Create a budget: Allocate funds for loan repayment, ensuring it’s integrated with your other expenses.

- Set realistic goals: Establish short-term and long-term goals for loan repayment, including potential milestones and rewards for achieving them.

- Monitor progress and adjust as needed: Regularly review your repayment plan and make adjustments based on changes in your financial circumstances.

Risks and Considerations

Private student loans, while offering access to funds for higher education, present several potential risks that borrowers should carefully consider before taking on this type of debt. Understanding these risks is crucial for making informed financial decisions and avoiding potential pitfalls. Failing to do so can lead to significant financial hardship.

Private student loans often come with higher interest rates than federal student loans. This means that the total cost of borrowing will be significantly higher over the life of the loan. Furthermore, private lenders typically offer fewer repayment options and protections compared to federal loans. This lack of flexibility can make it more difficult to manage repayments, especially during periods of financial instability. The accumulation of significant debt from private loans can have long-term consequences on credit scores and overall financial well-being.

Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe consequences. Unlike federal student loans, which offer various rehabilitation and forgiveness programs, private lenders generally have less lenient policies. Defaulting can result in damage to your credit score, wage garnishment, and legal action to recover the debt. The negative impact on your credit history can make it difficult to obtain future loans, rent an apartment, or even secure employment. Furthermore, collection agencies may aggressively pursue repayment, leading to significant stress and financial strain. The consequences can be far-reaching and long-lasting, impacting various aspects of your personal and financial life.

Comparison of Private and Federal Student Loans

Federal student loans generally offer more borrower protections and flexible repayment options than private student loans. Federal loans often have lower interest rates and may qualify for income-driven repayment plans, loan forgiveness programs, and deferment options during periods of financial hardship. Private loans, on the other hand, typically have higher interest rates, stricter repayment terms, and fewer options for borrowers facing financial difficulties. The choice between federal and private loans depends on individual circumstances and financial needs. A thorough understanding of the benefits and drawbacks of each type of loan is essential before making a decision.

Scenarios Where Private Loans May or May Not Be Suitable

Private student loans may be a suitable option for students who have exhausted their federal loan eligibility and still require additional funding to cover educational expenses. For example, a student pursuing a graduate degree with high tuition costs may find private loans necessary to supplement their federal loan limits. However, private loans may not be suitable for students with limited credit history or those anticipating financial challenges after graduation. For instance, a student entering a low-paying field may struggle to repay a private loan with a high interest rate. A student with poor credit may face high interest rates or even loan denial. Careful consideration of individual financial circumstances and future earning potential is crucial before taking on private student loan debt.

Alternative Funding Options

Securing funding for higher education can be a significant undertaking. While private student loans offer one avenue, several alternative financing options exist, each with its own set of advantages and disadvantages. Understanding these alternatives is crucial for making informed decisions about how to finance your education.

Exploring alternative funding sources can lead to significant cost savings and potentially reduce your reliance on loans with high interest rates. This section will Artikel various options and their comparative strengths and weaknesses.

Types of Alternative Funding Sources

A range of funding options exists beyond private student loans. These can be broadly categorized into grants, scholarships, and work-study programs. Each offers a different approach to funding your education, and careful consideration of their eligibility criteria and limitations is essential.

- Grants: Grants are generally need-based and do not require repayment. Examples include Federal Pell Grants and state-specific grants. Eligibility criteria vary depending on the granting institution and applicant’s financial situation.

- Scholarships: Scholarships are awarded based on merit, talent, or specific criteria set by the awarding institution. These can be offered by colleges, universities, private organizations, and corporations. Competition for scholarships can be intense, and the application process often involves essays and documentation.

- Work-Study Programs: Work-study programs provide part-time employment opportunities for students to earn money to help fund their education. Eligibility is often need-based and coordinated through the student’s college or university.

- Employer Tuition Reimbursement: Some employers offer tuition reimbursement programs to their employees, covering a portion or all of the cost of higher education. This is often contingent on continued employment with the company.

Comparison of Alternative Funding Options

The decision of which funding source to prioritize depends heavily on individual circumstances. A comparative analysis highlights the key differences:

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Grants | No repayment required; often need-based | Limited availability; competitive application process |

| Scholarships | Can significantly reduce educational costs; merit-based | Highly competitive; requires strong application materials |

| Work-Study | Earns income while studying; part-time flexibility | Limited earnings potential; may impact study time |

| Employer Tuition Reimbursement | Covers educational costs; potential for career advancement | Conditional on employment; may have restrictions on course selection |

Decision-Making Flowchart for Choosing a Funding Source

The selection of a funding source is a multi-step process. A flowchart can help visualize this:

[Imagine a flowchart here. The flowchart would begin with a “Start” box, leading to a decision box asking “Do you qualify for grants/scholarships?”. A “Yes” branch would lead to a box indicating “Apply for grants/scholarships,” while a “No” branch would lead to a decision box asking “Can you work part-time?”. A “Yes” branch would lead to a box indicating “Explore work-study options,” while a “No” branch would lead to a box indicating “Consider private loans or employer tuition reimbursement.” All branches would ultimately converge to an “End” box.] The flowchart visually guides individuals through assessing their eligibility for various funding options before considering private loans as a last resort. This systematic approach aids in making a well-informed decision about higher education financing.

Illustrative Scenarios

Understanding when a private student loan is a beneficial financial tool and when it becomes a detrimental burden requires careful consideration of individual circumstances. The following scenarios illustrate these contrasting situations, highlighting the importance of thorough financial planning before taking on private student loan debt.

Beneficial Private Student Loan Scenario

This scenario depicts a high-achieving student pursuing a specialized, high-demand field with strong post-graduation earning potential. Sarah, a recent high school graduate, has been accepted into a prestigious engineering program at a private university. Her family has saved diligently but still faces a significant funding gap after exhausting federal student aid options (Pell Grants and subsidized/unsubsidized federal loans). Her expected tuition, fees, and living expenses total $70,000 per year for four years. Federal loans cover $40,000 annually, leaving a $30,000 annual shortfall. Sarah’s family can contribute $10,000 annually, leaving a remaining $20,000 annual gap.

Sarah secures a private student loan with a competitive interest rate of 6% fixed for the entire loan term, and a manageable monthly payment structure after graduation, based on her projected salary in her field. Her projected starting salary post-graduation is $80,000, with a reasonable expectation of salary growth. Given her high earning potential and well-structured repayment plan, the private loan is a worthwhile investment to access a high-quality education that will substantially increase her lifetime earnings. The potential return on investment from her higher education outweighs the cost of the private loan. Her careful financial planning ensures the debt is manageable.

Detrimental Private Student Loan Scenario

This scenario illustrates a situation where a private student loan becomes a significant financial burden. Mark is a student pursuing a less lucrative degree program with limited post-graduation job prospects. He borrowed heavily through private loans to cover his education, accumulating $100,000 in debt with a high interest rate of 12% variable. Mark’s chosen major in Fine Arts resulted in limited employment opportunities after graduation, leading to a low starting salary of $30,000. His high-interest loan payments consume a substantial portion of his income, hindering his ability to save, invest, or address other financial obligations. The lack of sufficient income in relation to the high debt burden makes the private loan detrimental to his financial well-being. He struggles to meet his monthly payments, resulting in potential credit damage and financial hardship. This situation emphasizes the importance of aligning educational choices with future earning potential before accumulating substantial private student loan debt.

Closing Notes

Securing funding for higher education requires careful consideration of various factors. While private student loans can offer a crucial pathway to financing your studies, understanding their complexities is paramount. By carefully evaluating your eligibility, comparing offers from different lenders, and developing a robust repayment strategy, you can navigate the process effectively and minimize potential financial risks. Remember to explore all available options, including federal loans, scholarships, and grants, to create a comprehensive financial plan for your education.

Top FAQs

What is the difference between a co-signer and an endorser on a private student loan?

A co-signer shares responsibility for the loan repayment, while an endorser typically guarantees repayment only if the borrower defaults.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and simplify payments, but it’s crucial to compare offers carefully.

What happens if I default on a private student loan?

Defaulting can severely damage your credit score and lead to wage garnishment or legal action.

How can I improve my chances of loan approval?

A strong credit score, stable income, and a co-signer can significantly increase your chances of approval.