The pursuit of higher education often necessitates financial planning, and for many, private student loans become a crucial component. Understanding the intricacies of these loans—from eligibility requirements to repayment options and potential pitfalls—is paramount to making informed decisions and ensuring a smooth path towards academic success. This guide delves into the essential aspects of private student loans, providing clarity and actionable insights to empower prospective borrowers.

We’ll explore the diverse landscape of private student loan providers, comparing interest rates, fees, and repayment structures. We’ll also address critical concerns such as credit score impact, the application process, and the consequences of default. Ultimately, this resource aims to equip you with the knowledge needed to navigate the world of private student loans confidently and responsibly.

Types of Private Student Loans

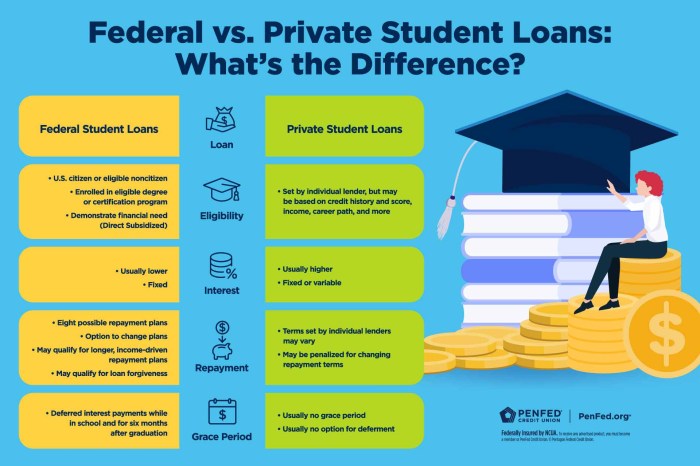

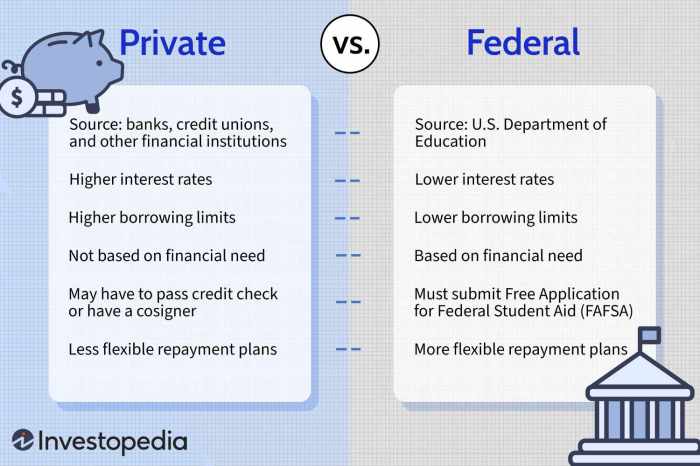

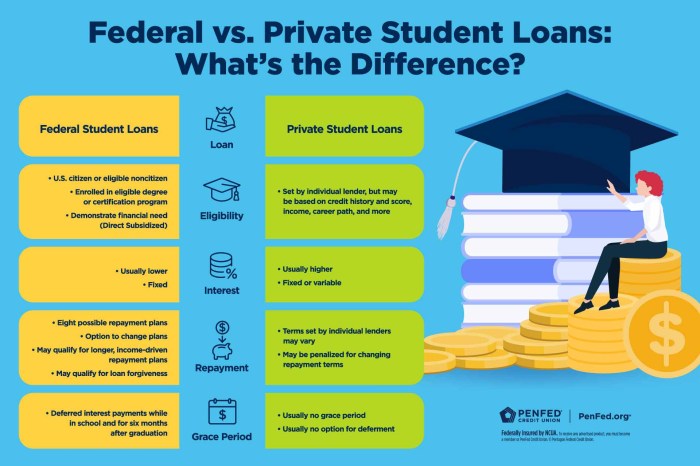

Private student loans are a crucial financial tool for many students seeking higher education, but understanding their nuances is essential. Unlike federal student loans, which are backed by the government, private loans are offered by banks, credit unions, and other financial institutions. This means the terms and conditions, including interest rates and repayment options, can vary significantly. Choosing the right private student loan requires careful consideration of your financial situation and future repayment capacity.

Federal student loans generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private loans typically lack these benefits, making them riskier if you face financial hardship. However, private loans might offer higher borrowing limits than federal loans in certain situations. It’s crucial to weigh the advantages and disadvantages of each before making a decision.

Federal vs. Private Student Loans

The key difference lies in the lender and the associated protections. Federal loans are backed by the government, offering more flexible repayment options and potential for loan forgiveness programs. Private loans, offered by private lenders, often have stricter terms and conditions, potentially resulting in higher interest rates and fewer repayment options. The eligibility criteria also differ, with federal loans often having broader eligibility requirements compared to private loans which frequently require a creditworthy co-signer.

Comparison of Private Student Loan Providers

Interest rates, repayment options, and fees vary considerably among private student loan providers. The following table compares four prominent lenders (note that rates and fees are subject to change and are examples only, not a guarantee). Always check the lender’s website for the most current information.

| Lender | Interest Rate (Example) | Repayment Options | Fees (Example) |

|---|---|---|---|

| Lender A | Variable, starting at 6.5% | Standard, graduated, extended | Origination fee: 1% |

| Lender B | Fixed, 7.0% | Standard, income-based (limited) | No origination fee |

| Lender C | Variable, starting at 6.0% | Standard, accelerated | Origination fee: 0.5% |

| Lender D | Fixed, 7.5% | Standard | Origination fee: 2% |

Types of Private Student Loans

Private student loans cater to various educational needs. Understanding the different types is crucial for choosing the right loan for your specific circumstances.

Undergraduate loans are designed to finance undergraduate studies, while graduate loans are specifically for graduate or professional programs. Parent loans allow parents to borrow money to help fund their child’s education. Each loan type might have unique eligibility requirements and interest rates.

Eligibility and Application Process

Securing a private student loan involves understanding the eligibility criteria and navigating the application process. Lenders assess applicants based on various factors to determine creditworthiness and the likelihood of repayment. The process itself typically involves several steps, from initial application to final loan disbursement.

Eligibility Requirements for Private Student Loans

Private student loan eligibility varies significantly among lenders. However, common requirements include a credit history (often requiring a credit score above a certain threshold), proof of enrollment in an eligible educational program, and the ability to demonstrate the need for the loan. Some lenders may also consider your co-signer’s creditworthiness if your credit history is insufficient. Specific requirements, such as minimum GPA or specific school accreditation, may also apply depending on the lender and loan program. For example, some lenders may prefer applicants enrolled in accredited four-year universities over vocational schools. A co-signer with a strong credit history can significantly improve your chances of approval, even if your own credit score is low.

The Private Student Loan Application Process

The application process generally involves these steps: First, you’ll need to research and select a lender, comparing interest rates, fees, and repayment options. Next, complete the lender’s online application form, providing personal information, educational details, and financial information. This will typically include details about your school, program of study, expected graduation date, and your current income and employment history. Then, you’ll need to provide supporting documentation, such as proof of enrollment, transcripts, and tax returns or pay stubs. The lender will then review your application and supporting documentation. This review process can take several days or weeks. Finally, upon approval, the loan funds will be disbursed directly to your school or to you, according to the lender’s disbursement policy.

Credit Score Impact on Loan Approval and Interest Rates

Your credit score plays a crucial role in both loan approval and the interest rate offered. A higher credit score generally indicates a lower risk to the lender, resulting in a greater likelihood of approval and potentially a lower interest rate. Conversely, a low credit score may lead to rejection or higher interest rates to compensate for the perceived increased risk of default. For example, an applicant with a credit score of 750 might qualify for a lower interest rate than an applicant with a score of 600. In some cases, a co-signer with a strong credit history can mitigate the impact of a low credit score.

Flowchart of the Private Student Loan Application Process

The following describes a flowchart illustrating the application process. The flowchart begins with the “Start” node. This is followed by a decision point: “Do you meet eligibility requirements?”. If yes, the process continues to “Complete Application”. If no, the process ends with “Application Denied”. After completing the application, the next step is “Submit Application and Supporting Documents”. This leads to a review process represented by a “Lender Review” node. The review results in a decision point: “Application Approved?”. If yes, the process moves to “Loan Disbursement”. If no, the process ends with “Application Denied”. Finally, the process ends with a “Loan Disbursement” node. This visual representation simplifies the process, but the actual timeline can vary depending on the lender and individual circumstances.

Interest Rates and Fees

Understanding the interest rates and fees associated with private student loans is crucial for responsible borrowing and managing your finances effectively. These costs significantly impact the total amount you’ll repay, so careful consideration is essential before accepting a loan.

Private student loan interest rates are determined by several factors, primarily your creditworthiness. Lenders assess your credit history, credit score, and debt-to-income ratio to gauge your risk of default. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk for the lender. Other factors can include the loan term (shorter terms often mean higher rates), the type of loan (e.g., undergraduate vs. graduate), and the prevailing market interest rates. The lender also considers your co-signer’s creditworthiness, if applicable, as this reduces their risk.

Interest Rate Scenarios and Total Loan Cost

Different interest rate scenarios can dramatically affect the total cost of your loan. For example, consider a $20,000 loan. A loan with a 6% fixed interest rate over 10 years would result in significantly lower total repayment compared to a loan with a 10% fixed interest rate over the same period. The higher interest rate would accumulate substantially more interest over the life of the loan, leading to a much larger total repayment amount. Similarly, a variable rate loan, while potentially starting lower, could increase significantly over time if market interest rates rise, increasing your overall repayment burden.

Private Student Loan Fees

Several fees are commonly associated with private student loans. Origination fees are one-time charges paid upfront, typically a percentage of the loan amount. These fees cover the lender’s administrative costs of processing the loan. Late payment fees are charged if you miss a payment, and they can vary significantly between lenders. Other potential fees might include prepayment penalties (though less common now), returned payment fees (if a payment is returned due to insufficient funds), and fees for certain loan modifications or deferments.

Fixed vs. Variable Interest Rates

| Feature | Fixed Interest Rate | Variable Interest Rate |

|---|---|---|

| Rate | Stays the same for the life of the loan. | Fluctuates based on market interest rates. |

| Predictability | Highly predictable monthly payments. | Monthly payments can change, potentially increasing or decreasing. |

| Risk | Lower risk of unexpectedly higher payments. | Higher risk of unexpectedly higher payments if interest rates rise. |

| Long-term cost | May be higher overall if market rates fall significantly. | May be lower overall if market rates stay low or fall. |

Repayment Options and Plans

Understanding your repayment options is crucial for managing your private student loans effectively. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several factors, including your income and financial goals, should be considered when selecting a repayment plan.

Types of Repayment Plans

Private student loan lenders typically offer a range of repayment plans designed to accommodate varying financial situations. These plans differ primarily in the length of the repayment period and the amount of the monthly payment. Common options include standard, graduated, and extended repayment plans.

- Standard Repayment Plan: This plan involves fixed monthly payments over a set period, usually 10 years. The monthly payment remains consistent throughout the repayment term. This predictability can be beneficial for budgeting, but the higher monthly payments might present a challenge for some borrowers.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over time. The initial lower payments can be helpful for borrowers in the early stages of their careers when income is typically lower. However, payments become progressively larger, potentially making them difficult to manage later in the repayment term.

- Extended Repayment Plan: This plan extends the repayment period beyond the standard 10 years, often up to 25 years. The longer repayment period results in lower monthly payments, making it more manageable for borrowers with limited income. However, the extended repayment period leads to a higher total interest paid over the life of the loan.

Comparing Repayment Plan Advantages and Disadvantages

The optimal repayment plan depends heavily on individual circumstances. A borrower with a stable, high income might prefer a standard plan to minimize total interest paid, while a borrower with a lower income might find a graduated or extended plan more suitable.

| Repayment Plan | Advantages | Disadvantages |

|---|---|---|

| Standard | Predictable payments, lower total interest paid | Higher monthly payments |

| Graduated | Lower initial payments, manageable early on | Increasingly higher payments, potentially difficult later |

| Extended | Lowest monthly payments | Highest total interest paid, longer repayment period |

Calculating Monthly Payments

Calculating the precise monthly payment requires using an amortization formula, which considers the loan principal, interest rate, and loan term. Many online loan calculators are available to simplify this process. For example, a $50,000 loan at 7% interest over 10 years (standard plan) might result in a monthly payment of approximately $550. However, the same loan on a 25-year extended plan might reduce the monthly payment to around $350, but at the cost of significantly more interest paid over the life of the loan.

The exact monthly payment can vary depending on the lender and the specific loan terms. It’s always advisable to use a loan calculator provided by your lender for the most accurate calculation.

Default and its Consequences

Defaulting on a private student loan can have severe and long-lasting financial repercussions. Understanding these consequences and proactively addressing potential payment difficulties is crucial for borrowers. Failure to repay your loan as agreed can significantly damage your credit score and limit your future financial opportunities.

Consequences of Default

Defaulting on a private student loan triggers a series of negative events. Your credit score will plummet, making it difficult to secure loans, credit cards, or even rent an apartment in the future. Collection agencies may aggressively pursue repayment, potentially leading to wage garnishment, bank levy (seizing funds from your bank account), or even lawsuits. Furthermore, your ability to obtain federal financial aid in the future may be jeopardized. The specific consequences can vary depending on the lender and the terms of your loan agreement. For example, a lender might report the default to credit bureaus, leading to a significant drop in your credit score, impacting your ability to secure future credit. Simultaneously, the lender could pursue legal action to recover the outstanding debt, resulting in wage garnishment or the seizure of assets.

Avoiding Default

Several proactive steps can help borrowers avoid default. Careful budgeting and financial planning are paramount. Creating a realistic budget that allocates funds for loan repayment is essential. Communicating with your lender is equally important. If you anticipate difficulty making payments, contact your lender immediately to discuss potential options. Explore alternative repayment plans or seek professional financial advice. Many lenders are willing to work with borrowers who demonstrate a genuine effort to manage their debt. Early intervention is key to preventing a default. For example, if unexpected job loss occurs, contacting the lender promptly to explain the situation and explore options like forbearance or deferment can prevent a default.

Options for Borrowers Facing Difficulty

Several options exist for borrowers struggling to make loan payments. Forbearance allows for a temporary suspension of payments, while deferment postpones payments for a specified period. Both options can provide short-term relief, but interest may still accrue during these periods, potentially increasing the total loan amount. Income-driven repayment plans, if available, may adjust payments based on your income and family size, making them more manageable. Consolidation may combine multiple loans into a single loan with a potentially lower monthly payment, although this might extend the repayment period. Careful consideration of the pros and cons of each option is crucial. For instance, while forbearance offers temporary relief, the accrued interest during this period will increase the total amount owed, potentially leading to higher payments in the future.

Visual Representation of Default Impact

Imagine a simple graph. The X-axis represents time, and the Y-axis represents credit score. A steady, upward trend line represents a borrower with a consistently improving credit score. Now, imagine a sharp, downward spike on this line – that represents the immediate impact of default. Following the spike, the line remains significantly lower than before, representing the long-term damage to creditworthiness, impacting opportunities for mortgages, car loans, and other credit-based purchases for years to come. The further the spike drops, the more severe the long-term consequences. The longer the line remains low, the more challenging it becomes to recover financially.

Alternatives to Private Student Loans

Securing funding for higher education is a crucial step, and while private student loans offer one avenue, exploring alternative financing options is equally important. Understanding the various possibilities and their implications allows students to make informed decisions that best suit their financial circumstances and long-term goals. This section will Artikel several alternatives and compare them to private student loans.

Alternative Financing Options for Higher Education

Numerous alternatives to private student loans exist, offering diverse paths to fund higher education. These options can significantly reduce reliance on loans, minimizing future debt burdens.

- Scholarships: Merit-based or need-based scholarships are awarded based on academic achievement, talent, or financial need. These funds generally do not require repayment. Many scholarships are offered by universities, colleges, private organizations, and corporations. Examples include the Gates Millennium Scholars Program, which provides scholarships to outstanding minority students, and numerous university-specific scholarships for high-achieving applicants.

- Grants: Similar to scholarships, grants are awarded based on financial need and generally do not require repayment. Federal grants, such as Pell Grants, are available to students who demonstrate significant financial need, while state and institutional grants may also be accessible. Eligibility criteria vary based on the specific grant program.

- Savings Plans: Proactive saving through 529 plans or other education savings accounts allows families to accumulate funds for college expenses over time. These plans often offer tax advantages and can significantly reduce the need for loans. Early contributions and consistent saving are key to maximizing the benefits of these plans. For instance, a family starting a 529 plan when a child is young can leverage the power of compound interest to accumulate a substantial amount by college age.

- Work-Study Programs: Many colleges and universities offer work-study programs that allow students to earn money while attending school. These programs provide part-time employment opportunities on campus or at related organizations, enabling students to offset some educational expenses.

Comparison of Private Student Loans and Alternative Financing Options

A direct comparison highlights the distinct advantages and disadvantages of each approach.

| Feature | Private Student Loans | Alternative Financing Options (Scholarships, Grants, Savings Plans, Work-Study) |

|---|---|---|

| Repayment | Required with interest | Generally not required (except for some loan-like programs with specific repayment terms) |

| Interest Rates | Variable, often high | No interest |

| Credit Check | Usually required (co-signer may be needed) | Generally not required |

| Availability | Widely available | Competitive, requires application and meeting eligibility criteria |

| Impact on Future Finances | Can lead to significant debt | Minimizes or eliminates debt |

Budgeting and Financial Planning for Higher Education

Effective budgeting and financial planning are paramount to successfully navigating the costs of higher education. A well-defined plan helps students and families make informed decisions about funding sources, manage expenses, and minimize debt accumulation.

- Create a Realistic Budget: This involves estimating tuition, fees, housing, books, transportation, and living expenses. Using online budgeting tools or spreadsheets can facilitate this process.

- Explore all Funding Options: Exhaust all possibilities, including scholarships, grants, and savings plans, before considering private student loans.

- Monitor Expenses: Regularly track spending to ensure adherence to the budget and identify areas for potential savings.

- Seek Financial Aid Counseling: Utilize the resources offered by colleges and universities, as well as independent financial aid advisors, to gain guidance on navigating the financial aid process.

Understanding Loan Terms and Conditions

Before signing any private student loan agreement, it’s crucial to thoroughly understand the terms and conditions. These documents often contain complex legal jargon, and overlooking key clauses can have significant financial consequences. This section will clarify essential terms and provide examples to help you navigate this process effectively.

Key Terms and Conditions in Private Student Loan Agreements

Private student loan agreements typically include a range of clauses covering various aspects of the loan, from interest rates and fees to repayment schedules and default provisions. Understanding these clauses is vital to making informed decisions about borrowing. Failure to understand these terms can lead to unforeseen costs and financial difficulties.

Examples of Common Clauses and Their Implications

One common clause is the definition of the interest rate. This will specify whether the rate is fixed or variable, and how it will be calculated. A fixed rate remains constant throughout the loan term, providing predictable monthly payments. A variable rate, however, fluctuates with market conditions, potentially leading to higher payments over time. For example, a variable rate loan might start at 5% but increase to 7% due to market changes, significantly impacting the total repayment amount. Another common clause is the grace period, which refers to the time after graduation before repayment begins. This period typically ranges from six months to a year, allowing borrowers time to find employment before starting repayments. However, interest may still accrue during this grace period, increasing the total loan amount. A borrower might have a six-month grace period, during which interest accrues on their $10,000 loan, potentially adding several hundred dollars to their total debt before payments even begin.

The Importance of Carefully Reviewing Loan Documents Before Signing

Carefully reviewing loan documents before signing is paramount. Don’t hesitate to seek clarification on anything you don’t understand. Consider consulting a financial advisor or student loan counselor to help you navigate the complexities of the agreement. Signing without fully comprehending the terms could lead to unexpected financial burdens and difficulties in managing your debt. It’s better to take your time and understand every aspect of the agreement than to rush into a potentially unfavorable financial commitment.

Glossary of Common Private Student Loan Terms

- Annual Percentage Rate (APR): The annual cost of borrowing, including interest and fees.

- Fixed Interest Rate: An interest rate that remains constant throughout the loan term.

- Variable Interest Rate: An interest rate that fluctuates based on market conditions.

- Grace Period: The period after graduation before loan repayment begins.

- Deferment: A temporary postponement of loan payments.

- Forbearance: A temporary reduction in loan payments.

- Default: Failure to make loan payments as agreed.

- Co-signer: An individual who agrees to repay the loan if the borrower defaults.

- Origination Fee: A fee charged by the lender for processing the loan application.

- Prepayment Penalty: A fee charged for paying off the loan early.

Closing Summary

Securing a private student loan is a significant financial commitment, demanding careful consideration and thorough understanding. By weighing the advantages and disadvantages, comparing different loan options, and planning for repayment, you can leverage these resources effectively to achieve your educational goals without jeopardizing your long-term financial well-being. Remember, proactive financial planning and responsible borrowing are key to a successful journey through higher education.

Query Resolution

What happens if I can’t make my private student loan payments?

Contact your lender immediately. They may offer options like forbearance (temporary suspension of payments) or deferment (postponement of payments). Failing to communicate can lead to serious consequences, including default.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully compare offers from different lenders to ensure you’re getting the best deal. Note that refinancing may extend your repayment period.

How do co-signers affect my private student loan application?

A co-signer with good credit significantly improves your chances of approval and can often secure a lower interest rate. However, the co-signer is equally responsible for repayment if you default.

Are there tax benefits associated with private student loans?

Unlike federal student loans, private student loans typically don’t offer direct tax benefits. However, interest paid might be deductible depending on your income and other factors; consult a tax professional for personalized advice.