The pursuit of higher education often involves navigating the complex landscape of student financing. While federal student loans provide a crucial foundation, many students find themselves needing supplemental funding. This is where private student loans enter the picture, offering a potential solution but also presenting a set of unique considerations. Understanding the intricacies of private student loans – from eligibility requirements and interest rates to repayment options and potential risks – is crucial for making informed financial decisions.

This guide aims to demystify the process of securing and managing private student loans. We’ll explore the various types of loans available, delve into the application process, and analyze the factors influencing interest rates and repayment plans. Furthermore, we will compare private loans to their federal counterparts, highlighting the advantages and disadvantages of each to empower you to make the best choices for your educational journey.

Types of Private Student Loans

Choosing the right student loan can significantly impact your financial future. While federal student loans offer various benefits and protections, private student loans provide another avenue for financing your education. Understanding the differences and various types of private loans is crucial for making informed decisions. This section will explore the key distinctions between federal and private loans and delve into the specifics of different private loan options.

Federal vs. Private Student Loans

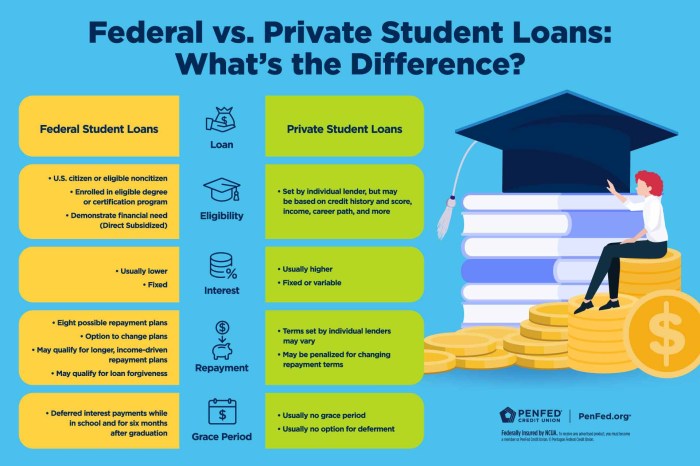

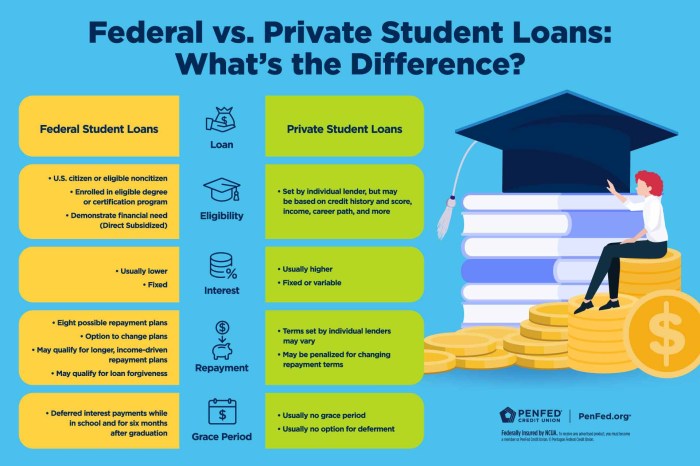

Federal student loans are offered by the government and typically come with more borrower protections than private loans. These protections can include income-driven repayment plans, deferment options during periods of financial hardship, and loan forgiveness programs under certain circumstances. In contrast, private student loans are offered by banks, credit unions, and other financial institutions. They generally have stricter eligibility requirements, potentially higher interest rates, and fewer borrower protections. The approval process for federal loans often considers need and financial background, while private loan approval heavily relies on creditworthiness.

Types of Private Student Loans

Private student loans are categorized in several ways, primarily based on interest rate type and the borrower’s relationship to the student.

Fixed-Rate Private Student Loans

Fixed-rate private student loans offer a consistent interest rate throughout the loan’s life. This predictability makes budgeting and repayment planning easier, as your monthly payments remain constant. The interest rate is set at the time the loan is originated and does not fluctuate with market changes. This offers stability and allows for accurate long-term financial projections. For example, a borrower might secure a fixed-rate loan with a 7% interest rate for the entire repayment period.

Variable-Rate Private Student Loans

Variable-rate private student loans have an interest rate that adjusts periodically based on an underlying index, such as the prime rate or LIBOR (although LIBOR is being phased out). This means your monthly payments could change over time, potentially increasing or decreasing depending on market conditions. While a variable rate might start lower than a fixed rate, it carries the risk of significant increases, making long-term budgeting more challenging. For instance, a variable-rate loan might start at 6% but could rise to 8% or even higher during the repayment period.

Parent Loans

Parent loans are private student loans taken out by a parent or guardian to finance a student’s education. These loans are typically offered with similar terms as student loans (fixed or variable rate), but the creditworthiness of the parent, not the student, is the primary factor in loan approval and interest rate determination. The parent is ultimately responsible for repayment, even if the student is unable to make payments.

Loan Terms: Interest Rates and Repayment Periods

The following table summarizes typical loan terms, though these can vary significantly based on lender, creditworthiness, and other factors. It is crucial to compare offers from multiple lenders before selecting a loan.

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Notes |

|---|---|---|---|

| Fixed-Rate Student Loan | 7% – 10% | 10 – 15 years | Interest rate remains constant throughout the loan term. |

| Variable-Rate Student Loan | 5% – 9% (initial) | 10 – 15 years | Interest rate fluctuates based on market indices. |

| Parent Loan (Fixed-Rate) | 8% – 12% | 10 – 20 years | Parent is responsible for repayment. |

| Parent Loan (Variable-Rate) | 6% – 10% (initial) | 10 – 20 years | Parent is responsible for repayment; interest rate fluctuates. |

Eligibility and Application Process

Securing a private student loan hinges on meeting specific eligibility requirements and navigating the application process effectively. Lenders assess applicants based on various factors to determine creditworthiness and the likelihood of repayment. Understanding these criteria and the steps involved is crucial for a successful application.

Eligibility criteria for private student loans vary among lenders, but common factors include credit history, income, and co-signer availability.

Credit Scores and Co-signers

A strong credit score is often a primary determinant of eligibility. Lenders generally prefer applicants with good to excellent credit scores, typically above 670. A higher credit score often translates to better loan terms, including lower interest rates. However, applicants with lower credit scores may still qualify, particularly if they can secure a co-signer with a strong credit history. A co-signer essentially agrees to repay the loan if the primary borrower defaults. The co-signer’s credit score significantly impacts the loan approval and interest rate. For example, a student with a limited credit history might secure a loan with a favorable interest rate if their parent, with an excellent credit score, acts as a co-signer. Conversely, lacking a strong credit history and a suitable co-signer can result in loan denial or less favorable terms.

Steps in Applying for a Private Student Loan

The application process generally involves several key steps. It’s important to carefully review the lender’s requirements and complete all necessary documentation accurately and promptly. Failure to do so may lead to delays or even rejection of the application.

- Pre-qualification: Many lenders offer pre-qualification tools allowing you to check your eligibility without impacting your credit score. This helps you understand your potential loan terms and shop around.

- Application Submission: Once you’ve chosen a lender, you’ll need to complete a formal application. This typically involves providing personal information, academic details (school, program, expected graduation date), and financial information (income, assets, debts).

- Credit Check and Verification: The lender will perform a credit check and verify the information provided in your application. This may involve contacting your school or employers.

- Co-signer Application (if needed): If a co-signer is required, they will need to complete a separate application and undergo a credit check.

- Loan Approval or Denial: After reviewing your application and creditworthiness, the lender will notify you of their decision. If approved, you’ll receive a loan offer outlining the terms and conditions.

- Loan Disbursement: Once you accept the loan offer, the funds are typically disbursed directly to your school. The disbursement schedule may be spread across multiple semesters or academic years.

Interest Rates and Fees

Understanding the interest rates and fees associated with private student loans is crucial for responsible borrowing. These costs significantly impact the overall repayment amount and should be carefully considered before accepting a loan. Failing to understand these financial aspects can lead to unexpected debt burdens.

Several factors influence the interest rate a lender offers on a private student loan. Your creditworthiness plays a significant role; a higher credit score generally results in a lower interest rate. The loan’s term (the length of time you have to repay) also affects the rate; longer repayment periods often come with higher interest rates. The type of loan, such as a fixed-rate or variable-rate loan, influences the rate as well. Additionally, the lender’s current market conditions and their risk assessment of the borrower contribute to the final interest rate.

Interest Rate Scenarios and Their Impact

Let’s consider two scenarios to illustrate the impact of different interest rates on the total loan cost. Suppose you borrow $20,000 for a 10-year loan.

Scenario 1: A 7% fixed interest rate would result in a total repayment of approximately $27,770, including interest. This means you’ll pay about $7,770 in interest over the life of the loan.

Scenario 2: A 9% fixed interest rate on the same loan would increase the total repayment to approximately $31,670. The interest paid increases to approximately $11,670, showcasing a significant difference in the total cost of the loan due solely to a 2% interest rate difference.

Comparison of Interest Rates from Different Lenders

The following table provides a hypothetical comparison of interest rates from three different private student loan lenders. Remember that these rates are examples and actual rates can vary significantly based on individual creditworthiness and other factors.

| Lender | Fixed Interest Rate (7-year loan) | Fixed Interest Rate (10-year loan) | Variable Interest Rate (7-year loan) |

|---|---|---|---|

| Lender A | 6.5% | 7.0% | 5.0% – 8.0% |

| Lender B | 7.2% | 7.7% | 5.5% – 8.5% |

| Lender C | 6.8% | 7.3% | 5.2% – 8.2% |

Note: Variable interest rates can fluctuate throughout the loan term based on market conditions. The range provided represents the potential interest rate range during the loan’s lifespan.

Fees Associated with Private Student Loans

In addition to interest, private student loans often involve various fees. These fees can include origination fees (charged by the lender for processing the loan), late payment fees (for missed or late payments), and prepayment penalties (for paying off the loan early).

It is vital to carefully review the loan terms and conditions to understand all applicable fees. These fees can add to the overall cost of borrowing and should be factored into your financial planning.

Repayment Options and Plans

Understanding your repayment options is crucial for effectively managing your private student loans. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline. Several options exist, each with its own advantages and disadvantages depending on your financial situation and preferences. Careful consideration of these options is essential before committing to a repayment plan.

Private student loan lenders typically offer a variety of repayment plans designed to accommodate different financial circumstances. These plans primarily differ in the length of the repayment period and the amount of the monthly payment. It’s important to review your loan agreement carefully to understand the specific options available to you and their associated terms and conditions.

Standard Repayment Plans

Standard repayment plans involve fixed monthly payments over a set period, usually 10 years. This option provides predictability in your monthly budget, as the payment amount remains consistent throughout the repayment term. However, it often results in higher monthly payments compared to other options with longer repayment periods. For example, a $50,000 loan at a 7% interest rate with a 10-year standard repayment plan would likely result in significantly higher monthly payments than a 15-year extended repayment plan. The trade-off is that you’ll pay off the loan quicker and accrue less interest in the long run.

Graduated Repayment Plans

Graduated repayment plans feature monthly payments that increase over time. Initial payments are lower, making them more manageable during the early stages of your career when income is typically lower. However, payments gradually increase, potentially leading to higher payments later on as your income is expected to rise. This approach offers flexibility in the short term, but requires careful budgeting as monthly payments will grow steadily. The total repayment period usually remains the same as the standard repayment plan, for example, 10 years.

Extended Repayment Plans

Extended repayment plans stretch the repayment period over a longer timeframe, typically 15 to 25 years. This results in lower monthly payments, making them easier to manage, especially if you have limited income or multiple debts. However, the longer repayment period will lead to a significantly higher total interest paid over the life of the loan. Consider the long-term financial implications before choosing this option. The reduced monthly payment can offer short-term relief, but comes at the cost of higher overall interest payments.

Income-Driven Repayment Plans

Income-driven repayment plans are generally not available for private student loans in the same way they are for federal student loans. While some private lenders may offer programs with flexible payment options based on income, these are often less comprehensive and may have stricter eligibility requirements. It is crucial to contact your private lender directly to inquire about the availability and specifics of any income-driven repayment plans they may offer. These plans might adjust your monthly payments based on your income and family size, but the details vary widely among lenders. There is no single standard model for private loan income-driven repayment plans.

It’s important to note that many private lenders do not offer income-driven repayment plans. The options listed above, particularly the extended repayment plan, might be your best alternative if you are struggling with repayments. Always review your loan agreement carefully and contact your lender to discuss your options before making a decision.

Potential Risks and Considerations

Private student loans, while offering access to funds for higher education, come with inherent risks that require careful consideration. Understanding these potential pitfalls and employing responsible borrowing strategies is crucial to avoiding overwhelming debt and ensuring a positive financial future. This section will explore the key risks associated with private student loans and provide guidance on navigating these challenges.

High Interest Rates and Debt Burden

Private student loans often carry significantly higher interest rates compared to federal student loans. This can lead to a substantial increase in the total cost of borrowing over the loan’s lifetime. The cumulative effect of high interest rates, compounded over many years, can result in a considerable debt burden that extends far beyond the completion of studies. For example, a $20,000 private loan with a 10% interest rate could easily cost $30,000 or more to repay, depending on the repayment plan. This increased cost can impact long-term financial goals like buying a home, investing, or starting a family.

Strategies for Responsible Borrowing and Debt Management

Effective debt management starts with careful planning and responsible borrowing. Before taking out a private student loan, it’s essential to explore all available federal loan options, which typically offer lower interest rates and more flexible repayment plans. Borrow only the amount absolutely necessary, meticulously tracking expenses to minimize borrowing. Creating a realistic budget that incorporates loan repayments is vital. Exploring options like loan refinancing, once you have established a good credit history, can help lower interest rates and potentially reduce the overall repayment burden. Furthermore, maintaining good credit health throughout the loan repayment process is crucial for accessing better financial options in the future.

Scenarios Where Private Loans May Be Beneficial and Where They May Not Be

Private student loans can be a beneficial tool in specific circumstances. For example, students who have exhausted their federal loan eligibility and still require additional funding might find private loans necessary to complete their education. However, private loans are generally less favorable than federal loans. They may not offer the same level of borrower protection or flexible repayment options. For instance, if a borrower faces financial hardship, federal loans often provide forbearance or deferment options, while private loan options might be less lenient. Therefore, private loans should only be considered as a last resort after exhausting all other funding avenues. In situations where the potential cost of the loan, including high interest, outweighs the long-term benefits of the education, it’s crucial to carefully weigh the pros and cons before proceeding. A clear understanding of the financial implications and a solid repayment plan are paramount to making an informed decision.

Comparison with Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding the key differences between these loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. This section will compare and contrast the benefits and drawbacks of each, helping you navigate this important process.

Federal student loans and private student loans offer distinct advantages and disadvantages. Federal loans generally provide more borrower protections and flexible repayment options, while private loans may offer higher loan amounts but often come with stricter terms and potentially higher interest rates. Careful consideration of your financial situation and long-term goals is necessary to determine which loan type best suits your needs.

Key Differences Between Federal and Private Student Loans

The following table summarizes the key differences between federal and private student loans, highlighting aspects such as interest rates, repayment options, and borrower protections.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower and fixed, set by the government. | Variable or fixed, determined by the lender and creditworthiness; typically higher than federal loan rates. |

| Loan Limits | Set by the government and vary depending on the student’s year in school and the type of loan. | Set by the lender and based on creditworthiness and the student’s co-signer’s credit, potentially higher than federal loan limits. |

| Repayment Options | Offers various income-driven repayment plans, deferment, and forbearance options. | Fewer repayment options, generally standard amortization schedules, and limited flexibility in times of financial hardship. |

| Borrower Protections | Strong borrower protections, including loan forgiveness programs (under certain circumstances) and federal regulations safeguarding against predatory lending practices. | Fewer borrower protections; repayment terms are determined by the lender, with less government oversight. |

| Credit Check | Generally does not require a credit check for subsidized loans. Unsubsidized loans may require a credit check for higher loan amounts. | Requires a credit check, and a good credit history is usually necessary for approval. A co-signer with good credit may be required. |

| Application Process | Relatively straightforward application process through the Free Application for Federal Student Aid (FAFSA). | More complex application process that may involve multiple lenders and credit checks. |

Examples of Loan Forgiveness Programs

Several federal student loan forgiveness programs exist, offering partial or complete loan forgiveness under specific circumstances. For example, the Public Service Loan Forgiveness (PSLF) program forgives remaining federal student loan debt after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness offers partial loan forgiveness to teachers who have taught full-time for five consecutive academic years in low-income schools or educational service agencies. These programs are not available for private student loans.

Illustrative Comparison: A Hypothetical Scenario

Consider two students, both needing $20,000 for tuition. Student A secures federal loans at a fixed 4% interest rate, while Student B obtains a private loan with a variable 7% interest rate. Over the loan’s lifetime, Student B will pay significantly more in interest, even with similar repayment plans. This difference highlights the long-term financial implications of choosing between federal and private student loans.

Finding the Best Private Student Loan

Securing the most suitable private student loan requires diligent research and careful comparison of various lenders. Understanding the key factors and employing effective comparison strategies can significantly impact the overall cost and terms of your loan. This section Artikels the steps involved in this crucial process.

Steps to Research and Compare Private Student Loan Lenders

Choosing the right private student loan lender involves a systematic approach. Begin by creating a list of potential lenders based on online research, recommendations, and pre-qualification checks. Then, meticulously gather information from each lender, focusing on the key factors discussed below. Finally, use loan comparison websites to streamline the process and visualize the differences between loan offers. This methodical approach ensures you make an informed decision aligned with your financial situation and repayment capabilities.

Factors to Consider When Choosing a Lender

Several critical factors influence the suitability of a private student loan. Ignoring any of these could lead to unforeseen financial burdens. A thorough assessment is vital to selecting a lender that aligns with your long-term financial goals.

- Interest Rates: Interest rates directly impact the total cost of your loan. Compare fixed versus variable rates, understanding the implications of each. A lower interest rate, even a fraction of a percentage point, can save you thousands of dollars over the loan’s life. For example, a 0.5% difference on a $20,000 loan over 10 years could result in hundreds of dollars in saved interest.

- Fees: Origination fees, late payment fees, and prepayment penalties can significantly increase the loan’s overall cost. Carefully review all associated fees and compare them across lenders. Some lenders might advertise low interest rates but have high fees, effectively negating the interest rate advantage.

- Customer Service: Access to responsive and helpful customer service is crucial, especially during challenging times. Look for lenders with readily available support channels, positive customer reviews, and a clear complaint resolution process. A responsive lender can make a significant difference in managing your loan effectively.

- Repayment Options: Flexibility in repayment options is essential. Compare lenders offering various repayment plans, such as graduated repayment, income-driven repayment (if available for private loans), or deferment options. Choose a lender that offers a repayment plan that aligns with your anticipated post-graduation income.

- Loan Terms: Examine loan terms carefully, including the loan’s length and any limitations on refinancing or consolidation. Shorter loan terms mean higher monthly payments but lower overall interest paid, while longer terms result in lower monthly payments but higher overall interest paid.

Using a Loan Comparison Website Effectively

Loan comparison websites aggregate information from multiple lenders, allowing for a side-by-side comparison of loan offers. To use these websites effectively, input your desired loan amount, credit score (if known), and other relevant information accurately. Pay close attention to the details provided, including the Annual Percentage Rate (APR), which reflects the total cost of the loan including interest and fees. Don’t solely rely on the advertised interest rate; always consider the APR for a complete picture. Remember to check the website’s credibility and ensure it’s comparing loans from a wide range of lenders to avoid biased results. For instance, a website listing only a few lenders might not represent the full market and limit your options.

Illustrative Example: Loan Scenario

Let’s consider a hypothetical scenario to illustrate the practical application of private student loans and their associated costs. This example will highlight the impact of different repayment plans on the total cost of borrowing.

This example uses simplified calculations for illustrative purposes. Real-world loan calculations can be more complex, taking into account factors like compounding interest and variable interest rates. Always consult your loan documents for precise figures.

Loan Details and Calculation

Sarah, a prospective college student, needs $20,000 to cover her tuition and living expenses. She secures a private student loan with a fixed annual interest rate of 7% over a 10-year repayment period. We will examine two repayment plans: a standard repayment plan and an accelerated repayment plan.

Under the standard 10-year plan, the monthly payment would be approximately $238. Using a loan amortization calculator (easily found online), the total interest paid over the 10 years would be approximately $7,700. This means the total cost of the loan would be $27,700 ($20,000 principal + $7,700 interest).

If Sarah opts for an accelerated repayment plan, shortening the repayment period to 7 years, her monthly payments would increase to approximately $326. However, this would significantly reduce the total interest paid, resulting in an estimated total interest of roughly $5,100. The total cost of the loan would be $25,100 ($20,000 principal + $5,100 interest).

Impact of Repayment Options

The difference between the standard and accelerated repayment plans highlights the significant impact of repayment plan selection on the overall cost of the loan. While the accelerated plan requires higher monthly payments, it leads to substantial savings in interest paid over the life of the loan. A difference of $2,600 ($7,700 – $5,100) in interest paid demonstrates the potential financial benefits of choosing a shorter repayment term, assuming the borrower can afford the higher monthly payments.

Note: These calculations are estimates. Actual payments and interest may vary based on the specific loan terms and the lender’s calculations.

Wrap-Up

Securing a private student loan can be a significant step towards achieving your educational goals, but it requires careful planning and a thorough understanding of the associated responsibilities. By diligently researching lenders, comparing loan terms, and developing a sound repayment strategy, you can mitigate potential risks and maximize the benefits of private student financing. Remember that responsible borrowing is key to ensuring a smooth transition from student to successful graduate. This guide provides a framework for making informed decisions; however, always consult with a financial advisor for personalized guidance.

User Queries

What is the difference between a fixed-rate and a variable-rate private student loan?

A fixed-rate loan has an interest rate that remains constant throughout the loan term, making it easier to budget. A variable-rate loan’s interest rate fluctuates based on market conditions, potentially leading to higher or lower payments over time.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers from different lenders before refinancing.

What happens if I default on my private student loan?

Defaulting on a private student loan can severely damage your credit score, potentially making it difficult to obtain loans or credit cards in the future. It may also lead to wage garnishment or legal action.

What are the implications of having a co-signer on a private student loan?

A co-signer shares responsibility for the loan. If you default, the lender can pursue the co-signer for payment. This can impact the co-signer’s credit score.

How do I choose the best private student loan lender?

Consider factors such as interest rates, fees, repayment options, customer service reviews, and lender reputation. Compare offers from multiple lenders before making a decision.