Securing funding for higher education is a crucial step for many students, and understanding the intricacies of private student loan applications is paramount. This guide delves into the process, offering a clear and concise overview of the steps involved, from initial application to repayment strategies. We’ll explore the nuances of dependent versus independent applications, the importance of credit history, and the potential benefits and drawbacks of co-signers. Furthermore, we will arm you with the knowledge to avoid predatory lenders and navigate the complexities of interest rates and repayment plans.

The journey through the private student loan application process can feel overwhelming, but with careful planning and a thorough understanding of the requirements, securing the necessary funds for your education becomes significantly more manageable. This guide provides the tools and information you need to make informed decisions and navigate this critical stage successfully.

Understanding the Private Student Loan Application Process

Securing a private student loan can significantly ease the financial burden of higher education. However, navigating the application process can feel overwhelming. This section will break down the key steps involved, highlight differences between dependent and independent applicants, and provide a guide to completing the application form.

The Typical Steps Involved in a Private Student Loan Application

The private student loan application process generally involves several key steps. First, you’ll need to research and select a lender, comparing interest rates, fees, and repayment options. Next, you’ll pre-qualify to get an estimate of how much you might be able to borrow. This usually involves providing some basic personal and financial information. Following pre-qualification, you’ll complete a full application, providing more detailed financial documentation. The lender will then review your application and make a credit decision. If approved, you’ll receive loan terms and finalize the loan agreement. Finally, the funds will be disbursed, usually directly to your educational institution.

Differences Between Applying as a Dependent Versus an Independent Student

The primary difference lies in the required documentation. Dependent students, typically those under 24 still claimed on their parents’ tax returns, usually need their parents to co-sign the loan. This means the parent shares responsibility for repayment if the student defaults. Independent students, generally those over 24, married, or with dependents, typically apply solely on their own creditworthiness. This often means stricter credit requirements and potentially higher interest rates for independent students with limited credit history. However, independent students may have access to higher loan amounts.

Completing a Private Student Loan Application Form

A step-by-step guide to completing a private student loan application form usually includes the following: First, you’ll provide personal information, including your name, address, date of birth, and social security number. Next, you’ll detail your educational information, such as the school you’re attending, your program of study, and your expected graduation date. You will then supply financial information, including your income (if applicable), assets, and debts. You might also need to provide details about your co-signer’s financial information if applicable. Finally, you’ll review the loan terms and electronically sign the agreement. Be sure to carefully read all terms and conditions before signing.

Comparison of Application Requirements Across Different Private Lenders

The specific requirements for private student loans can vary significantly among lenders. The table below provides a comparison of three hypothetical lenders (Note: These are examples and may not reflect actual lender policies):

| Lender | Credit Score Requirement | Co-signer Requirement (Dependent Students) | Required Documentation |

|---|---|---|---|

| Lender A | 660+ | Typically Required | Tax returns, pay stubs, bank statements |

| Lender B | 680+ | May be Required | Tax returns, bank statements, proof of enrollment |

| Lender C | 700+ | Not Required (for independent students with strong credit) | Tax returns, pay stubs, bank statements, credit report |

Required Documentation and Information

Applying for a private student loan requires providing various documents and information to the lender. This ensures the lender can assess your creditworthiness and determine your eligibility for a loan. Accuracy and completeness are crucial throughout the process.

The lender needs to verify your identity, assess your financial situation, and understand your educational goals to make an informed lending decision. Failing to provide complete and accurate information can lead to delays, loan denial, or even legal consequences.

Necessary Documents

Providing all required documentation is essential for a smooth and efficient application process. Incomplete applications often result in delays, and missing information may lead to rejection. Lenders typically require a range of documents to verify your identity, financial stability, and educational plans.

- Government-Issued Photo Identification: A driver’s license, passport, or state-issued ID card is typically required to verify your identity.

- Social Security Number (SSN): Your SSN is necessary for credit checks and loan processing.

- Proof of Enrollment: This usually involves providing an acceptance letter or enrollment verification from your chosen educational institution.

- Financial Aid Award Letter (if applicable): This document Artikels any financial aid you’ve received, helping the lender understand your overall financial picture.

- Tax Returns (or W-2s): These documents verify your income and tax history, crucial for assessing your ability to repay the loan.

- Bank Statements: Bank statements demonstrate your financial activity and can help assess your financial responsibility.

- Co-signer Information (if required): If you need a co-signer, their financial information, including credit reports and income verification, will also be needed.

Importance of Accurate Information

Submitting accurate and complete information is paramount to a successful loan application. Inaccurate or incomplete information can lead to delays, increased scrutiny, or even loan denial. The lender relies on the information you provide to assess your risk and make a responsible lending decision. Providing false information can have serious legal repercussions.

Consequences of Providing False Information

Providing false or misleading information on your loan application is a serious offense. It can lead to immediate loan denial, damage to your credit score, and potential legal action from the lender. In some cases, false information can result in criminal charges. Maintaining honesty and accuracy throughout the application process is crucial.

Application Checklist

Before beginning your application, use this checklist to ensure you have all the necessary documents and information:

- Government-Issued Photo ID

- Social Security Number

- Proof of Enrollment

- Financial Aid Award Letter (if applicable)

- Tax Returns (or W-2s) from the past [Number] years

- Bank Statements from the past [Number] months

- Co-signer Information (if applicable)

Credit History and Co-signers

Securing a private student loan often hinges on your creditworthiness. Lenders assess your credit history to gauge your ability and willingness to repay the loan. A strong credit history increases your chances of approval and may even lead to more favorable interest rates. Conversely, a limited or poor credit history can significantly impact your loan application.

Credit History’s Role in Loan Approval

Your credit history is a detailed record of your borrowing and repayment behavior. Lenders use credit scores, derived from this history, to evaluate risk. A higher credit score generally indicates a lower risk of default, resulting in a higher likelihood of loan approval and potentially lower interest rates. Factors considered include payment history (on-time payments are crucial), amounts owed, length of credit history, new credit applications, and credit mix (variety of credit accounts). A consistent history of responsible credit management significantly strengthens your application. Conversely, late payments, high debt-to-income ratios, or bankruptcies can negatively impact your chances.

Strategies for Applicants with Limited or Poor Credit History

Improving your creditworthiness before applying for a private student loan is highly advisable. This can involve several strategies. First, diligently pay all existing bills on time. Second, keep credit utilization low – aim to use less than 30% of your available credit. Third, consider becoming an authorized user on a credit card with a long, positive history. This can help build your credit history. Fourth, if you have any errors on your credit report, dispute them with the relevant credit bureaus. Finally, avoid opening multiple new credit accounts in a short period, as this can negatively impact your score. Consistent positive actions over time will gradually improve your credit profile.

Co-signer Responsibilities and Implications

A co-signer is an individual who agrees to repay the loan if the primary borrower (the student) defaults. This significantly reduces the lender’s risk. The co-signer assumes full financial responsibility for the loan, meaning they are legally obligated to repay the debt if the student fails to do so. This responsibility extends beyond the repayment period and can negatively impact the co-signer’s credit score if the borrower defaults. It’s crucial for both the student and co-signer to fully understand the implications before agreeing to this arrangement.

Benefits and Drawbacks of Using a Co-signer

Using a co-signer offers several advantages. It significantly increases the chances of loan approval, even with a limited or poor credit history. It can also lead to better interest rates and loan terms. However, it also presents drawbacks. The co-signer assumes significant financial risk and their credit score is at stake. The co-signer’s credit report will be affected by the loan’s repayment history. Moreover, the co-signer remains responsible for the loan even if the relationship with the borrower changes. Careful consideration of these factors is essential before involving a co-signer.

Interest Rates and Loan Terms

Understanding interest rates and loan terms is crucial for making informed decisions about private student loans. These factors significantly impact the overall cost of your education and your future financial obligations. Choosing a loan with favorable terms can save you thousands of dollars over the life of the loan.

Private student loan interest rates are determined by several factors, primarily your creditworthiness. Lenders assess your credit history, including your credit score, payment history, and debt-to-income ratio. A higher credit score generally translates to a lower interest rate, reflecting a lower perceived risk for the lender. Other factors influencing the interest rate include the loan amount, the loan term (length of repayment), and the type of loan. Some lenders may offer discounts for borrowers who enroll in autopay or have a co-signer with strong credit. Variable interest rates, which fluctuate with market conditions, are also common, offering the potential for lower initial rates but exposing you to increased costs if rates rise. Fixed interest rates remain constant throughout the loan’s life, providing predictable monthly payments.

Repayment Plan Options and Their Implications

Several repayment plan options are available for private student loans, each with different implications for your monthly payments and the total interest paid. Understanding these options is key to choosing a plan that aligns with your post-graduation financial situation.

Common repayment plans include:

- Standard Repayment: This plan typically involves fixed monthly payments over a set period (e.g., 5-15 years). While offering predictable payments, it may result in higher total interest paid due to the longer repayment period.

- Graduated Repayment: Payments start low and gradually increase over time. This can be helpful initially but leads to higher payments later in the repayment period.

- Extended Repayment: This option stretches the repayment period over a longer timeframe, reducing monthly payments but increasing the total interest paid significantly.

- Income-Driven Repayment (IDR): While less common with private loans than federal loans, some private lenders may offer IDR plans where your monthly payment is tied to your income. This can provide flexibility during periods of lower income but may result in a longer repayment period.

Comparison of Interest Rates and Loan Terms from Major Private Lenders

It’s essential to compare offers from multiple lenders before selecting a private student loan. Interest rates and loan terms can vary considerably. The following table provides a hypothetical comparison (actual rates and terms are subject to change and individual borrower qualifications):

| Lender | Interest Rate (Variable) | Interest Rate (Fixed) | Minimum Loan Term (Years) |

|---|---|---|---|

| Lender A | 6.5% – 10.5% | 7.0% – 11.0% | 5 |

| Lender B | 6.0% – 9.5% | 7.5% – 10.5% | 5 |

| Lender C | 7.0% – 11.0% | 8.0% – 12.0% | 10 |

Understanding the Total Cost of Borrowing

The total cost of borrowing includes not only the principal loan amount but also the accumulated interest over the loan’s life. It’s crucial to calculate this total cost before accepting a loan. A longer repayment period might seem appealing due to lower monthly payments, but it will likely result in significantly higher total interest paid. Using a loan amortization calculator can help you determine the total cost and visualize your monthly payments over the loan’s duration. For example, a $20,000 loan at 7% interest over 10 years will cost significantly more than the same loan at 7% interest over 5 years, even though the monthly payments are higher in the shorter-term option. The difference in total cost paid represents the accumulated interest.

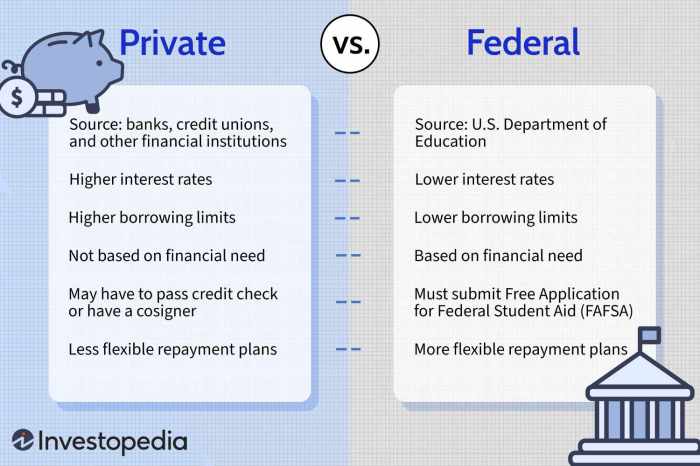

Comparison of Private vs. Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding the key differences between these loan types is essential for making an informed choice that aligns with your individual circumstances and financial goals. This section will compare and contrast these options, highlighting their advantages and disadvantages to help you navigate this important process.

Both federal and private student loans offer funding for higher education, but they differ significantly in their eligibility requirements, repayment terms, and overall benefits. Federal loans are backed by the government, while private loans are offered by banks and other financial institutions. This fundamental difference leads to a variety of other distinctions, which we will explore in detail.

Key Differences Between Private and Federal Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Eligibility | Generally available to students enrolled at least half-time in an eligible program; based on financial need for some programs. | Based on creditworthiness; co-signer often required for students with limited or no credit history. |

| Interest Rates | Fixed or variable rates set by the government; generally lower than private loan rates. | Variable or fixed rates determined by the lender; typically higher than federal loan rates, influenced by market conditions and borrower creditworthiness. |

| Repayment Options | Offers various repayment plans (standard, graduated, extended, income-driven) and options for deferment or forbearance in times of financial hardship. | Repayment options are typically less flexible and may not offer income-driven repayment plans or the same forbearance/deferment options as federal loans. |

| Loan Forgiveness Programs | Eligible for loan forgiveness programs (e.g., Public Service Loan Forgiveness, Teacher Loan Forgiveness) under specific circumstances. | Generally not eligible for government loan forgiveness programs. |

Advantages and Disadvantages of Federal Student Loans

Federal student loans provide numerous benefits, but also have some limitations. Understanding both aspects is crucial for a well-informed decision.

Advantages of Federal Student Loans

Federal loans offer several key advantages, including more favorable interest rates, flexible repayment options, and the possibility of loan forgiveness programs.

Disadvantages of Federal Student Loans

While offering significant advantages, federal loans may have stricter eligibility requirements and lower borrowing limits compared to private loans. The application process can also be more complex and time-consuming.

Advantages and Disadvantages of Private Student Loans

Private student loans can offer higher borrowing limits and potentially simpler application processes, but often come with higher interest rates and less flexible repayment options.

Advantages of Private Student Loans

Private loans may provide access to larger loan amounts than federal loans, making them suitable for students with higher educational expenses. The application process can be faster and simpler than for federal loans.

Disadvantages of Private Student Loans

Private loans typically have higher interest rates than federal loans, potentially leading to higher overall borrowing costs. They also often lack the flexible repayment options and loan forgiveness programs available with federal loans.

Scenarios Favoring One Loan Type Over the Other

The best choice between federal and private student loans depends heavily on individual circumstances. Here are some scenarios where one type might be preferred.

Scenario 1: Limited Credit History/Low Credit Score. Federal loans are generally preferable as they don’t require a strong credit history or a co-signer. Private loans are often inaccessible without a strong credit profile or a co-signer with good credit.

Scenario 2: High Educational Costs Exceeding Federal Loan Limits. In situations where the cost of education exceeds the maximum amount available through federal loans, private loans may be necessary to cover the remaining expenses. However, it’s crucial to carefully weigh the higher interest rates and less flexible repayment terms.

Scenario 3: Desire for Loan Forgiveness Programs. Federal loans offer eligibility for various loan forgiveness programs, making them attractive to students pursuing careers in public service or teaching. Private loans generally do not offer such options.

Avoiding Scams and Predatory Lending

Securing a private student loan can be a crucial step in financing your education, but it’s vital to navigate this process cautiously. Predatory lenders exploit vulnerable students, employing deceptive tactics to trap them in high-interest, difficult-to-repay loans. Understanding these tactics and recognizing warning signs is essential for protecting your financial future.

Predatory lenders often target student loan applicants through various deceptive methods. These tactics aim to confuse borrowers and pressure them into accepting unfavorable loan terms. Understanding these methods empowers you to make informed decisions and avoid falling victim to scams.

Common Tactics of Predatory Lenders

Predatory lenders frequently employ high-pressure sales tactics, promising quick approvals and easy application processes, often overlooking the long-term financial implications. They may deliberately obfuscate crucial information such as interest rates, fees, and repayment terms, making it difficult for borrowers to compare loan offers effectively. Some may even target students with poor credit scores, offering loans with extremely high interest rates, knowing that these students may have limited options. Another common tactic involves using deceptive marketing materials that exaggerate the benefits of their loans while downplaying the risks. Finally, they may employ aggressive collection practices once a loan is in default.

Recognizing and Avoiding Private Student Loan Scams

Several key indicators can help you identify potential scams. Be wary of unsolicited loan offers, particularly those that arrive via email or text message. Legitimate lenders rarely solicit borrowers directly in this manner. Always verify the lender’s legitimacy through independent research. Check the lender’s website for contact information, licensing details, and customer reviews. Scrutinize the loan agreement meticulously, paying close attention to the interest rate, fees, and repayment terms. If any aspect seems unclear or unreasonable, seek clarification before signing. Never provide sensitive personal information, such as your Social Security number or bank account details, unless you’re certain the lender is reputable and the communication channel is secure. If a lender pressures you to make a quick decision or asks for upfront fees, it’s a significant red flag.

Characteristics of a Reputable Private Student Loan Lender

Reputable private student loan lenders operate transparently, providing clear and concise information about their loan products. They will readily provide details on interest rates, fees, and repayment terms, allowing you to compare offers effectively. Their websites will feature readily available contact information, and their customer service representatives will be responsive and helpful. Reputable lenders will also adhere to all applicable laws and regulations, and they will never pressure you into accepting a loan you’re not comfortable with. They prioritize clear communication and a fair lending process. They also provide resources and educational materials to help borrowers understand their loan obligations and manage their finances effectively.

Red Flags Indicating a Potentially Predatory Loan Offer

A high interest rate significantly exceeding market rates is a major red flag. Hidden fees or unexpected charges should also raise concerns. Vague or unclear loan terms, pressure to sign quickly, and a lack of transparency are further warning signs. Unsolicited offers, particularly via email or text message, are often associated with scams. Aggressive collection tactics before the loan is even disbursed should also raise concerns. Finally, if a lender requires an upfront fee to process your application, it’s likely a scam. A reputable lender will never charge upfront fees.

Post-Application Process and Repayment

After submitting your private student loan application, the lender will review your information, including your credit history, co-signer details (if applicable), and the requested loan amount. This process can take several weeks, depending on the lender and the complexity of your application. You will receive updates on the status of your application throughout this period.

Loan Disbursement

Once your application is approved, the lender will disburse the loan funds. This typically occurs in installments, directly deposited into your school’s account or your personal account, depending on the lender’s policy and your school’s requirements. The first disbursement usually happens after you’ve enrolled in your classes and the school has confirmed your attendance. Subsequent disbursements may be tied to specific academic terms or semesters. The lender will provide you with specific details regarding the disbursement schedule and payment method.

Repayment Options and Strategies

Choosing the right repayment plan is crucial for managing your student loan debt effectively. Several repayment options are generally available, each with its own advantages and disadvantages.

Standard Repayment

This is the most common repayment plan, involving fixed monthly payments over a set period (typically 10-15 years). The monthly payment amount is calculated based on the loan’s principal balance, interest rate, and loan term. This plan allows for predictable budgeting but might result in higher total interest paid compared to other options.

Extended Repayment

This plan stretches the repayment period over a longer time frame, typically 20-25 years. This lowers your monthly payments, making them more manageable, but it significantly increases the total interest paid over the life of the loan.

Graduated Repayment

With this plan, your monthly payments start low and gradually increase over time. This can be helpful for recent graduates who anticipate higher earnings in the future. However, it is essential to understand that the overall interest paid will likely be higher compared to a standard repayment plan due to the longer period of interest accrual on the principal.

Income-Driven Repayment (IDR)

While less common with private loans than federal loans, some private lenders may offer income-driven repayment plans. These plans base your monthly payments on your income and family size. The remaining balance may be forgiven after a certain number of years, but this often involves significant interest accrual. Always check with your lender to see if this option is available.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $20,000 loan at 6% interest, demonstrating the differences between Standard and Extended Repayment plans. Remember, this is just an example, and your actual repayment schedule will depend on your loan terms and chosen plan.

| Month | Standard Repayment (10 years) | Extended Repayment (20 years) | Interest Paid (Difference) |

|---|---|---|---|

| 1 | $210 | $120 | $90 |

| 12 | $210 | $120 | $90 |

| 24 | $210 | $120 | $90 |

| 60 | $210 | $120 | $90 |

| 120 | $210 | $120 | $90 |

| Total Interest Paid (Approximate) | $6,000 | $12,000 | $6,000 |

Final Summary

Successfully navigating the private student loan application process requires careful attention to detail, a proactive approach to gathering necessary documentation, and a thorough understanding of the terms and conditions. By following the steps Artikeld in this guide, and by being aware of potential pitfalls such as predatory lending practices, you can significantly increase your chances of securing a loan that meets your needs and allows you to focus on your academic pursuits. Remember to compare offers from multiple lenders to ensure you find the most favorable terms. Your financial future and educational success depend on making informed choices.

Helpful Answers

What is the difference between a private and federal student loan?

Federal loans are offered by the government and typically have more favorable terms and protections for borrowers. Private loans are offered by banks and credit unions, often requiring a credit check and potentially higher interest rates.

What happens if I don’t repay my private student loan?

Failure to repay can lead to negative impacts on your credit score, wage garnishment, and potential legal action by the lender.

Can I refinance my private student loan?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it’s crucial to compare offers carefully before refinancing.

How long does the private student loan application process take?

The processing time varies depending on the lender and the completeness of your application. It can typically take several weeks or even months.

What if my application is denied?

Lenders will usually provide a reason for denial. You can try to improve your credit score, find a co-signer, or apply with a different lender.