The soaring cost of higher education has left many students grappling with the substantial burden of private student loan debt. This debt, unlike its federally backed counterpart, often comes with higher interest rates and less flexible repayment options, potentially casting a long shadow over borrowers’ financial futures. Understanding the intricacies of private student loans is crucial for navigating this complex landscape and making informed decisions.

This overview delves into the various aspects of private student loan debt, from its staggering growth and impact on specific demographics to the lending practices of private institutions and the potential long-term consequences for borrowers. We will also explore alternative financing options and discuss the importance of consumer protection in this often-opaque market.

The Magnitude of Private Student Loan Debt

The accumulation of private student loan debt in the United States represents a significant financial challenge for millions of borrowers. Understanding the scale of this debt, its impact on various demographics, and its growth trajectory is crucial for developing effective strategies to address this growing issue. This section will delve into the statistical realities of private student loan debt in the US.

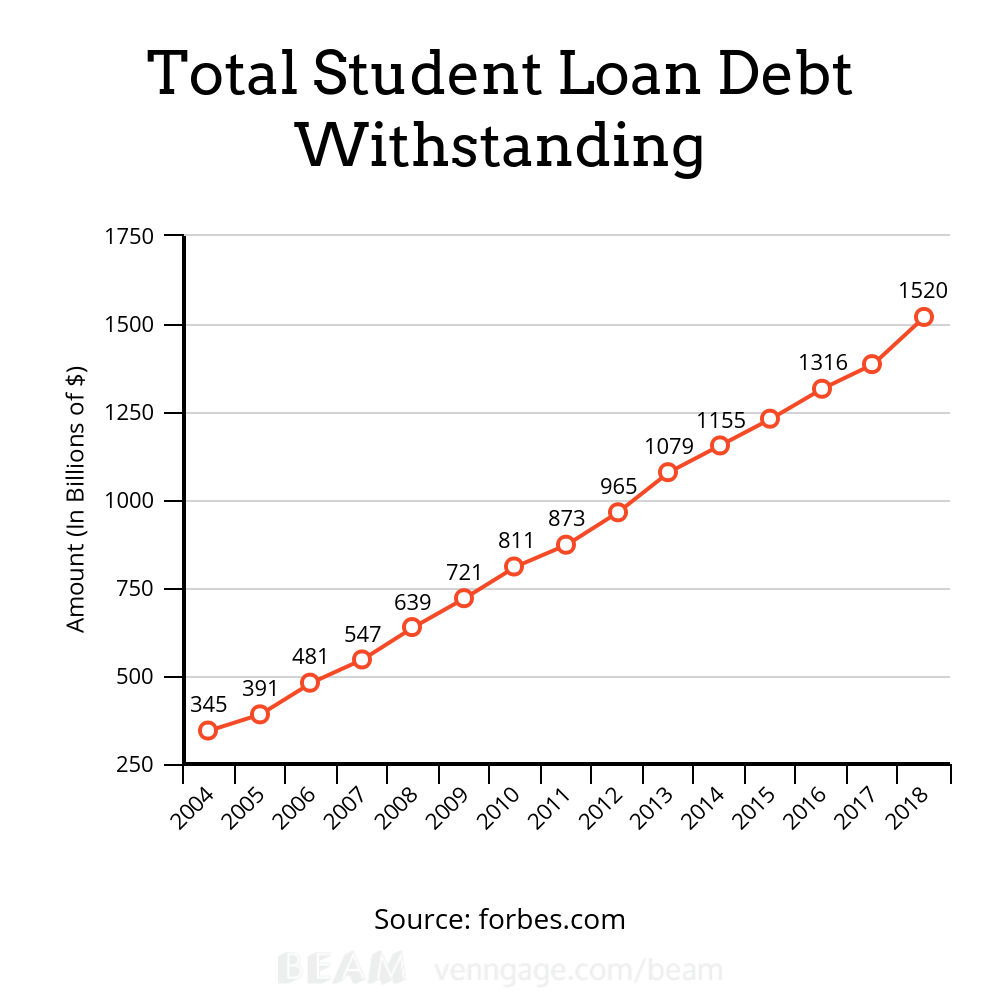

While precise figures fluctuate, the total amount of outstanding private student loan debt in the US is substantial and continues to rise. While federal student loan data is more readily available and tracked, comprehensive, publicly accessible data on private student loans lags. However, various reports from reputable sources like the Federal Reserve and the Consumer Financial Protection Bureau (CFPB) suggest a significant and growing burden. Over the past decade, this debt has experienced considerable growth, mirroring, although often at a faster rate, the overall increase in student loan borrowing.

Demographic Groups Most Affected by High Private Student Loan Debt

Private student loan debt disproportionately impacts specific demographic groups. For instance, borrowers from lower-income families often rely more heavily on private loans to supplement federal aid, leaving them with a larger debt burden relative to their income. Similarly, minority students and students attending for-profit institutions frequently find themselves facing higher private loan balances. Furthermore, those pursuing graduate or professional degrees, such as medical or law degrees, often accumulate substantial private loan debt due to the high cost of these programs. These groups often face a steeper climb to financial stability after graduation due to the weight of their debt.

Average Private Student Loan Debt Burden Across Educational Levels

The following table provides a comparison of average private student loan debt burdens across different educational levels. It’s important to note that these figures are estimates and can vary depending on the source and year of data collection. Moreover, these are averages; individual experiences can differ greatly.

| Educational Level | Average Private Student Loan Debt (USD) | Data Source (Illustrative) | Notes |

|---|---|---|---|

| Bachelor’s Degree | $20,000 – $30,000 | Estimated based on CFPB & Sallie Mae data | Wide variation based on institution and program |

| Master’s Degree | $40,000 – $60,000 | Estimated based on CFPB & Sallie Mae data | Higher costs and longer program duration contribute to larger debt |

| Professional Degree (e.g., Law, Medicine) | $100,000 – $200,000+ | Estimated based on CFPB & Sallie Mae data | Significant variation based on specialty and institution |

| Associate’s Degree | $10,000 – $20,000 | Estimated based on CFPB & Sallie Mae data | Generally lower debt compared to bachelor’s or graduate degrees |

Interest Rates and Repayment Terms

Private student loans, unlike their federal counterparts, operate within a market-driven system, resulting in a wider range of interest rates and repayment options. Understanding these intricacies is crucial for borrowers to make informed decisions and avoid potential financial hardship. This section will explore the typical interest rates and repayment structures associated with private student loans, highlighting key differences from federal loans and potential consequences of default.

Private student loan interest rates are significantly influenced by factors such as the borrower’s creditworthiness, the loan amount, and prevailing market conditions. Generally, these rates tend to be higher than those offered on federal student loans, which are subsidized by the government and often offer more favorable terms. The difference can be substantial, potentially adding thousands of dollars to the total cost of borrowing over the life of the loan. For example, a private loan might carry an interest rate of 7-13% or even higher, compared to a federal unsubsidized loan rate that might be in the 4-7% range (these are illustrative examples and actual rates vary considerably). The interest rate may also be fixed or variable, impacting the predictability of monthly payments.

Interest Rate Types and Their Implications

Private student loans commonly offer both fixed and variable interest rates. A fixed interest rate remains constant throughout the loan’s term, providing borrowers with predictable monthly payments. Conversely, a variable interest rate fluctuates based on market indices, leading to unpredictable monthly payments that can rise or fall over time. Borrowers with fixed interest rates benefit from stability, whereas those with variable rates might experience lower initial payments but face the risk of significantly higher payments later on. The choice between fixed and variable rates depends heavily on individual risk tolerance and financial circumstances. A borrower anticipating potential financial instability might prefer the predictability of a fixed rate, while one anticipating a rapid increase in income might risk a variable rate hoping for lower initial payments.

Repayment Options for Private Student Loans

Private lenders offer a variety of repayment plans, though they are generally less flexible than those available for federal loans. Common options include standard repayment plans (fixed monthly payments over a set term, usually 10-15 years), graduated repayment plans (payments start low and gradually increase), and extended repayment plans (longer repayment terms, leading to lower monthly payments but higher overall interest costs). Some lenders may also offer income-driven repayment plans, though these are less common and often less generous than federal income-driven repayment options. The selection of an appropriate repayment plan should consider the borrower’s current financial situation and future earning potential.

Consequences of Defaulting on Private Student Loans

Defaulting on a private student loan can have severe financial consequences. Unlike federal student loans, which have certain protections and options for rehabilitation, private student loan defaults often lead to:

- Damage to credit score: A significant drop in credit score, making it difficult to obtain credit in the future (mortgages, auto loans, credit cards).

- Wage garnishment: A portion of the borrower’s wages can be legally seized to repay the debt.

- Bankruptcy implications: While student loan debt is generally dischargeable in bankruptcy, it is more difficult to discharge private student loans than federal ones.

- Collection agency involvement: The debt may be sold to a collection agency, which can employ aggressive collection tactics.

- Legal action: Lenders may take legal action to recover the debt, potentially resulting in judgments and further financial penalties.

The Role of Private Lenders

Private student lenders play a significant role in financing higher education, particularly for students who may not qualify for federal loans or whose federal loan amounts are insufficient to cover their educational expenses. These lenders offer a range of loan products with varying terms and conditions, impacting students’ financial futures in substantial ways. Understanding their practices is crucial for prospective borrowers to make informed decisions.

Private lenders operate under different business models and utilize diverse lending practices. Their involvement in the student loan market has both advantages and disadvantages for borrowers.

Major Players in the Private Student Loan Market and Their Lending Practices

Several large financial institutions dominate the private student loan market. These include national banks like Sallie Mae (now Navient and Sallie Mae), Discover, and Citizens Bank, as well as smaller regional banks and credit unions. Their lending practices often involve a thorough credit check of both the student and co-signer (if required), assessment of the student’s academic record, and evaluation of the chosen educational program. Many lenders utilize sophisticated algorithms to assess risk and determine interest rates and loan terms. Some lenders offer a variety of loan products, including variable and fixed interest rate options, while others may focus on specific types of loans, such as those for graduate studies or professional programs. The application process usually involves submitting financial information, academic transcripts, and sometimes even a co-signer’s credit report.

Comparison of Lending Criteria Used by Different Private Lenders

Lending criteria vary across private lenders. While all lenders consider creditworthiness, the specific weight given to different factors differs. For example, some lenders may place greater emphasis on the applicant’s credit history, while others might prioritize the co-signer’s credit score. Similarly, the minimum credit score required can vary, as can the debt-to-income ratio thresholds. Some lenders may be more lenient regarding the type of degree pursued, while others might favor students enrolled in programs with higher projected earning potential. The interest rates offered also differ based on the applicant’s credit profile, the loan amount, and the repayment terms selected. A student with excellent credit and a strong co-signer might secure a lower interest rate compared to a student with a limited credit history.

Ethical Considerations Surrounding Private Student Lending Practices

Ethical concerns exist regarding certain private student lending practices. Predatory lending, characterized by excessively high interest rates, misleading terms, and aggressive marketing tactics, remains a significant issue. Borrowers may find themselves trapped in a cycle of debt due to unforeseen circumstances or unexpected changes in their financial situation. The lack of transparency in some loan agreements can further complicate the situation, making it difficult for borrowers to understand the full extent of their financial obligations. Moreover, the absence of robust consumer protection measures in the private student loan market has left many borrowers vulnerable to unfair or exploitative practices. The consequences can be severe, leading to financial hardship and impacting borrowers’ credit scores for years to come. Examples of predatory practices include undisclosed fees, balloon payments, and deceptive marketing that targets vulnerable students.

The Impact on Borrowers

Private student loan debt casts a long shadow over borrowers’ financial futures, impacting their ability to achieve key milestones and creating significant emotional burdens. The high cost of repayment can severely restrict financial flexibility and hinder long-term stability, affecting everything from homeownership to retirement planning.

The weight of significant private student loan debt can significantly impede a borrower’s journey towards financial stability. High monthly payments often consume a large portion of disposable income, leaving little room for saving, investing, or addressing unexpected expenses. This can delay or even prevent major life goals such as purchasing a home, starting a family, or adequately funding retirement. For example, a borrower burdened with a substantial private loan balance may struggle to meet the down payment requirements for a mortgage, even with a stable income. Similarly, the need to prioritize loan repayment can limit contributions to retirement accounts, potentially leading to a less secure financial future in later life.

Long-Term Financial Implications

High private student loan debt often leads to a cascade of negative financial consequences. The persistent pressure of loan repayments can make it difficult to save for retirement, purchase a home, or even build an emergency fund. This financial strain can extend beyond the individual, impacting family stability and future generations. Consider a scenario where a young professional dedicates a significant portion of their income to loan repayment, limiting their ability to save for their children’s education. This intergenerational impact highlights the far-reaching consequences of high private student loan debt. The inability to accumulate wealth also affects long-term financial security and opportunities for investment, potentially hindering wealth accumulation and intergenerational transfer of wealth.

Emotional and Psychological Toll

The stress associated with managing substantial student loan debt can have a profound impact on mental and emotional well-being. The constant pressure to make payments, coupled with the fear of default, can lead to anxiety, depression, and even sleep disturbances. This financial burden can also strain personal relationships, as individuals may struggle to maintain a healthy work-life balance or engage in social activities due to financial constraints. For example, a borrower may forgo opportunities for professional development or personal enrichment due to the need to prioritize loan repayment. This can negatively affect career advancement and overall life satisfaction. The emotional toll can extend to families as well, with financial stress impacting family dynamics and overall happiness.

Impact Across Life Stages

The effects of private student loan debt vary significantly depending on the borrower’s life stage. In early career stages, the burden of loan repayments can hinder career choices, potentially forcing individuals to accept lower-paying jobs with better repayment schedules. During mid-career, the pressure of loan repayment can make it challenging to save for retirement or pursue further education. In retirement, the lingering debt can reduce financial security and limit access to healthcare and other essential services. A person graduating with significant debt may struggle to enter fields requiring further education or specialization due to the financial burden. Someone in mid-career may find it challenging to buy a home or invest for retirement due to existing loan payments. In retirement, the unpaid balance may create a significant financial hardship, impacting the quality of life.

Government Regulation and Consumer Protection

The private student loan market, while offering an alternative to federal loans, operates with less stringent regulatory oversight. This lack of comprehensive regulation creates potential vulnerabilities for borrowers, leaving them susceptible to predatory lending practices and unfair terms. Understanding the existing regulations and advocating for stronger consumer protections is crucial for ensuring fair and transparent lending practices within this sector.

Existing government regulations concerning private student loans are primarily focused on disclosure requirements, aiming to provide borrowers with sufficient information to make informed decisions. The Truth in Lending Act (TILA), for example, mandates clear disclosure of interest rates, fees, and repayment terms. However, the effectiveness of these regulations is debated. Critics argue that the complexity of loan terms and the high-pressure environment surrounding college financing often overwhelm borrowers, rendering the disclosures insufficient to protect them from unfavorable loan structures. Furthermore, enforcement of existing regulations can be inconsistent, leaving some borrowers vulnerable to predatory lenders who may exploit loopholes or disregard regulatory requirements.

Existing Regulatory Frameworks and Their Limitations

The primary regulatory framework governing private student loans is the Truth in Lending Act (TILA), which requires lenders to disclose key loan terms clearly and accurately. However, the complexity of loan structures, coupled with the pressure students and families face during the college application process, often makes it difficult for borrowers to fully understand the implications of their loan agreements. Moreover, TILA does not address all aspects of predatory lending, such as deceptive marketing practices or unfair collection tactics. Other relevant regulations, like the Fair Credit Reporting Act (FCRA) and the Fair Debt Collection Practices Act (FDCPA), provide some protection, but their applicability to private student loans is sometimes unclear or inconsistently enforced. This lack of comprehensive oversight creates a gap in consumer protection, allowing some lenders to operate with practices that may not be in the best interests of the borrower. For example, variable interest rates, which can fluctuate significantly, can lead to unexpected increases in loan payments, placing borrowers in a difficult financial situation.

Potential Policy Changes to Enhance Consumer Protection

Several policy changes could significantly improve consumer protection in the private student loan market. One crucial step is strengthening enforcement of existing regulations, ensuring that lenders comply with disclosure requirements and avoid predatory practices. Increased funding for regulatory agencies and stricter penalties for violations could deter unethical behavior. Additionally, standardized loan terms and simplified disclosures could make it easier for borrowers to compare loan offers and make informed decisions. The implementation of a robust complaint mechanism, with readily accessible and effective channels for redress, is also crucial. Finally, consideration should be given to expanding the scope of regulations to address issues like deceptive marketing practices and unfair collection tactics. These changes would create a more level playing field, empowering borrowers to make informed choices and reducing their vulnerability to predatory lending.

Recommendations for Borrowers to Avoid Predatory Lending

Thorough research is paramount before signing any loan agreement. It is vital to compare offers from multiple lenders, carefully scrutinizing all terms and conditions, including interest rates, fees, and repayment options. Understanding the implications of different repayment plans, such as fixed versus variable interest rates, is crucial. Seek independent financial advice before committing to a loan. A financial advisor can help assess your financial situation, provide guidance on loan options, and ensure that you understand the long-term implications of your borrowing decisions.

- Shop around and compare loan offers from multiple lenders: Don’t settle for the first offer you receive. Compare interest rates, fees, and repayment terms to find the best deal.

- Read the loan agreement carefully before signing: Understand all terms and conditions, including interest rates, fees, and repayment options.

- Avoid lenders who make unrealistic promises or use high-pressure sales tactics: Be wary of lenders who guarantee approval or promise unusually low interest rates.

- Seek independent financial advice: A financial advisor can help you assess your financial situation and choose the best loan for your needs.

- Understand the implications of different repayment plans: Consider the long-term costs and implications of different repayment options.

Alternative Financing Options

The high cost of higher education often necessitates exploring funding sources beyond private student loans. Several alternatives exist, each with its own set of advantages and disadvantages, offering pathways to financing a college education without the potential burden of significant private debt. Careful consideration of these options is crucial for prospective students and their families.

Exploring alternative financing options can significantly impact a student’s overall financial health after graduation. By reducing reliance on private loans, students can avoid high interest rates and potentially overwhelming debt repayment schedules. This section will examine several key alternatives, comparing their benefits and drawbacks to private student loans.

Scholarships and Grants

Scholarships and grants represent non-repayable forms of financial aid. Scholarships are typically merit-based, awarded based on academic achievement, athletic ability, or other talents. Grants, on the other hand, are often need-based, distributed to students demonstrating financial hardship. Both significantly reduce the need for borrowing.

Unlike private student loans, scholarships and grants do not require repayment. This is a substantial advantage, eliminating the long-term financial burden associated with loan repayment. However, securing scholarships and grants can be competitive, requiring extensive applications and a strong academic record. The availability of these funds also varies greatly depending on the institution and the student’s profile. For example, a highly competitive scholarship at a prestigious university might require an exceptional GPA and standardized test scores, while need-based grants are subject to funding availability and the applicant’s financial need as determined by the Free Application for Federal Student Aid (FAFSA).

Income-Share Agreements (ISAs)

Income-share agreements are a relatively newer alternative to traditional student loans. With an ISA, investors provide funding for a student’s education in exchange for a percentage of their future income for a set period. This shifts the repayment burden from a fixed schedule to a percentage of earnings.

ISAs offer a potential advantage by aligning repayment with income. If a graduate earns less, their payments are lower. Conversely, high earners pay a larger percentage. However, ISAs can be less predictable than traditional loans, as the total repayment amount depends on the graduate’s future income. The percentage of income paid back and the length of the repayment period can vary widely among different ISA providers, requiring careful comparison before committing. Furthermore, the lack of widespread regulation around ISAs presents potential risks for borrowers.

Employer-Sponsored Tuition Assistance

Many employers offer tuition assistance programs to their employees, either fully or partially covering tuition costs for relevant courses or degrees. This can substantially reduce the need for external financing.

Employer-sponsored tuition assistance programs offer a significant advantage by reducing or eliminating the need for personal funds or loans. However, the availability of such programs is dependent on the employer, and eligibility criteria may vary widely. The programs often require the employee to work for the company for a certain period after completing their education, limiting career flexibility. Furthermore, the specific amount of tuition assistance offered may not cover the entire cost of education, leaving a gap that needs to be filled by other means.

Infographic Description

The infographic would visually compare the costs and benefits of private student loans, scholarships/grants, ISAs, and employer-sponsored tuition assistance. A bar graph could represent the total cost of education, broken down by the portion covered by each financing option. A separate section would use icons (e.g., dollar sign for cost, graduation cap for education, upward arrow for income potential) to represent the key advantages and disadvantages of each option, such as repayment terms, interest rates, and income potential post-graduation. A color-coding system would highlight the relative risks and rewards associated with each choice. For example, private student loans might be represented in red to indicate higher risk, while scholarships/grants would be in green to represent low risk and no repayment. The infographic would be clear, concise, and easily understandable, providing a quick visual comparison to aid decision-making.

Final Thoughts

Navigating the complexities of private student loan debt requires careful consideration of interest rates, repayment terms, and the potential long-term financial implications. While the burden can be significant, understanding the available resources, exploring alternative financing options, and advocating for stronger consumer protections are crucial steps towards mitigating the risks and achieving financial stability. By remaining informed and proactive, borrowers can better manage their debt and pave the way for a more secure financial future.

Questions and Answers

What happens if I can’t repay my private student loans?

Defaulting on private student loans can severely damage your credit score, leading to difficulty securing loans, credit cards, or even renting an apartment in the future. Collection agencies may pursue aggressive debt collection tactics.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, carefully compare offers from different lenders and consider the terms before refinancing.

Are there any government programs to help with private student loan debt?

Unfortunately, there are fewer government programs specifically designed to assist with private student loan debt compared to federal loans. However, exploring options like income-driven repayment plans (if offered by your lender) might be beneficial.

How do private student loan interest rates compare to federal loan rates?

Private student loan interest rates are typically higher than federal loan rates. The exact rate depends on your credit score, co-signer (if applicable), and the lender.