Navigating the complexities of private student loan interest can feel overwhelming. Understanding the nuances of interest rates, repayment plans, and the influence of credit history is crucial for responsible borrowing and long-term financial well-being. This guide provides a clear and concise overview of private student loan interest, equipping borrowers with the knowledge to make informed decisions and manage their debt effectively.

From the initial loan application to final repayment, interest plays a significant role in the overall cost. This guide explores the various factors that impact interest rates, including credit score, loan term, and lender policies. We’ll also examine strategies for minimizing interest payments and managing high-interest debt, offering practical advice and real-world examples to illustrate key concepts.

Understanding Private Student Loan Interest Rates

Securing a private student loan involves navigating a landscape of interest rates, which significantly impact the overall cost of your education. Understanding how these rates are determined and how they vary is crucial for making informed borrowing decisions. This section will explore the key factors that influence private student loan interest rates, the differences between fixed and variable rates, and provide examples of how these rates are calculated.

Factors Influencing Private Student Loan Interest Rates

Several factors contribute to the interest rate a lender offers on a private student loan. These factors are assessed by lenders to determine your creditworthiness and the associated risk of lending to you. A higher perceived risk generally translates to a higher interest rate. Key factors include your credit score, credit history, debt-to-income ratio, co-signer (if applicable), the loan amount, and the loan term. A strong credit history and a low debt-to-income ratio typically result in more favorable interest rates. The presence of a co-signer with good credit can also significantly improve your chances of obtaining a lower rate. Larger loan amounts may also attract slightly higher rates due to increased lender risk.

Fixed Versus Variable Interest Rates

Private student loans typically offer two main interest rate options: fixed and variable. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictable monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (though LIBOR is being phased out). This means your monthly payments could increase or decrease over time, depending on market conditions. While variable rates might start lower than fixed rates, the potential for increases makes them riskier for borrowers who prefer payment stability.

Comparison of Interest Rates Across Lenders

Interest rates for private student loans vary considerably among different lenders. Several factors influence the rates offered by each lender, including their internal risk assessment models, market conditions, and the specific loan programs they offer. It’s essential to compare offers from multiple lenders to secure the most favorable interest rate possible. This often requires checking rates from banks, credit unions, and online lenders. Keep in mind that advertised rates are often the lowest rates available and may only apply to borrowers with exceptional credit.

Interest Rate Calculation Examples

Private student loan interest is typically calculated using simple interest. The formula is: Interest = Principal x Rate x Time. For example, a $10,000 loan with a 7% annual interest rate over a 10-year term would accrue $700 in interest during the first year ($10,000 x 0.07 x 1). However, this interest is typically added to the principal, meaning that the second year’s interest calculation will be based on a higher principal amount. This is known as compounding interest. The total interest paid over the life of the loan will be significantly higher than the simple interest calculation would suggest due to this compounding effect. Accurate interest calculations will be reflected in your loan amortization schedule.

Interest Rates Across Different Loan Terms

The following table illustrates how interest rates can vary based on the loan term. Note that these are illustrative examples and actual rates will vary depending on the lender and the borrower’s creditworthiness.

| Loan Term (Years) | Example Lender A (Fixed Rate) | Example Lender B (Fixed Rate) | Example Lender C (Variable Rate) |

|---|---|---|---|

| 5 | 7.00% | 7.25% | 6.50% – 8.50% (initial rate) |

| 10 | 8.00% | 8.50% | 7.00% – 9.00% (initial rate) |

| 15 | 9.00% | 9.75% | 7.50% – 9.50% (initial rate) |

The Impact of Interest on Loan Repayment

Understanding how interest affects your private student loan repayment is crucial for long-term financial planning. High interest rates significantly increase the total amount you’ll pay back, potentially stretching your repayment period and impacting your future financial goals. This section will explore the relationship between interest and repayment, offering strategies to minimize its impact.

Interest, the cost of borrowing money, compounds over time, meaning interest is calculated not only on the principal loan amount but also on accumulated interest. This compounding effect can dramatically inflate the total cost of your loan, far exceeding the initial principal borrowed. For example, a small increase in the interest rate can lead to thousands of extra dollars paid over the life of the loan. Careful consideration of repayment plans and proactive strategies can significantly mitigate this effect.

Repayment Plans and Interest Accumulation

Different repayment plans influence how quickly you pay down your loan and, consequently, the total interest you accrue. Standard repayment plans typically involve fixed monthly payments over a set period (e.g., 10 years). Extended repayment plans lengthen the repayment period, lowering monthly payments but increasing overall interest paid. Income-driven repayment plans, if available, adjust monthly payments based on your income, offering flexibility but potentially extending the repayment timeline and total interest paid. The choice of plan significantly impacts the total cost. A shorter repayment period minimizes interest paid but necessitates higher monthly payments, while a longer period reduces monthly payments but increases the total interest paid over the life of the loan.

Strategies for Minimizing Interest Payments

Several strategies can help borrowers minimize interest payments on their private student loans. Making extra payments, even small amounts, significantly reduces the principal balance and the amount of interest calculated on that balance. This accelerates loan repayment and reduces the overall cost. Another effective strategy is to refinance your loans to a lower interest rate. This involves securing a new loan from a different lender at a more favorable interest rate, replacing your existing loans. Finally, diligent budgeting and financial planning are essential to ensure consistent on-time payments and avoid late payment fees, which add to the overall cost.

Hypothetical Repayment Schedule

Let’s consider a hypothetical $30,000 loan with two different interest rates and repayment periods.

| Interest Rate | Repayment Period (Years) | Monthly Payment (approx.) | Total Interest Paid (approx.) |

|---|---|---|---|

| 7% | 10 | $335 | $10,160 |

| 9% | 10 | $365 | $13,790 |

This demonstrates that a seemingly small difference in interest rate (2%) results in a substantial difference in total interest paid ($3,630 over 10 years).

Refinancing Scenarios

Refinancing can be beneficial when interest rates fall. For example, imagine a borrower with a $40,000 loan at 8% interest. If interest rates drop to 5%, refinancing could reduce their monthly payments and significantly lower the total interest paid over the life of the loan. Similarly, a borrower with multiple loans at varying interest rates could consolidate them into a single loan with a lower average interest rate through refinancing, simplifying payments and potentially saving money. This is particularly advantageous if the borrower qualifies for a significantly lower rate due to improved credit score or financial stability.

Avoiding High-Interest Private Student Loans

Securing a private student loan with a manageable interest rate is crucial for responsible borrowing and long-term financial health. High interest rates can significantly increase the total cost of your education and extend your repayment period, making it more challenging to manage your finances after graduation. Understanding the factors that influence interest rates and employing effective strategies to minimize them is essential for borrowers.

Strategies for Securing Lower Interest Rates

Several strategies can help borrowers secure lower interest rates on private student loans. These strategies often involve improving your creditworthiness, demonstrating financial responsibility, and strategically choosing your loan options. A combination of these approaches can lead to substantial savings over the life of the loan.

The Importance of a Strong Credit History

A strong credit history is a cornerstone of obtaining favorable interest rates on private student loans. Lenders assess your creditworthiness based on your past borrowing and repayment behavior, reflected in your credit score. A higher credit score demonstrates a lower risk to the lender, resulting in a lower interest rate offer. Building a strong credit history involves consistently making on-time payments on all credit accounts, keeping credit utilization low (the amount of credit used compared to the total available), and maintaining a diverse credit mix (different types of credit accounts). For example, a borrower with a credit score of 750 might qualify for a significantly lower interest rate than a borrower with a score of 600.

The Role of Co-signers in Reducing Interest Rates

A co-signer, typically a parent or other financially responsible individual, can significantly improve your chances of securing a lower interest rate. By adding a co-signer with a strong credit history, you essentially leverage their creditworthiness to reduce the perceived risk for the lender. This shared responsibility allows the lender to offer a more favorable interest rate. However, it’s crucial to remember that the co-signer is equally responsible for repayment should the borrower default.

Comparing Loan Options to Minimize Interest

Different private student loan providers offer various loan options with varying interest rates and terms. Carefully comparing these options is vital. Factors to consider include the fixed versus variable interest rate, the loan repayment period, and any associated fees. A fixed interest rate provides predictable monthly payments, while a variable interest rate fluctuates with market conditions. Shorter repayment periods lead to higher monthly payments but reduce the total interest paid over the life of the loan. Thorough research and comparison shopping are key to finding the most favorable loan terms. For example, a loan with a 6% fixed interest rate over 10 years will have a lower total interest cost than a loan with a 7% fixed interest rate over the same period.

Tips for Borrowers Seeking the Lowest Possible Interest Rates

Before applying for a private student loan, it’s beneficial to adopt proactive measures to improve your chances of securing the lowest interest rate.

- Maintain a high credit score.

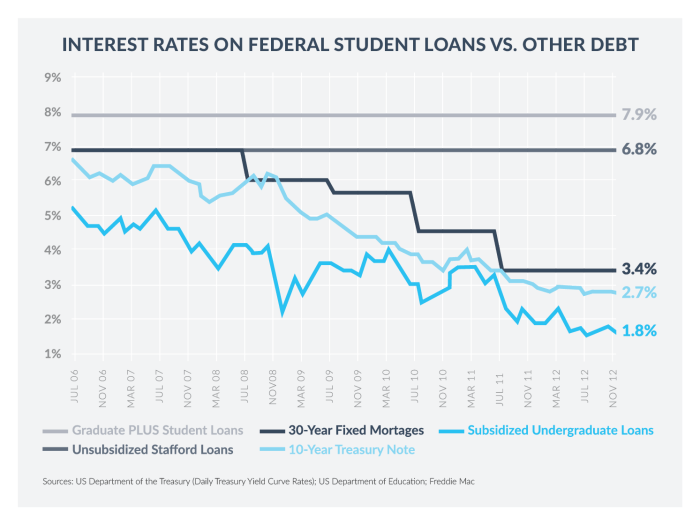

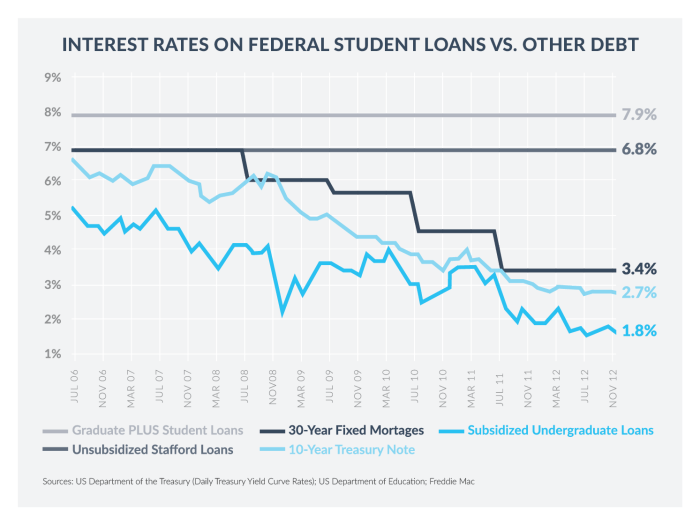

- Explore federal student loan options first, as they often offer lower interest rates.

- Shop around and compare offers from multiple lenders.

- Consider a co-signer to improve your eligibility and reduce interest rates.

- Choose a shorter repayment term, if affordable, to minimize overall interest payments.

- Negotiate with lenders for a better interest rate if possible.

- Understand all loan terms and fees before signing.

Managing Private Student Loan Debt with High Interest

Navigating high-interest private student loan debt can feel overwhelming, but proactive strategies can significantly improve your financial situation. Understanding your options and taking decisive action is key to minimizing the long-term impact of these loans. This section Artikels several approaches to effectively manage this type of debt.

Strategies for Managing High-Interest Private Student Loan Debt

Several methods exist to manage high-interest private student loans. These strategies aim to reduce the overall cost of borrowing and accelerate repayment. Prioritizing high-interest debt is crucial for long-term financial health.

- Prioritize High-Interest Loans: Focus extra payments on the loan with the highest interest rate first. This minimizes the total interest paid over the life of the loans.

- Refinance Your Loans: If your credit score has improved since you took out your loans, refinancing could lower your interest rate. Shop around for the best rates from multiple lenders. Be aware of fees associated with refinancing.

- Make Extra Payments: Even small extra payments can significantly reduce the principal balance and the total interest paid. Consider automating extra payments to make it easier.

- Debt Avalanche vs. Debt Snowball: The debt avalanche method focuses on paying off the highest-interest debt first, while the debt snowball method focuses on paying off the smallest debt first for psychological motivation. Choose the method that best suits your needs and personality.

Implications of Loan Forbearance and Deferment on Interest Accrual

Loan forbearance and deferment offer temporary pauses in loan payments, but they don’t eliminate interest. Understanding how interest accrues during these periods is vital to avoid increasing your debt burden.

Forbearance and deferment are temporary pauses in loan payments, but interest typically continues to accrue during these periods. This means that your loan balance will grow even though you’re not making payments. Upon the end of the forbearance or deferment period, the accumulated interest is often capitalized, meaning it’s added to your principal balance, increasing the total amount you owe. This results in a larger loan balance and higher monthly payments upon resumption of regular payments. For example, if you have a $10,000 loan with a 7% interest rate and defer payments for one year, you could accrue $700 in interest. This $700 is then added to your principal, leading to a higher total loan balance.

Resources and Advice for Borrowers Struggling with High-Interest Loan Payments

Numerous resources are available to assist borrowers facing challenges with high-interest loan payments. These resources offer guidance, counseling, and potential solutions.

- National Foundation for Credit Counseling (NFCC): The NFCC offers free or low-cost credit counseling services, including debt management plans.

- StudentAid.gov: The federal government’s website provides information on federal student loan programs and repayment options.

- Your Loan Servicer: Contact your loan servicer to discuss your options, such as hardship programs or repayment plans.

Step-by-Step Guide for Borrowers Seeking Debt Consolidation Options

Debt consolidation involves combining multiple loans into a single loan, often with a lower interest rate. This can simplify repayment and potentially reduce the overall cost of borrowing.

- Check Your Credit Report: Obtain a copy of your credit report to check your credit score and identify any errors.

- Shop Around for Lenders: Compare interest rates and fees from multiple lenders offering debt consolidation loans.

- Review Loan Terms: Carefully review the terms and conditions of each loan offer, including interest rates, fees, and repayment terms.

- Choose a Lender: Select the lender offering the most favorable terms.

- Complete the Application: Complete the loan application and provide the required documentation.

- Close the Loan: Once approved, the lender will disburse the funds to pay off your existing loans.

Potential Benefits and Drawbacks of Income-Driven Repayment Plans

Income-driven repayment plans adjust your monthly payments based on your income and family size. While they offer lower monthly payments, they often extend the repayment period and increase total interest paid.

Income-driven repayment plans (IDRs) can significantly reduce your monthly payments, making them more manageable. However, the lower monthly payment often comes at the cost of a longer repayment period, potentially leading to higher total interest paid over the life of the loan. For example, an IDR might reduce your monthly payment by half, but the repayment period could double. The trade-off between lower monthly payments and higher overall interest should be carefully considered. Furthermore, the specific terms and conditions of IDRs vary, so it is important to understand the specifics of the plan before enrolling.

The Role of Government Regulations on Private Student Loan Interest

While the federal government heavily regulates federal student loans, its influence on private student loan interest rates is more indirect. This influence stems from broader economic policies and, to a lesser extent, consumer protection regulations. Understanding this nuanced relationship is crucial for borrowers navigating the complexities of private student loan financing.

Government intervention in the student loan market has a long history, primarily focused on making higher education more accessible. Early interventions largely centered on subsidized federal loans, aiming to keep interest rates low and manageable for students. However, the shift towards a more market-based system, especially in the private loan sector, has altered the government’s role.

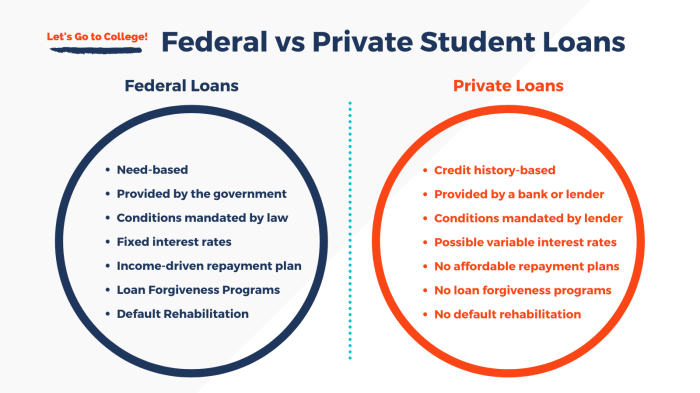

Government Regulation of Federal vs. Private Student Loans

Federal student loans are subject to extensive government regulation, including interest rate caps, eligibility criteria, and loan forgiveness programs. These regulations are designed to protect borrowers and ensure affordable access to higher education. In contrast, private student loans are largely unregulated regarding interest rates. Lenders set interest rates based on market conditions, the borrower’s creditworthiness, and other factors. This difference reflects the differing risk profiles associated with government-backed and privately funded loans. Federal loans have the backing of the government, reducing the lender’s risk, while private loans bear the full risk of default.

Indirect Government Influence on Private Lender Practices

Government policies can indirectly influence private lender practices in several ways. For example, changes in the federal funds rate, set by the Federal Reserve, impact the overall cost of borrowing, indirectly affecting private loan interest rates. Similarly, government initiatives aimed at improving financial literacy or credit counseling can improve borrowers’ credit scores, potentially leading to lower interest rates on private loans. Changes in tax laws regarding student loan interest deductions can also impact the profitability of private lending and thus influence the rates offered.

Hypothetical Scenario: Impact of a New Regulation

Imagine a hypothetical scenario where the government introduces a new regulation requiring private student loan lenders to disclose all fees and interest rate calculations transparently to borrowers *before* loan approval. This increased transparency could lead to greater competition among lenders, as borrowers would be more informed and able to compare offers effectively. Consequently, this increased competition might drive down interest rates as lenders strive to attract borrowers with more competitive offerings. This scenario demonstrates how even seemingly minor regulatory changes can have a significant ripple effect on the private student loan market. A real-world example of a similar effect could be seen with the increased scrutiny of payday lending practices, which led to some lenders altering their practices to maintain their market share and comply with regulations. Increased transparency in any financial market generally encourages more informed decisions from consumers, influencing the behaviour of those who supply the financial product.

Final Review

Successfully managing private student loan interest requires proactive planning and a thorough understanding of the available options. By carefully considering the factors discussed in this guide – from choosing a loan with favorable terms to employing effective repayment strategies – borrowers can significantly reduce their overall debt burden and pave the way for a brighter financial future. Remember, informed decisions are key to responsible borrowing and achieving long-term financial success.

Quick FAQs

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, while a variable interest rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may offer lower initial rates but carry more risk.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it’s crucial to compare offers from multiple lenders and understand the terms before refinancing.

What happens if I miss a payment on my private student loan?

Missing payments can negatively impact your credit score and may lead to late fees and increased interest charges. Contact your lender immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

How does my credit score affect my interest rate?

A higher credit score generally qualifies you for lower interest rates. Lenders view a good credit score as an indicator of lower risk.