The online forum Reddit offers a unique window into the realities of private student loan debt. From harrowing tales of default to triumphant stories of repayment, Reddit discussions provide a wealth of unfiltered experiences, revealing both the pitfalls and potential pathways to financial freedom. This exploration delves into the collective wisdom found within these online conversations, analyzing common themes, challenges, and strategies surrounding private student loan management.

This analysis examines user sentiment, lender performance, repayment strategies, refinancing options, and the impact of private student loans on overall financial health. We’ll explore the legal implications of default, discuss alternative financing methods, and illustrate real-world scenarios to provide a comprehensive understanding of the private student loan landscape as reflected in Reddit discussions.

Reddit Discussions on Private Student Loan Experiences

Reddit serves as a significant platform for individuals to share their experiences with private student loans, offering a wealth of unfiltered perspectives not always found in official lender materials. These discussions provide valuable insights into the realities of borrowing and repayment, highlighting both positive and negative aspects of the process. Analyzing these discussions reveals common themes and trends that can inform prospective borrowers and help them make informed decisions.

Common Themes in Private Student Loan Reddit Discussions

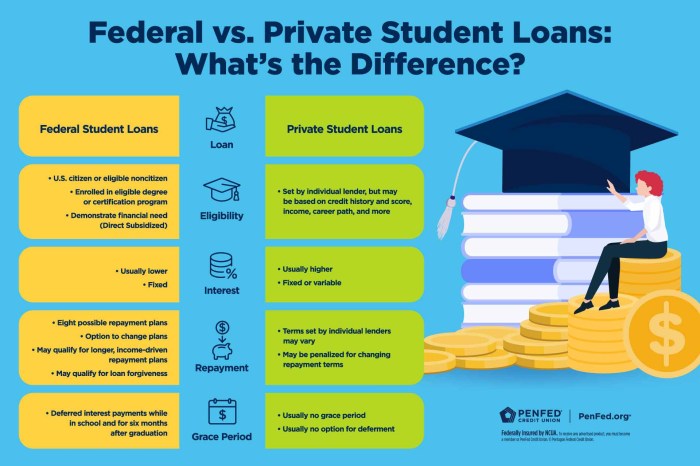

Private student loan discussions on Reddit frequently center around several key themes. High interest rates are a pervasive concern, with many users expressing frustration over the cost of borrowing compared to federal loan options. The complexity of the application process and the often-opaque terms and conditions are also frequently criticized. Another significant recurring theme revolves around customer service experiences, with many users reporting difficulties contacting lenders or receiving timely and helpful support. Finally, the challenges of repayment, including difficulties navigating deferment or forbearance options, are commonly discussed.

Frequently Mentioned Lenders

While numerous lenders are mentioned in Reddit discussions, some appear more frequently than others, both positively and negatively. Negative comments frequently target lenders perceived as having inflexible repayment options, poor customer service, or high fees. Conversely, lenders praised often receive positive feedback for their responsive customer service, clear communication, and flexible repayment plans. Specific lender names are omitted to avoid appearing to endorse or criticize particular institutions; however, analyzing the frequency of mentions alongside associated sentiment provides a valuable overview of user perception.

Categorization of User Comments

The following table summarizes the sentiment expressed in Reddit discussions regarding private student loans, categorized by sentiment and issue. The frequency column represents a relative measure, reflecting the approximate proportion of comments within each category based on a sample of Reddit threads. Note that these are estimates based on observation and do not represent a statistically rigorous analysis.

| Sentiment | Lender (if mentioned) | Issue | Frequency |

|---|---|---|---|

| Negative | Various | High interest rates | High |

| Negative | Various | Poor customer service | High |

| Negative | Various | Complex application process | Medium |

| Negative | Various | Difficult repayment process | Medium |

| Positive | Various | Excellent customer service | Medium |

| Positive | Various | Competitive interest rates | Low |

| Neutral | Various | Loan application details | Medium |

| Neutral | Various | Repayment plan options | Medium |

Repayment Strategies and Challenges

Navigating private student loan repayment can be a complex and often stressful process. Reddit discussions reveal a wide range of strategies employed by borrowers, alongside significant challenges they encounter. Understanding these strategies and hurdles is crucial for effective financial planning and managing debt. This section will explore common repayment approaches, difficulties faced, and how experiences vary based on loan amounts and repayment plans.

Common Repayment Strategies

Many Reddit users share their approaches to managing private student loan repayment. The effectiveness of each strategy often depends on individual circumstances, such as income, debt amount, and risk tolerance.

- Standard Repayment: This involves making consistent monthly payments over a fixed term, usually 10-15 years. This is the simplest approach but may lead to higher overall interest payments.

- Accelerated Repayment: Borrowers make larger monthly payments than required under the standard plan, shortening the repayment period and reducing total interest paid. This requires a higher level of financial discipline and available funds.

- Income-Driven Repayment (IDR): While not always available for private loans, some lenders offer plans where payments are adjusted based on income. This can provide temporary relief during periods of financial hardship, but it may extend the repayment period and increase total interest paid.

- Refinancing: This involves securing a new loan with a lower interest rate from a different lender, often reducing monthly payments and the overall cost of borrowing. This strategy requires good credit and a stable financial situation.

- Debt Consolidation: Combining multiple private student loans into a single loan can simplify repayment and potentially lower the interest rate. However, careful consideration of fees and terms is essential.

Challenges in Repaying Private Student Loans

Reddit users frequently highlight numerous challenges associated with private student loan repayment. These difficulties can significantly impact borrowers’ financial well-being and overall quality of life.

- High Interest Rates: Private student loans often carry significantly higher interest rates than federal loans, leading to substantial interest accumulation over the repayment period. This can make repayment more difficult and expensive.

- Lack of Flexible Repayment Options: Unlike federal loans, private loans typically offer fewer flexible repayment options, such as income-driven repayment plans or deferment periods. This can create financial hardship for borrowers facing unexpected life events or income fluctuations.

- Aggressive Collection Practices: Some lenders employ aggressive collection tactics when borrowers fall behind on payments. This can cause significant stress and damage credit scores.

- Difficulty in Refinancing: Securing a refinance loan with a lower interest rate can be challenging for borrowers with poor credit scores or unstable financial situations.

- Unexpected Expenses: Unexpected medical bills, job loss, or other life events can disrupt repayment plans and lead to delinquency.

Experiences Based on Loan Amounts and Repayment Plans

The challenges and strategies employed for private student loan repayment often vary depending on the loan amount and chosen repayment plan.

Borrowers with smaller loan amounts generally find repayment more manageable, even with higher interest rates. They may opt for accelerated repayment to minimize total interest paid. Conversely, individuals with substantial loan balances may struggle to make even minimum payments, potentially leading to delinquency and negative impacts on their credit. They might explore options like refinancing or income-driven plans (if available) to alleviate the burden.

The choice of repayment plan also significantly impacts the experience. A shorter repayment term under an accelerated plan leads to quicker debt elimination but requires higher monthly payments. Longer repayment periods offer lower monthly payments but result in significantly higher total interest paid. The optimal choice depends on individual financial circumstances and risk tolerance. For example, a borrower with a high income and strong financial stability might prioritize accelerated repayment, while someone with a lower income might opt for a longer repayment term to manage monthly expenses.

Debt Consolidation and Refinancing Options

Navigating the complexities of private student loan debt often leads borrowers to explore debt consolidation and refinancing strategies. Reddit discussions reveal a wide range of experiences, highlighting both the potential benefits and pitfalls of these approaches. Understanding the nuances of each option is crucial for making informed decisions.

Debt consolidation involves combining multiple loans into a single loan, often simplifying repayment. Refinancing, on the other hand, involves replacing existing loans with a new loan, typically at a lower interest rate. Reddit users frequently discuss both strategies, sharing their successes and challenges.

Successful and Unsuccessful Refinancing Experiences

Many Reddit users report successful refinancing experiences, often resulting in lower monthly payments and reduced overall interest paid. For example, a common thread involves borrowers with excellent credit scores securing significantly lower interest rates through refinancing, saving thousands of dollars over the life of their loans. Conversely, unsuccessful experiences often stem from borrowers with less-than-stellar credit scores being denied refinancing or receiving less favorable interest rates than anticipated. Some users also report difficulties refinancing federal loans, which often have stricter eligibility requirements. A recurring theme is the importance of shopping around and comparing offers from multiple lenders before making a decision.

Hypothetical Refinancing Scenario: Two Options Compared

Let’s consider a hypothetical scenario: Sarah owes $50,000 in private student loans with an average interest rate of 7%. She’s exploring two refinancing options:

Option A: A 5-year refinance loan with a 5% interest rate and a monthly payment of $920. The total interest paid over the life of the loan would be approximately $7,000.

Option B: A 10-year refinance loan with a 6% interest rate and a monthly payment of $560. The total interest paid over the life of the loan would be approximately $16,000.

Option A: Pros – Lower total interest paid, shorter repayment period; Cons – Higher monthly payment.

Option B: Pros – Lower monthly payment; Cons – Higher total interest paid, longer repayment period.

This scenario illustrates a common trade-off: lower monthly payments often come at the cost of paying more interest over the life of the loan. The best option depends on Sarah’s individual financial circumstances and priorities. A careful consideration of both the short-term and long-term implications is crucial.

Dealing with Loan Default and Collection Practices

Defaulting on a private student loan can have severe financial and legal consequences. Many Reddit users share stories of dealing with the stress and complexities of this situation, highlighting the aggressive tactics employed by some collection agencies and the challenges of navigating the legal system. Understanding the process and your rights is crucial to mitigating the damage and finding a path towards resolution.

Dealing with private student loan default often involves interactions with collection agencies. Reddit threads frequently discuss the tactics used by these agencies, ranging from repeated phone calls and threatening letters to wage garnishment and lawsuits. The legal ramifications of default are significant, potentially impacting credit scores, employment opportunities, and even the ability to obtain future loans or rent an apartment. Understanding these legal aspects is paramount to effectively addressing the situation.

Reddit Experiences with Loan Default and Collection Agencies

Reddit users consistently report high levels of stress and anxiety associated with private student loan default. Many describe receiving numerous calls from collection agencies at all hours, often using aggressive and intimidating tactics. Some accounts detail instances of harassment and misinformation provided by collection agencies regarding repayment options and legal repercussions. Other users describe the emotional toll of facing wage garnishment or legal action, highlighting the significant impact on their mental health and overall well-being. For example, one user recounted a situation where a collection agency falsely claimed they had a court order for wage garnishment, causing significant distress until the user independently verified the claim’s inaccuracy.

Legal Aspects of Private Student Loan Default

Defaulting on a private student loan triggers legal consequences that vary depending on state and federal laws. These consequences often include damage to credit scores, impacting future loan applications, credit card approvals, and even rental applications. Collection agencies can pursue legal action to recover the debt, potentially leading to wage garnishment, bank levy, or the seizure of assets. In some cases, lawsuits can result in judgments against the borrower, which can further impact their financial standing. Reddit discussions often emphasize the importance of understanding your rights under the Fair Debt Collection Practices Act (FDCPA), which protects consumers from abusive and unfair collection practices.

Step-by-Step Guide to Navigating Private Student Loan Default

Navigating a private student loan default requires a proactive and informed approach. Reddit user experiences suggest a systematic approach is crucial.

- Assess your situation: Determine the amount owed, the name of the lender and/or collection agency, and any legal actions already taken.

- Review your rights: Familiarize yourself with the FDCPA and your state’s laws regarding debt collection. Understand what actions are legally permissible and what constitutes harassment.

- Contact the lender or collection agency: Attempt to negotiate a repayment plan. Document all communication in writing. Consider seeking assistance from a non-profit credit counseling agency.

- Explore debt consolidation or refinancing options: If possible, consolidate your debt into a single, more manageable loan with a lower interest rate. Refinancing may reduce your monthly payments and help you avoid default.

- Seek legal counsel: If negotiations fail or you are facing legal action, consult with a lawyer specializing in debt collection or bankruptcy. They can advise you on your legal rights and options.

- Document everything: Keep detailed records of all communications, agreements, and legal documents. This documentation is essential if you need to dispute charges or take further legal action.

The Role of Credit Scores and Financial Health

Navigating the world of private student loans often hinges on your creditworthiness. Lenders use your credit score as a primary indicator of your ability to repay the loan, significantly influencing your approval chances and the interest rate you’ll receive. Reddit discussions reveal a strong correlation between a higher credit score and more favorable loan terms.

Your credit score is a numerical representation of your credit history, summarizing your responsible use of credit. It’s a crucial factor that lenders consider when assessing your risk profile. A higher score signifies lower risk to the lender, resulting in better loan offers. Conversely, a lower score can lead to loan rejection or significantly higher interest rates, increasing the overall cost of borrowing.

Credit Score and Private Student Loan Approval/Interest Rates

Reddit threads frequently illustrate the impact of credit scores on loan outcomes. Users with excellent credit scores (750 and above) often report receiving pre-approved offers with competitive interest rates and favorable terms. Conversely, those with poor credit scores (below 650) often describe facing higher interest rates, limited loan amounts, or even loan denials. The difference in monthly payments and total interest paid over the life of the loan can be substantial, highlighting the importance of maintaining a healthy credit score before applying for private student loans. For example, a user with a 780 credit score might secure a loan with a 5% interest rate, while a user with a 620 credit score might receive the same loan with a 12% interest rate, resulting in thousands of dollars more in interest payments over the loan’s term.

Factors Affecting Credit Scores and Their Impact on Loan Terms

Several factors influence credit scores and, consequently, private student loan terms. These include payment history (late or missed payments significantly harm scores), amounts owed (high credit utilization negatively impacts scores), length of credit history (longer history generally leads to better scores), new credit (opening multiple accounts in a short period can lower scores), and credit mix (a variety of credit accounts demonstrates responsible credit management). Each of these factors directly influences a lender’s perception of risk. For instance, consistently paying bills on time demonstrates reliability and reduces the perceived risk of default, leading to better loan offers. Conversely, a history of missed payments indicates higher risk, potentially resulting in loan rejection or higher interest rates.

Impact of Private Student Loan Debt on Overall Financial Health

Reddit discussions frequently highlight the significant impact of private student loan debt on overall financial health. Many users describe the challenges of balancing loan repayments with other financial obligations, such as rent, groceries, and transportation. High monthly payments can severely restrict financial flexibility, limiting opportunities for saving, investing, or pursuing other financial goals. The psychological stress associated with substantial debt is also a recurring theme, with users expressing feelings of anxiety and frustration. Furthermore, the inability to manage student loan debt effectively can lead to a downward spiral, impacting credit scores further and potentially resulting in loan default, which has severe long-term financial consequences. This demonstrates the importance of careful budgeting, responsible borrowing, and proactive debt management strategies.

Alternatives to Private Student Loans

Securing funding for higher education is a significant undertaking, and private student loans are often considered a last resort due to their potentially high interest rates and stringent repayment terms. This section explores viable alternatives to private student loans, comparing their advantages and disadvantages based on common Reddit discussions. Understanding these options empowers students to make informed decisions about financing their education.

Comparison of Financing Options for Higher Education

Many Reddit threads highlight the importance of exploring all available options before resorting to private loans. A comprehensive approach involves considering scholarships, grants, federal loans, and even creative financing strategies discussed within the community. The following table summarizes the key aspects of each:

| Option | Pros | Cons | Reddit User Feedback |

|---|---|---|---|

| Federal Student Loans | Lower interest rates than private loans, flexible repayment plans, potential for loan forgiveness programs (e.g., Public Service Loan Forgiveness), government protection against predatory lending practices. | Requires filling out the FAFSA, may require a credit check (depending on the loan type), loan amounts may not fully cover educational costs. | “Federal loans are the way to go first. Much better interest rates and more borrower protections.” – u/ResponsibleStudent123 |

| Scholarships | Free money, doesn’t need to be repaid, can significantly reduce overall borrowing. | Highly competitive, requires significant research and application effort, may have specific eligibility criteria. | “Spent months applying for scholarships, but it was worth it! Got enough to cover my tuition.” – u/ScholarshipSeeker |

| Grants | Free money, doesn’t need to be repaid, often based on financial need. | Limited availability, highly competitive, may require specific eligibility criteria. | “Grants were a lifesaver. I wouldn’t have been able to afford college without them.” – u/GrantRecipient |

| Work-Study Programs | Earn money while studying, helps cover expenses, builds valuable work experience. | Limited hours available, may not cover all expenses, work may interfere with studies. | “Work-study helped me pay for books and some living expenses. It wasn’t a lot, but every bit helped.” – u/WorkingStudent |

| Part-Time Employment | Flexible schedule, supplemental income, can help cover expenses. | May limit study time, may require significant time management skills, income may be inconsistent. | “Working part-time definitely impacted my grades, but it allowed me to avoid taking out as many loans.” – u/BalancingAct |

| Family Contributions | Can significantly reduce borrowing needs, strengthens family bonds. | May not be a viable option for all students, may create financial strain on family. | “My parents helped me out a lot, which I’m very grateful for. It made a huge difference.” – u/FamilySupport |

Illustrative Examples of User Experiences

Understanding the diverse impacts of private student loans requires looking at real-world scenarios. The following examples highlight both the challenges and potential successes associated with managing private student loan debt. These are hypothetical scenarios, but they reflect common experiences shared by many borrowers.

Struggling with High Private Student Loan Debt

Sarah graduated with a significant amount of private student loan debt, accumulated alongside federal loans to fund her graduate degree. Her monthly payments, encompassing both federal and private loans, consumed a substantial portion of her post-graduation income. The interest rates on her private loans were higher than her federal loans, leading to faster accumulation of debt. Her initial repayment plan was based on the minimum payment amount, a strategy that ultimately prolonged her repayment period and significantly increased the total interest paid. This resulted in limited funds for savings, investments, and other crucial financial goals. She found herself constantly stressed about her finances, impacting her mental well-being and limiting her ability to explore career opportunities that might not have offered immediate high salaries. Her lifestyle was significantly restricted; she deferred major purchases, like a car or a down payment on a house, and often relied on credit cards to cover unexpected expenses, further complicating her financial situation. The weight of her debt significantly affected her overall quality of life.

Successful Private Student Loan Repayment Journey

Mark, after careful planning, secured a job that offered a competitive salary upon graduation. He had a well-defined strategy for managing his private student loan debt. First, he meticulously tracked all his loan details, including interest rates, repayment terms, and minimum payment amounts. He then prioritized aggressively paying down his highest-interest private loans first, employing the avalanche method. He also explored options for refinancing his loans to secure a lower interest rate, successfully lowering his monthly payments and reducing the total interest paid over the life of the loan. He lived below his means, meticulously budgeting his expenses and avoiding unnecessary spending. He also actively sought opportunities for professional development and career advancement to increase his earning potential. Through consistent discipline and strategic financial planning, Mark managed to pay off his private student loans ahead of schedule, achieving financial stability and security. This allowed him to focus on other financial goals, such as saving for a down payment on a house and investing for his future.

Concluding Remarks

Reddit’s vibrant community offers a valuable resource for navigating the complexities of private student loans. While individual experiences vary widely, common threads emerge regarding repayment strategies, lender reliability, and the long-term impact on financial well-being. By understanding the challenges and successes shared on Reddit, prospective and current borrowers can make informed decisions, advocate for their rights, and develop effective strategies for managing their student loan debt responsibly.

FAQ Insights

What is the general sentiment towards private student loans on Reddit?

Reddit discussions reveal a mixed sentiment, with many expressing frustration over high interest rates, aggressive collection practices, and difficulty in repayment. However, positive experiences with certain lenders and successful refinancing stories are also documented.

Are there specific lenders frequently praised or criticized on Reddit?

While specific lender names often appear, it’s crucial to remember that individual experiences vary widely. A thorough independent review of any lender is recommended before making borrowing decisions.

How can I find relevant Reddit threads on private student loans?

Use specific s in the Reddit search bar, such as “private student loans,” “student loan refinancing,” or “student loan debt.” Subreddits like r/personalfinance and r/studentloan often contain relevant discussions.

What are the legal ramifications of defaulting on a private student loan?

Defaulting on a private student loan can lead to wage garnishment, bank account levies, and damage to your credit score. Seek legal counsel if facing default.