Navigating the complexities of student loan debt can feel overwhelming, especially when faced with private loan repayments. Many borrowers find themselves seeking relief, and understanding the options available is crucial for long-term financial well-being. This guide explores various private student loan relief programs, outlining eligibility criteria, application processes, and potential long-term implications. We’ll also delve into alternative debt management strategies and highlight common scams to avoid.

From income-driven repayment plans to forbearance and deferment options, the landscape of private student loan relief is diverse. Each program carries its own set of requirements and consequences, making informed decision-making paramount. This resource aims to empower borrowers with the knowledge needed to make sound financial choices and navigate their path towards debt reduction effectively.

Eligibility Criteria for Private Student Loan Relief Programs

Securing relief from private student loan debt often hinges on meeting specific eligibility criteria set by individual lenders. These criteria vary significantly, making it crucial to understand the requirements before applying for any program. Factors like income, credit score, and loan type all play a role in determining eligibility.

Income Requirements for Private Student Loan Relief Programs

Many private student loan relief programs consider your income as a key eligibility factor. Lenders typically assess your income-to-debt ratio to determine your ability to manage repayments. Lower income levels may qualify you for programs offering income-driven repayment plans or forbearance, temporarily suspending or reducing your monthly payments. However, the specific income thresholds vary widely among lenders and programs. Some may use gross income, while others might focus on net income or adjusted gross income. It is essential to check the specific requirements with your lender. For instance, one lender might offer relief for borrowers earning below $40,000 annually, while another might set the limit at $55,000.

Credit Score Thresholds and Their Impact on Program Access

Your credit score significantly impacts your access to private student loan relief programs. Lenders often use credit scores to assess your creditworthiness and repayment history. A higher credit score generally improves your chances of approval for various relief options, such as loan modification or refinancing. Conversely, a low credit score can limit your eligibility for many programs. Some programs may require a minimum credit score, while others may offer relief but with less favorable terms. For example, a borrower with a credit score above 700 might qualify for a lower interest rate on a refinanced loan, while a borrower with a score below 600 might only qualify for a forbearance program with stricter terms.

Comparison of Eligibility Requirements Across Different Lenders and Programs

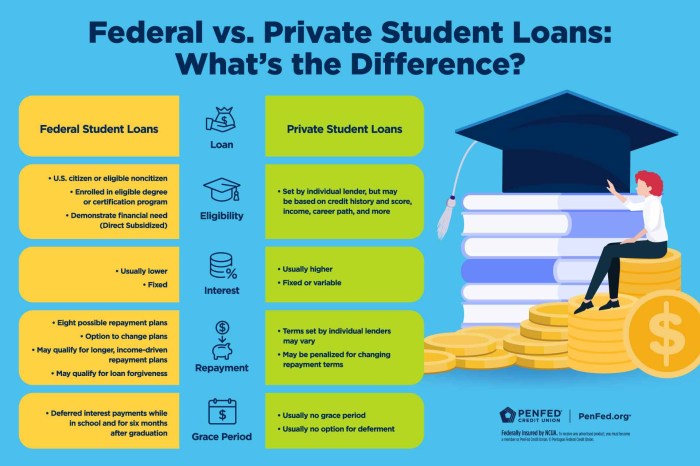

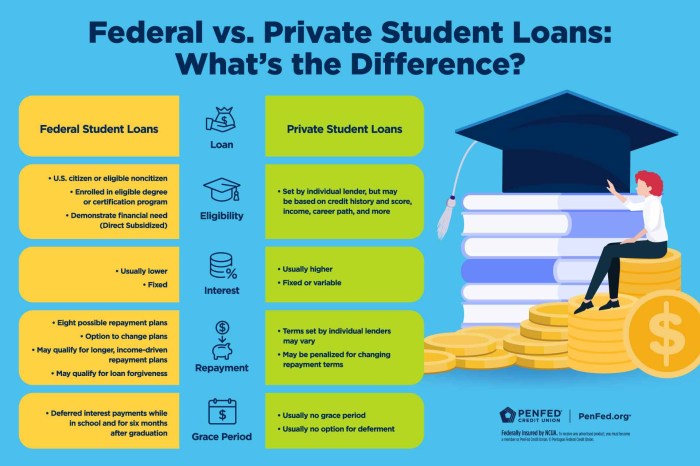

Eligibility requirements for private student loan relief programs differ substantially across lenders. Some lenders may offer more flexible options for borrowers with lower incomes or credit scores, while others may have stricter requirements. Understanding these differences is crucial for finding the most suitable program. Factors such as the type of loan (e.g., federal vs. private), the loan’s original terms, and the borrower’s financial situation all play a role in determining eligibility. For example, one lender might prioritize borrowers with federal student loans, while another might focus on borrowers with specific types of private loans.

Eligibility Criteria Comparison Table

| Lender | Income Requirements | Credit Score Requirements | Other Requirements |

|---|---|---|---|

| Lender A | Typically requires documentation of income, specific income thresholds vary by program. | Minimum score often required, specific score varies by program and loan type. | May require proof of enrollment or hardship. |

| Lender B | Income-based repayment plans often available, specific income limits apply. | Generally requires a good credit history, specific score thresholds vary. | May require detailed financial documentation. |

| Lender C | Income verification usually required, specific income limits vary by program. | Credit score plays a significant role in determining eligibility and terms. | Specific loan types may be eligible for certain programs. |

Types of Private Student Loan Relief Programs

Private student loan relief programs offer various options to help borrowers manage their debt. Understanding the differences between these programs is crucial for selecting the best approach for your individual financial situation. Each program has its own set of requirements, benefits, and potential drawbacks.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. Several variations exist, each with slightly different eligibility criteria and calculation methods. The goal is to make payments more manageable, potentially leading to loan forgiveness after a specified period (often 20 or 25 years, depending on the plan and lender). These plans are generally not offered directly by private lenders, but some may offer similar programs with their own terms. It’s important to carefully review the specific terms of any IDR-like program offered by a private lender as they may differ significantly from federal IDR plans.

- Advantage: Lower monthly payments, potentially leading to loan forgiveness.

- Disadvantage: Longer repayment periods, potentially leading to paying more interest overall. Eligibility requirements may be strict and the forgiveness amount might be taxed as income.

Forbearance

Forbearance temporarily suspends or reduces your monthly payments. This provides short-term relief, but interest typically continues to accrue. The length of forbearance varies depending on the lender and your circumstances. Repeated use of forbearance can negatively impact your credit score. Private lenders may offer forbearance periods, but the specifics will be Artikeld in your loan agreement.

- Advantage: Provides temporary relief from payments.

- Disadvantage: Interest continues to accrue, increasing the total amount owed. Can negatively affect credit score if used frequently.

Deferment

Similar to forbearance, deferment temporarily postpones your payments. However, unlike forbearance, some types of deferment may also temporarily suspend interest accrual, though this is less common with private loans. Eligibility criteria for deferment are typically stricter than for forbearance, and are usually tied to specific circumstances such as unemployment or enrollment in school. Private lenders may or may not offer deferment options; this depends entirely on the lender’s policies.

- Advantage: Temporary pause in payments, potentially without interest accrual (depending on the lender and specific program).

- Disadvantage: Strict eligibility requirements. Still requires repayment of the deferred amount later.

Loan Modification

A loan modification changes the terms of your loan, such as the interest rate, repayment period, or monthly payment amount. This is typically offered if you’re experiencing financial hardship and can demonstrate your inability to meet your current payment obligations. Private lenders may offer loan modifications, but they are not guaranteed and often require extensive documentation. The terms of a modified loan will depend entirely on the lender’s assessment and your individual situation.

- Advantage: Can make payments more manageable long-term.

- Disadvantage: May involve increased total interest paid over the life of the loan. Requires demonstrating financial hardship and may involve a lengthy application process.

Application Process and Required Documentation

Applying for private student loan relief programs can seem daunting, but understanding the process and gathering the necessary documentation beforehand significantly increases your chances of success. The specific requirements vary depending on the lender and the type of relief program, but generally involve a multi-step application and submission of supporting evidence. Careful preparation is key to a smooth and efficient application.

The application process typically involves several key steps, from initial eligibility checks to final approval. Understanding these steps and the required documentation will help streamline the process and minimize potential delays. It’s crucial to accurately and completely fill out all forms, ensuring all information provided is correct and consistent across all documents. Failure to do so may result in application rejection or significant processing delays.

Steps Involved in Applying for Private Student Loan Relief Programs

The application process usually begins with an online application. Applicants will need to create an account, providing personal information such as name, date of birth, social security number, and contact details. Next, they’ll need to provide details about their student loans, including lender names, loan amounts, and account numbers. After submitting the application, applicants may be required to upload supporting documentation, such as proof of income, tax returns, or employment verification. Finally, the lender will review the application and supporting documents and notify the applicant of their decision. This process can take several weeks or even months depending on the lender and the volume of applications.

Required Documentation for Private Student Loan Relief Programs

The specific documents required vary depending on the program and the lender. However, common documents include proof of identity (such as a driver’s license or passport), proof of income (such as pay stubs or tax returns), and documentation of your student loans (such as loan statements or promissory notes). Some programs may also require additional documentation, such as proof of hardship or medical records. It’s crucial to check the specific requirements of the program you are applying for before submitting your application.

- Proof of Identity (Driver’s License, Passport)

- Proof of Income (Pay stubs, W-2 forms, Tax returns)

- Student Loan Documentation (Loan statements, Promissory notes)

- Proof of Hardship (Medical records, unemployment documentation)

Common Application Errors and How to Avoid Them

Incomplete applications are a major cause of delays and rejections. Applicants should carefully review all forms before submitting them to ensure accuracy and completeness. Inaccurate information, such as incorrect loan amounts or dates, can also lead to delays or rejections. Applicants should double-check all information before submitting their application. Finally, missing required documents can also cause significant delays. Applicants should gather all necessary documents before starting the application process.

Step-by-Step Guide with Screenshots (Hypothetical Program)

Let’s imagine a hypothetical program called “Loan Relief Solutions.”

Step 1: Accessing the Application Portal

[Screenshot description: A screenshot depicting a webpage showing the Loan Relief Solutions logo and a prominent “Apply Now” button. The webpage is clean and easy to navigate, with clear headings and concise text.]

Step 2: Creating an Account

[Screenshot description: A screenshot showing a registration form. Fields include Name, Email, Password, Date of Birth, and Social Security Number (partially obscured for privacy). Clear instructions and error messages are visible.]

Step 3: Entering Loan Information

[Screenshot description: A screenshot of a multi-section form requesting details about each student loan. Sections include Lender Name, Loan Amount, Account Number, and Loan Type. A progress bar indicates the completion status.]

Step 4: Uploading Supporting Documents

[Screenshot description: A screenshot showing a file upload section. It clearly indicates accepted file types and maximum file sizes. An example of a successfully uploaded document is displayed.]

Step 5: Review and Submission

[Screenshot description: A screenshot displaying a summary page reviewing all entered information. A prominent “Submit Application” button is clearly visible. A checkbox for acknowledging terms and conditions is also present.]

Step 6: Confirmation

[Screenshot description: A screenshot showing a confirmation message, including an application reference number and instructions on what to expect next.]

Long-Term Financial Implications of Private Student Loan Relief

Securing private student loan relief can significantly alter your long-term financial trajectory. Understanding the potential impacts on your overall debt, repayment schedule, and overall financial health is crucial before accepting any program. This section will explore the long-term financial implications of various private student loan relief options, comparing them to the original loan terms.

Impact of Relief Programs on Long-Term Debt

Private student loan relief programs often modify the original loan terms, potentially affecting the total amount repaid over the life of the loan. Some programs may reduce the principal balance, leading to lower overall payments and a faster payoff. Others might extend the repayment period, lowering monthly payments but increasing the total interest paid. For example, a program offering a principal reduction of 10% on a $50,000 loan would immediately decrease the outstanding debt to $45,000. However, a program extending the repayment period from 10 years to 15 years might result in lower monthly payments but significantly higher overall interest accrued over the extended timeframe. The best option depends on individual circumstances and financial priorities.

Effects of Different Repayment Plans on Interest Payments

The repayment plan chosen significantly influences the total interest paid. Shorter repayment terms mean higher monthly payments but less interest paid overall. Conversely, longer repayment periods result in lower monthly payments but substantially higher total interest charges. Consider a $30,000 loan with a 7% interest rate. A 10-year repayment plan will have higher monthly payments but a significantly lower total interest paid compared to a 20-year repayment plan, where the lower monthly payments are offset by substantially more interest accrued over the longer repayment period. Careful consideration of these trade-offs is essential.

Financial Implications of Accepting Relief versus Original Repayment Plan

Choosing between accepting a relief program and sticking with the original repayment plan requires a thorough financial assessment. Factors to consider include the total amount repaid, the monthly payment affordability, and the impact on long-term financial goals. For instance, accepting a program that reduces the principal but increases the interest rate might still be beneficial if the reduced monthly payment allows for faster debt reduction through additional contributions. Conversely, a program that extends the repayment period, leading to lower monthly payments but substantially higher total interest, might not be financially advantageous in the long run. The decision should align with your individual financial circumstances and priorities.

Long-Term Cost Comparison: Relief Programs vs. Original Loan Terms

The following table illustrates the long-term cost differences between various hypothetical relief program options and the original loan terms. These are examples and actual results will vary depending on the specific terms of the loan and the relief program offered.

| Program | Original Loan Terms | Program A (Principal Reduction) | Program B (Extended Repayment) |

|---|---|---|---|

| Loan Amount | $40,000 | $36,000 | $40,000 |

| Interest Rate | 7% | 7.5% | 7% |

| Repayment Term | 10 years | 8 years | 15 years |

| Monthly Payment | $438 | $480 | $300 |

| Total Interest Paid | $16,560 | $11,520 | $25,000 |

| Total Repaid | $56,560 | $47,520 | $65,000 |

Alternatives to Private Student Loan Relief Programs

Managing private student loan debt can be challenging, and while private student loan relief programs offer potential solutions, they are not always accessible or suitable for everyone. Understanding alternative strategies is crucial for borrowers seeking effective debt management solutions. These alternatives often provide more control and flexibility than relying solely on the availability and terms of relief programs.

Several strategies exist for managing private student loan debt, each with its own advantages and disadvantages. The best approach depends on individual circumstances, such as income, credit score, and the overall amount of debt. Careful consideration of these factors is essential for making an informed decision.

Refinancing Private Student Loans

Refinancing involves replacing your existing private student loans with a new loan from a different lender, typically at a lower interest rate. This can significantly reduce your monthly payments and the total amount of interest paid over the life of the loan. A lower interest rate translates to considerable savings over time, making it an attractive option for borrowers with good credit. However, refinancing might not be suitable for those with poor credit scores, as lenders may offer less favorable terms or deny the application altogether. Furthermore, refinancing may extend the repayment period, leading to a higher total amount repaid despite the lower monthly payments.

Consolidating Private Student Loans

Debt consolidation involves combining multiple private student loans into a single loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering the overall interest rate, though not always to the same extent as refinancing. Consolidation can streamline the repayment process, making it easier to track and manage payments. However, similar to refinancing, consolidation might extend the repayment period, potentially increasing the total interest paid over time. Additionally, the interest rate on a consolidated loan may not be significantly lower than the weighted average of the original loans.

Comparison of Alternatives with Private Student Loan Relief Programs

| Feature | Private Loan Relief Programs | Refinancing | Consolidation |

|---|---|---|---|

| Eligibility | Specific criteria; often limited availability | Good to excellent credit score typically required | Generally more accessible than refinancing |

| Interest Rate | May reduce interest rate, but terms vary widely | Potentially lower interest rate than existing loans | May or may not lower the interest rate significantly |

| Monthly Payments | May lower monthly payments, depending on the program | Potentially lower monthly payments | May simplify payments but not necessarily lower them |

| Loan Term | May extend or shorten loan term | Can extend or shorten loan term | Often extends loan term |

| Total Interest Paid | Can vary greatly depending on program terms | Potentially lower total interest paid | May increase or decrease total interest paid |

Choosing the Best Debt Management Strategy

The following flowchart illustrates the decision-making process for selecting the most appropriate debt management strategy:

Flowchart Description: The flowchart begins with a “Start” node. It then branches into two main paths: “Eligible for Private Loan Relief Program?” If yes, the borrower proceeds to evaluate the terms of the program and decide whether to accept the offer. If no, the borrower moves to the next decision point: “Good Credit Score?”. A “yes” answer leads to the “Refinance” option. A “no” answer leads to the “Consolidate” option. Each option has a corresponding end node indicating the chosen strategy. Finally, there’s a feedback loop suggesting reviewing the chosen strategy periodically to ensure it remains the best option given changing circumstances.

Scams and Misleading Information Related to Private Student Loan Relief

Navigating the landscape of private student loan relief can be challenging, particularly given the prevalence of scams and misleading information designed to exploit borrowers facing financial hardship. Understanding these tactics is crucial to protecting yourself from fraudulent schemes and making informed decisions about your financial future. This section will Artikel common scams, examples of misleading information, and strategies for avoiding them.

The proliferation of deceptive practices targeting individuals seeking student loan relief necessitates a vigilant approach. Many unscrupulous actors prey on the desperation of borrowers, offering false promises of quick fixes and substantial debt reduction. These scams often involve upfront fees, hidden charges, or unrealistic claims of immediate loan forgiveness. Misleading information, meanwhile, can take the form of exaggerated advertising, unsubstantiated guarantees, or confusing legal jargon intended to obscure the true terms and conditions of a purported relief program.

Common Scams Targeting Individuals Seeking Student Loan Relief

Several common scams exploit the vulnerabilities of individuals struggling with student loan debt. These scams frequently involve upfront fees for services that are never delivered, promises of loan forgiveness that are legally impossible, or the manipulation of borrowers into signing contracts with hidden clauses and exorbitant fees. For example, some companies advertise “guaranteed loan forgiveness” programs, implying a direct connection to government programs, when in reality, they offer no legitimate services. Others may claim to be affiliated with the Department of Education or other official bodies, creating a false sense of security and legitimacy. These scams often target individuals through online advertising, social media, and even unsolicited phone calls.

Examples of Misleading Information Related to Private Student Loan Relief Programs

Misleading information can be just as damaging as outright scams. Advertisements might exaggerate the benefits of a program, omitting crucial details like high fees or stringent eligibility requirements. For instance, a company might advertise a “low monthly payment” plan without disclosing the extended repayment period and resulting increase in total interest paid. Another common tactic is to use confusing or technical language to obscure the true costs and risks involved. This can make it difficult for borrowers to understand the terms of a program and make an informed decision. The use of testimonials without proper verification also adds to the misleading nature of many advertisements.

Strategies for Identifying and Avoiding Scams and Misleading Information

Protecting yourself from scams and misleading information requires a proactive approach. Thoroughly research any company or program before engaging with them. Check online reviews and ratings from reputable sources. Verify the company’s legitimacy with the Better Business Bureau or other consumer protection agencies. Be wary of any program that guarantees quick or easy loan forgiveness, requires upfront fees, or uses high-pressure sales tactics. Read all contracts and agreements carefully before signing them, paying close attention to the fine print. If something sounds too good to be true, it probably is.

Red Flags Indicating Potential Scams Related to Student Loan Relief

Understanding the warning signs of a scam can significantly reduce your risk. Here are some key red flags to watch out for:

- Promises of guaranteed loan forgiveness without any legitimate government program affiliation.

- Requests for upfront fees or payments before any services are rendered.

- High-pressure sales tactics or attempts to rush you into a decision.

- Unrealistic claims or promises of immediate debt reduction.

- Lack of transparency regarding fees, terms, and conditions.

- Use of confusing or technical language to obscure important details.

- Websites or advertisements with poor grammar or unprofessional design.

- Unverified or unsubstantiated testimonials.

- Claims of affiliation with government agencies without proper verification.

- Requests for personal financial information without proper security measures.

Epilogue

Successfully managing private student loan debt often requires a proactive and informed approach. Understanding the various relief programs available, along with alternative strategies like refinancing or consolidation, is key to developing a personalized debt management plan. By carefully considering eligibility criteria, long-term financial implications, and potential scams, borrowers can make well-informed decisions that align with their individual circumstances and financial goals. Remember to thoroughly research all options and seek professional advice when necessary.

FAQ Summary

What happens if I miss a payment on a private student loan?

Missing payments can result in late fees, damage your credit score, and potentially lead to default, which has serious financial consequences.

Can I consolidate my private student loans?

Yes, consolidating private student loans can simplify repayment by combining multiple loans into one, potentially with a lower interest rate. However, carefully compare terms before consolidating.

Are there government programs that help with private student loans?

Government programs primarily focus on federal student loans. However, some private lenders may offer programs that align with government initiatives.

How do I find a reputable private student loan relief company?

Research thoroughly, check reviews, and be wary of companies promising unrealistic results or charging upfront fees. Consult with a financial advisor for guidance.