The weight of private student loan debt can feel overwhelming, but understanding your repayment options is the first step towards financial freedom. This guide delves into the complexities of private student loan repayment, offering practical strategies and valuable insights to help you manage your debt effectively and build a secure financial future. We’ll explore various repayment plans, debt management techniques, and resources available to navigate this challenging but surmountable journey.

From understanding different repayment plan structures and their implications to exploring debt consolidation and refinancing options, this resource provides a holistic approach to tackling private student loan repayment. We will also examine the impact of these loans on your overall financial well-being and offer advice on long-term financial planning post-repayment.

Understanding Private Student Loan Repayment Plans

Choosing the right repayment plan for your private student loans is crucial for managing your debt effectively and minimizing long-term costs. Understanding the various options and their implications will empower you to make informed decisions aligned with your financial situation.

Types of Private Student Loan Repayment Plans

Private student loan lenders offer a variety of repayment plans, though the specifics can vary significantly between lenders. Common options include:

Standard Repayment: This is typically the default plan, involving fixed monthly payments over a set period (usually 10-15 years). It offers predictability but may result in higher total interest paid compared to other options.

Graduated Repayment: Payments start low and gradually increase over time, often reflecting the expectation of increased income. This can be helpful initially but could lead to larger payments later.

Extended Repayment: This plan extends the repayment period, leading to lower monthly payments. However, it also generally results in significantly higher total interest paid due to the longer repayment timeframe.

Income-Driven Repayment (IDR): While less common for private loans than federal loans, some private lenders offer IDR plans. These plans base monthly payments on a percentage of your income, often adjusting payments as your income fluctuates. Eligibility criteria and specific terms will vary greatly.

Factors Influencing Repayment Plan Selection

Several factors play a significant role in determining the most suitable repayment plan for an individual.

Interest Rates: Higher interest rates necessitate a plan that prioritizes faster repayment to minimize the total interest paid, even if it means higher monthly payments.

Loan Amounts: Larger loan balances often benefit from longer repayment periods to reduce the burden of monthly payments, though this comes at the cost of increased overall interest.

Income: Current and projected income levels are critical considerations. Individuals with lower incomes might prefer plans with lower initial payments, while those with higher incomes might prioritize faster repayment.

Financial Goals: Short-term and long-term financial goals should also be factored in. If rapid debt elimination is a priority, a shorter repayment period with higher monthly payments might be preferable.

Comparison of Repayment Plan Benefits and Drawbacks

Each repayment plan presents a trade-off between monthly payment affordability and total interest paid. A shorter repayment period will lead to lower overall interest but higher monthly payments, while a longer repayment period will reduce monthly payments but increase the total interest paid over the life of the loan. Income-driven plans offer flexibility but may not always be the most efficient way to pay off debt, especially if income increases significantly. Careful consideration of your individual circumstances and financial goals is paramount.

Private Student Loan Repayment Plan Features

| Plan Name | Minimum Payment | Interest Accrual | Repayment Period |

|---|---|---|---|

| Standard Repayment | Fixed, based on loan amount and interest rate | Accrues throughout the repayment period | Typically 10-15 years |

| Graduated Repayment | Starts low, increases over time | Accrues throughout the repayment period | Typically 10-15 years |

| Extended Repayment | Lower than standard repayment | Accrues throughout the repayment period | Typically longer than 15 years |

| Income-Driven Repayment (if offered) | Percentage of income | Accrues throughout the repayment period | Varies, potentially longer than other plans |

Managing Private Student Loan Debt

Successfully navigating private student loan repayment requires a proactive and organized approach. Understanding your repayment options, budgeting effectively, and maintaining open communication with your lender are crucial for avoiding financial hardship and maintaining a healthy credit score. This section will Artikel strategies to effectively manage your private student loan debt.

Budgeting and Prioritizing Private Student Loan Repayments

Creating a realistic budget is paramount to successful loan repayment. This involves tracking your income and expenses to identify areas where you can cut back and allocate more funds towards your student loans. Prioritizing high-interest loans for repayment can significantly reduce the overall interest paid over the life of the loans. Consider using budgeting apps or spreadsheets to monitor your spending and track your progress towards your repayment goals. For example, a person earning $40,000 annually might allocate $500 monthly towards their highest-interest loan, even if it means reducing discretionary spending on entertainment or dining out. This targeted approach can accelerate debt reduction and save substantial amounts on interest.

Negotiating Lower Interest Rates or Modified Repayment Terms

Many lenders are willing to negotiate lower interest rates or modified repayment terms, particularly if you have a history of on-time payments. Contacting your lender directly to discuss your financial situation and explore options such as refinancing or forbearance can be beneficial. Strong credit scores significantly improve your chances of securing a more favorable repayment plan. For instance, someone with an excellent credit score might be able to refinance their loans at a lower interest rate, reducing their monthly payments and overall interest paid. Conversely, individuals with poor credit may find it more challenging to negotiate favorable terms.

Consequences of Defaulting on Private Student Loans

Defaulting on private student loans has serious repercussions. It can severely damage your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Collection agencies may pursue aggressive debt collection tactics, including wage garnishment or lawsuits. Furthermore, defaulting on a private student loan may negatively impact your ability to secure employment in certain fields. The long-term financial consequences of default can be substantial and far-reaching, impacting various aspects of your personal and professional life.

Impact of Credit Score on Repayment Options

Your credit score plays a pivotal role in determining the repayment options available to you. A high credit score often qualifies you for lower interest rates, better repayment terms, and a wider range of refinancing opportunities. Conversely, a low credit score may limit your options, potentially leading to higher interest rates, less flexible repayment plans, and difficulty securing refinancing. Maintaining a good credit score is crucial for managing your private student loans effectively and minimizing long-term financial burdens. Regularly monitoring your credit report and addressing any inaccuracies is recommended.

Government Programs and Resources for Private Student Loan Repayment

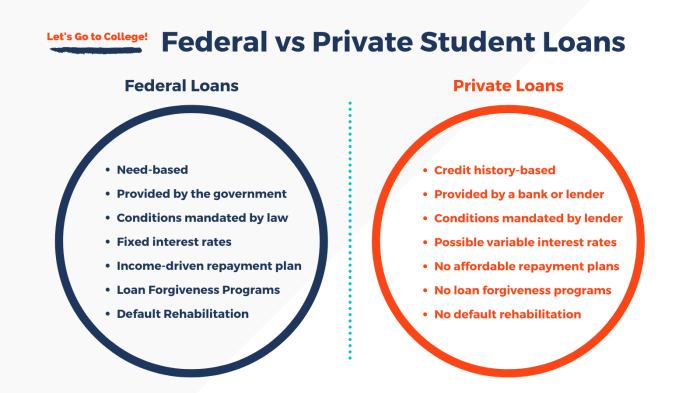

While the government doesn’t directly assist with private student loan repayment in the same way it does with federal loans, several programs and resources can indirectly help manage and reduce your debt burden. These programs often focus on improving your financial literacy, credit score, or providing avenues for debt consolidation or management, ultimately making private loan repayment more manageable.

Understanding these resources and how they can benefit you is crucial for navigating the complexities of private student loan repayment. Many individuals find that a multi-pronged approach, combining several of these strategies, proves most effective.

Credit Counseling Agencies

Credit counseling agencies, often non-profit organizations, offer free or low-cost services to help individuals manage their debt. These agencies can provide guidance on budgeting, creating a debt repayment plan, and negotiating with creditors. While they don’t directly pay off your loans, they can provide valuable tools and strategies to improve your financial situation and make repayment more achievable. Eligibility typically involves having debt and a willingness to participate in a financial counseling program. The process usually begins with a consultation to assess your financial situation and develop a personalized plan.

Financial Literacy Programs

Numerous government and non-profit organizations offer financial literacy programs designed to educate individuals about responsible money management. These programs often cover topics such as budgeting, saving, investing, and debt management. Improved financial literacy can empower you to make informed decisions about your finances, potentially leading to better debt management strategies and improved credit scores. These programs are generally open to anyone interested in improving their financial knowledge, regardless of their debt level. Participation often involves attending workshops, online courses, or accessing educational materials.

Debt Management Plans (DMPs)

Through credit counseling agencies, individuals can enroll in Debt Management Plans (DMPs). A DMP consolidates multiple debts, including potentially private student loans, into a single monthly payment with a lower interest rate. This can simplify repayment and potentially reduce the overall cost of borrowing. Eligibility typically involves having manageable debt and a willingness to adhere to the DMP terms. The process involves working with a credit counselor to create a plan, negotiate with creditors, and manage monthly payments.

Flowchart Illustrating the Process of Applying for Relevant Government Assistance (Indirect Support)

The flowchart below illustrates a simplified process for accessing indirect government support for private student loan repayment. Note that this is a generalized representation and specific requirements may vary depending on the program and agency.

[Diagram Description: The flowchart begins with a “Start” box. It then branches to “Identify Financial Need and Goals,” leading to “Research Government Resources (Credit Counseling, Financial Literacy Programs).” This then leads to “Contact Chosen Agency/Program,” followed by “Complete Application/Enrollment Process.” This leads to “Receive Services/Guidance,” followed by “Implement Debt Management Strategies.” Finally, the flowchart concludes with an “End” box.]

Exploring Debt Consolidation and Refinancing Options

Navigating the complexities of private student loan repayment often leads borrowers to consider debt consolidation and refinancing as potential strategies for simplifying their debt management and potentially lowering their monthly payments. Understanding the nuances of each option is crucial for making an informed decision.

Debt consolidation and refinancing, while both aiming to streamline student loan payments, differ significantly in their mechanisms. Consolidation involves combining multiple loans into a single loan, often with a new lender. Refinancing, on the other hand, replaces existing loans with a new loan, typically at a lower interest rate. Both can simplify repayment, but refinancing usually offers the potential for better interest rates and potentially lower monthly payments.

Debt Consolidation and Refinancing Compared

Debt consolidation gathers your various private student loans into one single payment, often with a new lender. This simplifies the repayment process by reducing the number of payments you need to track. Refinancing, conversely, replaces your existing loans with a new loan, usually at a more favorable interest rate. This can lead to significant long-term savings due to lower interest payments. While both aim to simplify repayment, refinancing generally offers a more impactful reduction in overall cost.

Refinancing a Private Student Loan: A Step-by-Step Guide

The refinancing process typically involves several steps. First, you’ll need to check your credit score and obtain a credit report to understand your financial standing. Next, research different lenders, comparing interest rates, fees, and repayment terms. Once you’ve selected a lender, you’ll need to complete an application, providing necessary documentation such as income verification and details of your existing loans. After approval, the lender will pay off your existing loans and you’ll begin making payments on the new loan. It is crucial to thoroughly compare offers from multiple lenders to secure the most favorable terms.

Potential Risks and Benefits of Debt Consolidation

Understanding the potential advantages and disadvantages of debt consolidation is key to making an informed decision.

- Benefits: Simplified repayment process with a single monthly payment; potentially lower monthly payments (though this depends on the new loan’s terms); improved organization of debt management.

- Risks: Higher interest rates compared to existing loans; potential for longer repayment periods, leading to increased overall interest paid; impact on credit score during the application process.

Potential Risks and Benefits of Refinancing

Similarly, weighing the potential benefits against the risks associated with refinancing is essential before proceeding.

- Benefits: Lower interest rates leading to significant long-term savings; potentially lower monthly payments; potential for a shorter repayment period.

- Risks: Loss of certain borrower benefits associated with federal loans (e.g., income-driven repayment plans); potential for higher fees compared to consolidation; impact on credit score during the application process; risk of increased monthly payments if a shorter repayment period is chosen.

Long-Term Financial Planning After Repayment

Congratulations on completing your private student loan repayment! This significant achievement marks a pivotal moment, allowing you to focus on building a strong financial future. Now is the time to shift your financial priorities from debt repayment to wealth building and securing your long-term financial well-being. Strategic planning is key to maximizing your financial potential.

Building a Strong Financial Foundation

Successfully navigating student loan repayment demonstrates financial discipline. Leverage this momentum to establish a robust financial foundation. This involves creating a comprehensive budget, prioritizing savings, and developing sound investment strategies. A well-structured financial plan acts as a roadmap, guiding your decisions and ensuring your financial goals are met. Consistent budgeting, informed saving, and strategic investment are crucial pillars of this plan.

Strategies for Saving and Investing

Saving and investing are interconnected aspects of long-term financial planning. Saving provides a financial safety net and funds for short-term goals, while investing helps your money grow over time to achieve long-term objectives like retirement or a down payment on a house. Consider diversifying your investments across different asset classes (stocks, bonds, real estate) to manage risk effectively. A common approach is to start with a high-yield savings account for emergency funds and gradually transition to investing in a diversified portfolio suitable for your risk tolerance and time horizon. For example, someone with a longer time horizon before retirement might invest more aggressively in stocks, while someone closer to retirement might prioritize lower-risk investments like bonds.

Establishing an Emergency Fund

An emergency fund acts as a crucial buffer against unexpected financial setbacks. Aim to save 3-6 months’ worth of living expenses in a readily accessible account, such as a high-yield savings account or money market account. This fund should cover essential expenses like rent, utilities, groceries, and transportation in case of job loss, medical emergencies, or unexpected repairs. Having this safety net provides peace of mind and prevents you from accumulating new debt during unforeseen circumstances. For instance, if your annual living expenses are $36,000, your emergency fund should ideally contain between $9,000 and $18,000.

Creating a Post-Repayment Budget

Budgeting remains crucial even after loan repayment. A post-repayment budget should reflect your new financial priorities and goals. Consider using a budgeting app or spreadsheet to track income and expenses. Allocate funds for savings, investments, debt repayment (if any remaining), and essential living expenses.

Sample Post-Repayment Budget Scenario

Let’s assume a monthly net income of $4,000 after taxes. A sample budget might allocate:

| Category | Amount |

|---|---|

| Housing | $1,000 |

| Food | $500 |

| Transportation | $300 |

| Utilities | $200 |

| Savings (Emergency Fund & Investments) | $1,000 |

| Debt Repayment (if applicable) | $0 |

| Personal Spending | $1,000 |

This is a sample budget, and the allocation will vary based on individual circumstances and financial goals. The key is to create a budget that aligns with your priorities and allows you to save and invest consistently. Remember to regularly review and adjust your budget as your income and expenses change.

The Impact of Private Student Loan Debt on Financial Well-being

Private student loan debt can significantly impact an individual’s financial well-being, extending far beyond the immediate repayment period. The weight of these loans can cast a long shadow over future financial decisions, affecting everything from homeownership to retirement planning. Understanding this impact is crucial for effective debt management and long-term financial security.

The potential long-term financial consequences of high private student loan debt are substantial. High monthly payments can severely restrict disposable income, limiting the ability to save for retirement, purchase a home, or build an emergency fund. This can lead to a cycle of debt, where individuals struggle to meet their loan obligations while simultaneously facing unexpected expenses, potentially necessitating further borrowing. For example, someone burdened with significant private student loan debt might delay starting a family or forgo opportunities for career advancement that require relocation due to the financial constraints imposed by their loan repayments. Furthermore, the interest accrued on these loans can significantly increase the total amount owed over time, compounding the financial burden.

Long-Term Financial Consequences of High Private Student Loan Debt

High private student loan debt can hinder major life milestones. Delayed homeownership, limited retirement savings, and reduced investment opportunities are common consequences. The inability to save adequately for retirement can lead to financial insecurity in later life, potentially requiring continued work or reliance on government assistance. Similarly, the inability to save for a down payment significantly delays or prevents homeownership, a cornerstone of financial stability for many. The reduced ability to invest also limits the potential for wealth accumulation, widening the gap between those with and without significant student loan debt. Consider the case of two individuals: one with substantial private student loan debt and one without. After 10 years, the individual without debt likely has a significantly larger net worth due to homeownership, retirement savings, and investment opportunities.

Psychological Effects of Student Loan Debt

The psychological impact of student loan debt is often overlooked but equally significant. The constant stress of repayment can lead to anxiety, depression, and even feelings of hopelessness. This can affect overall mental health and well-being, impacting relationships, job performance, and overall life satisfaction. The weight of debt can also create feelings of guilt and shame, especially when individuals feel they have failed to meet their financial expectations. This constant pressure can negatively impact decision-making abilities and lead to poor financial choices. For example, individuals under extreme financial stress might make impulsive purchases or resort to high-interest loans to alleviate immediate pressures, further worsening their financial situation.

Maintaining Financial Well-being While Managing Student Loan Debt

Maintaining financial well-being while managing student loan debt requires a proactive and strategic approach. Creating a realistic budget that prioritizes loan repayment while allocating funds for essential expenses and savings is crucial. Exploring different repayment plans, such as income-driven repayment (if available), can help manage monthly payments. Seeking professional financial advice can provide personalized strategies for debt management and long-term financial planning. Building an emergency fund is also essential to avoid further debt accumulation in case of unexpected expenses. Additionally, focusing on career advancement and exploring opportunities for higher income can improve the ability to manage and repay debt more quickly.

The Relationship Between Student Loan Debt and Overall Financial Health

A visual representation could be a graph showing a negative correlation between the level of student loan debt and overall financial health. The x-axis would represent the amount of student loan debt, ranging from low to high. The y-axis would represent overall financial health, measured by factors like net worth, savings rate, credit score, and stress levels. The graph would show a downward-sloping line, illustrating that as student loan debt increases, overall financial health tends to decrease. A healthy individual with low debt would be represented by a point high on the y-axis and low on the x-axis, while an individual struggling with high debt would be represented by a point low on the y-axis and high on the x-axis. The graph would visually demonstrate the significant impact of high student loan debt on various aspects of an individual’s financial well-being.

Final Review

Successfully managing private student loan repayment requires careful planning, proactive strategies, and a clear understanding of available resources. By utilizing the information and tools presented in this guide, you can gain control of your debt, mitigate potential risks, and build a solid foundation for long-term financial stability. Remember, seeking professional financial advice tailored to your specific circumstances can further enhance your repayment journey and provide valuable support.

Popular Questions

What happens if I miss a private student loan payment?

Missing payments can result in late fees, increased interest accrual, damage to your credit score, and potential collection actions by the lender.

Can I negotiate my private student loan terms?

Yes, it’s worth contacting your lender to discuss options like modifying your repayment plan or potentially negotiating a lower interest rate, especially if you’re facing financial hardship. Be prepared to explain your situation clearly.

What is the difference between forbearance and deferment?

Forbearance temporarily suspends or reduces your payments, but interest usually continues to accrue. Deferment postpones payments, and in some cases, interest accrual may also be suspended.

How does my credit score affect my repayment options?

A higher credit score often qualifies you for better interest rates and more favorable repayment terms. A lower score may limit your options and lead to higher interest rates.

Are there any non-profit organizations that can help with private student loan repayment?

Yes, many non-profit credit counseling agencies offer free or low-cost guidance on managing student loan debt and exploring repayment options. They can provide budgeting assistance and help you create a repayment plan.