Navigating the complexities of student loan repayment can feel overwhelming, but understanding your options is key to financial freedom. A private student loan repayment calculator empowers you to take control by providing clear, personalized projections based on your unique loan details. This tool allows you to explore different repayment scenarios, compare plans, and make informed decisions about your financial future.

This guide will delve into the functionality of these calculators, highlighting their benefits and limitations. We’ll examine how factors like interest rates and repayment periods impact your monthly payments and overall cost, offering practical examples and scenarios to illustrate their effective use. By understanding the power of these tools, you can confidently chart a course towards successful debt management.

Understanding Private Student Loan Repayment Calculators

Private student loan repayment calculators are invaluable tools for prospective and current borrowers. They provide a clear picture of potential repayment scenarios, allowing individuals to make informed decisions about their borrowing and repayment strategies. These calculators simplify a complex process, offering estimations of monthly payments, total interest paid, and the overall cost of borrowing.

Private student loan repayment calculators function by taking several key input parameters and applying standard loan amortization formulas to estimate future payments. This allows borrowers to explore different repayment options and their financial implications.

Input Parameters for Private Student Loan Repayment Calculators

Several crucial pieces of information are required to accurately estimate repayment. The accuracy of the calculator’s output directly depends on the precision of these inputs. Inaccurate or incomplete information will lead to inaccurate projections.

- Loan Amount: The total principal balance of the loan(s).

- Interest Rate: The annual interest rate charged on the loan. This is usually expressed as a percentage.

- Loan Term (Repayment Period): The length of time, typically expressed in years or months, allocated to repay the loan in full.

- Repayment Plan Type: The chosen repayment method (e.g., standard, extended, graduated). Each plan affects the payment schedule and total interest paid differently.

- Fees: Some calculators allow for the inclusion of origination fees or other loan-related charges. These can significantly impact the overall cost.

Repayment Plan Options and Calculator Outputs

Different repayment plans significantly alter the monthly payment amount, the total interest paid, and the overall loan repayment timeline. Calculators illustrate these differences clearly.

- Standard Repayment Plan: This typically involves fixed monthly payments over a set period (e.g., 10 years). Calculators will show a consistent monthly payment amount for the duration. For example, a $50,000 loan at 7% interest over 10 years might result in a monthly payment of approximately $590, with a total interest paid around $17,000.

- Extended Repayment Plan: This plan stretches the repayment period, leading to lower monthly payments but higher total interest paid. A $50,000 loan at 7% interest extended to 20 years might have a monthly payment of approximately $390, but total interest paid could exceed $30,000.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be helpful initially, but the later payments will be significantly higher. A calculator would illustrate this increasing payment schedule. For example, early payments might be around $300, rising to $700 or more in later years, with total interest paid falling somewhere between the standard and extended plans.

Key Features and Benefits of Using a Calculator

Navigating the complexities of private student loan repayment can be daunting. A repayment calculator offers a powerful tool to simplify this process, providing clarity and control over your financial future. By inputting key details about your loans, you gain valuable insights that empower informed decision-making and alleviate the stress associated with managing student loan debt.

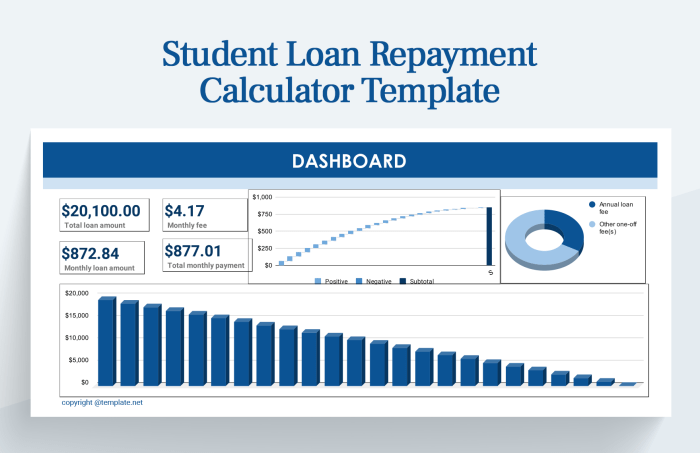

A private student loan repayment calculator offers several significant benefits. Primarily, it provides a clear and concise overview of your repayment options, allowing you to compare different repayment plans and their associated costs. This comparison can reveal substantial differences in total interest paid and overall repayment time, ultimately saving you significant money over the life of your loans. Furthermore, calculators often incorporate features that allow you to explore the impact of extra payments or refinancing on your overall repayment schedule, empowering you to proactively manage your debt and accelerate your path to becoming debt-free.

Repayment Plan Comparison and Cost Analysis

Different online calculators offer varying features, but most include the ability to input loan details such as principal balance, interest rate, and loan term. Some advanced calculators might even accommodate multiple loans with different terms and interest rates. The core benefit lies in their ability to simulate different repayment scenarios, allowing you to compare the total cost of repayment under various plans, such as standard repayment, extended repayment, or income-driven repayment (if applicable to private loans, though this is less common). For example, comparing a 10-year repayment plan versus a 15-year plan for a $50,000 loan at 7% interest would clearly illustrate the significant difference in total interest paid – likely tens of thousands of dollars. This clear visualization helps borrowers make informed choices aligned with their financial goals and risk tolerance.

Exploration of Extra Payment and Refinancing Scenarios

Many calculators go beyond basic repayment projections. They allow users to input potential extra payments to see how this affects the overall repayment timeline and reduces total interest paid. For instance, by adding an extra $100 per month to a $20,000 loan at 6% interest, the calculator would show a shorter repayment period and a considerable reduction in total interest. Similarly, some calculators offer the ability to simulate refinancing scenarios, allowing users to see the potential impact of securing a lower interest rate through refinancing with a different lender. This feature is particularly useful in a fluctuating interest rate environment, allowing borrowers to assess whether refinancing would be a financially advantageous move.

Budgeting and Financial Planning Assistance

Integrating student loan repayment into a comprehensive financial plan is crucial. A repayment calculator facilitates this by providing a clear picture of your monthly payment obligation. This allows you to accurately incorporate this expense into your monthly budget, ensuring that you have sufficient funds available for other essential expenses like housing, food, and transportation. By accurately projecting future payments, borrowers can avoid financial strain and make informed decisions about other financial goals, such as saving for a down payment on a house or investing in retirement. The calculator’s projections offer a realistic assessment of your financial capacity, preventing overextension and promoting responsible financial management.

Factors Affecting Repayment Calculations

Understanding the factors that influence your private student loan repayment is crucial for effective financial planning. Several key variables significantly impact your monthly payments and the total amount you ultimately repay. This section will explore the most influential of these factors.

The primary factors determining your repayment plan are the interest rate and the loan repayment term. These two elements interact to shape your monthly payment amount and the total interest you accrue over the life of the loan. A higher interest rate increases the cost of borrowing, leading to higher monthly payments and a greater overall repayment amount. Conversely, a longer repayment period reduces monthly payments but increases the total interest paid. Let’s examine each factor in detail.

Interest Rate Impact on Repayment Costs

The interest rate applied to your loan directly affects the total cost of borrowing. A higher interest rate means a larger portion of your monthly payment goes towards interest, leaving less to pay down the principal balance. This results in a longer repayment period and significantly higher overall interest paid. For example, a 7% interest rate on a $20,000 loan will lead to a much higher total repayment than a 4% interest rate, even with the same repayment period. The difference in total interest paid can amount to thousands of dollars over the life of the loan.

Repayment Period Impact on Monthly Payments and Total Interest

The length of your repayment period, typically expressed in years, also plays a crucial role in your monthly payment amount and the total interest paid. Choosing a shorter repayment period will lead to higher monthly payments, but significantly reduces the total interest paid over the life of the loan. Conversely, opting for a longer repayment period lowers your monthly payments, but substantially increases the total interest you’ll pay. This is because you’re accruing interest for a longer duration. Consider the trade-off between affordability and long-term cost savings when selecting a repayment period.

Illustrative Example: Interest Rate and Repayment Period Effects

The following table illustrates the impact of varying interest rates and repayment periods on a sample loan of $20,000. Note that these calculations are simplified and do not account for potential fees or other charges that might be associated with your specific loan.

| Interest Rate | Repayment Period (Years) | Monthly Payment | Total Interest Paid | Total Amount Paid |

|---|---|---|---|---|

| 4% | 5 | $361.04 | $1662.27 | $21662.27 |

| 4% | 10 | $192.55 | $3661.98 | $23661.98 |

| 7% | 5 | $388.05 | $2283.01 | $22283.01 |

| 7% | 10 | $221.11 | $5266.44 | $25266.44 |

Scenarios and Examples of Calculator Use

A private student loan repayment calculator is a powerful tool for understanding and managing your student loan debt. By inputting key information, you can explore various repayment scenarios and make informed decisions about your financial future. This section will illustrate the calculator’s usefulness through several practical examples.

Understanding the different repayment options available and their long-term financial implications is crucial for effective debt management. A calculator simplifies this process by providing clear, concise projections based on your specific circumstances.

Refinancing Scenario

Let’s say you have $50,000 in private student loans with a 7% interest rate and a 10-year repayment term. Your monthly payment is approximately $590. You’re considering refinancing to a lower interest rate of 5%. Using a repayment calculator, you input the original loan amount, interest rate, and repayment term. Then, you input the new potential interest rate of 5%. The calculator shows you that refinancing would reduce your monthly payment to approximately $507 and save you roughly $10,000 in interest over the life of the loan. This illustrates the potential benefits of refinancing and helps you make an informed decision.

Budgeting for Repayment

Imagine you have $30,000 in private student loans at 6% interest with a 12-year repayment plan. You want to see how this loan impacts your monthly budget alongside other expenses like rent, groceries, and transportation. You input the loan details into the calculator. The calculator shows a monthly payment of approximately $300. By comparing this figure to your existing monthly expenses, you can create a realistic budget that incorporates your student loan repayment. This helps avoid financial strain and ensures you can comfortably manage your debt.

Exploring Different Repayment Plans

Suppose you have $40,000 in private student loans at 8% interest. You are unsure whether to choose a 5-year, 10-year, or 15-year repayment plan. Using the calculator, you input the loan amount and interest rate, then explore each repayment option individually. The calculator displays the monthly payment, total interest paid, and total amount paid for each plan. For example:

- 5-year plan: Higher monthly payment (approximately $790), lower total interest paid (approximately $10,000).

- 10-year plan: Lower monthly payment (approximately $460), higher total interest paid (approximately $19,000).

- 15-year plan: Lowest monthly payment (approximately $340), highest total interest paid (approximately $29,000).

This allows you to weigh the trade-offs between shorter repayment periods with higher monthly payments and longer periods with lower monthly payments but greater overall interest costs.

Impact of Extra Payments

Let’s say you have a $25,000 loan at 9% interest with a 10-year repayment term. You’re curious about the impact of making extra principal payments each month. You use the calculator to input the loan details and then add an additional $100 to your monthly payment. The calculator shows that by making this extra payment, you can significantly reduce the total interest paid and shorten the repayment term. For example, adding $100 to the monthly payment could reduce the total interest paid by several thousand dollars and potentially save you years on your repayment schedule.

Potential Limitations and Considerations

While online private student loan repayment calculators offer valuable tools for planning, it’s crucial to understand their limitations. These calculators provide estimates based on the data you input, and several factors can influence the accuracy of these projections. Over-reliance on a single calculation without considering external variables could lead to inaccurate financial planning.

These calculators typically rely on simplified models and may not account for the complexities of real-world financial situations. For example, they often assume consistent interest rates and steady income throughout the repayment period, which rarely holds true in practice. Furthermore, unforeseen circumstances like job loss or medical emergencies are generally not factored into these calculations.

Limitations of Online Calculators

Online calculators, while helpful, present a simplified view of a complex financial situation. They typically assume a fixed interest rate throughout the loan term, which is often not the case with variable-rate loans. Similarly, they usually don’t account for additional fees that might be associated with your loan, such as late payment fees or prepayment penalties. The calculations also typically assume consistent monthly payments, failing to consider the potential for extra payments or periods of forbearance. Finally, these calculators often lack the ability to model the effects of refinancing, which could significantly alter your repayment schedule and total interest paid.

Factors Not Typically Included in Calculator Models

Several significant factors influencing repayment are often omitted from standard calculator models. Unexpected job loss, for instance, can dramatically impact your ability to make timely payments, potentially leading to delinquency and increased interest charges. Changes in interest rates, especially with variable-rate loans, can also significantly alter your monthly payment amount and total repayment cost. Unforeseen medical expenses or other major life events can also necessitate changes to your repayment plan, such as requesting a deferment or forbearance, which the calculator might not accurately reflect. These external factors highlight the need for a holistic financial plan that extends beyond the output of a single calculator.

Visual Representation of Unexpected Income Changes

A line graph effectively illustrates the impact of unexpected income changes on a repayment plan. The x-axis represents time (in months), and the y-axis represents the remaining loan balance. A baseline line would show the projected repayment schedule with a consistent income. If an unexpected job loss occurs, a sharp upward deviation from the baseline would illustrate the increased loan balance due to missed or reduced payments. This deviation would be more pronounced with higher interest rates and longer periods of unemployment. Once income is restored, the line would gradually descend, but it might not return to the original baseline, reflecting the accumulated interest during the period of reduced income. This visual representation clearly shows how external events can significantly disrupt a planned repayment trajectory, emphasizing the importance of financial preparedness and contingency planning.

Alternative Repayment Strategies

While standard amortization is the most common repayment method for private student loans, several alternative strategies can help borrowers manage their debt more effectively. These strategies offer varying degrees of flexibility and may be more suitable depending on individual financial circumstances. It’s crucial to understand the implications of each approach before making a decision.

Understanding the differences between these strategies is key to choosing the best path for your financial situation. Factors such as your income, expenses, and overall financial goals should heavily influence your selection. Remember to carefully review the terms and conditions of your loan agreement and consult with a financial advisor if needed.

Income-Driven Repayment (IDR) Plans for Private Loans

While primarily associated with federal student loans, some private lenders offer income-driven repayment plans. These plans adjust your monthly payments based on your income and family size. However, it’s important to note that private lenders are not mandated to offer these plans, and their availability and specific terms vary significantly.

| Repayment Strategy | Monthly Payment Variability | Total Repayment Cost | Eligibility Requirements |

|---|---|---|---|

| Standard Amortization | Fixed | Predictable; typically lower than IDR | Generally available to all borrowers |

| Income-Driven Repayment (Private Lender) | Variable; adjusted based on income | Potentially higher due to longer repayment periods | Varies greatly by lender; may require income verification |

| Extended Repayment Plan | Fixed, but lower than standard | Higher due to accumulated interest over a longer period | Offered by some lenders; may require meeting certain criteria |

| Deferment or Forbearance | Temporarily reduced or zero | Higher due to accumulated interest | Typically available for temporary hardship; specific requirements vary by lender |

Comparison of Repayment Strategies

The table above highlights the key differences between several repayment strategies. Note that the “Total Repayment Cost” is an estimate, as the actual cost depends on factors like the interest rate and the length of the repayment period. For example, an income-driven plan might result in a lower monthly payment, but the total repayment cost could be higher due to the extended repayment period and accrued interest. Similarly, an extended repayment plan lowers monthly payments, but the overall cost increases due to longer interest accrual.

Considerations for Choosing a Repayment Strategy

The best repayment strategy depends on your individual financial situation and priorities. If you prioritize lower monthly payments, an income-driven plan or extended repayment plan might be suitable. However, these options usually lead to higher total repayment costs. If you prioritize minimizing total repayment cost, a standard amortization plan is generally the best choice, even if the monthly payments are higher. Deferment or forbearance should be considered only as a short-term solution for financial hardship, as they ultimately increase the total cost.

Conclusive Thoughts

Ultimately, a private student loan repayment calculator serves as an invaluable resource for anyone facing the challenge of student loan debt. By providing a clear picture of potential repayment paths, it empowers borrowers to make informed choices, budget effectively, and work towards a debt-free future. Remember to consider the limitations of any calculator and consult with a financial advisor for personalized guidance.

Question & Answer Hub

What happens if my interest rate changes during repayment?

Most calculators don’t account for fluctuating interest rates. For a more accurate projection, consider using a range of potential interest rates or consulting a financial professional.

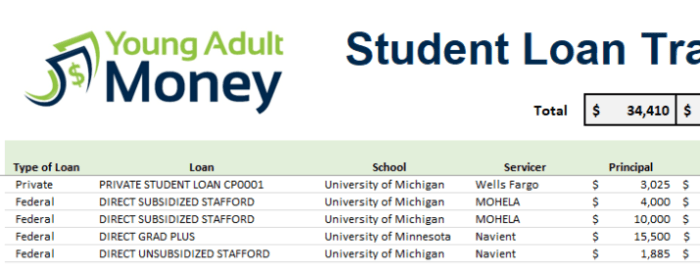

Can I use a calculator for loans with multiple lenders?

Many calculators handle only one loan at a time. You’ll need to calculate each loan separately and then sum the results to get a total repayment picture.

Are there calculators that account for income-driven repayment plans for private loans?

While standard calculators primarily focus on fixed-payment plans, some advanced calculators or financial planning software may offer more sophisticated models that incorporate income-based adjustments. However, this feature is less common for private loans compared to federal loans.

How accurate are online student loan calculators?

Online calculators provide estimates based on the information you input. They are helpful for comparison but may not capture all nuances of your specific loan terms or unforeseen circumstances.