Navigating the world of higher education funding can be daunting, particularly when considering private student loans. This guide delves into the intricacies of private student loans offered by banks in the US, providing a clear understanding of the application process, interest rates, repayment options, and potential risks. We’ll explore the key differences between private and federal loans, empowering you to make informed decisions about financing your education.

From understanding eligibility requirements and comparing loan features across various banks to managing repayment and protecting yourself from predatory lending practices, we aim to equip you with the knowledge necessary to confidently navigate the landscape of private student loan financing. We’ll also examine the long-term impact on your credit score and discuss strategies for responsible debt management.

Overview of Private Student Loan Banks

Private student loans, offered by banks and other financial institutions, represent a significant funding source for higher education in the United States. They supplement federal student loan programs, providing an alternative for students who need additional financial assistance or whose borrowing needs exceed federal loan limits. Understanding the landscape of private student loan providers, their offerings, and the key distinctions between private and federal loans is crucial for prospective borrowers.

Private student loan offerings have evolved significantly since their inception. Initially, these loans were primarily offered by smaller banks and credit unions, often with limited product diversity and stringent eligibility requirements. Over time, the market expanded with the entry of larger national banks and specialized lenders, leading to increased competition and a wider range of loan products, including variable and fixed interest rates, different repayment options, and co-signer provisions. This increased competition, however, also meant a more complex landscape for borrowers to navigate.

Major Private Student Loan Banks and Their Offerings

The following table summarizes some major banks offering private student loans in the US. Note that specific loan features, interest rates, and eligibility requirements are subject to change and vary based on individual creditworthiness and the lender’s policies. It’s crucial to check directly with the lender for the most up-to-date information.

| Bank Name | Loan Features | Interest Rates (range) | Eligibility Requirements |

|---|---|---|---|

| Sallie Mae | Variable and fixed interest rates, various repayment options, co-signer options available | Variable: 6.5% – 14%, Fixed: 7% – 15% (Approximate ranges, subject to change) | Good credit history (or co-signer with good credit), enrollment in an eligible degree program |

| Discover | Fixed interest rates, flexible repayment plans, potential for cashback rewards | 7% – 13% (Approximate range, subject to change) | Good credit history (or co-signer with good credit), enrollment in an eligible degree program |

| Wells Fargo | Variable and fixed interest rates, various repayment options, co-signer options available | Variable: 6% – 14%, Fixed: 7% – 15% (Approximate ranges, subject to change) | Good credit history (or co-signer with good credit), enrollment in an eligible degree program |

| PNC | Fixed interest rates, autopay discounts, co-signer options | 7% – 14% (Approximate range, subject to change) | Good credit history (or co-signer with good credit), enrollment in an eligible degree program |

Key Differences Between Private and Federal Student Loans

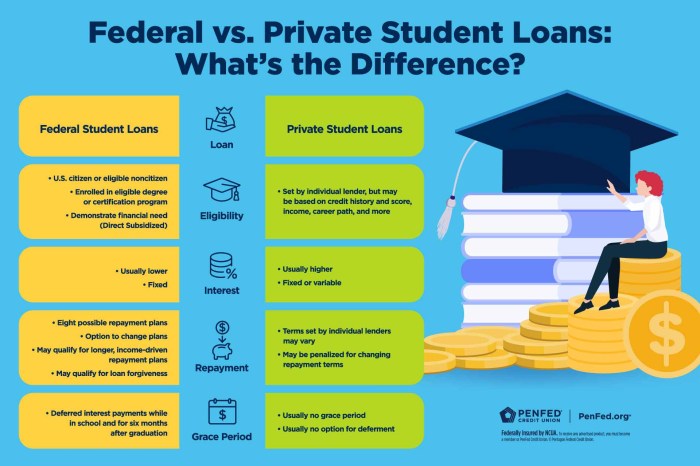

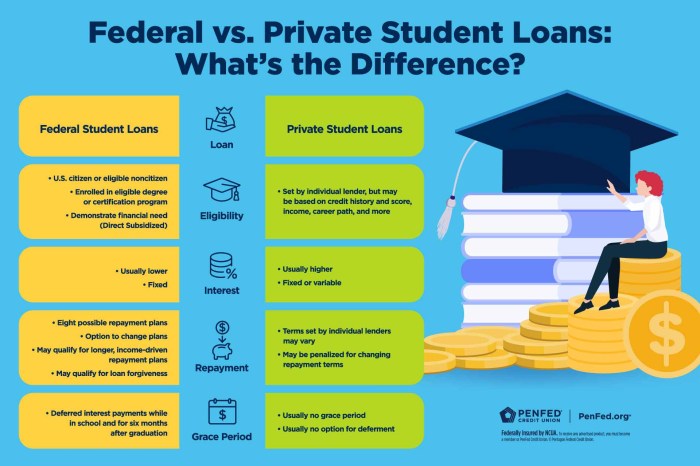

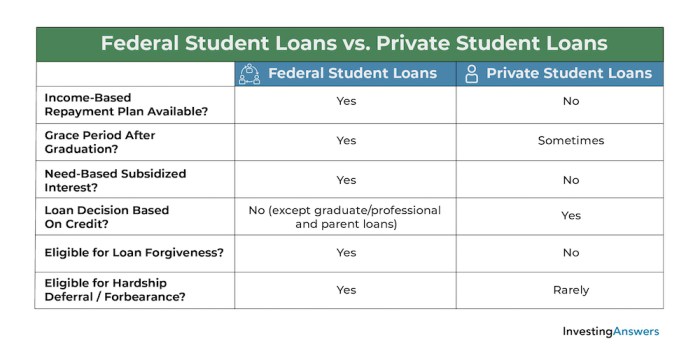

Federal student loans and private student loans differ significantly in their terms, eligibility criteria, and borrower protections. Understanding these differences is critical in making informed borrowing decisions.

Federal student loans are offered by the U.S. government and typically offer more borrower protections, including income-driven repayment plans, loan forgiveness programs (under certain circumstances), and deferment options in case of financial hardship. Eligibility is based primarily on financial need and enrollment in an eligible educational program. Interest rates are generally lower than those for private loans.

Private student loans, on the other hand, are offered by banks and other private lenders. While they may offer more flexible repayment options in some cases, they generally lack the robust borrower protections of federal loans. Eligibility often depends heavily on creditworthiness, requiring a good credit history or a co-signer with good credit. Interest rates are typically higher and can vary significantly based on credit score and market conditions. Defaulting on a private student loan can have severe consequences, potentially impacting credit scores and future borrowing opportunities.

Loan Application and Approval Process

Securing a private student loan involves a multi-step process that varies slightly depending on the lending institution. Understanding these steps is crucial for a smooth and efficient application experience. Generally, the process begins with an initial application and culminates in loan disbursement. Factors like credit history, co-signer availability, and the applicant’s financial situation significantly influence the approval process.

The typical steps involved in applying for a private student loan from a bank include completing an online application, providing documentation to verify your identity and financial information, undergoing a credit check, receiving a loan offer (if approved), and finally accepting the loan terms and receiving the funds. The time it takes to complete this process can range from a few days to several weeks, depending on the lender and the applicant’s circumstances.

Private Student Loan Application Process Steps

A visual representation of the process could be illustrated with a flowchart. The flowchart would begin with the “Application Submission” box, followed by a decision point: “Complete Application & Required Documentation?”. If yes, the flow proceeds to “Credit Check and Income Verification,” then to “Loan Offer,” and finally to “Loan Acceptance and Disbursement.” If the application is incomplete, the flow would loop back to “Application Submission.” Similarly, if the credit check or income verification reveals insufficient eligibility, the flow would lead to “Application Denial.” This flowchart visually represents the conditional nature of the process.

Comparison of Application Processes Across Three Banks

Let’s compare the application processes of three hypothetical banks: Bank A, Bank B, and Bank C. Bank A emphasizes a streamlined online application with quick pre-qualification, followed by a relatively fast turnaround time for loan approvals. Bank B requires more extensive documentation and has a more rigorous credit check, leading to a potentially longer approval process. Bank C offers a hybrid approach, combining an online application with the option of speaking to a loan officer, providing a more personalized experience but potentially a slower approval timeline. These differences highlight the variations in application processes across different lending institutions. While all three banks would require similar basic information (such as personal details, academic information, and financial information), the level of scrutiny and the speed of the process could vary considerably. For instance, Bank A might primarily focus on automated credit scoring, while Bank B might involve manual review by a loan officer, potentially delaying the process but allowing for more nuanced consideration of individual circumstances. Bank C’s hybrid approach attempts to balance speed and personalization.

Interest Rates and Repayment Options

Understanding the interest rates and repayment options for private student loans is crucial for borrowers to make informed decisions and manage their debt effectively. Choosing the right repayment plan can significantly impact the total cost and the length of time it takes to repay the loan. This section will explore the factors influencing interest rates and provide examples of common repayment plans.

Several factors influence the interest rate a bank offers on a private student loan. These factors are often assessed during the loan application process. A borrower’s credit history plays a significant role; a strong credit history typically results in a lower interest rate. The loan amount itself can also be a factor, with larger loans potentially attracting higher rates. The loan term – the length of time you have to repay the loan – influences the interest rate as well; longer repayment periods generally lead to higher overall interest costs, although monthly payments are lower. Finally, the presence of a co-signer can affect the interest rate. A co-signer with good credit can often secure a lower rate for the borrower. The specific interest rate offered will also depend on the bank’s prevailing interest rates and their lending policies.

Repayment Plan Examples

Private student loan lenders typically offer a range of repayment plans to suit different borrowers’ financial situations and preferences. Understanding the pros and cons of each is important for choosing the best option. These plans often include variations in terms and conditions, and borrowers should carefully review the terms offered by their lender.

- Standard Repayment: This is typically a fixed monthly payment spread over a set number of years (e.g., 10 or 15 years).

- Pros: Predictable monthly payments, loan is repaid within a defined timeframe.

- Cons: Higher monthly payments compared to other options, may not be suitable for borrowers with limited immediate income.

- Graduated Repayment: Payments start low and gradually increase over time.

- Pros: Lower initial payments are easier to manage, particularly helpful for recent graduates.

- Cons: Payments become progressively higher, potentially becoming difficult to manage later on; the overall repayment time can be longer.

- Extended Repayment: This plan stretches the repayment period over a longer timeframe (e.g., 20 or 25 years).

- Pros: Significantly lower monthly payments.

- Cons: Results in substantially higher overall interest paid due to the extended repayment period.

- Income-Driven Repayment (IDR): While less common with private loans than federal loans, some lenders may offer plans where payments are tied to a percentage of the borrower’s income.

- Pros: More manageable payments during periods of lower income.

- Cons: May lead to a longer repayment period and higher overall interest paid; specific terms and eligibility criteria vary greatly by lender.

Impact of Interest Rates and Repayment Plans on Total Loan Cost

The choice of repayment plan and the interest rate significantly impact the total cost of a loan. Consider this hypothetical scenario:

Let’s assume a $50,000 loan. Borrower A chooses a standard 10-year repayment plan with a 7% interest rate, while Borrower B opts for a 15-year plan with the same interest rate. Using a loan amortization calculator (easily found online), we can estimate the total cost.

| Borrower | Loan Term (Years) | Interest Rate | Approximate Monthly Payment | Approximate Total Interest Paid | Approximate Total Cost |

|---|---|---|---|---|---|

| A | 10 | 7% | $550 | $16,000 | $66,000 |

| B | 15 | 7% | $400 | $27,000 | $77,000 |

This demonstrates that while Borrower B has lower monthly payments, they end up paying significantly more in interest over the life of the loan. This is a simplified example, and actual figures will vary based on the specific terms and conditions of the loan.

Loan Forgiveness and Consolidation

Private student loans, unlike their federal counterparts, generally do not offer government-sponsored forgiveness programs. This means the options for loan forgiveness are significantly more limited. Understanding the landscape of loan consolidation, however, can offer some avenues for managing and potentially simplifying repayment.

The possibility of loan forgiveness for private student loans is largely dependent on the specific terms of your loan agreement and the lender’s policies. Some lenders may offer hardship programs that temporarily reduce or suspend payments under specific circumstances, such as job loss or serious illness. However, these programs rarely lead to complete loan forgiveness. It is crucial to carefully review your loan documents and contact your lender directly to explore any available options. Be prepared to provide extensive documentation to support your claim.

Private Student Loan Forgiveness Programs

While comprehensive forgiveness is unlikely, some lenders might offer partial forgiveness or debt reduction programs under very specific circumstances. These programs typically require borrowers to demonstrate significant financial hardship or unforeseen events that have severely impacted their ability to repay. These programs are usually highly competitive, and approval is not guaranteed. The criteria for eligibility, documentation requirements, and the extent of potential forgiveness vary widely between lenders. It’s essential to consult each lender individually to determine the availability and specifics of any such programs.

Consolidating Private Student Loans

Consolidating multiple private student loans involves combining several individual loans into a single, new loan. This process simplifies repayment by reducing the number of monthly payments and potentially lowering your overall monthly payment amount. However, it’s crucial to understand the implications before proceeding. The process typically involves applying to a new lender who will pay off your existing loans and provide a new loan with a single monthly payment.

Benefits and Drawbacks of Loan Consolidation

The potential benefits of consolidating private student loans include a simplified repayment process, potentially lower monthly payments (though the overall interest paid may be higher), and the convenience of dealing with a single lender. However, there are also drawbacks to consider. Consolidation may result in a higher overall interest paid over the life of the loan, particularly if the new loan carries a higher interest rate than some of your existing loans. Furthermore, consolidating may extend the repayment period, leading to higher total interest charges. It is vital to compare the terms of your current loans with the terms of the proposed consolidated loan before making a decision. Carefully analyze the total interest paid over the life of the loan for both scenarios to make an informed choice.

Risks and Considerations

Private student loans, while offering access to funds for higher education, come with inherent risks that borrowers must carefully consider before taking on debt. Understanding these risks and implementing effective management strategies is crucial for avoiding financial hardship. Failure to do so can lead to significant long-term consequences.

High interest rates and the potential for substantial debt burden are primary concerns. Unlike federal student loans, which often have lower, fixed interest rates, private loans can have variable rates that fluctuate with market conditions. This variability can lead to unpredictable and potentially higher monthly payments over the loan’s lifetime. Furthermore, the total amount repaid can significantly exceed the original loan amount, especially if borrowers struggle to make timely payments. The accumulation of interest can quickly escalate the debt, creating a substantial financial burden that may extend well beyond the completion of studies.

High Interest Rates and Debt Burden

Private student loan interest rates are often significantly higher than those offered on federal student loans. This disparity can result in a substantial increase in the total cost of borrowing. For example, a $50,000 private student loan with a 10% interest rate will accumulate considerably more interest over the repayment period compared to a similar loan with a 5% interest rate. This difference can amount to tens of thousands of dollars over the life of the loan. Borrowers should carefully compare interest rates from multiple lenders before selecting a loan to minimize the overall cost. It’s also important to understand whether the interest rate is fixed or variable. A variable rate can increase over time, leading to unpredictable and potentially higher payments.

Effective Debt Management Strategies

Managing private student loan debt effectively requires proactive planning and responsible financial habits. Creating a realistic budget that prioritizes loan repayment is essential. This involves tracking income and expenses to identify areas where spending can be reduced. Exploring options such as income-driven repayment plans (if available with the lender) can help to adjust monthly payments based on income levels. Regular communication with lenders is crucial to address any concerns or potential difficulties in making payments. Consider consolidating multiple loans into a single loan with a lower interest rate to simplify repayment and potentially reduce the overall cost. Finally, actively seeking financial counseling from reputable sources can provide valuable guidance and support in navigating debt management challenges.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe financial repercussions. Lenders may pursue legal action to recover the outstanding debt, which can include wage garnishment, bank account levies, and even lawsuits. A default will negatively impact credit scores, making it difficult to obtain future loans, credit cards, or even rent an apartment. Furthermore, defaulting on a private student loan can significantly damage your financial reputation, impacting your ability to secure employment or obtain favorable financial terms in the future. The long-term consequences of default can be far-reaching and significantly hinder financial stability. Therefore, proactive debt management is crucial to prevent such dire consequences.

Comparison with Other Funding Options

Securing funding for higher education involves navigating a variety of options, each with its own set of advantages and disadvantages. Understanding the nuances of these different funding avenues is crucial for making informed financial decisions. This section compares and contrasts private student loans from banks with other common methods of financing college, allowing for a comprehensive assessment of your best approach.

Choosing the right mix of funding sources can significantly impact the overall cost and long-term financial implications of your education. A balanced approach often proves most effective, minimizing reliance on any single, potentially high-risk, source of funding.

Comparison of Funding Options for Higher Education

The following table summarizes the key features of several common higher education funding options, highlighting their relative strengths and weaknesses. Consider these factors carefully when developing your financial plan.

| Funding Option | Pros | Cons | Application Process |

|---|---|---|---|

| Private Student Loans (Banks) | Can fill funding gaps; flexible repayment options available in some cases; potentially higher loan amounts than federal loans. | Higher interest rates than federal loans; requires good credit or a co-signer; can lead to significant debt if not managed carefully; potential for variable interest rates. | Application submitted directly to the bank; credit check and income verification required; approval depends on creditworthiness and financial history. |

| Federal Student Loans | Lower interest rates than private loans; various repayment plans available; potential for loan forgiveness programs (depending on career path); generally easier to qualify for than private loans. | Loan amounts may be limited; may require a longer repayment period; interest may accrue while in school (depending on loan type). | Application submitted through the Free Application for Federal Student Aid (FAFSA); credit check not typically required; approval based on financial need and eligibility. |

| Scholarships | Free money; does not need to be repaid; can significantly reduce overall education costs. | Highly competitive; specific eligibility requirements; may require high academic achievement or demonstrated financial need; limited availability. | Application varies depending on the scholarship provider; may involve essays, transcripts, and letters of recommendation; deadlines vary. |

| Grants | Free money; does not need to be repaid; often based on financial need; can significantly reduce overall education costs. | Limited availability; highly competitive; specific eligibility requirements; may require demonstration of financial need. | Application usually through the FAFSA; approval based on financial need and eligibility. |

Advantages and Disadvantages of Combining Funding Sources

Utilizing a combination of funding sources offers a strategic approach to financing higher education. This diversified strategy can mitigate risks and leverage the benefits of each funding type.

For example, a student might secure federal student loans for a portion of their tuition, supplement this with grants and scholarships to reduce the overall loan burden, and finally use a private loan to cover any remaining expenses. This blended approach minimizes reliance on high-interest private loans while ensuring full tuition coverage. However, managing multiple loan repayments and understanding the terms of each loan becomes crucial.

Conversely, relying solely on private loans carries significant risk, potentially leading to substantial debt with high interest payments. A combination approach allows for greater financial flexibility and reduces the potential for overwhelming debt.

Impact on Credit Score

Taking out and repaying private student loans significantly impacts your credit score, influencing your ability to access credit in the future. Understanding this impact is crucial for responsible borrowing and financial planning. A strong credit history is essential not only for securing favorable loan terms but also for numerous other financial endeavors.

Private student loans, like other forms of credit, are reported to credit bureaus. On-time payments build a positive credit history, increasing your credit score. Conversely, missed or late payments negatively affect your score, potentially making it harder to obtain loans, credit cards, or even rent an apartment in the future. The impact is a direct reflection of your creditworthiness as perceived by lenders.

Credit Score Improvement Through Repayment

Consistent on-time payments are the most effective way to improve your credit score after taking out a private student loan. Each successful payment demonstrates your responsibility in managing debt, leading to a gradual increase in your credit score. For example, a borrower who consistently makes their monthly payments for two years will see a noticeable improvement compared to someone with a history of late payments. The frequency of reporting to credit bureaus further amplifies the effect of responsible repayment behavior. Regular payments contribute positively to your payment history, which constitutes a significant portion of your credit score calculation.

Credit Score Decline Due to Delinquency

Conversely, late or missed payments can severely damage your credit score. Even a single missed payment can trigger a negative mark on your credit report, impacting your credit score for several years. For instance, a borrower who consistently misses payments for three months could see their credit score drop significantly, making it challenging to qualify for future loans or obtain favorable interest rates. Furthermore, a pattern of delinquency can lead to collection efforts, which further negatively impacts your credit report and score. This can have long-term consequences, making it harder to secure financial products in the future.

Importance of a Good Credit Score for Loan Application

A good credit score is paramount when applying for a private student loan. Lenders use credit scores to assess the risk associated with lending money. A higher credit score indicates a lower risk, making you a more attractive borrower and potentially leading to lower interest rates and more favorable loan terms. Conversely, a poor credit score might result in higher interest rates, stricter loan terms, or even loan denial. Therefore, maintaining a good credit score before and during the loan repayment process is vital for securing the best possible terms on your private student loan. In some cases, a co-signer with good credit might be required to mitigate the risk associated with a poor credit score.

Consumer Protection and Regulations

Navigating the world of private student loans requires awareness of the legal protections in place to safeguard borrowers from unfair or deceptive practices. Several federal and state laws are designed to prevent predatory lending and ensure transparency in the loan process. Understanding these regulations is crucial for making informed decisions and avoiding potential pitfalls.

Private student loans are subject to a variety of consumer protection laws, primarily at the federal level. The Truth in Lending Act (TILA), for example, mandates that lenders disclose all loan terms clearly and concisely, including the annual percentage rate (APR), fees, and repayment schedule. This ensures borrowers understand the true cost of borrowing before committing to a loan. The Fair Credit Reporting Act (FCRA) protects borrowers’ credit information and ensures accuracy in credit reports, which are often used in loan applications. Additionally, state-specific laws may offer further protections, varying in their specifics from state to state. It is advisable to research your state’s specific regulations alongside the federal ones.

Examples of Predatory Lending Practices

Predatory lending practices in the private student loan market can take several forms. One common example is the use of deceptive marketing tactics, such as advertising extremely low introductory interest rates that quickly increase after a short period. Another involves undisclosed fees or hidden charges that significantly inflate the overall cost of the loan. Some lenders might also engage in aggressive collection practices, harassing borrowers with excessive calls or threats. Finally, lenders might target students with poor credit or limited financial literacy, offering loans with unfavorable terms that they may not fully understand. These practices often exploit vulnerable borrowers and can lead to significant financial hardship.

Protecting Borrowers from Unfair Lending Practices

Borrowers can take several steps to protect themselves from unfair lending practices. Thoroughly researching and comparing loan offers from multiple lenders is paramount. Carefully reviewing loan documents and understanding all terms and conditions before signing is crucial. If a lender’s practices seem questionable, borrowers should seek independent advice from a financial advisor or consumer protection agency. Maintaining good credit and financial literacy are also key to securing favorable loan terms. Finally, understanding and utilizing available resources such as the Consumer Financial Protection Bureau (CFPB) website can empower borrowers to navigate the loan process effectively and report any suspected predatory practices.

Wrap-Up

Securing funding for higher education is a significant step, and choosing between private and federal student loans requires careful consideration. This guide has provided a comprehensive overview of private student loans offered by banks, highlighting the advantages and disadvantages, application processes, and potential risks. By understanding the intricacies of interest rates, repayment options, and the impact on your credit score, you can make informed decisions that align with your financial goals and long-term well-being. Remember to thoroughly research your options and compare offers before committing to a loan.

FAQ Insights

What happens if I can’t repay my private student loan?

Failure to repay your private student loan can result in serious consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you anticipate difficulties in repayment to explore options like deferment or forbearance.

Can I refinance my private student loans?

Yes, refinancing your private student loans may be possible. This involves obtaining a new loan to pay off your existing loans, potentially at a lower interest rate. However, eligibility requirements vary depending on your credit score and financial situation.

Are there any tax benefits associated with private student loans?

Unlike federal student loans, private student loans typically do not offer tax benefits such as deductions or credits. Always consult a tax professional for personalized advice.

How do private student loan interest rates compare to credit card interest rates?

Private student loan interest rates are generally lower than credit card interest rates, but they still vary significantly depending on factors like your credit score and the loan terms. It’s crucial to compare rates from multiple lenders.