Securing higher education shouldn’t hinge on credit history. Many students, particularly those embarking on their academic journey, lack the established credit needed for traditional private student loans. This often creates a significant hurdle, leaving them unsure of how to finance their education. This guide navigates the complexities of obtaining private student loans even without a credit score, offering insights into eligibility, co-signers, interest rates, and alternative funding options.

We’ll explore the various pathways available to students seeking financial aid, highlighting the crucial role of co-signers, comparing interest rates and loan terms from different lenders, and providing a step-by-step guide to the application process. Understanding the associated fees and charges is equally important, and we’ll delve into responsible borrowing strategies to help you manage your student loan debt effectively. Ultimately, the goal is to empower students to make informed decisions and successfully navigate the financing of their education.

Eligibility Requirements for No-Credit Student Loans

Securing a private student loan without a credit history can be challenging, but it’s not impossible. Lenders assess risk differently for applicants with no credit, focusing on other factors to determine creditworthiness. Understanding these requirements is crucial for a successful application.

Eligibility for private student loans without a credit history typically relies on a combination of factors beyond a traditional credit score. Lenders will look for indicators of your ability and willingness to repay the loan. This often involves demonstrating financial responsibility and stability, even in the absence of a formal credit history.

Required Documentation for No-Credit Loan Applicants

Lenders will likely request various documents to verify your information and assess your eligibility. Providing complete and accurate documentation is essential for a smooth application process. Missing or incomplete information can delay or even prevent loan approval.

The specific documents requested can vary depending on the lender, but common examples include:

- Completed Application Form: This form gathers essential personal and financial details.

- Proof of Enrollment: Acceptance letter or enrollment verification from your chosen educational institution.

- Parent/Co-signer Information (if applicable): If you lack credit history, a parent or co-signer with established credit may be required. Their financial information will be necessary.

- Bank Statements: These demonstrate your financial activity and savings, providing insight into your financial management.

- Tax Returns (if applicable): These can be used to verify income and financial stability, particularly for independent students.

- Proof of Income (if applicable): Pay stubs or employment verification letters may be needed to demonstrate your earning capacity.

Comparison of Eligibility Requirements Across Lenders

The following table compares the eligibility requirements of three hypothetical private student loan providers (Provider A, Provider B, and Provider C) for students with no credit history. Note that these are examples and actual lender requirements may vary. Always check directly with the lender for the most up-to-date information.

| Requirement | Provider A | Provider B | Provider C |

|---|---|---|---|

| Minimum Age | 18 | 18 | 19 |

| Enrollment Status | Enrolled at least half-time | Enrolled at least half-time | Full-time enrollment required |

| Co-signer Requirement | Required | Recommended | Not required, but may improve interest rates |

| Minimum GPA | 2.5 | No minimum GPA | 2.0 |

| Income Verification | Required for applicants without co-signer | Required for applicants without co-signer | Not required |

| Proof of Assets | May be requested | Not required | May be requested |

Co-signers and Their Role

Securing a private student loan without a credit history can be challenging. Many lenders require a co-signer to mitigate the risk associated with lending to a borrower with no established creditworthiness. A co-signer acts as a guarantor, essentially promising to repay the loan if the student borrower defaults. Understanding the implications for both parties is crucial before entering into such an agreement.

The role of a co-signer is fundamentally to share the responsibility of loan repayment. They essentially vouch for the student’s ability to repay the loan, providing the lender with additional assurance. This significantly improves the student’s chances of loan approval and often leads to more favorable interest rates. However, this shared responsibility carries significant implications for both the student and the co-signer, requiring careful consideration.

Advantages and Disadvantages for the Student

A co-signer offers several key advantages to the student borrower. Firstly, it dramatically increases the likelihood of loan approval. Secondly, the presence of a co-signer often translates to lower interest rates, resulting in substantial savings over the life of the loan. However, the student should be aware that any missed payments will negatively impact both their credit score and the co-signer’s credit score. Furthermore, the student remains fully responsible for repaying the loan, even if the co-signer is willing to assist. Failure to do so will damage their credit and could result in legal action.

Advantages and Disadvantages for the Co-signer

For the co-signer, the primary advantage is the opportunity to help a loved one achieve their educational goals. However, the disadvantages are substantial. The co-signer assumes full financial responsibility for the loan if the student defaults. This can significantly impact their credit score and financial stability, potentially affecting their ability to secure future loans or even purchase a home. The co-signer’s credit report will reflect the loan, even if the student makes all payments on time. A missed payment by the student becomes a missed payment on the co-signer’s record.

Responsibilities of a Co-Signer

It is crucial for potential co-signers to understand their obligations before agreeing to co-sign a student loan. The following points Artikel the key responsibilities:

- Financial Responsibility: The co-signer is legally obligated to repay the loan if the student defaults.

- Monitoring Loan Payments: While not directly responsible for making payments, the co-signer should monitor the student’s repayment progress to ensure timely payments.

- Credit Impact Awareness: The co-signer must understand that the loan will appear on their credit report, affecting their credit score.

- Communication with Lender: The co-signer may need to communicate with the lender in case of payment issues or changes in circumstances.

- Understanding Loan Terms: A thorough understanding of the loan agreement, including interest rates, repayment terms, and penalties for late payments, is essential.

Interest Rates and Loan Terms

Securing a private student loan with no credit history presents unique challenges, primarily revolving around interest rates and repayment terms. Lenders assess risk differently for applicants without established credit, often resulting in higher interest rates compared to those with strong credit scores. Understanding these variations is crucial for making informed borrowing decisions. This section details the typical interest rates, loan terms, and repayment options offered by private lenders to students lacking a credit history.

Interest rates on private student loans for students with no credit are significantly influenced by several factors. The loan amount requested is a key determinant; larger loan amounts often carry higher interest rates due to the increased risk for the lender. Repayment terms also play a role; longer repayment periods may lead to higher overall interest costs, although monthly payments will be lower. Finally, the lender’s own risk assessment practices and prevailing market interest rates will affect the final rate offered.

Interest Rate Comparisons and Loan Terms

The following table provides a hypothetical comparison of interest rates, loan terms, and repayment options from three different private lenders. Remember that these are examples and actual rates and terms may vary depending on individual circumstances and the lender’s current offerings. It is crucial to shop around and compare offers from multiple lenders before making a decision.

| Lender | Interest Rate (Approximate) | Loan Terms (Example) | Repayment Options |

|---|---|---|---|

| Lender A | 8.5% – 12% (Variable) | 5-15 years | Fixed monthly payments, graduated payments (increasing over time) |

| Lender B | 9% – 13% (Fixed) | 7-10 years | Fixed monthly payments |

| Lender C | 7.5% – 11% (Variable) | 5-12 years | Fixed monthly payments, interest-only payments (for a limited period) |

Repayment Options Explained

Private student loan lenders typically offer a range of repayment options designed to suit various financial situations. Fixed interest rates remain constant throughout the loan term, providing predictability in monthly payments. Variable interest rates, on the other hand, fluctuate based on market conditions, potentially leading to higher or lower payments over time. Different repayment plans, such as graduated repayment (payments increase over time) or interest-only payments (paying only the interest for a specified period), offer flexibility but should be carefully considered for their long-term implications on total interest paid.

Finding and Applying for Loans

Securing a private student loan without a credit history requires a strategic approach. Understanding the process, available resources, and necessary documentation is crucial for a successful application. This section Artikels the steps involved in finding and applying for a private student loan when you lack established credit.

The process of obtaining a private student loan with no credit history typically involves researching lenders, comparing loan offers, gathering required documents, and completing the application. It’s important to remember that finding a lender willing to work with you may require more effort than for applicants with established credit. However, with diligent research and preparation, you can increase your chances of approval.

Locating Potential Lenders

Finding suitable lenders involves exploring various avenues. Many online lenders specialize in loans for students with limited or no credit history. These lenders often have user-friendly websites that allow you to compare loan terms and interest rates quickly. Additionally, you can contact your college or university’s financial aid office; they may offer guidance on private loan options or have partnerships with specific lenders. Finally, researching and comparing offers from multiple lenders is vital to secure the most favorable terms.

Reputable Resources for Private Student Loan Information

Several reliable resources provide information on private student loans. These include the websites of reputable lenders, independent financial aid websites that offer loan comparison tools, and government-sponsored resources like the Federal Student Aid website (studentaid.gov). While the federal site primarily focuses on federal loans, it often includes helpful information on private loan options and general financial aid advice. Reviewing information from multiple sources helps ensure you’re making an informed decision.

The Application Process and Required Documents

The application process generally begins with pre-qualification. This step allows you to see what loan offers you might qualify for without impacting your credit score. The lender will typically request basic information such as your age, education level, and desired loan amount. Following pre-qualification, a formal application is required. This typically involves providing more detailed information, including your academic transcripts, proof of enrollment, and, importantly, information about a co-signer if required. Lenders will also often conduct a credit check (which may or may not affect your credit score, depending on the lender’s policy), and verify your income and employment information. The entire process, from application to funding, can take several weeks. Be prepared for thorough review of your application.

Typical Documents Required for Application

The specific documents required may vary by lender, but common documents include:

- Completed loan application

- Proof of enrollment (acceptance letter, enrollment verification)

- Academic transcripts (showing GPA or academic standing)

- Government-issued photo ID

- Co-signer’s information (if required) including their credit report and financial information

- Proof of income (pay stubs, tax returns)

Understanding Loan Fees and Charges

Private student loans, while offering crucial funding for higher education, often come with various fees that can significantly impact the total cost of borrowing. Understanding these fees is essential for making informed decisions and budgeting effectively. Failing to account for these charges can lead to unexpected financial burdens after graduation.

Understanding the different types of fees and how they’re calculated is key to responsible borrowing. This section will clarify common fees and provide a simple example to illustrate their cumulative effect.

Origination Fees

Origination fees are one-time charges levied by the lender when you receive your loan. These fees compensate the lender for the administrative costs associated with processing your loan application. Origination fees are typically expressed as a percentage of the loan amount. For example, a 1% origination fee on a $10,000 loan would amount to $100. This fee is usually deducted from the total loan amount you receive, meaning you’ll receive $9,900 instead of $10,000. The exact percentage varies depending on the lender and the specific loan terms.

Late Payment Fees

Late payment fees are charged when you fail to make a payment by the due date. These fees can range from a small fixed amount to a percentage of the missed payment. Consistent late payments can significantly increase the overall cost of your loan and negatively impact your credit score. It is crucial to set up automatic payments or reminders to avoid incurring these penalties.

Prepayment Penalties

Some private student loans include prepayment penalties. This means you’ll be charged a fee if you pay off your loan early. These penalties are designed to compensate the lender for lost interest income. However, many lenders now offer loans without prepayment penalties, so it’s essential to compare loan offers carefully before selecting a loan. The penalty amount can vary greatly depending on the lender and the loan terms; it could be a percentage of the remaining loan balance or a fixed dollar amount.

Calculating Total Loan Cost

Let’s consider a hypothetical example to illustrate how fees impact the total cost. Suppose you borrow $10,000 with a 6% annual interest rate over 10 years. If there’s a 1% origination fee ($100), you’ll receive $9,900. Over 10 years, the total interest paid, assuming simple interest for this example (the actual calculation is more complex with compounding interest), might be approximately $6,000. Adding the origination fee, the total cost of the loan would be approximately $16,100 ($9,900 + $6,000 + $100). Note that this is a simplified example; the actual interest paid would be higher due to compounding interest. Using a loan amortization calculator is recommended for a precise calculation.

Summary of Potential Fees and Charges

- Origination Fees: A one-time fee charged at the beginning of the loan.

- Late Payment Fees: Charged for missed or late payments.

- Prepayment Penalties: A fee for paying off the loan early.

- Returned Payment Fees: Charged if a payment is returned due to insufficient funds.

- Default Fees: Significant fees and penalties incurred if the loan goes into default.

Alternatives to Private Student Loans

Securing funding for higher education can be challenging, especially for students without established credit histories. While private student loans might seem like an option, they often come with high interest rates and stringent requirements. Fortunately, several alternatives exist that offer more favorable terms and conditions. Exploring these alternatives is crucial for making informed financial decisions about your education.

Exploring these alternatives can significantly impact your financial well-being during and after your studies. Understanding the nuances of each option will empower you to choose the best path towards financing your education.

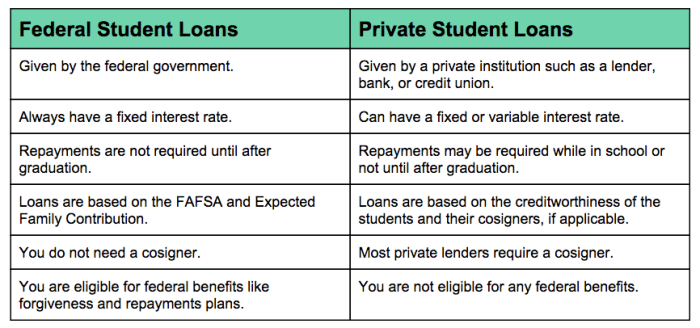

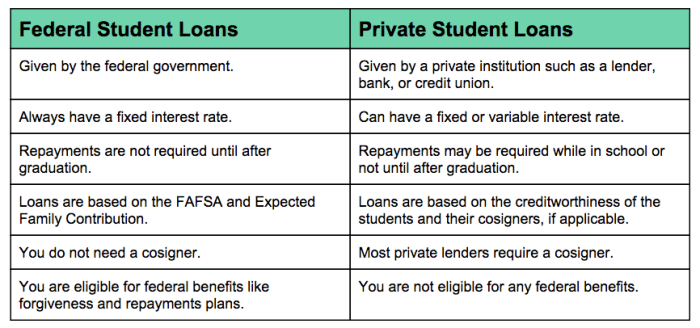

Federal Student Loans

Federal student loans are a primary alternative to private loans. These loans are offered by the government and generally have more favorable terms, including lower interest rates and flexible repayment options. Eligibility is based on financial need and enrollment status. The application process involves completing the Free Application for Federal Student Aid (FAFSA). Different types of federal student loans exist, including subsidized and unsubsidized loans, each with its own set of benefits and drawbacks. For instance, subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. Understanding the differences between these loan types is vital for making informed borrowing decisions.

Grants and Scholarships

Grants and scholarships represent non-repayable forms of financial aid. Unlike loans, you don’t need to repay grants or scholarships. These funds are typically awarded based on academic merit, financial need, or specific criteria set by the awarding institution or organization. Numerous organizations offer scholarships, ranging from government agencies to private foundations and corporations. Diligent research and application are crucial for securing these valuable funds. Many scholarships require essays, letters of recommendation, and transcripts. The application process can be competitive, but the rewards of securing free funding for education are substantial.

Work-Study Programs

Work-study programs provide part-time employment opportunities for students to earn money to help pay for educational expenses. Eligibility is determined through the FAFSA. These programs often involve on-campus jobs, allowing students to balance work and studies. The earnings from work-study can be used to cover tuition, fees, books, and other educational costs. While the income generated may not cover all educational expenses, it can significantly reduce the need for borrowing. Work-study programs offer valuable practical experience and financial assistance.

Comparison of Funding Options

| Funding Option | Advantages | Disadvantages | Eligibility |

|---|---|---|---|

| Federal Student Loans | Lower interest rates, flexible repayment options, government backing | Requires repayment, may accrue interest, impacts credit score | Financial need and enrollment status (FAFSA required) |

| Grants | Don’t need to be repaid, can significantly reduce educational costs | Competitive application process, limited availability, specific eligibility criteria | Merit, financial need, specific criteria (varies by grant) |

| Work-Study | Earns income to help pay for education, provides valuable work experience | Limited earning potential, may not cover all expenses, requires time commitment | Financial need and enrollment status (FAFSA required) |

Managing Student Loan Debt

Securing a private student loan, especially without established credit, requires careful planning and responsible financial management. Understanding how to effectively manage your debt from the outset is crucial to avoiding future financial difficulties. This section Artikels key strategies for responsible borrowing and repayment.

Successfully navigating student loan repayment involves a proactive approach to budgeting, creating a realistic repayment plan, and understanding the potential consequences of default. By implementing these strategies, you can minimize financial stress and achieve your long-term financial goals.

Responsible Borrowing Strategies

Borrowing responsibly begins with understanding your financial needs and exploring all available funding options. Avoid borrowing more than absolutely necessary for tuition, fees, and essential living expenses. Carefully compare loan offers from different lenders, paying close attention to interest rates, fees, and repayment terms. A lower interest rate can significantly reduce your overall borrowing costs. Before signing any loan documents, thoroughly read and understand all terms and conditions. Consider creating a detailed budget to track your income and expenses, ensuring you can comfortably manage monthly loan payments alongside other financial obligations.

Creating a Repayment Plan

A well-structured repayment plan is essential for successful debt management. Start by creating a realistic budget that incorporates your loan payments. Explore different repayment options offered by your lender, such as graduated repayment (lower payments initially, increasing over time) or income-driven repayment (payments based on your income). Consider automating your loan payments to avoid late fees and ensure consistent repayment. Regularly monitor your loan balance and track your progress towards repayment. Building a solid financial foundation early on will set you up for success. For example, setting aside a small amount each month into a savings account can provide a buffer for unexpected expenses and prevent you from falling behind on payments.

Consequences of Loan Default and Available Options

Defaulting on a student loan can have serious financial consequences, including damage to your credit score, wage garnishment, and difficulty obtaining future loans or credit. Your credit score will suffer significantly, making it harder to secure mortgages, car loans, or even rent an apartment in the future. In severe cases, the government may garnish your wages to recover the debt. However, if you find yourself struggling to make your loan payments, several options are available. Contact your lender immediately to discuss your situation and explore potential solutions, such as forbearance (temporary suspension of payments) or deferment (postponement of payments). You may also qualify for income-driven repayment plans, which adjust your monthly payments based on your income and family size. Seeking guidance from a non-profit credit counseling agency can provide valuable support and assistance in navigating these challenging situations. They can help you create a manageable repayment plan and negotiate with your lenders.

Last Point

Navigating the world of private student loans without a credit history can seem daunting, but with careful planning and understanding of the available options, it’s entirely achievable. By exploring co-signer possibilities, researching lenders, and considering alternative funding sources, students can secure the financial resources they need to pursue their educational goals. Remember, responsible borrowing and diligent debt management are key to ensuring a positive outcome. This guide serves as a starting point; further research tailored to your specific circumstances is always recommended.

Q&A

What if I have a poor credit history, not just no credit?

Lenders will still consider your application, but securing a loan may be more challenging. A co-signer is often crucial in these cases. You may also be offered higher interest rates.

Can I refinance my private student loan later?

Yes, refinancing is an option once you’ve built credit and your financial situation improves. Refinancing could potentially lower your interest rate and simplify payments.

What are the consequences of defaulting on a private student loan?

Consequences can be severe, including damage to your credit score, wage garnishment, and legal action. It’s crucial to prioritize repayment and explore options like deferment or forbearance if you’re struggling.

Are there any government programs that can help me get a loan without credit?

Federal student loans are generally easier to obtain than private loans, even without a credit history. They often have more flexible repayment options and may offer better interest rates.