Navigating the world of private student loans can feel like deciphering a complex financial code. Understanding private student loan interest rates is crucial for responsible borrowing and avoiding potential financial pitfalls. This guide unravels the intricacies of interest rates, empowering you to make informed decisions and secure the best possible terms for your education financing.

From the factors influencing your rate to effective repayment strategies and comparisons with federal loans, we’ll explore every aspect to help you manage your student loan debt effectively. We’ll also delve into the application process, potential risks, and the importance of understanding your loan agreement.

Understanding Private Student Loan Interest Rates

Securing a private student loan involves understanding the interest rates, as they significantly impact the overall cost of your education. Interest rates are the price you pay for borrowing money, expressed as a percentage of the loan amount. Lower interest rates translate to lower monthly payments and less overall interest paid over the life of the loan.

Factors Influencing Private Student Loan Interest Rates

Several factors contribute to the interest rate a lender offers on a private student loan. These factors are carefully assessed by lenders to determine the risk associated with lending to a particular borrower. A higher perceived risk generally results in a higher interest rate. Key factors include credit history, credit score, debt-to-income ratio, loan amount, and the presence of a cosigner. Lenders also consider the loan term – shorter terms often come with slightly lower rates. Finally, the prevailing market interest rates influence the rates offered across the board.

Fixed Versus Variable Interest Rates

Private student loans can come with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s life, providing predictability in monthly payments. A variable interest rate, on the other hand, fluctuates based on an underlying benchmark rate, such as the prime rate or LIBOR (although LIBOR is being phased out). While variable rates might start lower, they can increase or decrease over time, leading to unpredictable monthly payments. Choosing between a fixed and variable rate depends on individual risk tolerance and financial outlook. A borrower anticipating a period of low interest rates might prefer a variable rate initially, while those seeking stability often choose a fixed rate.

Credit Score’s Impact on Interest Rates

Your credit score is a crucial factor determining your interest rate. Lenders use credit scores to assess your creditworthiness – your ability to repay the loan. A higher credit score (generally above 700) typically qualifies you for a lower interest rate, reflecting lower perceived risk to the lender. Conversely, a lower credit score (below 670) often results in a higher interest rate, or even loan denial, as lenders see you as a higher-risk borrower. For example, a borrower with a 750 credit score might receive an interest rate of 6%, while a borrower with a 650 credit score might receive a rate of 10% or more, or be unable to secure a loan without a cosigner.

Interest Rate Comparison Across Lenders

Private student loan interest rates vary considerably across different lenders. Factors like lender policies, market conditions, and the borrower’s profile influence these differences. Some lenders might offer more competitive rates to attract borrowers, while others might prioritize specific risk profiles. It’s crucial to compare offers from multiple lenders before selecting a loan to secure the most favorable terms. For instance, Lender A might offer a 7% interest rate while Lender B offers 8% for a similar loan amount and borrower profile.

Typical Interest Rate Ranges

| Credit Score | Loan Amount ($) (Example Range) |

Typical Interest Rate Range (%) |

|---|---|---|

| 750+ (Excellent) | 10,000 – 50,000 | 6% – 8% |

| 700-749 (Good) | 10,000 – 50,000 | 7% – 9% |

| 650-699 (Fair) | 10,000 – 50,000 | 9% – 12% |

| Below 650 (Poor) | 10,000 – 50,000 | 12% + or Loan Denial |

The Application and Approval Process

Securing a private student loan involves navigating a specific application and approval process. Understanding this process, from initial application to final approval, is crucial for prospective borrowers to increase their chances of securing funding and a favorable interest rate. This section Artikels the key steps involved, the information lenders require, common reasons for denial, and strategies to improve your chances of approval.

Steps in the Private Student Loan Application Process

The application process typically involves several key steps. First, you’ll need to research and select a lender. Next, you’ll complete the loan application, providing necessary financial and academic information. After submission, the lender will review your application, potentially requesting additional documentation. Following a credit check and verification of information, the lender will make a decision regarding approval or denial. Finally, if approved, you’ll receive loan terms, including the interest rate, and must accept the loan agreement.

Information Required by Lenders

Lenders require comprehensive information to assess your creditworthiness and determine your eligibility for a loan. This typically includes your personal information (name, address, social security number), academic information (school enrollment status, degree program), financial information (income, credit history, existing debts), and co-signer information (if applicable). A strong credit history and sufficient income are often key factors in determining approval. The specific documents requested may vary between lenders.

Common Reasons for Loan Application Denials

Several factors can lead to a private student loan application being denied. Poor credit history is a major factor, as lenders assess your ability to repay the loan based on your past financial behavior. Insufficient income to cover repayment obligations is another common reason. Lack of a co-signer, especially for applicants with limited credit history, can also result in denial. Inaccurate or incomplete application information can delay the process or lead to rejection. Finally, the lender might deem the requested loan amount excessive relative to your financial profile.

Strategies for Improving Loan Approval and Securing a Lower Interest Rate

Improving your chances of approval and securing a lower interest rate involves proactive steps. Building a strong credit history through responsible credit card usage and timely debt repayment is crucial. Maintaining a healthy debt-to-income ratio demonstrates your financial responsibility. Securing a co-signer with good credit can significantly improve your chances of approval, especially if your credit history is limited. Shopping around and comparing offers from multiple lenders allows you to secure the most favorable terms. Finally, demonstrating a strong academic record and a clear plan for post-graduation employment can strengthen your application.

Flowchart of the Private Student Loan Application and Approval Process

The following describes a flowchart illustrating the application process. The flowchart begins with “Start,” proceeds through “Research and Select Lender,” “Complete Application,” “Lender Review and Documentation Request,” “Credit Check and Verification,” “Approval/Denial Decision,” “Loan Agreement,” and concludes with “End.” Each step is connected by arrows indicating the flow of the process. If the application is denied, there is a branch indicating the possibility of reapplying after addressing the reasons for denial. If approved, the process moves towards loan agreement and disbursement. The flowchart visually represents the sequential nature of the application process and the decision points involved.

Repayment Options and Strategies

Navigating the repayment of private student loans requires understanding the available options and developing a strategic approach to minimize costs and accelerate debt elimination. Different repayment plans offer varying levels of flexibility and impact your overall repayment timeline and interest paid. Choosing the right plan and employing effective repayment strategies are crucial for successful debt management.

Private Student Loan Repayment Plan Comparison

Private student loan lenders offer a variety of repayment plans, often including standard repayment, graduated repayment, extended repayment, and sometimes income-driven repayment (though less common than with federal loans). A standard repayment plan involves fixed monthly payments over a set term (typically 5-15 years). Graduated repayment starts with lower monthly payments that gradually increase over time. Extended repayment plans stretch the repayment period, lowering monthly payments but increasing the total interest paid. Income-driven repayment plans (if offered) adjust payments based on your income and family size. The best option depends on your individual financial circumstances and long-term goals. For example, a recent graduate with a low income might benefit from a graduated or extended plan, while someone with a stable, higher income might prefer a standard plan to pay off the loan more quickly.

Repayment Calculation Examples

Let’s illustrate repayment calculations with two examples. Assume a 10-year repayment period.

Example 1: $30,000 loan at 7% interest. The monthly payment would be approximately $350. The total interest paid over the 10 years would be around $12,000.

Example 2: $30,000 loan at 10% interest. The monthly payment would be approximately $390. The total interest paid over the 10 years would be approximately $16,800.

These examples demonstrate the significant impact of interest rates on the total cost of borrowing. A higher interest rate results in substantially higher total interest paid over the life of the loan.

Strategies for Minimizing Interest Payments and Accelerating Repayment

Several strategies can help borrowers minimize interest payments and repay their loans faster. These include making extra payments, refinancing to a lower interest rate, and prioritizing high-interest loans. Making even small extra payments each month can significantly reduce the total interest paid and shorten the repayment period. Refinancing your loans to a lower interest rate, if available, can lead to considerable savings over the life of the loan. Prioritizing high-interest loans ensures that you are tackling the most expensive debt first.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe financial consequences. These consequences can include damage to your credit score, wage garnishment, and legal action by the lender. A damaged credit score can make it difficult to obtain credit in the future, such as for a mortgage or car loan. Wage garnishment involves a portion of your paycheck being seized to repay the debt. Legal action can result in judgments against you and further financial penalties. The specific consequences vary depending on the lender and state laws.

Tips for Effective Repayment Planning

Effective repayment planning is crucial for managing private student loan debt. Here are some key tips:

- Create a realistic budget that accounts for all income and expenses.

- Prioritize high-interest debt.

- Explore options for refinancing or consolidation.

- Automate loan payments to ensure timely payments.

- Consider making extra payments whenever possible.

- Communicate with your lender if you encounter financial hardship.

- Track your progress regularly and adjust your plan as needed.

Comparing Private Loans with Federal Loans

Choosing between private and federal student loans is a crucial decision impacting your financial future. Understanding the key differences, particularly regarding interest rates and repayment options, is vital for making an informed choice. This section will Artikel these differences to help you determine which loan type best suits your circumstances.

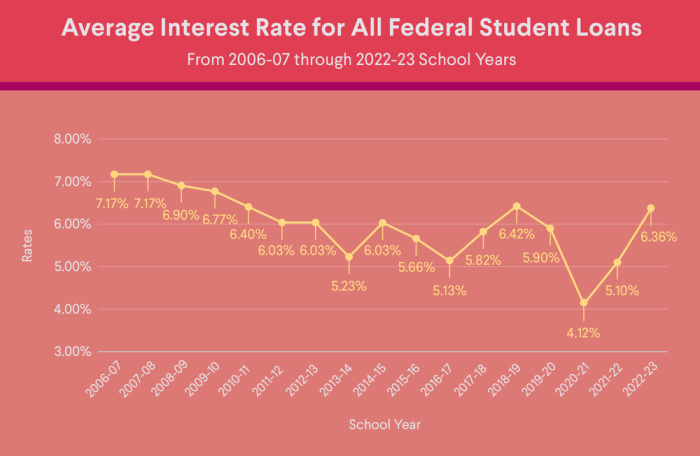

Interest Rate Differences

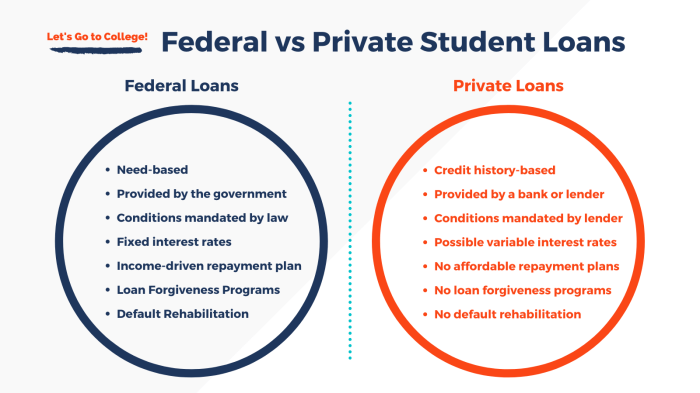

Private and federal student loans operate under distinct interest rate structures. Federal student loan interest rates are generally set by the government and tend to be lower than those offered by private lenders. These rates can fluctuate based on market conditions but remain relatively predictable. Private student loan interest rates, however, are determined by the lender and are significantly influenced by your creditworthiness, credit history, and the loan’s terms. Borrowers with excellent credit may secure lower rates, while those with poor credit or limited credit history may face substantially higher interest rates. This variability makes it difficult to predict private loan interest rates precisely.

Benefits and Drawbacks of Each Loan Type

Federal student loans offer several advantages. Their interest rates are typically lower, and they often come with various repayment options, including income-driven repayment plans that adjust payments based on your income and family size. However, federal loan amounts are often capped, meaning you might not receive sufficient funding to cover all your educational expenses. Additionally, eligibility for federal loans depends on factors such as your enrollment status and financial need.

Private student loans can provide access to larger loan amounts, potentially bridging the gap between federal funding and your educational costs. However, they generally come with higher interest rates and may require a co-signer if you lack a strong credit history. Repayment options are often less flexible than federal loan options. The interest rates on private loans can be significantly higher, leading to a greater overall cost over the life of the loan.

Circumstances Favoring Private or Federal Loans

Federal student loans are generally the preferred choice for students who qualify, especially those with limited or no credit history. The lower interest rates and flexible repayment options offer significant long-term financial benefits. However, if federal loans don’t cover all educational expenses, a private loan might be necessary to supplement the funding. This situation requires careful consideration of the higher interest rates and less flexible repayment options associated with private loans. Borrowers should thoroughly weigh the benefits and drawbacks before taking on private debt.

Comparison Table

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally lower, set by the government | Variable, based on creditworthiness; generally higher |

| Loan Amounts | Often capped; may not cover full costs | Potentially higher amounts available |

| Repayment Options | More flexible options, including income-driven plans | Fewer options; typically fixed payments |

| Eligibility | Based on enrollment status and financial need | Based on creditworthiness; may require a co-signer |

Potential Risks and Considerations

Taking out a private student loan can be a significant financial decision, and it’s crucial to understand the potential risks involved before signing on the dotted line. High interest rates, complex terms, and the potential for financial hardship are all factors that need careful consideration. This section will Artikel some key risks and considerations to help you make an informed choice.

High interest rates on private student loans can significantly increase the total cost of your education. Understanding the loan agreement’s terms and conditions is paramount to avoiding unexpected fees and financial strain. Furthermore, the implications of co-signing a loan, and the process of refinancing to secure a lower rate, are important aspects to explore.

Understanding Loan Agreement Terms

Before signing any loan agreement, thoroughly review all terms and conditions. Pay close attention to the interest rate (both fixed and variable), fees (origination fees, late payment fees, etc.), repayment schedule, and any prepayment penalties. Understanding these details will help you budget effectively and avoid unexpected costs. A failure to understand these terms can lead to unforeseen financial burdens and difficulties in repayment. For example, a seemingly small difference in interest rate over the life of a loan can translate into thousands of dollars in additional interest payments. Similarly, overlooking late payment fees can quickly add to your debt burden.

The Implications of Co-signing

Co-signing a private student loan means you’re legally responsible for repaying the loan if the primary borrower defaults. This carries significant financial risk. If the borrower fails to make payments, the lender will pursue you for the full amount owed. This could severely impact your credit score and financial stability. Consider the potential consequences carefully before agreeing to co-sign. For example, if a co-signer has a good credit history and co-signs for a large loan, a default by the borrower could negatively impact their ability to secure future loans or credit cards.

Repayment Challenges Due to High Interest Rates

High interest rates can make repayment significantly more difficult. Consider a scenario where a student borrows $50,000 at a 10% interest rate. Compared to a 5% interest rate, the total interest paid over the life of the loan could be substantially higher, leading to a much larger total repayment amount. This increased cost could significantly impact the borrower’s ability to manage other financial obligations, such as rent, utilities, and living expenses. In such situations, borrowers may find themselves struggling to make minimum payments, leading to delinquency and further negative consequences. Budgeting meticulously and exploring repayment options early on are crucial to mitigate these risks.

Refinancing Private Student Loans

Refinancing a private student loan involves obtaining a new loan from a different lender to replace your existing loan. This can be beneficial if you can secure a lower interest rate. However, it’s important to shop around and compare offers from multiple lenders. The process typically involves applying for a new loan, providing documentation of your income and creditworthiness, and undergoing a credit check. Successful refinancing can result in lower monthly payments and a reduced total repayment amount, offering significant long-term financial benefits. However, it is important to note that refinancing may not always be an option, and eligibility depends on the borrower’s credit score and financial situation.

Wrap-Up

Securing a private student loan requires careful consideration of interest rates, repayment options, and potential risks. By understanding the factors that influence interest rates, comparing offers from different lenders, and developing a robust repayment plan, you can significantly improve your financial outlook. Remember, informed borrowing is the key to responsible debt management and achieving your educational goals without unnecessary financial strain.

Questions and Answers

What is the difference between a fixed and variable interest rate on a private student loan?

A fixed interest rate remains constant throughout the loan term, while a variable interest rate fluctuates based on market indexes, potentially leading to higher or lower payments over time.

Can I refinance my private student loan to get a lower interest rate?

Yes, refinancing allows you to replace your existing loan with a new one from a different lender, potentially securing a lower interest rate. However, eligibility requirements vary.

What happens if I default on my private student loan?

Defaulting on a private student loan can severely damage your credit score, lead to wage garnishment, and result in legal action by the lender.

How does my credit score affect my private student loan interest rate?

A higher credit score generally qualifies you for a lower interest rate, reflecting lower perceived risk to the lender.

What are some strategies for paying off my private student loans faster?

Strategies include making extra payments, exploring refinancing options, and considering income-driven repayment plans (if available).