Navigating the complex world of higher education financing often leads students and their families to consider private student loans as a supplemental funding source. These loans, while offering potential benefits, also carry significant risks. Understanding the nuances of private student loan interest rates, repayment options, eligibility requirements, and associated fees is crucial for making informed decisions that align with individual financial circumstances and long-term goals. This exploration delves into the advantages and disadvantages of private student loans, empowering you to make the best choices for your educational journey.

This guide provides a comprehensive overview of private student loans, comparing them to federal options and outlining the critical factors to consider before taking on this significant financial commitment. We will explore the application process, the role of co-signers, and the potential long-term impact on your credit score. Ultimately, the aim is to equip you with the knowledge needed to weigh the pros and cons effectively.

Interest Rates and Repayment Terms

Choosing a private student loan involves careful consideration of interest rates and repayment terms, as these significantly impact the overall cost and affordability of your loan. Understanding the nuances of these factors is crucial for making an informed decision that aligns with your financial capabilities and long-term goals. Lower interest rates translate to lower overall borrowing costs, while flexible repayment options can help manage monthly payments and prevent financial strain.

Private student loan interest rates are variable, meaning they fluctuate based on market conditions, and are typically higher than federal student loan interest rates. The specific rate offered depends on several factors, including your credit score, credit history, co-signer (if applicable), and the loan terms. It’s essential to shop around and compare offers from multiple lenders before committing to a loan.

Private Student Loan Interest Rate Comparison

The following table provides a comparison of interest rates from four hypothetical private student loan providers. Remember that these rates are examples and actual rates will vary based on individual circumstances. Always check the lender’s website for the most up-to-date information.

| Lender | Variable APR Range | Fixed APR Range | Minimum Credit Score |

|---|---|---|---|

| Lender A | 6.00% – 14.00% | 7.00% – 15.00% | 660 |

| Lender B | 5.50% – 13.50% | 6.50% – 14.50% | 680 |

| Lender C | 6.50% – 15.00% | 7.50% – 16.00% | 640 |

| Lender D | 7.00% – 16.00% | 8.00% – 17.00% | 700 |

Repayment Options

Private student loan providers offer a variety of repayment options to cater to different financial situations and preferences. The choice of repayment plan significantly influences the total interest paid over the life of the loan.

- Standard Repayment: This plan typically involves fixed monthly payments over a set period (e.g., 10-15 years). It results in the lowest total interest paid but may have higher monthly payments.

- Graduated Repayment: Payments start low and gradually increase over time, making them more manageable initially. However, this often results in higher total interest paid compared to standard repayment.

- Extended Repayment: This plan stretches the repayment period, lowering monthly payments. However, it significantly increases the total interest paid due to the longer repayment timeframe.

- Income-Driven Repayment (IDR): While less common with private loans than federal loans, some providers might offer plans where monthly payments are tied to your income. This can provide flexibility during periods of low income, but the repayment period might be extended, leading to higher overall interest costs.

Impact of Repayment Plan Choice on Total Interest

Selecting a different repayment plan directly impacts the total interest paid over the loan’s lifetime. For example, choosing an extended repayment plan with a longer repayment period will generally result in a higher total interest paid, even if the monthly payments are lower. Conversely, a standard repayment plan with higher monthly payments will usually lead to a lower total interest paid due to the shorter repayment period. Consider the long-term financial implications carefully before selecting a repayment plan. A longer repayment period might offer short-term relief but can substantially increase the overall cost of the loan. For instance, a $50,000 loan at 7% interest over 10 years would cost significantly less in total interest than the same loan over 20 years.

Eligibility and Application Process

Securing a private student loan involves navigating a specific eligibility process and completing a detailed application. Understanding these aspects is crucial for a successful loan application. The requirements and steps can vary slightly between lenders, but the general process remains consistent.

Eligibility for private student loans hinges on several key factors, primarily revolving around creditworthiness and financial stability. Lenders assess applicants based on their credit history, income, and the presence of a co-signer.

Credit History and Co-Signer Requirements

A strong credit history is often a prerequisite for approval. Lenders review credit scores and reports to gauge an applicant’s ability to repay the loan. A higher credit score generally increases the chances of approval and may result in more favorable interest rates. However, if an applicant lacks a substantial credit history or has a low credit score, securing a co-signer—someone with good credit who agrees to share responsibility for repayment—significantly improves the likelihood of loan approval. The co-signer essentially acts as a guarantor, mitigating the lender’s risk. Examples of individuals who might act as co-signers include parents, grandparents, or other financially stable relatives.

Income Verification

Lenders typically require verification of income to assess the applicant’s ability to repay the loan. This process often involves providing documentation such as pay stubs, tax returns, or bank statements. The lender uses this information to evaluate the applicant’s debt-to-income ratio and overall financial stability. A stable income stream demonstrates a capacity for consistent loan repayments. For example, a consistent salary from a full-time job would be viewed more favorably than sporadic income from freelance work.

Required Documents

The application process typically requires several key documents. These generally include a completed loan application form, proof of identity (such as a driver’s license or passport), social security number, proof of enrollment in a degree program, and verification of income and credit history. Additional documents might be requested depending on the lender and the individual circumstances of the applicant. For instance, some lenders may require transcripts or proof of residency.

Step-by-Step Application Guide

The application process usually involves these steps:

- Research and compare lenders: Explore various private student loan providers, comparing interest rates, fees, and repayment options.

- Pre-qualify: Many lenders offer a pre-qualification process, allowing you to check your eligibility without impacting your credit score.

- Complete the application: Fill out the loan application form accurately and completely, providing all required information and documentation.

- Provide documentation: Submit the necessary supporting documents, such as proof of identity, income verification, and credit history information.

- Await approval: The lender will review your application and supporting documents. This process may take several days or weeks.

- Loan disbursement: Once approved, the funds will be disbursed according to the terms of your loan agreement, typically directly to your educational institution.

Fees and Charges

Private student loans, while offering a crucial funding source for higher education, often come with various fees that can significantly impact the total cost of borrowing. Understanding these fees is vital for making informed borrowing decisions and budgeting effectively for repayment. Failing to account for these additional costs can lead to unexpected financial strain.

Several types of fees are commonly associated with private student loans. These fees can vary widely depending on the lender, the loan terms, and the borrower’s creditworthiness. It’s crucial to carefully review the loan agreement before signing to understand the full extent of these charges.

Origination Fees

Origination fees are charges levied by the lender to cover the administrative costs of processing your loan application. These fees are typically calculated as a percentage of the total loan amount and are deducted from the loan proceeds before you receive the funds. For example, a 1% origination fee on a $10,000 loan would result in a $100 fee, meaning you would receive $9,900. Higher loan amounts generally result in higher origination fees.

Late Payment Fees

Late payment fees are penalties imposed when a loan payment is not received by the lender on or before the due date. These fees can range from a flat fee to a percentage of the missed payment, and they can add up significantly over time. Consistent late payments can severely damage your credit score and potentially lead to further penalties or even loan default. For instance, a lender might charge a $25 flat fee or a 5% fee of the missed payment amount.

Prepayment Penalties

Prepayment penalties are charges incurred if you pay off your loan before its scheduled maturity date. While less common with private student loans than with other types of loans, some lenders may still impose these penalties. These penalties can be a percentage of the remaining loan balance or a fixed dollar amount. It’s essential to check your loan agreement to determine whether a prepayment penalty applies. Borrowers should carefully weigh the potential benefits of early repayment against any potential prepayment penalties.

Other Potential Fees

Beyond the fees mentioned above, other charges might apply depending on the lender and loan terms. These could include fees for returned payments, insufficient funds, or wire transfer fees. Always thoroughly review the loan documents to understand all associated costs.

| Fee Type | Description | Example |

|---|---|---|

| Origination Fee | Fee charged for processing the loan application. | 1% of the loan amount |

| Late Payment Fee | Penalty for late payments. | $25 flat fee or 5% of the missed payment |

| Prepayment Penalty | Penalty for paying off the loan early. | 1% of the remaining balance |

| Returned Payment Fee | Fee for a payment that is returned due to insufficient funds. | $30-$50 |

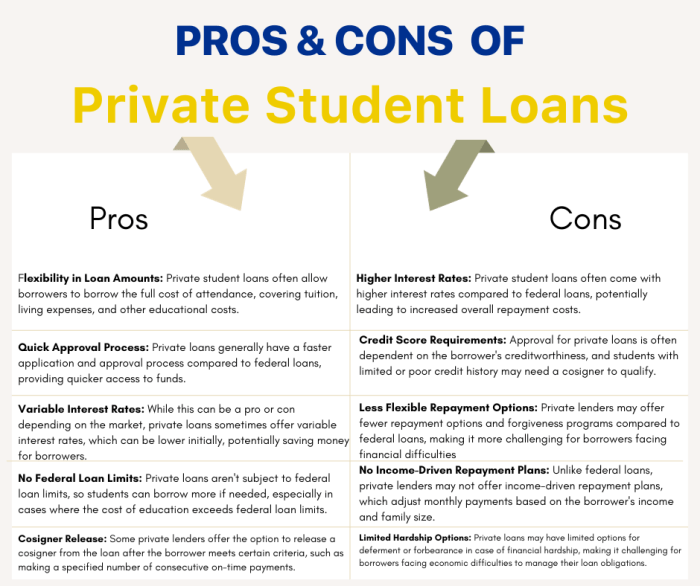

Advantages of Private Student Loans

Private student loans, while often overshadowed by federal options, can offer significant advantages in specific circumstances. They can be a valuable supplement or even a primary source of funding for higher education when federal loans fall short of meeting a student’s financial needs. Understanding these advantages is crucial for making informed borrowing decisions.

Private student loans may be a preferable choice when a student’s federal loan eligibility is limited or insufficient to cover the total cost of attendance. This often happens when a student has already maxed out their federal loan limits or if the cost of their education exceeds the amount of federal aid they are awarded. Furthermore, private loans can offer flexibility in terms of repayment options and loan amounts, potentially providing a more tailored financing solution compared to the standardized federal loan programs.

Situations Favoring Private Student Loans

Private student loans can prove advantageous in several scenarios. For instance, a student attending a high-cost private university might find their federal loan limits insufficient to cover tuition, fees, and living expenses. In such cases, a private loan can bridge the funding gap. Similarly, students pursuing graduate or professional degrees, which often involve higher tuition costs than undergraduate programs, might require supplemental private financing. Finally, students with exceptional academic achievements or specific skills might be eligible for private loans with competitive interest rates and favorable terms, further enhancing their attractiveness.

Scenario: Federal vs. Federal and Private Loans

Consider two students, both attending the same university. Student A relies solely on federal student loans, receiving $20,000 annually for four years. Their total federal loan debt after graduation is $80,000. Student B, facing higher tuition costs, also utilizes $20,000 in federal loans annually but supplements this with $10,000 in private loans each year. Student B’s total debt is higher ($120,000), but they were able to attend the university and pursue their chosen degree, which may lead to higher earning potential. The success of this strategy depends entirely on the student’s ability to manage their increased debt load and the return on their investment in education.

Benefits Offered by Private Lenders

Private lenders may offer benefits not available through federal loan programs. Some private lenders offer flexible repayment options, such as allowing for shorter repayment periods to reduce overall interest paid, or extended repayment periods to lower monthly payments. Others might provide loan forgiveness programs under certain circumstances, such as job loss or death. Furthermore, some private loans offer variable interest rates that could potentially be lower than fixed federal loan rates in periods of low interest. It is crucial, however, to carefully review the terms and conditions of any private loan before signing, as these benefits are not always guaranteed and may come with associated fees or restrictions.

Disadvantages of Private Student Loans

Private student loans, while offering a potential solution for financing higher education, come with significant drawbacks that borrowers should carefully consider before taking them on. Unlike federal student loans, private loans lack many crucial consumer protections and can lead to considerable financial hardship if not managed properly. Understanding these disadvantages is crucial for making informed borrowing decisions.

Private student loans often carry higher interest rates than federal loans, leading to a substantially larger overall repayment amount. This increased cost can significantly impact a borrower’s long-term financial stability. The lack of federal protections, such as income-driven repayment plans and loan forgiveness programs, further exacerbates the risks associated with private borrowing.

High Interest Rates and Lack of Federal Protections

Private student loan interest rates are typically variable and can fluctuate based on market conditions. This variability makes budgeting for repayment more challenging compared to federal loans, which often offer fixed interest rates or more predictable rate adjustments. Moreover, private loans generally lack the robust consumer protections afforded by federal student loans. Federal loans offer various repayment plans tailored to individual financial situations, including income-driven repayment options that adjust monthly payments based on income and family size. These options are usually absent in private loan agreements. Furthermore, federal loans may be eligible for loan forgiveness programs under certain circumstances, such as working in public service, which is not typically the case with private loans. The absence of these safety nets increases the financial risk for borrowers. For example, a borrower with a federal loan might qualify for a lower monthly payment through an income-driven repayment plan during periods of unemployment or financial hardship, a benefit not typically extended to private loans.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan can have severe financial consequences. Unlike federal student loans, which have specific procedures and protections for borrowers in default, private loan defaults can lead to significant damage to a borrower’s credit score, wage garnishment, and legal action from the lender. Collection agencies may aggressively pursue repayment, and the debt can be sold to other entities, further complicating the situation. The impact on credit scores can make it difficult to obtain future loans, rent an apartment, or even secure employment. For instance, a default could result in a significant drop in credit score, making it challenging to purchase a home or a car in the future, even years after the debt is resolved. The legal repercussions can also include lawsuits and wage garnishments, significantly impacting a borrower’s financial well-being.

Challenges of Refinancing a Private Student Loan

Refinancing a private student loan can be more complex than refinancing federal student loans. Lenders assess applicants based on their creditworthiness, income, and debt-to-income ratio. Borrowers with poor credit scores or high debt levels may find it difficult to secure a refinancing loan with favorable terms, or may be unable to refinance at all. Even if refinancing is possible, the interest rate offered might not be significantly lower than the existing rate, negating the potential benefits of refinancing. The process can also be time-consuming and involve substantial paperwork. For example, a borrower with a high debt-to-income ratio due to multiple private loans might struggle to find a lender willing to offer a lower interest rate, making refinancing less appealing. This contrasts with federal student loan consolidation, which simplifies repayment by combining multiple loans into a single one, potentially at a lower interest rate, although this isn’t always the case.

Co-signers and Their Role

Securing a private student loan can be challenging, especially for students with limited or no credit history. In such cases, a co-signer often becomes a crucial element in the loan application process. A co-signer is an individual who agrees to be jointly responsible for repaying the loan if the primary borrower (the student) defaults. Their role significantly impacts the loan’s approval and terms.

A co-signer’s primary responsibility is to guarantee the loan repayment. This means that if the student fails to make payments, the lender will pursue the co-signer for the outstanding balance. The co-signer’s creditworthiness directly influences the loan’s approval and interest rate. The lender assesses both the borrower’s and the co-signer’s credit history, income, and debt-to-income ratio to determine the risk involved. A co-signer with a strong credit score and stable financial standing can significantly improve the chances of loan approval and secure a lower interest rate for the borrower.

Co-signer Credit Score’s Impact on Loan Approval and Interest Rates

The co-signer’s credit score plays a pivotal role in the loan approval process. Lenders view a co-signer with a high credit score as a lower risk, increasing the likelihood of loan approval, even if the borrower has a limited credit history or a lower credit score. Conversely, a co-signer with a poor credit score may hinder the loan application, potentially leading to rejection or less favorable terms. For example, a student with a thin credit file might be approved for a loan with a 7% interest rate if they have a co-signer with an excellent credit score (750+). However, the same student might be denied the loan or offered a much higher interest rate (e.g., 12%) without a co-signer or with a co-signer possessing a poor credit score (below 600). The impact of the co-signer’s credit score on the interest rate is substantial, potentially saving the borrower thousands of dollars over the life of the loan.

Benefits and Drawbacks for Borrowers

For borrowers, having a co-signer can unlock access to loans that might otherwise be unavailable. It also often leads to more favorable interest rates, reducing the overall cost of borrowing. However, the borrower must remain aware of their responsibility to repay the loan. Defaulting on the loan will negatively impact both the borrower’s and the co-signer’s credit scores.

Benefits and Drawbacks for Co-signers

Co-signing a student loan can be a significant act of support, but it comes with substantial risks. The primary benefit for the co-signer is helping a loved one achieve their educational goals. However, the co-signer assumes full financial responsibility for the loan if the borrower defaults. This can severely impact the co-signer’s credit score and financial stability, potentially hindering their ability to secure loans or other financial products in the future. For instance, a co-signer who is already nearing retirement might find their ability to obtain a mortgage severely compromised if the borrower defaults on the loan. Therefore, careful consideration of the potential risks is essential before agreeing to co-sign a student loan.

Comparison with Federal Student Loans

Choosing between private and federal student loans is a crucial decision impacting a student’s financial future. Understanding the key differences between these loan types is essential for making an informed choice. This comparison highlights the significant variations in terms of interest rates, repayment options, and borrower protections.

Federal and private student loans offer distinct advantages and disadvantages. Federal loans generally provide more borrower protections and flexible repayment options, while private loans might offer higher loan amounts or more favorable interest rates in specific circumstances. The best choice depends heavily on individual financial circumstances and creditworthiness.

Key Differences Between Federal and Private Student Loans

The following table summarizes the key distinctions between federal and private student loans. Consider these factors carefully when deciding which type of loan best suits your needs.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Fixed or variable, generally lower than private loans. Rates are set by the government. | Variable or fixed, generally higher than federal loans. Rates depend on creditworthiness and market conditions. |

| Repayment Options | Various income-driven repayment plans, deferment, and forbearance options available. | Fewer repayment options, typically standard repayment plans. Deferment and forbearance may be available, but less common and often require specific circumstances. |

| Loan Forgiveness Programs | Eligibility for loan forgiveness programs (e.g., Public Service Loan Forgiveness) based on career choice and other factors. | No government loan forgiveness programs applicable. |

| Credit Check | Generally, no credit check required for federal subsidized loans. Unsubsidized loans may require a credit check for certain loan amounts. | Credit check required; creditworthiness significantly impacts interest rates and loan approval. |

| Default Protections | Stronger consumer protections in case of default, including options for rehabilitation and income-driven repayment plans. | Fewer consumer protections; default can severely impact credit score. |

Scenario: Choosing a Federal Loan

Maria, a first-year college student with limited credit history, needs financial assistance for her tuition. Because she lacks a strong credit history, securing a private loan with a favorable interest rate would be challenging. Federal student loans are a better option for her, offering access to funds regardless of her credit score and providing various repayment options and borrower protections should she face financial hardship.

Scenario: Choosing a Private Loan

David, a graduate student with an established credit history and high credit score, requires a significant loan amount to cover his advanced degree. He has already maxed out his federal loan eligibility. To cover the remaining tuition costs, a private loan may be a suitable choice. His strong credit history allows him to potentially negotiate a competitive interest rate and loan terms.

Impact on Credit Score

Taking out a private student loan and managing its repayment can significantly impact your credit score. Understanding this impact is crucial for responsible borrowing and financial planning. Both positive and negative effects are possible, depending on your borrowing and repayment behavior.

Private student loans, like other forms of credit, are reported to the major credit bureaus (Equifax, Experian, and TransUnion). Your repayment history is a key factor influencing your credit score. On-time payments contribute positively, building a strong credit history and boosting your score. Conversely, missed or late payments can severely damage your credit score, making it harder to obtain future loans or even rent an apartment. The impact is felt throughout the loan’s lifecycle, from the initial application to the final payment.

Credit Score Impact During Repayment

Consistent on-time payments are vital for maintaining a healthy credit score while repaying student loans. Each on-time payment demonstrates responsible credit management, which positively affects your credit utilization ratio (the amount of credit you use compared to your total available credit). A low credit utilization ratio is generally preferred by lenders and contributes to a higher credit score. Conversely, late or missed payments will negatively impact your credit score, potentially leading to a lower credit rating and higher interest rates on future loans. The severity of the negative impact depends on the frequency and duration of the missed payments. For example, consistently missing payments by even a few days can significantly lower your score over time. A single missed payment can have a noticeable impact, and multiple missed payments can have a much more significant and lasting effect.

Credit Score Impact After Loan Payoff

Once your private student loan is paid off in full, the positive impact on your credit score will continue. The closed account will remain on your credit report for several years, indicating a history of responsible credit management. This positive history can help you qualify for better interest rates on future loans, such as mortgages or auto loans. However, it is important to note that the positive impact of a paid-off loan diminishes over time as newer credit activity takes precedence. Therefore, maintaining a healthy credit profile even after paying off your student loans remains important for long-term financial health. For example, continuing to use credit cards responsibly and making timely payments on other loans will ensure a positive credit history continues to build.

Strategies for Managing Credit Scores While Repaying Student Loans

Effective strategies for managing your credit score while repaying student loans include setting up automatic payments to avoid late payments, monitoring your credit report regularly for errors, and maintaining a low credit utilization ratio by paying down credit card balances promptly. Budgeting and financial planning are also essential to ensure timely payments. Consider exploring different repayment options offered by your lender, such as income-driven repayment plans (if available for private loans), to manage your monthly payments effectively. Proactively addressing any financial difficulties or potential payment challenges with your lender can also help mitigate negative impacts on your credit score.

Ultimate Conclusion

In conclusion, the decision of whether or not to utilize private student loans is deeply personal and hinges on a careful assessment of individual circumstances. While they can provide necessary funding to bridge the gap between federal aid and tuition costs, it’s vital to understand the potential drawbacks, such as higher interest rates and the absence of federal protections. By thoroughly weighing the advantages and disadvantages, considering the long-term financial implications, and seeking professional advice when necessary, you can make an informed decision that aligns with your financial well-being and educational aspirations. Remember to explore all available options and choose the path that best suits your unique needs.

Expert Answers

What happens if I default on a private student loan?

Defaulting on a private student loan can severely damage your credit score, making it difficult to obtain future loans or credit. It can also lead to wage garnishment, bank account levies, and legal action.

Can I refinance a private student loan?

Yes, refinancing is possible, potentially lowering your interest rate or simplifying your repayment plan. However, eligibility depends on your credit score and income. Shop around for the best rates and terms.

Are there any tax benefits associated with private student loans?

Unlike federal student loans, private student loans generally do not offer any federal tax benefits. However, consult a tax professional to determine if any deductions might apply based on your specific circumstances.

How do private student loans impact my credit score during repayment?

On-time payments build positive credit history, while missed payments negatively impact your score. Consistent, timely payments demonstrate responsible credit management, benefiting your credit score.