Navigating the world of private student loans can feel overwhelming, especially when faced with the complexities of interest rates. Understanding these rates is crucial for making informed decisions about financing your education and avoiding potential financial pitfalls down the road. This guide delves into the key factors influencing these rates, empowering you to make the best choices for your future.

From the impact of your credit score to the various repayment options available, we’ll explore the intricacies of private student loan rates. We’ll also compare different lenders, helping you to identify the most advantageous loan terms and ultimately, securing the best possible rate for your circumstances. This comprehensive overview will equip you with the knowledge necessary to confidently approach the process of securing private student loan financing.

Understanding Private Student Loan Rates

Securing a private student loan can be a significant step in financing your education. Understanding the interest rates associated with these loans is crucial for making informed financial decisions and avoiding potential pitfalls. This section will delve into the factors that influence these rates, the differences between fixed and variable rates, and offer a comparison of rates from several prominent private lenders.

Factors Influencing Private Student Loan Interest Rates

Several key factors determine the interest rate you’ll receive on a private student loan. These factors are often assessed by lenders during the application process to gauge your creditworthiness and risk profile. A higher risk profile generally translates to a higher interest rate. Credit history plays a significant role, with borrowers possessing a strong credit history typically securing more favorable rates. Your income and debt-to-income ratio are also considered, as these indicators reflect your ability to repay the loan. The loan amount itself can also influence the rate; larger loan amounts might come with slightly higher rates due to increased risk for the lender. Finally, the lender’s own pricing models and market conditions play a part in setting interest rates.

Fixed Versus Variable Interest Rates

Private student loans typically offer two main interest rate options: fixed and variable. A fixed interest rate remains constant throughout the loan’s life, providing predictability in your monthly payments. This offers stability and allows for easier budgeting. In contrast, a variable interest rate fluctuates based on an underlying benchmark index, such as the prime rate or LIBOR (though LIBOR is being phased out). While a variable rate might start lower than a fixed rate, it carries the risk of increasing over time, potentially leading to higher payments. The choice between a fixed and variable rate depends on your risk tolerance and long-term financial outlook. Borrowers who prefer predictability often opt for fixed rates, while those willing to accept some risk in exchange for potentially lower initial payments may choose variable rates.

Comparison of Interest Rates Offered by Various Private Lenders

Interest rates offered by private lenders can vary significantly. It’s essential to compare offers from multiple lenders before making a decision. Factors such as credit score, loan amount, and repayment terms all impact the final interest rate. While specific rates are subject to change based on market conditions and individual borrower profiles, a general comparison can highlight the range of rates available. It’s always recommended to check directly with the lender for the most up-to-date information.

| Lender | Interest Rate Range (Approximate) | Fees (Approximate) | Repayment Options |

|---|---|---|---|

| Lender A | 6.00% – 14.00% | Origination fee: 1% – 4% | Standard, Graduated, Income-Based |

| Lender B | 5.50% – 13.50% | Origination fee: 0.5% – 3% | Standard, Extended |

| Lender C | 7.00% – 15.00% | Origination fee: 2% – 5% | Standard, Accelerated |

| Lender D | 6.50% – 14.50% | Origination fee: 1.5% – 4.5% | Standard, Income-Driven |

Credit Score and Interest Rates

Your credit score plays a significant role in determining the interest rate you’ll receive on a private student loan. Lenders use your credit history to assess your risk – essentially, how likely you are to repay the loan. A higher credit score indicates lower risk, resulting in more favorable interest rates. Conversely, a lower credit score suggests higher risk, leading to higher interest rates or even loan denial. Understanding this relationship is crucial for securing the best possible terms on your student loan.

Private student loan lenders often use a credit scoring model, like FICO, to evaluate applicants. These models consider various factors from your credit report, such as payment history, amounts owed, length of credit history, and new credit. The specific scoring system and the weight given to each factor can vary between lenders, but the general principle remains consistent: a higher score translates to a lower interest rate.

Interest Rate Variations Based on Credit Score

The impact of credit score on interest rates can be substantial. For example, let’s consider hypothetical scenarios for a $10,000 private student loan over 10 years. An applicant with an excellent credit score (750 or higher) might qualify for an interest rate around 6%, while someone with a fair credit score (650-699) might face an interest rate closer to 10%. This difference in interest rates can result in thousands of dollars in additional interest paid over the life of the loan. An applicant with a poor credit score (below 650) may find it extremely difficult to secure a private student loan at all, or they might be offered rates significantly exceeding 10%, making repayment a considerable burden. These examples illustrate the significant financial implications of credit score on private student loan interest rates.

Improving Credit Score for Lower Interest Rates

Improving your credit score before applying for a private student loan can lead to substantial savings. Even a modest increase in your score can translate to a lower interest rate, significantly reducing the overall cost of your loan. A proactive approach to credit management can yield significant long-term benefits.

Improving your credit score requires consistent effort and responsible financial behavior. Here are some key strategies:

The following strategies can significantly contribute to improving your credit score before applying for a private student loan. Consistent application of these strategies will demonstrate responsible credit management to lenders.

- Pay all bills on time: This is the single most important factor influencing your credit score. Late payments can severely damage your credit. Set up automatic payments to avoid missed deadlines.

- Keep credit utilization low: Aim to keep your credit card balances below 30% of your total credit limit. High credit utilization signals higher risk to lenders.

- Maintain a mix of credit accounts: Having a variety of credit accounts, such as credit cards and installment loans, can positively impact your credit score. However, avoid opening multiple accounts in a short period.

- Monitor your credit report regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) for errors or inaccuracies. Dispute any errors promptly.

- Avoid applying for too much new credit: Multiple credit applications in a short period can negatively impact your credit score. Only apply for credit when necessary.

Loan Terms and Repayment Options

Choosing the right repayment plan for your private student loan is crucial, as it directly impacts your monthly payments and the total interest you’ll pay over the life of the loan. Understanding the various options available is essential for making an informed financial decision. Different lenders offer a range of repayment terms and plans, each with its own set of advantages and disadvantages.

Understanding the interplay between loan terms and repayment options is vital for effective financial planning. The length of your repayment period significantly influences your monthly payment amount and the total interest accrued. Shorter repayment terms mean higher monthly payments but lower overall interest costs, while longer terms result in lower monthly payments but higher total interest. Carefully considering your financial situation and long-term goals is crucial in selecting the most suitable plan.

Standard Repayment Plans

Standard repayment plans are the most common option offered by private student loan lenders. These plans typically involve fixed monthly payments over a set period, such as 5, 10, or 15 years. The fixed payment amount remains consistent throughout the repayment term, making budgeting easier. However, the total interest paid will be higher with longer repayment periods. For example, a 10-year loan will typically have lower monthly payments than a 5-year loan but will accrue significantly more interest over its lifetime.

Graduated Repayment Plans

Graduated repayment plans offer lower initial monthly payments that gradually increase over time. This can be beneficial for borrowers who anticipate increased income in the future. However, it’s important to be aware that the later payments can become substantially higher, potentially making budgeting challenging as the repayment period progresses. This plan might be suitable for recent graduates expecting salary growth, but careful budgeting is crucial.

Income-Driven Repayment Plans

While less common with private loans than federal loans, some private lenders may offer income-driven repayment plans. These plans tie your monthly payment to your income, typically adjusting payments based on your income and family size. This offers flexibility during periods of lower income but may result in a longer repayment period and higher overall interest paid. The specific criteria and calculations vary widely among lenders.

Extended Repayment Plans

Some lenders offer extended repayment plans, allowing borrowers to stretch their repayment period beyond the standard options. This lowers monthly payments but significantly increases the total interest paid. While this option provides immediate short-term relief, it should be approached cautiously, as the long-term financial implications can be substantial. Consider this option only after carefully weighing the cost of increased interest against the benefit of lower monthly payments.

Repayment Plan Comparison

Understanding the key differences between these plans is crucial for making the best choice. The following table summarizes the key features of each repayment option:

| Repayment Plan | Monthly Payment | Total Interest Paid | Repayment Period | Suitability |

|---|---|---|---|---|

| Standard | Fixed | Moderate | 5-15 years | Borrowers with stable income and a desire to pay off the loan quickly. |

| Graduated | Increasing | Moderate to High | 5-15 years | Borrowers anticipating income growth. |

| Income-Driven (if available) | Variable (based on income) | High | Potentially very long | Borrowers with fluctuating income. |

| Extended | Low | Very High | Longer than standard plans | Borrowers needing immediate short-term payment relief. |

Fees and Other Charges

Private student loans, while offering a crucial funding source for higher education, often come with various fees that can significantly impact the total cost of borrowing. Understanding these fees is essential for making informed borrowing decisions and comparing offers from different lenders. Failing to account for these additional costs can lead to unexpected expenses and a higher overall debt burden.

Several types of fees are commonly associated with private student loans. Origination fees, for instance, are charged by the lender upon loan disbursement and represent a percentage of the loan amount. Late payment fees are incurred when payments are not made by the due date, adding to the principal balance. Other potential fees include prepayment penalties (though less common now), returned check fees, and potentially fees for specific services like loan consolidation or deferment. The specific fees charged, and their amounts, vary significantly depending on the lender and the terms of the loan agreement.

Origination Fees

Origination fees are upfront charges paid to the lender at the time the loan is disbursed. These fees typically range from 0% to 5% of the loan amount, although some lenders may charge higher fees. For example, a $20,000 loan with a 3% origination fee would result in a $600 fee, meaning the borrower receives only $19,400. This fee immediately reduces the amount of money available to the student for educational expenses. The impact of origination fees is particularly noticeable for larger loan amounts.

Late Payment Fees

Late payment fees are penalties imposed for missed or late loan payments. These fees can range from a fixed dollar amount (e.g., $25) to a percentage of the missed payment. Consistent late payments can rapidly increase the total debt owed. For example, a $25 late fee on a monthly payment of $200 represents a 12.5% increase in that month’s payment. Accumulated late fees can significantly inflate the overall cost of the loan over its lifetime.

Comparison of Fee Structures

Different private lenders employ varying fee structures. Some lenders may offer loans with no origination fees, while others may charge significant upfront costs. Similarly, late payment fees vary widely. Comparing these fees is crucial in selecting the most cost-effective loan. It’s important to carefully review the loan terms and fee schedule provided by each lender before making a decision.

Fee Comparison Table

| Lender | Origination Fee | Late Payment Fee | Other Fees (Examples) |

|---|---|---|---|

| Lender A | 0% | $25 | Returned check fee: $30 |

| Lender B | 1% | $35 | None specified |

| Lender C | 2% | 2% of missed payment | Prepayment penalty: (If applicable) |

| Lender D | 3% | $25 | Returned check fee: $35; Late payment reporting fee: $15 |

Co-signers and Their Role

Securing a private student loan can be challenging, especially for students with limited or no credit history. A co-signer significantly improves the chances of loan approval and can often lead to more favorable terms. Understanding the role of a co-signer is crucial for both the borrower and the co-signer.

A co-signer is an individual who agrees to be jointly responsible for repaying a student loan if the primary borrower (the student) fails to make payments. Essentially, they act as a guarantor, lending their creditworthiness to strengthen the loan application. This shared responsibility significantly reduces the lender’s risk.

Co-signer Benefits and Responsibilities

The benefits for the student borrower are clear: increased likelihood of loan approval and potentially a lower interest rate. However, the co-signer takes on significant responsibilities. They are legally obligated to repay the loan if the borrower defaults. This can have serious financial consequences, impacting their credit score and overall financial health. Therefore, becoming a co-signer is a major decision that requires careful consideration.

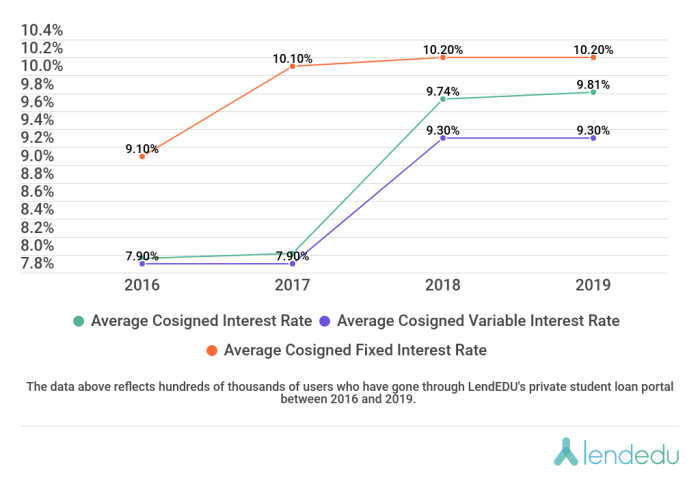

Impact of Co-signer’s Credit Score on Interest Rates

The co-signer’s credit score plays a pivotal role in determining the interest rate offered on the loan. Lenders assess the creditworthiness of both the borrower and the co-signer. A co-signer with a strong credit history (high credit score) can significantly improve the chances of securing a lower interest rate for the borrower. Conversely, a co-signer with a poor credit history might result in a higher interest rate, or even loan denial. For example, a student with a limited credit history might qualify for a 7% interest rate with a co-signer who has an excellent credit score, but without a co-signer, they might face a 10% or even higher rate, or no loan at all.

Removing a Co-signer from a Private Student Loan

Removing a co-signer from a private student loan is typically possible, but it requires the borrower to demonstrate a strong track record of responsible repayment. This usually involves making consistent on-time payments for a significant period, often 12-24 months or more, building a solid credit history. The specific requirements vary depending on the lender. The process usually involves submitting an application to the lender and providing documentation of the borrower’s improved financial standing and credit history. Once the lender reviews the application and is satisfied with the borrower’s creditworthiness, they may release the co-signer from their obligations. It’s important to contact the lender directly to understand their specific requirements for co-signer release.

Shopping for the Best Rates

Securing the best interest rate on a private student loan requires a strategic approach. By diligently comparing offers and understanding the factors influencing rates, you can significantly reduce the overall cost of your loan. This process involves several key steps, from pre-qualification to final loan selection.

Finding the most favorable private student loan rates involves more than simply applying to the first lender you encounter. A systematic approach ensures you explore all available options and secure the best possible terms for your circumstances. This section Artikels a step-by-step guide to help you navigate this process effectively.

Pre-qualification and Multiple Offers

Pre-qualification allows you to obtain a preliminary interest rate estimate without impacting your credit score significantly. This provides a valuable benchmark for comparison when you receive formal loan offers. It’s crucial to obtain multiple offers from different lenders to compare interest rates, fees, and repayment options. The more offers you have, the greater your chance of finding the most advantageous loan terms. Remember, pre-qualification is not a binding commitment; it simply provides a snapshot of your eligibility.

Key Factors to Consider When Comparing Loan Offers

Several key factors influence the attractiveness of a private student loan offer. These include the interest rate (both fixed and variable), loan fees, repayment terms (length of the loan and repayment schedule), and any additional charges or penalties. Comparing these elements across multiple lenders allows you to make an informed decision based on your individual financial circumstances and long-term goals. For instance, a slightly higher interest rate might be acceptable if it comes with lower fees or more flexible repayment options.

A Step-by-Step Guide to Shopping for Private Student Loans

- Check your credit score: Understanding your credit score is the first step. A higher credit score typically translates to lower interest rates. You can obtain your credit report from annualcreditreport.com for free.

- Pre-qualify with multiple lenders: Use online pre-qualification tools offered by various private student loan lenders. This allows you to compare interest rate estimates without affecting your credit score significantly. Aim for at least three to five lenders.

- Compare loan offers carefully: Pay close attention to the Annual Percentage Rate (APR), which includes interest and fees. Also, compare loan terms, repayment options, and any potential penalties for early repayment or late payments.

- Consider your financial situation: Choose a loan that aligns with your budget and repayment capacity. Avoid loans with terms that could create undue financial hardship.

- Read the fine print: Thoroughly review all loan documents before signing. Understand all fees, interest rates, and repayment terms to avoid unexpected costs or complications.

- Choose the best loan: Select the loan that offers the best combination of interest rate, fees, and repayment terms based on your financial situation and long-term goals.

Checklist for Searching for a Private Student Loan

Before you begin your search, consider creating a checklist to ensure you cover all essential aspects. This organized approach minimizes the risk of overlooking crucial details. The checklist should include items such as confirming your credit score, identifying your borrowing needs, researching reputable lenders, comparing APRs and fees, understanding repayment options, and verifying the lender’s licensing and reputation. This structured approach will guide you through the process efficiently and effectively.

Potential Risks and Considerations

Taking out private student loans can be a significant financial decision with potential long-term consequences. It’s crucial to understand the inherent risks involved before committing to a loan, ensuring you’re making an informed choice aligned with your financial capabilities and future prospects. Careful consideration of these risks can help mitigate potential problems and ensure a smoother repayment process.

Private student loans, unlike federal loans, often come with higher interest rates and less flexible repayment options. This can lead to a substantial debt burden, impacting your financial well-being for years to come. The potential for unexpected financial hardship further emphasizes the need for a thorough understanding of the risks involved.

High Interest Rates and Debt Burden

High interest rates significantly increase the total cost of borrowing. The longer it takes to repay the loan, the more interest accrues, potentially leading to a situation where the total amount repaid far exceeds the initial loan amount. This can severely limit financial flexibility, making it difficult to save for major life events like buying a home or investing in retirement. The accumulation of debt can create considerable financial stress and limit opportunities for future financial growth. Responsible budgeting and a realistic repayment plan are essential to manage this risk effectively.

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan has severe consequences. Unlike federal loans, which offer various rehabilitation and forgiveness programs, private loan defaults can result in significant damage to your credit score, making it difficult to obtain future loans for things like a mortgage or car. Collection agencies may pursue aggressive debt collection methods, including wage garnishment or legal action. The long-term financial implications of default can be devastating, hindering your ability to achieve your financial goals.

Responsible Borrowing and Debt Management Strategies

Effective debt management begins with responsible borrowing. Before taking out any private student loans, carefully evaluate your financial situation, including your current income, expenses, and anticipated future earnings. Create a realistic budget that incorporates loan repayments and other essential expenses. Explore all available options, including scholarships, grants, and federal student loans, which often offer more favorable terms. Consider the potential long-term financial implications of the loan amount before signing any agreements. Regularly monitor your loan balance and repayment progress, and don’t hesitate to seek professional financial advice if needed.

Long-Term Financial Implications

The long-term financial implications of private student loans vary significantly depending on factors such as the interest rate, loan amount, and repayment plan. For example, a high-interest loan with a long repayment period could result in significantly higher total repayment costs compared to a loan with a lower interest rate and a shorter repayment term. This difference can have a substantial impact on your long-term financial health, potentially delaying major life purchases or investments. Conversely, responsible borrowing and diligent repayment can minimize these risks and pave the way for greater financial security in the future. Understanding these potential outcomes helps in making informed borrowing decisions.

Ultimate Conclusion

Securing a private student loan requires careful consideration of numerous factors. By understanding the interplay between credit score, loan terms, fees, and lender comparisons, you can significantly improve your chances of obtaining a favorable interest rate. Remember, proactive planning and informed decision-making are essential to manage your student loan debt effectively and achieve your long-term financial goals. Don’t hesitate to seek further guidance from financial professionals if needed.

Clarifying Questions

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates may initially be lower but carry more risk.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and simplify payments, but it’s important to carefully compare offers and consider the terms before refinancing.

What happens if I default on my private student loan?

Defaulting can severely damage your credit score, leading to difficulty obtaining future loans and other financial products. It can also result in wage garnishment or legal action.

How long does it take to get approved for a private student loan?

Approval times vary by lender, but generally range from a few days to several weeks, depending on the complexity of your application and the lender’s processing speed.