The landscape of higher education financing has been significantly shaped by the rise of privatized student loans. This system, where private institutions offer loans alongside federal programs, presents both opportunities and challenges for students navigating the complexities of funding their education. Understanding the intricacies of this market is crucial for making informed financial decisions and navigating the potential pitfalls of private debt.

This exploration delves into the historical context of privatized student loans, examining their evolution, the motivations of private lenders, and the impact on borrowers. We will compare private loans with their federal counterparts, analyze regulatory oversight, and discuss the long-term economic consequences of this increasingly prevalent financial instrument. The aim is to provide a balanced and informative perspective on this critical aspect of higher education funding.

Historical Context of Privatized Student Loans

The rise of private student loans in the United States represents a significant shift in how higher education is financed. Before the significant expansion of the private sector, federal student aid programs were the primary source of funding for college. This shift, however, was not sudden but rather a gradual evolution driven by policy changes, market forces, and evolving student needs.

The pre-privatization landscape was largely dominated by government-backed student loans, primarily through the Guaranteed Student Loan (GSL) program. This program, established in the 1960s, guaranteed loans made by private lenders to students, mitigating risk for lenders and ensuring broader access to credit for students. Lending was relatively straightforward, with a focus on creditworthiness and the ability to repay, though the process was not without its complexities. The federal government’s role was primarily to guarantee repayment, thus ensuring a steady flow of funds to students. This system, while effective in providing access, also lacked robust consumer protections and was susceptible to fluctuations in the broader financial markets.

The Evolution of Privatization

The expansion of the private student loan market was facilitated by a series of legislative changes and market dynamics. The 1990s witnessed a gradual shift away from the GSL program, with increased emphasis on direct lending by the federal government. This created a space for private lenders to step in and fill the gap for students who did not qualify for federal aid or who needed additional funding beyond their federal loan limits. The passage of the Higher Education Act of 1965 and its subsequent reauthorizations played a crucial role, progressively shaping the regulatory environment and influencing the growth of both federal and private student loan programs. These reauthorizations often included adjustments to eligibility criteria, loan limits, and repayment terms, indirectly influencing the market share of private lenders.

Key Legislative Changes

Several key legislative changes directly or indirectly influenced the growth of the private student loan market. For example, changes in eligibility requirements for federal loans, such as stricter credit checks or income limitations, inadvertently increased the demand for private loans. Furthermore, limitations on federal loan amounts left a funding gap that private lenders eagerly filled. These legislative adjustments, while often intended to improve efficiency and reduce government spending, created an environment conducive to private sector involvement in student lending. The overall effect was a dual system, with federal loans providing a baseline and private loans offering supplemental financing.

Major Private Lenders

Several major financial institutions played a significant role in the private student loan market at different points in its history. In the earlier stages of privatization, regional banks and savings and loan associations were prominent lenders. Later, larger national banks and specialized financial services companies entered the market, often offering more diverse loan products and marketing strategies. Examples include Sallie Mae (originally the Student Loan Marketing Association), which played a crucial role in the GSL program before becoming a major private lender, and other large financial institutions like Chase, Wells Fargo, and Citibank, who each offered their own student loan products at various times. The competitive landscape changed significantly over time, with mergers, acquisitions, and shifts in market focus shaping the composition of major players.

The Role of Private Lenders

Private lenders play a significant role in the student loan market, offering an alternative to federal loan programs. Their involvement stems from a combination of profit motives and a perceived gap in the market for certain borrowers. Understanding their operations is crucial for evaluating the overall landscape of student financing.

Private lenders’ primary motivation is profit. They are for-profit institutions, and their involvement in student lending is driven by the expectation of financial return. They assess risk, set interest rates, and manage repayment terms to maximize their profits while minimizing potential losses from defaults. This contrasts with federal loan programs, which are primarily driven by social and economic policy goals.

Lender Motivations and Risk Assessment

Private lenders evaluate the creditworthiness of student loan applicants rigorously. Their lending criteria typically include credit history (or a co-signer with good credit), income, debt-to-income ratio, and the applicant’s intended course of study and projected post-graduation earning potential. Sophisticated risk assessment models, often incorporating statistical analysis and predictive algorithms, are employed to determine the likelihood of loan repayment. High-risk borrowers may be denied loans or offered loans with higher interest rates and stricter terms. This process aims to mitigate the risk of default and protect the lender’s financial interests.

Interest Rates and Repayment Terms

Private student loans generally carry higher interest rates than federal loans. This is due to the higher risk associated with private lending and the lenders’ need to generate profit. The interest rate offered to an individual borrower depends on their creditworthiness and the terms of the loan. Repayment terms, including loan amortization schedules and repayment periods, also vary depending on the lender and the borrower’s risk profile. Federal loan programs often offer more flexible repayment options, such as income-driven repayment plans, which are designed to make repayment more manageable for borrowers facing financial hardship. Private lenders typically offer fewer such options, making repayment potentially more challenging for some borrowers.

Comparison of Private Student Loan Providers

The following table compares the features of three major private student loan providers. Note that interest rates and fees can change, and these figures represent a snapshot in time. It’s crucial to check the most current information directly with the lender before making any decisions.

| Lender | Interest Rate Range (Example – Subject to Change) | Repayment Options | Additional Fees |

|---|---|---|---|

| Lender A | 4.5% – 13% | Standard, Graduated, Extended | Origination fee, late payment fee |

| Lender B | 5% – 14% | Standard, Income-Based (limited eligibility) | Origination fee, prepayment penalty (in some cases) |

| Lender C | 6% – 15% | Standard, Fixed-Rate, Variable-Rate | Late payment fee, returned check fee |

Impact on Borrowers

The shift towards private student loans has significantly altered the landscape of higher education financing, resulting in a diverse range of experiences for borrowers. While some have benefited from flexible repayment options or lower initial interest rates compared to federal loans, many others have faced considerable challenges navigating the complexities of private lending. Understanding these diverse experiences is crucial to assessing the overall impact of this financial shift.

Borrower Experiences with Private Student Loans

Private student loans offer a seemingly appealing alternative to federal loans for some students, particularly those who don’t qualify for federal aid or need to borrow more than the federal limits allow. However, the reality of managing these loans can be vastly different from expectations. Positive experiences often involve securing loans with competitive interest rates or flexible repayment plans tailored to individual circumstances. Conversely, negative experiences frequently involve high interest rates that increase the overall cost of borrowing, aggressive collection practices by lenders, and a lack of borrower protections compared to federal loan programs.

Challenges in Managing Private Student Loan Debt

Managing private student loan debt presents unique challenges. Unlike federal loans, which often offer income-driven repayment plans, deferment options, and forbearance programs, private loans typically provide fewer options for borrowers facing financial hardship. This rigidity can lead to delinquency and default, triggering negative consequences such as damaged credit scores and potential legal action. The lack of consistent oversight and regulatory protection afforded to federal loans further exacerbates these challenges, leaving borrowers vulnerable to predatory lending practices. Navigating the complexities of multiple private loans from different lenders can also be overwhelming, making it difficult for borrowers to track payments and manage their debt effectively.

Impact on Credit Scores and Financial Well-being

Private student loan debt can significantly impact a borrower’s credit score and overall financial well-being. Late or missed payments, as well as default, can severely damage credit scores, making it difficult to secure future loans, rent an apartment, or even obtain certain jobs. The high interest rates associated with private loans can also lead to a substantial increase in the total amount repaid, potentially hindering borrowers’ ability to save for retirement, buy a home, or achieve other financial goals. The long-term financial consequences of accumulating significant private student loan debt can be substantial, often extending far beyond the repayment period.

Hypothetical Case Study: Private vs. Federal Loan

Consider two hypothetical students, both needing $20,000 for their education. Student A secures a federal loan with a fixed interest rate of 5% and a 10-year repayment plan. Student B takes out a private loan with a variable interest rate that starts at 7% but could potentially rise to 10% based on market conditions. Over the course of the repayment period, Student A’s total repayment will be significantly less than Student B’s, even accounting for potential increases in Student B’s interest rate. Furthermore, Student A has access to various repayment options and protections offered under federal loan programs, while Student B faces greater financial risk and fewer options should they experience financial hardship. This disparity highlights the potential long-term financial consequences of choosing a private loan over a federal loan.

Comparison with Federal Student Loan Programs

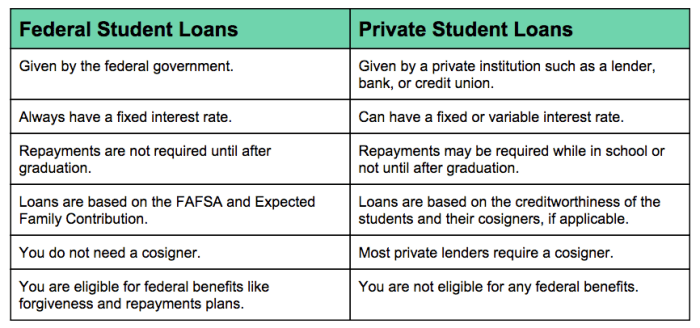

Choosing between federal and private student loans is a crucial decision impacting a borrower’s financial future. Understanding the key differences between these two loan types is essential for making an informed choice that aligns with individual circumstances and financial goals. Both offer access to funds for higher education, but their terms, benefits, and potential drawbacks differ significantly.

Federal student loans, backed by the U.S. government, offer several advantages over private loans. These benefits stem from government guarantees and regulations designed to protect borrowers. Conversely, private student loans, offered by banks and other financial institutions, are subject to market forces and may carry higher interest rates and less borrower protection. The optimal choice depends heavily on individual creditworthiness, financial need, and the specific terms offered.

Benefits and Drawbacks of Federal vs. Private Student Loans

Federal student loans typically offer lower interest rates than private loans, especially for borrowers with limited or no credit history. They also come with various repayment plans, including income-driven repayment options that adjust monthly payments based on income and family size. Furthermore, federal loans often provide borrower protections, such as deferment and forbearance options during periods of financial hardship. However, federal loans may have lower borrowing limits compared to private loans, and the application process can be more complex.

Private student loans, on the other hand, may offer higher borrowing limits, potentially covering the full cost of tuition and other expenses. The application process can be simpler and faster than for federal loans. However, private loans usually carry higher interest rates, especially for borrowers with poor credit. They generally lack the borrower protections offered by federal loans, and repayment options may be less flexible. Additionally, the interest rates on private loans are variable, meaning they can fluctuate throughout the repayment period.

Situations Where a Private Student Loan Might Be Suitable

A private student loan might be a suitable option for students who have exhausted their federal loan eligibility but still need additional funding to cover educational expenses. This might occur if a student’s cost of attendance exceeds the maximum federal loan amount. Borrowers with excellent credit scores may also find that private loans offer more competitive interest rates than federal loans. Another scenario is when a student is pursuing a graduate degree or professional program that doesn’t receive sufficient federal funding. It’s crucial, however, to thoroughly compare interest rates and repayment terms before committing to a private loan.

The Role of Federal Loan Forgiveness Programs

Federal loan forgiveness programs aim to mitigate the burden of student loan debt for specific borrowers. These programs, such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness, offer the potential for complete loan forgiveness after meeting certain criteria, such as working in a qualifying public service job for a specified period. While these programs offer significant relief, eligibility requirements can be stringent, and the process of obtaining forgiveness can be lengthy and complex. The existence of these programs, however, provides a crucial safety net for eligible borrowers, reducing the long-term financial strain of student loan debt. However, it’s essential to remember that these programs are not guaranteed, and changes in legislation could impact eligibility.

Key Differences Between Federal and Private Student Loan Programs

The following points highlight the key distinctions between federal and private student loan programs:

- Interest Rates: Federal loans generally have lower, fixed interest rates, while private loans often have higher, variable interest rates.

- Repayment Options: Federal loans offer various repayment plans, including income-driven repayment, while private loans typically offer fewer options.

- Borrower Protections: Federal loans provide various borrower protections, such as deferment and forbearance, which are less common with private loans.

- Loan Forgiveness Programs: Federal loans are eligible for federal loan forgiveness programs, while private loans are not.

- Credit Requirements: Federal loans typically have less stringent credit requirements than private loans.

- Application Process: The application process for federal loans can be more complex but generally involves less risk.

Regulatory Oversight and Consumer Protection

The private student loan market, unlike its federal counterpart, operates with less stringent regulatory oversight, leading to significant variations in consumer protection measures and increased potential for predatory lending practices. This section examines the existing regulatory framework, its effectiveness, and notable examples of both successful and unsuccessful consumer protection initiatives.

The regulatory framework governing private student lenders is primarily state-based, with the Consumer Financial Protection Bureau (CFPB) playing a significant, albeit limited, role at the federal level. States have varying laws regarding interest rates, fees, and disclosure requirements for private student loans. However, the patchwork nature of state regulations creates inconsistencies and potential loopholes that can be exploited by lenders. The CFPB’s authority is mainly focused on ensuring fair lending practices and preventing discrimination, but its jurisdiction over private student loans is not as extensive as its oversight of other consumer financial products. This fragmented regulatory environment contributes to the challenges in effectively protecting borrowers.

Effectiveness of Existing Consumer Protection Measures

Existing consumer protection measures for private student loan borrowers are demonstrably uneven in their effectiveness. While some states have robust regulations requiring clear disclosures of loan terms and protecting borrowers from abusive practices, many others lack comprehensive protections. The absence of a unified federal standard allows for significant disparities in borrower protections across different states. Furthermore, enforcement of existing regulations often proves challenging, leaving many borrowers vulnerable to predatory lending tactics. The lack of a standardized complaint process and the difficulties borrowers face in navigating complex legal processes further hinder the effectiveness of existing measures.

Predatory Lending Practices in the Private Student Loan Market

Predatory lending practices in the private student loan market manifest in various forms. These include charging excessively high interest rates, imposing significant upfront fees, and employing aggressive marketing tactics targeting vulnerable students. Some lenders may also engage in deceptive practices by failing to fully disclose loan terms or by concealing unfavorable features of the loan agreements. For example, lenders may offer loans with variable interest rates that can fluctuate significantly, leading to unexpected increases in monthly payments. Another common tactic involves adding unnecessary add-on products or insurance that increases the overall cost of the loan without providing significant benefit to the borrower. These practices disproportionately affect students from low-income backgrounds or those with limited financial literacy.

Examples of Consumer Protection Initiatives

Several initiatives, both successful and unsuccessful, illustrate the challenges in regulating the private student loan market. Successful initiatives often involve strong state-level regulations that mandate clear disclosures, limit interest rates, and establish robust enforcement mechanisms. For example, states with strong consumer protection laws have seen a reduction in complaints related to predatory lending in the private student loan market. Conversely, unsuccessful initiatives often stem from weak or inconsistently enforced regulations, leading to a continued prevalence of predatory lending. For instance, states with minimal regulations often experience a higher incidence of borrower complaints and lawsuits against private lenders. The effectiveness of any initiative depends significantly on the level of enforcement and the clarity of the regulations. A lack of funding for enforcement agencies or ambiguous regulatory language can severely undermine even the best-intentioned consumer protection efforts.

Long-Term Economic Consequences

The widespread adoption of private student loans has created a complex web of long-term economic consequences, impacting individual borrowers, the higher education system, and the overall macroeconomic landscape. Understanding these consequences is crucial for developing effective policy solutions and ensuring a sustainable and equitable higher education system.

The significant accumulation of private student loan debt exerts considerable pressure on the economy. This debt can hinder consumer spending, reduce investment in other sectors, and ultimately dampen economic growth. Borrowers burdened with substantial repayment obligations may postpone major purchases like homes or cars, impacting related industries. Furthermore, the weight of debt can restrict entrepreneurial activity, as individuals may be less inclined to start businesses due to financial constraints.

Macroeconomic Effects of Widespread Private Student Loan Debt

High levels of private student loan debt can lead to decreased aggregate demand. As borrowers dedicate a larger portion of their income to loan repayments, their discretionary spending diminishes, impacting overall consumer spending and potentially slowing economic growth. This effect is amplified when considering the demographic group most affected – young adults – who are typically key drivers of consumption in the economy. For example, a study by the Federal Reserve Bank of New York found a statistically significant negative correlation between student debt and consumer spending. The reduced consumer demand can then lead to decreased investment and hiring by businesses, creating a ripple effect throughout the economy.

Impact of Private Student Loan Debt on Future Economic Growth

The accumulation of private student loan debt poses a significant threat to future economic growth. The burden of repayment can delay major life milestones like homeownership and starting a family, hindering the formation of new households and consequently reducing overall economic activity. Furthermore, high levels of student loan debt can negatively impact human capital development, as individuals may forgo further education or training due to financial constraints. This reduction in human capital ultimately lowers productivity and innovation, impeding long-term economic growth. This is particularly concerning given the growing importance of higher education and specialized skills in a knowledge-based economy.

Implications of Private Student Loan Debt on Higher Education Affordability and Access

The rise of private student loans, while providing access to higher education for some, has exacerbated the affordability crisis. The high interest rates and less flexible repayment options offered by private lenders can create a debt trap for many borrowers, limiting their ability to pursue their chosen careers and contributing to financial instability. This can disproportionately affect students from low-income backgrounds, widening the existing inequality in access to higher education. The resulting increase in overall student debt contributes to the perception that higher education is unaffordable and inaccessible, potentially discouraging prospective students from pursuing higher education altogether.

Visual Representation of the Private Student Loan System

Imagine a circular flow diagram. At the center is the student receiving the loan from a private lender (represented by a bank or financial institution). Arrows radiate outward. One arrow points to the university, showing the flow of tuition payments. Another points to the student, representing the funds used for living expenses. A third arrow points to the lender, illustrating the repayment of the loan, often with interest. Finally, an arrow points to the government (if applicable), depicting the role of regulatory bodies overseeing the loan process and potentially providing some consumer protection. The diagram visually represents how the money flows through the system, with the lender profiting from interest, the university receiving tuition, and the student potentially facing long-term financial strain. The overall size of the arrows illustrates the magnitude of money involved at each stage, and the potential for imbalances and negative consequences for the borrower.

Epilogue

In conclusion, the privatization of student loans presents a multifaceted issue with significant implications for students, lenders, and the broader economy. While private loans can offer flexibility and potentially lower interest rates in certain circumstances, the risks associated with high debt burdens and less stringent borrower protections warrant careful consideration. A thorough understanding of the differences between federal and private loans, coupled with responsible borrowing practices, is essential for navigating this complex financial landscape and ensuring a positive outcome for students pursuing higher education.

General Inquiries

What happens if I can’t repay my private student loan?

Defaulting on a private student loan can severely damage your credit score, leading to difficulty obtaining future loans or credit cards. Collection agencies may pursue legal action to recover the debt.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, refinancing typically involves taking out a new loan to pay off the existing ones, and eligibility depends on your credit score and income.

Are private student loans eligible for federal forgiveness programs?

No, private student loans are not eligible for federal loan forgiveness programs like Public Service Loan Forgiveness (PSLF) or income-driven repayment plans.

What are the tax implications of private student loans?

Interest paid on private student loans is generally not tax-deductible, unlike some federal student loan interest. Consult a tax professional for specific advice.