The weight of student loan debt is a pervasive issue impacting millions, casting a long shadow over personal finances and future prospects. This isn’t just about numbers; it’s about the real-life struggles of individuals navigating complex repayment plans, grappling with the emotional toll of overwhelming debt, and making difficult choices about their future. This exploration delves into the multifaceted challenges surrounding student loans, examining the root causes, exploring available solutions, and offering insights into navigating this increasingly complex landscape.

From the soaring costs of higher education to the difficulties of repayment in a volatile job market, the student loan crisis affects individuals across various demographics. Understanding the intricacies of different repayment options, forgiveness programs, and alternative financing methods is crucial for making informed decisions and achieving financial well-being. This analysis will provide a clear picture of the current situation, explore potential solutions, and empower readers to take control of their financial futures.

High Student Loan Debt Levels

The burden of student loan debt in the United States has reached staggering levels, significantly impacting the financial well-being of millions of Americans and posing a considerable challenge to the nation’s economic stability. Understanding the scope of this issue requires examining the current debt amounts, historical trends, and the disparities experienced across different demographic groups.

Student loan debt has steadily increased over the past few decades, driven by rising tuition costs and a growing reliance on borrowing to finance higher education. The average student loan debt for borrowers has climbed significantly, placing a substantial financial strain on graduates as they enter the workforce. This debt often delays major life milestones such as homeownership, starting a family, and investing in retirement.

Average Debt Amounts and Trends

The total amount of student loan debt outstanding in the United States is in the trillions of dollars. While precise figures fluctuate, reports from organizations like the Federal Reserve and the Department of Education consistently show an upward trend. For example, the average debt for borrowers who graduated in recent years often exceeds $37,000, a number that has been steadily increasing year over year. This average, however, masks significant variations based on factors like the type of institution attended (public versus private), the degree pursued, and the length of the educational program. The rising cost of tuition, coupled with the increasing need for advanced degrees in a competitive job market, contributes to this escalating debt burden.

Demographic Disparities in Student Loan Debt

The impact of student loan debt is not evenly distributed across all demographics. Significant disparities exist based on income, race, and education level. Borrowers from lower-income backgrounds often face greater challenges in repaying their loans due to limited earning potential post-graduation. Similarly, racial and ethnic minorities often carry a disproportionately higher debt burden, reflecting existing inequalities in access to higher education and financial resources. Individuals pursuing advanced degrees, while potentially increasing their earning potential in the long run, accumulate significantly more debt during their studies.

Demographic Breakdown of Student Loan Debt

| Demographic Group | Average Debt | Percentage of Graduates with Debt | Median Income Post-Graduation |

|---|---|---|---|

| White Graduates | $35,000 (Estimate) | 65% (Estimate) | $55,000 (Estimate) |

| Black Graduates | $40,000 (Estimate) | 70% (Estimate) | $48,000 (Estimate) |

| Hispanic Graduates | $38,000 (Estimate) | 72% (Estimate) | $45,000 (Estimate) |

| Low-Income Graduates | $42,000 (Estimate) | 75% (Estimate) | $40,000 (Estimate) |

Note: The data presented in the table are estimates and may vary depending on the source and year. Precise figures require referencing specific studies and reports from reliable sources such as the U.S. Department of Education, the Federal Reserve, and reputable research institutions.

Difficulty Repaying Loans

Repaying student loans can be a significant challenge for many borrowers, often extending far beyond the initial expectation of manageable monthly payments. Numerous factors contribute to this difficulty, creating a complex financial landscape for those burdened with student loan debt. Understanding these challenges is crucial for both borrowers and policymakers alike.

Many borrowers face substantial hurdles in repaying their student loans. Unemployment, underemployment, and unexpected life events significantly impact repayment capacity. For instance, a recent graduate may struggle to find a job in their field, leading to lower-than-expected income and difficulty meeting loan payments. Similarly, unexpected medical expenses, family emergencies, or housing instability can quickly derail even the most meticulously planned repayment strategy. These unforeseen circumstances can create a cascade effect, leading to missed payments, delinquency, and ultimately, a worsening debt burden.

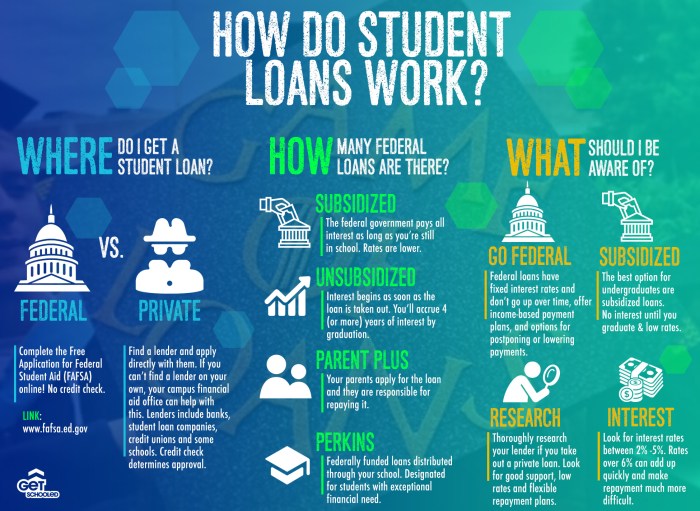

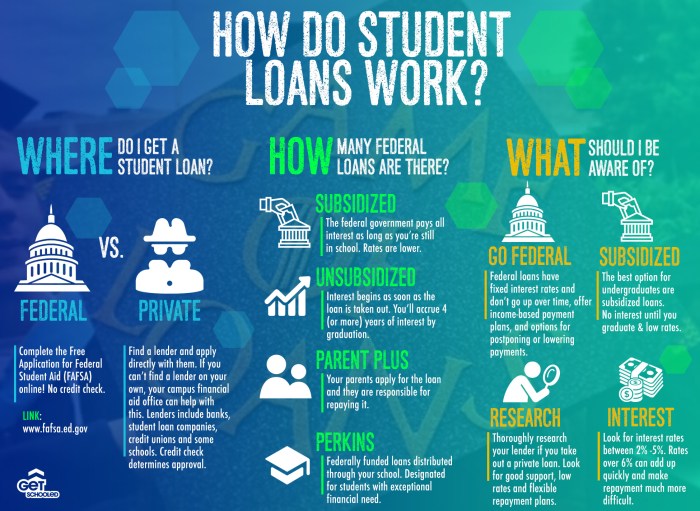

Repayment Plan Options

Several repayment plans are designed to help borrowers manage their student loan debt. These plans vary in their terms and conditions, offering different approaches to repayment based on individual financial situations. Choosing the right plan is crucial for long-term financial health.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s straightforward but may result in higher monthly payments compared to other options. A benefit is the shorter repayment period, leading to less interest accrued overall.

- Graduated Repayment Plan: Payments start low and gradually increase over time. This can be helpful in the early years after graduation when income is typically lower. However, the longer repayment period (up to 10 years) can result in significantly more interest paid over the life of the loan.

- Extended Repayment Plan: This plan stretches payments over a longer period, typically 25 years. Lower monthly payments are a significant advantage, making it more manageable for borrowers with limited income. However, the extended repayment period significantly increases the total interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on a borrower’s income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans offer lower monthly payments and potentially loan forgiveness after a certain number of years of qualifying payments. However, they often lead to a longer repayment period and potentially higher overall interest costs.

The Impact of Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This effectively increases the total amount owed, making repayment more challenging. For example, if a borrower misses a payment, the unpaid interest is capitalized, increasing the principal. Subsequent payments then go towards paying down this larger principal balance, potentially leading to a cycle of accumulating debt. The impact of interest capitalization can be substantial, significantly increasing the total cost of the loan over its lifetime. It’s crucial for borrowers to understand this process and make every effort to avoid missed payments to minimize the effects of capitalization.

The Impact of Student Loan Debt on Personal Finances

Student loan debt significantly impacts various aspects of personal finance, often delaying or hindering major life milestones and creating ongoing financial strain. The weight of monthly payments can restrict financial flexibility and limit opportunities for saving and investing, impacting everything from housing choices to retirement planning. Understanding this impact is crucial for effective financial planning and well-being.

The high cost of student loans can significantly affect major life decisions. The burden of repayment often forces graduates to postpone or forgo significant life events.

Delayed Homeownership

The substantial monthly payments associated with student loans can reduce a borrower’s ability to qualify for a mortgage. Lenders assess debt-to-income ratios, and high student loan payments can significantly lower the amount a borrower can afford to borrow for a home. This often means delaying homeownership, renting for longer periods, or settling for smaller or less desirable properties. For example, someone with $50,000 in student loan debt and a $500 monthly payment might find it challenging to secure a mortgage compared to someone with no student loan debt, even with similar incomes. The impact extends beyond simply owning a home; it affects the ability to build equity and benefit from potential appreciation in property value.

Delayed Family Formation

Starting a family is often delayed due to the financial strain of student loan repayments. The costs associated with raising children, including childcare, healthcare, and education, are substantial. Adding significant student loan payments to this mix can create a significant financial burden, leading many to postpone having children until they feel more financially secure. This can impact life plans and family dynamics, creating stress and potentially leading to later family formation than initially desired.

Reduced Retirement Savings

Student loan debt often leads to reduced retirement savings. With a significant portion of income allocated to loan repayments, the amount available for retirement contributions is significantly diminished. This can have long-term consequences, potentially leading to a less comfortable retirement. For instance, a young professional may be forced to prioritize student loan payments over contributing to a 401(k) or IRA, impacting the long-term growth of their retirement nest egg. This delay in saving could lead to a shortfall in retirement income, forcing them to rely more heavily on Social Security or other sources of income later in life.

Hypothetical Budget Illustrating Financial Strain

The following budget illustrates the financial strain of significant student loan payments. This is a hypothetical example, and individual circumstances will vary.

- Housing: $1,200 (Rent or Mortgage)

- Food: $500 (Groceries and Dining Out)

- Transportation: $300 (Car Payment, Gas, Insurance, Public Transportation)

- Student Loan Payments: $700 (Monthly Payment on $50,000 Loan)

- Savings: $0 (No funds available after essential expenses)

This budget shows a person with significant student loan payments having little to no money left for savings or other discretionary spending. This highlights the significant financial constraint imposed by high student loan debt. Any unexpected expense, such as a car repair or medical bill, could easily lead to financial hardship.

The Role of Student Loan Forgiveness Programs

Student loan forgiveness programs aim to alleviate the burden of student debt for eligible borrowers. These programs, while offering potential relief, operate under specific criteria and have both advantages and disadvantages for individuals and the broader economy. Understanding their mechanics and implications is crucial for both borrowers navigating repayment and policymakers shaping future debt management strategies.

Several federal student loan forgiveness programs exist, each with unique eligibility requirements. These programs typically target specific groups of borrowers or professions, offering partial or complete loan forgiveness after meeting certain conditions. The complexity of these programs, however, often makes it challenging for borrowers to determine their eligibility and navigate the application process.

Existing Student Loan Forgiveness Programs and Eligibility

The Public Service Loan Forgiveness (PSLF) program, for example, forgives the remaining balance on Direct Loans after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. The Teacher Loan Forgiveness program offers forgiveness of up to $17,500 in eligible loans for teachers who have completed five years of full-time teaching in low-income schools or educational service agencies. Other programs, like the Income-Driven Repayment (IDR) plans, don’t directly forgive loans but can significantly reduce monthly payments, potentially leading to loan forgiveness after a certain period, depending on the plan and income. Eligibility criteria vary significantly across these programs and often involve factors such as loan type, employment history, and income level.

Comparison of Benefits and Drawbacks of Forgiveness Programs

Benefits of student loan forgiveness programs include reduced financial strain on borrowers, potentially leading to increased spending and economic growth. Forgiveness can also incentivize individuals to pursue careers in public service or education, addressing workforce shortages in these sectors. However, drawbacks include the potential for increased federal budget deficits and the possibility of inequitable distribution of benefits, favoring certain borrowers over others. For instance, the PSLF program initially had very low forgiveness rates due to strict eligibility requirements and administrative complexities. Moreover, the impact on the economy can be complex, with potential positive effects from increased consumer spending offset by potential negative effects from increased government debt.

Potential Impact of Forgiveness Programs on Borrowers and the Economy

The impact of student loan forgiveness on borrowers is demonstrably positive for those who qualify and receive relief. This can lead to improved credit scores, increased homeownership rates, and enhanced financial stability. However, for those who do not qualify, the program may feel unfair and could create further economic inequality. Economically, large-scale forgiveness programs could stimulate demand and economic growth by freeing up disposable income. However, there are also concerns about potential inflation and the long-term fiscal sustainability of such programs. For example, the 2021-2022 pandemic-related pause on student loan payments demonstrated a temporary positive effect on consumer spending, but it also highlighted the long-term need for more sustainable solutions. The ultimate economic impact depends heavily on the scale and design of the forgiveness program, as well as the broader economic context.

The Influence of Higher Education Costs

The escalating cost of higher education is a significant factor contributing to the current student loan debt crisis. The rising price of tuition, coupled with stagnant or declining state funding, has forced many students to rely heavily on loans to finance their education. This section explores the key drivers of these rising costs and their direct impact on student indebtedness.

The increasing cost of higher education is a multifaceted problem with no single, easy solution. Several interconnected factors have contributed to this upward trend, creating a perfect storm that has left many students struggling under a mountain of debt.

Factors Contributing to Rising Higher Education Costs

Several factors have contributed to the dramatic increase in the cost of higher education over the past few decades. These include increased administrative expenses, tuition hikes, and reduced state funding for public institutions. The interplay of these factors has resulted in a system where the cost of a college education has far outpaced inflation and wage growth.

The Correlation Between Tuition Costs and Student Loan Debt

A strong correlation exists between the rising cost of tuition and the increasing levels of student loan debt. As tuition fees have climbed, students have increasingly relied on loans to cover the gap between their resources and the ever-increasing cost of attendance. This reliance on borrowing has led to a substantial increase in the average student loan debt burden carried by graduates. This correlation can be visualized as a sharply upward trending line graph.

Visual Representation of Tuition Costs and Student Loan Debt

Imagine a line graph spanning the past two decades (2004-2024). The x-axis represents the year, and the y-axis represents the dollar amount. Two lines are plotted on this graph. The first line, representing average annual tuition costs, starts relatively low in 2004 and steadily increases at a steeper and steeper rate throughout the graph’s duration. The second line, representing average student loan debt per graduate, mirrors the tuition cost line, starting lower but consistently rising and tracking closely with the tuition cost line. The gap between the two lines might slightly widen over time, reflecting the increasing reliance on loans to cover costs even beyond the tuition increase itself. The overall impression is one of a dramatic and consistent upward trend for both tuition costs and student loan debt, clearly illustrating their interconnected relationship. This visual representation would clearly show how the increase in tuition costs directly correlates with and fuels the increase in student loan debt.

Alternatives to Traditional Student Loans

Navigating the complexities of higher education financing doesn’t always necessitate relying solely on traditional student loans. A range of alternative funding options exist, each with its own set of advantages and disadvantages. Understanding these alternatives empowers students and families to make informed decisions that best suit their individual financial circumstances and long-term goals.

Exploring these alternatives can lead to significantly reduced debt burdens and increased financial flexibility after graduation. This section will delve into several key options, comparing their features and highlighting their application processes.

Scholarships

Scholarships represent a form of financial aid that doesn’t require repayment. They are typically awarded based on merit, academic achievement, talent, or demonstrated financial need. A wide array of scholarships exist, sponsored by universities, private organizations, corporations, and even individuals. The application processes vary, often involving essays, transcripts, and letters of recommendation. Securing scholarships can substantially reduce the overall cost of higher education. For example, a student might receive a merit-based scholarship from their university covering a significant portion of their tuition, reducing the need for loans. Another example could be a need-based scholarship from a charitable foundation, providing financial assistance to students from low-income families.

Grants

Similar to scholarships, grants are forms of financial aid that don’t need to be repaid. However, grants are generally awarded based on demonstrated financial need, determined through the completion of the Free Application for Federal Student Aid (FAFSA). Federal Pell Grants are a prime example, offering financial assistance to undergraduate students with exceptional financial need. State governments and individual colleges also offer various grants based on factors like residency, major, or specific academic achievements. A student demonstrating significant financial hardship through the FAFSA might receive a Pell Grant, helping to cover tuition and other educational expenses. State-sponsored grants often have specific eligibility criteria, such as maintaining a certain GPA or pursuing a degree in a high-demand field.

Income Share Agreements (ISAs)

Income Share Agreements offer a unique alternative to traditional loans. With an ISA, investors or organizations provide funding for a student’s education in exchange for a percentage of their future income for a set period. The repayment amount is directly tied to the student’s post-graduation earnings, meaning that higher earners repay more, while lower earners repay less or nothing at all. ISAs can be attractive for students concerned about high debt levels, but they carry the risk of longer repayment periods and potential income limitations. For instance, a student might receive an ISA to cover tuition, agreeing to pay 10% of their income for the next five years after graduation. If their income is high, their repayments will be substantial; however, if their income is low, their repayments may be minimal or nonexistent. The application process for ISAs typically involves a detailed financial assessment and evaluation of the student’s chosen field of study and career prospects.

The Psychological Impact of Student Loan Debt

The weight of significant student loan debt extends far beyond the financial realm, significantly impacting the mental and emotional well-being of borrowers. The constant pressure of repayment, coupled with the uncertainty of the future, can lead to a range of negative psychological consequences, affecting overall life satisfaction and personal relationships. Understanding these impacts is crucial for developing effective coping mechanisms and seeking appropriate support.

The mental health consequences associated with substantial student loan debt are considerable. High levels of stress, anxiety, and depression are commonly reported among borrowers struggling with repayment. This is often exacerbated by feelings of guilt, shame, and failure, particularly when borrowers feel they have fallen short of expectations or are unable to meet their financial obligations. The pervasive nature of this financial burden can seep into all aspects of life, impacting sleep quality, relationships, and overall life satisfaction. Studies have shown a correlation between high student loan debt and increased rates of mental health disorders, highlighting the severity of this often-overlooked consequence.

Stress and Anxiety Related to Student Loan Repayment

The persistent worry about making monthly payments, managing interest accrual, and the long-term implications of debt can lead to chronic stress and anxiety. This can manifest physically through symptoms like headaches, digestive issues, and insomnia. For example, a borrower consistently worrying about defaulting on their loans might experience heightened anxiety leading to difficulty concentrating at work or experiencing strained relationships with family and friends due to the constant financial pressure. Effective stress management techniques, such as mindfulness exercises, regular physical activity, and sufficient sleep, are crucial for mitigating these negative effects.

Depression and Feelings of Hopelessness

The overwhelming nature of student loan debt can contribute to feelings of hopelessness and depression, particularly when borrowers feel trapped in a cycle of debt with no clear path to financial freedom. This can lead to feelings of powerlessness and a sense of being overwhelmed by the situation. For instance, a recent graduate struggling to find a high-paying job while facing mounting loan payments might experience significant depressive symptoms, leading to withdrawal from social activities and a loss of motivation. Seeking professional help from a therapist or counselor can provide essential support and guidance during these challenging times.

Strategies for Managing the Emotional Burden of Student Loan Debt

Creating a realistic budget and sticking to it is paramount. This involves identifying essential expenses, tracking spending habits, and prioritizing loan repayment within the budget. Open communication with family and friends can provide a vital support system, reducing feelings of isolation and providing emotional encouragement. Exploring alternative repayment plans, such as income-driven repayment programs, can alleviate immediate financial pressure and reduce stress. Furthermore, prioritizing self-care activities, such as engaging in hobbies, spending time in nature, or practicing mindfulness, can help manage stress and improve overall well-being.

Resources Available to Help Borrowers Cope

Several resources are available to assist borrowers in managing the psychological impact of student loan debt. Non-profit organizations often offer financial counseling and debt management services, providing guidance and support to borrowers struggling with repayment. Mental health professionals, such as therapists and counselors, can provide crucial support in coping with the emotional toll of debt. Furthermore, many universities and colleges offer career counseling services that can assist graduates in finding employment that aligns with their skills and career goals, improving their financial stability and reducing stress associated with loan repayment. Utilizing these resources can significantly improve the borrower’s mental and emotional well-being during this challenging period.

Ultimate Conclusion

Navigating the complexities of student loan debt requires a multifaceted approach, encompassing financial planning, emotional resilience, and a thorough understanding of available resources. While the challenges are significant, this overview has highlighted the crucial need for informed decision-making, proactive financial management, and advocacy for systemic changes that address the root causes of the student loan crisis. By understanding the various facets of this issue – from the rising costs of education to the psychological impact of debt – individuals can better equip themselves to navigate this challenging terrain and build a secure financial future.

FAQ Section

What happens if I default on my student loans?

Defaulting on student loans has serious consequences, including wage garnishment, tax refund offset, and damage to your credit score, making it difficult to obtain loans or credit in the future.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple federal student loans into a single loan with a new repayment plan. This can simplify repayment but may not always lower your overall interest rate.

Are there any income-based repayment plans available?

Yes, several income-driven repayment plans adjust your monthly payments based on your income and family size. These plans can make repayment more manageable, but they may extend the repayment period.

What if I lose my job and can’t afford my student loan payments?

Contact your loan servicer immediately. They may offer temporary forbearance or deferment, allowing you to temporarily suspend or reduce your payments.