Navigating the complexities of student loan debt can feel overwhelming, but numerous programs exist to offer assistance. This guide explores the diverse landscape of federal and state initiatives designed to alleviate the burden of student loan repayment, providing clarity on eligibility, application processes, and the potential benefits and drawbacks of each program. Understanding these options is crucial for borrowers seeking financial relief and a path towards debt-free living.

From income-driven repayment plans to loan forgiveness programs, the options available can significantly impact your financial future. This resource aims to demystify the process, empowering you with the knowledge to make informed decisions about your student loan repayment strategy. We’ll examine various programs in detail, comparing their features and helping you identify the best fit for your individual circumstances.

Types of Programs

Navigating the landscape of student loan repayment assistance can be challenging. Numerous federal and state programs offer various forms of support, each with its own eligibility criteria and benefits. Understanding these differences is crucial for borrowers seeking to manage their debt effectively. This section will Artikel several key programs and highlight the distinctions between loan forgiveness and repayment assistance.

Federal and State Student Loan Repayment Assistance Programs

The following table summarizes some key federal and state programs. Note that eligibility requirements and program details can change, so it’s essential to consult official government websites for the most up-to-date information. State programs vary significantly, and many states offer additional assistance beyond what’s listed here. This table provides a general overview and is not exhaustive.

| Program Name | Eligibility Requirements | Repayment Methods | Maximum Assistance Amount |

|---|---|---|---|

| Public Service Loan Forgiveness (PSLF) | Work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an income-driven repayment plan. | Income-Driven Repayment Plans | Full loan forgiveness |

| Income-Driven Repayment (IDR) Plans (Federal) | Vary by plan, generally based on income and family size. | Several plans available (IBR, PAYE, REPAYE, ICR); monthly payments are calculated based on income and family size. | Varies by plan and individual circumstances; remaining balance may be forgiven after 20-25 years. |

| Teacher Loan Forgiveness Program | Teach full-time for five consecutive academic years in a low-income school or educational service agency. | Loan forgiveness | Up to $17,500 in qualified loans. |

| State Loan Repayment Assistance Programs (Examples) | Vary widely by state; often require residency and employment in specific fields (e.g., healthcare, teaching). | Loan forgiveness, grants, or direct repayment assistance. | Varies significantly by state and program. |

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing monthly payments on your income and family size. Several federal IDR plans exist, each with slightly different features:

IDR plans offer several key advantages for borrowers struggling with high student loan payments. These plans can significantly reduce monthly payments, potentially making them more affordable. However, it is important to understand that extending the repayment period may lead to paying more in interest over the life of the loan.

- Income-Based Repayment (IBR): Payments are calculated based on your discretionary income and loan amount. The repayment period can be up to 25 years.

- Pay As You Earn (PAYE): Payments are capped at 10% of your discretionary income. The repayment period is 20 years.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, but includes both undergraduate and graduate loans in the calculation. The repayment period is 20 or 25 years.

- Income-Contingent Repayment (ICR): Payments are based on your income and family size, with a repayment period of up to 25 years.

Loan Forgiveness Programs versus Repayment Assistance Programs

Loan forgiveness programs eliminate a portion or all of your student loan debt after meeting specific requirements, while repayment assistance programs lower your monthly payments or provide financial aid to help you repay your loans. Loan forgiveness programs typically require a significant time commitment or service in a specific field, while repayment assistance programs offer more flexible options for borrowers with varying financial situations. The key difference lies in the ultimate outcome: forgiveness eliminates the debt, while assistance modifies the repayment terms.

Eligibility Criteria

Gaining access to student loan repayment assistance programs often hinges on meeting specific eligibility requirements. These criteria vary depending on the program, but generally revolve around income levels, credit history, and the type of student loan you hold. Understanding these prerequisites is crucial for determining your suitability for participation.

Eligibility for these programs is multifaceted, encompassing various financial and personal factors. Meeting all requirements is necessary to qualify for assistance. Failure to meet even one criterion can disqualify an applicant.

Income Thresholds

Many student loan repayment assistance programs set income thresholds to determine eligibility. These thresholds are often expressed as a percentage of the federal poverty guideline or a specific dollar amount, adjusted annually to account for inflation. For example, a program might only assist borrowers whose annual income is below 150% of the federal poverty level for their family size. Applicants will need to provide documentation verifying their income, such as tax returns or pay stubs. Exceeding the income limit automatically disqualifies an applicant.

Credit Score Requirements

Some programs, particularly those involving income-driven repayment plans or loan refinancing options, may consider credit scores. While not all programs mandate a minimum credit score, a higher score can improve your chances of approval and may lead to more favorable terms. A good credit score demonstrates responsible financial behavior, reducing the perceived risk for lenders. Programs may specify a minimum credit score, or they may use credit scores to determine interest rates or repayment terms.

Eligible Loan Types

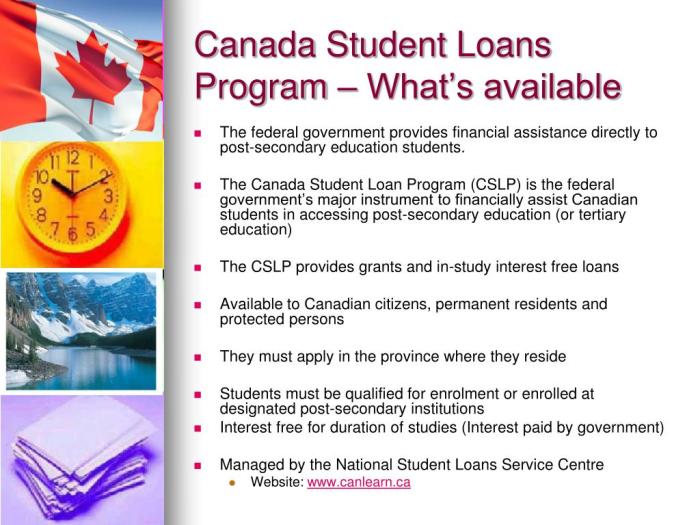

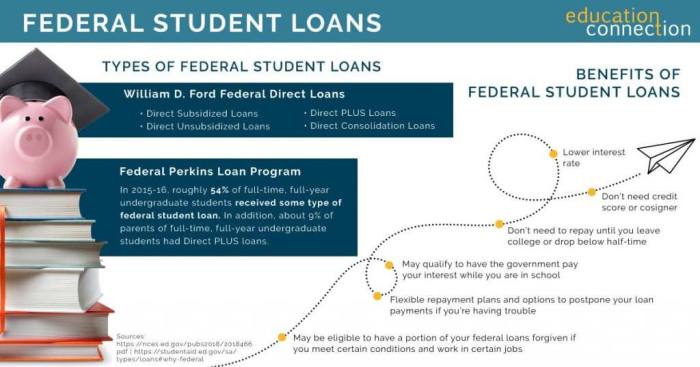

The types of student loans eligible for assistance vary widely. Federal student loans (such as Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans, and Federal Perkins Loans) are often included in many programs. However, private student loans may or may not be eligible, depending on the specific program’s guidelines. Some programs might focus exclusively on federal loans, while others may offer assistance for both federal and private loans, possibly with different terms and conditions for each.

Specific Professions or Fields of Study

Certain professions or fields of study may qualify for additional assistance or loan forgiveness programs. For instance, teachers, nurses, and individuals working in public service positions often have access to loan forgiveness programs based on their employment. Similarly, some programs might target graduates in specific high-demand fields like STEM (Science, Technology, Engineering, and Mathematics) or healthcare. These programs aim to incentivize individuals to pursue careers in critical sectors and alleviate the financial burden of student debt.

Application Process

Applying for student loan repayment programs can seem daunting, but understanding the steps involved simplifies the process. Each program has its own specific requirements and procedures, so careful attention to detail is crucial for a successful application. The following Artikels the general process and provides examples, but it’s essential to consult the official program guidelines for the most accurate and up-to-date information.

Steps Involved in Applying for Student Loan Repayment Programs

The application process typically involves several key steps. While the exact steps may vary slightly depending on the specific program, the overall process remains relatively consistent. Careful review of the program’s website is crucial for ensuring you meet all requirements.

- Gather Required Documentation: Before starting the application, collect all necessary documents to expedite the process. This will prevent delays and ensure a smooth application submission.

- Complete the Application Form: Carefully complete the application form, providing accurate and complete information. Inaccuracies or omissions can lead to delays or rejection of your application.

- Submit the Application: Submit your completed application and all supporting documentation according to the program’s instructions. Confirm receipt of your application to avoid any potential issues.

- Follow Up: After submitting your application, follow up as needed to check on the status of your application. Most programs provide online portals or contact information for updates.

- Review and Accept: Once approved, carefully review the terms and conditions before accepting the program’s offer. Understanding the terms is vital to managing your repayment effectively.

Required Documentation Examples

Providing complete and accurate documentation is critical for a successful application. Missing documents can lead to delays or rejection. The following are examples of commonly required documents; however, the specific requirements vary depending on the program.

- Federal Student Aid (FAFSA) Data: Many programs require access to your FAFSA data to verify your student loan information.

- Tax Returns (IRS Forms 1040): Proof of income is often required to determine eligibility for income-driven repayment plans.

- Proof of Employment: Some programs may require documentation to verify your employment status and income.

- Student Loan Documentation: You will need to provide details of your student loans, including loan amounts, interest rates, and lenders.

- Identification Documents: Valid government-issued identification is usually required to verify your identity.

Program Timelines and Processing Times

Processing times vary significantly depending on the program and the volume of applications. Some programs may provide a specific timeframe, while others may offer only an estimate. It is important to allow sufficient time for processing.

For example, some income-driven repayment plans might take several weeks to process, while others might take a few months. Certain forgiveness programs could have even longer processing times due to the extensive verification required. Regularly checking the status of your application is recommended.

Program Benefits and Limitations

Understanding the benefits and limitations of various student loan repayment assistance programs is crucial for making informed decisions. Different programs offer varying levels of support, and it’s important to weigh these advantages against potential drawbacks before enrolling. Careful consideration of your individual financial situation and long-term goals is essential.

Program benefits can include reduced monthly payments, loan forgiveness, and ultimately, a faster path to becoming debt-free. However, limitations might involve eligibility requirements, income restrictions, and potential tax implications. A thorough understanding of these factors will empower you to choose the program best suited to your needs.

Program Comparison

The following table compares and contrasts the benefits and limitations of three hypothetical student loan repayment assistance programs. Remember that specific program details vary and should be verified directly with the program provider.

| Program Name | Benefits | Limitations | Potential Downsides |

|---|---|---|---|

| Income-Based Repayment (IBR) | Lower monthly payments based on income and family size; potential for loan forgiveness after 20-25 years. | Higher total interest paid over the life of the loan; complex calculations and potential for unexpected payment increases. | Longer repayment period leading to higher overall interest costs; potential for difficulties if income fluctuates significantly. |

| Public Service Loan Forgiveness (PSLF) | Complete loan forgiveness after 120 qualifying monthly payments while working full-time for a qualifying government or non-profit organization. | Strict eligibility requirements; requires consistent employment in a qualifying role; potential for delays or denials if documentation isn’t perfect. | Requires a commitment to working in public service for an extended period; no forgiveness if requirements aren’t met precisely. |

| Employer Repayment Assistance | Employer contributes directly to loan repayment; reduces borrower’s monthly payment burden. | Limited availability; dependent on employer participation; may be subject to employer’s specific rules and conditions. | Loss of benefit if employment changes; potential tax implications on employer contributions (see below). |

Tax Implications

Student loan repayment assistance programs can have significant tax implications. For example, employer contributions towards student loan repayment are often considered taxable income to the employee. This means the employee will need to report this amount on their tax return and pay income tax on it. Conversely, loan forgiveness under programs like PSLF may be considered taxable income in some circumstances, although there are currently some exceptions. It is crucial to consult a tax professional to understand the specific tax implications of any program you are considering.

Hypothetical Scenario

Let’s consider Sarah, a teacher with $50,000 in student loan debt. She’s considering the PSLF program. Without PSLF, her monthly payment might be $500, resulting in total interest payments of $30,000 over 10 years. With PSLF, assuming she meets all requirements, her monthly payments are still $500 for 10 years, but after 120 qualifying payments, the remaining balance is forgiven. While she pays the same monthly amount, the total interest paid will be significantly less than $30,000. However, she needs to consider the opportunity cost of working in public service for 10 years. She also needs to factor in the potential tax implications of the forgiven loan amount. This example highlights the complexities of evaluating the financial impact of such programs.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program is a federal initiative designed to incentivize individuals pursuing careers in public service by offering loan forgiveness after 120 qualifying monthly payments. This program can significantly reduce or eliminate student loan debt for eligible borrowers, providing much-needed financial relief. Understanding the eligibility requirements and the step-by-step process is crucial for successful participation.

Eligibility Requirements for PSLF

The PSLF program has specific requirements for both the type of employment and the types of loans that qualify. Meeting all criteria is essential for loan forgiveness consideration. Failure to meet even one requirement can disqualify a borrower from the program.

Qualifying Employment

To qualify for PSLF, you must work full-time for a government organization or a non-profit organization. “Full-time” is generally defined as at least 30 hours per week. The employer must be a federal, state, local, or tribal government organization or a 501(c)(3) non-profit organization. Independent contractors generally do not qualify. Your employment must be continuous; temporary or intermittent positions may not count towards the 120 payments.

Examples of Qualifying Professions

Many professions contribute to public service and may qualify for PSLF. Here are some examples:

- Teachers (public schools)

- Law enforcement officers

- Firefighters

- Social workers

- Public defenders

- Military service members

- Non-profit organization employees (in roles directly supporting the organization’s mission)

It is crucial to verify your employer’s eligibility directly through the PSLF website.

Qualifying Loan Types

Only certain types of federal student loans are eligible for PSLF. Direct Loans are eligible, but Federal Family Education Loans (FFEL) and Perkins Loans generally are not, unless they have been consolidated into a Direct Consolidation Loan. Borrowers should carefully review their loan documents to ensure eligibility.

The PSLF Step-by-Step Process

The PSLF process involves several key steps:

- Consolidate Loans (if necessary): If you have FFEL or Perkins Loans, consolidate them into a Direct Consolidation Loan.

- Complete the PSLF Form: Annually, or whenever there’s a change in employment, submit the PSLF Employment Certification Form to your loan servicer. This form requires your employer to verify your employment and hours worked.

- Make 120 Qualifying Payments: Make 120 qualifying monthly payments under an income-driven repayment plan while employed full-time by a qualifying employer.

- Track Your Progress: Regularly check your loan servicer’s website for updates on your PSLF progress.

- Apply for Forgiveness: After making 120 qualifying payments, apply for loan forgiveness through your loan servicer.

Note: Payments made before consolidation into a Direct Loan may not count toward the 120 payment requirement. It is vital to maintain accurate records of your employment and payments.

Finding Reliable Information

Navigating the world of student loan repayment assistance can be confusing, with a plethora of information available from various sources. It’s crucial to distinguish credible information from misinformation to make informed decisions about your financial future. Understanding where to find accurate and trustworthy data is paramount to successfully managing your student loan debt.

Locating reliable information requires a discerning approach. Many organizations provide helpful resources, but it’s essential to critically evaluate the source’s credibility and the information’s accuracy before acting on it. Misleading information can have significant financial consequences.

Reliable Information Sources

Finding trustworthy information about student loan repayment programs is essential for making informed decisions. The following resources offer accurate and up-to-date details:

- Federal Student Aid (FSA): The official website of the U.S. Department of Education’s Federal Student Aid office (studentaid.gov) is the primary source for information on federal student loan programs. It provides detailed explanations of eligibility requirements, application processes, and repayment options.

- National Foundation for Credit Counseling (NFCC): The NFCC (nfcc.org) is a non-profit organization that offers free and low-cost credit counseling services. They provide unbiased information on various debt management strategies, including student loan repayment.

- Your Loan Servicer: Your loan servicer is the company responsible for managing your student loans. They can provide personalized information about your specific loans and repayment options. Contact information is usually found on your monthly statement or on the servicer’s website.

- The Consumer Financial Protection Bureau (CFPB): The CFPB (consumerfinance.gov) is a U.S. government agency that protects consumers’ financial rights. They offer resources and information on various financial topics, including student loan debt.

Verifying Information Source Legitimacy

Before relying on any information source, it’s crucial to verify its legitimacy. Consider these strategies:

Look for official government websites (.gov) or established non-profit organizations (.org). Be wary of websites with generic top-level domains (.com) unless they are well-known and reputable. Check for contact information, such as a physical address and phone number. Legitimate organizations are usually transparent about their contact details. Examine the website’s “About Us” section for information about the organization’s mission, history, and staff. Look for evidence of third-party endorsements or affiliations with reputable organizations. Cross-reference information found on one website with other credible sources to ensure consistency. If the information is drastically different across multiple sources, it may be unreliable.

Understanding Program Terms and Conditions

Before applying for any student loan repayment assistance program, thoroughly review the terms and conditions. This includes understanding the eligibility criteria, repayment schedule, potential penalties for non-compliance, and any associated fees. Failing to fully understand these terms can lead to unexpected financial burdens. Carefully read all program documentation and seek clarification from the program administrator if anything is unclear. Consider seeking advice from a financial advisor or credit counselor to help you navigate the complexities of student loan repayment programs.

Closing Summary

Successfully managing student loan debt requires careful planning and a thorough understanding of the available resources. This guide has provided an overview of various programs designed to assist in repayment, highlighting eligibility criteria, application processes, and potential benefits. By understanding the nuances of each program and utilizing the provided resources, borrowers can navigate the complexities of student loan repayment more effectively and work towards a more financially secure future. Remember to thoroughly research and verify information from reliable sources before making any decisions.

FAQ Section

What is the difference between loan forgiveness and repayment assistance?

Loan forgiveness programs eliminate a portion or all of your student loan debt, while repayment assistance programs modify your repayment plan to make it more manageable, often through lower monthly payments.

Are private student loans eligible for any of these programs?

Most federal programs primarily cover federal student loans. Eligibility for private loans varies significantly depending on the specific program and lender.

What happens if I miss a payment while participating in a repayment assistance program?

Missing payments can negatively impact your credit score and may jeopardize your eligibility for continued participation in the program. Contact your loan servicer immediately if you anticipate difficulties making payments.

How long does the application process typically take?

Processing times vary depending on the program and the volume of applications. Allow ample time for processing and expect potential delays.