Navigating the complexities of student loan debt can feel overwhelming, but understanding the available assistance programs is crucial for financial well-being. This guide provides a comprehensive overview of federal and state programs designed to alleviate the burden of student loan repayment, offering insights into eligibility criteria, application processes, and effective debt management strategies. We’ll explore various repayment plans, loan forgiveness options, and resources to help borrowers make informed decisions and achieve long-term financial stability.

From income-driven repayment plans to loan forgiveness programs targeting specific professions, the landscape of student loan assistance is diverse. This guide aims to demystify the process, empowering readers with the knowledge to navigate this crucial aspect of personal finance effectively. We will delve into the practical aspects of managing student loan debt, including budgeting tips and strategies for avoiding default. The ultimate goal is to equip borrowers with the tools and resources they need to succeed.

Types of Student Loan Assistance Programs

Navigating the complexities of student loan repayment can be daunting. Fortunately, several federal and state programs offer assistance to borrowers facing financial hardship or seeking to manage their debt more effectively. Understanding the different types of programs and their eligibility requirements is crucial for making informed decisions about your repayment strategy.

This section provides an overview of various student loan assistance programs available in the United States, highlighting their key features and differences. We will explore both federal and state initiatives, emphasizing the distinctions between income-driven repayment plans and other repayment options.

Federal and State Student Loan Assistance Programs

The following table summarizes some key federal and state programs. Note that eligibility requirements and program details can change, so it’s essential to consult the official program websites for the most up-to-date information.

| Program Name | Eligibility Requirements | Type of Assistance | Application Process |

|---|---|---|---|

| Federal Income-Driven Repayment (IDR) Plans (e.g., ICR, PAYE, REPAYE,IBR) | Federal student loans; meet income requirements | Adjusted monthly payments based on income and family size | Apply through your loan servicer |

| Public Service Loan Forgiveness (PSLF) | Federal student loans; work full-time for a qualifying government or non-profit organization; make 120 qualifying monthly payments under an IDR plan | Loan forgiveness after 120 qualifying payments | Apply through your loan servicer |

| Teacher Loan Forgiveness Program | Federal student loans; teach full-time for five consecutive academic years in a low-income school or educational service agency | Loan forgiveness up to $17,500 | Apply through your loan servicer |

| State-Specific Programs (vary widely) | Vary by state; often require residency and specific employment or income criteria | Vary by state; may include grants, loan repayment assistance, or tax benefits | Vary by state; check your state’s higher education agency website |

Income-Driven Repayment Plans vs. Other Repayment Options

Income-driven repayment (IDR) plans and standard repayment plans differ significantly in how monthly payments are calculated and the overall repayment timeline.

IDR plans base monthly payments on your income and family size, resulting in lower monthly payments than standard plans. However, this often leads to a longer repayment period and potentially higher total interest paid over the life of the loan. Standard repayment plans have fixed monthly payments over a 10-year period, leading to quicker loan payoff but potentially higher monthly payments.

Other repayment options include extended repayment plans (longer repayment periods than standard plans) and graduated repayment plans (payments increase over time).

Benefits and Drawbacks of Income-Driven Repayment Plans

IDR plans offer several advantages but also come with potential disadvantages. Careful consideration of both is crucial before enrolling.

- Benefits: Lower monthly payments, making budgeting easier; potential for loan forgiveness after a specified period (e.g., PSLF).

- Drawbacks: Longer repayment period, leading to higher total interest paid; complex eligibility requirements; potential for unexpected changes in payment amounts based on income fluctuations.

Benefits and Drawbacks of Standard Repayment Plans

Standard repayment plans provide a straightforward approach to loan repayment, but it’s important to understand the potential challenges.

- Benefits: Fixed monthly payments, simplifying budgeting; shorter repayment period, leading to less interest paid overall.

- Drawbacks: Higher monthly payments, potentially straining finances; no potential for loan forgiveness.

Eligibility Criteria for Student Loan Programs

Navigating the landscape of student loan assistance programs requires a clear understanding of eligibility requirements. These criteria vary significantly depending on the specific program, and meeting the requirements for one program doesn’t automatically guarantee eligibility for another. This section will Artikel key eligibility factors for major federal programs and provide examples of situations where individuals might qualify for multiple types of assistance.

Eligibility for federal student loan forgiveness and repayment assistance programs hinges on several key factors. These factors often include the type of loan, employment in public service or specific fields, income level, and loan repayment history. It is crucial to carefully review the specific requirements for each program, as they can change.

Federal Student Loan Forgiveness Program Eligibility Requirements

Several federal programs offer loan forgiveness, but eligibility varies greatly. For instance, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. The Teacher Loan Forgiveness program, on the other hand, has different requirements, focusing on teaching in low-income schools or educational service agencies for five consecutive academic years. Finally, the Income-Driven Repayment (IDR) plans, while not forgiveness programs themselves, can lead to loan forgiveness after a certain number of years, based on income and loan balance. Each program has specific and often stringent requirements.

Examples of Qualifying for Multiple Programs

It’s possible to qualify for multiple student loan assistance programs simultaneously or sequentially. For example, a teacher working for a qualifying non-profit organization could potentially qualify for both the PSLF program and the Teacher Loan Forgiveness program, although they would likely need to choose which program to pursue, as benefits cannot be doubled. Similarly, someone working in public service and utilizing an IDR plan could eventually qualify for loan forgiveness through both the IDR plan and the PSLF program, provided they meet all the respective requirements for each. These scenarios highlight the complexity of the system and the importance of careful planning.

Flowchart for Determining Eligibility

A flowchart can simplify the decision-making process. The flowchart would begin with a question about the type of loan held (Federal vs. Private). For Federal loans, the next step would be to identify the type of employment (Public Service, Teaching, etc.). Based on employment type, the flowchart would branch to different programs (PSLF, Teacher Loan Forgiveness, etc.). If the employment type doesn’t align with specific programs, the flowchart would lead to an assessment of income to determine eligibility for IDR plans. For private loans, the flowchart would direct the individual to explore private loan refinancing or hardship programs, highlighting the differences between federal and private loan assistance options. This flowchart visually represents the path to determining eligibility, emphasizing the need for individualized assessment based on the specific circumstances.

Application Processes and Required Documentation

Applying for student loan assistance can seem daunting, but understanding the process and required documentation for each program simplifies the task. This section Artikels the application procedures and necessary paperwork for several common programs, emphasizing the similarities and differences to aid in your decision-making. Remember to always check the official program websites for the most up-to-date information.

The application process generally involves completing an application form, gathering supporting documents, and submitting the completed application. The specific requirements and timelines vary depending on the program.

Federal Student Loan Consolidation Application Process

The application process for federal student loan consolidation involves several key steps. This process simplifies repayment by combining multiple federal loans into a single loan with a potentially lower monthly payment.

- Complete the Consolidation Application: This is typically done online through the Federal Student Aid website (studentaid.gov).

- Gather Required Documentation: This includes your Federal Student Aid ID (FSA ID), Social Security number, and information about your existing federal student loans.

- Review and Submit: Carefully review your application for accuracy before submitting it electronically.

- Await Processing: The processing time varies, but you’ll receive notification once your application is processed and your loan is consolidated.

Common documents required for federal student loan consolidation include:

- Federal Student Aid ID (FSA ID)

- Social Security Number

- Information on all federal student loans to be consolidated (loan numbers, lenders, balances)

Income-Driven Repayment Plan Application Process

Income-driven repayment plans adjust your monthly student loan payments based on your income and family size. The application process is straightforward but requires providing financial information.

- Determine Eligibility: Check if you qualify for an income-driven repayment plan based on your income and loan type.

- Complete the Application: This is often done online through your loan servicer’s website.

- Provide Income Documentation: You’ll need to submit proof of income, such as tax returns or pay stubs.

- Submit Application and Supporting Documents: Submit your completed application and all required documents to your loan servicer.

Common documents required for income-driven repayment plans include:

- Tax returns (IRS Form 1040)

- Pay stubs

- Proof of family size (e.g., birth certificates)

- Loan information (loan numbers, balances)

Private Student Loan Refinance Application Process

Refinancing a private student loan involves replacing your existing loan with a new one from a different lender, potentially at a lower interest rate. The application process typically involves a credit check.

- Compare Lenders and Rates: Research different lenders and compare their interest rates, fees, and repayment terms.

- Complete the Application: Complete the online application provided by the chosen lender.

- Provide Financial Information: This usually includes your income, credit history, and information about your existing private student loans.

- Undergo Credit Check: The lender will perform a credit check to assess your creditworthiness.

- Await Approval: The lender will review your application and notify you of their decision.

Common documents required for private student loan refinancing include:

- Proof of income (tax returns, pay stubs)

- Information on existing private student loans (loan numbers, balances, lenders)

- Social Security number

- Bank statements

Comparison of Federal and Private Loan Application Processes

The following table summarizes the key differences in the application processes for federal and private student loan programs.

| Feature | Federal Loan Programs | Private Loan Programs |

|---|---|---|

| Application Process | Generally online through studentaid.gov; simpler process | Typically online through lender’s website; more complex process |

| Credit Check | Not required for most federal loan programs | Usually required; impacts interest rate and approval |

| Income Verification | Required for income-driven repayment plans | Often required for loan approval and determining interest rate |

| Documentation | FSA ID, Social Security number, loan information | Proof of income, credit history, loan information, bank statements |

Managing Student Loan Debt Effectively

Successfully navigating student loan repayment requires a proactive and organized approach. Effective strategies combine careful budgeting, smart repayment planning, and a commitment to avoiding default. Understanding your options and actively managing your debt can significantly reduce stress and improve your long-term financial health.

Budgeting and Managing Student Loan Payments

Creating a realistic budget is the cornerstone of effective student loan management. This involves tracking all income and expenses to identify areas where savings can be maximized. Prioritize student loan payments within your budget, considering the interest rates and repayment terms of each loan. Explore different repayment plans, such as income-driven repayment (IDR) plans, which adjust payments based on your income and family size. These plans can lower monthly payments, but they may extend the repayment period and increase the total interest paid over the life of the loan. Regularly reviewing and adjusting your budget ensures it remains aligned with your financial circumstances. For example, a borrower might allocate 20% of their monthly income towards student loan payments, prioritizing these payments above discretionary spending like entertainment or dining out.

Avoiding Student Loan Default

Defaulting on student loans has severe consequences, including damage to your credit score, wage garnishment, and potential tax refund offset. To avoid default, maintain open communication with your loan servicer. Contact them immediately if you anticipate difficulty making payments. Explore options such as deferment or forbearance, which temporarily suspend or reduce payments. However, remember that interest may still accrue during these periods. Consider consolidating your loans to simplify repayment and potentially lower your monthly payment. Finally, consistently making even minimum payments demonstrates responsibility and helps avoid default. For instance, if a borrower anticipates job loss, proactively contacting their servicer to explore options like forbearance is crucial to prevent default.

Resources for Borrowers Facing Financial Hardship

Numerous resources are available to assist borrowers experiencing financial difficulties. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, helping borrowers create a budget and negotiate with creditors. The U.S. Department of Education provides information on various repayment plans and hardship programs. Additionally, many non-profit organizations offer financial literacy workshops and resources specifically tailored to student loan borrowers. These organizations can provide personalized guidance and support, helping borrowers navigate complex repayment options and avoid default. For example, the Student Loan Borrower Assistance website offers a wealth of information and resources to help borrowers understand their options and make informed decisions.

Understanding Loan Forgiveness and Cancellation Programs

Loan forgiveness and cancellation programs offer a lifeline to borrowers struggling with student loan debt. These programs, offered by the federal government and sometimes by private lenders, can significantly reduce or eliminate your loan balance under specific circumstances. Understanding the eligibility requirements and the potential benefits is crucial for determining if you qualify for assistance.

Public Service Loan Forgiveness (PSLF) Program Criteria

The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility hinges on several factors. Borrowers must have Direct Loans; Federal Family Education Loans (FFEL) and Perkins Loans are not eligible unless they’ve been consolidated into Direct Consolidation Loans. Employment must be continuous full-time for a qualifying employer, and payments must be made on time. The program’s complexities necessitate careful attention to detail throughout the repayment process. Any errors in the application process or payment history could result in ineligibility.

Teacher Loan Forgiveness Program Requirements

The Teacher Loan Forgiveness program offers forgiveness for up to $17,500 of your federal student loans if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency. To qualify, you must teach in a public or private elementary, secondary, or special education school that serves students from low-income families. Specific documentation proving employment and the school’s low-income status is required. This program is specifically designed to incentivize individuals to pursue teaching careers in underserved communities.

Loan Forgiveness Programs for Specific Careers or Professions

Several loan forgiveness programs exist for specific careers beyond teaching and public service. These programs often target professions in high demand or those serving underserved populations. For example, some states or organizations offer loan forgiveness or repayment assistance for healthcare professionals working in rural areas or those specializing in specific medical fields facing shortages. These programs usually have specific requirements regarding the type of employment, the length of service, and the location of work. Eligibility criteria vary greatly depending on the specific program and the sponsoring organization.

Calculating Potential Savings from Loan Forgiveness Programs

Calculating potential savings requires understanding your current loan balance, interest rate, and the amount of forgiveness offered by the program. Let’s consider a hypothetical scenario. Suppose a borrower has a $50,000 loan with a 5% interest rate. If they qualify for $17,500 in Teacher Loan Forgiveness, their remaining loan balance would be $32,500. Over the life of the loan, this represents significant savings, both in the principal amount and the interest accrued. The exact savings will depend on the repayment plan chosen and the length of time to repay the remaining balance. Using a loan amortization calculator readily available online, borrowers can easily calculate the precise savings they could achieve under different loan forgiveness scenarios. For instance, a $10,000 reduction in a $50,000 loan at 6% interest could save thousands of dollars in total interest payments over the loan’s lifetime.

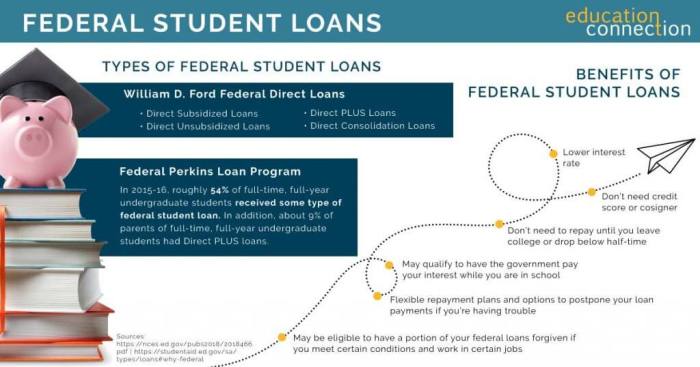

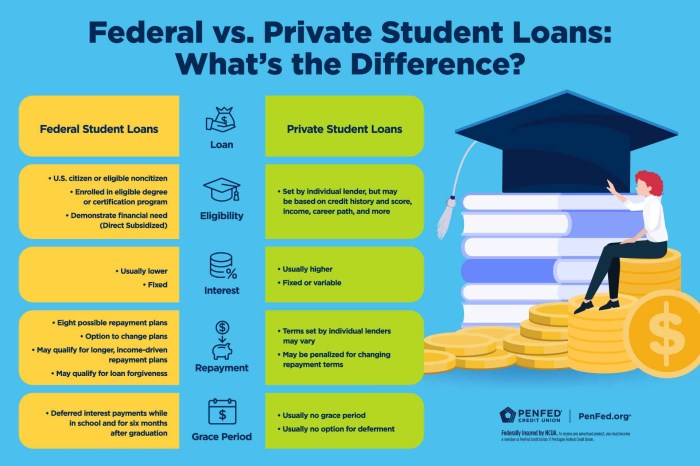

Comparison of Private vs. Federal Student Loan Repayment Options

Choosing between federal and private student loans significantly impacts your repayment journey. Understanding the differences in repayment options, interest rates, and fees is crucial for making informed financial decisions. This section compares and contrasts the key features of each loan type to help you navigate the complexities of student loan repayment.

Federal and private student loans offer distinct repayment structures and associated benefits and drawbacks. Federal loans generally provide more borrower protections and flexible repayment options, while private loans may offer lower interest rates for borrowers with excellent credit. However, private loans often lack the same government-backed safeguards.

Federal Student Loan Repayment Options

Federal student loans offer a variety of repayment plans designed to accommodate diverse financial situations. These plans aim to make repayment manageable while ensuring borrowers eventually pay off their debt. The availability of income-driven repayment plans is a significant advantage for federal loans.

Private Student Loan Repayment Options

Private student loans typically offer fewer repayment options compared to federal loans. Repayment plans are usually standard, fixed-rate plans, with less flexibility to adjust payments based on income or financial hardship. Borrowers should carefully review the terms of their private loan agreements before signing.

Comparison of Interest Rates, Fees, and Repayment Terms

The following table summarizes the key differences between federal and private student loan interest rates, fees, and repayment terms. Note that specific rates and fees can vary depending on the lender, creditworthiness, and loan type.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Generally fixed, but can vary based on loan type and interest rate index. Rates are typically lower than private loans, especially for subsidized loans. | Variable or fixed; rates are typically higher and depend on the borrower’s credit score and market conditions. Higher credit scores often result in lower interest rates. |

| Fees | May include origination fees, which are deducted from the loan disbursement. Fees are generally lower than those associated with private loans. | Can include origination fees, prepayment penalties, and other fees. These fees can significantly increase the overall cost of the loan. |

| Repayment Terms | Offer a range of repayment plans, including standard, graduated, extended, and income-driven repayment options. Loan forgiveness programs may also be available. | Typically offer standard repayment plans with fixed monthly payments over a set period. Flexibility in repayment terms is generally limited. |

| Borrower Protections | Include deferment and forbearance options in times of financial hardship, as well as government protections against unfair lending practices. | Fewer borrower protections; options for deferment and forbearance are less common and may be subject to lender approval. There’s less regulatory oversight. |

Advantages and Disadvantages of Federal and Private Student Loans

Choosing between federal and private loans requires weighing the advantages and disadvantages of each. Federal loans generally offer more borrower protections and flexible repayment options, but may have higher interest rates for some borrowers. Private loans might offer lower interest rates for those with good credit, but lack the same level of consumer protection. The best choice depends on individual circumstances and financial profiles.

Impact of Student Loan Debt on Personal Finances

Student loan debt can significantly impact personal finances, extending far beyond the immediate repayment period. The weight of these loans can influence major life decisions and create long-term financial constraints, affecting everything from saving for retirement to achieving financial independence. Understanding these potential consequences is crucial for effective debt management and planning for a secure financial future.

The long-term financial consequences of student loan debt are multifaceted. High monthly payments can reduce disposable income, limiting the ability to save for emergencies, retirement, or other significant financial goals. This can lead to delayed homeownership, restricted investment opportunities, and difficulty building wealth. Furthermore, the interest accrued over time can substantially increase the total amount owed, prolonging the repayment period and exacerbating the financial burden. For example, a $50,000 loan at a 6% interest rate could easily balloon to over $70,000 over ten years if not managed effectively.

Effect on Major Life Decisions

Student loan debt often delays or prevents major life milestones. The financial strain of monthly payments can make buying a home, a significant investment requiring a large down payment and ongoing mortgage costs, significantly more challenging. Similarly, starting a family can be impacted; the expenses associated with raising children, from childcare to education, are already considerable, and adding substantial loan payments can create significant financial pressure. Many individuals postpone marriage or having children until their debt is managed more effectively, highlighting the pervasive influence of student loans on personal choices. For instance, a couple burdened with combined student loan debt of $100,000 might find it extremely difficult to save for a down payment on a house and simultaneously manage the costs of raising a child.

Impact of Different Repayment Strategies

The choice of repayment strategy significantly impacts long-term financial well-being. A standard repayment plan, while straightforward, may stretch repayments over a long period, leading to significantly higher interest payments. Income-driven repayment plans, on the other hand, adjust payments based on income, offering short-term relief but potentially extending the repayment period even further. Refinancing, while potentially lowering interest rates, may require excellent credit and could involve additional fees. For example, someone choosing a standard repayment plan for a $40,000 loan at 7% interest might pay significantly more in interest over the life of the loan compared to someone who refinanced at a lower interest rate or opted for an income-driven plan that initially lowers monthly payments but extends the repayment timeframe. The optimal strategy depends on individual financial circumstances and risk tolerance.

Resources and Support for Student Loan Borrowers

Navigating the complexities of student loan repayment can be challenging. Fortunately, numerous resources and support systems exist to guide borrowers through the process, from understanding repayment options to resolving payment difficulties. This section provides an overview of these vital resources and practical steps to take when facing financial hardship.

Accessing the right support is crucial for successful student loan management. Whether you need help understanding your repayment plan, exploring options for loan forgiveness, or dealing with financial difficulties, there are organizations and government agencies ready to assist.

Reputable Websites and Organizations Offering Assistance

Several reputable websites and organizations provide comprehensive information and support to student loan borrowers. These resources offer guidance on various aspects of loan management, from understanding repayment plans to exploring options for loan forgiveness or consolidation.

- Federal Student Aid (FSA): The official U.S. Department of Education website for federal student aid. Provides information on loan repayment plans, forgiveness programs, and other relevant resources. Contact information can be found on their website.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering free and low-cost credit counseling services, including student loan debt management. They can help create a budget, negotiate with lenders, and explore debt management options.

- Student Loan Borrower Assistance (SLBA): Many non-profit organizations provide assistance to student loan borrowers. These organizations often offer free counseling and advocacy services. It is advisable to research organizations in your area or nationally recognized ones.

Contact Information for Relevant Government Agencies and Non-Profit Organizations

Direct contact with the relevant authorities can expedite the resolution of student loan issues. Below are some key contacts.

| Organization | Website | Phone Number (Example – replace with actual numbers) |

|---|---|---|

| Federal Student Aid (FSA) | studentaid.gov | 1-800-4-FED-AID |

| National Foundation for Credit Counseling (NFCC) | nfcc.org | (Example – replace with actual number) |

| (Add other relevant organizations and their contact information) |

Steps to Take When Struggling to Make Student Loan Payments

Facing difficulty in making student loan payments requires proactive steps to avoid default. Early intervention is key to preventing serious financial consequences.

- Contact your loan servicer immediately: Do not wait until you miss a payment. Explain your situation and explore available options.

- Explore repayment plan options: Inquire about income-driven repayment plans (IDR), which adjust your monthly payments based on your income and family size. Deferment or forbearance may also be available, temporarily suspending payments.

- Seek professional financial counseling: A credit counselor can help you create a budget, prioritize debts, and explore debt management strategies.

- Consider loan consolidation: Combining multiple loans into a single loan can simplify repayment and potentially lower your monthly payments.

- Explore loan forgiveness or cancellation programs: Certain professions or circumstances may qualify you for loan forgiveness or cancellation. Research the eligibility requirements for these programs.

Last Word

Successfully managing student loan debt requires proactive planning and a thorough understanding of available resources. This guide has provided a framework for navigating the complexities of student loan assistance programs, from exploring eligibility criteria and application processes to implementing effective debt management strategies. By leveraging the information presented here, borrowers can make informed decisions, optimize their repayment plans, and ultimately achieve long-term financial security. Remember to explore all available options and seek professional advice when needed.

FAQ Guide

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically offer more flexible repayment options and protections for borrowers. Private loans are from banks or lenders and often have stricter terms.

Can I consolidate my student loans?

Yes, loan consolidation combines multiple loans into one, potentially simplifying repayment. However, it may not always lower your interest rate.

What happens if I default on my student loans?

Defaulting can lead to wage garnishment, tax refund offset, and damage to your credit score. It’s crucial to contact your loan servicer if you’re struggling to make payments.

Are there any programs for borrowers with disabilities?

Yes, programs like Total and Permanent Disability discharge may be available to borrowers who meet specific criteria.