Navigating the complex landscape of higher education financing often leads students and families to consider private student loans as a supplementary funding source. These loans, while offering potential benefits, also present significant risks. Understanding the intricacies of interest rates, repayment options, and the potential impact on credit scores is crucial before committing to this financial path. This exploration will delve into the key advantages and disadvantages of private student loans, providing a comprehensive overview to aid informed decision-making.

This analysis will examine the various factors involved in securing and repaying private student loans, comparing them to federal loan alternatives. We will explore the nuances of interest rates, fees, and repayment plans, highlighting the potential long-term financial implications. The goal is to equip readers with the knowledge necessary to make responsible choices regarding their higher education financing.

Interest Rates and Fees

Private student loans, unlike federal loans, are offered by private lenders such as banks and credit unions. This means the terms and conditions, including interest rates and fees, can vary significantly. Understanding these differences is crucial for making informed borrowing decisions. This section will detail the key aspects of interest rates and fees associated with private student loans.

Private student loan interest rates are generally higher than those of federal student loans. Federal student loan rates are set by the government and tend to be more competitive, especially for undergraduate students. For example, a federal unsubsidized loan might have an interest rate of around 5% for the 2023-2024 academic year, while a comparable private loan could range from 7% to 15% or even higher, depending on the borrower’s creditworthiness and the lender. The actual interest rate will also depend on the loan term; longer loan terms typically result in higher interest rates to compensate the lender for the increased risk.

Interest Rate Comparison: Private vs. Federal Loans

The difference in interest rates between private and federal loans can significantly impact the total cost of repayment. Consider a $20,000 loan. Over a 10-year repayment period, a 5% interest rate (like a federal loan) would result in approximately $6,000 in interest, whereas a 10% interest rate (a common rate for private loans) would result in approximately $12,000 in interest. This illustrates the substantial cost difference that even a small percentage point increase can create over the life of the loan.

Private Student Loan Fees

In addition to interest, private student loans often include various fees that can add to the overall cost. These fees can vary significantly between lenders. Common fees include origination fees, late payment fees, and prepayment penalties. Understanding these fees is crucial for budgeting and choosing the right lender.

Comparison of Fees Across Lenders

The following table compares common fees charged by several major private student loan lenders (Note: These are examples and actual fees may vary based on the specific loan terms and the lender’s policies. Always check with the lender for the most up-to-date information).

| Fee Type | Lender A | Lender B | Lender C |

|---|---|---|---|

| Origination Fee | 1% of loan amount | 0% | 0.5% of loan amount |

| Late Payment Fee | $25-$50 | $30 | $25 |

| Prepayment Penalty | None | None | 3 months’ interest |

Variable vs. Fixed Interest Rates

Private student loans typically offer both variable and fixed interest rates. A fixed interest rate remains constant throughout the loan term, making it easier to budget and predict the total cost of repayment. A variable interest rate, on the other hand, fluctuates with market conditions. While a variable rate might start lower than a fixed rate, it can increase significantly over time, leading to unpredictable and potentially higher overall costs. Borrowers should carefully consider their risk tolerance and financial situation before choosing between a variable and fixed interest rate.

Loan Repayment Options

Choosing the right repayment plan for your private student loan is crucial for managing your debt effectively. The plan you select significantly impacts your monthly payments, the total interest you pay over the life of the loan, and your overall financial health. Understanding the various options available allows you to make an informed decision that aligns with your financial circumstances and long-term goals.

Private student loan lenders typically offer several repayment plans, each with its own set of advantages and disadvantages. The best option depends on your individual financial situation, including your income, expenses, and debt tolerance. It’s essential to carefully consider all aspects before committing to a specific plan.

Repayment Plan Options

Several repayment plans are commonly offered for private student loans. These plans differ primarily in the length of the repayment period and the amount of the monthly payment. Let’s examine the most prevalent options:

- Standard Repayment: This is typically a fixed monthly payment plan spread over a set number of years (e.g., 10 or 15 years). It offers predictable payments but may result in higher monthly payments compared to other options.

- Graduated Repayment: Payments start low and gradually increase over time, typically annually. This can be beneficial in the early stages of your career when your income is likely lower. However, your payments will become substantially larger later in the repayment term.

- Extended Repayment: This plan stretches the repayment period over a longer timeframe, leading to lower monthly payments. However, you will pay significantly more interest over the life of the loan.

- Income-Driven Repayment (IDR): While less common for private loans than federal loans, some lenders may offer IDR plans. These plans tie your monthly payment to your income and family size. Payments are typically lower, but the repayment period is often longer, potentially leading to higher total interest paid. Note that loan forgiveness is usually not available for private loans under an IDR plan.

Advantages and Disadvantages of Repayment Plans

The following table summarizes the key advantages and disadvantages of each repayment plan. Keep in mind that specific terms and conditions will vary by lender.

| Repayment Plan | Advantages | Disadvantages | Best Suited For |

|---|---|---|---|

| Standard Repayment | Predictable payments, shorter repayment period | Higher monthly payments, may be challenging early in career | Borrowers with stable income and ability to manage higher payments |

| Graduated Repayment | Lower initial payments, manageable early in career | Substantially higher payments later in repayment period, total interest paid can be high | Borrowers expecting significant income growth over time |

| Extended Repayment | Lowest monthly payments | Longest repayment period, significantly higher total interest paid | Borrowers with limited income or high debt burden |

| Income-Driven Repayment (if offered) | Payments adjusted to income, potentially lower monthly payments | Longer repayment period, potentially higher total interest paid, no loan forgiveness (usually) | Borrowers with fluctuating income or significant financial challenges |

Sample Monthly Payment Comparison

Let’s illustrate the differences with a sample $50,000 loan at a 7% interest rate:

| Repayment Plan | Repayment Period (Years) | Approximate Monthly Payment |

|---|---|---|

| Standard (10-year) | 10 | $550 |

| Graduated (10-year) | 10 | Starts around $400, increases annually |

| Extended (15-year) | 15 | $400 |

| IDR (Example, 20-year) | 20 (Illustrative, varies greatly by income) | Varies greatly depending on income; could be significantly lower than other options |

Note: These are approximate figures. Actual monthly payments will depend on the specific terms of your loan agreement, including interest rate and fees.

Eligibility and Application Process

Securing a private student loan involves a distinct process and set of eligibility criteria compared to federal loans. Understanding these differences is crucial for prospective borrowers to navigate the application successfully and make informed decisions. The primary distinctions lie in the lender’s assessment of creditworthiness and the required documentation.

Private student loan eligibility hinges significantly on the applicant’s credit history and financial stability. Unlike federal loans, which primarily consider factors like enrollment status and financial need, private lenders evaluate applicants based on their credit score, debt-to-income ratio, and overall financial health. This often makes securing a private loan more challenging for students with limited credit history or less-than-ideal financial situations.

Eligibility Requirements for Private Student Loans

Private lenders establish their own eligibility criteria, but common requirements include a minimum credit score (often above 670), a demonstrated ability to repay the loan, and proof of enrollment in an eligible educational program. Some lenders may also require a co-signer, especially for students with limited or no credit history. In contrast, federal student loans have broader eligibility requirements, focusing primarily on enrollment status and the completion of the Free Application for Federal Student Aid (FAFSA). Federal loans generally do not require a co-signer and offer more lenient credit requirements, making them accessible to a wider range of students.

The Private Student Loan Application Process

The application process typically involves completing an online application form, providing personal and financial information, and submitting supporting documentation. This documentation may include proof of enrollment, transcripts, tax returns, and pay stubs (if applicable). A crucial step is the credit check conducted by the lender to assess the applicant’s creditworthiness. Lenders will review credit reports and scores to determine the applicant’s risk profile and to set interest rates and loan terms accordingly. A high credit score often translates to more favorable loan terms, while a lower score may necessitate a co-signer or result in higher interest rates.

The Role of Co-signers in Private Student Loans

A co-signer is an individual who agrees to share responsibility for repaying the loan if the primary borrower defaults. Co-signers are often required when the applicant lacks a sufficient credit history or has a low credit score. For the borrower, having a co-signer can significantly improve their chances of loan approval and may result in more favorable interest rates. However, it also means that the co-signer assumes significant financial risk. If the borrower fails to repay the loan, the co-signer becomes legally obligated to make the payments. This can have serious implications for the co-signer’s credit score and financial stability. Therefore, it’s essential for both borrower and co-signer to carefully consider the responsibilities and potential consequences before entering into a co-signed loan agreement. A thorough understanding of the loan terms and the potential risks involved is crucial for both parties.

Impact on Credit Score

Private student loans, unlike federal loans, significantly impact your credit score throughout the borrowing process and beyond. Understanding this impact is crucial for responsible financial planning and maintaining a healthy credit profile. Your credit score is a vital factor lenders consider when assessing your creditworthiness, influencing not only the interest rates you qualify for but also your access to various financial products.

The effect of private student loans on your credit score is multifaceted. On-time payments consistently build your credit history, demonstrating responsible borrowing behavior to credit bureaus. Conversely, missed or late payments negatively impact your credit score, potentially leading to more expensive borrowing options in the future. Defaulting on a private student loan has severe consequences, severely damaging your credit score and potentially leading to legal action.

Credit Score Impact During Repayment

Responsible management of private student loans is key to a positive credit impact. Consistent on-time payments contribute positively to your credit history, increasing your credit score over time. This positive credit history can translate to better interest rates on future loans, credit cards, and even mortgages. Conversely, late or missed payments can significantly lower your credit score, making it more difficult and expensive to obtain credit in the future. For example, a single missed payment could drop your score by several points, and repeated delinquencies can lead to a substantial decrease, potentially making it difficult to secure favorable terms on future loans. Building a strong credit history through consistent on-time payments on your student loans is a significant step toward improving your overall financial health.

Credit Score Impact in Case of Default

Defaulting on a private student loan has severe and long-lasting repercussions. A default is reported to credit bureaus, resulting in a significant and immediate drop in your credit score. This negative mark remains on your credit report for seven years, making it incredibly challenging to obtain credit during this period. Further, debt collectors may pursue legal action, potentially leading to wage garnishment or the seizure of assets. The consequences extend beyond the immediate financial impact; a poor credit score can affect your ability to rent an apartment, purchase a car, or even secure employment in certain fields. For instance, a prospective employer might use your credit report as a measure of your reliability and financial responsibility. A defaulted loan severely damages your financial standing and can take years to repair.

Impact of Poor Credit Score on Loan Terms

A poor credit score significantly impacts the interest rates and terms offered on private student loans. Lenders perceive borrowers with low credit scores as higher risk, leading them to offer loans with higher interest rates to compensate for the increased risk. This translates to significantly higher overall loan costs. Furthermore, lenders might impose stricter terms, such as requiring a co-signer or offering smaller loan amounts than those available to borrowers with better credit scores. For example, a borrower with a poor credit score might face an interest rate of 12% or higher, while a borrower with excellent credit might qualify for a rate of 6% or lower. This difference can amount to thousands of dollars in additional interest paid over the life of the loan. The impact of a poor credit score can extend beyond the initial loan terms; it can affect future borrowing opportunities and financial decisions.

Alternatives to Private Student Loans

Securing funding for higher education involves careful consideration of various financing options. While private student loans offer a potential solution, they are not always the most advantageous choice. Understanding the alternatives and their implications is crucial for making informed decisions about your educational financing. This section will compare private student loans with other funding sources, illustrating how to calculate the total cost of education under different scenarios and highlighting situations where alternatives are preferable.

Several alternatives to private student loans exist, each with its own set of advantages and disadvantages. These include federal student loans, scholarships, grants, and savings plans. A thorough comparison helps students choose the most suitable financing method based on their individual circumstances and financial profile.

Comparison of Financing Options for Higher Education

The following table summarizes the key differences between private student loans and other financing options for higher education. Note that specific details, such as interest rates and eligibility criteria, can vary depending on the lender or awarding institution.

| Financing Option | Interest Rates | Repayment Terms | Eligibility |

|---|---|---|---|

| Federal Student Loans | Generally lower than private loans; vary based on loan type and interest rate changes. | Flexible repayment plans available, including income-driven repayment options. | Based on financial need and enrollment status; typically requires FAFSA completion. |

| Private Student Loans | Variable or fixed; generally higher than federal loans; vary based on creditworthiness. | Typically fixed terms; repayment begins after a grace period. | Based on credit history, income, and co-signer availability; credit check required. |

| Scholarships | No interest; often based on merit or need. | No repayment required. | Varies depending on the scholarship provider; may require applications and essays. |

| Grants | No interest; usually based on financial need. | No repayment required. | Based on financial need; typically requires FAFSA completion. |

| Savings Plans (e.g., 529 Plans) | No interest (unless invested in interest-bearing accounts); earnings grow tax-deferred. | Funds are withdrawn as needed for qualified education expenses. | Open to anyone; contributions may be limited. |

Calculating the Total Cost of Education

Calculating the total cost of education requires considering tuition, fees, room and board, books, and other expenses. The total cost will vary depending on the institution, program, and living arrangements. The following examples illustrate how different financing options impact the overall cost.

Example 1: Let’s assume the total cost of education is $50,000. If a student uses a combination of $20,000 in federal loans (with a 5% interest rate over 10 years), $10,000 in scholarships, and $20,000 from savings, the total repayment cost for the federal loan portion would be approximately $25,000 ($20,000 principal + $5,000 interest, assuming simple interest for simplification). The total cost of education is still $50,000 but with a manageable loan repayment plan.

Example 2: If the same $50,000 cost is covered entirely by a private loan with a 10% interest rate over 10 years, the total repayment cost could be significantly higher, potentially exceeding $70,000 depending on the compounding and other fees.

Situations Where Alternatives are Preferable

Alternatives to private student loans are often preferable in various situations. For instance, federal student loans typically offer lower interest rates and more flexible repayment options. Scholarships and grants provide free money that doesn’t need to be repaid, reducing the overall debt burden. Savings plans allow families to proactively fund education without incurring debt.

For example, a student with excellent academic achievements and strong financial need might prioritize applying for scholarships and grants before considering private loans. A family with a well-established 529 plan might find that their savings can significantly reduce or even eliminate the need for any loans.

Default and its Consequences

Defaulting on a private student loan can have severe and long-lasting financial repercussions. Unlike federal student loans, which offer various protections and repayment options, private loans are governed by the terms set by the lender. Failure to meet these terms can lead to a significant decline in creditworthiness and potential legal action. Understanding these consequences is crucial for responsible borrowing and proactive management of student loan debt.

Defaulting on a private student loan triggers a cascade of negative events that can severely impact your financial future. The most immediate consequence is a substantial drop in your credit score. This can make it difficult, if not impossible, to secure future loans, rent an apartment, or even get a job in some fields. Furthermore, lenders may pursue aggressive collection tactics, including wage garnishment, where a portion of your paycheck is automatically seized to pay off the debt. In extreme cases, lawsuits and judgments can result, potentially leading to the seizure of assets. The stress and anxiety associated with these actions can also significantly impact your overall well-being.

Consequences of Default

The consequences of private student loan default extend far beyond simply a damaged credit score. Lenders have various legal avenues to recover their losses. Wage garnishment, as mentioned, allows them to directly deduct a portion of your earnings. This can leave you with significantly reduced disposable income, making it challenging to meet your basic living expenses. Legal action, including lawsuits and judgments, can lead to further financial penalties, such as court costs and attorney fees. These legal actions can also result in the seizure of assets, such as bank accounts or property, to satisfy the debt. The long-term impact on your financial health can be devastating, potentially delaying major life milestones like homeownership or retirement planning.

Available Options for Borrowers Facing Repayment Difficulties

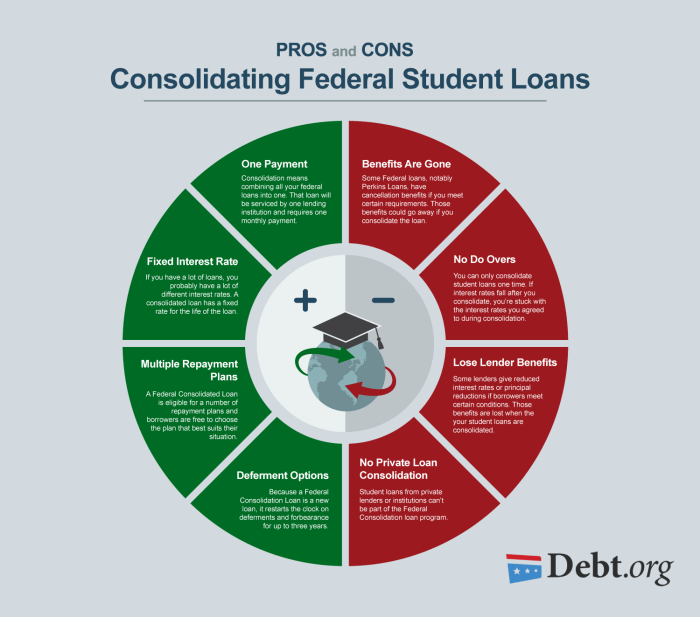

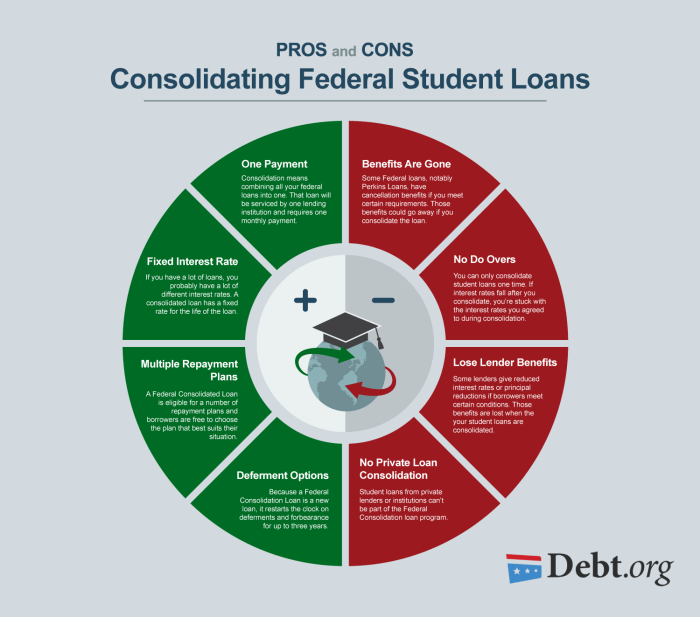

While the consequences of default are severe, borrowers facing repayment challenges have options to explore before reaching that point. Loan modification involves renegotiating the terms of your loan with the lender, potentially lowering your monthly payments or extending the repayment period. Forbearance offers a temporary pause on payments, but interest may still accrue during this period. Debt consolidation involves combining multiple loans into a single loan with potentially more favorable terms. Each of these options requires communication with your lender and may involve providing documentation of your financial hardship. It is crucial to contact your lender as soon as you anticipate difficulties in making payments to explore these possibilities and avoid default.

Long-Term Financial Impact of Loan Default: A Visual Representation

Imagine a graph with time on the x-axis (representing years) and financial well-being on the y-axis. A solid upward-sloping line represents the trajectory of someone responsibly managing their student loans, steadily improving their financial standing over time. This line reflects consistent payments, building credit, and achieving financial goals like homeownership and retirement savings. In contrast, a sharply downward-sloping line illustrates the impact of default. This line plunges dramatically after the default, reflecting the immediate credit score damage, the loss of income due to wage garnishment, and the accumulation of additional debt from legal fees and penalties. The line might show slight upward trends over time as the individual works to rebuild their credit, but it will always remain significantly below the line representing responsible repayment, indicating a long-term financial disadvantage. The gap between these two lines vividly illustrates the significant and lasting negative financial consequences of defaulting on a private student loan, potentially delaying major life milestones for years, if not decades. For example, someone who defaults might delay homeownership by 10-15 years or significantly reduce their retirement savings. This visual powerfully conveys the importance of proactive loan management and exploring available options before defaulting.

Final Review

In conclusion, the decision of whether or not to utilize private student loans requires careful consideration of individual circumstances and financial goals. While they can provide access to crucial funding for higher education, the potential drawbacks, such as higher interest rates and less flexible repayment options, cannot be overlooked. A thorough understanding of the pros and cons, along with a realistic assessment of one’s financial situation and creditworthiness, is essential for making an informed and responsible choice. By weighing the potential benefits against the inherent risks, students and families can navigate the complexities of student loan financing and make the best decision for their future.

Commonly Asked Questions

What happens if I can’t repay my private student loan?

Defaulting on a private student loan can severely damage your credit score, leading to difficulty securing future loans or credit cards. Collection agencies may pursue legal action, potentially resulting in wage garnishment or legal judgments.

Can I refinance my private student loan?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, it often requires a good credit score and may involve fees.

Are there any government programs to help with private student loan repayment?

No, government programs generally do not assist with private student loan repayment. Federal student loans offer more robust repayment assistance options.

How do private student loans affect my taxes?

Interest paid on private student loans is generally not tax deductible, unlike interest on some federal student loans.