Navigating the world of private student loans can feel overwhelming. Unlike federal loans, private loans come with a diverse range of lenders, interest rates, and repayment options, each impacting your financial future significantly. Understanding the nuances of these loans—from eligibility criteria to the long-term implications for your credit score—is crucial for responsible borrowing and effective debt management. This guide provides a comprehensive overview to empower you with the knowledge needed to make informed decisions.

We will explore the various types of private student loans available, comparing them to federal options and detailing the application process. We’ll delve into interest rates, fees, repayment plans, and the crucial role of co-signers. Furthermore, we’ll examine the impact on your credit score and discuss alternative funding options to help you choose the best path for your educational journey. Ultimately, the goal is to equip you with the tools to successfully manage your student loan debt and build a strong financial foundation.

Types of Private Student Loans

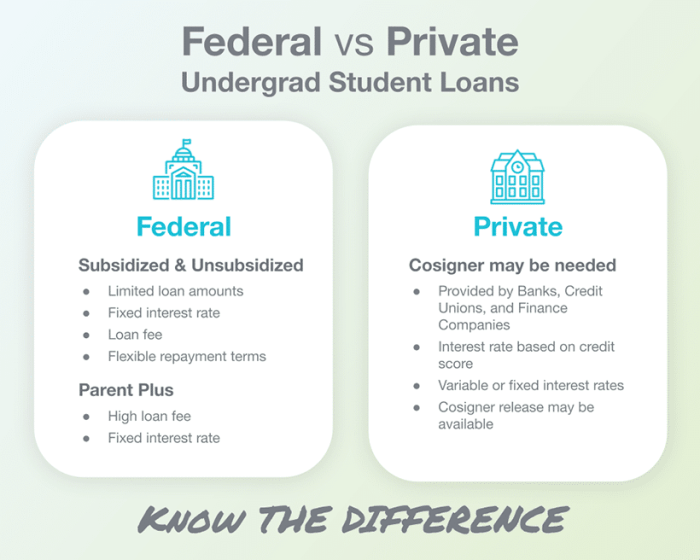

Private student loans are offered by banks, credit unions, and other financial institutions, unlike federal student loans which are government-backed. Understanding the differences is crucial for responsible borrowing. This section will detail the various types of private student loans, comparing them to federal options, and exploring repayment options, interest rates, and fees.

Federal vs. Private Student Loans

Federal student loans generally offer more borrower protections than private loans. These protections include income-driven repayment plans, deferment and forbearance options in times of financial hardship, and loan forgiveness programs under certain circumstances. Private loans, however, often have less stringent eligibility requirements and may offer higher loan amounts, but they lack these crucial safeguards. Federal loans typically have fixed interest rates, while private loan rates are variable and can fluctuate based on market conditions. Creditworthiness plays a significant role in securing a private loan and obtaining a favorable interest rate.

Private Student Loan Repayment Options

Private student loan repayment options vary by lender. Common options include standard repayment (fixed monthly payments over a set period), graduated repayment (payments start low and increase over time), and extended repayment (longer repayment period, resulting in lower monthly payments but higher overall interest paid). Some lenders may offer income-driven repayment plans, but these are less common than with federal loans. It’s essential to carefully review the terms and conditions of each loan to understand the repayment options available and choose the plan that best suits your financial situation.

Interest Rates and Fees Associated with Private Student Loans

Private student loan interest rates are variable and depend on several factors, including your credit score, credit history, co-signer (if applicable), the loan amount, and the lender. Generally, borrowers with strong credit scores and a co-signer will qualify for lower interest rates. Fees associated with private student loans can include origination fees (charged upfront), late payment fees, and prepayment penalties (though these are becoming less common). These fees can significantly impact the overall cost of the loan, so it’s crucial to compare the total cost of borrowing across different lenders.

Comparison of Private Student Loan Providers

The following table compares four private student loan providers. Note that interest rates and fees are subject to change and are based on current market conditions and individual borrower qualifications. This data should be considered for illustrative purposes only and should not be considered financial advice. Always check with the individual lender for the most up-to-date information.

| Lender | Interest Rate (Example) | Fees (Example) | Repayment Terms (Example) |

|---|---|---|---|

| Lender A | Variable, 7-12% | Origination fee: 1-3% | 5-15 years |

| Lender B | Fixed, 8-13% | Origination fee: 0-2% | 7-10 years |

| Lender C | Variable, 6-11% | Late payment fee: $25 | 5-12 years |

| Lender D | Fixed, 9-14% | No origination fee | 10-20 years |

Eligibility and Application Process

Securing a private student loan involves navigating specific eligibility requirements and a multi-step application process. Understanding these aspects is crucial for a successful loan application. Lenders assess various factors to determine your creditworthiness and ability to repay the loan.

Eligibility Criteria for Private Student Loans

Private student loan eligibility hinges on several key factors. Lenders typically review your credit history, income, and debt-to-income ratio. A strong credit history, demonstrating responsible financial management, significantly improves your chances of approval. A co-signer, someone with established credit who agrees to share responsibility for repayment, can often help overcome credit challenges. Your income, or that of your co-signer, provides assurance of your ability to make monthly payments. Finally, your debt-to-income ratio, which compares your existing debts to your income, indicates your overall financial burden. A lower ratio generally improves your eligibility. Some lenders may also consider your academic record, particularly your enrollment status at an accredited institution.

Steps Involved in Applying for a Private Student Loan

The application process generally begins with researching lenders and comparing loan terms. Once a suitable lender is identified, you’ll need to complete an online application form, providing personal and financial information. This will be followed by a credit check and verification of your income and enrollment. If approved, you’ll receive a loan offer outlining the terms, including interest rates, fees, and repayment schedule. You will then need to accept the loan offer and finalize the loan agreement. Finally, the funds are disbursed, usually directly to the educational institution.

Required Documentation for a Private Student Loan Application

Lenders require specific documentation to verify your identity, financial situation, and enrollment status. This typically includes a government-issued ID, such as a driver’s license or passport. Proof of income, such as pay stubs or tax returns, is necessary to demonstrate your repayment capacity. Your social security number is also required for verification purposes. Finally, proof of enrollment, such as an acceptance letter from your school or a current enrollment statement, is essential to confirm your student status. Additional documents may be requested depending on the lender and individual circumstances. For instance, a co-signer may need to provide similar documentation.

Application Process Flowchart

The following description Artikels a typical private student loan application process. Imagine a flowchart with distinct boxes connected by arrows indicating the flow.

* Start: The process begins with the applicant researching lenders and comparing loan options. This is represented by a starting box.

* Application Submission: The next box represents the submission of the online application, including all necessary personal and financial information. An arrow points from the research box to this application submission box.

* Credit Check & Verification: An arrow leads from the application submission box to a box representing the lender’s credit check and verification of the applicant’s income and enrollment status.

* Loan Offer: If approved, an arrow points to a box signifying the lender’s loan offer, detailing terms and conditions.

* Loan Acceptance & Agreement: An arrow connects the loan offer box to a box representing the applicant’s acceptance of the offer and signing of the loan agreement.

* Funds Disbursement: The final box, connected by an arrow from the loan agreement box, indicates the disbursement of funds to the educational institution.

* End: The process concludes.

Interest Rates and Fees

Understanding the interest rates and fees associated with private student loans is crucial for responsible borrowing. These costs significantly impact the total amount you’ll repay, so it’s essential to carefully consider them before accepting a loan. The interest rate determines how much your loan will cost over time, while fees add extra charges to the overall loan amount.

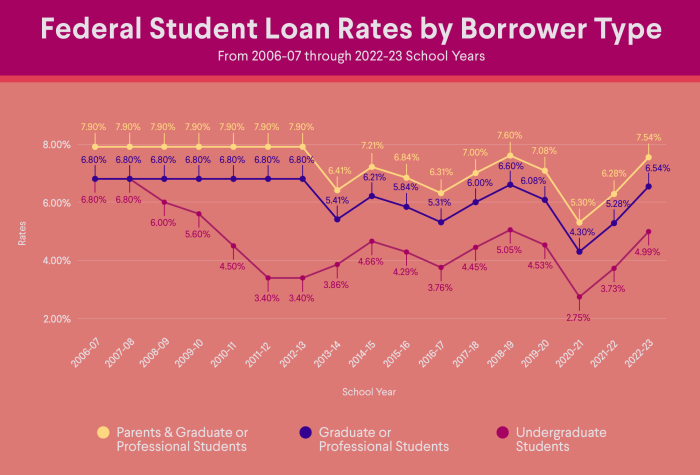

Private student loan interest rates are determined by several factors, primarily your creditworthiness. Lenders assess your credit history, credit score, and debt-to-income ratio to gauge your risk of default. A higher credit score and a strong credit history generally result in lower interest rates. Other factors include the loan term (shorter terms usually mean higher rates), the type of loan (loans secured by collateral may have lower rates), and the current market interest rates. Your co-signer’s creditworthiness, if applicable, can also affect your interest rate.

Interest Rate Scenarios and Repayment Impact

Let’s consider a few scenarios to illustrate how interest rates affect repayment. Suppose you borrow $20,000 with a 10-year repayment period. With a 6% interest rate, your monthly payment would be approximately $222 and your total repayment would be around $26,640. However, with an 8% interest rate, your monthly payment would increase to approximately $240, and your total repayment would rise to approximately $28,800. This demonstrates that even a small difference in the interest rate can significantly increase the total cost of your loan over time. A higher interest rate results in a larger amount of interest paid over the life of the loan.

Common Fees Associated with Private Student Loans

It’s important to be aware of the various fees that can be associated with private student loans. These fees add to the overall cost of borrowing and should be carefully considered.

Understanding these fees allows borrowers to make informed decisions and potentially save money in the long run. Some lenders may offer loans with no origination fees, while others may charge a percentage of the loan amount. Late payment penalties can significantly increase the total cost of the loan if payments are consistently missed.

- Origination Fees: A one-time fee charged by the lender upon disbursement of the loan. This fee typically ranges from 0% to 5% of the loan amount.

- Late Payment Penalties: A fee assessed when a payment is made after the due date. The amount of the penalty varies depending on the lender and the length of the delay.

- Prepayment Penalties: Some lenders may charge a fee if you pay off your loan early. However, many private student loans do not include this fee.

- Returned Payment Fees: A fee charged if a payment is returned due to insufficient funds.

- Default Fees: These are charged when a loan enters default due to nonpayment. These fees can be substantial and significantly increase the amount owed.

Repayment Plans and Options

Understanding your repayment options is crucial for successfully managing your private student loans. Different repayment plans offer varying levels of flexibility and impact your monthly payments and overall loan cost. Choosing the right plan depends on your individual financial situation and long-term goals. Careful consideration of the advantages and disadvantages of each plan is essential before making a decision.

Private Student Loan Repayment Plan Options

Private student loan lenders offer a range of repayment plans, often more diverse than those available for federal student loans. These plans typically include options to adjust your payment amount and potentially the loan term, though specific options vary by lender. Common plans include:

| Repayment Plan | Description | Advantages | Disadvantages |

|---|---|---|---|

| Standard Repayment | Fixed monthly payments over a set loan term (usually 5-15 years). | Predictable payments, shorter repayment period. | Higher monthly payments, may be difficult to manage on a tight budget. |

| Extended Repayment | Lower monthly payments spread over a longer loan term (potentially up to 25 years). | Lower monthly payments, easier budget management. | Higher total interest paid, longer time to become debt-free. |

| Graduated Repayment | Payments start low and gradually increase over time. | Lower initial payments, helpful for recent graduates. | Payments become significantly higher later in the repayment period, potential for difficulty managing increased payments. |

| Income-Driven Repayment (IDR) | Payments are based on a percentage of your income. Availability varies by lender. | Payments adjust to income fluctuations, potentially more manageable during periods of lower income. | May extend the repayment period significantly, resulting in higher total interest paid. Requires regular income verification. |

| Deferment | Temporarily postpones payments, often with interest accruing. Eligibility criteria and conditions vary. | Provides short-term relief from payments during financial hardship. | Interest continues to accrue, leading to a larger overall loan balance. May impact credit score. |

| Forbearance | Similar to deferment, but typically involves temporary suspension of payments, with interest accruing. Conditions vary. | Offers temporary relief from payments. | Interest continues to accrue, potentially leading to a larger loan balance. May negatively impact credit score. |

Consequences of Defaulting on a Private Student Loan

Defaulting on a private student loan has severe financial consequences. These consequences can significantly impact your credit score, making it difficult to obtain future loans, credit cards, or even rent an apartment. Lenders may pursue legal action, including wage garnishment or bank levy to recover the debt. Your credit report will reflect the default, potentially hindering your ability to secure favorable terms on future loans for years to come. In some cases, the debt may be sold to a collections agency, adding further complications to the repayment process. The specific consequences can vary depending on the lender and state laws, but the overall impact is generally negative and long-lasting. For example, a default could result in a significant drop in credit score, making it difficult to qualify for a mortgage or auto loan for several years.

Co-signers and Loan Consolidation

Securing a private student loan can sometimes require a co-signer, especially for borrowers with limited credit history. Understanding the role of a co-signer and the process of loan consolidation is crucial for effective student loan management.

The Role of a Co-signer in Private Student Loans

A co-signer is an individual who agrees to share responsibility for repaying your private student loan. Lenders often require co-signers for borrowers deemed to be high-risk, typically those with low or no credit scores, limited income, or a short credit history. Essentially, the co-signer acts as a guarantor, promising to repay the loan if the primary borrower defaults. Their creditworthiness is a significant factor in the lender’s decision to approve the loan and often influences the interest rate offered.

Benefits and Drawbacks of Using a Co-signer

Having a co-signer can significantly improve your chances of loan approval and potentially secure a lower interest rate. This translates to lower overall borrowing costs and faster debt repayment. However, it also means sharing the responsibility for repayment with another person. If the primary borrower defaults, the co-signer becomes fully responsible for the remaining loan balance, which can negatively impact their credit score and financial stability. Choosing a co-signer should involve careful consideration of the potential implications for both parties.

The Process of Consolidating Multiple Private Student Loans

Consolidating private student loans involves combining multiple loans into a single, new loan. This typically simplifies repayment by reducing the number of monthly payments and potentially lowering the overall monthly payment amount, although the total interest paid might increase depending on the new interest rate. The process usually begins by researching potential lenders offering consolidation options. Each lender will have its own application process, requiring documentation such as your existing loan details and financial information. Once approved, the lender pays off your existing loans, and you begin making payments on the new consolidated loan.

Advantages and Disadvantages of Loan Consolidation

Consolidating private student loans can simplify repayment by reducing the number of monthly payments and potentially lowering the monthly payment amount. A single monthly payment can be easier to manage and track. However, consolidation might result in a higher total interest paid over the life of the loan if the new interest rate is higher than the average rate of the original loans. Furthermore, consolidating loans might extend the repayment period, potentially increasing the total interest paid. Careful comparison of interest rates and repayment terms is crucial before deciding to consolidate.

Impact on Credit Score

Taking out private student loans can significantly impact your credit score, both positively and negatively. Responsible management is crucial for building a strong credit history, while neglecting your loans can lead to serious consequences. Understanding how these loans affect your credit and implementing effective management strategies is key to maintaining a healthy financial profile.

Private student loans, like other forms of credit, are reported to the major credit bureaus (Equifax, Experian, and TransUnion). On-time payments are a significant factor in determining your creditworthiness. Consistent, timely payments contribute positively to your credit score, demonstrating your reliability as a borrower. Conversely, missed or late payments will negatively impact your credit score, potentially making it harder to obtain future credit at favorable terms. The severity of the negative impact depends on the frequency and severity of the delinquency. For example, a single late payment might result in a minor score reduction, while repeated late payments or defaulting on the loan could severely damage your credit score. Furthermore, the amount of debt relative to your available credit (credit utilization ratio) also plays a role. A high utilization ratio suggests a higher level of financial risk, negatively affecting your score.

Credit Score Impact of Private Student Loan Management

Effective management of private student loans is essential for maintaining a positive credit score. Strategic planning, proactive communication with lenders, and responsible budgeting are crucial components of this process. For example, a borrower who consistently makes on-time payments on their student loans demonstrates responsible financial behavior, leading to a gradual increase in their credit score over time. This improved creditworthiness can then translate to better interest rates on future loans, such as mortgages or auto loans. In contrast, a borrower who consistently misses payments or defaults on their loan will experience a significant drop in their credit score, potentially impacting their ability to secure future credit. The impact can be substantial, potentially leading to higher interest rates or even denial of credit applications.

Examples of Responsible Loan Management and Positive Credit Score Impact

Consider two borrowers, Sarah and John. Sarah diligently makes all her student loan payments on time. Her responsible behavior results in a steady increase in her credit score, allowing her to secure a mortgage with a favorable interest rate a few years later. John, on the other hand, struggles to manage his student loan payments, resulting in several late payments and a significant drop in his credit score. This negatively impacts his ability to obtain a car loan, forcing him to pay a higher interest rate. This illustrates how responsible loan management directly translates to a better credit score and improved financial opportunities.

Best Practices for Managing Student Loan Debt

It is crucial to develop a robust strategy for managing student loan debt to protect your credit score. The following best practices are recommended:

- Create a Realistic Budget: Track your income and expenses to determine how much you can comfortably allocate towards student loan repayments each month.

- Prioritize Loan Payments: Make on-time payments a top priority. Set up automatic payments to avoid missing deadlines.

- Communicate with Your Lender: If you anticipate difficulty making a payment, contact your lender immediately to explore options such as forbearance or deferment.

- Explore Repayment Options: Research different repayment plans to find one that best suits your financial situation. Consider income-driven repayment plans if needed.

- Monitor Your Credit Report: Regularly check your credit report for accuracy and identify any potential issues early on.

Alternatives to Private Student Loans

Securing funding for higher education can be a significant undertaking. While private student loans offer a readily available option, they often come with high interest rates and stringent repayment terms. Fortunately, several alternatives exist that may prove more beneficial in the long run. Exploring these alternatives carefully is crucial to making an informed decision about financing your education.

Before committing to private student loans, it’s vital to exhaust other funding avenues. These alternatives can significantly reduce your reliance on private loans, minimizing your debt burden and long-term financial strain. This section Artikels these alternatives, comparing their advantages and disadvantages to private loans, and guiding you through the application process.

Federal Student Loans

Federal student loans are a significantly different funding source compared to private loans. They offer several advantages, including lower interest rates, flexible repayment plans (including income-driven repayment), and various borrower protections. These loans are disbursed directly by the federal government and are subject to regulations designed to protect students. In contrast to private loans, eligibility is based on financial need and academic merit, not solely on creditworthiness. The application process involves completing the Free Application for Federal Student Aid (FAFSA).

Scholarships and Grants

Scholarships and grants represent forms of financial aid that do not require repayment. Scholarships are typically awarded based on merit, such as academic achievement, athletic ability, or community involvement. Grants are usually need-based, considering the applicant’s financial situation and family income. Both are highly competitive, requiring thorough research and timely applications. Many scholarships and grants are offered by colleges, universities, private organizations, and corporations. Searching for and applying for these opportunities requires diligence and careful planning.

Researching and Applying for Scholarships and Grants

Effectively researching and applying for scholarships and grants involves a multi-step process. First, identify potential funding sources using online databases like Fastweb or Scholarships.com. Next, carefully review the eligibility requirements and application deadlines for each opportunity. Prepare strong applications that highlight your qualifications and achievements, paying close attention to essay prompts and required materials. Finally, track your applications and follow up as needed. The earlier you begin this process, the better your chances of securing funding.

Comparison of Funding Sources

| Funding Source | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Private Student Loans | Variable, typically higher | Variable, determined by lender | Creditworthiness, income |

| Federal Student Loans | Fixed, typically lower | Flexible repayment plans available | Financial need, enrollment in eligible program |

| Scholarships | N/A (no repayment) | N/A (no repayment) | Merit-based (academic achievement, talent, etc.) |

| Grants | N/A (no repayment) | N/A (no repayment) | Financial need |

Understanding Loan Terms and Conditions

Navigating the complexities of a private student loan agreement requires a thorough understanding of its terms and conditions. These terms dictate the borrower’s responsibilities and the lender’s expectations, impacting repayment schedules, interest accrual, and overall financial obligations. Careful review before signing is crucial to avoid unexpected costs and potential financial hardship.

Private student loan agreements typically include a range of clauses that significantly affect the borrower’s financial commitments. Understanding these clauses empowers borrowers to make informed decisions and negotiate favorable terms, if possible. Failing to understand these clauses can lead to unforeseen consequences and difficulties in managing the loan.

Key Terms and Conditions in Private Student Loan Agreements

Several key terms consistently appear in private student loan agreements. Understanding these terms allows borrowers to assess the true cost of borrowing and make well-informed decisions about their loan.

- Interest Rate: This is the percentage charged on the outstanding loan balance. It can be fixed (remaining constant throughout the loan term) or variable (fluctuating based on market conditions). Understanding the interest rate’s type and calculation method is crucial for budgeting.

- Fees: Various fees can be associated with private student loans, such as origination fees (charged at the start), late payment fees, and prepayment penalties (for paying off the loan early). These fees add to the overall cost of borrowing.

- Repayment Terms: This specifies the loan’s repayment period (e.g., 10 years) and the monthly payment amount. Understanding the repayment schedule is crucial for budgeting and financial planning.

- Default Provisions: These Artikel the consequences of failing to make timely payments, such as late fees, damage to credit score, and potential legal action. Understanding these consequences is essential for responsible loan management.

- Deferment and Forbearance Options: These clauses describe the conditions under which borrowers can temporarily postpone or reduce their loan payments. Understanding these options can be vital during periods of financial hardship.

Examples of Clauses Requiring Careful Review

Certain clauses within private student loan agreements warrant extra scrutiny. These clauses often contain fine print that can significantly impact the borrower’s financial obligations.

- Arbitration Clauses: These clauses mandate dispute resolution through arbitration rather than court proceedings. This can limit a borrower’s legal recourse.

- Variable Interest Rate Clauses: If the interest rate is variable, the agreement should clearly specify how the rate is adjusted and the potential for significant rate increases.

- Prepayment Penalty Clauses: These clauses impose fees for paying off the loan early. Borrowers should carefully consider the potential costs before making early payments.

Negotiating Loan Terms and Conditions

While not always possible, borrowers can sometimes negotiate certain aspects of their loan terms. This requires careful preparation and a clear understanding of the loan market.

- Shop Around: Comparing offers from multiple lenders can increase the likelihood of securing favorable terms.

- Strong Credit History: A good credit score often qualifies borrowers for better interest rates and terms.

- Co-signer: Having a co-signer with excellent credit can improve chances of securing a loan with favorable terms.

- Demonstrate Financial Responsibility: A well-structured budget and a history of responsible financial management can enhance negotiating power.

Sample Loan Agreement Highlights

The following is a simplified representation of key clauses that might appear in a private student loan agreement. This is not a legal document and should not be considered a substitute for professional legal advice.

| Clause | Description |

|---|---|

| Principal Loan Amount | $20,000 |

| Interest Rate | 7% Fixed |

| Repayment Term | 10 years |

| Monthly Payment | $220 (approximate) |

| Late Payment Fee | $25 |

| Prepayment Penalty | None |

| Default Provisions | Refer to Section 7 of the agreement |

Managing Student Loan Debt

Successfully navigating private student loan debt requires a proactive and organized approach. Effective strategies combine careful budgeting, strategic repayment planning, and awareness of available resources. Understanding your loan terms and consistently monitoring your progress are crucial for minimizing stress and achieving timely repayment.

Effective Strategies for Repaying Private Student Loan Debt

Budgeting and Financial Planning

Creating a realistic budget is paramount to successful student loan repayment. This involves tracking all income and expenses to identify areas where savings can be maximized. A detailed budget allows borrowers to allocate a specific amount each month towards loan payments, ensuring consistent progress. Unexpected expenses can derail repayment plans, so building an emergency fund is also advisable. Consider using budgeting apps or spreadsheets to track your finances effectively. A sample budget template is provided below.

Sample Budget Template

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Monthly Salary | $XXXX | Student Loan Payment | $XXXX |

| Other Income | $XXXX | Rent/Mortgage | $XXXX |

| Total Income | $XXXX | Utilities | $XXXX |

| Groceries | $XXXX | ||

| Transportation | $XXXX | ||

| Insurance | $XXXX | ||

| Entertainment | $XXXX | ||

| Savings | $XXXX | ||

| Other Expenses | $XXXX | ||

| Total Expenses | $XXXX | ||

| Net Income | $XXXX |

Note: Replace “XXXX” with your actual figures. This is a simplified template; adjust categories to reflect your individual spending habits.

Resources for Borrowers Facing Repayment Difficulties

Borrowers experiencing difficulty repaying their loans should explore available resources. Contacting their loan servicer is the first step. Servicers may offer forbearance, deferment, or income-driven repayment plans, temporarily reducing or adjusting monthly payments. Non-profit credit counseling agencies can provide guidance on budgeting, debt management, and exploring options like debt consolidation or settlement. In some cases, government programs may offer assistance. It’s crucial to act promptly and communicate openly with your lender to avoid default.

Understanding Loan Deferment and Forbearance

Deferment and forbearance are temporary pauses in loan payments. Deferment typically requires meeting specific eligibility criteria, such as returning to school or experiencing unemployment. Forbearance is often granted for more general financial hardship but may accrue interest. Both options can provide short-term relief, but it’s essential to understand the long-term implications, including potential increases in the total amount owed due to accumulated interest.

Loan Consolidation and Refinancing

Consolidating multiple private student loans into a single loan can simplify repayment. This may offer a lower interest rate or a more manageable monthly payment, depending on the terms of the new loan. Refinancing involves obtaining a new loan from a different lender to replace your existing loans. This strategy might also result in a lower interest rate, but it’s crucial to carefully compare offers and ensure the new terms are favorable. Always thoroughly research and compare options before making any decisions.

Final Wrap-Up

Securing a private student loan is a significant financial commitment requiring careful consideration. By understanding the various loan types, eligibility requirements, interest rates, fees, and repayment options, you can make an informed decision that aligns with your financial situation and long-term goals. Remember to thoroughly research lenders, compare terms, and consider the potential impact on your credit score. Proactive planning and responsible debt management are key to successfully navigating the complexities of private student loans and achieving your educational aspirations.

Frequently Asked Questions

What is the difference between federal and private student loans?

Federal student loans are offered by the government and typically have more borrower protections, fixed interest rates, and income-driven repayment plans. Private student loans are offered by banks and other financial institutions, often with variable interest rates and fewer repayment options. Eligibility requirements also differ.

Can I refinance my private student loans?

Yes, refinancing can potentially lower your interest rate and monthly payment, but it depends on your credit score and current interest rates. Be sure to compare offers from multiple lenders before refinancing.

What happens if I default on a private student loan?

Defaulting on a private student loan can severely damage your credit score, making it difficult to obtain loans or credit in the future. It can also lead to wage garnishment and legal action.

How long does it take to get approved for a private student loan?

The approval process varies by lender, but it typically takes a few weeks. Factors like your credit score and financial history can affect the processing time.