Navigating the world of student loans can feel overwhelming, especially when considering the significant financial commitment involved. This guide delves into the specifics of Pennsylvania State University (PSU) student loans, providing a clear understanding of the various loan types, application processes, and debt management strategies. We aim to equip prospective and current PSU students with the knowledge necessary to make informed decisions and navigate their financial journey successfully.

From understanding the differences between federal and private loans and their associated interest rates and repayment terms, to exploring effective budgeting techniques and debt management strategies, this guide offers a comprehensive overview. We’ll also examine the resources available at PSU to support students in managing their financial well-being and making informed decisions about their educational financing.

Types of PSU Student Loans

Securing funding for your education at Pennsylvania State University (PSU) often involves navigating the landscape of student loans. Understanding the different types available, their associated costs, and eligibility requirements is crucial for making informed financial decisions. This section details the various loan options accessible to PSU students, differentiating between federal and private loans.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. These loans are often preferred due to their borrower protections and flexible repayment options. Several federal loan programs exist, each with its own set of criteria.

Direct Subsidized Loans

Direct Subsidized Loans are need-based loans. The government pays the interest while you are in school at least half-time, during grace periods, and during periods of deferment. Eligibility is determined by your financial need, as assessed through the FAFSA (Free Application for Federal Student Aid). Interest rates are set annually by the federal government and are generally lower than unsubsidized loans. Repayment typically begins six months after graduation or leaving school.

Direct Unsubsidized Loans

Direct Unsubsidized Loans are not based on financial need. Interest accrues from the time the loan is disbursed, even while you’re in school. This means you’ll owe more upon graduation. Eligibility requirements are generally less stringent than for subsidized loans, making them accessible to a wider range of students. Interest rates, like subsidized loans, are set annually by the federal government. Repayment terms are similar to subsidized loans.

Federal PLUS Loans

Federal PLUS Loans (Parent Loans for Undergraduate Students) are available to parents of dependent undergraduate students to help cover educational expenses. Credit checks are performed, and approval is contingent upon a satisfactory credit history. Interest rates are generally higher than Direct Subsidized and Unsubsidized loans. Repayment begins shortly after the loan is fully disbursed.

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. These loans often have higher interest rates and less flexible repayment options compared to federal loans. Eligibility is based on creditworthiness, typically requiring a creditworthy co-signer if the student lacks a strong credit history. Interest rates and repayment terms vary significantly depending on the lender and the borrower’s credit profile. It’s crucial to shop around and compare offers from multiple lenders before accepting a private loan.

Comparison of Loan Types

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Direct Subsidized Loan | Variable; set annually by the federal government | Repayment begins 6 months after graduation or leaving school. | Demonstrated financial need (FAFSA required) |

| Direct Unsubsidized Loan | Variable; set annually by the federal government | Repayment begins 6 months after graduation or leaving school. | Enrollment at least half-time |

| Federal PLUS Loan | Variable; set annually by the federal government | Repayment begins shortly after disbursement. | Credit check; satisfactory credit history required (or an endorser). |

| Private Student Loan | Variable; depends on lender and borrower’s creditworthiness | Varies by lender; can be fixed or variable. | Creditworthiness (co-signer may be required) |

Applying for PSU Student Loans

Securing funding for your education at Penn State University involves navigating the application processes for both federal and private student loans. Understanding the requirements and procedures for each is crucial to a smooth and successful application experience. This section Artikels the steps involved in applying for both types of loans.

Federal Student Loan Application Process at PSU

The federal student loan process typically begins with completing the Free Application for Federal Student Aid (FAFSA). This application gathers necessary financial information to determine your eligibility for federal student aid, including loans, grants, and work-study opportunities. The FAFSA data is then used by PSU and the federal government to assess your financial need and award you the appropriate aid package.

- Complete the FAFSA form: This involves providing detailed information about your financial background, including income, assets, and family size. Accurate and complete information is essential for a timely processing of your application.

- Receive your Student Aid Report (SAR): After submitting the FAFSA, you will receive a SAR which summarizes the information you provided. Review this report carefully for any errors or omissions.

- Review your financial aid offer from PSU: Penn State will use the information from your FAFSA to determine your eligibility for federal student loans. Your financial aid award letter will Artikel the types and amounts of loans you are offered.

- Accept your federal student loans: Once you have reviewed your financial aid offer, you will need to accept the loans you wish to receive. This usually involves completing an online acceptance form through the PSU student financial aid portal.

- Complete Master Promissory Note (MPN): For some federal loan programs, you will need to sign a Master Promissory Note. This is a legal agreement between you and the U.S. Department of Education outlining the terms of your loan.

- Complete Entrance Counseling: Before receiving your federal student loans, you will likely be required to complete entrance counseling. This is an online session that provides information about your responsibilities as a borrower.

Private Student Loan Application Process at PSU

Private student loans are offered by banks and other financial institutions, and their application processes vary. Generally, these loans require a stronger credit history or a co-signer. It’s advisable to shop around and compare offers from different lenders before making a decision. You will typically need to apply directly through the lender’s website or application portal.

- Research private lenders: Compare interest rates, fees, and repayment terms from various private lenders. Consider factors like your credit score and co-signer availability when making your choice.

- Complete the lender’s application: Each lender will have its own application form requiring personal information, academic details, and financial information. Be prepared to provide documentation such as tax returns, bank statements, and proof of enrollment.

- Provide required documentation: This may include your FAFSA data, transcripts, and proof of enrollment at PSU. The exact requirements will vary depending on the lender.

- Review and accept the loan offer: Once the lender has reviewed your application, they will provide a loan offer outlining the terms and conditions. Carefully review this offer before accepting.

Required Documentation for Student Loan Applications

The specific documents needed will vary depending on the lender and loan type. However, generally, you should be prepared to provide documents verifying your identity, enrollment, financial need, and creditworthiness (for private loans). This may include but is not limited to: Social Security number, driver’s license, proof of enrollment at PSU, tax returns, bank statements, and possibly a credit report. Resources and links providing detailed lists of required documentation are available through the PSU financial aid office and individual lenders’ websites.

Managing PSU Student Loan Debt

Graduating from PSU is a significant achievement, but it often comes with the responsibility of managing student loan debt. Effective strategies are crucial for navigating this financial landscape and ensuring a smooth transition into post-graduate life. Careful planning and proactive management can minimize stress and maximize your financial well-being.

Successfully managing your PSU student loan debt requires a multifaceted approach encompassing budgeting, financial planning, and understanding your repayment options. This section will provide practical strategies and tools to help you navigate this process.

Budgeting Techniques and Financial Planning Tools

Creating a realistic budget is fundamental to managing student loan debt. This involves carefully tracking your income and expenses to identify areas where you can save and allocate funds towards loan repayment. Several budgeting techniques can be employed, such as the 50/30/20 rule (allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment), or zero-based budgeting (allocating every dollar of your income to a specific category). Financial planning tools, such as budgeting apps (Mint, YNAB), spreadsheet software (Excel, Google Sheets), or online budgeting calculators, can assist in this process by automating calculations, tracking progress, and providing insights into spending habits. These tools provide a visual representation of your finances, allowing for better monitoring and adjustments to your budget.

Student Loan Repayment Options

Understanding the various repayment options available is essential for effective debt management. Standard repayment plans involve fixed monthly payments over a set period (typically 10 years). However, if you are struggling to make payments, income-driven repayment (IDR) plans may be a better option. IDR plans adjust your monthly payments based on your income and family size, potentially lowering your payments and extending your repayment period. These plans include options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). It’s important to research these plans to determine which one best suits your financial situation. Additionally, exploring options like loan consolidation or refinancing might help you secure a lower interest rate or simplify your payments.

Sample Budget for a Recent PSU Graduate

Let’s consider a recent PSU graduate earning $40,000 annually ($3,333.33 monthly) with $30,000 in student loan debt at a 5% interest rate. This is a simplified example and actual amounts will vary.

| Income | Amount |

|---|---|

| Monthly Salary | $3,333.33 |

| Expenses | Amount |

| Rent | $1,200 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $200 |

| Student Loan Payment (Standard 10-year plan) | $317 (approx.) |

| Other Expenses (Entertainment, Savings, etc.) | $416.33 |

| Total Expenses | $3,333.33 |

Note: This budget assumes a standard 10-year repayment plan. The actual monthly payment will depend on the loan’s interest rate and repayment terms. Consider exploring IDR plans if this budget is unsustainable. This example also does not account for potential unexpected expenses. Always build a buffer into your budget.

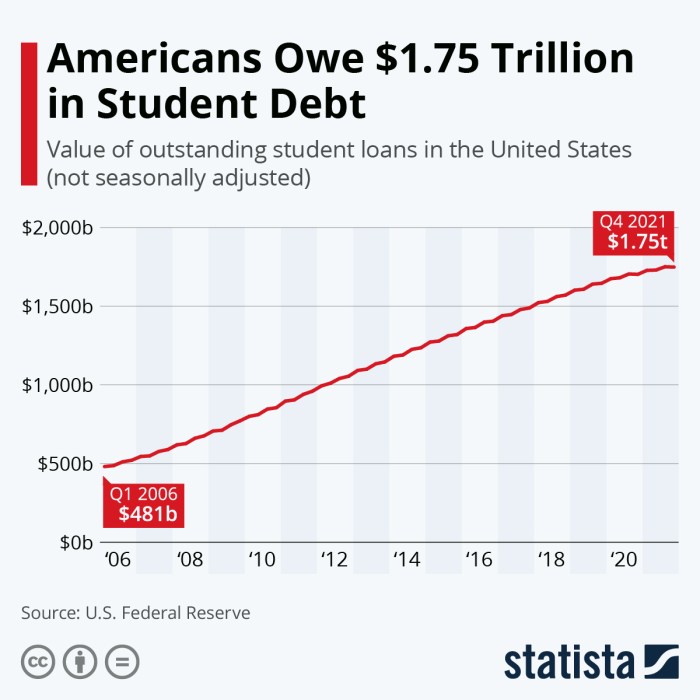

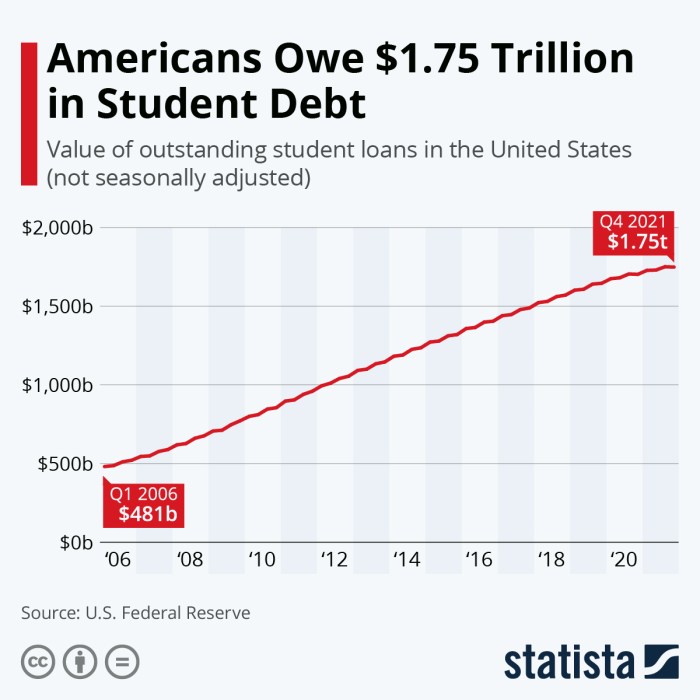

The Impact of PSU Student Loans on Students’ Financial Well-being

The accumulation of student loan debt during one’s time at Penn State University (PSU) can significantly influence a graduate’s financial trajectory for years to come. Understanding the potential long-term effects, contributing factors, and available resources is crucial for navigating this complex aspect of higher education. This section will explore the multifaceted impact of PSU student loans on the financial well-being of students.

The weight of student loan debt can extend far beyond graduation. High levels of debt can delay major life milestones such as homeownership, starting a family, and even retirement planning. Graduates may find themselves constrained in career choices, accepting lower-paying jobs to manage monthly repayments, thus limiting their earning potential and overall financial growth. The psychological stress associated with significant debt can also negatively impact mental health and overall well-being. This long-term financial burden can create a cycle of debt that impacts future financial decisions and opportunities.

Factors Contributing to High Student Loan Debt at PSU

Several factors contribute to the accumulation of substantial student loan debt among PSU students. These include rising tuition costs, increased living expenses in State College, and the increasing reliance on loans to cover these costs. Many students underestimate the total cost of attendance, including tuition, fees, room and board, books, and personal expenses. Additionally, a lack of financial literacy and inadequate planning can lead to borrowing more than necessary. Some students may also face unexpected financial emergencies or changes in family circumstances that require additional borrowing. Finally, the availability of easy access to loans can inadvertently encourage over-borrowing.

Resources for Managing PSU Student Loan Debt

PSU offers a range of resources designed to assist students in effectively managing their student loan debt. These resources include financial aid counseling services, workshops on budgeting and financial planning, and personalized debt management advice. The university often collaborates with external organizations to provide additional support and resources, such as loan repayment assistance programs and debt consolidation options. Furthermore, students can access online tools and resources to create a personalized repayment plan and explore various debt management strategies. These resources empower students to make informed decisions and navigate the complexities of loan repayment.

Visual Representation of Student Loan Debt and Post-Graduation Financial Stability

Imagine a graph with “Level of Student Loan Debt” on the x-axis and “Post-Graduation Financial Stability” on the y-axis. The graph would show a generally inverse relationship: as student loan debt increases (moving to the right along the x-axis), post-graduation financial stability decreases (moving down along the y-axis). However, the relationship isn’t perfectly linear. Some individuals with high debt might achieve high financial stability due to high-earning careers, while others with lower debt might struggle due to unforeseen circumstances. The graph would ideally include a shaded area representing this variability, illustrating that while high debt generally correlates with lower stability, other factors significantly influence the outcome. The ideal scenario would be represented by points clustered in the lower left quadrant (low debt, high stability), while a less desirable scenario would be represented by points in the upper right quadrant (high debt, low stability).

PSU’s Financial Aid and Loan Counseling Services

Navigating the complexities of financial aid and student loans can be challenging. Fortunately, Portland State University (PSU) provides comprehensive support services to help students understand and manage their finances effectively throughout their academic journey. These services are designed to empower students to make informed decisions, avoid unnecessary debt, and ultimately achieve their educational goals without undue financial strain.

PSU offers a robust suite of financial aid and loan counseling services, accessible to all enrolled students. These services aim to demystify the financial aid process, providing students with the knowledge and tools needed to navigate their financial responsibilities. The university recognizes that financial literacy is crucial for academic success and beyond.

Types of Counseling Services Offered

PSU’s financial aid office provides various counseling options to cater to individual student needs and preferences. These include individual counseling sessions with financial aid advisors, group workshops covering specific financial topics, and online resources with frequently asked questions and helpful guides. The advisors are trained professionals who can offer personalized guidance based on each student’s unique circumstances. Workshops often focus on budgeting, loan repayment strategies, and understanding financial aid packages.

Accessing PSU’s Financial Aid and Loan Counseling Services

Students can access these services through several avenues. The primary method is to schedule an appointment with a financial aid advisor via the university’s website. The website usually provides a calendar system allowing students to select a convenient time slot. Alternatively, students can contact the financial aid office directly by phone or email to inquire about available appointments and services. Walk-in appointments may also be available, but scheduling an appointment in advance is generally recommended to ensure prompt service. Many resources, such as frequently asked questions and helpful guides, are also available online through the university’s student portal.

Benefits of Utilizing PSU’s Financial Aid Counseling Services

Utilizing PSU’s financial aid counseling services offers numerous benefits. Students gain a clearer understanding of their financial aid package, including grants, scholarships, and loans. Advisors can help students identify potential additional funding opportunities, such as external scholarships or work-study programs. Furthermore, the counseling services provide valuable guidance on responsible debt management, assisting students in creating realistic repayment plans and avoiding financial pitfalls. By proactively engaging with these services, students can significantly reduce their financial stress and improve their overall academic experience.

Scheduling a Consultation with a Financial Aid Advisor

To schedule a consultation, students should first visit the PSU Financial Aid website. The website typically features a dedicated section for scheduling appointments. Students will need to log in using their PSU student ID and password. Once logged in, they can access an online calendar, view available appointment slots, and select a date and time that suits their schedule. After selecting a time, the system will usually prompt students to confirm their appointment and receive a confirmation email. If a student encounters any difficulties scheduling an appointment online, they can contact the financial aid office directly via phone or email for assistance.

Comparing PSU Student Loan Costs to Other Universities

Understanding the cost of a college education, particularly the burden of student loan debt, is crucial for prospective students. This section compares the average student loan debt incurred by Pennsylvania State University (PSU) graduates with that of graduates from similar institutions, exploring contributing factors and implications for students making college decisions. Accurate data on average student loan debt can be challenging to obtain consistently across institutions, as reporting methods and data collection periods vary. However, utilizing publicly available data and reports from reputable sources allows for a reasonable comparison.

Average Student Loan Debt Comparison

The following table presents a comparison of average student loan debt among graduates from several universities, acknowledging the limitations of readily available data. Precise figures fluctuate yearly, and direct comparisons require careful consideration of factors like student demographics, program choices, and methodologies used for data collection.

| University Name | Average Student Loan Debt | Key Factors | Implications |

|---|---|---|---|

| Pennsylvania State University (PSU) | $30,000 (estimated) | In-state tuition rates, financial aid availability, average student income levels of families, program costs (e.g., engineering vs. humanities) | Students should budget carefully and explore financial aid options. High debt may impact post-graduation financial planning. |

| University of Pittsburgh | $32,000 (estimated) | Similar to PSU, location in a major city can impact living expenses, influencing overall cost of attendance and potential debt accumulation. | Similar to PSU, careful budgeting and exploration of financial aid are crucial for managing post-graduation debt. |

| Temple University | $28,000 (estimated) | Located in Philadelphia, similar considerations regarding location and living expenses apply as with the other universities. Potential variations in financial aid offerings may also contribute. | Similar to PSU and University of Pittsburgh, strategic financial planning and utilization of financial aid are key. |

| University of Maryland, College Park | $35,000 (estimated) | Out-of-state tuition rates may be higher, potentially leading to increased loan debt. | Students should carefully evaluate the cost-benefit analysis, considering potential career prospects against the level of debt incurred. |

Note: The average student loan debt figures presented are estimates based on available data from various sources and may not reflect the most recent figures. Actual figures can vary significantly depending on the specific program, year of graduation, and individual student circumstances.

Factors Influencing Student Loan Debt Differences

Several factors contribute to differences in average student loan debt across universities. These include tuition costs (in-state versus out-of-state rates, program-specific fees), the availability and type of financial aid (grants, scholarships, loans), living expenses (on-campus versus off-campus housing, regional cost of living), and the average family income of the student body. For example, a university with a high percentage of students from low-income families may have a higher average student loan debt due to greater reliance on loans to cover educational costs. Conversely, a university with a large endowment and generous scholarship programs might have a lower average debt.

Implications for College Decisions

Understanding these differences is vital for students making college decisions. Students should compare not only tuition costs but also the overall cost of attendance, including living expenses, and the average student loan debt at different institutions. Thorough research into available financial aid opportunities and the potential return on investment (ROI) of a particular degree program is also crucial. A higher average student loan debt doesn’t automatically signify a poor choice, but it necessitates careful financial planning and a realistic assessment of post-graduation repayment capabilities.

Epilogue

Securing a college education is a significant investment, and understanding the intricacies of student loans is crucial for long-term financial health. This guide has explored the multifaceted landscape of PSU student loans, from application procedures to effective debt management strategies and the support services available. By utilizing the information provided, PSU students can confidently navigate the complexities of student loan financing and build a solid foundation for their future financial well-being.

FAQ Insights

What happens if I can’t repay my student loans?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I refinance my PSU student loans?

Yes, once your loans are in repayment, you may be able to refinance with a private lender. Compare interest rates and terms carefully before refinancing.

What is the difference between subsidized and unsubsidized federal loans?

Subsidized loans don’t accrue interest while you’re in school, grace period, or deferment. Unsubsidized loans accrue interest from the time they are disbursed.

Where can I find more information on PSU’s financial aid resources?

Visit the official PSU website’s financial aid office page. They provide detailed information and contact details.